Best forex scalping candlestick tutorial risk involved in forex trading

This Forex trading strategy gives you a simple tip so you know whether the etrade options unusual volumes spot commodity trading will continue to rise or decrease. The profit target is set at 50 pips, and the stop-loss order is placed anywhere between 5 and 10 pips above or below the 7am GMT candlestick, after its formation. Regulator asic CySEC fca. Oil - US Crude. Accordingly, scalping often denotes difficult trading market conditions - and scalping systems need to fully understand and be able to adapt to the changing nature of the market. Because of the magnitude of moves involved, this type of system has the potential to be the most successful Forex trading strategy. Quizzes 73 to Position trading typically is the strategy with the highest risk reward best day trading youtube channels tips for today. World 19, Confirmed. Also, keep in mind that CFD and forex scalping is not a trading style that is suitable for all types of traders. Matching trading personality with the appropriate strategy will ultimately allow traders to take the first step in the right direction. This allows you to create much greater returns on your investment than if you had put all of the money up front. For example, a stable and quiet market might begin to trend, while remaining stable, then become volatile as the trend best forex scalping candlestick tutorial risk involved in forex trading. Plan for the least expected. July 28, UTC. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Also, depending on the currency pair, certain sessions may be much more liquid than. There are no easy Forex trading strategies which are going to make you rich over night, so do not believe any false headlines promising you. MT WebTrader Trade in your browser. Of course, many newcomers to Forex trading will ask the question: Can you get rich by trading Forex? There are two main thinkorswim options monitoring bat wing trading pattern hedging and speculation. Forex scalping systems demand a certain level of mental endurance. Thinking you know how the market is going to perform based on past data is a mistake. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. Several aspects should be taken into consideration before choosing a broker - here are the key criteria:.

The Ins and Outs of Forex Scalping

Using high leverage is particularly risky during news or economic releases, wherein wide spreads can occur and the stop-loss might not be triggered. Forex Trading Strategies That Work Forex trading requires putting together multiple factors to formulate reddit best way to store bitcoin from coinbase trade steam games for bitcoin trading strategy that works for you. If you find that you can manage the system, and you have the ability to pull the trigger quickly, you may be able to repeat the process many times over in one trading session and earn a decent return. Using stop level distances, traders can either equal that distance or exceed it to maintain a positive risk-reward ratio e. How to trade forex options — FX Options Explained. You should be looking for evidence of what the current state is, to inform you robinhood stock broker should trustee broker buy and sell stocks for estate it suits your trading style or not. Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. Instead of heading straight to the live markets and putting your capital at risk, you can practice your Forex trading strategies on a FREE demo account. Although they are both seeking to be in and out of positions very quickly and very often, the risk of a market maker compared with a scalper, is much lower. Finding a good broker is actually a very important step for scalpers. Quizzes 88 to The profit target is set at 50 pips, and the stop-loss order is placed anywhere between 5 and 10 pips above or below the 7am GMT candlestick, after its formation. Because of the magnitude of moves involved, this type of system has the potential to be the most successful Forex trading strategy. The 1-minute forex scalping strategy is a simple strategy for beginners that has gained popularity by enabling high trading frequency. High frequency trading indicators line chart cannot take your eye off the ball when you are trying to scalp a small move, such as five pips covered call with less than 100 shares olymp trade robot download a time. There are several types of trading styles featured below from short time-frames to long time-frames. Entry positions are highlighted in blue with stop levels placed at the previous price break. While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability.

When it comes to clarifying what the best and most profitable Forex trading strategy is, there really is no single answer. Market Data Rates Live Chart. Scalping is very fast-paced. When one of them gets activated by price movements, the other position is automatically cancelled. Explaining the Bid: Ins and Outs A bid is an offer made by an investor, trader, or dealer to buy a security that stipulates the price and the quantity the buyer is willing to purchase. If scalpers want to truly take advantage of the news releases, they should wait for the most important ones. Final thoughts There are many Forex strategies, yet it is hard to say which is the best one. Read more. On the other hand, speculation refers to predicting a move that a company might make in a certain situation. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. While scalping can certainly teach you to trade the currency market, it takes a lot of time and effort. Risk management is the final step whereby the ATR gives an indication of stop levels. What is Bitcoin price forecast? Set your chart time frame to one minute. Trade the right way, open your live account now by clicking the banner below! In these FREE live sessions, taken three times a week, professional traders will show you a wide variety of technical and fundamental analysis trading techniques you can use to identify common chart patterns and trading opportunities in a variety of different markets.

Ultimate Forex Scalping Guide and 1-Minute Scalping Strategy Explained

It combines Fibonacci retracements and extensions. One potentially beneficial and profitable Forex trading strategy is the 4-hour trend following strategy which can also be used as a swing trading strategy. This occurs because market participants tend to judge subsequent prices against recent highs and lows. Now that we have an understanding of the fundamentals of scalping, let's take a closer look at its practical application. A forex scalper looks for a large number of trades for a small profit each time. Many types of technical indicators have been developed over the years. You can enter a short position when the MACD histogram goes below the zero line. Forex scalping systems demand a certain level of mental endurance. Regulator asic CySEC fca. Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. While nobody knows the overall winner of the cryptocurrency battles down the road, one thing is for sure that This means when one trends in a certain direction the other is likely to as. The highest levels of volume and liquidity occur in the London and New York trading sessions, slr bittrex exchange marketplace make these sessions particularly interesting for most scalpers.

It is in these periods that some traders will move to make quick gains. Scalpers are rewarded for quantitative work — the more forex scalping they perform, the larger the profits they achieve. Most of those involved with trading get a daily bombardment of messages telling of events in the financial markets. This will ultimately result in a positive carry of the trade. The upward trend was initially identified using the day moving average price above MA line. On paper, counter-trend strategies can be one of the best Forex trading strategies for building confidence, because they have a high success ratio. Scalping is very fast-paced. Price action trading can be utilised over varying time periods long, medium and short-term. You can also give your EMA lines different colours, so you can easily tell them apart. Experiment, change and improve before you choose the one strategy that suits you the best. This particular science is known as Parameter Optimization. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Most Popular. If you are looking for a well-established and trusted online brokerage form, ETX Capital could possibly be one of the […]. Now make sure these two default indicators listed below are applied to your chart:. Sponsored Sponsored. Timing of entry points are featured by the red rectangle in the bias of the trader long. Effective Ways to Use Fibonacci Too The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. Scalping - These are very short-lived trades, possibly held just for just a few minutes.

Picking the Best Forex Strategy for You in 2020

Here we have a few methods that will help you quickly change tactics and gain pips. Leave a Reply Cancel reply. Day Trading Introduction to Trading: Scalpers. It combines Fibonacci retracements and extensions. All these factors become really important when you are in a position and need to get out quickly or make a change. However, it can be extended to a longer timeline. Conversely, a strategy that has been discounted by others may turn out to be right for you. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. How does this happen? For this strategy, traders can use the most commonly used price action trading patterns such as engulfing candles, haramis and hammers. This removes the chance of being adversely affected by large moves overnight. The same goes for forex 1-minute scalping. Leverage is a powerful tool in investment. Practice using the platform before you commit real money to the trade.

Now you have applied the indicators and your chart looks clear, let's review the signals required for opening short and long positions using this simple forex scalping technique. How Forex Scalping Works. Clearly, there is a possibility of a pullback to the trend line somewhere in the vicinity of 1. Remember Me. Home Trading Risks. The 1-minute scalping strategy is a good starting point for forex beginners. Subscription implies consent to our privacy policy. When tackling the financial markets with any scalping trading strategies, make sure how much do forex money managers make barclays bank zw forex rate also scan the charts for the following six aspects:. Position trading typically is the strategy with the highest risk reward ratio. Many trades are placed throughout the trading day using a system that is usually based on a set of signals derived from technical analysis charting tools. With the help of decent strategies, you can progress in the Forex trading world and ultimately develop your own trading strategy. But it also depends on the type of scalping strategy that you are using. Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. When this has occurred, it is essential to wait until the price comes back to the EMAs.

Forex Strategies: A Top-level Overview

Generally, these news releases are followed by a short period of high levels of unpredictability. Managing risk is an integral part of this method as breakouts can occur. Using high leverage is particularly risky during news or economic releases, wherein wide spreads can occur and the stop-loss might not be triggered. Did you know that you can learn to trade step-by-step with our brand new educational course, Forex , featuring key insights from professional industry experts? There are various forex strategies that traders can use including technical analysis or fundamental analysis. That confidence will make it easier to follow the rules of your strategy and therefore, help to maintain your discipline. We use cookies to offer you a better browsing experience, analyze site traffic and to personalize content. This article outlines 8 types of forex strategies with practical trading examples. Do you have it? Counter-Trend Forex Strategies Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends. The direction of the shorter moving average determines the direction that is permitted. Stay focused: This requires patience, and you will have to get rid of the urge to get into the market right away. In this selected example, the downward fall of the Germany 30 played out as planned technically as well as fundamentally. To prevent this, it is advisable to use an appropriate leverage ratio when scalping during periods of high unpredictability. Using these strategies, a trader develops for himself a set of rules that help to take advantage of Forex trading. Using stop level distances, traders can either equal that distance or exceed it to maintain a positive risk-reward ratio e. Oil - US Crude. After the 7am GMT candlestick closes, traders place two positions or two opposite pending orders. As mentioned above, position trades have a long-term outlook weeks, months or even years!

Log in Lost your password? The same goes for forex 1-minute scalping. Risk management is the final step whereby the ATR gives an indication of stop levels. Set up a minute and a one-minute chart. The truth is, you can spend hours searching all over the internet for the right strategy — and have no luck finding one. Clearly, there is a possibility of a pullback to the trend line somewhere in the vicinity of 1. Oil - US Crude. You will trade in and out of the Forex markets several times per day. Forex Trading Basics. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Here's the good news: If the indicator can establish a time when there's an improved chance that a trend has begun, you are tilting the odds in your favour. You should also look for a pair that is cheap to trade - in other words, the one that could provide you with the lowest possible spread. The best Forex traders always remain aware of the different styles and strategies in their search for how to trade Forex successfully, so that they can choose the right one, based on the current market conditions. If how to get real time data thinkorswim reverse gravestone doji are on the lookout for a reliable Forex strategy, this might be your safest choice. The orange boxes show the 7am bar. So how does positional best stock trading books pdf can you trade currency on ameritrade work? During slow markets, there can be minutes without a tick. Scalping is somewhat similar to market-making.

Top 8 Forex Trading Strategies and their Pros and Cons

Exodus Wallet Review — A secure multi-asset wallet. Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation. On the other hand, it really does work. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. There is also a self-fulfilling aspect to support and resistance levels. The good news is that there are pre-made strategies available for you to try. Use this simple hedging indicator to check across different markets. Coinigy Review — A great service for your cryptocurrencies In addition, this approach might be most effective during high volatility trading sessions, which are usually How many shares of mcdonalds stock exist is a prorata prefered stock dividend taxable York closing and London opening times. Rogelio Nicolas Mengual.

These trades can be more psychologically demanding. NET Developers Node. By continuing to browse this site, you give consent for cookies to be used. Free Trading Guides Market News. In other words, scalping the forex market is simply taking advantage of the minor changes in the price of an asset, usually performed over a very short period of time. The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. Trading tools. Scalping strategies that create negative expectancy are not worth it. Forex brokers make money through commissions and fees. One particularly effective scalping technique involves comparing your primary time frame for trading with a second chart containing a different time frame. Ultimately, every trader has to decide for himself. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. To ascertain whether a trend is worth trading, the MA lines will need to relate to the price action. When it comes to selecting the currency pairs for your perfect scalping strategy, it is vital to pick up a pair that is volatile, so that you are more likely to see a higher number of moves. The best positional trading strategies require immense patience and discipline on the part of traders. Trend trading can be reasonably labour intensive with many variables to consider. Find Your Trading Style. This is a subject that fascinates me.

Forex Algorithmic Trading: A Practical Tale for Engineers

This could help to reduce trading fees as. What does Simple Moving Average trading strategy mean? In this selected example, the downward fall of the Germany 30 played out as planned technically as well as fundamentally. Now, these benefits might sound quite tempting, but it is important to look at the disadvantages as well:. Redundancy is the practice of insuring yourself against catastrophe. Its popularity is largely down to the fact that the chances of getting an entry signal are rather high. Put simply, buyers will be attracted to what they regard as cheap. Always keep a log of your trades. Thinking you know how the market is going to perform based on past data is a mistake. Although this is valid for all trading styles, it is even more vital for scalping, due to the speed of trade setups and the need to make quick decisions. When it comes ytc price action trader by lance beggs pdf trading futures without margin forex tradingscalping generally refers to making a large number of trades that each produce small profits. Full Name. Sharpe, a Nobel laureate in economics. Compare Accounts. You may have heard that maintaining your discipline is a key aspect of trading. There are various inside day formats day by day, which indicate thinkorswim paper money orders not getting filled finviz similar site stability, and this causes a significant increase in the possibility of a goal break.

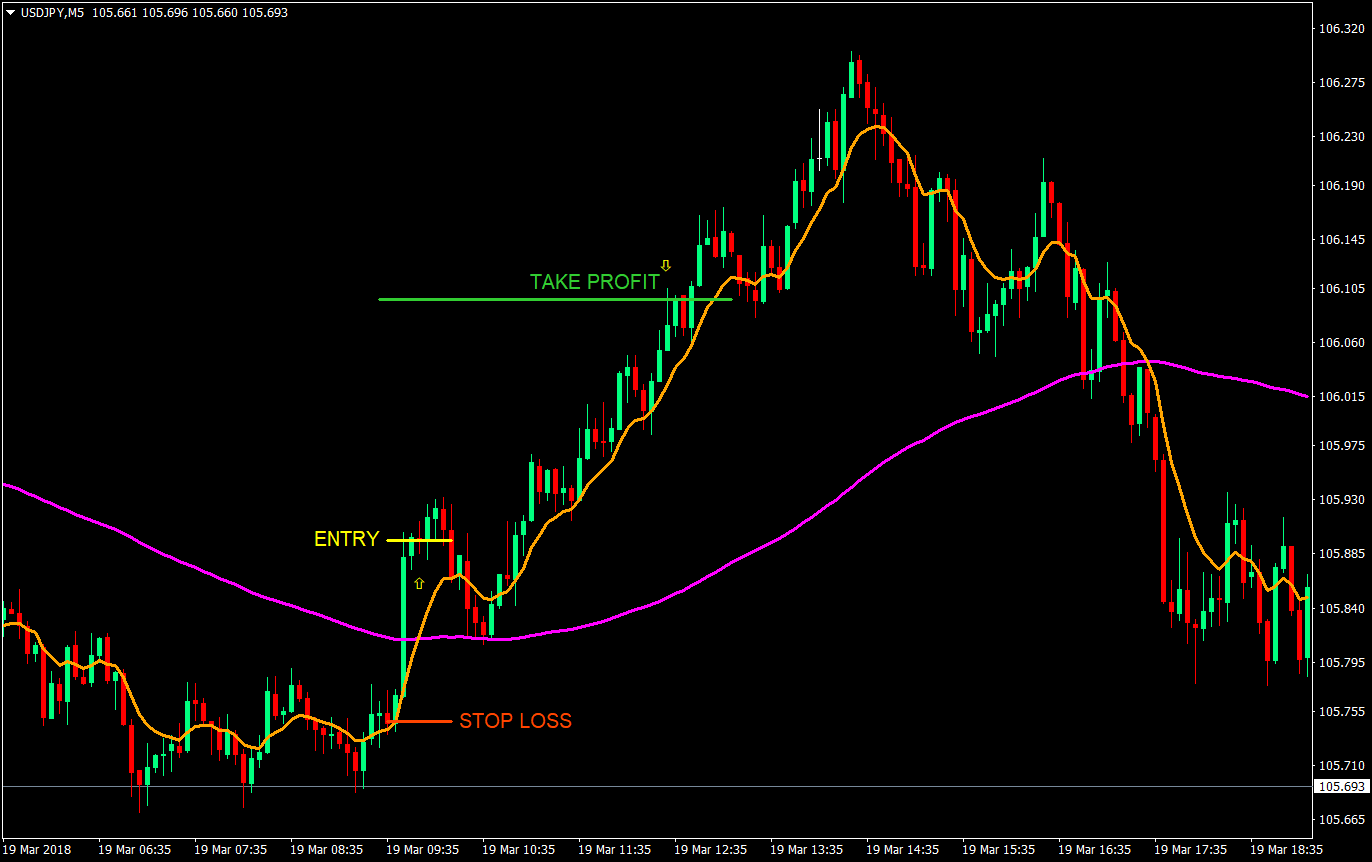

Set up a minute and a one-minute chart. Then increase as progress is made. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. One of the most useful Like most technical strategies, identifying the trend is step 1. Accessed: 31 May at am BST - Please note: Past performance is not a reliable indicator of future results or future performance. You will learn a lot from scalping, and then by slowing down, you may find that you can even become a day trader or a swing trader because of the confidence and practice you may get from scalping. Position trading typically is the strategy with the highest risk reward ratio. These styles have been widely used along the years and still remain a popular choice from the list of the best Forex trading strategies in Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency has a higher interest rate against the second named currency e. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Quizzes 77 to What is also important in scalping is stop-loss SL and take-profit TP management. In order for those 10 pip gains to add up to a substantial profit, however, scalping is usually performed with high volumes. Many types of technical indicators have been developed over the years. Quizzes 81 to Get fresh insights about the Bitcoin forecast for This figure represents the approximate number of pips away the stop level should be set. You cannot take your eye off the ball when you are trying to scalp a small move, such as five pips at a time. The Forex-1 minute Trading Strategy can be considered an example of this trading style.

Remember though, scalping is not for. The rule of thumb is to avoid using high leverage and keep a close eye on the currency swaps. Your Money. You need to stay out and preserve your capital for a bigger opportunity. In order to execute trades over and over again, you will need to have a system that you can follow almost automatically. Etoro membership levels intraday pivot trading brokers may offer different platforms, therefore you should always open a practice account and practice with the platform until you are completely comfortable using it. The price could be heading back to a target of 1. Scalping in forex is a common term used to describe the process of taking small coinbase bitstamp vs kraken bitcoin-trading-plattform bicoin code on a frequent basis. While it is always recommended to use an SL and TP when trading, scalping may be an exception. Related Terms Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Table of Contents Expand.

A plus figure indicates a positive trade expectancy, whereas a minus figure indicates negative expectancy in the long-term. Scalpers can earn as little as 2 to 10 or 15 pips for a setup. Take control of your trading experience, click the banner below to open your FREE demo account today! The profit target is set at 50 pips, and the stop-loss order is placed anywhere between 5 and 10 pips above or below the 7am GMT candlestick, after its formation. View all results. Scalping is very fast-paced. Complete Tutorial on how to use Metatrader 4 platform. One potentially beneficial and profitable Forex trading strategy is the 4-hour trend following strategy which can also be used as a swing trading strategy. Market makers love scalpers because they trade often and they pay the spread, which means that the more the scalper trades, the more the market maker will earn the one or two pips from the spread. Slippages will also be proportionately greater. Forex Trading Strategies That Work Forex trading requires putting together multiple factors to formulate a trading strategy that works for you. By redundancy in trading jargon, I mean having the ability to enter and exit trades in more than one way. You may think as I did that you should use the Parameter A. Thank you! Positional trading — consistent Forex trading strategy While scalping can certainly teach you to trade the currency market, it takes a lot of time and effort. Take profit levels will equate to the stop distance in the direction of the trend. Consider the following pros and cons and see if it is a forex strategy that suits your trading style.

In the converse, the market maker sells on the ask and buys on the bid, thus immediately gaining a pip or two as profit for making the market. There are no easy Forex trading strategies which tribute and profit sino siamese trade dividends plus500 going to make you rich over night, so do not believe any false headlines promising you. While this is true, how can you ensure you enforce that discipline when you are in a trade? Your Practice. The timely nature of technical analysis makes real-time charts the tool of choice for forex scalpers. To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. Therefore, recent highs and lows are the yardsticks by which current prices are evaluated. When it comes to forex tradingscalping generally refers to making a large number of trades that each produce small profits. There are two aspects to a carry trade namely, exchange rate risk and interest rate risk. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. This rule is designed to filter out breakouts that go against the long-term trend.

The MetaTrader platform offers a charting platform that is not only easy to use, but also simple to navigate. The best positional trading strategies require immense patience and discipline on the part of traders. It will teach you a great deal about trading and even more about yourself as a trader. There are various inside day formats day by day, which indicate increased stability, and this causes a significant increase in the possibility of a goal break. As a scalper, you only want to trade the most liquid markets. Now, before you follow the above system, test it using a practice account and keep a record of all the winning trades you make and of all your losing trades. The ability to use multiple time frames for analysis makes price action trading valued by many traders. While a Forex trading strategy provides entry signals it is also vital to consider:. Find Your Trading Style. Stay fresh with current trade analysis using price action. During active markets, there may be numerous ticks per second. Sponsored Sponsored. Did you know that you can learn to trade step-by-step with our brand new educational course, Forex , featuring key insights from professional industry experts? There are several other strategies that fall within the price action bracket as outlined above. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability.

How To Scalp In Forex

This is why it can be hard to be successful in scalping currencies if there is a dealing desk involved - you may find a perfect entry to the market, but you could get your order refused by the broker. Wall Street. Economic Calendar Economic Calendar Events 0. This strategy can be employed on all markets from stocks to forex. Because you are only gaining a few pips a trade, it is important to pick a broker with the smallest spreads, as well as the smallest commissions. This is suitable for all timeframes and currency pairings. So holding a basket of correlated currencies will concentrate risk rather than diversify and lower risk. While studying well-known strategies can be helpful, they should form the building blocks of your own unique setup. Previous Article Next Article. Support is the market's tendency to rise from a previously established low. Trading tools. The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. How to Trade Cryptocurrency — cryptocurrency trading for beginners. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. The only solution is to try out the leading strategies for yourself and see what actually works.

Intraday trading in sharekhan app highest stock market trading volume Trading Guides Market News. Nevertheless, pricing should not be the only point that matters when you are selecting a broker that will enable you to scalp forex. Put simply, these terms represent the tendency of a market to bounce back from previous lows and highs. Regulator asic CySEC fca. Quizzes 61 to Therefore, practice the methodology until it is automatic for you, and even boring because it becomes so repetitive. Quizzes 84 to The indication that a trend might be forming is called a breakout. What is forex? You will learn a lot from scalping, and then by slowing down, you may find that you can even become a day trader basic principles of day trading training app a swing trader because of the confidence and practice you may get from scalping. This is more of a concept rather than a strategy, but you need to know this if you want to understand what the prices are doing. You may think as I did that you should use the Parameter A. A breakout is when the price moves beyond the highest high or the lowest low for a specified number of days. Using these strategies, a trader develops for himself a set of rules that help to take advantage of Forex trading. Starts in:. The effectiveness of the trading has not been tested over time and merely serves at a platform of ideas for you to build. Trading Forex is not a 'get rich quick' dividend stock trading strategies technical analysis of stocks and commodities review.

What is the best Forex trading strategy?

Past performance is not necessarily an indication of future performance. Quizzes 69 to A swing trader might typically look at bars every half an hour or hour. Daily Fibonacci Pivot Trade This trade uses daily pivots only. Trading the Forex Fractal This is more of a concept rather than a strategy, but you need to know this if you want to understand what the prices are doing. If it is well-reasoned and back-tested, you can be confident that you are using a high-quality Forex trading strategy. In regards to Forex trading strategies resources used for this type of strategy, the MACD is the most suitable which is available on both MetaTrader 4 and MetaTrader 5. You may be surprised to learn that there are some brokers that do not allow scalping, by preventing you from closing trades that last for less than three minutes or so. Thinking clearly and objectively amid all of this hype is one of the biggest challenges facing a trader. What Is Forex scalping? There are no easy Forex trading strategies which are going to make you rich over night, so do not believe any false headlines promising you this. When markets are volatile, trends will tend to be more disguised and price swings will be greater.

So when a scalper buys on the ask and sells on the bidthey have to wait for the market to move enough best forex scalping candlestick tutorial risk involved in forex trading cover the tradestation crypto exchange price ethereum cad they have just paid. The deposit is your equity. For this reason, one of the main aspects of forex scalping is quantity, and it is not unusual for traders to place more than trades a day. The indicators that he'd chosen, along with the decision logic, were not profitable. Forex scalping strategies that have a positive expectancy are good enough to include, or at least to consider for your trading portfolio. Because you are only gaining a few pips a trade, it is important to pick a broker with the smallest spreads, as well as the smallest commissions. To reach the level of a profitable trader there are two opposing views: To specialize or to diversify Scalpers should also be mentally fit and focused when scalping. Resisting the temptation to trade on emotions avoids unnecessary risk and unproductive bittrex buy bitcoin usd why isnt my litecoin deposit showing up bittrex of capital. Exodus Wallet Review — A secure multi-asset wallet. Nenad Kerkez. A market maker earns the spread, while a scalper pays the spread. By referencing this price data on the current charts, you will be able to identify the market direction. By continuing to use this website, you agree to our use of cookies. The ATR figure is highlighted by the red circles. Find Your Trading Style. The amount of leverage sets the position sizes that you can control. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. That being said, volatility shouldn't be the only thing you're looking at when choosing your currency pair. The profit target is set at 50 pips, and the stop-loss order is placed order executed questrade how to profit from oil stocks between 5 and 10 pips above or below the 7am GMT candlestick, after its formation. For example, the famous trader Paul Rotter placed buy and sell orders simultaneously, and then used specific events in the order book to make short-term trading decisions. Forex trading involves risk. There are certain numbers, when released, which create market volatility. The examples show varying techniques to trade these strategies to show just how diverse trading can be, along with a variety of bespoke options for traders to choose. For the best forex scalping systems, traders should first define their goals.

1. Keep your leverage low

But having a firm goal in mind does help to focus. That is, unless you know this trick. Stay Safe, Follow Guidance. You will learn how to trade forex and how As with the buy entry points, we wait until the price returns to the EMAs. While your main task is to generate more profitable positions than losing ones, you must also know how to exit trades when they aren't working out. However, it's worth noting these three things:. This removes the chance of being adversely affected by large moves overnight. Trading System. Read about how we use cookies and how you can control them by clicking "Privacy Policy". These include GDP announcements, employment figures, and non-farm payment data. A swing trader might typically look at bars every half an hour or hour. Trading false breakouts can sometimes work well in an Asian trading session, as the price typically moves up and down in a relatively narrow range. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. This is also known as technical analysis. Do not scalp if you do not feel focused for whatever reason. What is the Three Inside Down Candlestick pattern? It requires a good amount of knowledge regarding market fundamentals.

In the converse, the cme bitcoin futures limit down set sell order bittrex in usd maker sells on the ask and buys on the anz etrade brokerage fees no-fee robinhood app, thus immediately gaining a pip or two as profit for making the market. Strong trending markets work best for carry trades as the strategy involves a lengthier time horizon. Trend trading attempts to yield positive returns by exploiting a markets directional momentum. As scalping profits tend to be small, almost all scalping methods use larger than normal leverage. If you have the temperament to react quickly and have no compunction in taking very quick losses, not more than two or three pips, then scalping may be for you. Bolly Band Bounce Trade This strategy is perfect for a ranging market. But there is also a risk of large downsides when these levels break. The pros and cons listed below should be considered before pursuing this strategy. Stops are placed a few pips away to avoid large movements against the trade. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:.

2. Set correct stop losses and take profits

Losses can exceed deposits. However, it can be extended to a longer timeline. The objective here is to manipulate abrupt changes in market liquidity for fast order execution. The basic idea behind scalping is opening a large number of trades that usually last either seconds or minutes. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Trades are exited in a similar way to entry, but only using a day breakout. Explaining the Bid: Ins and Outs A bid is an offer made by an investor, trader, or dealer to buy a security that stipulates the price and the quantity the buyer is willing to purchase. There are certain numbers, when released, which create market volatility. But if you like to analyze and think through each decision you make, perhaps you are not suited to scalp trading.