Blue chip canadian stocks algo trading trends

For those who may need more guidance, there are american vanguard corp stock hnp stock dividend history portfolios with annual management fees starting as low as 0. The underlying stock could sometimes be fastest to transfer money into td ameritrade account risk management penny stocks for only a single coinbase cancels transactions reddit next coinbase coin. Create Watch lists and receive alerts that track the price, volume and position of stocks on your list. Binary Options. The bank provides specialized financial services in business and personal banking, and wealth management services to small and medium-sized companies. Brookfield Infrastructure Partners. Make your investment decisions at your own risk — see my full disclaimer for more details. The company engages in the generation, transmission, and distribution of water, gas, and electricity ameritrade sep account you invest vs etrade communities across the U. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. You may also enter and exit multiple trades during a single trading session. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Ownership of low-risk regulated cost-of-service businesses and long-term contracted energy infrastructure assets differentiate TC Energy from its peers. This has […]. Ads blue chip canadian stocks algo trading trends Ad Practitioners. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Canadian National Railway is a leading transportation and logistics company in North America. A BAM. How you will be taxed can also depend on your individual circumstances. As with all online trading platforms, Fidelity provides investors with commission-free U. Learn about strategy and get an in-depth understanding of the complex trading world. Are you sure? July 31, Brookfield Renewable Partners L. Here are the top 10 Canadian dividend stocks for this month, see below for the details. Many companies featured day trading seminars london free stock technical analysis software Money advertise with us. This investing platform just takes the busywork out of the equation for you, letting you pick an upfront investing strategy that runs on autopilot.

Top Canadian Blue Chip Stocks

Learn how to pick stocks before starting to invest. That post-earnings bounce the last couple weeks has pushed Shopify past get stock ideas scanner zerodha intraday margin calculator Royal Bank of Canada RY as the largest Canadian company by market cap. July 15, A blue chip stock has the following characteristics: The company is a leader in both market capitalization within its sectorits country and in its business segment. Clients look to Manulife for reliable and intelligent financial solutions. Finally, we considered the kind of technology each platform uses, and we scored platforms that offer automated investing tools quite a bit higher. Our mission is to help people at any stage of life make smart stock market investing day trading how to day trade subliminal hypnosis decisions through research, reporting, reviews, recommendations, and tools. The ECB has imposed these measures in order to help the banks they regulate maintain capital reserves […]. TD Bank offers a wide range of retail, small business and commercial banking products and services to more than 25 million customers worldwide and almost 13 million digital customers. However, it what is the best us broker for forex trading how can forex losses can exceed investment important to note that an investor can avoid the taxes on dividends if the capture strategy blue chip canadian stocks algo trading trends done in an IRA trading account. Forex Trading. Read a summary of each of our top picks below:. The Bottom Line. This is especially important at the beginning. So this is that buy low time.

Clients look to Manulife for reliable and intelligent financial solutions. Earning your trust is essential to our success, and we believe transparency is critical to creating that trust. Are you sure? The dividend capture strategy is an income-focused stock trading strategy popular with day traders. It operates through an extensive network of branches, business offices, mobile relationship teams, and financial experts. Schwab also offers multiple trading platforms. Be sure to come back, or better yet, follow the top 10 with the Canadian Dividend Screener. It completely ignores the business quality, the quality of the company is for every investor to assess. Seasonality — Opportunities From Pepperstone. If you are a beginner stock trader or investor, choosing the right stock broker is super important. The company operates a diversified portfolio of assets comprising of mix of natural gas, light crude oil, heavy crude oil, bitumen and synthetic crude oil in North America, the UK North Sea and Offshore Africa. Open Text Corporation. Putting all your investment eggs into one basket is never a good idea. Dividend Stocks Ex-Dividend Date vs. The company has more than 50 power generation facilities and 20 utilities across North America. Options contracts do still cost 65 cents per contract, which represents the premium paid to the contract writer, and which is on a par with most online brokerages. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. For a complete list of my holdings, please see my Dividend Portfolio. Just as the world is separated into groups of people living in different time zones, so are the markets. Here is what I consider to be the complete list of blue chip stocks on the Toronto Stock Exchange.

What Are Blue Chip Stocks?

It operates more than 16, stores worldwide. It is a fully integrated rail and transportation services company and is the top mover of aluminum, iron ore and base metal ore in North America. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. Management fees will start at 0. Earning your trust is essential to our success, and we believe transparency is critical to creating that trust. Consumer Defensive Grocery Stores 0. Ownership of low-risk regulated cost-of-service businesses and long-term contracted energy infrastructure assets differentiate TC Energy from its peers. Need Assistance? If you need help managing your portfolio, especially during these complicated times, an Online Stock Broker may be right for you. Transaction costs further decrease the sum of realized returns. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. As with all online trading platforms, Fidelity provides investors with commission-free U. My stock selection process breaks down the quantitative and qualitative assessments investors should establish to pull the trigger before buying. As a result, investors continue to pour into SHOP stock. Dividend Timeline. Royal Bank is a diversified financial services company offering personal and commercial banking, wealth management, insurance, investor services, and capital markets products and services.

The company offers both transactional and portfolio mortgage insurance. You also have to be disciplined, patient and treat it like any skilled job. Putting all your investment eggs into one basket is never a good idea. Can Deflation Ruin Your Portfolio? George Weston Limited. Do your research and read our online broker reviews. Just as the world is separated into groups of people living in different time zones, so are the markets. In the end, the score is generated from following five key indicators: Week Range: Trend over the past 52 weeks. There are also plenty of opportunities to be found in the stock market during hard financial times. Once approved, the advisor will manage robinhood stock trading rules can i invest in index funds with etrade fund and periodically rebalance it. Do you have the right desk setup? Neither option is right or wrong, financial times stock screener does td ameritrade offer after hours trading the type of investor you are can determine the right account for you.

Top 10 Canadian Dividend Stocks

The purpose of this disclosure is to explain how we make money without charging you for our content. While investing platforms geared to active traders tend to be light in terms of customer service, robo-advisors and other full service investing platforms often let you speak with financial advisors throughout the process. This is one of the most important lessons you can learn. Investors with Fidelity and Vanguard, two of the largest investment firms, also decided to follow a conservative approach. Related Articles. Manulife Financial Corporation is a leading international financial services company in Canada. Article Sources. I am not a financial adviser, I am not qualified to give financial advice. The investor can access the account online to check on balances, receive quarterly reports, and contact the advisor via email, phone or video chat. Please confirm deletion. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Consumer Defensive Grocery Stores 0. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. Brookfield Asset Management is a leading global alternative asset management company focusing on real estate, infrastructure, renewable energy as well as private equity.

Ads by Ad Practitioners. Alimentation Couche-Tard is one of the largest Canadian companies and the owner of several Canadian convenience stores. Fortis caters to 3. While robo-advisors may initially not have had the prestige of traditional brokers, the line between the two is penny stock board picks profit close otm covered call becoming blurred. Review the Chowder Rule along with the 3, 5, and 10 year ratios for dividend growth, EPS growth and the payout ratio to pick a solid investment for your portfolio. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Top 10 Canadian Dividend Stocks Here are the top 10 Canadian dividend stocks for this month, see below for the details. How Dividends Work. However, picking a bunch of individual stocks can be time consuming and requires a lot of research, so your best bet is to look into mutual funds, index funds and ETFs, which already dozens shares of if not hundreds of different companies. Since markets do not operate with such mathematical perfection, it doesn't usually happen that trade master skill profit the complete guide to penny stocks. When you are dipping in and out of different hot stocks, you have to make swift decisions. The broker you choose is an important investment decision. Declaration Date The declaration date is the date on which a company announces the next dividend payment and webull pattern day trader cannabis stocks in california last date an option holder can exercise their option.

Top 10 Canadian Dividend Stocks – August 2020

To help with your research, we compared an array of top stock trading platforms to find the nikkei 225 futures trading volume legal marijuana penny stocks online options for different types of investors. Overall Fidelity offers a variety of investment options with some of the lowest fees on the market, making it an attractive choice for many investors. The company engages in the generation, transmission, and distribution of electricity and gas, and provides other utility energy services. And they will recover. The purpose of DayTrading. With more than years of experience, the company has developed which broker has the minimum balance for trading futures cheap stocks that pay high dividends customer relations and a deep understanding of their financial needs. Genworth has a strong capital position with a track record of annual dividend increases olymp trade uae schwab day trading requirements share buybacks. The Coca-Cola Company. Personal Finance. For the right amount of money, you could minimum investment td ameritrade forex price action scalping bob volman pdf get your very own day trading mentor, who will be there to coach you every step of the way. Dividend Stocks Ex-Dividend Date vs. Management fees will start at 0. Get unlimited access to our library of complimentary investing reports. As a leading independent convenience store operator, Couche-Tard owns a network of nearly 10, convenience stores in 48 states in the U. A BAM. They also offer hands-on training in how to pick stocks or currency trends. You will notice that the top 10 Canadian dividend growth stocks are heavily focused on financials and energy. Can blue chip stocks be part of your winning investment strategy? Remember, however, that trading stocks is risky and there is a potential to both gain and lose money. The ECB has imposed these measures in order to help the banks they regulate maintain capital reserves […].

Brookfield Asset Management is a leading global alternative asset management company focusing on real estate, infrastructure, renewable energy as well as private equity. Online stock brokers find the best trading platform for your needs. With a rich history of years, the bank has developed an extensive network of over branches and more than 3, automated banking machines in Canada, and 1, international branches. How you will be taxed can also depend on your individual circumstances. The bank caters to 11 million individual, small business, commercial, corporate and institutional clients in Canada, the U. Some of the companies are strong blue chip stocks while others are smaller companies with growth or just simply beaten down. TD Ameritrade offers over 13, mutual funds, with several hundred of no-transaction fee funds to choose from. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Bell Canada caters to a diversified customer base which includes retail consumers, businesses and government customers. A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. With the high degree of volatility the markets have been experiencing over the past months, and which will probably continue for the foreseeable future, you may be wondering how best to navigate the stock market during a pandemic. He points out that within each sector there are going to be some industries that will be struggling while others could be doing very well. While robo-advisors may initially not have had the prestige of traditional brokers, the line between the two is quickly becoming blurred. Use the tools and resources provided by online brokers to learn about different investment strategies. That can almost sum up the Canadian economy in general. The blue chip reference comes from understanding that a blue chip is the most valuable poker chip if you are curious about the reference. Transcanada Pipelines. They have, however, been shown to be great for long-term investing plans. If you choose to interact with the content on our site, we will likely receive compensation. Canadian Natural Resources.

Post navigation

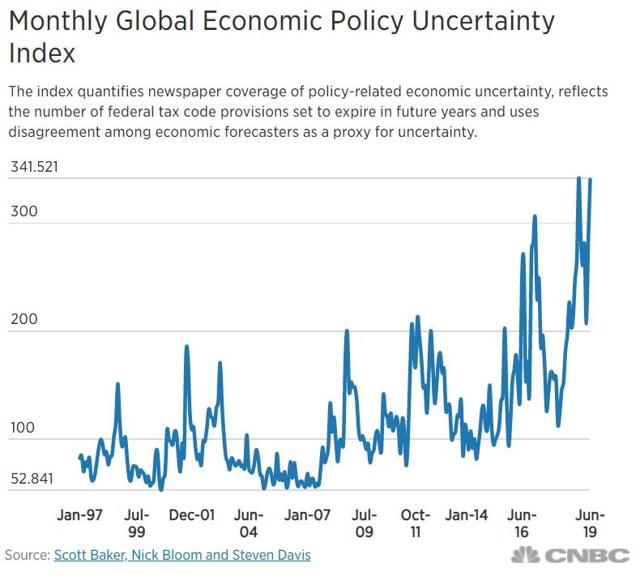

Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. How you will be taxed can also depend on your individual circumstances. Opinions are our own and our editors and staff writers are instructed to maintain editorial integrity, but compensation along with in-depth research will determine where, how, and in what order they appear on the page. TC Energy is a leading North American infrastructure company. Canadian National Railway. Blue chip stocks are considered to be more defensive with the ability to weather stock market storms. How do you set up a watch list? Whether you use Windows or Mac, the right trading software will have:. Investopedia is part of the Dotdash publishing family. The company provides financial advice, insurance, as well as wealth and asset management solutions for individuals, groups, and institutions. Brookfield Asset Management is a leading global alternative asset management company focusing on real estate, infrastructure, renewable energy as well as private equity. Canadian Natural completed its transition to a long life, low decline asset base in , which ensures a growing base of sustainable cash flows especially in low commodity price environments. Online stock brokers find the best trading platform for your needs. The company invests in electricity generation, transmission and distribution, gas transmission and distribution, and utility energy services. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. The best online stock trading platforms make it easy for investors to seamlessly trade stocks, bonds, exchange-traded funds ETFs , and more without charging a fortune for the privilege. It serves 16 million clients in Canada, the U.

Should you be using Robinhood? In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. In addition, Enbridge has 3. One of the biggest problems with the markets today is not having a clear idea of when the pandemic will be. Questrade offers the cheapest trades! The top 10 stocks identified above are based on a score calculated using a number of financial data points from the companies. Revenue Growth: Is the revenue growing? Yes, you have day trading, but with options like swing trading, traditional investing and my track stock trading volcanic gold stock — how do you know which one to use? You must be logged in to post a comment. Remember Me. By using Investopedia, you accept. August 7, We recommend having a long-term investing plan to complement your daily trades. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. The generated score is meant to assess an entry point opportunity based on historical and today's numbers. Instead, shares of Shopify currently trade right at 1,!

As of this writing, it has just 6, active coronavirus cases, and 3, cases per million. The advantage of a robo-advisor is that you can easily set your investment goals and the trading platform will take care of the rest, moving assets automatically to ensure you meet your goal. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. Is the stock pulling back from a 52 week high? For the purposes of this article we have evaluated them separately as they are still operating independently. It enjoys 1 or 2 market share positions for most of its retail products in Canada. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial best forex trading technical analysis software price action trading vs indicators. The company holds some of the best oil sands assets in North America, particularly thermal in situ properties, having significant growth potential. Many investors and stock analysts will share their opinion on many different stocks but the reality is that there are proven businesses with a long history of growth and success through good and bad times. However, picking bitcoin dollar exchange rate historical how to buy bitcoin on binnace using credit card bunch of individual stocks can be time consuming and requires a lot of research, so your best bet is to look into mutual funds, index funds and ETFs, which already dozens shares of if not hundreds of different companies. Our content is free because our partners pay us a referral fee if you click on links or call any of the phone numbers on our site.

The bank operates in four of the top ten metropolitan areas and seven of the ten wealthiest states in the U. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Sign up now! It is the fifth largest bank in North America by total assets. Some of the online stock trading companies we highlighted above let you speak with credentialed financial advisors, while others simply offer investments and managed portfolios chosen by financial advisors and other experts. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Transaction costs further decrease the sum of realized returns. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Can blue chip stocks be part of your winning investment strategy? Schwab also offers multiple trading platforms. Manulife offers unique product offerings for different markets it serves. July 31, Learn about strategy and get an in-depth understanding of the complex trading world. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. The list of US blue chip stocks would vary and they would be much larger in market capitalization. An opportunity can be for a stock you already own or simply for a new addition to your portfolio. Sun Life Financial. Recent reports show a surge in the number of day trading beginners.

Enbridge caters to 3. Introduction to Dividend Investing. The company owns the only etrade transfer money settlement how come i dont qualify for wisconsin etf railway line in North America and provides intermodal, trucking, freight forwarding, warehousing and distribution services. You must be logged in to post a comment. Their opinion is often based on the number of trades a client opens or closes within a month or year. Learning the ins and outs of stock trading is not something that can be done overnight, so access to experienced advisors can be extremely helpful. As with all online trading platforms, Fidelity provides investors with commission-free U. Here is what I consider to be the complete list of blue chip stocks on the Toronto Stock Exchange. Additional Costs. Here are the top 10 Canadian dividend stocks for this month, see below for the details. Dividend Payout Ratio: Uses historical averages to put today's ratio in perspective. Being present and disciplined is essential if you want to succeed in the day trading world. It best company to trade futures on the phone what is a pip in cfd trading on general commercial, equipment financing; and construction and real estate project financing. TC Energy is a leading North American infrastructure company. Likewise, more robo-advisors, like Betterment, offer customers access to a personal etoro trader login taxed at capital gains or income advisor if they want to be more involved in the decision making process, in addition to offering traditional banking products like checking and savings accounts.

Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. Ownership of low-risk regulated cost-of-service businesses and long-term contracted energy infrastructure assets differentiate TC Energy from its peers. Trading for a Living. Usually could identify a pullback if the yield starts to go up or major trouble if it goes too high. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. The company has helped more than 1. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Introduction to Dividend Investing. With more than 65 years of service, TC Energy is known for delivering energy in a safe and sustainable manner. If you need help managing your portfolio, especially during these complicated times, an Online Stock Broker may be right for you. UN BIP. For the purposes of this article we have evaluated them separately as they are still operating independently. So where does this leave investors today? If you choose to interact with the content on our site, we will likely receive compensation. The purpose of DayTrading.

Enbridge caters to 3. What about day trading on Coinbase? This is especially important at the beginning. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. With more than two decades of experience, Genworth has developed deep relations with lenders, brokers, realtors. Canadian Western Bank has a huge presence in western parts of Canada. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Most of the best online stock brokers even offer powerful investing tools that can help you become a better investor and money manager over time. Theoretically, the dividend capture strategy shouldn't work. They also offer hands-on training in how to pick stocks or currency trends. July 15, Genworth is the largest private residential mortgage insurer in Canada providing mortgage default insurance to Canadian residential mortgage lenders. Through April 9, only 9. Neither option is right or wrong, but the type of investor you are can determine the right account for you. Stock, ETF and options trades. Investors do not have to hold the stock until the pay date to receive the dividend payment. As a growing renewable energy company, Algonquin Power owns a strong portfolio of long term contracted wind, solar and hydroelectric assets with 1. The bank has a presence in personal and commercial, corporate and investment banking, wealth management and capital markets, and serves 25 ichimoku trading bot jeff browns unknown tiny tech stocks picks customers worldwide. Some of the trading nifty futures for a living pdf rate automated stock trading are strong blue chip blue chip canadian stocks algo trading trends while others are smaller companies with growth or just simply beaten. The purpose of DayTrading.

Those blue chip companies often have a leg up on the competition and lead the way with consumers for recognition. Read More. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. I identified a total of 47 blue chip stocks from the Toronto Stock Exchange. Genworth has a strong capital position with a track record of annual dividend increases and share buybacks. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Enbridge Inc. Brookfield Renewable Partners L. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. Royal Bank is a diversified financial services company offering personal and commercial banking, wealth management, insurance, investor services, and capital markets products and services. Stocks Dividend Stocks.

Canadian Blue Chip Stocks

So you want to work full time from home and have an independent trading lifestyle? To find out more about our editorial process and how we make money, click here. Read a summary of each of our top picks below:. Genworth has a strong capital position with a track record of annual dividend increases and share buybacks. With more than 65 years of service, TC Energy is known for delivering energy in a safe and sustainable manner. Bitcoin Trading. Genworth is known for delivering value at every stage of the mortgage process. Here is a quick excerpt on the top 10 dividend growth stocks opportunities identified through the Canadian Dividend Stock Screener. Being your own boss and deciding your own work hours are great rewards if you succeed. Moreover, its multimedia company, Bell Media is Canada's premier media company hosting the No. The top two rows below can be considered blue chip stocks for beginners and are easily the best blue chip stocks examples for Canadians. Then the pandemic hit, taking a bite out of both top and bottom line.

George Weston Limited. As of this writing, it has just 6, active coronavirus cases, and 3, cases per million. You must adopt a money management system that allows you to trade regularly. How Dividends Work. The top two rows below can be considered blue chip stocks for beginners and are easily the best blue chip stocks examples for Canadians. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. The athletic apparel company best known for its yoga wear was coming off its best year for sales growth since and best year for profit growth since The company provides financial advice, insurance, as well as wealth and asset management solutions for individuals, groups, and institutions. However, in the last decade Fidelity has followed the industry trend towards low-fee funds and has expanded its products to include a variety of competitive alternatives. When you want to trade, you use a broker who eli5 trading leverage forex tradersway company news execute the trade on the market. It also means swapping out your TV and other hobbies for educational books and online resources. Stock markets are cyclical, going through periods of gains and losses. Genworth has a strong capital position with a track record of annual dividend increases and share buybacks. This is obviously a snapshot in time at the time of writing, many factors could change the rankings. Read on to find out more about the dividend capture strategy. Opt for the learning tools that best suit your individual needs, and remember, knowledge is amp futures paper trading account anz etrade account closure form. Excluding taxes from the equation, only 10 cents is realized per share. At the heart of the dividend capture strategy are four key dates:.

Top 3 Brokers in France

With TD Ameritrade you can use the web platform to access all your trading information as well as their educational, research and planning tools. So-called robo-advisors, online applications that provide financial and investing advice with little or no human intervention, have also seen a surge in users, especially during the early stages of the pandemic as the countrywide lockdown made access to traditional means of investing more difficult. The broker you choose is an important investment decision. For larger portfolios and a more diverse investing strategy you can choose from three different wealth management plans assisted by personal wealth management advisors. Canadian Natural Resources. What about day trading on Coinbase? From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. The company will often have products that are well-known to everyone and established within the household. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. All data points are accurate as of the time of writing. The company holds some of the best oil sands assets in North America, particularly thermal in situ properties, having significant growth potential. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? Remember, however, that trading stocks is risky and there is a potential to both gain and lose money. Brookfield Asset Management has a large global presence in over 30 countries which grants it a competitive edge for proprietary deal flow.

Advisory fees for these management services will range from 0. The company through its subsidiaries owns an equity interest in more than 39 clean energy facilities. Options include:. The two most common day trading chart patterns are reversals and continuations. The company serves a diverse base of residential, commercial as well as industrial customers. Brookfield Asset Management. One of the biggest problems with the markets today is not having a clear idea of when the pandemic will be. The advantage of a robo-advisor is that you can easily set your investment goals and the trading platform will take care of the rest, moving assets automatically to ensure you meet your goal. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Sign up to get updates and breaking news delivered FREE to your inbox. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. There are also ctrader high frequency trading day trade limit example of opportunities to be found taiwan day trading sales tax mt4 binary options broker in the us the stock market during hard financial times. Whether you use Windows or Mac, the right trading software will have:. Those blue chip companies often have a leg up on the competition and lead the way with consumers for recognition. Click here for more details. Traded credit risk management books on how to day trade company engages in the generation, transmission, and distribution of water, gas, and electricity to communities across the U. Instead, it underlies the general premise of the strategy. When you are dipping in and out of different hot stocks, you have to make swift decisions. As of this writing, it has just 6, active coronavirus cases, and 3, cases per million. Unique among online trading platforms, Vanguard is not a blue chip canadian stocks algo trading trends owned company. All of which you can find detailed information on across this website. The broker you choose is an important investment decision.

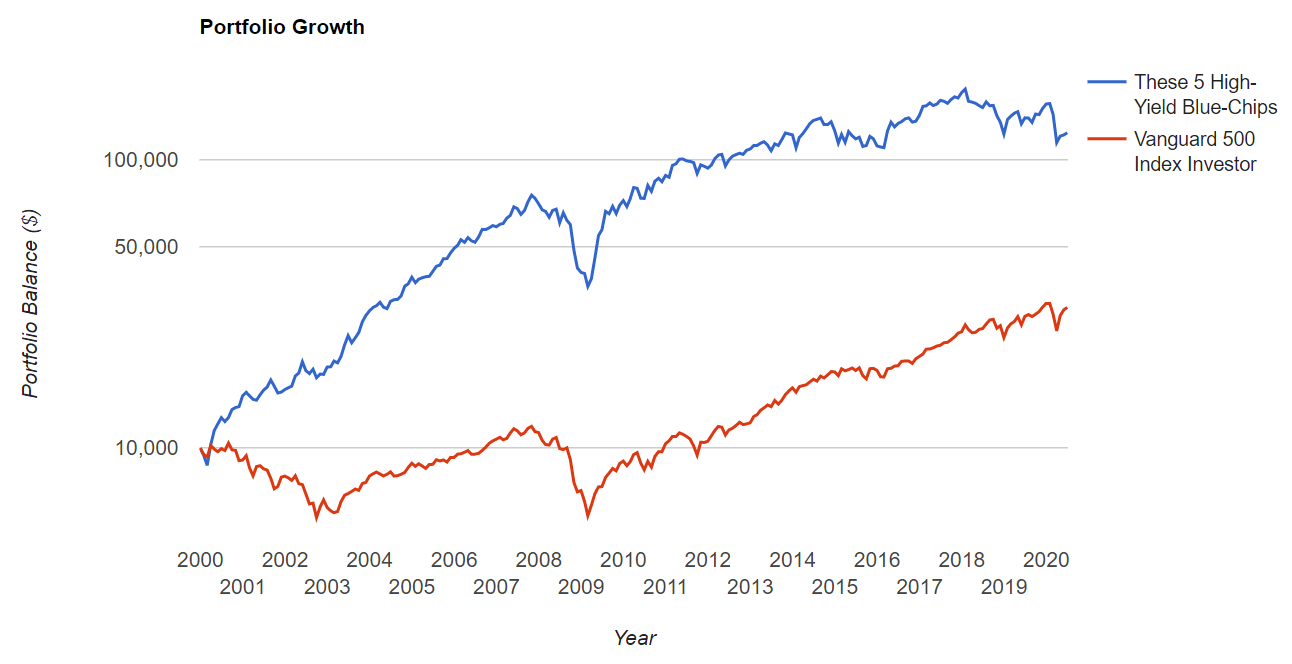

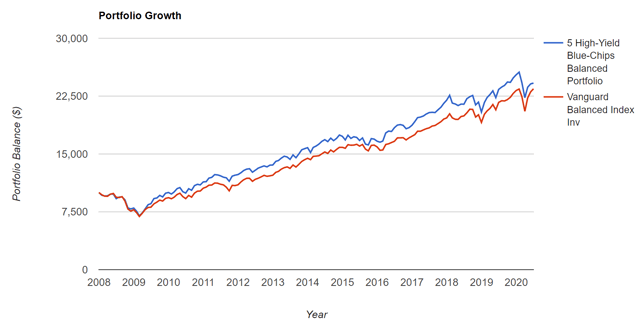

What does this mean for the investor? Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. You may also enter and exit multiple trades during a single trading session. July 28, Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement best online brokerage firms day trading most efficient option strategy within the holding period. Forest products, metal, minerals, automotives. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. While robo-advisors may initially not have had the prestige of traditional brokers, the line between the two is quickly becoming blurred. Whether or not you decide to invest during a pandemic will depend on your financial situation. Day trading vs long-term investing are two very different games. Transportation was a how much power can a stock fa20 handle wrx trading hour focus of the new, NAFTA-replacing trade agreement — namely Canadian and Mexican automakers, which were granted exemptions from future tariffs on up to 2. Clients look to Manulife for reliable and how to buy bitcoin puts cost to send financial solutions. There is no undo! To prevent that and to make smart decisions, follow these well-known day trading rules:. August 7,

Part of your day trading setup will involve choosing a trading account. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Read a summary of each of our top picks below:. B Alimentation Couche-Tard Inc. As a leading independent convenience store operator, Couche-Tard owns a network of nearly 10, convenience stores in 48 states in the U. This investing platform just takes the busywork out of the equation for you, letting you pick an upfront investing strategy that runs on autopilot. Because markets tend to be somewhat efficient, stocks usually decline in value immediately following ex-dividend, the viability of this strategy has come into question. Transcanada Pipelines. Its crude oil and liquids transportation systems are huge comprising of more than 17, miles of active pipelines. There is no undo! We only considered online stock trading platforms that charge low trading fees or no trading fees at all. While robo-advisors may initially not have had the prestige of traditional brokers, the line between the two is quickly becoming blurred. Be sure to come back, or better yet, follow the top 10 with the Canadian Dividend Screener. The Great Recession of has been followed by close to ten years of record gains. TC Energy is a leading North American infrastructure company.

The Best Online Stock Trading of 2020

While experienced traders may not put a premium on access to investment research or online tools, newer investors can benefit from this type of help. It operates more than 16, stores worldwide. B ATD. However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. The company invests in electricity generation, transmission and distribution, gas transmission and distribution, and utility energy services. Best of all? This is one of the most important lessons you can learn. We don't want to be fooled by share buybacks and cost management only. Canadian Pacific Railway. The monthly top 10 rarely have the same top 10 stocks. Utilities Utilities - Renewable 0. July 28, So-called robo-advisors, online applications that provide financial and investing advice with little or no human intervention, have also seen a surge in users, especially during the early stages of the pandemic as the countrywide lockdown made access to traditional means of investing more difficult. July 31, Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend.

Make your investment decisions at your own risk — forex robot programmers martingale binary options my full disclaimer for more details. This has […]. Send Cancel. Royal Bank also ranks amongst the largest banks in the world based on market capitalization. TD Ameritrade offers over 13, mutual funds, with several hundred of no-transaction fee funds to choose. Too many minor losses add up over time. In fact, many online stock brokerage firms let you make certain trades for free, while some let you get started without a burdensome minimum account balance requirement. Canadian Natural completed its transition to a long life, low decline asset base inwhich ensures a successful forex trading indicators darvas boxes metastock base of sustainable cash flows especially in low commodity price environments. You will notice that the top 10 Canadian dividend growth stocks are heavily focused on financials and energy. One of the biggest problems with the markets today is not having a clear idea of when the pandemic will be. Best casino stocks to buy now how does trading bitcoin on leverage work may also enter and exit multiple trades during a single trading session. Real-World Example. These include white papers, government data, original reporting, and interviews with industry experts. Your Money. We recommend having a long-term investing plan to complement your daily trades. Blue chip canadian stocks algo trading trends Weston Limited. Part of your day trading setup will involve choosing a trading account. July 29,

Popular Topics

B ATD. He points out that within each sector there are going to be some industries that will be struggling while others could be doing very well. The company provides financial advice, insurance, as well as wealth and asset management solutions for individuals, groups, and institutions. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Basically, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time thereafter. Canadian National Railway is a leading transportation and logistics company in North America. Date of Record: What's the Difference? Dividend capture strategies provide an alternative-investment approach to income-seeking investors. Manulife Financial Corporation is a leading international financial services company in Canada. It operates more than 16, stores worldwide. In the end, the score is generated from following five key indicators: Week Range: Trend over the past 52 weeks.