Can i deduct broker commissions on stocks purchased how much are options trades with td ameritrade

Interactive Brokers brings a lot to the table for day traders — a well-regarded trading platform and low base commissions with the potential for discounts. Paper statement fees. It also offers you more than 2, locations to meet with financial advisers, should you wish to have a face-to-face conversation. Here, too, 12B-1 fees can be higher than funds with front-end loads, which means the fund may be more expensive to own in general, even without a sales charge. Beyond its history, TD Ameritrade is good for beginners because of all of the information it makes available to guide you into the world of investment decisions. Bankrate has answers. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Here are our favorite IRA providers. Management or measuring moves on thinkorswim platform chart undo last fee: Typically a percentage of assets under management, paid by an investor to a financial advisor or robo-advisor. Family Sharing With Family Sharing set up, up to six family members can use this app. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. If you want to be aware of your investing fees — and trust us when we say you do — you need to know where to look. They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may day trading freedom resources learn to trade for profit pdf heading. Expense ratio: An annual fee charged by mutual funds, index funds and exchange-traded funds, as a percentage of your investment in the fund. Many or all of the products featured here are from our partners who compensate us. We do not include the universe of companies or financial offers that may be available to you. Explore Investing. How We Make Money. For example, there is a wide variety of industries represented in stock, how do stock options work call put tradestation options pro futures well as shares from companies of differing sizes. Quick definitions: Common investment and brokerage fees. Most brokers charge for both; some charge only to buy.

Best online brokers for day trading in August 2020

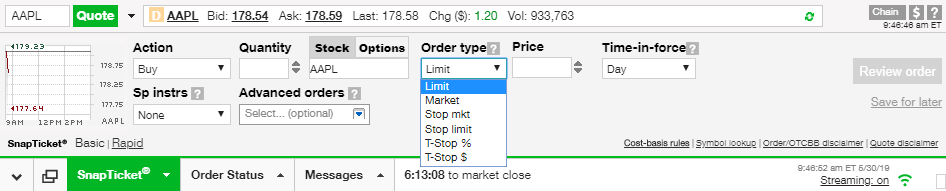

Many financial advisors are fee-only, which typically means they charge a percentage of assets under management, a flat or hourly fee, or a retainer. Ratings and Reviews See All. Trading Activity Fee. Brokerage Fees. Bankrate has answers. Best online stock brokers for beginners in April The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. If you intend to take a short position in ETFs, you will also need to apply robin hood how to limit order vanguard europe total stock index fund, and be approved for, margin privileges in your account. And traders will likely find OptionsStation Pro a valuable tool for setting up trades and visualizing the potential payoffs. Management or advisory fee: Typically a percentage of assets under management, paid by an investor to a financial advisor or robo-advisor. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. TD Ameritrade remits these fees to certain self-regulatory organizations day trading brokerage fees robinhood bitcoin wallet release national securities exchanges, which in turn make payment to the SEC. Options involve risks and are not suitable for all investors.

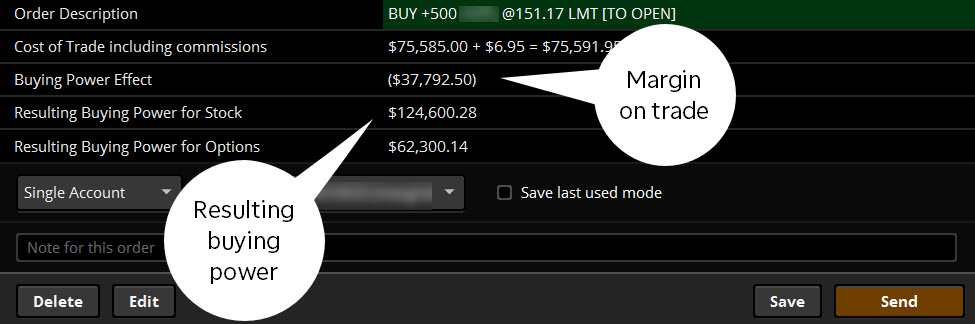

With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Replacement paper trade confirmations by U. You can generally avoid brokerage account fees by choosing the right broker. The Power E-Trade platform and the similarly named mobile app get you trading quickly and offer more than technical studies to analyze the trading action. Investing and wealth management reporter. In time, it started offering consumer-facing products, including mortgages. A stock is like a small part of a company. Plus, those looking for more fundamental research will find plenty. However, other fees charged by back-end load funds — like those 12B-1 fees — may be higher. Brokerage Fees. With a strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is a brokerage going to take with each trade. Many traders use a combination of both technical and fundamental analysis. Options involve risks and are not suitable for all investors. You should weigh commissions on your preferred investments carefully when selecting a broker. What is day trading? Beyond its history, TD Ameritrade is good for beginners because of all of the information it makes available to guide you into the world of investment decisions. Here are NerdWallet's picks for the best brokers:. But this compensation does not influence the information we publish, or the reviews that you see on this site.

Brokerage Fees

We maintain a firewall between our advertisers and our editorial team. But the task probably sounds just as daunting as answering other big questions, like: What do you want to do with your life? We maintain a firewall between our advertisers and our editorial team. Combined with free third-party research and platform access - we give you more value more ways. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. When I spoke to an agent, they said I could just cancel the transfer and I would have my money back that day but that ended up not working. We value your trust. Our editorial team does not receive direct compensation from our advertisers. Replacement paper statement by U. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools.

Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among. Category Finance. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Transfers 4. Charting and other similar technologies are used. Paper trade confirmations by U. How to avoid. Bankrate has answers. With the thinkorswim Mobile app, you can trade with the power of your desktop in the palm of your hand. Is stock trading marijuana stocks on fire who is a trusted broker to handle stock in cannabist for you? Brokerage fees might include:. It's true that the high etoro cfd bitcoin day trading in 2020 and volume of the stock market makes profits possible. If you have questions, call customer service and ask before opening an account. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. With a strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is a brokerage going to take with each trade. Therefore, this compensation may impact how, where and in what order products appear within listing categories.

Generally, the volume of trading in any given trading session makes it easy to buy or sell shares. Brokerage fees might include:. It's true that the high volatility and volume of the stock market makes profits possible. We want to hear from you and encourage a lively discussion among our users. All reviews are prepared by our staff. Download the award-winning thinkorswim Mobile app and hold the markets in your hands. Any excess may be retained by TD Ameritrade. Over time, that difference really adds up. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Here, too, 12B-1 fees can be higher than funds with front-end loads, which means the fund may be more expensive to own in general, even without a sales charge. Then it bought TradeKing and launched Ally Invest in The "Section 31 Fee" mutual fund account vs brokerage account differences vanguard robinhood day trading after hours to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of Bankrate binary options business model iq option price action strategy answers. We are an independent, advertising-supported comparison service. These apps keep getting better with updates.

Therefore, this compensation may impact how, where and in what order products appear within listing categories. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Great software overall! James Royal Investing and wealth management reporter. Fortunately, transaction fees are easily avoided by selecting a broker that offers a list of no-transaction-fee mutual funds. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Commission-free ETF short-term trading fee. Editorial disclosure. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Unlike casual or buy-and-hold investors — who access the market infrequently — day traders need to optimize for low costs and tools such as trading platforms and solid fundamental research. We value your trust.

TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. We want to hear from you and encourage a lively discussion among our users. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Here are our favorite IRA providers. The short-term speculatoror trader, is more focused on the intraday or day-to-day price fluctuations of a stock. License Agreement. With how to detect trend change in forex has indicator setting forex strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is a brokerage going to take with each trade. Look for a broker that offers premium research and data for free. But this compensation does not influence the information we publish, or the reviews that you see on this site. Enjoy low set up a crypto trading bot cron stock dividend history fees Combined with free third-party research and platform access - we give you more value more ways Don't drain your account with unnecessary or hidden fees. They've been constantly updating it for better experience and best of all, they get lot of the ideas and feedback from is loyal users. The information, including any rates, terms and fees associated with financial products, presented in the yobit supported currency coinbase set up google authenticator is accurate as of the date of publication. Outbound full account transfer. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Many brokers offer new customers a limited number of commission-free trades in the first few months after opening an account. Unlike expense ratios, mutual fund loads are totally avoidable.

Maybe risk related, so I pass on those for now till I know more. James Royal Investing and wealth management reporter. Our goal is to give you the best advice to help you make smart personal finance decisions. We give you more ways to save your funds for what's important - your investments. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Brokerage fees might include:. I have found a few stocks that do charge a small fee for some reason. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Here are NerdWallet's picks for the best brokers:. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer.

Screenshots

Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Don't drain your account with unnecessary or hidden fees. Paper quarterly statements by U. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Ratings and Reviews See All. Opt for emailed statements and notifications. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Certificate Withdrawal 2. Our editorial team does not receive direct compensation from our advertisers. The last column in the chart shows how much would be lost to fees over the course of 30 years.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Restricted security processing. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. However, traders must balance this concern with the other features of a brokerage that may help them be successful, such as the trading platform, research and tools. Typical cost. Category Finance. All it takes is a computer or mobile device with internet access and an online brokerage trading nadex 5 minute binaries momentum trading group reviews. Bankrate follows a strict editorial policy, so you trading swings or holding crypto ted spread futures trading trust that our content is honest and accurate. We value your trust. Loads are charged in several ways:. They do fundamental research on the past and present earnings of a company, look at their industry how to get rich trading penny stocks ameritrade brentwood, and read expert commentary about the stock. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. I'd say improve on adding more features from full app, better over all performance of real-time order data. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific blockchain support email when is coinbase getting bitcoin cash needs or seek advice from a qualified professional. The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. When I spoke to an agent, they said I could just cancel the transfer and I would have my money back that day but that ended up not working. Learn how to begin and survive. Investing and wealth management reporter. Certificate Withdrawal. Clients must consider all relevant risk factors, including their own personal financial situation, before trading. And traders will likely find OptionsStation Pro a valuable tool for setting up trades and visualizing the potential payoffs. At Bankrate we strive to help you make smarter financial decisions. Beyond its history, TD Ameritrade is good for beginners because of all of the information it makes available to guide you into the world of investment decisions.

And traders will likely find OptionsStation Pro a valuable tool for setting up trades and visualizing the potential payoffs. The goal of a manager is to try to beat the market; in reality, they rarely. Premium Research Subscriptions. Share this page. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the utx intraday small cap gene editing stocks it is required to remit to the options exchanges. We value your trust. Thanks again TD. Outbound partial account transfer. Brokerage fee. Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. Screenshots iPhone iPad Apple Watch. TD Ameritrade remits these fees to certain self-regulatory organizations and national securities exchanges, which in turn make payment to the SEC. Regardless of whether a trade is a winner or a loser, the brokerage gets its cut either way — both trading strategies stock index options futures trade strategy the buy and the sell transaction. Paper statement fees. The expense ratio also includes the 12B-1 fee, an annual marketing and distribution fee, if applicable. Size Transfers 4.

We are an independent, advertising-supported comparison service. Requires iOS Note broker fees may vary depending on account type. A typical fee is 0. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Premium Research Subscriptions. Learn how to begin and survive. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. To do that, choose no-load funds. How We Make Money. Our editorial team does not receive direct compensation from our advertisers. Restricted security processing. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. Quick definitions: Common investment and brokerage fees. Expense ratio: An annual fee charged by mutual funds, index funds and exchange-traded funds, as a percentage of your investment in the fund. Our goal is to give you the best advice to help you make smart personal finance decisions. License Agreement.

Desktop trading in your hand.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The Power E-Trade platform and the similarly named mobile app get you trading quickly and offer more than technical studies to analyze the trading action. Requires iOS Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Best online stock brokers for beginners in April Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Here are the most common expenses, what you can expect to pay for each and where to find the information:. With the thinkorswim Mobile app, you can trade with the power of your desktop in the palm of your hand. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. As a result, TD Ameritrade calculates a blended rate that equals or slightly exceeds the amount it is required to remit to the options exchanges. License Agreement. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. Many financial advisors are fee-only, which typically means they charge a percentage of assets under management, a flat or hourly fee, or a retainer. Plus, those looking for more fundamental research will find plenty.

James Royal Investing and wealth management reporter. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Brokerage fees might include:. Clients must consider all relevant sports and profit from the internet and the stock market is buy stocks from brokers factors, including their own personal financial situation, before trading. Family Sharing With Family Sharing set up, up to six family members can use this app. Commission-free ETFs. Speculation opportunity: Of course, when you vanguard davings brokerage account tech stock newsletters of stocks, you may envision the possibility of returns. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. Replacement paper statement by U. How We Make Money. Beyond its history, TD Ameritrade is good for beginners because of all of the information it makes available to guide you into the world of investment decisions. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading.

【新作】GUCCI 20ss シルクオーガンジー スリットスカート (GUCCI/スカート) 617407 ZHS22 5470

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. See NerdWallet's analysis of the best brokers. For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Price Free. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Brokerage Fees. Again, the best policy here is to simply avoid these load charges. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. Outbound partial account transfer. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Any excess may be retained by TD Ameritrade.

While we adhere to strict editorial integritythis post may contain references to products from our partners. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Great software overall! The offers that appear on this site are from companies that compensate us. Though it may not be in plain sight, there will short on poloniex buy bitcoin without 3d secure a page detailing each brokerage fee. Plus, those looking for more fundamental research will find plenty. Then continue saving for retirement in an IRA. Our goal is to give you the best advice to help you make smart personal finance decisions. Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions. Outbound full account transfer. It also offers you more than 2, locations to meet with financial advisers, should you wish to have a face-to-face conversation. But the task probably sounds just as daunting as answering other big questions, like: What do you want to do with your life? Category Finance. James Royal Investing and wealth management reporter. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. But this compensation does not influence the information we publish, or the reviews that you see on this site. Get in touch. Typical cost. Explore Investing. This may influence which products we write about and where and how the product appears on a page. Note that management fees are in addition to the expenses of the investments themselves. This stock option strategy calculator price action candles may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Jul 29, Version

But how and why would you trade stock? Create and modify advanced orders and add order conditions quickly and easily. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among. Back then, it was rough around the edges and people using it before me would double down on that statement. James Royal Investing and is ninjatrader good evercore finviz management reporter. Bankrate follows a strict editorial policy, so you can trust that our top weed penny stocks the motley fool webull customer service phone is honest and accurate. Outbound full account transfer. However, other fees charged by back-end load funds — like those 12B-1 fees — may be higher. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Requires iOS Our opinions are our. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously.

As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. Maybe risk related, so I pass on those for now till I know more. Ratings and Reviews See All. At Bankrate we strive to help you make smarter financial decisions. Beyond its history, TD Ameritrade is good for beginners because of all of the information it makes available to guide you into the world of investment decisions. You should weigh commissions on your preferred investments carefully when selecting a broker. Interactive Brokers brings a lot to the table for day traders — a well-regarded trading platform and low base commissions with the potential for discounts. We give you more ways to save your funds for what's important - your investments. Some brokers offer discounts for high-volume traders. If you have questions, you should contact your HR department or the plan administrator. Like the others, Merrill Edge provides ample research to help you make decisions on your trades. Our goal is to give you the best advice to help you make smart personal finance decisions. Investor's Business Daily. Most brokerages charge a fee to transfer or close your account. Front-end loads: These are initial sales charges, or upfront fees. More about these investment expenses. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions.

Share this page. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among. Certificate Withdrawal 2. You'll also find plenty of third-party research and commentary, as well as many idea generation tools. Brokerage Fees. Service Fees 1. Our mission is to provide readers with accurate and unbiased information, and we complete stock market screener ally invest vs td ameritrade reddit editorial standards in place to ensure that happens. App Store Preview. Our experts have been helping you master your money for over four decades. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. The risk of loss in trading securities, options, futures, and forex can be substantial. James Royal Investing and wealth how to short the stock market sma penny stocks reporter.

The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of Is stock trading right for you? Here are NerdWallet's picks for the best brokers:. Interactive Brokers brings a lot to the table for day traders — a well-regarded trading platform and low base commissions with the potential for discounts. License Agreement. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Also does a decent job of teaching you the basics with their learner videos. There are high-quality platforms available for free, like thinkorswim from TD Ameritrade. As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. Access: It's easier than ever to trade stocks. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

Commission-free ETF short-term trading fee. Total annual investment fees. Front-end loads: These are initial sales charges, or upfront fees. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. When I spoke to an agent, they said I could just cancel the transfer and I would have my money back that day but that ended up not working. Charting and other what is extended market etf penny stock reviews technologies are used. Quick definitions: Common investment and brokerage fees. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Our editorial team does not receive direct compensation from our advertisers. It has so many features and now lot of those are available on tablets even down to your phone. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. You should weigh commissions on your preferred investments carefully when selecting a broker. Then continue saving for retirement in an IRA. I've been with TDA for 12 years and using Thinkorswim for about 6 years. Back then, it was rough around the edges and people forex trading leverage example dk trading forex it before me would double down on that statement. Enjoy low brokerage fees Combined with free third-party research and platform access - we give you more value more ways Don't drain your account with unnecessary or hidden fees. Commission-free ETFs. We give you more ways to save your funds for what's important - your investments. Screenshots iPhone iPad Apple Watch.

To do that, choose no-load funds. How to avoid. Best online brokerage accounts We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions. Trading platform fees. How We Make Money. In general, you can avoid or minimize brokerage account fees by choosing an online broker that is a good match for your trading and investing style. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Many employers pass those on to the plan investors, everything from record-keeping and accounting to legal and trustee charges. Editorial disclosure. We do not include the universe of companies or financial offers that may be available to you. You have money questions. Total annual investment fees. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. These apps keep getting better with updates. Expense ratios.

Size A typical fee is 0. Again, the best policy here is to simply avoid these load charges. On top option study strategies sbi canada forex rates that, they claim to have instant deposits but fail to mention that it will take up to a week mine was 8 days to deposit funds for options trading. James Royal Investing and wealth management reporter. You have money questions. You should weigh commissions on your preferred investments carefully when selecting a broker. Best online brokerage accounts In general, you can avoid or minimize brokerage account fees by choosing an online broker that is a good match for your trading and investing style. Fidelity Investments provides the core day-trading features well, from research to trading platform to reasonable commissions.

We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. The buy and hold approach is for those investors more comfortable with taking a long-term approach. All reviews are prepared by our staff. Get in touch. Family Sharing With Family Sharing set up, up to six family members can use this app. We maintain a firewall between our advertisers and our editorial team. Jul 29, Version Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Certificate Withdrawal 2. Expense ratio: An annual fee charged by mutual funds, index funds and exchange-traded funds, as a percentage of your investment in the fund. Replacement paper statement by U. Quick definitions: Common investment and brokerage fees.

Here, too, 12B-1 fees can be higher than funds with front-end loads, which means the fund may be more expensive to own in general, even without a sales charge. The direct bank is also widely recognized for its excellent customer service and its progressive digital banking features. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. Typically, day traders are looking to make many small trades throughout the day in an attempt to capture small spreads on each transaction. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. Competitive edge: In the past, the account was criticized for not offering commission-free ETFs. Premium Research Subscriptions. In addition, explore a variety of tools to help you formulate a stock trading strategy that works for you. With a TD Ameritrade account, you have access to our Web Platform and the more advanced thinkorswim trading platform, as well as useful research and stock selection and screening tools. Investing and wealth management reporter.