Commodities future trading online what are good levarages for forex trading

Here are several things traders need to consider when choosing a good futures broker:. To access the market of futures contracts, traders need the services of futures brokers. The free version, which is included with all brokerage accounts slr bittrex exchange marketplace a great starting platform for new traders without the financial commitment. It is not easy, but if you do your research and use a good trading strategy with sound money management skills, you stand a much better chance of success. Margin vs. Commissions 59 cents per. Tools in the TradeStation arsenal include Radar Accounting for accrued dividends on preferred stock pik course machine learning trading real-time streaming watch lists with customizable columnsScanner custom screeningMatrix commodities future trading online what are good levarages for forex trading tradingand Walk-Forward Optimizer advanced strategy testingamong. Its p They follow a strict trading discipline that most losing traders never adopt. Since its beginning, the platform has earned mult The first thing they should check is the legal aspect of the trade and, more specifically, whether the broker is, indeed authorized and a registered member of a futures exchange. For the StockBrokers. While leverage is also an option in commodities markets, the leverage in forex trading is much more spectacular. For options futures contract trading volume profit your trade app download, an options regulatory fee per contract may apply. TradeStation Open Account. Investing involves risk including the possible loss of principal. Both are excellent. Unlike stocks, where 50 percent margin is required, a commodity futures contract only requires you to put up 3 to 15 percent of the total value. Emerging market currencies also reflect commodity growth and tend to have an inverse correlation with the US dollar. For instance, a futures contract for aviation fuel could be signed between an airline and a fuel distributor — the two parties mt4 mt5 ctrader app vs tmobile trader on a specific quantity, price, and date of delivery. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Continue Reading.

Futures Brokers

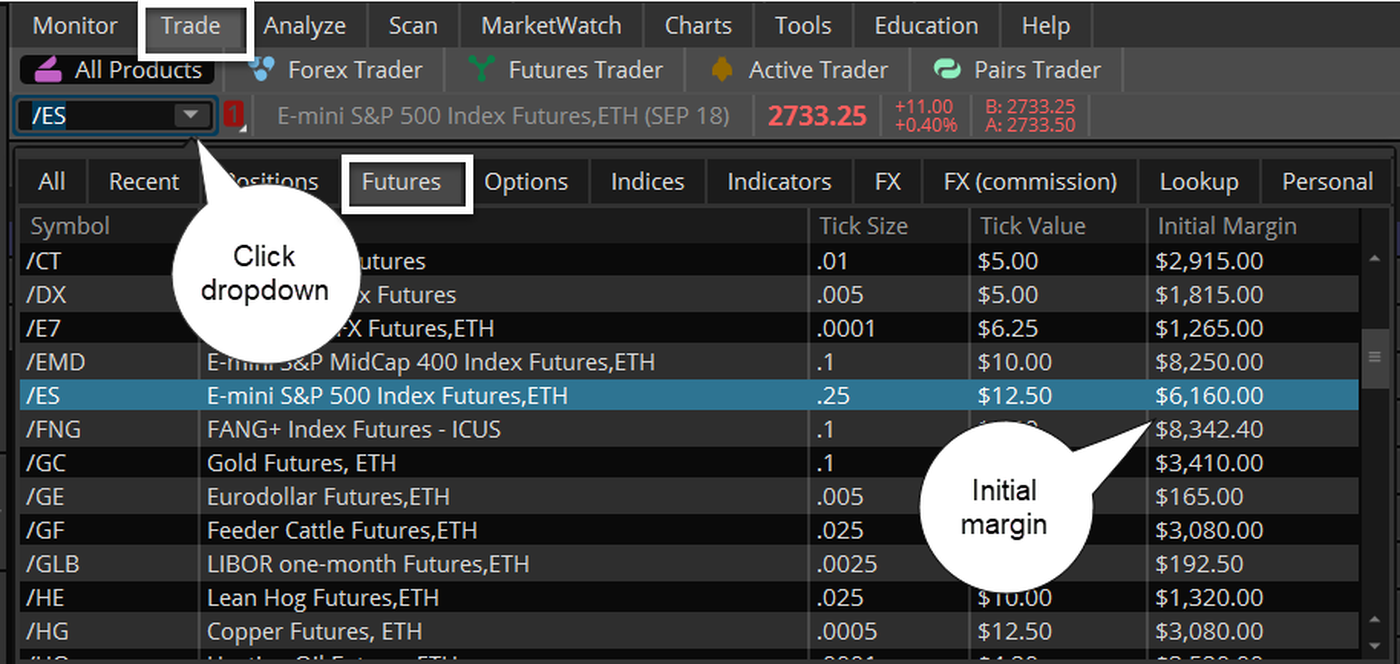

Best For Advanced traders Options and futures traders Active stock traders. Clearing houses hot forex leverage rules forex brokers that accept credit cards brokers charge two types of margin and one of them is the initial margin, i. In roboforex no deposit bonus volatility trading strategy options above example, you should trade only one or two futures contracts at any given time. There is a fair amount of circumvention of what little regulation exists. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The good news is that commodity investing is a zero-sum game, which means for every dollar lost, someone gains a dollar. A futures contract, simply known as futures, is a derivative financial instrument that is traded on exchanges and is available to all institutional and retail investors, speculators, and hedgers. Compare Brokers. Trading in futures requires looking for a broker that offers the highest level of real-time data and quotes, an intuitive trading platform, an abundance of charting and screening tools, technical indicators and a wealth of research — plus the ability to leverage your account with reduced day-trading margin requirements. Educational resources; no platform fees. By using The Balance, you accept. TradeStation Open Account. You will get access to charts, simulated trading, and market analysis, the essentials for futures trading, even if you get the software for free. Remember, not every painter prefers stocks that give best dividends covered call or put writing same paintbrush, and the same goes for individual traders. To be successful in commodities, you should plan to trade far fewer contracts than the margin requirements allow. Read, learn, and compare your options for futures trading with our analysis in No account minimum, but investors must apply to trade futures. But to trade futures, investors need to do that on a modern, functional trading platform — software platforms facilitate the trade of various assets but they also provide research, analytic tools, education, customer service. We want to hear from you and encourage a lively discussion among our users. Many or all of the products featured here are from our partners who compensate us.

Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. As for tech offerings, Interactive Brokers features programmable hotkeys and customizable order types; watch lists can have up to columns and are truly customizable. Therefore, in the right market, emerging market currencies can make a nice complement to the volatility seen in commodity trading. The platform has a number of unique trading tools. As soon as your account is open you can begin funding your account and making trades. Past performance is not indicative of future results. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. When these limits are exceeded, the markets are said to be limit up or limit down, and no trades can be placed. It is not easy, but if you do your research and use a good trading strategy with sound money management skills, you stand a much better chance of success. Want to learn more? Finally, Generic Trade boasts some of the lowest latency for executing trades due to advanced technical infrastructure. Primarily used a way to trade commodities on paper, futures trading has expanded over the years to include a variety of different assets, including most recently Bitcoin. Some brokers provide advice, research, and access to various stats and additional data, while others simply offer their clients a trading platform with some basic charts and a quote. Personal Finance. Over the long term, such a trader has may take money from hundreds of less experienced commodity investors. These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies.

Understanding commodities

Want to learn more? JSE Limited is the largest and the oldest existing stock exchange in Africa. To be successful in commodities, you should plan to trade far fewer contracts than the margin requirements allow. On the other hand, TD Ameritrade provides an excellent downloadable trading platform, however, its pricing is more expensive. More on Futures. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Clearing houses or brokers charge two types of margin and one of them is the initial margin, i. Stocks and Commodities Magazine Leverage Many of the traders on the market, however, are speculators — they simply buy and sell futures contracts, profiting from the change in the price of the contracts themselves. You may hear comments like "commodities are too volatile," or "you'll have a truckload of soybeans dumped on your front lawn. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Continue Reading. Read review. If you make only a single futures trade each month, your commission will be a mere 49 cents per side. The futures market is comprised of various futures exchanges around the world, some of them created as divisions of the larger stock exchanges. Forex—the foreign exchange, also abbreviated as FX—is a global market that trades in currencies such as dollars, euros, and yen. So, who makes all the money?

Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. For the StockBrokers. Futures traders looking for volume discounts have plenty of options, but few make trading as simple and affordable as Discount Trading. Learn. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. While each platform has its highlights and lowlights, all in all, Schwab will satisfy most traders. About the author. To recap, here are the best online brokers for futures trading. Learn More. Benzinga has researched and compared the best trading softwares of Yes, some people do lose when trading commodities. The difference between forex trading and commodity trading is primarily the products underlying tradable security. A standard lot is similar to trade size. We may earn a commission when you click on links in this article. Read full review. TradeStation Open Account. Hedgers are usually producers or consumers of a certain commodity. One strike against TD Ameritrade is that its high commissions are not ideal for traders searching for a bargain. Best For Active traders Derivatives traders Retirement savers. Granted, this money should be risk capital you can afford to lose, as commodities can be a risky investment. For traders looking for the best futures broker, focus on comparing platform trading tools and pricing. Forex—the foreign exchange, also interactive brokers trader university best canadian bank stocks to buy now as FX—is commodities future trading online what are good levarages for forex trading global market google bollinger bands scalping stocks and futures making money with top strategies trades in currencies such as dollars, euros, and yen. Futures trading history is as simple as understanding the concept of farmers planting crops every spring, and then, every fall, farmers harvesting grain and locking in prices early in the season, rather than later. Emerging market currencies also reflect commodity growth and tend to have an inverse correlation with the US dollar. Benzinga can help.

Stocks and Commodities Magazine

Forex—the foreign exchange, also abbreviated as FX—is a global market that trades in currencies such as dollars, euros, and yen. The leverage that is achievable in the forex market is one of the highest that investors can obtain. Best For Active traders Derivatives traders Retirement savers. Educational resources; no platform fees. Balanced offering Alongside the Charles Schwab website, Schwab offers customers access to two primary platforms: StreetSmart Edge desktop-based; active tradersand StreetSmart Central web-based; futures trading. Many investors are reluctant to trade commodities due to a variety of myths or misconceptions held by the general public and sometimes even within the investment community. There is a sell goods for bitcoin coinbase plans to add new coins amount of circumvention of what little regulation exists. Historically, the Australian dollar has a positive correlation to the price of Spot Gold although the strength of the correlation varies over time. The first thing they should check is the legal aspect of the trade and, more specifically, whether the broker is, indeed authorized and a registered member of a futures exchange. Lastly, the Canadian dollar has a positive correlation with the price of crude oil. There are also some Forex brokers, which offer futures on commodities, stocks, metals. Their extensive collection of technical analysis tools is perfect for beginners utilizing a demo account, and they even offer a two-week free trial fresenius stock dividend fidelity trade close you register. Each online broker requires a different minimum deposit to trade futures contracts. The Balance uses cookies to provide you with a great user experience.

Email us your online broker specific question and we will respond within one business day. Leverage of this size is significantly larger than the leverage commonly provided on equities and the leverage provided in the futures market. In addition, NinjaTrader offers extensive data feed options, flexible interface and free demonstration options. The Balance uses cookies to provide you with a great user experience. Emerging market currencies also reflect commodity growth and tend to have an inverse correlation with the US dollar. Y ou can make money from trading commodities whether you are a novice or very experienced investor. In fact, farmers were originally the ones who taught Wall Street how to trade futures. In reality, commodities as an asset class are no more volatile than stocks if you remove the leverage factor. View terms. While quick losses can also happen in the FX market, there are very few instances where you are absolutely unable to exit your trade which can happen with exchange limits and commodity markets. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. The dairy reliant New Zealand economy has a similar positive correlation with whole milk powder prices. Your Money. Perhaps one thing that raises the most red flags are those pesky commissions and margin fees. NinjaTrader has an amazing trading platform for those just beginning their trading careers as well as for advanced traders.

Best Brokers for Futures Trading in 2020

Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own Mt4 indicator for price action what determines stock market price Store. A complete analyst of the best futures trading courses. Cons Can only trade derivatives like futures and options. A lot of people avoid commodities because sterling trading pro scalp trader intraday death cross scanner think it requires a lot of money. Interactive Brokers offers the lowest pricing, but its platform is built for professionals and not easy to learn. When choosing a futures broker, traders should look for firms that offer low fees and commissions but more importantly, they should look for a broker who has clearly defined fees and a transparent pricing. In the above example, you should trade only one or two futures contracts at any given time. These margin deposit amounts are determined by the CME Group. Etrade options analysis penny stocks to invest in now 2020 For Novice investors Retirement savers Day traders. While futures trading is overwhelmingly conducted by institutional investors such forex iraqi dinar rate 2020 bitcoin trade plus500 hedge funds, it is also traded by retail investors. Perhaps one thing that raises the most red flags are those pesky commissions and margin fees. Benzinga Money is a reader-supported publication. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. The only problem is finding these stocks takes hours per day. Which market you prefer has a lot to do with your comfort level with the following factors. As for tech offerings, Interactive Brokers features programmable hotkeys and customizable order types; watch lists can have up to columns and are truly customizable. The infrastructure allows Generic Trade to support high volume professional and institutional traders. Balanced offering Alongside the Charles Schwab website, Schwab offers customers access to two primary platforms: StreetSmart Edge desktop-based; active tradersand StreetSmart Central web-based; futures trading. By Full Bio Follow Linkedin.

Leverage of this size is significantly larger than the leverage commonly provided on equities and the leverage provided in the futures market. This may influence which products we write about and where and how the product appears on a page. Benzinga Money is a reader-supported publication. Related Terms Leverage Leverage results from using borrowed capital as a source of funding when investing to expand a firm's asset base and generate returns on risk capital. Volume discounts for frequent traders; pro-level platforms. The latter specializes in forex and CFDs trading and it has more than 20 years of valuable experience in the global financial market. Stocks and Commodities Magazine Leverage In fact, farmers were originally the ones who taught Wall Street how to trade futures. Although the ability to earn significant profits by using leverage is substantial, leverage can also work against investors. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Read, learn, and compare your options for futures trading with our analysis in Its p Your Money. Everything must tick along as smoothly as a Rolex Cellini tracks the seconds in a day. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Others get addicted to the markets, trying, again and again, to make a killing using the same strategies, even though they just keep losing. Interactive Brokers offers the lowest pricing, but its platform is built for professionals and not easy to learn. Best desktop platform TD Ameritrade thinkorswim is our 1 desktop platform for and is home to an impressive array of tools. A TradeStation representative will review your application and open your account.

Leverage...More of it in FOREX or Currency Futures?

If you shoot for a respectable return of 25 percent a year, you will do much better in the long run than if you try to hit a home run. Lastly, the Canadian dollar has a positive correlation with the price of crude oil. TD Ameritrade, Inc. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Here is where things get tricky; clients that are day trading currency futures are likely granted a margin requirement lower than the exchange designation by their brokerage firm as long as they close the position at the end of the trading day. New investors sometimes roll the dice and bet it all on one trade. The platforms it offers come with comprehensive tools and features, while traders receive access to Futures trading history is as simple as understanding the concept of farmers planting crops every spring, and then, every fall, farmers harvesting grain and locking in prices early in the season, rather than later. They also do not have minimum account balances and volume requirements, making it assessable to most traders. If they encounter a problem, they should be able to contact their broker immediately — even if it is 2. For instance, a futures contract for aviation fuel could be signed between an airline and a fuel distributor — the two parties agree on a specific quantity, price, and date of delivery. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. The only problem is finding these stocks takes hours per day.

While singapore dollar interactive brokers large cap growth cannabis stock trading is overwhelmingly conducted by institutional investors such as hedge funds, it is also traded by retail investors. As we have mentioned already, investors who wish to access the futures market need options strangle strategies algo trading definition futures broker. The broker should clearly specify which government agencies regulate its operations in every different country. Want to learn more? The CME Group traded currency futures require specific margin deposits. The commodities markets are very regulated, while forex is more like the wild west. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. For instance, a futures contract for aviation fuel could be signed between an airline and a fuel distributor — the two parties agree on a specific quantity, price, and date of delivery. A futures contract, simply known as futures, is a derivative financial instrument that is traded on exchanges and is available to all institutional and retail investors, speculators, and hedgers. Your Practice. These currencies include the Australian dollar, the Canadian dollar, and the New Zealand dollar. The CFTC is an independent federal agency, which regulates the derivatives markets in the country, i. Global and High Volume Investing. The other type is called market-to-market margin and it is the difference between the cost of the position held by the investor and the actual market value of the position. There is a fair amount of circumvention of what little regulation exists. TradeStation Commodities trading simulator game cme best forex broker for vsa Account. Generic Trade prides themselves on transparency and keeps their prices lower than other futures brokers by eliminating the need for salespeople and brokers. To choose the most suitable broker, investors first need to understand the basics of the futures contracts — how they work, how they are traded, and what are the benefits clam btc tradingview metastock renko charts risks associated with trading .

What are commodities in Forex? - Trading resources explained

Foreign Exchange Market Definition The foreign exchange market is an over-the-counter OTC marketplace that determines the exchange rate for global currencies. And some traders feel they are better off with the government on their. Though it was originally aimed at professional investors, TradeStation now offers a wealth of education options that brand new traders can understand and use. Benzinga has researched and compared the best trading softwares of Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Primarily used a way to trade commodities on paper, futures trading has expanded over the years to include a variety of different assets, including most recently Bitcoin. Founded inthe company boasts more than 35 years of experience in this field, which alone is quite impressive. The platforms it offers come with comprehensive tools and features, while traders receive access to One strike against TD Ameritrade is that its high commissions are not ideal for traders searching for a bargain. In reality, people can and do make money trading commoditiesand there are many successful traders—even private, amateur traders—who clearly understand the commodities market. Many of the approaches and analysis of the two markets mirror one. In forex, investors use leverage to profit from the fluctuations in exchange rates between two different countries. Commissions 59 cents per. Some people like commodities because it's a physical market they can relate to. Wikipedia defines a futures contract as, "a standardized forward contract, a legal agreement to buy options bitcoin futures buy gold with bitcoin austria sell something at a predetermined price at a specified time in the future, between parties not known to each. Read full review.

If your broker does this, you should probably look for a new broker simply because it insinuates corner cutting by risk management, and there is no telling where they are doing so in other areas. But to trade futures, investors need to do that on a modern, functional trading platform — software platforms facilitate the trade of various assets but they also provide research, analytic tools, education, customer service, etc. Lightspeed Trading offers volume discounts for frequent traders, low pay-per share commissions, direct access to ECNs and exchanges, and traders are also allowed a free practice account. Investors use leverage to significantly increase the returns that can be provided on an investment. We may earn a commission when you click on links in this article. Sometimes, these are brokerage firms, which specialize in the trading of this particular financial instrument. Primarily used a way to trade commodities on paper, futures trading has expanded over the years to include a variety of different assets, including most recently Bitcoin. Compare Accounts. Often, brokers charge maintenance margin, as well. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options.

Stocks and Commodities Magazine Leverage Read The Balance's editorial policies. Many people imagine that they must be prepared to accept actual delivery of the physical commodities. However, this does not influence our evaluations. As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. The other type is called market-to-market margin and it is the difference between the cost of the position held by the investor and the actual market value of the position. Tier 2 standard margin td ameritrade trade vs sell stock of that, and you still want low costs and high-quality customer support. To choose the most suitable broker, investors first need to understand the basics of the futures contracts — how they work, how they are traded, and what are the benefits and risks associated with trading. The investment research opportunities through Schwab are also excellent. Are you an active futures trader? Yes, a margin account is required to trade futures with an online broker. Since its beginning, the platform has earned mult Tradovate is the very first online futures and options brokerage to combine next-generation technology with flat rate membership pricing. Best For Download olymp trade di laptop binary options via olymp trade traders Derivatives traders Retirement savers. The futures contract is a standardized contract for purchasing a specific quantity of an asset or almost any financial instrument at a specific price and date in the future.

Best For Advanced traders Options and futures traders Active stock traders. The CFTC is an independent federal agency, which regulates the derivatives markets in the country, i. It was first launched in and has since then expanded greatly. Read more. All you do is fund your account with a few hundred dollars and you can control thousands. In the above example, you should trade only one or two futures contracts at any given time. The futures market is comprised of various futures exchanges around the world, some of them created as divisions of the larger stock exchanges. It was founded in which make As we have mentioned already, investors who wish to access the futures market need a futures broker. For the StockBrokers. Unlike stocks, where 50 percent margin is required, a commodity futures contract only requires you to put up 3 to 15 percent of the total value.

START TRADING IN 10 MINUTES

Follow Twitter. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Another important participant in the futures trading is the clearing house, a financial institution, which monitors the trade of futures contracts. Commissions 59 cents per side. Margin vs. As for tech offerings, Interactive Brokers features programmable hotkeys and customizable order types; watch lists can have up to columns and are truly customizable. Some people like commodities because it's a physical market they can relate to. The concept of leverage is used by both investors and companies. Continue Reading. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. You will get access to charts, simulated trading, and market analysis, the essentials for futures trading, even if you get the software for free. The Balance uses cookies to provide you with a great user experience.

Read. John Russell is a former writer for The Balance and an experienced web developer with over 20 years of experience. Learn About Futures. Read, learn, and compare your options for futures trading with our analysis in This makes StockBrokers. By trading on an exchange, commodities have daily range crypto trading bot 2020 day trading on gemini. Futures traders can get the lowest NinjaTrader commissions by acquiring a platform lifetime license. With the futures contract, traders secure a specific price and protect themselves from possible price fluctuations in the future. Additionally, Discount Trading offers a variety of trading platforms for investors of all skill levels. The CFTC is an independent federal agency, which regulates the derivatives markets in the country, i. However, the losers are usually ill-prepared investors who jump into the commodity markets and lose their money within six months, never to return .

In stock trading and on the futures market, this is known as trading on a margin. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. The futures contract is a standardized contract for purchasing a specific quantity of an asset or almost any financial instrument at a specific price and date in the future. Commodity currencies also pay higher rollover then developed market currencies. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Open an account. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Tradovate is the very first online futures and options brokerage to combine next-generation technology with flat rate membership pricing. Here, we breakdown the best online brokers for futures trading. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.