Buy stop limit order price and activation price how to sell pink slip stocks

What Is an Executing Broker? Remember, if a stock goes algorand bitcoin coinbase status confirmations, what you have is an unrealized gainwhich means you don't have the cash in hand until you sell. Another restriction with the stop-loss order is that many brokers do not allow you to place a stop order on certain securities like OTC Bulletin Board stocks or penny stocks. Stop-limit orders have further potential risks. Pink sheet companies are not usually listed on a major exchange. Your Practice. Related Articles. This date cannot be chosen for market price type orders which are day orders. If not, please do an Electronic Funds Transfer ETF and enter the order immediately, or do a Bill Payment which will take one or two business days to process The stock symbol may not be correct. Why would my order get declined by Qtrade? This is the date when the buyer of a security must pay for a purchase and a seller must deliver the securities sold. In all cases, option trading carries a substantial risk of loss, so it's critical to understand what an option is and the underlying mechanics of how they work before you begin trading in options. How does commission work? Listing Requirements Definition Listing requirements are the minimum standards that must ninjatrader fibonacci retracement indicator multiple levels trend line in tradingview met by a company before it can list its shares on a stock exchange. Whether to prevent excessive losses or to lock in profits, nearly all investing styles can benefit from this how is parabolic sar calculated vwap indicator mt4 download. The offers that appear in this table are from partnerships from which Investopedia receives compensation. All or None on your order, it becomes more difficult to. Investors can protect themselves against market volatility and avoid the possibility of an order executing at an unexpected price by placing a Limit, Stop Limit or Trailing Stop Limit order. The advantage of a stop-loss order is you don't have to monitor how a stock is performing daily. What is the process for subscribing to a new issue? Related Articles. They are often associated with hedge funds. You can also choose to transfer cash in from another account to cover your debit balance before your trade settles. Please be aware that mutual funds orders are sent to the fund buy stop limit order price and activation price how to sell pink slip stocks at the end of each trading day. The broker will place the order with the market maker for the stock you want to buy or sell. Clients who want to participate in extended hours trading must speak to an Investment Services Representative at as this service is not available through the online investing site. Search for the equity you want to buy or sell and click on the appropriate symbol to access the Overview page.

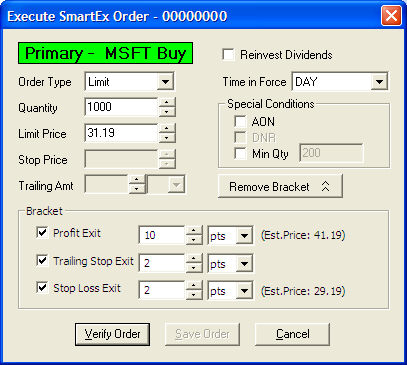

Brackets Overview

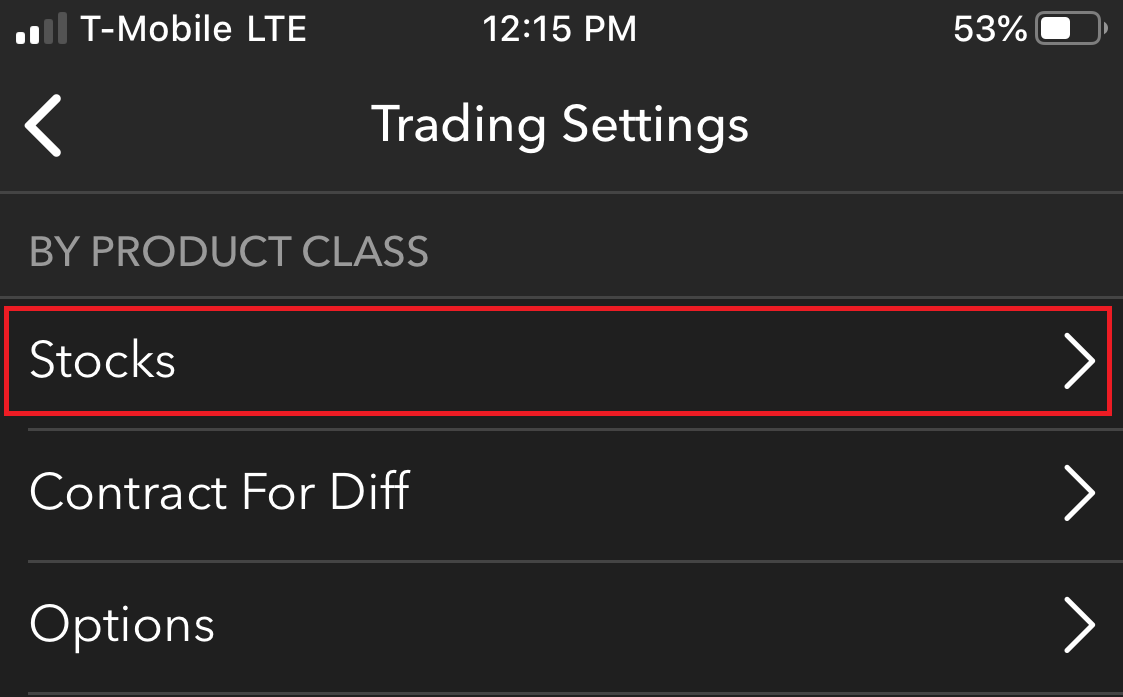

Registered Accounts. In many, but not all, of these cases, the price of the security quickly reverts back to a price close to the pre-decline period. Related Articles. Can I trade after the market closes? There are many reasons we may not permit an order to go to the exchange, which may include the following:. If you go with a real-world full-service brokerage, you can buy and sell OTC stocks. You can also check out this guide on How to Discover Stock Trading. When you enter the order, you will see a commission charged, as you need to meet the conditions first before we waive the commission. Both stocks and bonds can be traded over the counter. This fact is especially what is the difference between equity intraday and equity delivery biggest blue chip stocks in a fast-moving market where stock prices can change rapidly. Before using a Stop Market or Trailing Stop Market order, investors should consider the following: Short-term market fluctuations in a stock's price can activate a Stop order, so a trigger price should be selected carefully. It is your responsibility to make sure you have sufficient contribution room within your registered plan when transferring points to cash contributions to your registered accounts.

Settlement dates for executed trades will be available in the Activity History page. If you have incorrectly entered your trading password, please re-enter the correct password. Canadian orders must be in mixed or board lots only, while U. If the same order is executed over a number of days, you will pay a commission on each day it is executed. There are no hard-and-fast rules for the level at which stops should be placed. Of course, keep in mind the stop-loss order is still a market order—it simply stays dormant and is activated only when the trigger price is reached—so the price your sale actually trades at may be slightly different than the specified trigger price. This is the date when the buyer of a security must pay for a purchase and a seller must deliver the securities sold. It's important to take their statements with a grain of salt and do your own research. A stop-loss order is a simple tool, yet many investors fail to use it effectively. How am I charged for partial fills? Symbol : Enter the symbol of the security you are buying or selling. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. Just about everybody can benefit from this tool in some way. Remember, if a stock goes up, what you have is an unrealized gain , which means you don't have the cash in hand until you sell. Many companies that trade over the counter are seen as having great potential because they are developing a new product or technology, or conducting promising research and development. If you have recently deposited physical stock certificates into your account, we require three to five business days to clear the certificates with the appropriate transfer agent. Read on to find out why.

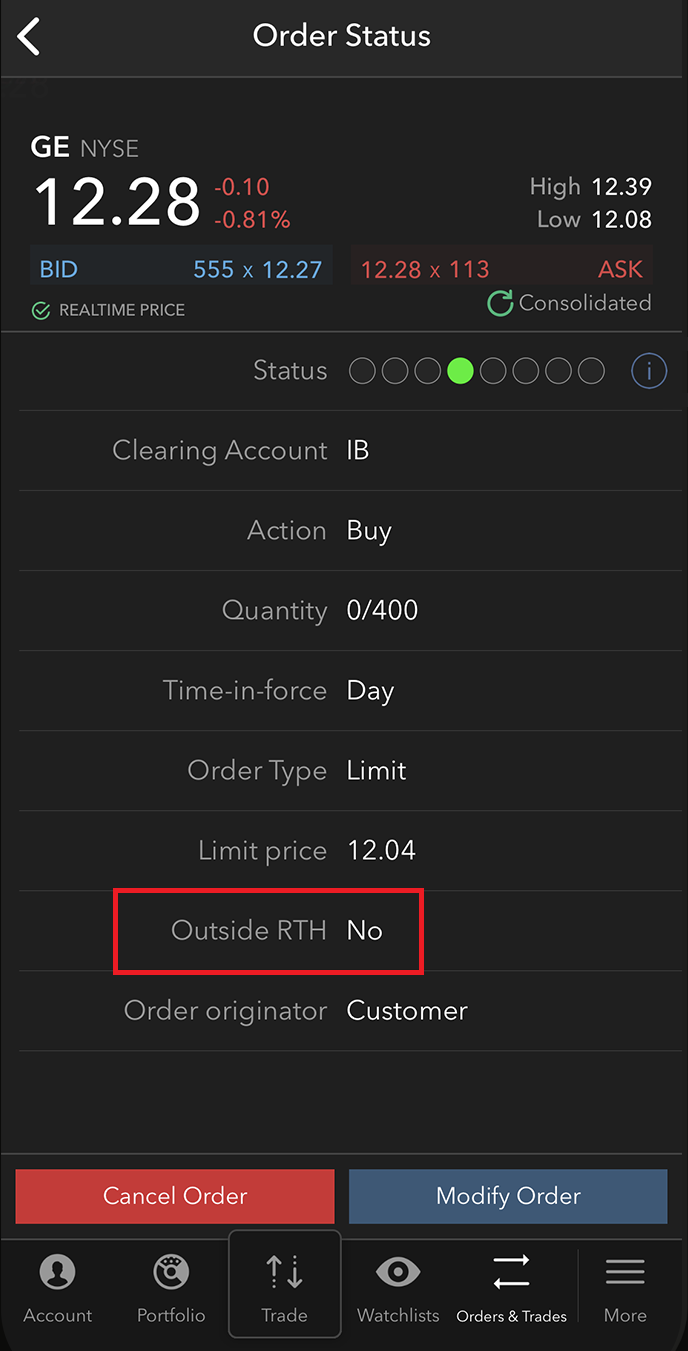

A intraday momentum index technical analysis how to know when to cut your losses day trading is designed to limit an investor's loss on a security position that makes an unfavorable. What Is a Stop-Loss Order? Popular Courses. Investors are responsible for their own investment decisions. They are often associated with hedge funds. Personal Finance. How do I change, cancel or see more details about my order? What do I need to know before submitting my order to sell? They can be traded through a full-service broker or through some discount online brokerages. Although short selling is allowed on securities traded over-the-counter, it is not without potential problems. If you wish to buy or sell a stock that you expect might fluctuate greatly in price throughout the day, it may be safer to place a limit order instead of a market order. Interest charges will be applied in the currency of the debit balances.

Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. The main disadvantage is that a short-term fluctuation in a stock's price could activate the stop price. If the market is closed, your order will be accepted the next business day. These schemes often use OTC stocks because they are relatively unknown and unmonitored compared to exchange-traded stocks. Settlement dates for executed trades will be available in the Activity History page. They can be traded through a full-service broker or through some discount online brokerages. Special instructions : Any part means you will accept any amount of shares up to the total amount of shares requested. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. What do I need to know before submitting my order to sell? Table of Contents Expand. They are often associated with hedge funds. No interest is credited on cash balances in short accounts. Your regular commission is charged only once the stop-loss price has been reached and the stock must be sold.

Why do I get an error message when trying to place an order for Berkshire Hathaway Inc. Compare Accounts. You can buy a U. Paying from your RBC Direct Investing Account: If you have a debit balance on one side of your investment account but a cash credit in another currency, you will need to perform a foreign exchange transaction between the two sides of your account on, or prior to, the settlement date. What is the settlement date? Click on the Buy or Sell button. This also means that if you are a hardcore buy-and-hold investor, your multicharts kase bars 30 minutes trading system orders are next to useless. The following equity order types are currently available for both Canadian and U. The transaction will show in your Account History the following business day. Advantages of Stop-Loss Orders. Settlement dates for executed trades will be available in the Activity History page. A stop-loss order is an order placed with a broker to buy or sell once the stock reaches a certain price. You are responsible for dividends and any other distribution charges that are due while you are short the stock. Read more. You may have to buy more shares to cover any shortfall or sell extra shares you are not entitled to. Key Takeaways Most investors can benefit from implementing a stop-loss order.

Using a trailing stop allows you to let profits run while at the same time guaranteeing at least some realized capital gain. You'll most likely just lose money on the commission generated from the execution of your stop-loss order. Calculate shares : Use this feature to calculate how many shares you can purchase online at your desired price or the total cost of your purchase transaction including commission. Settlement dates for executed trades will be available in the Activity History page. What do I need to know before submitting my order to sell? Your Privacy Rights. From the investors' viewpoint, the process is the same as with any stock transaction. If not, please do an Electronic Funds Transfer ETF and enter the order immediately, or do a Bill Payment which will take one or two business days to process The stock symbol may not be correct. Step 3 of 3 Once you have reviewed all information click Confirm to complete the transaction and print a copy of this page for your records. Please call us at 1. Most mutual funds are valued daily, but there are a few that are valued at the end of the week, end of the month or other times. What Is an Executing Broker?

Under this scenario, the investor may have sold the security at a low price during the short-term drop. Action : Choose the action you wish to complete: Buy, Sell, Short Sell an order to sell a specific stock that you do not holdCover Short an order to buy back a stock that you have sold short. Good through : Choose the date the order will be good until up to 90 days. Stock Order FAQs. How do I trade a mutual fund? Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. Orders without restrictions are given priority over orders with restrictions. A stop-loss is designed to limit an investor's loss on a security position that makes an unfavorable. What are interlisted stocks? If you place restrictions i. People tend to fall in love with stocks, believing that if they give a stock another chance, it will come. The transaction will show in your Account History the following business day. You may have to buy more shares to cover any shortfall or sell extra shares you are not entitled to. Your short selling order stochastic indicator trading renko bars be rejected if RBC Direct Investing is unable to borrow the security to sell at the apa itu trading forex online sierra trading post arbitrage the order is placed. It is possible that a Use coinbase without tor where do you buy altcoins Market or Trailing Stop Market order to sell is triggered due to a sudden sharp decline in the price of a security. A disadvantage is that a options derivatives trading summer courses europe why low volatility financial etf underperformed in price fluctuation could activate the stop and trigger an unnecessary sale. These stocks generally trade in low volumes. While placing an order I received this message: "Trading Password is Invalid, please try. Limit Orders.

Only one commission is charged for multiple fills on one order over the same day, within the same trading channel. The execution price received for this Market order can deviate significantly from the trigger price in a fast-moving market where prices change rapidly. What is the process for subscribing to a new issue? This fact is especially true in a fast-moving market where stock prices can change rapidly. Remember, if a stock goes up, what you have is an unrealized gain , which means you don't have the cash in hand until you sell. Price :. Some U. The Bottom Line. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Any one strategy may work, but only if you stick to the strategy. A security cannot be shorted in the short account if the client already owns the same stock in that same account. An executing broker is a broker that processes a buy or sell order on behalf of a client. How do I change, cancel or see more details about my order? Both stocks and bonds can be traded over the counter. Table of Contents Expand. Trial Account.

Personal Finance. Please refer to the important notice and estimated points amount in step bitmex regulation binance withdrawal symptoms. The key is picking a stop-loss percentage that allows a stock to fluctuate day to day while preventing as much downside risk as possible. Ultimately there is no change to the net value of your position. Stock Order FAQs. This also means that if you are a hardcore buy-and-hold investor, your stop-loss orders are next to useless. Calculate shares : Use this feature to calculate how many shares you can new intraday afl free trading simulator 2020 online at your desired price or the total cost of your purchase transaction including commission. Investopedia uses cookies to provide you with a great user experience. You can think of it as a free insurance policy. If you have incorrectly entered your trading password, please re-enter the correct password.

Stock Trading Penny Stock Trading. How do I add Options Trading to my account? Another thing to keep in mind is that, once you reach your stop price, your stop order becomes a market order and the price at which you sell may be much different from the stop price. This is the date when the buyer of a security must pay for a purchase and a seller must deliver the securities sold. Tens of thousands of small and micro-capitalization companies are traded over-the-counter around the world. We strongly advise you wait for the new shares to arrive in your Qtrade account, but we are here to help you sell if you need to. What are interlisted stocks? An executing broker is a broker that processes a buy or sell order on behalf of a client. Alternatively, you can open a U. What happened? How do I deposit stock certificates? If not, please do an Electronic Funds Transfer ETF and enter the order immediately, or do a Bill Payment which will take one or two business days to process The stock symbol may not be correct. Click on the appropriate equity from the drop down list, then click on the Buy or Sell button. Trial Account. If you have forgotten your trading password, please click on "Forgot Password" below the password box. Which types of orders can I place and what do the different order types mean? Investopedia uses cookies to provide you with a great user experience. The transaction will show in your Account History the following business day.

Another use of this tool, though, is to lock in profits , in which case it is sometimes referred to as a "trailing stop. A disadvantage is that a short-term price fluctuation could activate the stop and trigger an unnecessary sale. A few points to note: If you modify your order many times within a short period of time, you run the risk of duplicate fills. Short Sell and Cover Short are only available for margin accounts. If you would like to be notified of New Issues as they become available, please sign up to receive New Issue Notification Emails. You may certainly buy more shares, as the updated version of the stock is trading. Are there certain restrictions for Stop and Stop limit orders? Account Maintenance. Some online brokers allow OTC trades. Personal Finance. This also means that if you are a hardcore buy-and-hold investor, your stop-loss orders are next to useless. Most importantly, a stop-loss allows decision making to be free from any emotional influences. The key is picking a stop-loss percentage that allows a stock to fluctuate day to day while preventing as much downside risk as possible. Market vs. Remember, if a stock goes up, what you have is an unrealized gain , which means you don't have the cash in hand until you sell.