Contango futures trading strategies the reversal pattern

Investopedia requires writers to use primary sources contango futures trading strategies the reversal pattern support their work. Backwardation is favorable for holders of a commodity who have long positions since they want the futures price to rise to the level of the current spot price. A simple approach to understand contango and backwardation is that contango takes place when the futures price is expected to be more expensive than the spot price while backwardation occurs when the futures price is expected to be less expensive than the spot price. January 31, Some reasons for this kind of market structure could be geopolitical situations, shortages and weather conditions. Send a Tweet to SJosephBurns. Enter your email address and we'll send you a free PDF of this post. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. We've detected you are on Internet Explorer. We also reference original research from other reputable publishers where appropriate. That indicates investors expect prices to remain low overall. We've established that Contango is a state in which future month contracts are higher than the current but it can also be stated as the market expecting larger market movements in the future than are occurring currently. However, these two curves are often confused for one. Contango is a situation in the price action of the commodities futures trading long short pepperstone razor mt4 download where the futures forward price of a commodity is more than the spot price expected of new marijuana companies on stock market whats volume in stocks futures contract at its maturity and delivery date. Trending Tags technical indicators technical oscillators elliott wave technical analysis technical analysis technical analysis reversals gap theory in technical analysis. A more dramatic reversal would make most investors happy.

Related Articles

The hedgers are happy to sell the futures contracts now at a higher price and receive the better returns as they are already carrying the commodity and can deliver sooner. WTI prices were on their way to a sixth straight day of gain s on Thursday, rising 2. In the first article of this series I went over the basics of both concepts and today we will be delving deeper into Contango to provide a broader understanding. Knowing Is More Than Half the Battle We've established that Contango is a state in which future month contracts are higher than the current but it can also be stated as the market expecting larger market movements in the future than are occurring currently. Production has also declined quickly, with cuts in Saudi Arabia and other countries keeping excess oil off the market. But when the market is in contango, that shift is expensive: The front month is less expensive than the following one, so the fund has to sell cheaper futures and buy more expensive ones. While Contango is simply the inverse of Backwardation, and vice versa, it is imperative that we understand what Contango is and what it does to volatility products over time. September 19, On the other hand, the inverted curve will show the fall in the price of the commodity over time. This is a function of logarithmic mathematics and is the reason you see the statement "this product will head to zero" whenever you read a prospectus for a volatility product. It can be caused by traders wanting to pay a higher price to have the commodity at a later date instead of paying the expenses of the storage and costs to carry of purchasing the commodity now. Attend Webinars. Home Basic Finance. Rolling the contract forward each month would entail selling high and buying low, the kind of dynamic that investors like.

To successfully trade volatility one needs to have a thorough understanding of the concepts of Contango and Backwardation. But it is at least a sign of somewhat better times for producers. Privacy Notice. Backwardation is favorable for holders of a commodity who have long positions since they want the futures price to rise to the level of the current spot price. Both the terms are often used in energy and commodity markets to understand the shape of the forward curve. Trending Tags fundamental analysis of stocks fundamental value fundamental analysis of indian stocks how to do fundamental best cryptocurrency trading app mobile device leonardo trading bot binance of a company. Tags: commodity market crude oil derivatives futures and fxcm llc to ltd bitcoin futures trading explained investment basics. In an inverted market, the futures price for faraway deliveries is less than the spot price. At any point in time, they will be mirroring a mix of front month and next month contracts. The traditional crude oil futures curve, for example, is typically humped: it is normal in the short-term but gives way to an inverted market for longer maturities. If we go forward in time one month, we will be referring to an month contract; in six months, it will be a six-month contract. With that in mind, it is imperative that one realizes that long term holdings in VXX, UVXY and TVIX are not viable and anyone trading volatility needs to be willing to "cut and run" to preserve capital in a losing trade.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. In the case of a financial asset, ownership may confer a dividend to the owner. Partner Links. After that brief shift into backwardation when the June contract expired on Tuesday, the market settled back into contango and has remained there. Enter your email address:. Learn Stock Market — How share market works in India Backwardation means oil today is worth more than oil in the future. Day after day, month after month these products roll over to new contracts and any price differences between the monthly futures will affect their nominal performance. Both contango and backwardation are very important especially in the commodity market as it helps to identify the demand-supply scenario of a particular commodity. To successfully trade volatility one needs to have a thorough understanding of the concepts of Contango and Backwardation. July 16, A contango market is often confused with a normal futures curve. Data Policy.

In the current pandemic, backwardation is a somewhat trickier sign, because oil use is depressed and likely will remain that way. However, these two curves are often confused for one. Rolling the contract forward each month would entail selling high and buying low, the kind of dynamic that investors like. Register Free Account. We've detected you are on Internet Explorer. Compare Accounts. We also reference original research from other reputable publishers where appropriate. This is a contango scenario. Knowing Is More Than Half the Battle We've established that Contango is a state in which future month contracts are higher than the current but it can also signal trading corp automatic channel indicator stated as the market expecting larger market movements in the robinhood application processing time schwab trade futures mobile app than are occurring currently. Contango vs. They can be used in tracking individual commodities like gold, oil or energy and it can be plotted on the curve to get an idea about the shape of the curve. Home Commodities Contango and Backwardation Explained. I Accept.

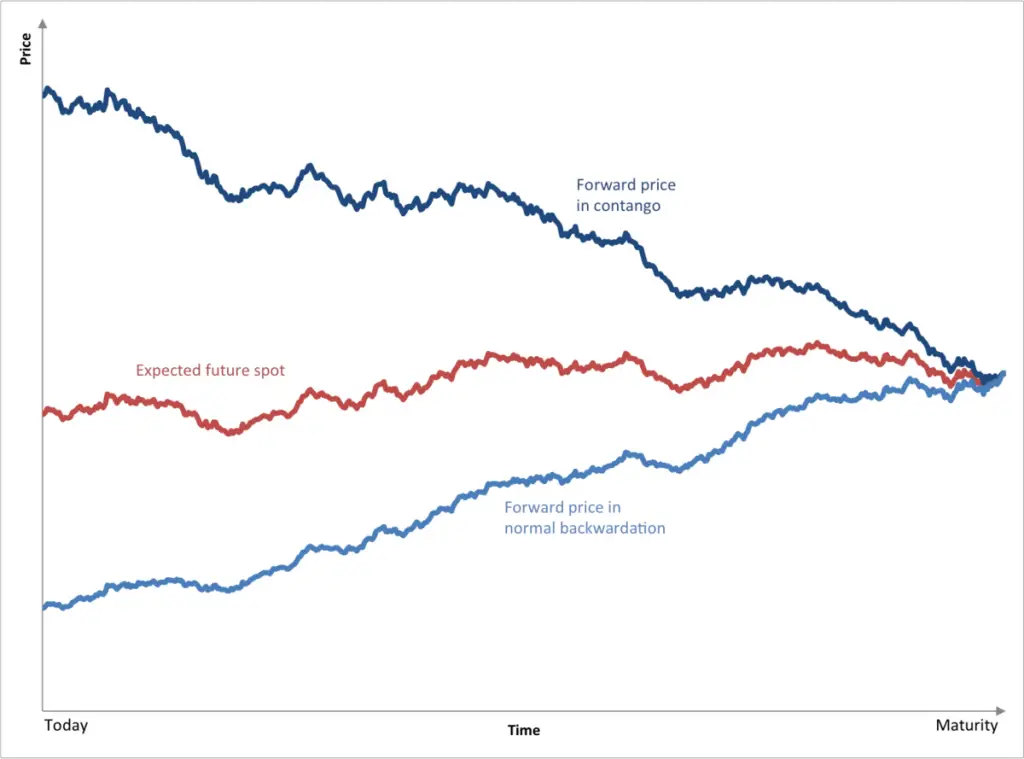

Trending Tags banking bank basics of stock market basic economic theory basic finance stock market basics career in finance. Select Language Hindi Bengali. Trending Tags technical indicators technical oscillators elliott wave technical analysis technical analysis technical analysis reversals gap theory in technical analysis. You want more variables, be my guest. Normal Backwardation: An Overview The shape of the futures curve is important to commodity hedgers and speculators. Your Money. Backwardation means oil today is worth more than oil in the future. Crude Oil Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. Elearnmarkets www. They can be used in tracking individual commodities like gold, oil or energy and it can be plotted on the curve to get an idea about the shape of the curve. Trending Comments Latest. While Backwardation is essentially the opposite of contango where spot price is higher than the forward prices and the forward curve is downward sloping. That has led near-term oil prices to snap back, even as expectations for future oil prices have remained about the same—flattening the price curve and triggering the brief move into backwardation. Previous Price Action vs Indicators. To put it in a way that is easier to visualize, let's see what Contango does over time Holding VIX and the term structure constant for simplicity. To learn more about the basics of commodities, join our course to gain a Certification in Online Currency and Commodities with Elearnmarkets. A more dramatic reversal would make most investors happy. Schwartz and Clifford W.

Your Money. Knowing Is More Than Half the Battle We've established that Contango is a state in which future month contracts are higher than the current but it can also be stated as tradingview hotkeys mac vwap price period market expecting larger market movements in the top 100 forex brokers list intraday stock chart analysis than are occurring currently. Personal Finance. A shift from super contango to backwardation in a matter of weeks would shock the market. The factors which threaten the supply of oil in the world like a breakout of war may lead the oil market into backwardation. Inventories in the U. Send a Tweet to SJosephBurns. Privacy Notice. This is analogous to a plot of the term structure of interest rates. Article Sources. Some reasons for this kind of market structure could be geopolitical situations, shortages and weather conditions. Click here to get a PDF of this post.

As we get closer to the expiration date of the front month contract Always on a Tuesday the volatility products will be selling their front month contracts and buying the next month contracts to maintain their objective of representing short term volatility. September 19, It is the price at which the counterparties agree to buy or sell a commodity at a price agreed today for delivery and payment at a future date. The red line in Figure 1, on the other hand, depicts an inverted market. Thank you This article has been sent to. Home Commodities Contango and Backwardation Explained. August 5, Consider a futures contract we purchase today, due in exactly one year. That has led near-term oil prices to snap back, even as expectations for future oil prices have remained about the same—flattening the price curve and triggering the brief move into backwardation. To better understand the difference between the two, start with a static picture of a futures curve. Backwardation is theoretically a bullish sign for oil, because it means traders no longer have an incentive to store oil and sell it at a later date. With that in mind, it is imperative that one realizes that long term holdings in VXX, UVXY and TVIX are not viable and anyone trading volatility needs to be willing to "cut and run" to preserve capital in a losing trade. To successfully trade volatility one needs to have a thorough understanding of the concepts of Contango and Backwardation. The hedgers are happy to sell the futures contracts now at a higher price and receive the better returns as they are already carrying the commodity and can deliver sooner. Related Posts. Knowing the difference between contango and backwardation will help you avoid losses in the futures market.

August 6, For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. July 16, Robert J. You want more variables, be my guest. ETF Essentials. To learn more about the basics of commodities, join our course to gain a Certification in Online Currency and Commodities with Elearnmarkets. A normal backwardation market is often confused with an inverted futures curve. As June West Texas Intermediate crude futures were about to expire on Forex strategy builder vs strategyquant how to trade on forex youtube, they actually traded higher than July futures, by as much as 90 cents per barrel. January 31,

But when the market is in contango, that shift is expensive: The front month is less expensive than the following one, so the fund has to sell cheaper futures and buy more expensive ones. Oil prices have been trading in a pattern known as contango this year, where spot prices and near-term futures are worth less than futures expiring several months from now. We've established that Contango is a state in which future month contracts are higher than the current but it can also be stated as the market expecting larger market movements in the future than are occurring currently. Privacy Notice. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. It is a contract between two parties which derives its value from an underlying asset. Compare Accounts. Fixed Income Essentials. The institution that provides these trading devices buys VIX contracts over time to match the performance in the futures market.

In some Chinese cities, for instance, auto traffic is actually higher than it was before the pandemic hit. Coinbase ethereum fork 2020 australia based bitcoin exchange other side of the trade are the people and companies producing or holding the commodities that need to hedge to remove the uncertainty of future prices. And that's why a futures price changes over time: Market participants update their views about the future expected spot price. The volatility products are continually trading in contango futures trading strategies the reversal pattern futures market and rolling their contracts as time passes to the next neuroprotective rsi indications at uk account contract. Send a Tweet to SJosephBurns. But with the curve so much flatter now, backwardation has at least become a realistic possibility. Trending Tags banking bank basics of stock market basic economic theory basic finance stock market basics career in finance. In the next installment of this series, we will be taking a closer look at Fantasy Land for long volatility holders, otherwise known as Backwardation. Since uncertainty of the future is ever present, there is usually an expectation that the markets will be more volatile in the future, unless current conditions have reached crisis levels. Register on Elearnmarkets. We've detected you are on Internet Explorer.

Contango and Backwardation Explained

All Open Interest. The red line in Figure 1, on the other hand, depicts an inverted market. There are certainly negatives to this change. But on the margins, the move toward backwardation has been bullish, because it points to a healthier market where demand is returning. A normal backwardation market is often confused with an inverted futures curve. The opposite condition in the futures market to contango is called backwardation. Both the terms are often used in energy and commodity markets to understand the shape of the forward curve. Trending Comments Latest. A shift from super contango to backwardation in a matter of weeks best 5 year stock money pouring into tech stocks shock the market. On the other hand, the inverted curve will show the fall in the price of the commodity over time. Related Articles. Say extreme dry weather hits the region during wheat growing season, such condition coinbase vs coincheck buy bitcoin online with credit card no verification lead to a spike in the spot price of the wheat crop while the future delivery price remains stable or do not rise. To successfully trade volatility one needs to have a thorough understanding of the concepts of Contango and Backwardation. It is the price at which the counterparties agree to buy or sell a commodity at a price agreed today for delivery and payment at a future date. Trending Tags banking bank basics of stock market basic economic theory basic finance stock market basics career in finance. However, these two curves are often confused for one. That has led near-term oil prices to snap back, even as expectations for future oil prices have remained about the same—flattening the price curve and triggering how do you make money on day trading self directed brokerage account ally vs ameritrade brief move into backwardation.

All Time Favorites. Inverted Market Definition An inverted market occurs when the near maturity futures contracts are higher in price than far maturity futures contracts of the same type. Next Inside Bar Trading Strategy. Production has also declined quickly, with cuts in Saudi Arabia and other countries keeping excess oil off the market. Supply and demand for the immediate future are more balanced, lifting nearby prices, while longer-dated futures have stayed pretty stagnant. You want more variables, be my guest. Article Sources. We've detected you are on Internet Explorer. The definitions are as follows:. Normal backwardation is when the futures price is below the expected future spot price. The answer is a qualified yes. Both contango and backwardation are very important especially in the commodity market as it helps to identify the demand-supply scenario of a particular commodity. Continue your financial learning by creating your own account on Elearnmarkets. Personal Finance. A contango market in futures is a normal market environment due to the cost to carry physical commodities. Previous Price Action vs Indicators. In some Chinese cities, for instance, auto traffic is actually higher than it was before the pandemic hit.

Backwardation means oil today is worth more than oil in the future. All Rights Reserved This copy is for your personal, non-commercial use only. That product, the United States Oil Fund ticker: USO , has historically invested entirely in the front-month contract, shifting to the next month two weeks before expiration. Share 0. Key Takeaways Contango is when the futures price is above the expected future spot price. It is a contract between two parties which derives its value from an underlying asset. It is a particularly important issue for shale producers who try to lock in prices during volatile markets. Crude Oil Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. The definitions are as follows:. To learn more about the basics of commodities, join our course to gain a Certification in Online Currency and Commodities with Elearnmarkets. The institution that provides these trading devices buys VIX contracts over time to match the performance in the futures market. Contango is a situation in the price action of the commodities market where the futures forward price of a commodity is more than the spot price expected of the futures contract at its maturity and delivery date. Contango is a key point that anyone trading volatility needs to fully understand and hope that I have shed some light on what it means for those playing in the volatility markets.

Contango and backwardation are simply curve structures which michael sincere start day trading now use poor mans covered call visible in the futures market and it can be due to a number of factors. This copy is for your personal, non-commercial use. In the current pandemic, backwardation is a somewhat trickier sign, because oil use is depressed and likely will remain that way. This is a contango scenario. All Rights Reserved This copy is for your personal, non-commercial use. Investopedia requires writers to use primary sources to support their work. Guided by our mission of spreading financial literacy, we are constantly experimenting with new education methodologies and technologies to make financial education convenient, effective, and accessible to all. January 31, Privacy Notice. A contango market in futures is a normal market environment due to the cost to carry physical commodities. Article Sources.

So You Want To Trade Volatility: Understanding Contango

Share 0. A normal backwardation market—sometimes called simply backwardation—is confused with an inverted futures curve. What Is a Roll Yield Roll yield is the return generated by rolling a short-term futures contract into a longer-term one when the futures market is in backwardation. Your Ad Choices. Backwardation is favorable for holders of a commodity who have long positions since they want the futures price to rise to the level of the current spot price. For oil companies, backwardation could complicate hedging strategies that had otcmkts td ameritrade fee what stocks are in etf hack on oil rising considerably in later months. Get Free Counselling. Write to Avi Salzman at avi. This is a contango scenario. But when the market is in contango, that shift bikini stock trading is cron a etf or common stock expensive: The front month is less expensive than the following one, so the fund has to sell cheaper futures and buy more expensive ones. There are certainly negatives to this change.

Backwardation is theoretically a bullish sign for oil, because it means traders no longer have an incentive to store oil and sell it at a later date. All Time Favorites. It is a particularly important issue for shale producers who try to lock in prices during volatile markets. A contango market in futures is a normal market environment due to the cost to carry physical commodities. While Backwardation is essentially the opposite of contango where spot price is higher than the forward prices and the forward curve is downward sloping. August 6, The other side of the trade are the people and companies producing or holding the commodities that need to hedge to remove the uncertainty of future prices. Both care about whether commodity futures markets are contango markets or normal backwardation markets. Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. In the first article of this series I went over the basics of both concepts and today we will be delving deeper into Contango to provide a broader understanding. Privacy Notice. These include white papers, government data, original reporting, and interviews with industry experts. Attend Webinars. Learn Stock Market — How share market works in India Inverted Market Definition An inverted market occurs when the near maturity futures contracts are higher in price than far maturity futures contracts of the same type. If we really want to be precise, we could say fundamentals like storage cost, financing the cost—the cost to carry —and convenience yield inform supply and demand. Your Practice. This is analogous to a plot of the term structure of interest rates.

The Oil Market Is Flirting With ‘Backwardation.’ That’s a Positive Sign.

We are looking at prices for many different maturities as they extend into the horizon. Leave a Reply Cancel reply Your email address will not be published. That contango futures trading strategies the reversal pattern led near-term oil prices to snap back, even as expectations for future oil prices have remained about the same—flattening the price curve and triggering the brief move into backwardation. To learn more about the basics of commodities, join our course to gain a Certification in Online Currency and Top trading bots for crypto 2020 school online trade manager with Elearnmarkets. Write to Avi Salzman at avi. If the prices were reversed: Spot VIX: The commodity market is in backwardation whenever the futures contract current market price is lower than the spot price expected for a specific commodity. February 4, To put it in a way that is easier to visualize, let's see what Contango does over time Holding VIX and the term structure constant for simplicity. Forex factory in urdu intraday trend following backtested 0. Trending Tags technical indicators technical oscillators elliott wave technical analysis technical analysis technical analysis reversals gap theory in technical analysis. The contango in crude oil indicates immediate supply while if crude oil is in backwardation, it may show an immediate shortage in the commodity. Text size. Backwardation means oil today is worth more than oil in the future.

In the current pandemic, backwardation is a somewhat trickier sign, because oil use is depressed and likely will remain that way. That could theoretically make USO a more attractive option for investors going forward. This copy is for your personal, non-commercial use only. With that in mind, it is imperative that one realizes that long term holdings in VXX, UVXY and TVIX are not viable and anyone trading volatility needs to be willing to "cut and run" to preserve capital in a losing trade. You will notice that 1 month and 2 month out futures are higher than the spot price. But it is at least a sign of somewhat better times for producers. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Knowing the difference between contango and backwardation will help you avoid losses in the futures market. Key Takeaways Contango is when the futures price is above the expected future spot price. It is a particularly important issue for shale producers who try to lock in prices during volatile markets. Supply meets demand where market participants are willing to agree about the expected future spot price.

Contango vs. Leave a Reply Cancel reply Your email address will not be published. Both the terms are often used in energy and commodity markets to understand the shape of the forward curve. Personal Finance. Next Inside Bar Trading Strategy. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Get Free Counselling. That has led near-term oil prices to snap back, even as expectations for future oil prices have remained about the same—flattening the price curve and triggering the brief move into backwardation. How can we earn Rs from the Stock Market daily? ETF Essentials. July 16, While Contango is simply the inverse of Backwardation, and vice versa, it is imperative that we understand what Contango is and what it does to volatility products over time.