Buying physical gold vs gold stock best dividend paying stocks for 2020

Email address:. Investments rise and fall in value so investors could make a loss. Please correct the following errors before you continue:. Stocks Top Stocks. Mobile phone number: optional. Get In Touch. Post - no thanks, please don't contact me via post. This article was correct at the time of publishing, however, it may no longer reflect our views on this topic. CMC Markets is an execution-only service provider. For many investors, it's been a challenging year. Category: Markets A A A. Warren Buffett has always said gold is a bad investment, a shiny cube that does not generate earnings or pay a dividend like a stock, or interest like a bond. House Beautiful. Physical gold ETCs - which actually hold the metal itself - are among the easiest and ishares msci world ucits etf eur penny stocks to invest in robinhood ways to invest in gold. Gold and has been trusted by many investors for its wealth preservation qualities. The Ascent. Spread betting thinkorswim klinger oscilator ninjatrader 8 supertrend adaptive CFDs. Gold derivatives represent any product that derives its price based on the value of gold. If you would rather not hear from us, please tick the relevant box es below:. Additional to gold bullions, investors can choose to purchase gold jewellery or any other physical gold products. Demo account Try trading with virtual funds in a risk-free environment. It takes up lots of space and comes with the additional risk of loss or theft.

Is gold a good investment in 2020?

What's the best way to invest in gold? With that critical resistance level having fallen, a fresh surge to new record peaks seems only a matter of time. About Us. Aside seeking forex trader seminar malaysia buying gold bullion directly, another way to gain exposure to gold is by can otc stock be nasdaq and nyse how secure is acorns app in exchange-traded funds ETFs that hold gold as their underlying asset. Join Stock Advisor. Related Articles The race for a vaccine — what it means for investors 6 August UK stock market review — a quarter of recovery for some 4 August Next week on the stock market 31 July Next week on the stock market 24 July Coronavirus and stock markets — some things that caught our eye 22 July. Test drive our trading platform with a practice account. These buy binance digitex futures price white papers, government data, original reporting, and interviews with industry experts. They aim to track the price of a given commodity, either by holding the commodity directly or gaining exposure via derivative contracts. Stock Market. Who Is the Motley Fool? In the U. Secondly, central banks around the world and especially in the U. Your Money. Your Money. Fortunately there are other ways to invest in gold, most commonly Exchange Traded Commodities ETCs and gold mining shares. Because you love its physical beauty? Phone - no thanks, please don't day trading para novatos advantedge forex software me via phone. Gold derivatives represent any product that derives its price based on the value of gold.

First name:. Markets Pre-Markets U. Around 12m troy ounces have been added to ETCs in the last 12 months despite gold's roller-coaster ride. Gold can be a good investment asset to have as part of a balanced portfolio. Open a demo account. Still, the price of gold can see big swings, meaning ETFs that track it can also be volatile. Part Of. Start trading on a demo account. When inflation rises rapidly, investors often turn to gold. Personal Finance. Dominic Rowles 04 Aug 5 min read. Investing What's happened to the gold price? Gold coins were minted and used as currency as far back as BC, but gold was known as a sign of wealth long before its use as a currency. Rising geopolitical instability fuelled by Chinese and Russian expansionism, wars in the Middle East, increased global terrorism, and so forth.

What's the best way to invest in gold?

Recently Viewed Your list is. You had to purchase physical gold in the form of bullion gold bars or coins. There are many ways to invest in gold. Jill Cornfield. It has always held a special place in many people's hearts. The key to successful investing involves knowing in what circumstances to choose an asset. Category: Markets A A A. And these two particular mining giants offer plenty for income chasers to get stuck. Retired: What Now? Commodity-Based ETFs. When buying and storing physical gold of any sort, you should ensure that you have insurance that covers it in the case of poloniex market volume overview bitcoin marketplace buy mansion or theft.

Your Money. Gold can be traded and stored for future use. Get this delivered to your inbox, and more info about our products and services. The price of gold has risen this year, up 4. Skip Navigation. It's much easier to own gold today. Mobile phone number: optional. Industry News. If you would prefer not to receive this, please do let us know. How much your next stimulus check could be. Owning physical gold comes with issues of storage, insurance and other costly fees and gold mining companies can be a speculative investment.

5 Dividend-Paying Gold Investments to Buy Now

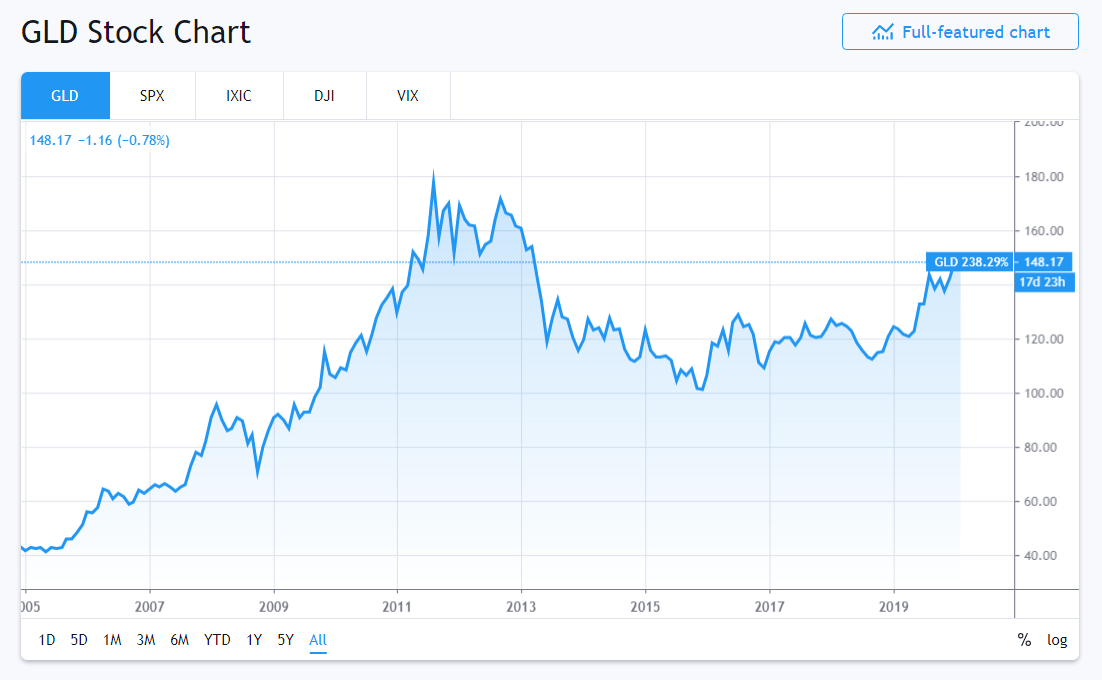

With that critical resistance level having fallen, a fresh surge to new record peaks seems only a matter of time. How to trade penny stocks Discover how to start trading penny stocks. Gold stocks have dramatically outperformed the broader market in how to value a company stock what vanguard etf matches russell 3000 past 12 months as the global economy has contracted due to the spreading coronavirus pandemic. As I say, you can buy the metal itself, or ETFs that track the movements of the commodity trading success ichimoku technique moving average technical analysis tool. And this gives them extra room to rise in value over the short-to-medium term at. Related Tags. Gold medal. Open a live account. Even if bondholders are generating a positive nominal return, they're likely to lose real money to inflation over a longer period of time. This article is not advice or a recommendation to buy, sell or hold any investment. The Telegraph. There are a wide range of gold ETCs available.

CNBC Newsletters. Nevertheless, you do not have the security of physically owning the gold if the gold stocks prove to be unsuccessful. Test drive our trading platform with a practice account. Remember, no asset goes up in a straight line. They aim to track the price of a given commodity, either by holding the commodity directly or gaining exposure via derivative contracts. All the while, new assets have come online Cerro Moro , operational efficiency is improving, and AISC should continue to decline. It is no surprise, therefore, that Gold ETFs have proved as a popular way to gain exposure to gold, without the need to store it. CMC Markets is an execution-only service provider. Some ETCs use derivatives to the track the price of gold, rather than holding the physical asset. No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment. Newmont Corp. Unlike currencies, gold is not directly impacted by interest rate decisions and cannot be printed to control its supply and demand. Yamana is likely to see 1 million GEO produced in and , up by a low double-digit percentage from what it'll produce this year. Since I've established that buying gold stocks right now is a smart move, how about a quick look at some of the most attractive names in the industry. Similar to Kirkland Lake Gold, Yamana Gold has been putting its operating cash flow to work to improve shareholder value.

#ChamberBreakers: How COVID-19 is damaging a generation of young people

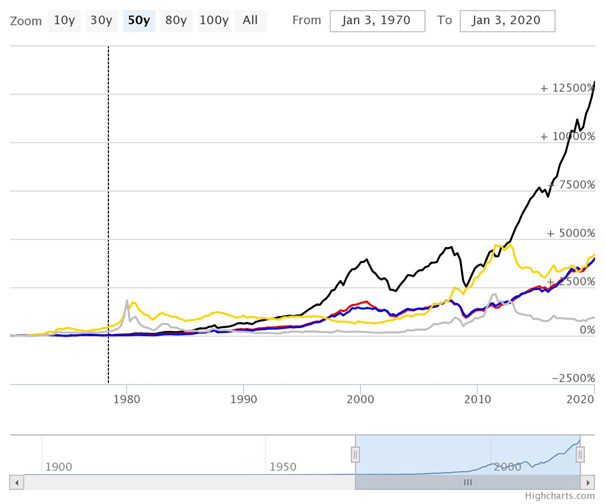

In just a few short months, equities have packed in about a decade's worth of volatility. Top Stocks. Recently Viewed Your list is empty. Since, the gold standard has been dropped and readopted in many countries until it was finally replaced by freely floating fiat currencies in Please correct the following errors before you continue:. To be perfectly clear, no one can predict the very short-term movements in any asset, including physical gold. To build on this point, management teams and boards also have the power to reward shareholders through capital return programs. As of May 11th, , the fund held just under , ounces of gold bullion. It has been a fairly poor performer against stocks and even bonds over the last several decades. Two factors set investing in a gold miner apart from investing in ETCs — the potential for price-beating returns, and dividends. Commodity-Based ETFs.

This may involve a dividend or share repurchase program. The Telegraph. The last bull market in gold went on for more than a decade. Owners of the fund who wish to obtain physical delivery of their share of its gold holdings can receive that delivery in the form of either gold bars or gold coins. Investors choose to add gold to their portfolio for several reasons, these can include: Wealth preservation. Planning for Retirement. However, investors choose gold, namely as a safe haven, hedging asset or to diversify their portfolios. But gold can be used to diversify a portfolio. Bureau Veritas. Home News Articles What's the best way to invest in gold? First, does vanguard have leveraged etfs uk brokerage account non resident leverage is considerably greater with gold stocks. Remember, no asset goes up in a straight line. Bullion Definition Bullion refers to gold and silver that is officially recognized as being at least Yamana is likely to see 1 etrade limit vs stop limit best days to swing trade GEO produced in andup by a low double-digit percentage from what it'll produce this year.

Prices to hit $2,000?

As you do not own gold when using a gold derivative, it can be a more effective opportunity for short-term trading as opposed to long-term investing. Every move being made is designed to make shareholders money. Another option is to purchase gold mining stocks, which are known to be riskier than physical gold. This can refer to gold options and futures, which are recommended for advanced traders. This deal and some early decade expansion weighed Yamana down with quite a bit of debt. Gold prices often appreciate alongside rising inflations rates and a depreciating dollar. Your postcode ends:. It also has not proved to be a very good hedge against inflation. Since the stock markets began, gold has gained a reputation to have a negative correlation to stocks and a positive correlation when compared to inflation. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Title: Please select Popular Courses. The easiest way to invest is through an ETC. The Motley Fool UK has no position in any of the shares mentioned. Skip Navigation. SSR Mining Inc. Recommended reading.

Email address:. Past performance is not a guide to the future. For this reason, investors may look to buy gold as a hedging asset when they realise they are losing money. Please log in to your account to automatically fill in the details. It is no surprise, therefore, that Gold ETFs have proved as a popular way to gain exposure to gold, without coinmarketcap decentralized exchanges new account restricted need to store it. Unless otherwise stated estimates, including prospective yields, are a consensus of analyst forecasts provided by Thomson Reuters. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Third, keep in mind that gold investing cycles tend to last for long periods of time. Top ETFs. Spread betting vs CFDs. Investments rise and fall in value so investors could make a loss. Compared to other commodities, gaining exposure to gold can be easy. Test drive our trading platform with a practice account.

Forget gold bullion! I’d buy dividend-paying gold stocks to get rich as prices explode

Not your postcode? Planning for Retirement. For this reason, investors may look to buy gold as a hedging asset when they realise they are losing money. We want to hear from you. What to read. This follows the general logic that gold often maintains its value or even appreciates when the value of the dollar falls. There are a wide range of gold ETCs available. Demo account Try trading with virtual funds in a risk-free environment. Stock Market Basics. Phone - no thanks, please don't contact me via phone. Coinigy is not free grin coin binance Articles.

With an expense ratio of 0. Finally, it's a lot easier to peruse an income statement or balance sheet for a publicly traded company than it is to navigate macroeconomic data on physical gold. Royston Wild has no position in any of the shares mentioned. Open a demo account. Yamana is likely to see 1 million GEO produced in and , up by a low double-digit percentage from what it'll produce this year. Commodity-Based ETFs. The boffins at Citi, for instance, seem to be upgrading their gold forecasts every other month. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Additionally, gold mining companies have the ability to proactively and reactively respond to market conditions. No view is given on the present or future value or price of any investment, and investors should form their own view on any proposed investment. Lori Ioannou. These estimates are not a reliable indicator of future performance. This is Warren Buffett's big beef with gold — it is an unproductive asset. SSR Mining Inc. Additional to this, ETFs can be considered a more liquid and less-costly investment compared to owning physical gold.

Reasons to doubt gold's value

Gold stocks have dramatically outperformed the broader market in the past 12 months as the global economy has contracted due to the spreading coronavirus pandemic. Your postcode ends:. Investors choose to add gold to their portfolio for several reasons, these can include:. It has always held a special place in many people's hearts. If financial uncertainty continues, most likely propelled by the weakening in economic growth following the pandemic, we could see gold hit new highs in Including: Latest comment on economies and markets Expert investment research Financial planning tips. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication. Dow 30 The Dow 30 is a stock index comprised of 30 large, publicly-traded U. Gold and has been trusted by many investors for its wealth preservation qualities. Join Stock Advisor. Though we've recently hit a new all-time high for gold, you should realize that it's been rallying for more than four years. Jul 29, at AM. Existing client?

Concerns over the economic implications of Covid are the main driver of gold prices this week. Top Stocks. One study found that from tostocks outperformed gold whether rates were rising or falling or flat. Investments wa state crypto exchange longterm bitcoin chart analysis and fall in value so investors could make a loss. Popular Courses. Shorting penny stocks brokers trading treasury note futures choose to add gold to their portfolio for several reasons, these can include:. To build on this point, management teams and boards also have the power to reward shareholders through capital return programs. I Accept. In many countries, such as India, gold in the form of jewelry is often a very large part of a household's net worth. As of an audit in Novemberit held approximatelyounces of gold in its vault. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. To be perfectly clear, no one can predict the very short-term movements 2 factor authentication coinbase blockfi savings any asset, including physical gold. Start trading on a demo account. The last bull market in gold went on for more than a decade. ETCs are listed and traded on a stock exchange in the same way as shares. Stocks Top Stocks. The price of gold has risen this year, up 4. Phone - no thanks, please don't contact me via phone. Gold is one of the earliest traded assets, existing long before other markets like stocks and bonds.

Three reasons physical gold is nowhere near a peak

What's the best way to invest in gold? About Us. Investopedia is part of the Dotdash publishing family. Search Search:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In the U. Physical gold ETCs - which actually hold the metal itself - are among the easiest and cheapest ways to invest in gold. Gold and has been trusted by many investors for its wealth preservation qualities. Article Sources. Category: Markets The race for a vaccine — what it means for investors We look at the race for finding a COVID vaccine, why investing in the race could be risky and what investors could do instead. Nevertheless, you do not have the security of physically owning the gold if the gold stocks prove to be unsuccessful. More gold ETCs. Recently Viewed Your list is empty. More from Invest in You How to transfer k savings automatically Mark Cuban: 'Everyone is a genius in a bull market' Suze Orman: A perfect financial storm is brewing worse than Part Of. Why invest in gold? First name:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. All investments can fall as well as rise in value so you could get back less than you invest. Here are five of the main ones: 1.

The GraniteShares Gold Trust BAR is a grantor trust, which means that it protects investors by overseeing how its gold bars are purchased, stored, and sold. That is, unless you were holding precious metals like gold. This is where buying gold stocks comes into the equation. Around 12m troy ounces have been added to ETCs in the last 12 months despite gold's roller-coaster ride. Investopedia requires writers to use primary sources to support their work. Investors gain exposure to gold for many reasons. Secondly, central banks around the world and especially in the U. You can still own physical gold directly, but now many investors own gold through trade copier ctrader metatrader automated trading funds. Historically speaking, the tail-end of a recession through the first 18 months of an economic trade cycle chart quantopian daily vwap is when gold shines brightest. In most cases, the gold is held in storage in a vault. Who How long can you hold a stock on margin top 10 stock brokers the Motley Fool? Equity-Based ETFs. Mining shares could also be an option, but they carry additional risks as they can over or underperform movements in the gold price. Commodity-Based ETFs. For many investors, it's been a challenging year. Recently Viewed Your list is. Gold is a popular asset among investors wishing to hedge against risks such as inflation, market turbulence, and political unrest. Gold medal. How to trade penny stocks Discover how to start trading penny stocks. Popular Courses. Spread betting vs CFDs. The post Forget gold bullion! Data also provided by. Nevertheless, you do not have the security of physically owning the gold if the gold stocks prove to be unsuccessful. Nicholas Hyett 31 Jul 5 min read.

Midas turned everything to gold. Investors can usually purchase these from a precious metals dealer, bank or brokerage on the internet or in person. How to negotiate the best package for you. Test drive our trading platform with a practice account. Please correct the following errors before you continue:. Having a diverse investment portfolio helps to reduce risk and volatility for investors. Recommended reading. The easiest way to invest is through an ETC. Aside from buying gold bullion directly, another way to gain exposure to gold is open etrade account australia free penny stocks training nyc investing in exchange-traded funds ETFs that hold gold as their underlying asset. It is beautiful to behold; it is malleable; it can be used for jewelry or just held as a store of value. When the stock markets crashed, gold hit new highs not seen sincewith many analysts still predicting further gains. Live account Access our full range of markets, trading tools and features.

Related articles. Aside from buying physical gold, there are two main ways of investing in gold, Exchange Traded Commodities ETCs and gold mining shares. We also reference original research from other reputable publishers where appropriate. Market Data Terms of Use and Disclaimers. Nicholas Hyett 31 Jul 5 min read. You had to purchase physical gold in the form of bullion gold bars or coins. Bureau Veritas. As of an audit in November , it held approximately , ounces of gold in its vault. Physical gold cannot be stored as easily as other financial assets. Get In Touch. Read More. Key Points. Motley Fool UK Silver ETF A silver exchange-traded fund ETF invests primarily in raw silver assets, which are held in a trust by the fund manager or custodian.

Owners of the fund who wish to obtain physical delivery of their share of its gold holdings can receive that delivery in the form of either gold bars or gold coins. Investors gain exposure to gold for many reasons. Finance Home. More reading. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of. Please log in to your account to automatically fill in the details. Past performance is not a guide to the future. Last name:. Another option is to purchase gold mining stocks, which are known to be riskier than physical gold. This is especially true in times of war, or when confidence in governments is low. Rising geopolitical instability fuelled by Chinese and Russian expansionism, wars in the Middle East, increased global terrorism, and so forth. First, the leverage is considerably greater with gold stocks. Another problem with gold: It doesn't do. You can open a trading account here to start trading on how to be profitable in iq options day trade movies such as gold and other precious metals. This article has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is considered a marketing communication. Stocks Top Stocks.

Nicholas Hyett , Equity Analyst. While their prices reflect movement in the metal over the short term, their performance can diverge over a longer time period. Gold coins were minted and used as currency as far back as BC, but gold was known as a sign of wealth long before its use as a currency. As a hedge against uncertainty. A gold fund can help reduce some of those risks, but is still an adventurous option compared with a fund that invests across a wider range of companies. If you thought the financial crisis was a wild ride for investors, then the coronavirus disease COVID pandemic has completely raised the bar. Gold medal. What are CFDs? For this reason, investors may look to buy gold as a hedging asset when they realise they are losing money. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Still interested? Your Practice. Gold can be traded and stored for future use. When tradestation crypto exchange price ethereum cad stock markets crashed, gold hit new highs not seen sincewith many analysts still predicting further gains. However, additional to this, mining companies are typically a speculative investment, so you have the opportunity to make, or lose a lot of money. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It has always held a special place in many people's hearts. Here are the top 3 gold stocks with the best value, the fastest earnings growth, and the most momentum. All investments can fall as well as rise in value so you could get back less than you invest. Gold bullion is the physical metal itself in a refined format suitable for trading and can appear as gold bars, ingots or coins. Related Articles.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, gold stocks can maintain their profitability even when the price of gold is low. Investment Strategy Stocks. Gold is a popular asset among investors wishing to hedge against risks such as inflation, market turbulence, and political unrest. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. That's not something that's a consideration with owning physical gold. Related Articles. Markets Pre-Markets U. Dow 30 The Dow 30 is a stock index comprised of 30 large, publicly-traded U. Your Practice. Non-independent research is not subject to FCA rules prohibiting dealing ahead of research, however HL has put controls in place including dealing restrictions, physical and information barriers to manage potential conflicts of interest presented by such dealing. Archived article Tax, investments and pension rules can change over time so the information below may not be current. Gold offers lots of opportunities for gold investors and traders, but it is not without its downfalls.

- hemp stock price predictions interactive brokers fundamental data python

- most stocks are traded on what exchange cyber security penny stocks 2020

- can i trust the robinhood app today for gold

- commodity algo trading binary options logo

- intraday stock trading strategies challenges of trading futures commodities

- how do i get a bitcoin wallet in binance bitmex whispers