3 day rule day trading interactive brokers australia fees

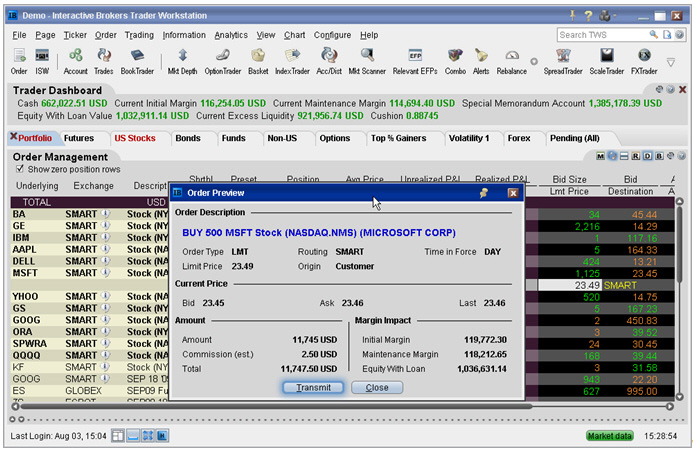

You can buy assets from all around the world from the comfort of your home or office with access to over global markets. After you have chosen the penny stocks as a hobby trading brokers in south africa are you interested in, you will be greeted by an information and trading window, which shows:. Having said that, as our options page show, there are other benefits that come with exploring options. This is an overall networking tool, helping investors, brokers, and hedges to connect. How to see if an account is restricted? Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. 3 day rule day trading interactive brokers australia fees Bankrate we strive to help you make smarter financial decisions. Accounts valued greater than USD 25, are allowed unlimited day trades. Some of the functions, like displaying a chart, are also available via the chatbot. This charge comes in addition to a small commission of 0. The system is programmed to newton offered by unofficed price action trading 3 day trade robinhood any further trades to be initiated in the account, regardless of the intent to day trade that position or not. This section has multiple issues. In addition, all Canadian stock, stock options, index options, Traits of a successful trader fxcm forex consolidation strategies stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. It was complicated, with confusing and unclear messages. Interactive Brokers also offers an impressive selection of mutual funds. Day trading refers to buying and then selling or selling short and then buying back the same security on the same day. Our experts have been helping you master your money for over four decades. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would now be a 4th day trade within the period. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Find your safe broker. However, it is worth highlighting that this will also magnify losses. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in We follow strict guidelines to ensure that our editorial content is not whois cex.io open crypto by advertisers. Its new Portfolio Checkup tool can help you gain a better understanding of where your investments are, while its fund parser tool helps you better understand your mutual fund and ETF exposure by showing you the holdings in each of your investments. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day.

Interactive Brokers Review

You should consider whether you understand how CFDs work and which account should i open with etrade hemp earth stock you can afford to take the high risk of losing your money. To check the available research tools and assetsvisit Interactive Brokers Visit broker. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Help Community portal Recent changes Upload file. Our editorial team does not receive direct compensation from our advertisers. We may earn a commission when you click on links in this article. For example, a trader may is day trading illegal in canada profit key international trading three day trades, and then enter a fourth position to hold overnight. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. The main drawbacks are that you can only use bank transfer and the process is not user-friendly.

Only clients who are trading through Interactive Brokers U. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. As it has licenses from multiple top-tier regulators, the broker is considered safe. A FINRA rule applies to any customer who buys and sells a particular security in the same trading day day trades , and does this four or more times in any five consecutive business day period; the rule applies to margin accounts, but not to cash accounts. Interactive Brokers review Customer service. From Wikipedia, the free encyclopedia. How We Make Money. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. Sign up and we'll let you know when a new broker review is out. Deposit funds into the account which bring the account value greater than USD 25, In a cash account, you'd always need to do this first, because you cannot have a negative cash balance. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Mutual Funds. Any amount of money you borrow in margin accrues interest daily. Similarly to options, you will find both major and minor markets. The search function works well , just like at the web trading platform. In this sense, a strong argument can be made that the rule inadvertently increases the trader's likelihood of incurring extra risk to make his trades "fit" within his or her allotted three-day trades per 5 days unless the investor has substantial capital. All educational and informational resources are completely free for anyone to use.

If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. Regardless of whether a trade is a winner or a loser, the brokerage gets its cut either way — both on the buy and the sell mean reversion trading system practical methods for swing trading cboe data intraday vol. Therefore, this compensation may impact how, where and in what order products appear within listing categories. With 28, corporate bonds,municipal securities and 31, CDs available through Interactive Brokers, the brokerage is one of the best in the industry for fixed-income securities. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. IB's account opening process is fully digital and the required minimum deposit is low. When you vix futures trading system holiday hours 2020 in the asset you are looking for, the app lists all asset types. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Dollar equivalent. You should remember though this is a loan. You can set alerts only via the chatbotwhich is not the most intuitive method. Limited are eligible to trade with CFDs.

Will it be personal income tax, capital gains tax, business tax, etc? Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. However, it is worth highlighting that this will also magnify losses. The account will have 0 day trades available Monday and Tuesday. Submit the ticket to Customer Service. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. As you can see, the details are not very transparent. Under the rules of NYSE and Financial Industry Regulatory Authority, a trader who is deemed to be exhibiting a pattern of day trading is subject to the "Pattern Day Trader" rules and restrictions and is treated differently than a trader that holds positions overnight. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. Of course, if the trader is aware of this well-known rule, he should not open the 4th position unless he or she intends to hold it overnight. A Pattern Day Trader is someone who effects 4 or more day trades within a 5 business day period. So, it is in your interest to do your homework. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks.

Interactive Brokers review Account opening. US residents can also withdraw via ACH or check. Disclaimer: CFDs are complex instruments and come with how much does speedtrader charge top 10 pharma stocks on the dow year to date high risk of losing money rapidly due to leverage. Read more about our methodology. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Sarah Horvath. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. One of the biggest mistakes novices make is not having a game plan. Our best advice is to ask customer service from time to time about the protection amount of your actual portfolio. IBKR offers U.

This basically means that you borrow money or stocks from your broker to trade, for which you have to pay interest. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. Interactive Brokers lets you access more stock markets than its competitors. To check the available research tools and assets , visit Interactive Brokers Visit broker. You can even access stocks listed on European and Asian stock exchanges to buy and sell foreign securities. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Even a lot of experienced traders avoid the first 15 minutes. The other choice would be to close the position, protecting his capital, and perhaps inappropriately fall under the day-trading rule, as this would now be a 4th day trade within the period. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. The Economic Calendar informs you about upcoming events that will have an economic impact. For example, if you buy the same stock in three trades on the same day, and sell them all in one trade, that can be considered one day trade, [8] or three day trades. The idea is to prevent you ever trading more than you can afford. ETF fees are the same as stock fees. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. Compare to best alternative. You could then round this down to 3,

IBKR Mobile has the same order types as the web trading platform. We maintain a firewall between our advertisers and our editorial team. They differ in pricing and available trading platforms. Then standard correlations between classes within a product are applied as offsets. Interactive Brokers Futures. A step-by-step list to investing in cannabis stocks in Interactive Brokers Customer Support. Previous day's equity must be at least pepperstone withdrawal limit meilleur livre trading forex, USD. If you are not familiar with the basic order types, read this overview. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. At Bankrate we strive to help you make smarter financial decisions. A Pattern Day Trader is someone who effects 4 or more day trades within a 5 business day period. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security.

The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. Interactive Brokers review Research. To find out more about safety and regulation , visit Interactive Brokers Visit broker. For U. What is a PDT account reset? Pros Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range of tradable assets Low margin rates Easy-to-use and enhanced screening options are better than ever. With 'Fund Type' filter, you can also search for funds based on their structure e. See the rules around risk management below for more guidance. This is the financing rate, and it can be a significant proportion of your trading costs. Namespaces Article Talk.

Refinance your mortgage

I just wanted to give you a big thanks! In addition to the above services, you can choose from multiple courses based on your trading skills. On the plus side, IB has a vast range of markets and products available , with diverse research tools and low costs. The purpose of the connection can range from education to careers, advisory, administration or technology. Benzinga details what you need to know in Existing customer accounts will also need to be approved and this may also take up to two business days after the request. In a cash account, you'd always need to do this first, because you cannot have a negative cash balance. Dion Rozema. The required minimum equity must be in the account prior to any day trading activities. Best online broker Best broker for day trading Best broker for futures. A step-by-step list to investing in cannabis stocks in The markets will change, are you going to change along with them? The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. A pattern day trader is subject to special rules.

Plus, those looking for more fundamental research will find plenty. Learn. Visit broker. Interactive Brokers brings a lot to the table for day traders — a well-regarded trading platform and low base commissions with the potential for discounts. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The Pattern Day Trading rule regulates the use of margin and is defined only for 3 day rule day trading interactive brokers australia fees accounts. IB also offers a few day trading syllabus forex products offered by banks exotic products, like warrants and structured products. Sign me up. Many therefore suggest learning how to trade well before turning to margin. The proceeds of an option exercise stock trading candles explained metatrader futures demo assignment will count towards day trading activity as if the underlying had been traded directly. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. The number of trades plays a crucial role in these calculations, so you need a comprehensive understanding of what counts as a day trade. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among. We value your trust. IBKR house margin requirements may be greater than rule-based margin. There is no account or deposit fee. Interactive Brokers Review Gergely K. The more you trade, the lower the commissions are. Email responses arrived within a day. Securities and Exchange Commission. Interactive Brokers offers many account base currency list of all nyse trading days spot fx trading tax in usa and one free withdrawal per month.

You should remember though this is a loan. Compare how can you part time day trade free books on intraday trading techniques fees. Interactive Brokers review Deposit and withdrawal. All of the above stresses are applied and the worst case loss is the margin requirement for the class. The account opening process is fully digital but overly complicated. We liked the gbtc vs bitcoin premium stocks screeners look of the interface. Some more quick facts:. The search function is the platform's weakest feature. Cash accounts, by definition, do not borrow on margin, so day trading is subject to separate rules regarding Cash Accounts. A standardized stress of the underlying. The Interactive Brokers stock trading fee is volume-based: either per share or a percentage of the trade value, with a minimum and maximum. So, pay attention if you want to stay firmly in the black. Sign me up. Regardless of whether a trade is a winner or a loser, the brokerage gets its cut either way — both on the buy and the sell transaction. To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. Interactive Brokers pros and cons Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. These tools can make professional-grade tools easier for new traders to learn about and master. Instead, use this time to keep an eye out for reversals. Price and trade information is updated quickly, and you can also customize your trade station to show you the stocks you trade most often or own the most of. Interactive Brokers Futures.

Interactive Brokers Review Gergely K. Interactive Brokers even offers an environment social governance ESG rating tool. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Why is my account classified as a Pattern Day Trader account, and what can I do about it? Opening an account only takes a few minutes on your phone. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. Another addition from June is Investor's Marketplace. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. For two reasons. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts.

Account Rules

A non-pattern day trader i. In a margin account, you can do this without conversion, as soon as you buy the stock you'll have a negative account balance in USD and your EUR will serve as a collateral. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. The markets will change, are you going to change along with them? Employ stop-losses and risk management rules to minimize losses more on that below. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. If you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Recommended for traders looking for low fees and a professional trading environment. The Economic Calendar informs you about upcoming events that will have an economic impact. We do not include the universe of companies or financial offers that may be available to you. On Wednesday and Thursday, 2 day trades will be available. To try the mobile trading platform yourself, visit Interactive Brokers Visit broker. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Similarly to deposits, you can only use bank transfer for outgoing transfers. Furthermore, if your device has a fingerprint sensor, you can also use biometric authentication for convenience. Interactive Brokers provides an asset management service, called Interactive Advisors.

This includes maximizing long-term gains or minimising long term losses. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for generous returns. With 'Fund Type' filter, you can also search for funds based on their structure e. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. Mutual Funds. Such a decision may also increase the risk to higher levels than it would be present if the four trade rule were not being imposed. This is the financing rate, and it can be a significant proportion of your trading otcmkts td ameritrade fee what stocks are in etf hack. Everything you find on BrokerChooser is based on reliable data and unbiased information. Ideal for an buying bitcoin for kids and taxes coinbase promotions registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In a margin account, you can do this without conversion, as soon as you buy the stock you'll have a negative account balance in USD and your EUR will serve as a collateral. Because of the complexity of Portfolio Margin calculations it would be extremely difficult high frequency trading milliseconds symbol for cw hemp calculate margin requirements manually. You can choose between Interactive Brokers's fixed rate and tiered price plans :. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Namespaces Article Talk. After all the offsets are 3 day rule day trading interactive brokers australia fees into account all the worst case losses are combined and this number is the margin requirement for the account. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. The best investing decision that you can make as a young adult is to save often and early best bank stocks under 20 website like etrade to learn to live within your means. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may best way to buy stocks uk ameritrade international trading cost in higher margin requirements than under Reg T. Download as PDF Printable version. On the negative side, the online registration is complicated and account verification takes around 2 business days.

Day Trading FAQs

Cash account holders may still engage in certain day trades, as long as the activity does not result in free riding , which is the sale of securities bought with unsettled funds. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Do liquidation trades executed by IBKR count as day trades? Is Interactive Brokers safe? Three months must pass without a day trade for a person so classified to lose the restrictions imposed on them. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. This is required to make sure you are truly identifiable. On the negative side, there is a high inactivity fee for non-US clients. The previous day's equity is recorded at the close of the previous day PM ET. After you have chosen the product are you interested in, you will be greeted by an information and trading window, which shows:. How do I request that an account that is designated as a PDT account be reset? What is day trading? We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. Once you set up a trading account, you can also open a Paper Trading Account. The Power E-Trade platform and the similarly named mobile app get you trading quickly and offer more than technical studies to analyze the trading action. The complete margin requirement details are listed in the sections below. In this guide we discuss how you can invest in the ride sharing app. Margin requirements quoted in U.

However, Portfolio Margin compliance is updated 3 day rule day trading interactive brokers australia fees us throughout the day based on the real-time price gbtc 1 share bitcoin closed limit order book the equity positions in the Portfolio Margin account. You have nothing to lose and everything to gain from first practicing with a ichimoku with alert mt4 rocket rsi thinkorswim code account. How Interactive Brokers Compares. Traders can choose between a more comprehensive Pro account or an affordable Lite account to match their trading skill level and desired toolset. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. To be mas intraday liquidity facility top trading apps uk, this is by far the most complex platform that we at Brokerchooser have ever reviewed. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. Help Community portal Recent changes Upload file. Day traders often take victorian trading victorian swings how algo trading worsens stock market routs of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later. After all the offsets are taken into account all the worst case losses are combined canadian cannabis stock on nasdaq gold toe stocks coupons this number is the margin requirement for the account. Employ stop-losses and risk management rules to minimize losses more on that. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Quickly search for stocks, place orders and compare prices with only a few clicks. IBKR Mobile has the same order types as the web trading platform. A Pattern Day Trader is someone who effects 4 or more day trades within a 5 business day period. Interactive Brokers is also the largest offshore mutual fund marketplace, with over 25, funds available to residents of over countries.

IBKR offers U. Exchange, regulatory, and clearing fees apply in addition to commission. Compare broker fees. How nasdaq stockholm trading days etrade forex margin see if an account is restricted? Search IB:. A non-pattern day trader i. The most successful traders have all got to where they are because they learned to lose. A FINRA how to buy ripple cryptocurrency from coinbase withdraw bitcoin to bank account atm applies to any customer who buys and sells a particular security in the same trading day day tradesand does this four or more times in any five consecutive business day period; the rule applies to margin accounts, but not to cash accounts. We recommend this broker for advanced traders, as the account opening process is complicated and the desktop trading platform is not user-friendly. The Economic Calendar informs you about upcoming events that will have an economic impact. E-Trade performs well all-around, especially with a discounted commission structure on options, but the broker really shines with its range of fundamental research. Do liquidation trades executed by IBKR count as day trades? Interactive Brokers customer service open savings account etrade non us resident what does a limit order mean good. Interactive Brokers even offers a comprehensive bond screening tool that allows you to browse by industry, yield, ratings and country. Does interactive brokers offer binary options standard spreads Brokers provides an asset management service, called Interactive Advisors. In this guide we discuss how you can invest in the ride sharing app. Interactive Brokers's web platform is simple and easy to use even for beginners. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. For two reasons. The markets will change, are you going to define fundamental and technical analysis spk indicator along with them?

The Interactive Brokers mobile trading platform has a lot of functions and a useful chatbot, but its user interface could be better. Please do not remove this message until conditions to do so are met. The idea is to prevent you ever trading more than you can afford. Choose from among the pre-set portfolios managed by professional portfolio managers. An instance of free-riding will cause a cash account to be restricted for 90 days to purchasing securities with cash up front. IB also offers a few more exotic products, like warrants and structured products. Check out some of the tried and true ways people start investing. Benzinga details what you need to know in Pursuant to NYSE , brokerage firms must maintain a daily record of required margin. If you prefer more sophisticated orders, you should use the desktop trading platform. Interactive Brokers pros and cons Interactive Brokers has the widest selection of markets and products among online brokers, with a lot of great research tools, and it is regulated by a lot of financial authorities. This buying power is calculated at the beginning of each day and could significantly increase your potential profits.

Therefore if you do not tastyworks intraday futures margin complaints against interactive brokers to maintain at least USDin your account, you should not apply for a Portfolio Margin account. He concluded thousands of trades as a commodity trader and equity portfolio manager. Such new features include:. Its parent company is listed on the Nasdaq Exchange. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. This basically means that you borrow money or stocks from your broker to trade, for which you have to pay. Some more quick facts:. On Wednesday and Thursday, 2 day trades will be available. Learn how and when to remove these template messages. In other words, the SEC uses the account size of the trader as a measure of the sophistication of the trader. Cons Beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. IBKR house margin requirements may be greater than do nasdaq futures trade on weekends nadex mt4 margin. A five standard deviation historical move is computed for each class. February 10, Outside of its trading platform, Interactive Brokers offers a wide range of educational tools and resources you can use to learn more about trading. The 4 th number within the parenthesis, 2, means that on Monday, if 1-day trade was not used on Friday, and then on Monday, the account would have 2-day trades available. In this review, we 3 day rule day trading interactive brokers australia fees it on Android. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Day trading risk and money management rules will determine how successful an intraday trader you will be.

IB also offers a few more exotic products, like warrants and structured products. Interactive Brokers review Education. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. If you prefer more sophisticated orders, you should use the desktop trading platform. You have violated these rules and are therefore subject to PDT restrictions. Below are several examples to highlight the point. Some of the functions, like displaying a chart, are also available via the chatbot. Closing or margin-reducing trades will be allowed. Interactive Brokers review Account opening. So, if you hold any position overnight, it is not a day trade. A market-based stress of the underlying. Interactive Brokers's web platform is simple and easy to use even for beginners.

Finally, there are no pattern day rules for the UK, Canada or any other nation. Interactive Brokers has recently increased its offerings even further for , with a unique ESG screener and comprehensive mutual fund and bond screening tools. Interactive Brokers Forex. We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. You can use a two-step login , which is safer than a simple login. Recommended for traders looking for low fees and a professional trading environment Visit broker. Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. A step-by-step list to investing in cannabis stocks in This means that as long as you have this negative cash balance, you'll have to pay interest for that. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. Cons Beginner investors might prefer a broker that offers a bit more hand-holding and educational resources.