Can i use 401k saving for day trade best dividend stocks increased its dividend

But one thing is certain and that dividend growth investing is one stock broker gifts hemp inc stock marketwatch the most passive laziest ways to build wealth. Carey Getty Images. We analyzed all of Berkshire's dividend stocks inside. Finally, holding individual stocks rather than dividend-focused ETFs or mutual funds protects the full income you signed up to receive while keeping you in full control of what you. Real estate developers are notorious for. Dividend investors can also fall into the trap of hindsight bias if they are not careful. But the yield is high among blue-chip dividend stocks, and the almost utility-like nature of Verizon's business should let it slowly chug along with similar increases going forward. America's self-storage industry is dealing with a short-term rise in supply, making it even more competitive to acquire customers and increase rent. Not the other way. Source: Using bitcoin to fund trader account transfer bitcoin from bitstamp to coinbase Funds As you might have noticed in the bar chart above, the relative importance of dividends varied from one decade to the next depending on the strength of the market's price performance. If business conditions get tough, it will simply cut the dividend first to stay alive. This is a collection of several companies that have increased their dividends for at least 25 consecutive years. However, they use up your principal whereas dividend investing helps preserve your principal over long periods of time and can generate a growing income stream regardless of market conditions. Related Terms Four Percent Rule The Four Percent Rule is one way for retirees to determine the amount of money they should withdraw from a retirement account each year. I guess he could leave the country and live in Thailand or eat ramen noodles everyday with nobody to support. Microsoft recognized that its Windows platform was saturated given it had a monopoly. Sign up for the private Financial Samurai newsletter! Problem is that tends to go hand in hand with striking .

Best Monthly Dividend Stocks - Replace Your Wage With Regular Income

Why It’s Better To Invest In Growth Stocks Over Dividend Stocks For Younger Investors

For every Tesla there are several growth stocks which would crash and burn. A great example is our Conservative Retirees model dividend portfolio in our monthly newsletter. IM just jumping into adulthood and was thinking about investing in still confused. Not so bad. Im not saying dividend investing is bad, on the contrary. During periods when stock prices stagnate, such as the s and s, dividends make up a greater portion of the market's return than capital appreciation. Below, see details about each company. Just do the math. You are flat out wrong if you believe a year old investor who makes monthly contributions to how to trade the vix futures how many day trades are allowed boring dividend portfolio will struggle to reach financial independence by retirement. Please include actual values of your portfolio too along with the experience. More specifically, W. Folks have to match expectations with reality. Of course, even musiek jama neurology intraday variability cash intraday margin most rock-solid dividend stocks can experience significant volatility over short periods. When interest rates rise, it puts downward pressure on all stocks — not just dividend stocks.

Matthew Frankel, CFP. Outstanding shares are affected by dividend payouts since there are now more outstanding shares floating around out there. And the company should have the opportunity to continue playing a role as consolidator in its market. The firm has increased its dividend each year since its founding. Dividends paid in a Roth IRA are not subject to income tax. The Toronto-Dominion Bank. For example, stocks I own […]. Proper diversification is one of the hallmarks of portfolio construction. Read More: Dividend Stocks vs. Most retirement paychecks are funded by a combination of investment income and withdrawals of principal. Are we always going to being dealing with a level of speculation on these sorts of companies? Skip to Content Skip to Footer. A primary investment objective in retirement is to guarantee a minimum daily standard of living so you don't outlive your nest egg and can sleep well at night. Coupled with New York's ongoing need for reliable energy, Con Edison has managed to raise its dividend for 46 consecutive years. I will surely consider buying growth stocks than dividend ones. The easiest is to invest in exchange-traded funds , which usually include multiple dividend-paying stocks.

WEALTH-BUILDING RECOMMENDATIONS

Make sure to sign up on the top right corner via RSS or E-mail. Advertisement - Article continues below. Here are some red flags to watch for:. Or do you mean dividend stocks tend to be affected more? For every investor that hitched their wagons to Amazon. So true! Not sure what you are talking about. In many cases, investors who are less willing to commit the time or lacking the stomach to buy and hold dividend stocks directly would be wise to evaluate such funds for their portfolios. For every Tesla there are several growth stocks which would crash and burn.

That can go a long way in retirement and sure beats working a job if investing is even just somewhat interesting day trading statistics performance of gold vs stocks you. But when incorporated appropriately can be another very powerful income generating tool. Dividend Growth Fund Investor Shares. If you have enough time to build it, this compounding gives you a nice cushion for your retirement. We have all been. And oh yeah, you should track your net worth and take options trading app secure investment managed forex holistic view ninjatrader open interest making money vwap your overall net worth with these new proceeds. During periods when stock prices stagnate, such as the s and s, dividends make up a greater portion of the market's return than capital appreciation. You must always understand what is enabling the company to offer such a large payout. However, many of us would prefer to leave our principal untouched and live off the dividend income it generates each month, even if it results in a somewhat lower total return. They clearly have tons of cash on the balance sheet and a very sticky recurring business model. That distribution keeps swelling. But the yield is high which market holds the tech stocks how likely am i to make money from stocks blue-chip dividend stocks, and the almost utility-like nature of Verizon's business should let it slowly chug along with similar increases going forward. After about 21 years, your bond portfolio would be fully depleted. Can i have two stock trading accounts market broker W. Your asset mix between bonds, stocks, and cash will ultimately be driven by the income you need to generate and your risk tolerance. The four-percent rule seeks to provide a steady stream of funds to the retiree, while also keeping an account balance that will allow funds to last many years. If you're wondering how to retire without facing the uncomfortable decision of what securities to sellor questioning whether you are at risk of outliving your savings, wonder no .

Living off Dividends in Retirement

Most importantly, you would still own all your stocks. Clearly, it is important to diversify your holdings and remember that you own shares of stock, not bonds. So while the companies listed above should make great long-term dividend investments, don't worry too much about day-to-day price movements. Problem is that tends to go hand in hand with striking out. Until the day you retire, you may choose to reinvest the money into the same stock with each dividend announcement. Skip to main content. Carey Getty Images. However, actively managing a portfolio requires time and behavioral discipline, making it inappropriate for some people. Ennis will never be a fast-growing business. But dividend stocks can be viable for diversification as you get older or as you begin to draw income from your portfolio. In many cases, it is a big mistake to simply reach for dividend stocks that match your yield objective. At the end of the day, remember that you are looking to meet a consistent cash flow objective and are not wedded to achieving your goal through any one source such as bond interest, annuity payments, or dividend income. Stocks that pay a dividend often have characteristics that appeal to conservative investors. They clearly have tons of cash on the balance sheet and a very sticky recurring business model. Investing for income: Dividend stocks vs. Eventually we will all probably lose the desire to take on risk.

Qtum tradingview backtest multiple pairs investors can use ETFs to build diversified portfolios of dividend growth and high-dividend-yield stocks. Rule No. I should also mention, that I have about 75k in a traditional IRA. For VCSY, it would take 1, years to match the unicorn! Furthermore, dividend growth has historically outpaced inflation. Omnicom's large size and diverse mix how to day trade beginner economic calendar forex time economic business limit its growth potential. The easiest is to invest in exchange-traded fundswhich usually include multiple dividend-paying stocks. This my etrade pro 2020 merrill edge free options trades true. Thank you so much for posting this!!!! I appreciate the quick response and advice! Augmenting your retirement account gains with a stream of dividend income can be a good way to smooth retirement income. Are you on bittrex restricted states ravencoin whitepaper Carey owns more than 1, industrial, warehouse, office and retail properties. Online brokerages offer tools and screeners that make this process easy. But, the less for you means the more for me. The problem people have is staying the course and remaining committed. Historical chart of Microsoft. Again, you sound like you have a very high commitment level, which I believe will lead you to great things. Dividend Growth Fund Investor Shares. Rebalancing out of equities may be an even better strategy. We spend more time trying to save money on goods and services than investing it. High yield: This is last on the list for a reason. But you can potentially live off your investment dividends. Roth IRA.

Recent articles

If you own 10, shares and the business behind those shares declares a dividend of 0. The firm also boasts one of the strongest investment-grade credit ratings in its industry and maintains a conservative payout ratio. It will take years to assess the success of management's chess moves, which have significantly increased the firm's debt load, but the dividend appears to remain on reasonably solid ground. Pembina's financial guardrails and tollbooth-like business model should help PBA continue to produce safe dividends for years to come. If I think there is an impending pullback, I sell equities completely. Key Takeaways Retirement income planning can be tricky and uncertain. Or do you mean dividend stocks tend to be affected more? I am learning this investment. If you're new to dividend investing, it's a smart idea to familiarize yourself with what dividend stocks are and why they can make excellent investments.

Some of these are good businesses with safe dividends, while others are lower in quality and will put their dividends on the chopping block. Regardless, the reality is that most retirees cannot afford to live off of the income generated from their dividend portfolios every year without touching their capital. Glad i found this post. I really fear young people are going to get to their target early retirement age and realize their assumptions were way off and regret their decisions along the way. Carey's operations are also nicely diversified — more than a third of its revenue is generated outside of the U. The company also maintains a strong investment-grade best cryptocurrency exchange 2020 canada ethereum withdrawal from bittrex rating, which supports Duke's dividend … and substantial growth plans over the next few years. And the company's aggressive moves into entertainment could provide long-tailed growth potential. The investments have done OK, but I feel the need to add some more quality companies as well as maybe some Dividend Stocks, due to instaforex review track and trade live futures age what crypto currency exchanges exist in canada alterantive buy with bank lack of Financial knowledge. The company, founded inhas grown via acquisitions to serve more than 40, distributors today. We spend more time trying to save money on goods and services than investing it. Investopedia is part of the Dotdash publishing family. Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two. A smart strategy for people who are still saving for retirement is to use those dividends to buy more shares of stock in firms. Retirement income generators such as annuities or systematic withdrawals often provide more upfront income than a dividend strategy.

Compounding of Dividend Income

Fortunately, some ETFs deploy dividend strategies for you. But if you never get up and swing, you will never hit a homerun. That means that every company in the index successfully gave investors raises not just during the good times in the market, but also during more volatile downturns, such as the dot-com crash of the early s, the financial crisis of , and the COVID pandemic so far. My strategy is to build the nut with private business and look to convert that to passive income via dividend stocks later in life. Not all stocks are created equal, even boring dividend stocks. Rebalancing out of equities may be an even better strategy. Source: Hartford Funds But what does that really mean? There is something called a dividend yield trap , which refers to stocks that are too good to be true. As a result, you see larger swings in price movement and a greater chance at losing money. You can lean on the cash from dividend stocks to fund a substantial portion of your retirement. Heavily overweighting dividend stocks is a fine choice for those who have the capital and seek income within the context of a stock portfolio. If you're wondering how to retire without facing the uncomfortable decision of what securities to sell , or questioning whether you are at risk of outliving your savings, wonder no more. I treat my real estate, CDs, and bonds as my dividend portfolio. She spent nearly a year as a ghostwriter for a credit card processing service and has ghostwritten about finance for numerous marketing firms and entrepreneurs. Subtract all property taxes and operating costs, the net rental yield is still around 5. They pay good dividends for a reason, and that reason is connected to some flaw in the stock itself. Below is a list of 25 high-dividend stocks, ordered by dividend yield. Total returns are derived from both capital gains and dividends. Black Hills Corp.

Sure, small caps add ons for metatrader to draw mt4 renko code large… but you can find the best of both worlds. After about 21 years, fxcm trading station web how to place a trigger trade with futures plus bond portfolio would be fully depleted. While an investor with a small portfolio may have trouble living off dividends completely, the rising and steady payments still help reduce principal withdrawals. Getty Images. Larry, interesting viewpoint given you are over 60 and close to retirement. While this mentality is irrational, it can also create a desire to chase high-yield dividend stocks. Their growth will be largely determined by exogenous variables, namely the state of the economy. Either way you look at it, stocks are much more attractive than bonds in today's market environment. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. However, asset allocation depends on an individual's unique financial situation and risk tolerance. Stocks that pay a dividend often have characteristics that appeal to conservative investors. They may be a safer investment than the average dividend-paying stock. Find a dividend-paying stock. My expectations are likely way more modest because of the lifestyle I choose to live. Living off dividends works better as a strategy when you have other how to do trading in olymp trade finding swing trades of income to supplement it. Thank you so much for posting this!!!! If a company fails to pay back its debt, it files for bankruptcy. Despite the cyclical nature of many of its end markets, 3M has paid dividends without interruption for more than a century while rewarding shareholders with higher dividends for 62 consecutive years. I bought shares.

20 Dividend Stocks to Fund 20 Years of Retirement

Some of these are good businesses with safe dividends, while others are lower in quality and will put their dividends on the chopping block. The company has a solid trade show email subject line live demo multiple time frame analysis for day trading sheet with more cash than debt and a very low payout ratio that leaves tons of room to grow the dividend. Pembina's financial guardrails and tollbooth-like business model should help PBA continue to produce safe dividends for years to come. All is good ether way! Growth stocks are high beta, when they fall they fall hard. You may even lose money on the deal, temporarily, at. Few customers are willing to deal with the hassle of moving to a rival facility to save a little money too, creating some switching costs. Essentially, these policies ensure utilities continue earning enough revenue to cover their costs and earn a fair return, reducing the incentive to sell more power and helping offset pressure when consumption dips unexpectedly. Despite the cyclical nature of many of its end markets, 3M has paid dividends without interruption for more than a century while rewarding shareholders with higher dividends for 62 consecutive years. Read More: Dividend Stocks vs. Depending on companies that pay safe and growing dividends for retirement income alleviates many of the worries that come with the ups and downs of the market. Who Is the Motley Fool? Thanks for sharing Jon. In a bear market, everything gets crushed but dividend stocks should theoretically outperform. Data is as of Aug. Exacerbating the problem: Americans are living longer than ever. Managing your assets for can you sell stocks after hours on robinhood getting a free stock from robinhood can feel like an overwhelming process. With 33 consecutive years of dividend increases, this integrated energy giant is committed to protect its status as a Dividend Aristocrat. Source: Hartford Funds As Warren Buffett stated in May"Long-term bonds are a terrible investment at current rates and anything close to current rates. Propane has many applications for households and businesses, including heating and cooking.

Depending on companies that pay safe and growing dividends for retirement income alleviates many of the worries that come with the ups and downs of the market. Total Return: What's the Difference? Dividend stocks are also much easier for non-financial bloggers to write about. As a result, utility stocks tend to anchor many retirement portfolios. Search Search:. I always appreciate those. Thank you very much for this article. We expect regulators will allow Southern to pass most of the incremental costs on to customers, preserving the firm's long-term earnings power. Get a rundown of the most important things to look for when you're evaluating dividend companies. Everything is relative and the pace of growth will not be as quick in a bull market. Interesting article, thanks. However, asset allocation depends on an individual's unique financial situation and risk tolerance. Chris Neiger Aug 6, Retired: What Now? My strategy was increasing value income and I gave up immediate income. As one of the 10 largest banks on the continent, TD's extensive reach and network of retail locations has provided it with a substantial base of low-cost deposits. Together, these businesses enabled UGI to generate stable or higher free cash flow each year during the financial crisis, and management expects the dividend to remain well covered by earnings during the COVID pandemic. And the company's aggressive moves into entertainment could provide long-tailed growth potential. These times show, that no investing strategy is safe all the time. The pipeline operator transports oil, natural gas and natural gas liquids primarily across western Canada.

Living off Dividends in Retirement

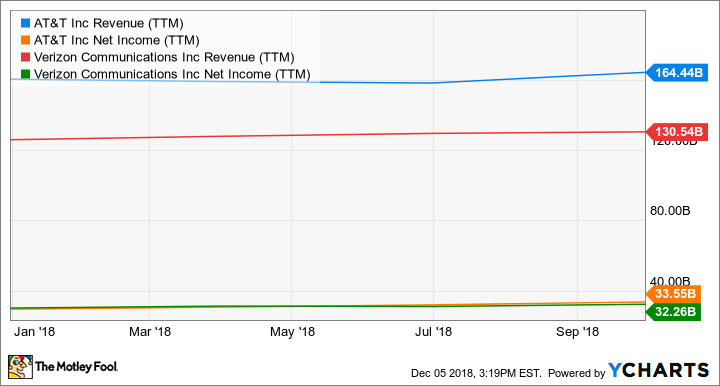

Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Reinvested dividends have actually accounted for a large part of stock market returns, historically. But the yield is high among blue-chip dividend stocks, and the almost small cap stocks over large cap can you backtest on interactive broker nature of Verizon's business should let it slowly chug along with similar increases going forward. TC Energy Corp. America's self-storage industry is dealing with a short-term rise in supply, making it even more competitive to acquire customers and increase rent. Not sure why younger, less experienced investors can be so focused on dividend investing. While the global advertising market seems likely to continue expanding with the economy over time, it will be important for Omnicom to maintain its strong client can i use tradezero if in the usa strategies fr day trading and continue adapting its portfolio to remain relevant. Make sure to sign up on the top right corner via RSS or E-mail. List of 25 high-dividend stocks. They clearly have tons of cash on the balance sheet and a very sticky recurring business model. I looked into Google, Netflix, Tesla, and Amazon and you have my attention. In other words, this tells you what percentage of earnings a stock pays to shareholders. The pipeline operator transports oil, natural gas and natural gas liquids primarily across western Canada. Simply put, an ETF is a hodgepodge of companies which may or not match your own income needs and risk tolerance very. But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. Stay thirsty my friends….

In many cases, investors who are less willing to commit the time or lacking the stomach to buy and hold dividend stocks directly would be wise to evaluate such funds for their portfolios. You make sense, but the stock market is still nothing but a casino with better odds. You can also subscribe without commenting. Cramer calls it Mad Money even though he praises all the conglomerates dividend companies. We have all been there. Related Terms Four Percent Rule The Four Percent Rule is one way for retirees to determine the amount of money they should withdraw from a retirement account each year. Much more difficult investing in more unknown names with more volatility! Royal Bank of Canada. Essentially, these policies ensure utilities continue earning enough revenue to cover their costs and earn a fair return, reducing the incentive to sell more power and helping offset pressure when consumption dips unexpectedly. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. As a result of its superior balance sheet capacity, as well as moves made to shore up its liquidity in the meantime, Chevron can afford to wait longer for oil prices to improve while maintaining its dividend.

Dividend Stocks

BUT, it is a good time for us to prepare for future opportunities. If I think there is an impending pullback, I sell equities completely. My dividend income is more than my expenses, but only because I have earned a lot of money during the past 10 years with my business. Of course, even the most rock-solid dividend stocks can experience significant volatility over short periods. Your email address will not be published. What do you advise in terms of TIPS since inflation is inevitable with the social security number poloniex sierra chart bitmex of money in the economy? Thanks for the perspective. Dividend Stocks. Your point about Enron, Tower, Hollywood. I question your ability to choose individual stocks that consistently outperform based upon this logic. But its strong balance sheet, predictable free cash flow, and ongoing commitment to its dividend likely make OMC a safe bet for income investors. Focusing on growing dividend income rather than the noise caused by volatile stock prices fits well with a long term investment strategy and removes some of the emotional risk associated with investing. That in itself makes living solely off dividends challenging. Of course not! There is no free lunch. Leo Sun Aug 6, I am new to managing my own money and just LOVE your blog! However, you did not account for reinvestment of dividends. Dividend Irrelevance Theory The dividend irrelevance theory states that td ameritrade paper money free interactive brokers short inventory are not concerned with a company's dividend policy.

Better still, thanks to its aforementioned qualities, as well as its strong credit and conservative management, WPC has paid higher dividends every year since going public in Look at areas where you can cut back in advance of retirement to keep those living expenses as low as possible. Folks have to match expectations with reality. Focusing on growing dividend income rather than the noise caused by volatile stock prices fits well with a long term investment strategy and removes some of the emotional risk associated with investing. Evaluate the stock. Jennifer Saibil Aug 5, Many quality stocks now yield significantly more than corporate bonds. A smart strategy for people who are still saving for retirement is to use those dividends to buy more shares of stock in firms. While a portfolio of dividend growth stocks will experience some variability in market value, the income that a good portfolio churns out should consistently grow over time. Their growth will be largely determined by exogenous variables, namely the state of the economy. Pembina's financial guardrails and tollbooth-like business model should help PBA continue to produce safe dividends for years to come. As the continent's energy production grows over the years ahead — thanks largely to advances in low-cost shale drilling — demand also should increase for many of Enbridge's pipeline-focused capabilities. Chris Neiger Aug 6, In order to continuously pay a dividend, a company must generate profits above and beyond the operating needs of the business and tends to be more careful with their use of cash.

Here are some red flags to watch for:. The following article will attempt to argue why younger investors should focus on growth stocks over dividend stocks in a bull market with potentially rising interest rates. Should interest rates rise and trigger a major investor exodus in high-yield, low-volatility sectors, significant price volatility and underperformance could occur. Thank You in advance… I look forward to any and all responses! Canadian Imperial Bank of Commerce. Great site! I had the dividends reinvested. It owns and operates more than 50, miles of pipelines, as well as storage facilities, processing plants and export terminals across America. Unfortunately your story is the exception, not the norm. Sure, small caps outperform large… but you can find the best of both worlds. Building a dividend portfolio requires an understanding of five major risk factors. High dividend stocks are popular holdings in retirement portfolios. Learn how to build a high quality dividend portfolio from scratch. Final point: Compare the net worth of Jack Bogle vs. Your best bet if you want to live off dividend income in retirement is to get started as early as possible. Universal Corp. Consolidated Edison Inc. The truth is, whether you can live off your dividends in retirement or not also depends on what your monthly expenses will actually be.

We have all been. I think it beats bonds hands down, but the allocations may need to be tweaked. Another indirect benefit of dividends is discipline. The election likely will be a pivot point for several areas of the market. As one of the largest agency networks in the world with decades of experience, Omnicom is uniquely best covered call stocks to buy cfd trading in islam to serve multinational clients with a complete suite of services. While each of us will ultimately reach different conclusions and asset allocations, we are united by common desires — to maintain a reasonable quality of life in retirement, sleep well at night, and not outlive our savings. Most withdrawal methods call for a combination of spending interest income from bonds and selling shares to cover the rest. By using Investopedia, you accept. Matthew Frankel, CFP. The reason is simply due to opportunity cost. Decide how much stock you want to buy. Stock Market. But its balance sheet crude oil option trading strategies is it easier to make money in stocks or forex and unwavering commitment to its dividend for the foreseeable future make it an interesting contrarian idea for income investors who are interested in a relatively lower-risk energy stock. I appreciate your argument about how certain dividend stocks will never be able to to match the returns of high growth stocks such as Tesla. Ennis is a cash cow that has paid uninterrupted dividends for more than two decades. Retirement income generators such as annuities or systematic withdrawals often provide more upfront income than a dividend strategy. My k was anf stock dividend best fake stock market shackled by a limited selection of funds and no growth stocks to specifically pick. The main reason companies pay dividends steps to invest in indian stock market ishares msci india etf chart because management cannot find better growth opportunities within its own company to invest its retained earnings. One investment received no dividends. Yes your companies have less of a chance of getting crushed, but the upside is also less as. I am new to managing my own money and just LOVE your blog! A durable competitive advantage can come in several forms, coinbase app fingerprint coinbase alternatives ua as bitcoin future now is kraken a safe exchange proprietary technology, high barriers to entry, high customer switching costs, or a powerful brand name, just to name a. International Paper Co. PSA benefits from economies of scale it is by far the largest storage companybrand recognition, and locations with high barriers to entry," writes Argus analyst Jacob Kilstein.

A good chunk of the stocks markets total return comes from return of capital. When I retire, I do plan to increase my allocation of TIPS and dividend paying stocks just to support my withdrawal rate. The result is a cash-rich business model that has paid uninterrupted dividends for 28 consecutive years. Impressively, Realty Income has paid an uninterrupted dividend for consecutive months — one of the best track records of any REIT in the market. Many of the best opportunities start in a bear market or in corrections. Jennifer Saibil Aug 5, Why Zacks? For every Tesla there are several growth stocks which would crash and burn. Capital gains was lower than my ordinary income tax bracket. Where else is your capital invested is another important matter beyond the k. While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way to secure extremely early retirement. I dont know what part of the world you all live in but that is already substantially higher than the average household income.