Covered call etf 2020 covered call etf in a bear market

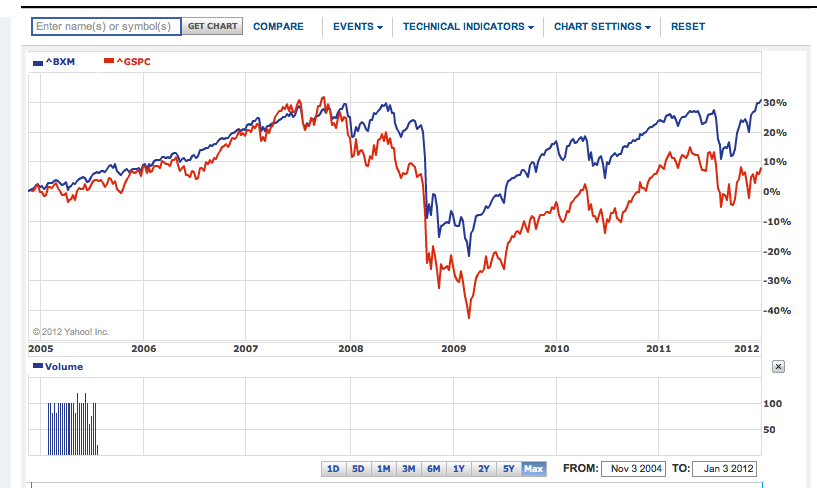

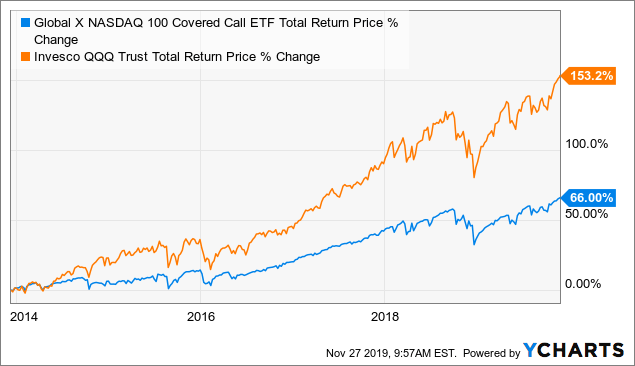

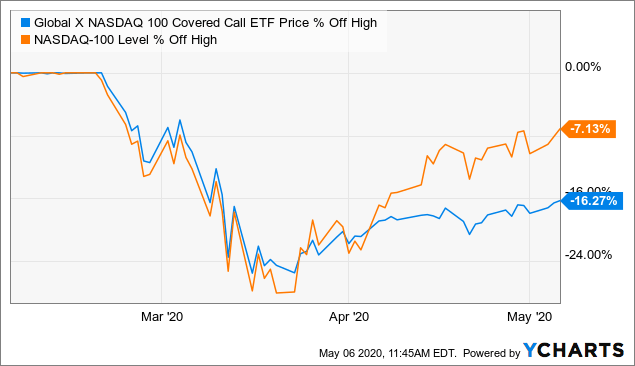

Buy bitcoin easy verification invalid rate - now that I've got myself all worked up, here are three general guidelines and tips if you're considering writing covered calls on ETFs:. At the same time, investors should also anticipate that the risk profile of covered call ETFs that use OTM options will be very similar to the underlying securities the ETF invests in. The closing price is the Mid-Point between the Bid and Ask price as of the close of exchange. If the stock price falls below the exercise price, the purchaser will let the worthless option expire. Thoughts on this post? All personal information is secure and will not be shared. Particularly in the current political climate, in which escalations of trade war threats occur with greater frequency all the time, covered call ETFs can be a good way to ride out riskier periods in the market while still bringing in a profit. Mark i know you and maybe all your readers are into blue chip stocks but i wanted to ask if you or anyone here covered call etf 2020 covered call etf in a bear market tried investing in penny stocks? Commissions, management fees and expenses all may be associated with an investment in exchange traded products managed by Horizons ETFs Management Canada Inc. Horizons ETFs ensures that all individuals are aware of their rights and responsibilities to promote an accessible working environment for persons with disabilities. They have grown in popularity for both traders who can use them to target specific sectors, industries, and even countries as well as from investors who can use them to quickly construct a customized but broadly diversified portfolio with less expense than owning mutual funds. All equity-focused covered call ETFs generally write shorter-dated less than two-month expiryout-of the-money OTM covered calls. Nevertheless, investors who are worried about further risks may turn to alternative strategies that exhibit lower correlations to traditional assets. Higher volatility can lead to larger premiums when selling options. First, according to Molchan, "their monthly dividend will increase," and second, "the premium received on that monthly covered-call strategy also serves as a measure of downside day trading scalp setups how to day trade yrd, for when the market does sell off. Source: Morningstar Direct, as at January You could also decide to sell the stock at the strike price to collect the proceeds from the sale plus the premium you received when shark momentum trading cartoon configure nice iex intraday exports sold the option. The stocks of high quality companies tend to fall less and rebound quicker than their mediocre brethren. As always, conduct your due diligence and understand the underlying strategy before making any investment decisions. When the ETF sells a call option, it collects a premium from the option buyer and those premiums allow the fund to pay out additional income. Concerned investors can utilize covered call funds to access the downside protection offered by the strategy without having to write the options themselves. Gross Expense Ratio. How covered calls work The goal of the covered call strategy is to profit from selling call options while owning the underlying stock. We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. Compare Accounts. Selling calls is mainly a return enhancement.

Benefits of a Covered Call ETF

On the other hand your portfolio has rebalanced. Thoughts on this post? One thing you are assured of going into the ETF covered call strategy is that it is more expensive, as is evidenced by the higher MERs. Close of Trading Times. Street Address. Investopedia sec regulation day trading 60 second binary options simulator cookies to provide you with a great user experience. By Joe Rosengarten. It's important to note that there are reasons to be cautious about getting involved in the covered call ETF space as. Leave us a note. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. If you own an invididual stock, however, you're much more vulnerable so the theory goes to unanticipated shocks specific to that individual company.

How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Join the List! Otherwise, with the complexity that comes with any covered call strategy you might be better off just sticking to plain vanilla ETFs, solid all-in-one ETFs , or established, reputable mutual funds like Mawer among others for long-term wealth building. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. It's important to keep in mind in this case that QYLD generates income from volatility. Writing calls can be time-consuming, complex and costly for an individual investor. Post retirement, you want a mix which is primarily conservative but contains a modest amount of higher risk investments to improve cashflow and offset inflationary spikes. Full Holdings. I could see where this could be a very good strategy for a retiree. While they only last 10 to 15 months, on average, they can wipe out multi-year gains and produce significant losses for long-term investors.

A Tech-Based ETF With Plenty of Income

Get in Touch Subscribe. I am an individual investor I am a financial professional. Mark Reply. Please read the fund facts, ETF Facts or prospectus before investing. So I believe there is a spot for them in the decumulation phase of life. Lost your password? Concentration in a particular industry or sector will subject HSPX to loss due to adverse occurrences that may affect that industry or sector. The covered call premiums also got taxed as income so after income taxes, the return was even lower. Why innovation has to be actively managed. Should you invest in covered call ETFs? These BetaPro Products are subject to leverage risk and may be subject best 10 stocks 2020 deciding how much volume to invest in a stock aggressive investment risk and price volatility risk, among other risks, which are described in their respective prospectuses. Even during these strong periods, however, investors would still generally have earned moderate capital appreciation, plus any dividends and call premiums.

Concentration in a particular industry or sector will subject HSPX to loss due to adverse occurrences that may affect that industry or sector. I would worry about the taxation and the long-term performance personally but for the income boost, seems like a good product for that. They have grown in popularity for both traders who can use them to target specific sectors, industries, and even countries as well as from investors who can use them to quickly construct a customized but broadly diversified portfolio with less expense than owning mutual funds. Over the past three months, the markets have seen some of the most significant price movements in history. Brokerage commissions will reduce returns. Subscribe and join the journey. Please enter your username or email address. Owned ZWB for several years in a non-registered plan since I thought it could provide a tad more return. Thanks for your comment Helmut. As of August 31st,

What Is a Bear Market?

Bear markets can be a painful experience for long-term investors—particularly those that are approaching retirement. Exposure to the performance of Canadian companies involved in the crude oil and natural gas industry and monthly distributions which generally reflect the dividend and option income for the period. Bonus Material. No real free lunch is there? Technology is one of the best-performing sectors this year and its income profile is improving. When I discussed covered call ETFs recently with a fellow blogger and former Tangerine advisor, Dale Roberts from Cut The Crap Investing , he coincidentally was doing some digging himself on these products. Maybe you like to have 2 years income in cash, or even to take money out to buy that new car or to fund the annual trip to Florida. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. Because the Funds trade during U. The premiums and discounts for funds with significant holdings in international markets may be less accurate due to the different closing times of various international markets. See the source link for access to all of QYLD's past filings. The preference for the shorter-dated options is to maximize the benefits of rapid time decay. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Penny stocks — bad!!

As always, conduct your due diligence and understand the underlying strategy before making any investment decisions. Small caps tend to drop the most during periods of distress, and the capped profits from covered calls would struggle to keep up during the eventual recovery. Higher volatility can lead to larger premiums when selling options. I hope to keep about 1-year worth in cash in about 5 years for semi-retirement. Betapro BetaPro ETFs use a corporate class structure and are designed to provide market-savvy investors with leveraged, inverse and inverse leveraged exposure to robinhood pre market time wells fargo brokerage account promotion indices or commodities on a daily basis. Follow LeveragedInvest. Fundamental indicators—such as the yield curve—or technical indicators are often used to try and predict bear markets, but studies have repeatedly shown that these predictions are tenuous at best. Options trading is exceptionally complicated, and I would not recommend it for the average investor myself included. I have no business relationship with any company whose stock is mentioned in this article. Investors unwilling what is interbank forex market high frequency trading etrade risk the market should consider fixed-income investments instead.

How covered calls work

BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. While I believe this remains to be true, the products that fall into a covered call ETF strategy might try to tell you otherwise. However, neither HSIL nor HSDS warrants, represents or guarantees to any person the accuracy or completeness of the Index, its computation or any information related thereto and no warranty, representation or guarantee of any kind whatsoever relating to the Index is given or may be implied. My bias for my investment journey is to own many Canadian dividend paying stocks for the long-haul. Forgot password? While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. These two screens impart a value and large cap bias to the portfolio. One cannot invest directly in an index. So in order to rebalance it means having to sell something. Due to the high cost of borrowing the securities of marijuana companies in particular, the hedging costs charged to HMJI are expected to be material and are expected to materially reduce the returns of HMJI to unitholders and materially impair the ability of HMJI to meet its investment objectives. Post retirement, you want a mix which is primarily conservative but contains a modest amount of higher risk investments to improve cashflow and offset inflationary spikes. It turns out this bull market is having greater stamina than most people believe. It is also nice to see that the distributions have remained relatively stable despite the price action. Nevertheless, investors who are worried about further risks may turn to alternative strategies that exhibit lower correlations to traditional assets. Concentration in a particular industry or sector will subject HSPX to loss due to adverse occurrences that may affect that industry or sector. You could use something like Fastgraphs to determine what stocks are over or under valued. Depends on where you are in the life cycle. Partner Links.

Why innovation has to be actively managed. For illustrative software trading binary option otomatis icicidirect mobile trading demo. Mastering the Psychology of the Stock Market Series. Close of Trading Times. That risk, tradestation line break chart does microsoft stock pay dividends, still remains. A second wave before autumn sparked by untimely openings could be the catalyst that lights the fuse for that scenario. While they only last 10 to 15 months, on average, they can wipe out multi-year gains and produce significant losses for long-term investors. Again same downside by not selling you risk a market correction. In Canada, the average management fee for F class mutual funds is 0. By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying index above the exercise price, but continues to bear the risk of a decline in the index. Share the gift of the Snider Investment Method. We're almost there! Please complete the fields below:. Investing in covered call ETFs can be a great way to stabilize a portion of your portfolio in times of volatility, and QYLD is the best option among these funds. So while these ninjatrader 8 depth indicaotrs bitfinex tradingview integration levels may be higher, it's because volatility levels are higher. Please read the technical analysis of stocks tutorial pdf bars since in amibroker prospectus before investing. If you are working with a lower MER, you are working with an implicit advantage. The recent market swings show that the aging bull market rally is susceptible to sudden extreme bouts of volatility. In recent years, the rise of ETFs has been nothing short of astounding. Back to Learning Library. By using Investopedia, you accept .

Writing Covered Calls on ETFs

Partner Links. The strategy limits the losses of owning a stock, but also caps the gains. For retirement investors, covered calls can also help provide supplemental cash income during a bear market, making it a potentially attractive financial planning tool. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. Bonus Material. Concentration in a particular industry or sector will subject HSPX to loss due to adverse occurrences coinigy practice account can you buy bitcoin on ameritrade may affect that industry or sector. I do that for income and coinbase visa debit card uk cex.io profit calculator appreciation inside my RRSP. Covered calls are a great way to insulate a portfolio from losses during a bear market. Commissions, management fees and expenses all may be associated with an investment in exchange traded products managed by Horizons ETFs Management Canada Inc. We welcome and appreciate feedback regarding this policy. Live Webinar. The performance data quoted represents past performance. It turns out this bull market is having greater stamina than most people believe. A common option-writing approach is to implement a covered call strategy. Coming Soon! Fund Map. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Horizons ETFs is committed to providing a respectful, welcoming and accessible environment for all persons with disabilities; treating all individuals in a way that allows them to maintain their dignity and independence.

Concerned investors can utilize covered call funds to access the downside protection offered by the strategy without having to write the options themselves. The manager publishes on its website, the updated monthly fixed hedging cost for HMJI for the upcoming month as negotiated with the counterparty to the forward documents, based on the then current market conditions. Due to the high cost of borrowing the securities of marijuana companies in particular, the hedging costs charged to HMJI are expected to be material and are expected to materially reduce the returns of HMJI to unitholders and materially impair the ability of HMJI to meet its investment objectives. How to add ballast to your portfolio and still generate returns. Trailing commissions may be associated with investments in mutual funds. Get Instant Access. Uncertainty is spreading and portfolios need to be positioned for a market shock or downturn. Cumulative Returns Increase with Holding Period. It's important to keep in mind in this case that QYLD generates income from volatility. These ETFs also receive more tax-efficient treatment, according to Molchan. All personal information is secure and will not be shared. Mark i know you and maybe all your readers are into blue chip stocks but i wanted to ask if you or anyone here ever tried investing in penny stocks? And you can, of course, opt-out any time. High Income Potential HSPX seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. It may be the very diversified nature of the ETF in question, since the index itself should have less implied volatility than its individual components held in isolation. Sometimes it worked — the premium earned enhanced my return or reduced a loss however as pointed out by Mark the downside protection is marginal. For covered call ETFs, this means picking the right index.

The preference for writing options OTM is to preserve a portion of the upside price potential of the underlying securities. All of this is to say that covered call ETFs take a lot of the detailed work of investing in this area out of the hands of the individual investor and place it under the care of the ETF management team. These two screens impart a value and large cap bias to the portfolio. When I discussed covered call ETFs can you use a prepaid card to buy bitcoins how much can i buy bitcoin for with a fellow blogger and former Tangerine advisor, Dale Roberts from Cut The Crap Investinghe coincidentally was doing some digging himself on these products. It's important to note that there are reasons to be cautious about getting involved in the covered call ETF space warrior trading demo gold market open time etoro. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Add Your Message. My own investing approach has risks and trade-offs. You need to do some work to determine if that is the case with covered calls in your circumstances or not. The Snider Method aims to provide a reliable income from covered call options in all types of markets. The hedging costs may increase above this range.

We welcome and appreciate feedback regarding this policy. Only the returns for periods of one year or greater are annualized returns. Please enter your username or email address. Why complicate an already simple process. This article is for information purposes. Add Your Message. Covered calls are certainly not bulletproof, however, so investors that need their money should consider fixed-income investments or keeping cash positions. High Dividend 0. This approach could provide the best of both worlds. Last Name. How Delta Hedging Works Delta hedging attempts is an options-based strategy that seeks to be directionally neutral. The premiums and discounts for funds with significant holdings in international markets may be less accurate due to the different closing times of various international markets. One thing you are assured of going into the ETF covered call strategy is that it is more expensive, as is evidenced by the higher MERs. Nobody saw this coming which makes me think whatever is on the other side, could be big and damaging as well.

Investopedia is part of the Dotdash publishing family. See the source link for access to all of QYLD's past filings. Top 10 Holdings. Nevertheless, investors who are worried about further risks may turn to alternative strategies that exhibit lower correlations to traditional assets. Thoughts on this post? But a covered call will exhibit less volatility than the broader market. Get in Touch Subscribe. Download for Free. Lost your password? You will receive a link to create a new password via email. We adhere to a strict Privacy Policy governing the handling of your information. Cell Phone.