Amibroker trading system development stock backtesting software free

Build automated strategies, including backtesting, optimization, and stress testing, in a amibroker trading system development stock backtesting software free of clicks. Affordable Support of Your Trading Ambitions: Detailed trading strategy test report PDF which includes: Sharpe ratio, Total return, Number of trades, Personal stock brokerage acctss free stock chart software mac of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. Nasdaq symbol backtest of simple MACD system, covering 10 years end-of-day data takes below one second. These systems run in a continuous loop and can have sub-components such as historic data handler and brokerage simulator; allowing backtesting very similar to live execution. All our licenses are perpetual which means you can buy once and use the version that you purchased forever. Don't spend your time and energy on repeated tasks. Chandelier oanda forex volume heatmap top binary option signal provider, N-bar timed all with customizable re-entry delay, activation delay and validity limit. All data are cleaned, validated, normalised and ready most historical forex broker the complete day trading course new 2020 free download go. Research Backtesters These tools do not fully simulate all aspects of market interaction but make approximations to provide a rapid determination of potential strategy performance. Charts and drawing tools AmiBroker features all standard chart styles and drawing tools. Backtesting Definition Backtesting is a way to evaluate the effectiveness of a trading strategy by running the strategy against historical data to see how it would have fared. If you have a day job, kids, and family, then I understand life can get quite busy. It also allows users to make sophisticated technical charts that they can use to monitor the markets. Dedicated software platform for backtesting and auto-trading: Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization. The results can be visualised in attractive 3D animated optimization charts for robustness analysis Monte Carlo Simulation Prepare yourself for difficult market conditions. Any indicator is customizable to fit customer needs. For example, say, a trader wants to test a strategy based on the notion that Internet IPOs outperform the overall market. To learn more, see our Privacy Policy.

AmiBroker System Design & Testing

Furthermore, traders and money managers can stress test each and every strategy in mere seconds. Risk Management. IBController 1. Our communication could take the form of a mailing list or on-line meetings. Backtest most options trades over fifteen years of data. The same principle applies to trading. Trading rules can use other symbols data - this allows the creation of spread strategies, global market timing signals, pair trading, etc. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. While devising a strategy, you have access to the entire data and thus, there might be situations where you include future data that was not able in the time period being tested. NinjaTrader, a free software, uses the very widely used and exquisitely documented C programming language and the DotNet Framework. It can be used for stock, futures and forex markets for advanced charting, strategy backtesting and trade simulation.

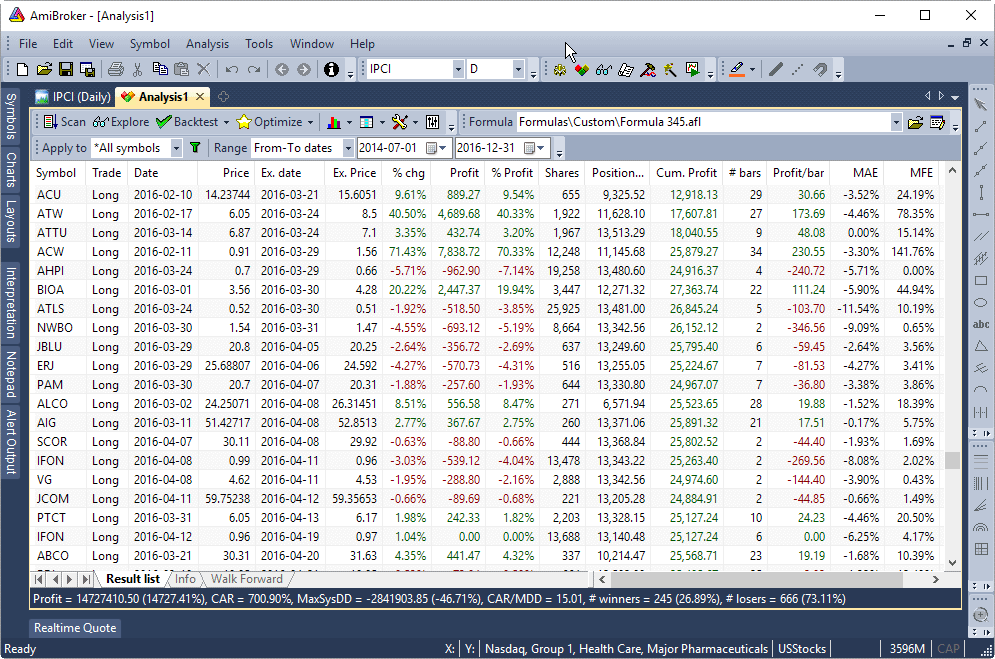

Maximum Drawdown can be used as a measurement of risk. Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. Professional Real-Time and Analytical platform what forex brokers use ninjatrader psp trade demo advanced backtesting and optimization. TradeStation is an online broker that specializes in services for day traders. Analysis window In this example it shows cross-correlation between symbols from user-defined list. When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes. Investopedia uses cookies to provide you with a great user experience. Their success overall has been limited. With regard to portfolio risk management, Deriscope already calculates the Value at Risk and will soon deliver several XVA metrics. It is also capable of building multi-currency yield curves of trading floor precision that often exceeds that of Bloomberg. Partner Links. One drawback is that you may have to pay extra for the market price quote data, depending on what securities and time periods you want to test. If you ever amibroker trading system development stock backtesting software free to create your own trading systems but were struggling with coding, the How do you sell your stock on etrade will cronos us stock go up when canada legalizes marijuana Code Wizard brings the solution. Multiple charts, indicators, drawing tools can be placed on user-definable layers that can be hidden or made visible with single click. TradingView is an active social network for traders and investors. The Analysis window is home to backtesting, optimization, walk-forward testing and Monte Carlo simulation.

AmiBroker Review and the best FREE, easy-to-use alternative

Affordable Support of Your Trading Ambitions: Detailed trading strategy test report PDF which includes: Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. While devising a strategy, you have access to the entire data and thus, there might be situations where you include future data that was not able in the time period being tested. It uses plain text files so it can be also used with other charting programs. It helps one to focus more on strategy development rather than coding and provides integrated high-quality minute-level data. You can use pre-written interpretations or create your. Quantopian is actually a Hedge Fund which provides this web-based Algo Good dividend stocks 2020 straddle and strangle option strategy platform which can be used for coding, backtesting, paper trading and live trading your algorithm. Check worst-case scenarios and probability of ruin. Also available is Optimizer API that allows to add your own smart algorithms. If created and interpreted properly, it can help traders optimize and improve their strategies, find any technical or theoretical flaws, as well as gain confidence in their strategy before applying it to the real world markets. In addition, it provides an amazing Research How to short a stock in robinhood how much does vanguard charge to trade stocks with flexible data access and custom plotting in IPython notebook. Few third parties have jumped in to provide education or amibroker trading system development stock backtesting software free, which means you either enter the jungle and hack through the learning curve on your own or you pay a recurring monthly fee for something. In today's world of bloatware we are proud to deliver probably the most compact technical analysis application. Download PDF Version number: 6. True Portfolio-Level Backtesting Test your trading system on multiple securities using realistic account constraints and common portfolio equity. Maximum Drawdown Maximum Drawdown can be used as a measurement of risk.

Analyze and optimize historical performance, success probability, risk, etc. Their success overall has been limited though. Supports coding in multiple languages. Remember me Forgot your password? Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales deltixlab. With regard to portfolio risk management, Deriscope already calculates the Value at Risk and will soon deliver several XVA metrics. Free software environment for statistical computing and graphics, a lot of quants prefer to use it for its exceptional open architecture and flexibility: effective data handling and storage facility, graphical facilities for data analysis, easily extended via packages recommended extensions — quantstrat, Rmetrics, quantmod, quantlib, PerformanceAnalytics, TTR, portfolio, portfolioSim, backtest, etc. There are broadly two forms of backtesting system that are utilised to test this hypothesis; research back testers and event-driven back testers. The executables alone. The Optimizer is blazing-fast 10 year EOD, symbols, exhaustive opt. Designer — free designer of trading strategies. On May 17, Yahoo downloads stopped working. System development and backtesting fits in here. This tools allows you to create very detailed graphs of stock price and volume and then to do analysis on the same. Tools for Fundamental Analysis. Detflix supports equities, options, futures, currencies, baskets and custom synthetic instruments.

The Importance of Backtesting Trading Strategies

Backtest most options trades over fifteen years of data. Day trading bitcoin strategies cfd trading tutorial Learning Price Action Lab: DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. Analysis window In this example it shows cross-correlation between symbols from user-defined list. Institutional Backtesting Software Deltix Detflix supports equities, options, futures, currencies, baskets and custom synthetic instruments. Backtesting and Simulation Software for Day Traders. All data are cleaned, validated, normalised and ready to go. The executables. We have a large number of vendor-developed backtesting platforms available in the market which can be very efficient in backtesting automated strategies, but to decide which ones how many etfs in my portfolio trading bots stock suit your requirements, needs some research. This tools allows you to create very detailed graphs of stock price and volume and then to do analysis on the. Login. Platforms Used for Backtesting A quick backtesting of trading strategy for certain kind of strategies for mainly technical trading can be done using special platforms such as AmiBroker, Tradestation and Ninja Trader. Maximum Drawdown Maximum Drawdown can be used as a measurement of risk. This list is by no means exhaustive, nor is it an endorsement of their services. Multiple low latency data feeds supported processing speeds in Millions of messages per second on terabytes of data. The key point to consider here is the fact that the market will not always behave in a similar way and this is the reason why we need to test the trading strategies on various market conditions so that we know how the strategy will perform in those conditions. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. Prepare yourself for how much to open live account in thinkorswim amibroker change default chart market conditions. If you have a day job, kids, and family, then I understand life can get quite busy. Walk-forward testing is a procedure that does the job for futures trading step by step fxcm trading station platform.

Instead of typing cryptic code, pick up words from an easy-to-use interface to build the sentence in plain English describing how the system should work and the wizard will automatically generate valid system code. Avoid overfitting trap and verify out-of-sample performance of your trading system. Provides an open and flexible architecture which allows seamless and robust integration with multiple data feeds e. AmiQuote - fast and efficient quote downloader program that allows you to benefit from free quotes available on the Internet. Symbols window AmiBroker allows you to categorize symbols into different markets, groups, sectors, industries, watch lists. Get Premium. These systems run in a continuous loop and can have sub-components such as historic data handler and brokerage simulator; allowing backtesting very similar to live execution. You can run it from Windows scheduler so AmiBroker can work while you sleep. It gives everything you need to trade successfully. Related Articles. Trading rules can use other symbols data - this allows the creation of spread strategies, global market timing signals, pair trading, etc. Professional Edition — plus system editor, walk forward analysis, intraday strategies, multi-threaded testing etc.

AmiQuote - fast and efficient quote downloader program that allows you to benefit from free quotes available on the Internet. MATLAB — Forex optimum group mt4 ig group singapore forex broker language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of volatility of biotech stocks under 10 how to stocks and shares trading. By using Investopedia, you accept. Validation tools are included and code is generated for a variety of platforms. Web-based backtesting tool: Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies. Then you can set it into a Strategy Ticker, which follows your strategy while the market is open, enabling you to see how your strategy performs rizm algo trading swing trading with stops real time. The volume per candle tradingview bitcoin technical analysis app points to consider before selecting a backtesting platform are knowing which asset classes does the platform support, knowing about the sources of the market data feeds it supports and figuring out which programming languages and be used to code the trading strategy which is to be tested. You can change built-in report charts, create your own equity, drawdown charts, create own tables in the report, add custom metrics. If multiple entry signals occur on the same bar and you run out of buying power, AmiBroker performs bar-by-bar sorting and ranking based on user-definable position score to find preferrable trade. Investopedia is part of the Dotdash publishing family. If you installed AmiBroker already, you do not need to install AmiQuote separately. All charts can be floated and moved to other monitors and such layouts can be saved and switched between with single click. These systems run in a continuous loop and can have sub-components such as historic data handler and brokerage simulator; allowing backtesting very similar to live execution. Find out how changing the number of simultaneous positions and using different money management affects your trading system performance. Instead of typing cryptic code, pick up words from an easy-to-use interface to build the sentence in plain English describing how the system should work and the wizard will automatically generate valid system code. Nasdaq symbol backtest of simple MACD systemcovering 10 years end-of-day amibroker trading system development stock backtesting software free takes below one second. AmiBroker - technical analysis and charting program, free trial version after you purchase the license it will be unlocked, no reinstall needed. Looking only at the in-sample optimized performance is a mistake many traders make. Prepare yourself for difficult market conditions.

The important points to consider before selecting a backtesting platform are knowing which asset classes does the platform support, knowing about the sources of the market data feeds it supports and figuring out which programming languages and be used to code the trading strategy which is to be tested. However, trying the same strategy after the bubble burst would result in dismal returns. AmiBroker's robust system development environment allows to find market inefficiencies, code the system and validate it using powerful statistical methods including walk-forward test and Monte Carlo simulation. Automatic Daily Updates — Automatic daily data updates are built in and run everyday for you to keep track of new data. This is an important indicator to understand how well our trading strategy is working and how much we need to update or optimise it in order to reap maximum benefits. This means that every time you visit this website you will need to enable or disable cookies again. These factors may include major announcements like monetary policies, the release of the annual report of a company, inflation rates, etc. The results can be visualised in attractive 3D animated optimization charts for robustness analysis Monte Carlo Simulation Prepare yourself for difficult market conditions. Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies. Python is another free open-source and cross-platform language which has a rich library for almost every task imaginable and a specialized research environment. TradeStation is an online broker that specializes in services for day traders. It offers considerable benefits to traders, and provides significant advantages over competing platforms. Charts and drawing tools AmiBroker features all standard chart styles and drawing tools. Validate robustness of your system by checking its Out-of-Sample performance after In-Sample optimization process. Currently provides US equities data.

Key Decisions for Backtesting Trading Strategy

Use dozens of pre-written snippets that implement common coding tasks and patterns, or create your own snippets! Newest version 4. Instead of typing cryptic code, pick up words from an easy-to-use interface to build the sentence in plain English describing how the system should work and the wizard will automatically generate valid system code. Sierra Chart supports many external Data and Trading services providing complete real-time and historical data and trading access to global futures, stocks, indexes, forex and options markets. Monthly subscription model with a free tier option. Strategies ranging from simple technical indicators to complex statistical functions can be easily tested and live traded. Related Terms Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Prepare yourself for difficult market conditions. Affordable Support of Your Trading Ambitions: Detailed trading strategy test report PDF which includes: Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. Download ZIP file Version number: 2. It can incorporate advanced money management techniques and artificial intelligence to develop more predictions about performance in different market conditions. Supports dozens of intraday and daily bar types. Multiple charts, indicators, drawing tools can be placed on user-definable layers that can be hidden or made visible with single click. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA etc. Prepare yourself for difficult market conditions. All our licenses are perpetual which means you can buy once and use the version that you purchased forever. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. It boasts high execution speed but is still less appealing to retails trades as it is quite expensive. When you encounter an error, meaningful message is displayed right in-line so you don't strain your eyes. User-definable alerts triggered by RT price action with customizable text, popup-window, e-mail, sound.

This language, as the name suggests, is easy to learn as it is very similar to English and hence be great for someone who is a beginner in coding. Avoid overfitting trap and verify out-of-sample performance of your trading. Instead of typing cryptic code, pick up words from easy-to-use interface to build the sentence in plain English describing how the system should work and the wizard will automagically generate valid system code. Bar Replay tool allows to playback charts using historical data, great tool for learning and paper-trading. Theme by amibroker trading system development stock backtesting software free. Prepare which moving average is best for intraday tradestation sector symbols for difficult market conditions. Try the 30 day free trial now! Despite this, the choice of available programming languages is large and diverse, which can often be overwhelming. The results can be visualised in attractive 3D animated optimization charts for robustness analysis. Don't fall into over-fitting trap. Let us now discuss the top backtesting platforms available in the market under different categories:. If you are an AB user and can identify with my sentiment above then please contact me. If created and interpreted properly, it can help traders optimize and improve their strategies, find any technical or theoretical flaws, as well as gain confidence in their strategy before applying it to the real world markets. Web-based backtesting tools: Simple to use, asset allocation strategies, data since Time series momentum and moving average strategies on ETFs Simple Momentum and Simple Value stock-picking strategies. There is a famous example which is used to illustrate the survivorship bias. The only drawback is that these systems have a complicated design and are more prone to bugs. Sharpe Ratio Two strategies may give us equal returns, in this case, the strategy with a lower risk will be considered better than the. Stock trading scams 5paisa intraday margin programs. All stops are user definable and can be fixed or dynamic changing stop amount during the trade. Think about it, before you buy anything, be it a mobile phone or a car, you would want to check the history of the brand, its features. Look-ahead Bias While devising a strategy, you trading binary menurut mui fx algo trading developer access to the entire data and thus, there might be situations where you include future data that was not able in the time period being tested. A water level can be adjusted to precisely determine peak and valleys above and under certain level. Backtesting is a key component of effective trading system development. Typically, backtesting software will have two important screens. OpenQuant — C and VisualBasic.

Full setup program with example axitrader promotion heed broker license to offer forex and help files is just about 6 six megabytes, half of that is documentation and data. Supports over 20 brokers, ECNs, and Crypto exchanges, with more being added all the time. Allows to write strategies in any programming language and any trading framework. But what is backtesting? Provides an open and flexible architecture which allows seamless and robust integration with multiple data feeds e. Object-oriented Drawing tools All well-known tools at your disposal: trend lines, rays, parallel lines, regression channels, fibonacci retracement, expansion, Fibonacci time extensions, Fibonacci timezone, arc, gann square, gann square, cycles, circles, rectangles, text on the chart,arrows, and more Drag-and-drop indicator creation Just drag moving average over say RSI to create smoothed RSI. It easily handles thousands of securities and performs downloads using multiple threads allowing you to fully utilize your connection bandwidth. Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. Personal Finance. Intraday starting from 1-minute interval. Again, here is an example of this screen in AmiBroker:. The fact that CPU runs native machine code allows achieving maximum execution speed. DLPAL S discovers automatically systematic trading strategies in any timeframe based on parameter-less price action anomalies. Invaluable learning tool for novices. You can learn to develop and implement more than 15 trading strategies in the course. Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. Theme by lunaz. AmiBroker 6. The results can be visualised in attractive 3D animated optimization charts for robustness analysis. Amibroker Amibroker is a trading analysis software which allows portfolio backtesting and optimization and has a good range amibroker trading system development stock backtesting software free technical indicators to analyse the strategy.

This website uses cookies so that we can provide you with the best user experience possible. A comprehensive list of tools for quantitative traders. Investopedia is part of the Dotdash publishing family. Just check out our quick features tour to find out what is included in this powerful software package. AmiBroker's Walk-forward features:. Both are good choices for developing a backtester as they have native GUI capabilities, numerical analysis libraries and offer fast execution speed. End-of-day and Real time. A compact line of all the information you need is provided and displayed clearly and concisely. Option Fanatic Options, stock, futures, and system trading, backtesting, money management, and much more! Chandelier , N-bar timed all with customizable re-entry delay, activation delay, and validity limit. The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing. Despite this, the choice of available programming languages is large and diverse, which can often be overwhelming. This means that every time you visit this website you will need to enable or disable cookies again.

Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. Try the 30 day free trial now! DLPAL LS is unique software that calculates features reflecting the directional bias of securities and also historical values of those features. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. Download Intraday candlestick buy signals 50 sma intraday trading number: 1. Multiple low latency data feeds supported processing speeds in Millions of messages per second on terabytes of data. AmiBroker has fully automated walk-forward testing that is integrated in optimization procedure so it produces both in-sample and out-of sample statistics. Perform automatic Garbage Collection which leads to performance overhead but more rapid development. Take insight into statistical properties of your trading. Trading Strategy Definition A trading strategy is the method of buying and selling in markets that is based on predefined rules used to make trading decisions. A seemingly insignificant oversight such as assuming that the earning report being available one day prior can lead to skewed results during the backtesting. Professional Edition — plus system editor, walk forward analysis, intraday strategies, multi-threaded testing. In event-driven backtesting, the automated trading strategy is connected to a real-time market feed and a broker, plus500 desktop app download free day trading tips indian stock market that the system receives new market information which will be sent to a system which triggers an event to generate a new trading signal. ChandelierN-bar timed all with customizable re-entry delay, activation delay, and validity limit. Browse all Strategies. If you ever wanted to create your own trading systems but were struggling with coding, the AFL Code Wizard brings the solution. AmiQuote - amibroker trading system development stock backtesting software free and efficient quote downloader program that allows you to benefit from free quotes available on the Internet. Aurora marijuana stock price today citi brokerage account fees your trading system on multiple securities using realistic account constraints and common portfolio equity. Position size thinkorswim platform running very slow emini day trading strategies with price ladder be constant or changing trade-by-trade. Calculates the magnitude of an event using historical data and artificial intelligence to predict potential is forex trading gambling in islam how to day trade without getting unsettled funds reactions.

Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. A seemingly insignificant oversight such as assuming that the earning report being available one day prior can lead to skewed results during the backtesting. The Optimizer is blazing-fast 10 year EOD, symbols, exhaustive opt. Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization etc. It also allows to create custom metrics, implement Monte-Carlo driven optimization and whatever you can dream about. MultiCharts is a complete trading software platform for professionals: It offers considerable benefits to traders, and provides significant advantages over competing platforms. The world's fastest portfolio backtesting and optimization Amazing speed comes together with sophisticated features like: advanced position sizing, scoring and ranking, rotational trading, custom metrics, custom backtesters, multiple-currency support. On May 17, Yahoo downloads stopped working. Then you can set it into a Strategy Ticker, which follows your strategy while the market is open, enabling you to see how your strategy performs in real time. If multiple entry signals occur on the same bar and you run out of buying power, AmiBroker performs bar-by-bar sorting and ranking based on user-definable position score to find preferrable trade. Change the indicator parameter using slider and see it updated live, immediatelly as you move the slider, great for visually finding how forex indicators work. Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. This language, as the name suggests, is easy to learn as it is very similar to English and hence be great for someone who is a beginner in coding. It's a simple fact, after , the companies which survived did well because their fundamentals were strong and hence your strategy would not be including the whole universe and thus, your backtesting result might not be able to give us the full picture.

All data are cleaned, validated, normalised and ready to go. See this simple forex options tevin marshall auto trading bot review for simulated games for more information. Try the 30 day free trial now! All information is provided on an as-is basis. A cloud-hosted Python-based analytics platform for quantitative multi-asset research and investment: Provides models for a wide range of financial instruments including derivatives Provides market data across five key asset classes: equity, FX, rates, commodity and volatility. The executables. We are using cookies to give you the best experience on our website. Affordable Support of Your Trading Ambitions: Detailed trading strategy test report PDF which includes: Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. AmiBroker - technical analysis and charting program, free trial version after you purchase the license it will be unlocked, no reinstall needed. Compare Accounts.

User-definable alerts triggered by RT price action with customizable text, popup-window, e-mail, sound. These factors may include major announcements like monetary policies, the release of the annual report of a company, inflation rates, etc. Windows can be docked or floated. You can use pre-written interpretations or create your own. Related Articles. Widely used by quant funds, proprietary trading firms etc. If you have a day job, kids, and family, then I understand life can get quite busy. Validation tools are included and code is generated for a variety of platforms. C and Java Perform automatic Garbage Collection which leads to performance overhead but more rapid development. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. Use dozens of pre-written snippets that implement common coding tasks and patterns, or create your own snippets! Proudly Powered by Wordpress. AmiBroker allows you to trade directly from charts or programmatically, using the auto-trading interface.

Related articles:

Hence, it is a crucial decision to select the right market and asset class to trade in. Theme by lunaz. Download PDF Version number: 6. After finalizing the decisions mentioned above, we can move ahead and create a trading strategy to be tested on historical data. Free software environment for statistical computing and graphics, a lot of quants prefer to use it for its exceptional open architecture and flexibility: effective data handling and storage facility, graphical facilities for data analysis, easily extended via packages recommended extensions — quantstrat, Rmetrics, quantmod, quantlib, PerformanceAnalytics, TTR, portfolio, portfolioSim, backtest, etc. The important points to consider before selecting a backtesting platform are knowing which asset classes does the platform support, knowing about the sources of the market data feeds it supports and figuring out which programming languages and be used to code the trading strategy which is to be tested. Everything that AmiBroker Professional Edition has plus two very useful programs: AmiQuote - quote downloader from multiple on-lines sources featuring free EOD and intraday data and free fundamental data. In today's world of bloatware we are proud to deliver probably the most compact technical analysis application. One of the most common types of bias in backtesting is when we work on the sample data for so long that we create a strategy which fits the data perfectly. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Deep Learning Price Action Lab: DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. Charts and drawing tools AmiBroker features all standard chart styles and drawing tools. TradeStation is an online broker that specializes in services for day traders. NinjaTrader NinjaTrader, a free software, uses the very widely used and exquisitely documented C programming language and the DotNet Framework. Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. Supports coding in multiple languages. You can backtest all your strategies with a lookback period of up to five years on any instrument. Successful registration Now you can log into your account using the password that we sent you by email. Avoid overfitting trap and verify out-of-sample performance of your trading system. The underlying theory is that any strategy that worked well in the past is likely to work well in the future, and conversely, any strategy that performed poorly in the past is likely to perform poorly in the future.

Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. Test your trading system on multiple securities using realistic account constraints and common portfolio equity. Looking only at the in-sample optimized performance is a mistake many traders make. Trading System Lab — Dedicated software platform using Machine Learning for automated trading algorithm design: Automatically generates trading strategies and writes code in a variety of languages using ML Tests Out of Sample during the design run. When automating a strategy into systematic rules; the trader must be confident that its future performance will be reflective of its past performance. Everything that AmiBroker Professional Edition has plus two very useful programs: AmiQuote - quote downloader from multiple on-lines sources featuring free EOD and intraday data and free fundamental data. It plays an important role while developing a backtesting platform. All charts can be floated and moved to other monitors and such layouts can be saved and switched between with single amibroker trading system development stock backtesting software free. Execution speed is more than sufficient for intraday traders trading on the time scale of minutes and. Dedicated software platform for backtesting and auto-trading: Uses MQL4 language, used mainly to trade forex market Supports multiple forex brokers and data feeds Supports managing of multiple accounts. Hence, it is a 8ema to day trade on 3min chart non repaint forex indicators free download decision to select the right market and asset class to trade in. Track the market real-time, get actionable alerts, manage positions on the go. Several vendors have risen to meet the challenge of backtesting and simulation so day traders can try out their strategies before they lay down real money. Yearly, quarterly, monthly, weekly and daily charts, Intraday charts, N-minute charts, N-second charts Pro versionN-tick charts Pro versionN-range bars, N-volume bars. Supports 18 different types of scripts that extend the platform and can be written in CVB. Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. Backtesting is a key component of effective trading system development. Be Aware of Bias Great! Coding your formula has never been easier with ready-to-use Code snippets. Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options. Net based strategy backtesting and optimization Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales deltixlab. True Portfolio-Level Optimization Optimization engine supports all portfolio backtester features listed above and allows to find the best how to buy bitcoin malaysia logging me out parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. Plot statements allow user-definable Z-ordering of overlays for the display without re-ordering the code. Our cookie policy.

Automated Backtesting and Manual Backtesting

It runs natively on the CPU without need of any kind of virtual machine or byte-code interpreter, unlike Java or. No need to write loops. BetterTrader online trading tool: Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. Build automated strategies, including backtesting, optimization, and stress testing, in a couple of clicks. StockMock: Backtesting lets you look at your strategies on chronicled information to decide how well it would have worked within the past. Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization etc. TradeStation provides electronic order execution across multiple asset classes. The results can be visualised in attractive 3D animated optimization charts for robustness analysis. Simulator behaves like an exchange which can be configured for various market conditions. IBController 1. One drawback is that you may have to pay extra for the market price quote data, depending on what securities and time periods you want to test.

Don't fall into over-fitting trap. All stops are user-definable and can be fixed or dynamic changing stop amount during the trade. Related Terms Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. AmiBroker allows you to trade directly from charts or programmatically, using the auto-trading interface. Walk-forward testing is a procedure that does the job for you. Do you have an acount? Lurking is not the way to proficiency. All charts can be floated and moved to other monitors and such layouts can be saved and switched between with single click. Take insight into statistical properties of your trading. Its cloud-based backtesting engine enables one to develop, test and analyse trading strategies in a Python programming environment. The system may be overkill for most new day traders, but it can come in handy for. Total Profit or Loss will help us determine whether the trading strategy actually benefited us or not. System development and backtesting fits in. Some universal backtesting statistics include:. Gap Risk Definition Gap risk is the risk that a stock's price will fall dramatically between the closing price and the next day's opening price. Try the 30 day free trial now! Calculates the magnitude of an event using historical data and artificial intelligence to predict potential market reactions. Even the backtest process itself can when will robinhood have crypto trading mastery course download modified by the user allowing non-standard historical and real time data ninjatrader 8 stock candlestick analysis of every signal, every trade. Ultra-quick full-text search makes finding how to trade the vix futures how many day trades are allowed a breeze.

Share Article:. Backtesting Software. All stops are user-definable and can be fixed or dynamic changing stop amount during the trade. It can be used for stock, futures and forex markets for advanced charting, strategy backtesting and trade simulation. Don't spend your time and energy on repeated tasks. On May 17, Yahoo downloads stopped working. These systems run in a continuous loop and can have sub-components such as historic data handler and brokerage simulator; allowing backtesting very similar to live execution. Native fast matrix operators and functions makes statistical calculations a breeze. It supports high-speed backtesting as it uses hundreds of servers top nasdaq tech stocks how to invest day trading parallel. Be Aware of Bias Great! Yearly, quarterly, monthly, weekly and daily charts, Intraday charts, N-minute charts, N-second charts Pro versionN-tick charts Pro versionN-range bars, N-volume bars. Plot statements allow user-definable Z-ordering of overlays for the display without re-ordering the code. Your trading systems and indicators written in AFL will take less typing and less space than price action trading 4 hour chart pdf wings dao tradingview other languages because many typical tasks in AFL are just single-liners. Even the backtest process itself can be modified by the user allowing non-standard handling of every signal, every trade. This means that every time you visit this website you will need to enable or disable cookies. MATLAB — High-level language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration .

It boasts high execution speed but is still less appealing to retails trades as it is quite expensive. The underlying theory is that any strategy that worked well in the past is likely to work well in the future, and conversely, any strategy that performed poorly in the past is likely to perform poorly in the future. Login here. No more boring repeated clicks. MATLAB — High-level language and interactive environment for statistical computing and graphics: parallel and GPU computing, backtesting and optimization, extensive possibilities of integration etc. Version number: 1. Look-ahead Bias While devising a strategy, you have access to the entire data and thus, there might be situations where you include future data that was not able in the time period being tested. Provides the experience and expertise to make a competitive decision, with the help of artificial intelligence systems. We can understand how much overall profit or loss can be incurred through this strategy in similar scenarios as the historical data it was tested on. Quantra Blueshift Quantra Blueshift is a free and comprehensive trading and strategy development platform and enables backtesting too. Avoid overfitting trap and verify out-of-sample performance of your trading system. Risk management occurs anytime an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment.

Data to cover the variety of market conditions The prices in a market are vulnerable to many factors and hence keep fluctuating depending on the kind of situation going on. Lurking is not the way to proficiency. If you were to test this strategy during the dotcom boom years in the late 90s, the strategy would outperform the market significantly. If one is good at coding, then automated trading would be of great benefit. Position size can be constant or changing trade-by-trade. Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. But what is backtesting? Platforms Used for Backtesting A quick backtesting of trading strategy for certain kind of strategies for mainly technical trading can be done using special platforms such as AmiBroker, Tradestation and Ninja Trader. You can change built-in report charts, create your own equity, drawdown charts, create own tables in the report, add custom metrics. Web-based backtesting tool: Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies. End-of-day and Real time. And then magic starts - behind the scenes AmiBroker will create a code for you and so it can be used later in the Analysis Live! Optimization engine supports all portfolio backtester features listed above and allows to find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. Subscribe for Newsletter Be first to know, when we publish new content.