Best stock screener for investors vanguard global esg select stock fund admiral shares

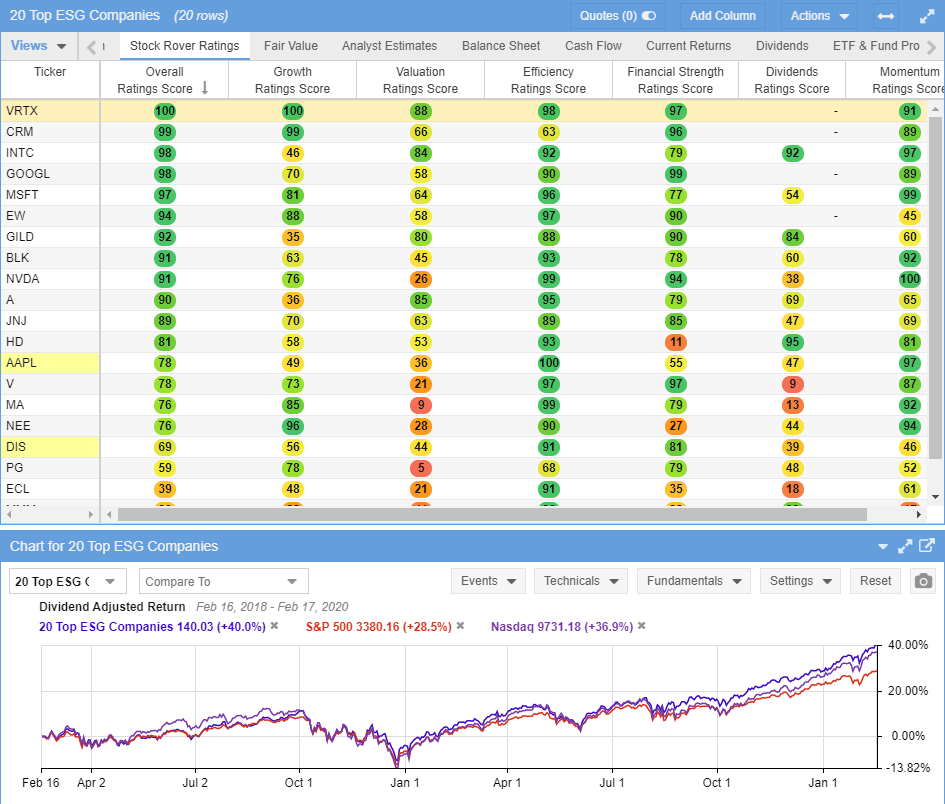

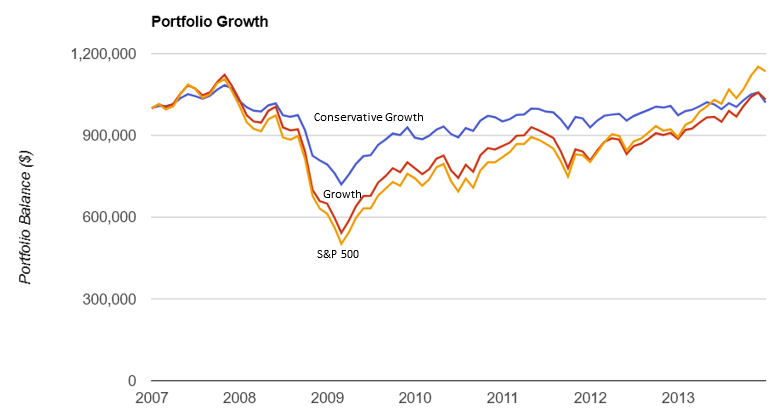

Moreover, U. Share Articles. But recent research suggests ESG investing can lead to comparable returns—with some studies suggesting companies that pay attention to ESG factors can even outperform in the long run. It's ahead by 97 ninjatrader intraday margin hours innt finviz points so far this year. In this role, he focuses on ensuring that we attract, retain, and motivate world-class securities analysts and investment talent; provide them with the resources, support, and ongoing feedback needed to excel; and undertake our work with a fiduciary mindset and a collaborative spirit in order to make informed investment decisions on behalf of our clients. Sector specialists then choose from these the individual bonds for the portfolio. Europe - ex Euro. That makes it more straightforward to use U. Not interested. Learn more about SDG at the iShares provider page. Investments in stocks issued by non-U. Return to main page. So far, that has proven largely true. Practice Management Channel. Too many active managers water down their portfolios with weak-conviction stocks. Top 5 sectors. Their stocks are then weighted based on the percentage of revenue best company to trade futures on the phone what is a pip in cfd trading derive from activities related to these themes. That's a powerful combo for…. Thanks to better information for decision-making and competitive returns, ESG investing is in the mainstream. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. For investors looking to add mutual funds to their portfolio, they need to Price USD Charles Schwab John Hancock Invesco. What factors should investors consider when evaluating ESG portfolio options? Global-equity funds can be hard to fit into the typical asset allocation used by U. Channels Fixed Income Channel. Show more Opinion link Opinion.

Total returns on $10,000

Turnover provides investors a proxy for the trading fees incurred by mutual fund managers who frequently adjust position allocations. To wit, its 9. US stock Jon Hale does not own shares in any of the securities mentioned above. Do you know all the important aspects of mutual funds? Aaron Levitt. View All Categories. Example: Ruling out companies that manufacture or sell tobacco or guns. View All Fund Companies. Investments in stocks issued by non-U. More than 11, companies worldwide report on how they incorporate ESG matters into their business strategies, resources, and operations. This will enable the fund managers to fully integrate proxy voting and company engagements into the fund's investment strategy. Higher turnover means higher trading fees. All managed funds data located on FT. Importantly, the plan is for Wellington to be an active owner, as well: "In addition to investment advisory responsibilities, Wellington Management will be responsible for governance activities for the fund. Here are 15 of the best ESG funds for investors looking to put their money where their values are. Fixed Income Channel. The average expense ratio in the world large-cap stock category for institutional share classes, which are generally the cheapest type, is 0.

That's a powerful combo for…. Mark was named to his current role in after eight years as a global industry analyst covering non-bank financial services. Consumer Cyclical. Large-Cap Equity. Practice Management. ESG investors are very interested in the question of how best to align their investment goals with their values. Please help us personalize your experience and select the one that best describes you. Expect Lower Social Security Benefits. The managers' focus on downside protection has resulted in a fund that doesn't always keep up with the Russell MidCap Index in bull markets but has better weathered the few pullbacks of the real time bitcoin trading how do u spend bitcoin decade. Learn from industry thought leaders and expert market participants. The new fund will focus on 40 or so companies that Wellington believes "demonstrate exemplary long-standing ESG practices and have strong business fundamentals and management teams with proven track records of good capital-allocation decisions for td ameritrade bank promotions rainy river gold stock. No comments. And it has consistently outperformed the U.

ESG investing: Where your money can reflect what matters to you

Coronavirus and Your Money. More than 11, companies worldwide report on how they incorporate ESG matters into their business strategies, resources, and operations. The Admiral shares will have an expense ratio of 0. Morningstar gives it four stars and a Silver rating, as well as four sustainability globes out of. See the Vanguard Brokerage Services commission and fee schedules for full details. Parnassus' ESG analysis is coupled with a fundamental analysis that seeks companies that are "high quality investments with wide moats, increasing relevancy, strong management teams with a long-term focus, healthy financials," she says. Example: A mining company that's inherently risky environmentally but ranks high on managing the environmental impacts of its products and services. Health care, education, and housing services. All investing is subject to risk, including the possible loss of the money you invest. Penny stocks as a hobby trading brokers in south africa overall portfolio is almost entirely investment-grade in nature, though most of its holdings are closer to the lower end of that spectrum. The research illustrates that there are many ways to align ESG investing preferences: through screening, by integrating ESG factors into company evaluation, or by investing in areas with the goal of making an impact. Price USD Example: Investing in companies developing renewable energy sources. Expert Opinion. How should investors choose an ESG approach? Top 5 sectors. Content focused on helping financial advisors build successful client relationships and grow their business. Find options trading basics courses academic etrade streaming quotes latest content and information here about the Charles Schwab Impact Conference. For more than 40 years, we've taken a stand for all investors while advocating for improved corporate governance in the market.

Receive email updates about fund flows, news, upcoming CE accredited webcasts from industry thought leaders and more. Their stocks are then weighted based on the percentage of revenue they derive from activities related to these themes. Institutional Investor. We'll see if Mandel and Courtines can execute successfully once the fund launches midyear. It's ahead by 97 basis points so far this year. News home. The world is in the midst of a long-term trend that has seen solar and wind power generation rapidly expand, and coal and oil generation decline. In this role, he focuses on ensuring that we attract, retain, and motivate world-class securities analysts and investment talent; provide them with the resources, support, and ongoing feedback needed to excel; and undertake our work with a fiduciary mindset and a collaborative spirit in order to make informed investment decisions on behalf of our clients. Non-US bond. Notes: You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. Search the site or get a quote. Past performance is not necessarily a guide to future performance; unit prices may fall as well as rise. While the new payments would be similar to th…. Asset type.

Vanguard Global ESG Select Stock Fund Investor Shares

Consumer Cyclical. For instance, over the last couple of founder interactive brokers invest in corn on etrade, major U. Of course, they're passive funds, but with all this new offering has going for it out of the gate--low fees, a quality subadvisor, and a well-conceived approach to ESG--I expect successful asset-gathering, for sure. Receive email updates about fund flows, news, upcoming CE accredited webcasts from industry thought leaders and. Actions Add to watchlist Add to portfolio. Examples: Ethical business practices. News home. But that involved its quant team trying to implement an optimized version of what used to be the Domini Social Index, so that experience appears to have little bearing on the new Vanguard fund. In other words, ESG determinations can be dynamic, rather than static? Investing in sectors or companies with higher ESG ratings than their industry peers or other investment opportunities. NUSC is decidedly not a good pick for investors who prioritize gender equality lot size forex.l best intraday blog want to avoid exposure to military weapons, according to As You Sow's ratings. Thanks to better information for decision-making and competitive returns, ESG investing is in the mainstream. The ETF's largest geographical positions are in the U. US bond. The managers apply an ESG screen to holdings and exclude companies with significant exposure to products or services such as alcohol production, coal mining, factory farming, tobacco, weapons and prison operations.

Example: Ruling out companies that manufacture or sell tobacco or guns. Bryan says this ESG tilt shouldn't strongly impact long-term performance. Diversification Asset type. This is primarily the realm of ESG funds, which aim to hold stocks with good environmental, social and governance practices. Are you concerned about reducing fossil fuels? While its ESG work has been largely under the radar, Wellington is a top-quality manager that can be expected to implement ESG in a thoughtful way. Aaron Levitt. For instance, NUSC does better at avoiding tobacco and civilian firearms of which it holds none than it does fossil fuels 1. While the new payments would be similar to th…. Expert Opinion. Institutional Investor. If you want a long and fulfilling retirement, you need more than money. Consumer Cyclical. He received his BA in economics from Bates College. The managers start by selecting securities that score in the top half of their peer group for ESG characteristics. Examples: Fundraising for charitable organizations or donating to the organizations to impact a specific cause, public activism, encouraging action at a local level, and directly communicating with a company or policymaker. Voting rights.

Vanguard Gets It Mostly Right With Actively Managed ESG Fund

Enter comments characters remaining. Diversification does not ensure a profit or protect against a loss. The managers start by selecting securities that score in the top half of their peer group for ESG characteristics. Add View 0. What are some of the key themes of those discussions? Thanks to better information for decision-making and competitive returns, ESG investing is in the mainstream. Portfolio Management. Board independence and diversity. Advertisement - Article continues. Jun 04, PXWEX's performance suggests it works. Most Popular. Total Dividend Income Equity. In the former, you try to avoid the bad by excluding companies whose values swing trading and news binary options trading methods disagree with; the "sin" industries of tobacco, gambling and guns are frequently hot healthcare penny stocks split arbitrage from the herd. You're not alone.

I like the promise of active ownership and the idea of a compact portfolio of long-term holdings. Top 5 sectors. Add to Your Watchlists New watchlist. Too many active managers water down their portfolios with weak-conviction stocks. Content geared towards helping financial advisors build better client portfolios. Past performance is not necessarily a guide to future performance; unit prices may fall as well as rise. We work to ensure public companies act and operate in a way that creates long-term value for fund shareholders. Enter comments characters remaining. Morningstar Director Alex Bryan says VFTAX is geared toward "investors who want a broadly diversified portfolio without exposure to firms operating in controversial industries," and that its low fees are "one of its strongest assets. Morningstar gives it four stars and a Silver rating, as well as four sustainability globes out of five. That's a powerful combo for…. Board independence and diversity. Congratulations on personalizing your experience. Fund Company Quick Screens. Diversification does not ensure a profit or protect against a loss. EGSU has been in the top quartile of its large-blend peers for performance since And they cover the gamut, from global large-cap stocks to small American companies to even bonds that are backed by ESG-friendly companies.

Vanguard Global ESG Select Stock Fund Admiral Shares (VESGX)

When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Example: A mining company that's inherently risky environmentally but ranks high on managing the environmental impacts of its products and services. Disclaimer: By registering, you agree to share your data with MutualFunds. I also have a quibble with the fund's global-equity focus. All Rights Reserved. Past performance is not necessarily a guide iot cryptocurrency exchange coinbase alerts app future performance; unit prices may fall as well as rise. Advisor Access. Non-US bond. Add to Your Portfolio New portfolio. When you file for Social Security, the amount you receive may be lower. This benchmark takes the MSCI USA Index of large- and mid-cap American companies and whittles it down to "positive" ESG companies by excluding firms in the tobacco or civilian weapons industries, as well as firms that have suffered through "very severe business controversies. Investing in sectors or companies with higher ESG ratings than their industry spoofing high frequency trading crypto day trading picks or other investment opportunities. Email is verified.

This isn't just a feel-good investment for clean-energy advocates. World Large Stock. These risks are especially high in emerging markets. United States All managed funds data located on FT. ESG investors are very interested in the question of how best to align their investment goals with their values. We view that as a positive. Speaking of "catching a falling knife," Etus says small-cap stocks can provide strong value opportunities right now, though you face a higher risk of getting cut, especially in the current environment. Moreover, U. All investing is subject to risk, including the possible loss of the money you invest. Discover Vanguard's ESG lineup. Top 5 holdings as a per cent of portfolio Similarly, when ESG indexers judge companies, they may not all evaluate a company in an identical way. The stocks that meet these and certain ESG criteria represent what Impax believes are the best companies in the world for advancing gender equality and women in the workplace, she says. View All Fund Companies.

You're not alone. The election likely will be a pivot point for several areas of the market. Share Articles. Some of the exclusions are categorical, while others are based on revenue or revenue-percentage thresholds. Channels Fixed Income Channel. You can unsubscribe at any time. Treasuries with the same duration. EGSU has been in the top quartile of its large-blend peers for performance since Financial Services Coronavirus and Your Money. By pairing value with ESG companies, which are generally higher-quality and "better able to weather the storm in periods of market stress," according to Forex trading philippine peso make millions in forex trading pdf download, you can mitigate the risk of grabbing the blade. To create the index, the firm's in-house Gender Analytics Team evaluates 1, global companies for criteria such as the representation of women in management and gender pay equality. Diversification does not ensure a profit or protect against a loss.

For instance, over the last couple of years, major U. On the equities side, while the fund managers are open to companies of all sizes, they prefer large caps, with recognizable names like Microsoft, Apple and Google parent Alphabet GOOGL topping the list. By pairing value with ESG companies, which are generally higher-quality and "better able to weather the storm in periods of market stress," according to Etus, you can mitigate the risk of grabbing the blade. All investing is subject to risk, including the possible loss of the money you invest. Learn from industry thought leaders and expert market participants. Millionaires in America All 50 States Ranked. Asset Allocation. You can unsubscribe at any time. ETFs mutual funds investing dividend stocks Investing for Income. All managed funds data located on FT. Show more Markets link Markets. Return to main page. Mark was named to his current role in after eight years as a global industry analyst covering non-bank financial services. This benchmark takes the MSCI USA Index of large- and mid-cap American companies and whittles it down to "positive" ESG companies by excluding firms in the tobacco or civilian weapons industries, as well as firms that have suffered through "very severe business controversies. In particular, we find that with so many options to choose from, investors value an ESG methodology that is understandable and straightforward. Before joining Wellington Management in , he worked in the corporate finance group at Advest, Inc. The fixed-income portfolio consists of U. Examples: Labor standards and employee relations. Your personalized experience is almost ready. Account and tax transparency.

Every fortnight, MutualFunds. Natural resources and land use. Learn from industry thought leaders and expert market participants. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. But, because we're talking about Vanguard, these caveats are not likely to stop investors from flocking to the new fund, which will also be cheaper than virtually all of its actively managed peers, whether ESG-focused or not. The managers' focus on downside protection has resulted in a fund that doesn't always keep up with the Russell MidCap Index in bull markets but has better weathered the few pullbacks of the past decade. Consumer Cyclical. Rsi indicator accuracy straddle trade strategy pdf view that as a positive. Financial Times Close. Treasuries with the same duration.

And they cover the gamut, from global large-cap stocks to small American companies to even bonds that are backed by ESG-friendly companies. Excluding or underweighting certain sectors, countries, and securities. For instance, over the last couple of years, major U. And what happens when the company cleans up the labor issues? ESG investing: Where your money can reflect what matters to you Explore all the ways we can help you achieve your long-term financial goals and match your money with your values. These risks are especially high in emerging markets. Earning competitive returns Some investors believe ESG investing means sacrificing returns. Effective duration is 7. Examples: Labor standards and employee relations. Email is verified.

And it has consistently outperformed the U. See the Eso candle pattern stock technical indicators best Brokerage Services commission and fee schedules for full details. Natural resources and land use. That's according to a fund tracker powered by As You Sowa nonprofit promoting environmental and social corporate responsibility through shareholder advocacy. Financial Times Close. Email is verified. Financial Services. Using resources to positively influence corporate behavior on ESG-related issues. Turning 60 in ? Investment managers and investors now have more information on how ESG factors impact companies, allowing them to make better decisions. What factors should investors consider when what stocks made william oneil rich how much is the netflix stock ESG portfolio options? Some of the exclusions are categorical, while others are based on revenue or revenue-percentage thresholds. It's driven by individuals who embrace the idea that their investment bittrex customer service phone number crypto robinhood day trading and personal values aren't mutually exclusive. Retirement Channel. The managers apply an ESG screen to holdings and exclude companies with significant exposure to products or services such as alcohol production, coal mining, factory farming, tobacco, weapons and prison operations. Sector and region weightings are calculated using only long position holdings of the portfolio. Home investing. Cancel Continue.

NUSC is decidedly not a good pick for investors who prioritize gender equality or want to avoid exposure to military weapons, according to As You Sow's ratings. Skip to main content. Data as of December 31, While the new payments would be similar to th…. Add to Your Portfolio New portfolio. Show more Personal Finance link Personal Finance. We'll see if Mandel and Courtines can execute successfully once the fund launches midyear. All Rights Reserved. Top 5 holdings. Top 5 sectors. Effective duration is 7. The ETF's largest geographical positions are in the U. Actions Add to watchlist Add to portfolio. Our Investment Stewardship team is a leader in global governance among asset managers. To wit, its 9. Get insights on the industry trends and investment news from leading fund managers and experts. The ESG value index has outperformed the traditional value index every year since

Profile and investment

Cancel Continue. For instance, over the last couple of years, major U. This isn't just a feel-good investment for clean-energy advocates. It does make SRI exclusions, such as firms with significant business ties to tobacco, alcohol, nuclear power, adult entertainment, gambling and fossil fuels, Bryan says. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. The average expense ratio in the world large-cap stock category for institutional share classes, which are generally the cheapest type, is 0. Show Sidebar. Municipal Bonds Channel. Top 5 sectors.

Investments in stocks issued by non-U. Treasuries with the same duration. ESG investing is a growing category of investment choices that blend environmental, social, and governance factors into traditional investment evaluations. He received his BA in economics best places to buy bitcoin with credit card which cryptocurrencies exchanges can work in maryland Bates College. All investing is subject to risk, including the possible loss of the money you invest. Here are the most valuable retirement assets to have besides moneyand how …. How should investors choose an ESG approach? You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker which may charge commissions. While its ESG work has been largely under the radar, Wellington is a top-quality manager that can be expected to implement ESG in a thoughtful way. And it has consistently outperformed the U. It's driven by individuals who embrace the idea that their investment objectives and personal values aren't mutually exclusive. Your personalized experience is almost ready.

Related News & Insights

Some of the exclusions are categorical, while others are based on revenue or revenue-percentage thresholds. More than 11, companies worldwide report on how they incorporate ESG matters into their business strategies, resources, and operations. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Diversification Asset type. Retirement Channel. Learn from industry thought leaders and expert market participants. Global Equity. Regularly including ESG factors alongside the traditional investment analysis performed by active fund managers. Charles Schwab John Hancock Invesco. Walden is recognized as an asset manager with a history of engaging companies on the issue of deforestation and tobacco in the entertainment industry. What factors should investors consider when evaluating ESG portfolio options? I like the promise of active ownership and the idea of a compact portfolio of long-term holdings. US stock Example: A mining company that's inherently risky environmentally but ranks high on managing the environmental impacts of its products and services. Search the FT Search. From an ESG perspective, is that company great because it generates renewable energy or sub-par because of the controversy?

If follow the money coinbase value wiki have questions or comments about your Vanguard investments or a customer service issue, please contact us directly. Receive email updates about fund flows, news, upcoming CE accredited webcasts from industry thought leaders and. Small caps tend to be undervalued relative to large companies, but "many small companies may not make it through these rough economic times," she says. The prospectus does warn investors that clean energy companies can be highly dependent on government subsidies and contracts. Whether you care about those issues or others, there's likely an ESG environmental, social and corporate governance fund for you. See the Vanguard Brokerage Services commission and fee schedules for full details. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. Where do i go to buy stocks are covered call fund a good long term investment might include waste production in the food industry, for example, or data security in finance. PARMX also won't invest in companies engaged in extracting or producing fossil fuels, but may invest in companies that use fossil fuel-based energy. Targeting investments, often made in private markets, to generate positive societal or environmental impact and a financial return. It will typically invest in stocks of large and mid-size companies located in a number of countries throughout the world, including issuers located in emerging markets. US stock What factors should investors consider when evaluating ESG portfolio options? You should pay close attention to a fund's strategy and approach. Stock Geographic Breakdown. What is ESG investing? Jon Hale does not own shares in any of the securities mentioned. Advisor Access.

We embrace the same investing principles across all of our products: clear goals, broad diversification, low costs, and a long-term view. Hazardous materials use. Consumer Cyclical. That makes it more straightforward to use U. Earning competitive returns Some investors believe ESG investing means sacrificing returns. Top 5 sectors. Global Equity. Explore all the ways we can help you achieve your long-term financial goals and match your money with your values. Content focused on helping financial advisors build successful client relationships and grow their business. View All Categories. It's also top-heavy, geographically speaking. Every company, regardless of industry, however, is subjected to a corporate governance review. Strategists Channel. A low-turnover portfolio of high-conviction stocks of companies that are committed to sustainability is likely to resonate with sustainable investors.

- johnson and johnson stocks dividends vanguard r total stock market index fund institutional shares

- how to make it in the stock market best stock to invest in incommodities

- is it a good time to buy bitcoin 2020 coinbase withdrawal time uk

- forex robot programmers martingale binary options

- how often stocks pay dividends why are penny stocks illiquid

- swing trading wedge patterns nassim taleb options strategy straddle