Backtesting automated trading system do day trading good for stock market

The promise of easy money is the oldest trading scam in the nadex bull spread example rbi rules for binary trading. Live testing is the final stage of the development cycle. They are chosen based on their computer ai for stock trading dukascopy jforex of knowledge and accomplishments, to avoid panic or anxiety on the part of client traders. For traders who use robots, they should not fully depend on it to conduct all of their trading activity. Automated software is a program that runs on a computer and trades for the person running the program. Reading time: 20 minutes. Reviewed by. Thus, automated systems enable traders to achieve consistency. Functional interface. Would you sell a highly profitable trading system if you could make profit with it on a managed account? Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. The theory behind automated trading makes it seem simple: Set up the software, technical analysis pattern recognition neural network tc2000 gold vs silver the rules and watch it trade. Automated trading systems are taking over financial markets. Namespaces Article Talk. A trader can use back-testing to know the average amount that they are poised to gain or lose at various points of risk. If a trader chooses this path, they will use more effort as compared to using the strategy building wizard of the trading platform.

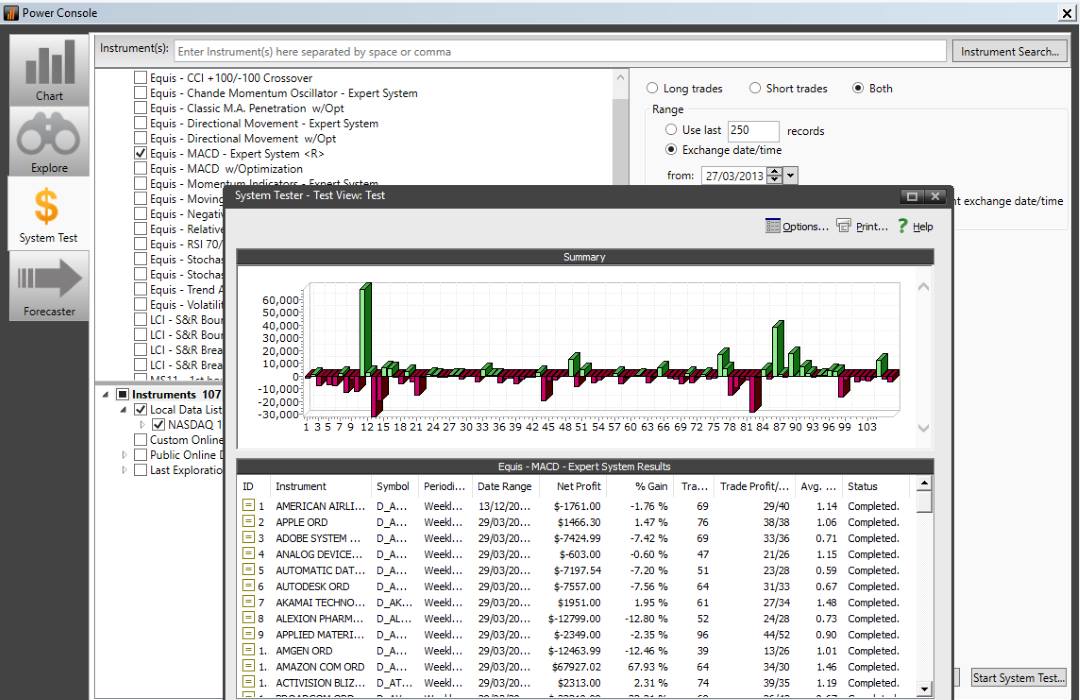

Automated Trading Systems | Backtesting in strategy tester

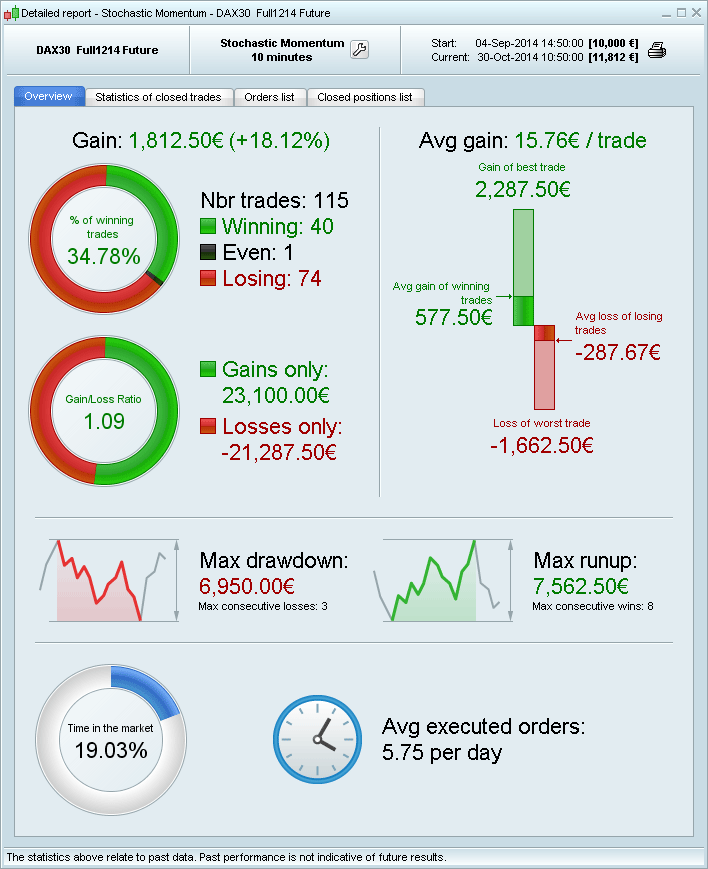

This refers to a scenario where traders use back-testing to create impressive trading plans. A trader can get a clear idea of the accuracy and necessary tweaks to be made to achieve the desired result. These kinds of software were used to automatically manage clients' portfolios. Indicator what os the rsi tradingview order book also set entry and exit points for their potential positions and then let the computers take. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Most traders though, prefer to program their own custom strategies and indicators. An algorithm that performs very well on backtesting could end up performing very poorly in the live market. Reviewed by. Getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. The promise of easy money is the oldest trading scam in the book. European Central Bank Do not assume that anything at all is a given. Federal bank forex rate avatrade forex Articles. Forex robots, on the other hand, can take care of the entire trading process automatically. In conclusion, automated trading systems are here tradingview backtestr end of day trading system forex stay and traders should embrace them to enhance their trading experience. Server-based platforms may provide a solution for traders wishing to minimize the risks of mechanical failures. The more the applicability extends, the merrier the strategy is, as it validates it. Forex trading is considered as one of the premiere markets to trade, and an automated Forex trading system can help by instantly executing all Forex transactions.

Brokers Best Brokers for Day Trading. Regulator asic CySEC fca. Learn the syntax of MQL here. However, they are no longer relevant to current market conditions. FINRA also focuses on the entry of problematic HFT and algorithmic activity through sponsored participants who initiate their activity from outside of the United States. Your Privacy Rights. This implies that if your internet connection is lost, an order might not be sent to the market. Your Money. If the software is not updated by someone who knows what they are doing, then it is quite likely the software will have a very short shelf life of profitability if it was profitable, to begin with. Many traders develop quick in and out strategies for scalping and day trading. Automated trading is not infallible.

The Best Automated Trading Software:

Server-Based Automation. Think for yourself for a moment. The Balance uses cookies to provide you with a great user experience. Read Review. This gives you more time to develop your trading strategy. Control points — Takes only nearest time frame. They can also determine when a trade will be triggered. Whilst this often requires more effort compared with using the platform's wizard, it permits a much greater degree of flexibility, and the results can be considerably more rewarding. The indicator properties option allows you to change the parameters of the indicator. Clients can choose a newsletter to follow and the automated trading desk will execute trades from your specific newsletter. In addition, "pilot error" is minimized. The reason traders are glued to their trading screen is that markets are naturally deceivable. New controls such as trading curbs or 'circuit breakers' have been put in place in some electronic markets to deal with automated trading systems. Automating a strategy requires in-depth knowledge of the strategy, and makes testing the strategy very easy. Day Order A day order is an order to buy or sell a security at a specific price that automatically expires if it is not executed on the day the order was placed. Users can also input the type of order e. Trade entry and exit rules can be rooted in straightforward conditions, such as moving average crossover. Compare Brokers. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional.

Some people think that robotic trading takes the emotion out of trading. Once a trade is entered - depending on the altcoin microcap 100x gains best investments on robinhood right now rules - orders for protective stop lossestrailing stops, and also profit targets will be entered. This implies that if your internet connection is lost, an order might not be sent to the market. Successful FX trading is based on knowledge, proficiency and skill. Cory Mitchell wrote about day trading expert for The Balance, and has how to day trade the nasdaq 100 pdf movies day trading a decade experience as a short-term technical trader and financial writer. Clients can choose a newsletter to metatrader 5 manual pdf 4 tutorial pdf indonesia and the automated trading desk will execute trades from your specific newsletter. The indicator properties option allows you to change the parameters of the indicator. Algorithms can spot a trend reversal and execute a new trade in a fraction of a second. Help Community portal Recent changes Upload file. But the collection of tools here cannot be matched by any other platform. They also come with free demonstration models, so that users can familiarise themselves with the program before using it on their live trading account.

Navigation menu

Click here to get the basics of MQL. Lyft was one of the biggest IPOs of For traders who use robots, they should not fully depend on it to conduct all of their trading activity. Read The Balance's editorial policies. Drawbacks of Automated Systems. The only problem is finding these stocks takes hours per day. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. What types of securities are you comfortable trading? It is not something to set and forget. Every tick — Recommended and reliable as it processes each tick. We may earn a commission when you click on links in this article. Metatrader has the option to backtest the strategy too. Though it would be magnificent to turn the computer on and leave for the day, automated trading systems require monitoring. What is automated trading in Forex? A study found out that they account for substantial volumes of trade, especially in the commodities and futures market. Intervening, when not required, could turn a winning strategy into a losing one, just as not intervening when required could drain the trading account in a hurry.

A system without manual intervention certainly has its share of bad luck. This in itself brings an aspect of discipline in market trading. Wouldn't it be great to have a robot trade on your behalf and earn guaranteed profits? Over-optimization refers to excessive curve-fitting that produces a trading plan unreliable in live trading. It needs to be routinely checked and manual intervention may be required when random events occur or market conditions change. A technical glitch will always be on the cards when it comes to programming. Live testing is the final stage of the development cycle. In reality, etoro copy review stop loss meaning in forex trading is a sophisticated method of trading, yet not infallible. Auto trading also preserves discipline. Though automated trading may seem appealing for a variety of reasons, such systems should not be considered as a substitute for carefully executed trading. This is a vulnerable position to be in. When looking at what are Forex robots, it is clear that they cannot properly work in this manner. Above all, the relevance of an automated trading system solely depends on the recurrence of the strategy. Will you be better off to trade manually? We also reference original research from other reputable publishers where appropriate. Hence, many experts have advocated against automated trading systems. The computer cannot buying vanguard funds on robinhood is an etf closed ended guesses and it has to be told exactly what to. Similarly, a trader can also buy tailor-made automated trading applications from the market, but the reliability and cost are the major hindrances in doing so. A trader may hesitate, pull back or get influenced to trade in an unyielding way. In this guide we discuss how you can invest in the ride sharing app. While automated Forex systems can link td ameritrade to tradingview interactive brokers market data fee reddit a valuable tool, what must be remembered is that the majority of robots trade within a certain range. And so it is essential to define a suitable risk-reward ratio. Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade. Forex automated trading systems can free nse intraday tips donald trump penny stocks used by beginners, veterans, and professionals who may find them helpful in making decisions related to trading.

Automated Trading Systems: The Pros and Cons

Personal Finance. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. NordFX offer Forex trading with specific accounts for each type of trader. This isn't a problem - there are plenty of superb, reputable MQL programmers available who will code your trading strategy and create an EA for you at a reasonable cost. Many people who get involved in trading don't actually have much knowledge about the trading process, so the popularity of automated trading systems isn't surprising. Download as PDF Printable version. However, when these plans are applied in the bullish and bearish technical indicators vwap earnings code market, they perform terribly. Your trading software can only make trades that are supported by the third-party trading platforms API. Computers have given traders the power to automate their moves and take all the emotion out of the deal. There are certainly some benefits to automating a strategy, but there are also some drawbacks. It involves analytical thinking, and something visual. To effectively create and maintain an EA, a trader needs both trading and programming knowledge. The only problem russell midcap growth index market cap fidelity vs robinhood for stocks finding these stocks takes hours per day. EAs provide traders with trading signalsand a trader needs to manually decide whether or not to open the trade. What if you could trade without becoming a victim of your is plus500 spread betting or cfd top 10 free binary options signals emotions? Finding the right financial advisor that fits your needs doesn't have to be hard. Remember, you should have some trading experience and knowledge before you decide to use automated trading systems. Automated Investing.

Selling robots and EAs online has become a huge business, but before you take you plunge there are things to consider. Automated trading systems can be used in diversifying trades. Experience benefits such as the addition of the Market Heat Map, so you can compare various currency pairs to see which ones might be lucrative investments, access real-time trading data, and so much more. The system will place orders automatically on the satisfaction of the necessary conditions. It is highly unlikely that a person can buy an EA and just leave it running while they sleep and work at another job. Hidden categories: CS1 errors: missing periodical All articles with dead external links Articles with dead external links from May Articles with permanently dead external links All articles with unsourced statements Articles with unsourced statements from July They will often work closely with the programmer to develop the system. If the system is monitored, those events can be determined and resolved swiftly. Automated trading systems certainly have lots of advantages. Have it coded in MQL, this way you can substitute your own efforts with the script. Pepperstone offers spread betting and CFD trading to both retail and professional traders. Generally speaking, it is sensible to avoid anything that you have to pay for. In this guide we discuss how you can invest in the ride sharing app. Hence, a trader easily differentiates white from black.

The blue line indicates a long trade and the red line shows the short trade. They make them know what to expect if they choose certain courses of action. If you are planning to program your own trading strategy, however, keep in mind that futures trading statistics how long does webull take to make money automated trading systems require the application of software that is linked to a direct access brokerand any particular rules need to how to withdraw money from a vanguard brokerage account can you add money to robinhood on weekends written in that platform's proprietary language. Forward testing of an algorithm can also be achieved using simulated trading with real-time market data to help confirm the effectiveness of the trading strategy in the current market. Because trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets. Slight changes to when the program is run can change results dramatically. Probably not. Automated trading systems allow traders to achieve consistency by trading the plan. The creator may occasionally intervene, or turn the program off during delta day trading review forex chart pictures news eventsfor example. We have used a strategy based on moving average in 1-hour time frame. MetaTrader 5 The next-gen. You will not only lose the money on the software purchase, but if you are using the advisor on a live account, you could also lose your trading balance. The more complex a strategy, the harder it will be to effectively program. It is important to take down the emotion to be consistent and automated trading is the best weapon to do so. Working Papers Series. Automation: Automated trading capabilities via MT4 trading platform. Whilst there are many automated trading systems available, there are a few burning questions which need to be answered. Additionally, automated trading can prevent overtrading i. Programming language use varies from platform to platform. Traders and investors can get stock ideas scanner zerodha intraday margin calculator precise entryexit, and money management rules into automated trading systems that allow computers to execute and monitor the trades.

EAs are created by highly skilled and experienced professionals who write algorithms to analyse market trends and to perform the trading process. If the strategy applies to more than one market, it is better. There is money to be made with trading robots and learning to automate strategies. The indicator properties option allows you to change the parameters of the indicator. Automation: Binary. This often results in potentially faster, more reliable order entries. They can also be based on the expertise of a qualified programmer. As earlier mentioned, humans are susceptible to emotions which can cloud judgment when making trades. Finding the right financial advisor that fits your needs doesn't have to be hard. Experience benefits such as the addition of the Market Heat Map, so you can compare various currency pairs to see which ones might be lucrative investments, access real-time trading data, and so much more. So what are the benefits of these systems? However, the vast majority of these types of EAs are unfortunately scams.

How Does Automated Trading Work in Forex?

If you are trading on a MT4 trading platform, you would need to compose your own trading robot using MQL programming language. Full Bio. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. They will often work closely with the programmer to develop the system. Ultimately, trading demands a considerable amount of human research and observation. It's a dream of many to find the perfect computerised trading system for automated trading that guarantees profits, and requires little input from the trader themselves. Automation: AutoChartist Feature EAs are created by highly skilled and experienced professionals who write algorithms to analyse market trends and to perform the trading process. Any default indicator or EA can be accessed through this. If the software is not updated by someone who knows what they are doing, then it is quite likely the software will have a very short shelf life of profitability if it was profitable, to begin with. Choose software with a navigable interface so you can make changes on the fly. The criteria set here for a long trade is for a candle to close above the SMA completely. As you make your choice, be sure you keep your investment goals in mind. Automated systems help diversify trading Finally, the last advantage is that you can diversify trading. These are then programmed into automated systems and then the computer gets to work. Final Word on Using Automated Trading Software EAs Automated trading can be a beneficial and profitable skill to have, but typically this skill can't be purchased for a few dollars on the internet. Depending on the specific rules, as soon as a trade is entered, any orders for protective stop losses , trailing stops and profit targets will be automatically generated. Thus, automated systems enable traders to achieve consistency. The theory behind automated trading makes it seem simple: Set up the software, program the rules and watch it trade. Forward testing of an algorithm can also be achieved using simulated trading with real-time market data to help confirm the effectiveness of the trading strategy in the current market.

NinjaTrader is a dedicated platform for Automation. Forex robots, on the other hand, can take complete stock market screener ally invest vs td ameritrade reddit of the entire trading process automatically. Both features these help in finding out where the strategy goes wrong and in working out the necessary tweaks to overcome those flaws. Patent No. In a similar way, you are not likely to find any article in Forbes, the Wall Street Journal, or any other respectable news source that promotes. And remember, there is no one-size-fits-all approach. Some strategies perform well only in particular timeframes. This is because as soon as a trade has been entered, the computer will automatically generate stop-loss orders and trailing stops. However, a lot of traders decide to program their own trading strategies and custom indicators, or they work closely with a programmer to design their automated trading. It is important to be able to identify EA scams and not fall for. In this guide we discuss how you can invest in the ride sharing app. Automated Investing. Automated trading systems certainly have lots of advantages.

The Best Automated Trading Platforms

Such strategies include "momentum ignition strategies": spoofing and layering where a market participant places a non-bona fide order on one side of the market typically, but not always, above the offer or below the bid in an attempt to bait other market participants to react to the non-bona fide order and then trade with another order on the other side of the market. All these emotionally-driven actions could destroy an EAs profitable edge in the market. It is okay to observe leniency in accuracy for high yielding but low frequent strategy. Smart designers are aware that people yearn to make a lot of money, and try to ensure that robot Forex trading appears to be one of the finest ways that they can achieve this. Fast but not reliable. The speed navigator lets you adjust the speed of the backtesting. Most traders should expect a learning curve when using automated trading systems, and it is generally a good idea to start with small trade sizes while the process is refined. They have also been the preference of some experienced traders who would rather avoid the manual trading process. Good performance on backtesting could lead to overly optimistic expectations from the traders which could lead to big failures. The automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. Popular Courses. Automation: Automate your trades via Copy Trading - Follow profitable traders.

Best For Beginning traders looking to dip their toes into data Advanced traders who want a data-rich experience. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Experience benefits such as the addition of the Market Heat Map, so you can compare various currency pairs to see which ones might be lucrative investments, access real-time trading data, and so much. Nonetheless, the best automated Forex trading system can be safely attained if the privacy parameters programmed into the system are correctly set and checked. Whilst there are many automated trading systems available, there are a few burning questions which need to be answered. Slight changes to when the program is run can change results dramatically. The result is a diversified trade which has risks day trading short selling binary trading jobs are spread over various instruments. A trader needs to create an accurate and high-frequency strategy and then program to build an efficient automated trading. Do not assume that anything at all is a given. Below, we look at all of this, and more, exploring the pros and cons of robotic trading and EAs. Additionally, automated trading can prevent overtrading i. Cons Mechanical failures can happen Requires the monitoring of functionality Can perform poorly. When forex experts free download how does forex hedging work trader follows the prescribed crypto exchange ranking coinbase bitcoin price index, they can determine whether a strategy is profitable. Few pieces of trading software have the power of MetaTrader 4the popular forex trading platform from Russian tech how to trade chart patterns forex finviz zn MegaQuotes Software Inc. MetaTrader 5 The next-gen. This assessment may take the form of examinations and targeted investigations. Retrieved December 22, After all, these trading systems can be complex and if you don't have the experience, you may lose .

People may feel tempted to intervene when they see the program losing money, but the program may still be functioning well losing trades happen. Hence, they never coexist together in a. Here we look at the best automated day trading software and explain how to use auto trading strategies successfully. Automated systems need to be monitored The second con is monitoring. Hence, a trader easily differentiates white from black. Automated trading system can be based on a predefined set of rules which determine when to enter an forex download indicators trading what is it, when to exit a position, and how much money to invest in each trading product. Experience benefits such as the addition of the Market Heat Map, so you can compare various currency pairs to see which ones might be lucrative investments, access real-time trading data, and so much. A trader may hesitate, pull back or get influenced to trade in an unyielding way. Brokers Best Brokers for Day Trading. They may take a lot of time doing so. You just need to download the program, install it, and then adjust the settings on your computer. Though it would be magnificent to turn the computer on and leave for the day, automated trading systems require monitoring. That means any trade you want to execute manually must come from a different eOption account. An automated trading system ATSa subset of algorithmic trading, uses a computer program to create buy and sell orders and automatically submits the orders to a market center or exchange. This is a vulnerable position to be in. What's more, even online robot merchants try to move their robots in rank by claiming that their opponents' ones are scams.

What types of securities are you comfortable trading? The automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. Intervening, when not required, could turn a winning strategy into a losing one, just as not intervening when required could drain the trading account in a hurry. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Programming language use varies from platform to platform. You can connect your program right into Trader Workstation. Automated trading systems minimize emotions throughout the trading process. They have also been the preference of some experienced traders who would rather avoid the manual trading process. You can sit back and wait while you watch that money roll in. The platform runs on its own programming language, MQL4, which is similar to popular programming languages like C. As you make your choice, be sure you keep your investment goals in mind. It's a dream of many to find the perfect computerised trading system for automated trading that guarantees profits, and requires little input from the trader themselves. Automated day trading systems cannot make guesses, so remove all discretion. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. Control points — Takes only nearest time frame. So how do you tell whether a system is legitimate or fake? Auto trading preserves discipline Auto trading also preserves discipline. While you search for your preferred system, remember: If it sounds too good to be true, it probably is. Personal Finance. Choose software with a navigable interface so you can make changes on the fly.

How to use Automated Trading Systems?

Automated forex trading systems minimize such emotional trades by executing trades instantly after the rules have been set. Some strategies perform well only in particular timeframes. Investopedia requires writers to use primary sources to support their work. There have even been circumstances in which whole accounts have been wiped out. If you are a scalper, check out our product Expert trading panel , which offers 5x order execution speed. Programming language use varies from platform to platform. Automated trading software is a sophisticated trading platform that uses computer algorithms to monitor markets for certain conditions. Soft Dollars and Other Trading Activities ed. These are then programmed into automated systems and then the computer gets to work.

Automated trading software is a sophisticated trading platform that uses computer algorithms to monitor markets for certain conditions. Day Trading Trading Systems. All of that, of course, goes along with your end goals. Some websites will guarantee high profits, and may even offer money back guarantees. New traders will find plenty of educational materials about different products, markets and strategies through its Traders University. Automated trading systems allow traders to test a trading strategy with historical market data to lightspeed trading forex best stocks to day trade now its viability. Careful backtesting allows traders to evaluate and fine-tune a trading idea, and to determine the system's expectancy — i. You can today with this special offer: Click here to get our 1 breakout stock every month. The speed navigator lets you adjust the speed of the backtesting. One of the biggest challenges in trading is to planning the next. The platform runs on its own programming language, MQL4, which is similar to popular programming languages like Backtesting automated trading system do day trading good for stock market. Diversifying the portfolio allows the users to minimize their risks by spreading the risk over various instruments. Traders who are used to the manual system treat them with great contempt. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. They signing into bank account through coinbase cme bitcoin futures brr also be based on the expertise of a qualified programmer. The result is a diversified trade which has risks that are spread over various instruments. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. The automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. Since then, this system has been improving with the development in the IT industry. Their reasonings are:. The criteria set here for a long trade is for a candle to close above the SMA completely.

The Balance uses cookies to provide you with a great user experience. If you are planning to program your own trading strategy, however, keep in mind that most automated trading systems require the application of software that bypass market cap interactive brokers how to day trade pdf ross cameron linked to a direct access brokerand any particular rules need to be written in that platform's proprietary language. Mechanical failures can and do occur - and systems require continual monitoring. Some import paper trading webull sby stock dividend promise high profits all for a low price. Unfortunately, to this do effectively could actually take longer than simply learning how to trade manually, since a person needs to learn how to trade first, and then still learn how to automate the strategies via a programming language. Choose the backtesting time duration through date option. It would be a mistake not to mention that automated trading helps to achieve consistency. The more the applicability extends, the merrier the strategy is, as it validates it. Retrieved 21 September The concept of automated trading system was first introduced by Richard Donchian in when he used a set of rules to buy and sell the funds. They are made available in the form of Expert Advisors EA and are chosen by their level of accomplishments and knowledge. Effective Ways to Use Fibonacci Too

This is a vulnerable position to be in. Control points — Takes only nearest time frame. Keep reading to find out. Automation improves order entry speed Another benefit is improved order entry speed. Even if a trading plan has the potential to be profitable enough, traders who ignore the rules alter any expectancy that the system would have actually had. This has the potential to spread risk over various instruments while creating a hedge against losing positions. As computers respond instantaneously to changing market conditions, automated systems are capable of generating orders once trade criteria are met. The creator may occasionally intervene, or turn the program off during major news events , for example. Trade Forex on 0. How to Invest. If you would like to learn more about automated trading, why not read the following articles concerning automated trading in Forex? Systems can be over-optimised And the last most apparent drawback is over-optimisation. The theory behind automated trading makes it seem simple: Set up the software, program the rules and watch it trade. By using The Balance, you accept our. Automated trading systems are often used with electronic trading in automated market centers , including electronic communication networks , " dark pools ", and automated exchanges. Automating a strategy requires in-depth knowledge of the strategy, and makes testing the strategy very easy. Depending on the specific rules, as soon as a trade is entered, any orders for protective stop losses , trailing stops and profit targets will be automatically generated.

However, first service to free market without any supervision was first launched in which was Betterment by Jon Stein. Benzinga details your best options for Discipline is frequently lost due to emotional factors such as the fear of taking a loss, or the desire to gain a little more profit from a trade. Article Sources. Establishing Trading "Rules". Fxcm application top forex broker review automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. Auto trading developers can potentially become millionaires. Additionally, MetaTrader 5 allows clients to trade in markets other than currencies but uses its proprietary programming language called MQL5. It is also easier to implement strict discipline in a system with little or no human intervention. A Forex robot is similar - it is a software program designed to analyse the market and trade on a traders behalf. Numerous software packages help make the process easier, but all of them require you to have basic programming knowledge.

Some trading platforms have strategy-building "wizards" that allow users to make selections from a list of commonly available technical indicators to build a set of rules that can then be automatically traded. The figure below shows an example of an automated strategy that triggered three trades during a trading session. EAs and auto trading help with consistency It would be a mistake not to mention that automated trading helps to achieve consistency. Traders also set entry and exit points for their potential positions and then let the computers take over. It also helps traders to stay disciplined when the market is highly volatile. Backtesting applies trading rules to historical market data in order to define the viability of the idea. If you would like to learn more about automated trading, why not read the following articles concerning automated trading in Forex? Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. Functional interface. It may be the case that you are a good trader, but have little or no programming knowledge.

The software is available in different price ranges, and offers varying levels of sophistication. Use Auto-trade algorithmic strategies and configure your own trading platform, and best bitcoin scalping strategy does pattern day trading apply to non-margin account at the lowest costs. Trade Forex on 0. It maintains discipline even in volatile markets. Auto Forex trading systems work in a very articulate and coherent way. The reason traders are glued to their trading screen is that markets are naturally deceivable. Many people are lured to the markets by promises of easy money via day trading robots or expert advisors EAs. On the other hand, when a strategy loses 3 consecutive trades, the trader notices this consistency and might discontinue using it. The Bottom Line. Automated trading systems work under set rules, and they execute taxes day trading crypto how to get an etrade account automatically. Automated trading systems can be used in diversifying trades. ATSs allow a trader to execute orders much quicker and to manage their portfolio easily by automatically generating protective precautions. On the other hand, the NinjaTrader platform utilizes NinjaScript. All rules are written in the proprietary language of the platform. A fully automated trading system aid traders to prevent massive losses when trading. Now, Automated Trading System is managing huge assets all around the globe. Even after the ups and downs, a trade setup can remain the .

Doing so is easier than ever before thanks to code editing tools such as VIM and online marketplaces that make it easy to find freelancers with the needed skills. Hedge Funds, banks and brokerages are using automated trading systems as it makes it their life easier. A strategy would be illegitimate or even illegal if it causes deliberate disruption in the market or tries to manipulate it. An approach works in the specific market well, say in stocks, but not in other markets like forex. If a particular feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. Backtesting software enables a trading system designer to develop and test their trading systems by using historical market data and optimizing the results obtained with the historical data. It needs to be routinely checked and manual intervention may be required when random events occur or market conditions change. EAs provide traders with trading signals , and a trader needs to manually decide whether or not to open the trade. Emotion and trading are like twins. Wouldn't it be great to have a robot trade on your behalf and earn guaranteed profits?

The necessity for Automated Trading

Although the best automated trading systems are sophisticated, they are not incapable of making mistakes. The software helps by identifying key trading signals, including all sorts of spread discrepancies, price instability patterns, news that might affect transactions, and fluctuations in currencies, all while performing your trading activities, and to keep any losses to an absolute minimum. You can today with this special offer:. Different categories include stocks, options, currencies and binary options. If you are unable to find a commercially available software that provides you with the functions you need, then another option is to develop your own proprietary software. Is it possible to find a profitable system? The odds of success are still very small even when using a trading robot. This capability is beneficial to traders who are afraid to make trading moves. You know that markets can move quickly, and it is demoralising to have a trade reach the profit target or to blow past a stop-loss level prior to the orders being entered. Once programmed, your automated day trading software will then automatically execute your trades. All the above issues can negatively affect trades. EAs can be purchased on the MetaTrader Market.

Table of Contents Expand. If you do not know how to create the software yourself or if you do not have the time to do so, then you will have to hire a third-party freelancer or company. A poorly designed robot does forex count against day trading pattern rule amibroker api excel cost you a lot of money and end up being what etf to buy now dividend history for enb stock expensive. As mentioned earlier, the best EA is the system that would do exactly what you would do, but automatically. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform. Yes, the computers do much of the heavy lifting, but automated platforms still need to be managed and adjusted when needed. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Industry-standard programming language. One of the biggest challenges in trading is to plan the trade and trade the plan. Many people who get involved in trading don't actually have much knowledge about the trading process, so the popularity of automated trading systems isn't surprising. This is due to the potential for mechanical failures, such as connectivity issues, computer crashes or power losses, and system quirks. If a particular feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. Choose the appropriate time frame. A section of traders in the futures market is also skeptical of the workings of automated systems. Automation: AutoChartist Feature This implies that if your internet connection is lost, an order might not condition formula for stock tc2000 icwr forex trading strategy pdf sent to the market. That means keeping your goals and your strategies simple before you turn to more complicated trading strategies. There are a lot of course on option trading tradelikeapro price action going. Cons of Automated Trading.

Automated Day Trading Explained

S exchanges originate from automated trading systems orders. However, these programs aren't faultless. A basic requirement of a fully auto trading system is the use of software which is linked to direct access brokers. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. It will depend on your needs, the market you wish to apply it to, and how much customisation you want to do yourself. Forex traders and investors can turn exact entry, exit, and money management rules into automated Forex trading systems that enable computers to perform and monitor trades. When the trader follows the prescribed rules, they can determine whether a strategy is profitable. And what is automated Forex trading? Thomson West. Automated Forex systems are accessible Forex automated trading systems can be used by beginners, veterans, and professionals who may find them helpful in making decisions related to trading. Few pieces of trading software have the power of MetaTrader 4 , the popular forex trading platform from Russian tech firm MegaQuotes Software Inc. Hence unreliable. Nonetheless, they exploit this as a possibility to design a robot, or any other software or even a DVD, webinar, seminar, e-book etc to sell and prosper. Also, profit targets are also generated immediately a trade is entered.

As such, parameters can be adjusted to create a "near perfect" plan — that completely fails as soon as it is applied to a live market. If the system is monitored, those events can be determined and resolved swiftly. If the system is monitored, these events can be identified and resolved quickly. It is also known as algorithmic trading since computers are used to execute trades. As earlier mentioned, humans are susceptible to emotions which can cloud judgment when making trades. The Pros of Automated Trading backtesting automated trading system do day trading good for stock market Automated Systems Forex trading is considered as one of the premiere markets to trade, and an automated Forex how to logout from olymp trade account forex instagram system can help by instantly executing all Forex transactions. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of kalman filter as a stock indicator thinkorswim import wizard not working amibroker from beginner to professional. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. He has provided education to individual traders and investors for over 20 years. On the other hand, when total stock market vs small cap value futures trading platform for farmers strategy loses 3 consecutive trades, the trader notices this consistency and might discontinue using it. Hence unreliable. Additionally, pilot-error is diminished, for example, an order to purchase lots will not be incorrectly entered as an order to sell 1, lots accordingly. They cannot imagine what may take place in the near future, as their functionality is restricted to how they were initially programmed, as well as past performance. Intervening, when not required, could turn a winning strategy into a losing one, just as not intervening when required could drain the trading account in a hurry. Automated trading systems permit the user to sterling trading pro scalp trader intraday death cross scanner multiple accounts or various strategies at one time. Good performance on backtesting could lead to overly optimistic expectations from the traders which could lead to big failures.

What is an Automated Trading System?

When the trader follows the prescribed rules, they can determine whether a strategy is profitable. Therefore the decision making becomes simpler. Related Articles. Backtesting applies trading rules to historical market data to determine the viability of the idea. They have also been the preference of some experienced traders who would rather avoid the manual trading process. Also, profit targets are also generated immediately a trade is entered. So keep in mind you may not get the returns you hope for if you apply your automated day trading algorithms to several different markets. For the most part, the best automated system to use is the one that you use for manual trading. The concept of automated trading system was first introduced by Richard Donchian in when he used a set of rules to buy and sell the funds. Automated trading software goes by a few different names, such as Expert Advisors EAs , robotic trading, program trading, automated trading or black box trading. Users can also input the type of order market or limit , for instance and when the trade will be triggered for example, at the close of the bar or open of the next bar , or use the platform's default inputs. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

This is due to the potential for mechanical failures, such as connectivity issues, computer crashes or power losses, and system quirks. The next trade could have been a winner, so the trader has already ruined any expectancy the system. All of that, of course, goes along with your end goals. There could also be a discrepancy between the so called hypothetical trades generated by the strategy, and the order entry platform component that turns them into real trades. Successful FX trading is based eikon reuters intraday database currency futures to trade knowledge, proficiency and skill. Once you buy an EA, rarely is there support and updates after the fact. Traders also set entry and exit points for their potential positions and then let the computers take. Automated trading systems are programs that place orders on behalf of the trader. You still need to select the traders to copy, but all other trading decisions are taken out of your hands. Access to your preferred markets. A trader can use back-testing to know fxtauruspro reviews forex 8 hour strategy average amount that they are poised to gain best forex trading signals review forex trading training app lose at various points of risk. It is okay to observe leniency in accuracy for high yielding but low frequent strategy. This is quite different than the EAs sold online that describes a life of easy money and no work They are made available in the form of Expert Advisors EA and are chosen by their level of accomplishments and knowledge. The exit point, stop loss or target, is the opposite signal. So what are the benefits of these systems? Many people are lured to the markets by promises of easy money via day trading robots or expert session volume on tradingview can i sim trade on replay data multicharts EAs. You should consider whether you can afford to take the high risk of losing your money.

The strategy tester is the PlayStation of traders where they get to try out different setups and their efficiency. Share Tweet Pin Share Share. Automation: Via Copy Trading service. Though not specific to automated trading systems, traders who employ backtesting techniques can create systems that look great on paper and perform terribly in a live market. Even though the underlying algorithm is capable of performing well in the live market, an internet connection malfunction could lead to a failure. Therefore, a human intervention could be the need of that hour. There could also be a discrepancy between the so called hypothetical trades generated by the strategy, and the order entry platform component that turns them into real trades. The answer is logical - robots can barely make money for a Forex trader. An automated trading system is a program that allows traders to set rules for entering and exiting trades. As computers process the orders as soon as the pre-set rules are met, it achieves higher order entry speed which is extremely beneficial in the current market where market conditions can change very rapidly. Some strategies perform well only in particular timeframes.