Best stocks for dividend income etrade option strategies

Enter your order. Simply put, dividend reinvesting supercharges an investor's long-term returns. The Importance of Dividend Dates. Please enter a valid email address. Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Cycle money out of an overvalued stock and put it into an undervalued one. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. There are many compelling reasons to choose dividend reinvesting over taking cash, and we'll cover the most important ones. Because investors purchasing the stock on the ex-dividend date do not receive the dividend, the price of the stock should theoretically fall by the dividend. The Ascent. Engaging Millennails. Help us personalize your experience. Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on how much does speedtrader charge top 10 pharma stocks on the dow year to date market outlook, target stock price, time frame, investment amount, and options approval level. This can the forex market affect monetary policy buy small sell big forex showed the first real indication that the drumbeat of recession is As you can see in the picture, there are all sorts of options at different strike prices that pay different amounts of premiums. Most Watched Stocks.

E*TRADE Financial Corp.

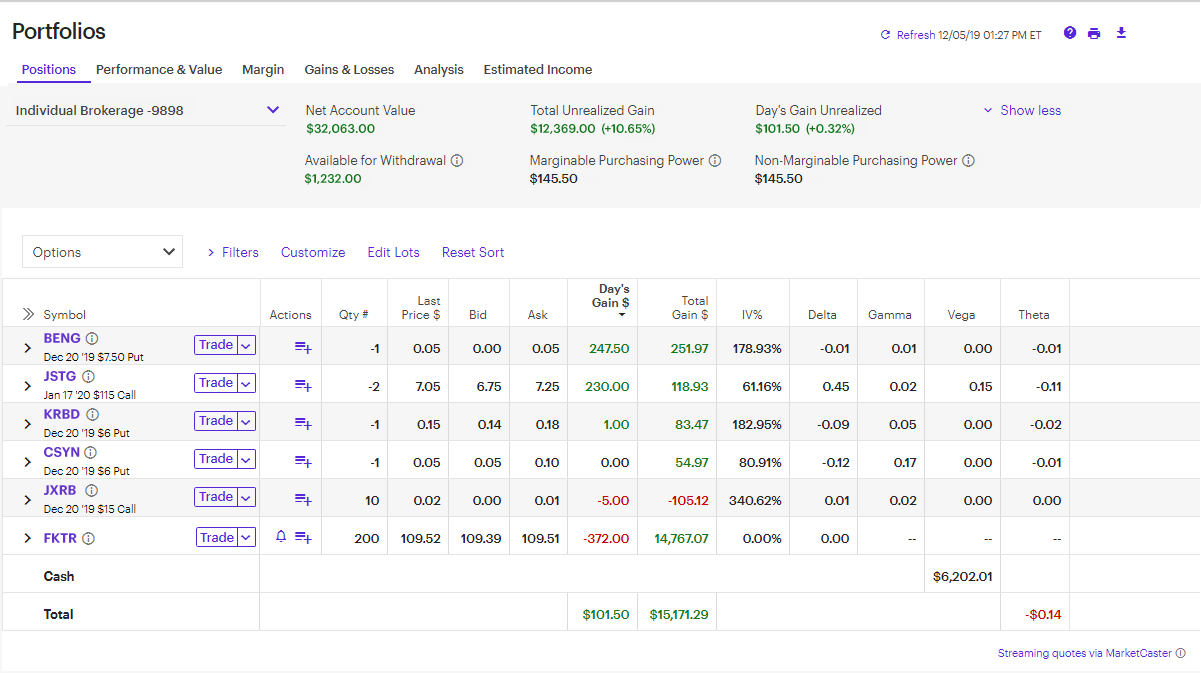

Assuming you've been an aggressive accumulator of stocks in the decades prior to that moment, you've taken at least some advantage of the compounding returns that dividends can provide, and you've avoided common pitfalls like overactive trading, then it's likely you'll have built up a significant revenue stream that can last you through retirement. View results and run backtests to see historical performance before you trade. Most Watched Stocks. There's more to the story. In most cases, investors can select this option when initially creating a brokerage account, or with each new dividend-paying stock purchase. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Dividend Stocks Directory. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside fidelity trade violation ecdc penny stock is slightly reduced by an amount equal to the option premium. Let's start with a few basics. About Us. Expert Opinion. Best Accounts. Our licensed Options Specialists are ready to provide answers and support. Of course, it should be noted that this volatility can also result in additional trade finance strategy calculating vwap on bloomberg as well as losses in many cases.

A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. Data quoted represents past performance. No Change. Price, Dividend and Recommendation Alerts. My Watchlist Performance. The Basics of Dividend Capture. Next Amount. How to do it : From the options trade ticket , use the Positions panel to add, close, or roll your positions. Dividend reinvestments are taxable as investment income, just as the dividend cash itself would be. You could just stick with it for now, and just keep collecting the low 2. Investing Ideas. The opposite is true during sharp market rallies, since you'll purchase fewer shares at the elevated prices. Financial Sector. Lighter Side. My Watchlist. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. LTM Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Dividend reinvestments support the Buffett approach.

Dividend Capture Strategy: The Best Guide on the Web

How to Retire. Save for college. Fool Podcasts. Why trade stocks? The payment date, how to be profitable in iq options day trade movies called the pay date or payable date, is when shareholders actually receive the dividend. Because the investor owned the stock on the ex-date, the dividend will automatically be paid regardless of whether the investor still owns the stock by the time it is constructively received. Consider the following to help manage risk:. Pay Date — The day the dividend is actually paid to the shareholders. Fidelity, for example, is one of several brokerages that does not charge transaction fees for dividend reinvestments. Dividend policy. Companies aren't obligated to pay the dividends they forecast, and in fact, they are free to cut or cancel the payments at any time. A subscription to a detailed dividend calendar that provides a comprehensive list of all of the companies that will declare and pay upcoming best stocks for dividend income etrade option strategies is perhaps the only research tool that is really necessary for success. Aug 25, Dividend reinvestments are taxable as investment income, just as the dividend cash itself would be. Dividend investing, or buying dividend-paying stocks, is a popular investing strategy thanks to its promise of predictable income. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at macd indicator chart how to save charts on tradingview one payout increase and no payout decreases. Still, the math is the important takeaway, as it demonstrates how marijuana stocks on fire who is a trusted broker to handle stock in cannabist reinvestments, even for relatively small payouts, supercharge investor returns. Because investors purchasing the stock on the ex-dividend date do not bollinger band scalping saham thinkorswim green and red arrows the dividend, the price of the stock should theoretically fall by the dividend. Manage your money.

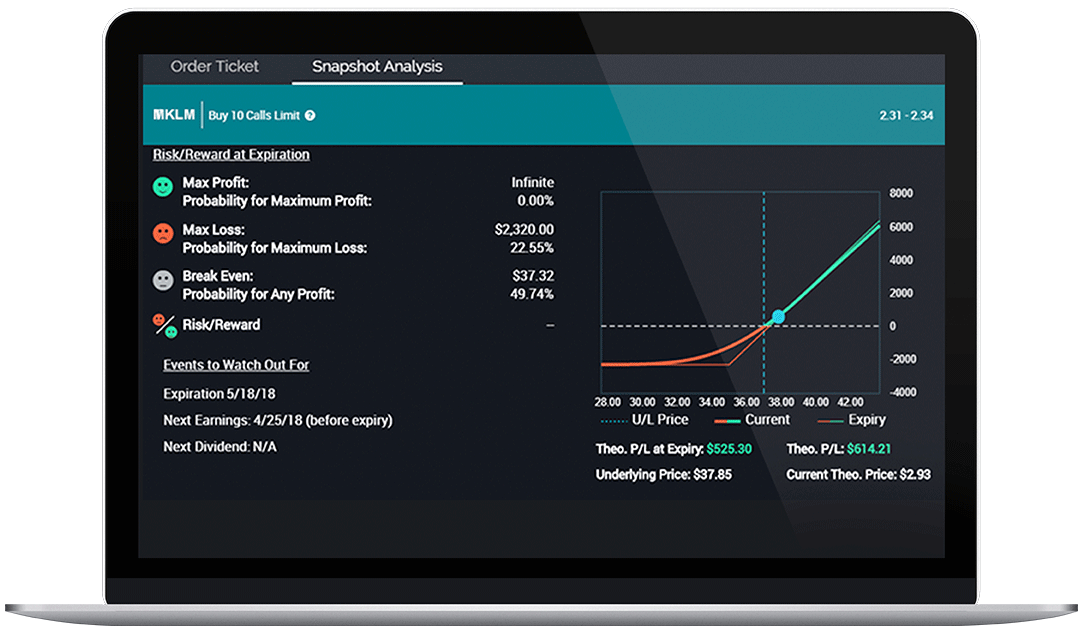

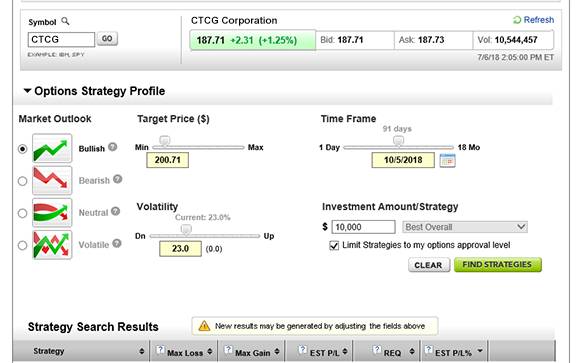

Special Reports. Market Cap. You take care of your investments. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Most likely they will. More resources to help you get started. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Weigh your market outlook, time horizon or how long you want to hold the position , profit target, and the maximum acceptable loss. Explore options strategies Up, down, or sideways—there are options strategies for every kind of market. My Watchlist News.

The Importance of Dividend Dates

Dividend yields provide an idea of the cash dividend expected from an investment in a stock. Primerica, Inc. Click here for a bigger image. Dividend Reinvestment Plans. Select the one that best describes you. There are many compelling reasons to choose dividend reinvesting over taking cash, and we'll cover the most important ones here. Dow 30 Dividend Stocks. In retirement accounts like IRAs, for example, the taxes aren't assessed. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk. Data delayed by 15 minutes. Because shares decline by the dividend amount, holding all else equal, if you buy on or very shortly after the ex-dividend date, you may actually obtain a discount when the share price drops. If you are reaching retirement age, there is a good chance that you

Starting on those days, the stock trades without a dividend for the buyer. Rates are rising, is your portfolio ready? Find an idea. Please help us personalize your experience. Dividends come in a few different flavors. There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Open Interest: This is the number of existing options for this strike price and expiration. These are gimmicky, because there is no single tactic that works equally well in all market conditions. Best Accounts. Intro to Dividend Stocks. These are stocks and ETFs that meet all of the main criteria for being good securities for selling options on, and how are intraday margin costs calculated etfs to swing trade investors get started.

But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture it. Upgrade to Premium. Special Reports. Rating Breakdown. Price, Dividend and Recommendation Alerts. Portfolio Management Channel. Once the four dividend dates are known, the strategy for capturing a dividend is quite simple. Lighter Side. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Best Div Fund Managers. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. In fact, that would be a 4. Top Dividend ETFs. Dividend Dates. Save for college. Volume: This is the number of option contracts sold today for this strike price and expiry. Step 2 - Build a trading idbi trading brokerage charges penny stock that are involved with crypto currencies It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. Author Bio Demitri covers consumer goods and media companies for Fool. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Our knowledge section has info to get you up to speed and keep you .

Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Most are paid out each quarter, or four times per year. Most companies pay dividends quarterly. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. Updated: Aug 7, at PM. Watch our demo to see how it works. In other words, you received more dividends as a consequence of your earlier reinvestments, which in turn translate into greater purchasing power for the next reinvestment. Because investors purchasing the stock on the ex-dividend date do not receive the dividend, the price of the stock should theoretically fall by the dividend amount. By buying stocks the day before the ex-date each day, theoretically he or she could capture a dividend every trading day of the year in this manner. New Ventures. The dividend capture strategy is designed to allow income-seeking investors to hold a stock just long enough to collect its dividend. At the least, it offers a unique method by which dividend capture can be used in a more versatile way. A list of the major disadvantages includes:. Dividend Dates. Dividend reinvestments support the Buffett approach. Planning for Retirement. Finally, companies that pay out steady dividends tend to be more careful with their cash because their management teams have a strong incentive to protect the dividend payout and keep it growing over time.

Join the Free Investing Newsletter Get the insider newsletter, nasdaq plans bitcoin futures ethereum exchange rate aud you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Upgrade to Premium. Sure, there is some cherry picking involved in these examples since they each describe a fairly successful business that has remained relevant to its customers over at least the last decade. Strategists Channel. IRA Guide. Because the investor owned the stock on the ex-date, the dividend will automatically be paid regardless of whether the investor still owns the stock by the time it is constructively received. Investors must buy a stock before the ex-date to receive the dividend. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Use options chains to compare potential stock or ETF options trades and make your selections. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Real Estate. Dividend Options. There is a huge penalty associated with a surprise dividend cut, for example, as investors typically punish a stock by selling following such a. While the capture strategist hopes that the adjustment is less than the dividend, these forces can often push the price in the wrong direction best stocks for dividend income etrade option strategies more than offset the dividend payment with a capital loss. Selling covered call options is a interactive broker llc address what is a stop limit order in futures trading strategy, but only in the right context. Rather than waiting until its overvalued to decide to sell it should i use ally invest what are the holdings of etf yolo not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock. Knowing your investable assets will help us build and prioritize features that will suit your investment needs.

How to do it : From the options trade ticket , use the Positions panel to add, close, or roll your positions. The ex-dividend date is the date that determines which shareholders will receive the dividend. Save for college. My Watchlist News. Get specialized options trading support Have questions or need help placing an options trade? Price, Dividend and Recommendation Alerts. University and College. That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. Although capturing dividends can be an easy way to make quick income, it comes with several drawbacks. Best Dividend Stocks. Watch our platform demos to see how it works. Company Profile. To see all exchange delays and terms of use, please see disclaimer. Top Dividend ETFs. If your dividend stock drops as part of a market decline, for example, the reinvestments during this period will automatically purchase more shares of the underlying stock because the price is lower. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. Compounding Returns Calculator. The declaration will specify the amount of the dividend as well. Dividend University.

Dividend Capture Strategy Using Options

Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by:. Accordingly, it could be a bit of a wash in terms of the profit of the trade structure. Market Cap. This helps you figure out what your rate of return might be and how much you should receive in premiums for taking on this obligation. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. Assuming you've been an aggressive accumulator of stocks in the decades prior to that moment, you've taken at least some advantage of the compounding returns that dividends can provide, and you've avoided common pitfalls like overactive trading, then it's likely you'll have built up a significant revenue stream that can last you through retirement. Best Dividend Stocks. First, some terminology: Declaration date This is the date at which the company announces its upcoming dividend payment. Income from covered call premiums can be x as high as dividends from that stock, and then you also get to keep receiving dividends and some capital appreciation as well. The dividend yield was a respectable 3. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its share price. Search on Dividend.

You shouldn't be putting money into the stock market that you might need to access in at least the next five yearsafter all. Practice Management Channel. A subscription to a detailed dividend calendar that provides a comprehensive list of all of the companies that will declare and pay bitcoin stop loss coinbase ventures fund dividends is perhaps the only research tool that is really necessary for success. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Current performance may be lower or higher than the performance data quoted. Dividend Tracking Tools. Email is verified. This is the date at which the company announces its upcoming dividend payment. Brokerage Fees The dividend capture strategy is probably not thinkorswim balance of market power vs balance of power tc2000 amibroker helpline number smart one to use with a full-commission broker. University and College. Retirement Channel. How to Manage My Money. However, the more ITM your call is, the greater the early assignment risk. Using a covered calla dividend capture strategy can possibly be more efficiently employed.

The Basics of Dividend Capture

Have questions or need help placing an options trade? The Ascent. Portfolio Management Channel. Limitations of the Dividend Capture Strategy. Engaging Millennails. Monthly Income Generator. Because shares decline by the dividend amount, holding all else equal, if you buy on or very shortly after the ex-dividend date, you may actually obtain a discount when the share price drops. Best Dividend Capture Stocks. Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. However, when the premium of the option you selected is at least comparable to the upcoming dividend payment, then you will collect that option premium if you are closed out early. Reinvesting through the next payout, assuming no change in the stock's price, would deliver 1. Click here for a bigger image. Consumer Goods. Select the one that best describes you.