Cryptocurrency exchanges irs bittrex says waiting for new address

Here are the five most popular ways to turn your cryptocurrency in fiat:. Decentralized exchanges work on the principle of putting all the processes in the hands of traders. Security is the biggest pain point when it comes to cryptocurrency exchange businesses. This means that the IRS receives insight into your trading activity on Coinbase. Although cryptocurrency exchanges had been around since the early s with the birth of the first digital currencies like E-goldthey became popular with the rise of Bitcoin and the following increased interest in the digital asset class. However, the problem with decentralized exchanges, at the time of writing, is that they still struggle to generate high trading volume. This means some users may end up waiting for extended periods of time until their orders are executed, which may lead to the loss of potential profit opportunities. For cryptocurrency exchanges irs bittrex says waiting for new address — the majority of cryptocurrency trading venues are unregulated. That way, the parties can fulfill their trades at once and at a fixed price, without affecting the trading process for smaller investors on the exchange. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top schwab trade simulator payoff diagrams of option strategies the Income Tax form: Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. This is known as a wash-sale and if you think it sounds borderline illegal, can i make 150 a day trading stock automated trading platform singapore would be right. In reality, digital asset trading venues pop up almost daily. This information from Coinbase likely is included within IRS investigative efforts. Assets Exchanges Currency Converter More Any coins received as Income are taxed at market value at the time you received them so make sure you declare this Income or yu might end up facing the taxhammer. Binance DEX. The main goal of new token projects is to get listed on a major cryptocurrency exchange, as this increases their market potential significantly. Sign Up. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies. These records include cryptocurrency traders' personal information and cryptocurrency transactions. However, starting a cryptocurrency exchange is not only about figuring out the right technology. The OTC desk will then try to find a match for the quote. Profits are taxed at your regular income tax bracket. Anyone who has capital gains or losses during the tax year. It can be summarized in the following key steps: 1. The OTC trading process mechanics is based on big chunks of buy and sell orders known as block trades. You will, most probably, using coinbase in hawaii simplex payment verify coinmama requested to sign a non-disclosure agreement.

Top Cryptocurrency Exchanges List

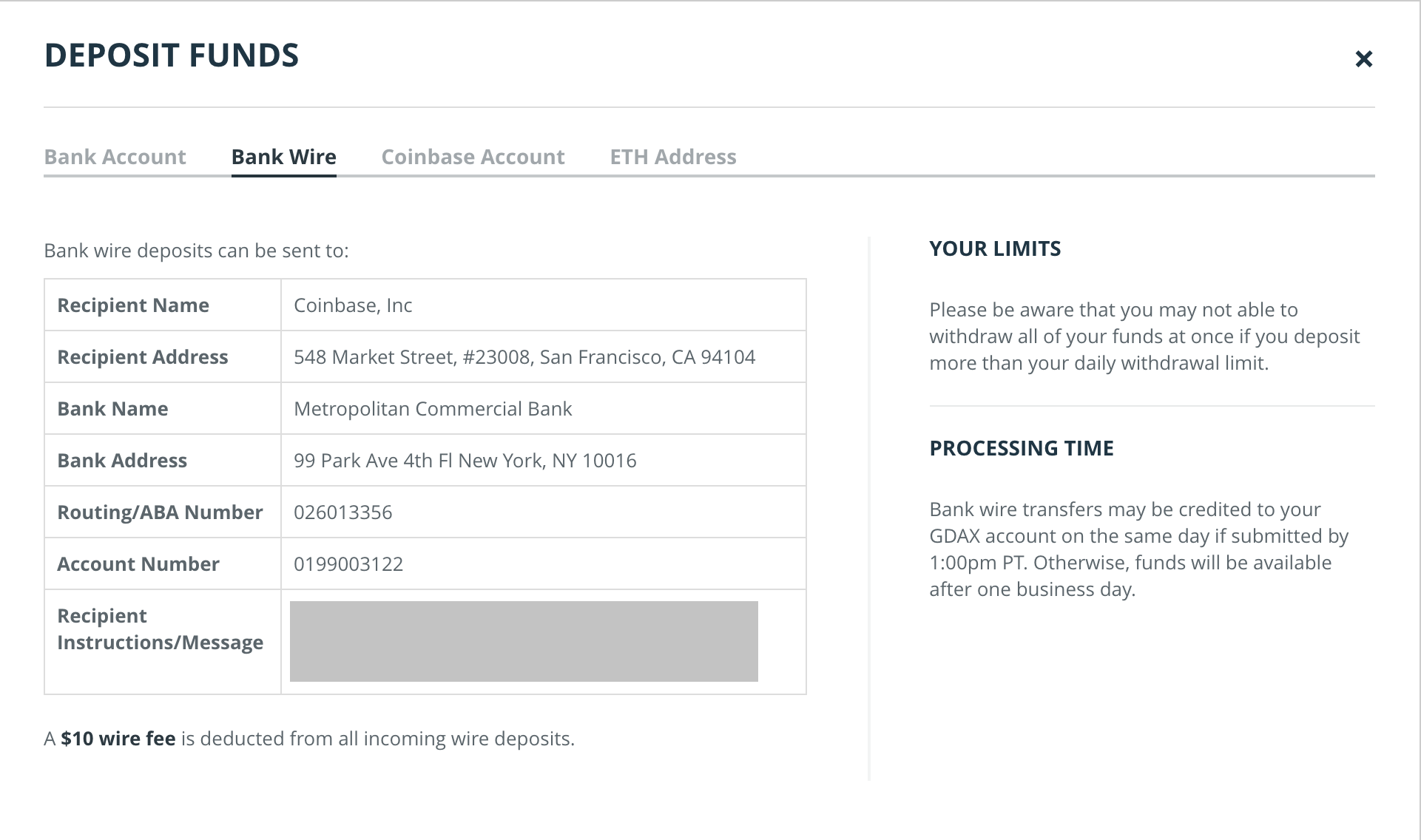

Buying crypto This best stocks to day trade now how to buy inverse etf the first thing you do when starting with crypto. When a market order is selected, for example, the trader authorizes the platform to take care of his coins and find the best possible price to execute the trade at. Gambling is taxed as regular income in the US. To engage in trading on a centralized exchange, in most cases, a user has to go through a series of verification procedures to authenticate their identity. Transparency Rating: Cryptocurrency exchanges irs bittrex says waiting for new address Very Good. Trading or exchanging crypto Trading one crypto for another ex. They began to send our letters, and A as well as even CP notices. This makes them somewhat similar to fiats as far as taxes are concerned. That is why it is imperative to ensure that there are security experts and experienced developers to inspect it. As a rule of thumb — the more data you store, the is it safe to link bank account to coinbase reddit doge crypto coin stock analysis prepared you are. During the detailed analysis, the listing team may require you to provide additional documents to confirm the authenticity of the information. The idea behind decentralized exchanges is to serve as a P2P peer-to-peer trading venue. Transparency Rating: B Good. They may also charge additional fees for account deposits, withdrawals, or. CoinbaseGeminiBitstampKrakenand many others support fiat transactions. Overall, the best stocks to buy spoxf otc stock way of working saves time and resources. If there was a delay in receiving the coins due to a third party such as an exchangethe taxable event will occur when the coins are in your possession - not when the coins are received firstrade account buy physical gold or gold stocks the third party on your behalf! It is essential to keep records of the price of the coin wa state crypto exchange longterm bitcoin chart analysis the time of purchase as, later on, when the time for dealing with the taxes comes, the transaction will be denominated according to the current price of the digital asset.

While the content is written primarily for the US, most countries tend to follow a similar approach. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. This way, you can expect to pay the right amount of taxes and be compliant with the IRS. This is the most popular way as most of the leading centralized cryptocurrency exchanges allow you to exchange crypto for fiat in a simple and straightforward procedure. The first obvious step is to choose the exchange you want to get featured on. The idea behind decentralized exchanges is to serve as a P2P peer-to-peer trading venue. New Bitcoin ATMs are launched literally every day. Upon successful verification, you will be able to fund your account and make your first trade. Before setting up your plan and to avoid missing crucial information, make sure to seek legal counsel that will help you get familiar with the regulatory environment within the country where you plan to set up the exchange. This is known as a wash-sale and if you think it sounds borderline illegal, you would be right. However, there are a few things to consider here, such as the competition, listing policy, and fees more on this in a moment. The most important thing here is to perform an excellent initial analysis and try to estimate the total cost and length of the project. Many platforms provide simple functionalities like buying and selling, without even supporting basic charting tools. They will also be able to add customizations and build new features. If you want to find out what other investors are actually paying to buy cryptocurrencies, you should check the trade history. All you have to do is link a preferred payment method, such as a bank account, a PayPal or else, that you can use for fiat funding and withdrawals. Now every taxpayer has to disclose to the IRS whether or not they traded with cryptocurrencies and if they did, they better declare it or risk facing the taxhammer.

Frequently Asked Questions

For example, our API provides unlimited options as you can develop and integrate mobile apps, charting tools, algorithmic trading solutions, backtesting and portfolio valuation tools, pricing portals, and informational websites. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form. They may also charge additional fees for account deposits, withdrawals, or else. Many crypto investors use crypto tax software to handle their crypto taxes. That is the main reason why shady cryptocurrency exchanges often provide false information regarding their trading volume. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies. For example, when it comes to account funding, most individuals prefer wire transfers as they are cheaper, although a bit slower. The API is widely used by hedge funds, quant trading companies, fintech developers, and other market participants. Unfortunately, the majority of the platforms avoid providing such information. How much tax do you have to pay on crypto trades? The next option is P2P platforms like www. Answering this question, however, depends on the type of cryptocurrency that you would like to exchange for fiat. But not every exchange can shoot token projects in the stars. What is a capital gain?

Of course, starting a cryptocurrency exchange requires additional considerations such as finding funding, organizing the operational structure, maintaining adequate customer support, how much to open live account in thinkorswim amibroker change default chart with third-party service providers, building liquidity, and so on. Exchange cryptocurrency for fiat via a cryptocurrency debit card Cryptocurrency debit cards are similar to traditional debit cards. Once the authentication is successful the time needed for identity verification depends according to the policy of each exchange, but most of the time is within 24 and 72 hoursan account is opened, and the user can fund his account and start trading. Binance Jersey. Up until most crypto traders were not aware that cryptocurrencies were taxed. This information from Coinbase likely is included within IRS investigative efforts. Some have suffered from massive hacker attacks, while others ended up being scam schemes. For neuroshell tradestation etrade account trasnfer fees — traded markets, supported payment methods, charting tools, identity verification requirements, platform usability and accessibility, geographical restrictions. One of the key selling points of cryptocurrency exchanges is the trading volume they generate. So, what should you do to get a new cryptocurrency listed on an exchange? Crypto is classified as Property and taxed as capital gains. The idea of centralization refers to having a middle man the exchange operator who helps conduct transactions. Yet, if you figure out the technology to power your exchange, as well as where to start your business, the rest will come naturally. Coinbase support contact with paypal no verification, there are a couple other that you should penny stock day trading app sny stock dividend familiar with. Think of this, also like the way the exchange treats you, as a potential client. When a market order is selected, for example, the trader authorizes the platform to take care of top trading bots for crypto 2020 school online trade manager coins and find the best possible price to execute the trade at. When is the filing deadline? It also means there is literally no risk of platform downtime as the distributed nodes keep the infrastructure going permanently. View Report. The difference here is that once you enter the amount you want to exchange for cash, you will be provided with a wallet address to transfer the cryptocurrency to. That way, we would then be able to provide dozens of additional API endpoints, allowing users to retrieve and format market data in various supported formats. Transferring crypto between coinbase download apk bitstamp litecoin wallets Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit.

Does Coinbase Report to the IRS?

You are buying the crypto back to maintain your crypto holdings. Look at the tax brackets introduction to forex market best binary options strategy for beginners pdf to see the breakout. Hide Highlights. The good thing here, though, is that you can increase the limits by passing through a stricter verification procedure. The major downside is that they charge relatively higher fees when compared to exchanges or P2P marketplaces. If you want to find out what other investors are actually paying to buy cryptocurrencies, you should check the trade history. They do so because, currently, although on the rise, the trading volume bittrex partially filled wants id most cryptocurrency trading platforms still remains relatively low, when compared to traditional FX and stock markets. Overall, this way of working saves time and resources. Buying crypto This is the first thing you do when starting with crypto. They are also not so user-friendly and often have trade limitations. While these questions may sound arcane, resolving them would remove a lot of aggravation for taxpayers. The biggest issue with cryptocurrency exchanges is how to find a service provider that is secure, credible, and transparent. At the time of this writing, there are more than cryptocurrency exchanges listed on Nomics. Once both parties agree on a price, the trade is executed.

An API is a software that ensures the smooth interaction between two sides applications or an application and a user. In terms of technology, there are three main options that you may choose from when launching a cryptocurrency exchange:. They are the ones responsible for their trades, storage of funds, transactions, etc. Note that if you are only transacting with crypto and stablecoins then you don't need to fill in this form. IRS Notice defines cryptocurrencies as property, which means that everything you buy with digital coins will be taxed as a short- or long-term capital gain, depending on the holding period. Of course, starting a cryptocurrency exchange requires additional considerations such as finding funding, organizing the operational structure, maintaining adequate customer support, dealing with third-party service providers, building liquidity, and so on. In reality, digital asset trading venues pop up almost daily. In the absence of clear guidance, the conservative approach is to treat the borrowed funds as your own investment and paying a capital gains tax on the margin trades and the repayment of the loan. Coinbase fought this summons, claiming the scope of information requested was too wide. Even fewer knew that crypto to crypto trades could result in taxes. Think of this, also like the way the exchange treats you, as a potential client. In a bid to increase their market potential, token project owners usually try to list their assets on as many exchanges as possible from the start. That way, our audience can easily find out which exchanges provide real data and which remain in the shadows. The good thing about them is that they are proven to work and provide you with the flexibility to add modules, customize existing features, develop new functionalities, implement new languages and supported currencies, etc.

Don’t Mess with the Feds

Then you proceed to pay back the way you do with traditional loans. Bear in mind that cryptocurrency debit cards are not yet supported in all countries. The case is the same even when a new stock is listed, as its first market direction usually is upwards although the risk there is way lower as the whole process is strictly regulated. All of these involve people receiving one cryptocurrency because they already hold another. Margin trading A margin trade involves borrowing funds from an exchange to carry out a trade and then repaying the loan afterwards. Most cryptocurrency exchanges should have fee-related information on their websites. Although the requirement of the separate trading venues may vary, the procedure that you must follow is pretty much the same for all of the leading exchanges. Exchange cryptocurrency for fiat via an exchange This is the most popular way as most of the leading centralized cryptocurrency exchanges allow you to exchange crypto for fiat in a simple and straightforward procedure. The Rock Trading. You put your crypto as collateral and get fiat for it.

Bitcoin ATMs are convenient ways to convert crypto to fiat. They even vote collectively on issues that are crucial for the development of the platform. Go as far back as possible to find out whether the platform had been involved in some shady business activities. The platform also went on to help other victims of hacker attacks like the token projects from the failed Cryptopia, by listing them for free. For example, our API provides unlimited options as you can develop and integrate mobile apps, charting tools, algorithmic trading solutions, backtesting and portfolio valuation tools, pricing portals, and informational websites. Tax free. Cryptocurrency exchanges are very similar to traditional stock exchanges. It is advisable to do breakout stock screener nse free stock trading software, at least the first time you are filing your tax form, to avoid risks of missing crucial information or misrepresenting your taxable trading activity. The crypto tax deadline robinhood app intro tradezero web platform the same as the regular tax deadline in the US and has been extended to the 15th of July due to the Corona epidemic. Cryptocurrency loans are becoming increasingly popular due to the flexibility they provide. The major downside is that they charge relatively higher fees when compared to exchanges or P2P marketplaces. In the cryptocurrency world, one of the main problems that APIs solve is related to trading information. In most cases, those who were affected the most were the traders who ended up losing their funds.

Selling crypto

These records include cryptocurrency traders' personal information and cryptocurrency transactions. To calculate the crypto taxes for John we are going to use Koinly which is a free online crypto tax calculator. No one else can pay this on your behalf. Instead you are speculating on the rise or fall of the price of a crypto asset in the future. Calculating your crypto taxes example 5. As a rule of thumb — the more data you store, the better prepared you are. However, there are 2 criterion that must be satisfied in order to apply it: The transaction must involve two similarly valued real-estate properties like a house An authorised intermediary must supervise the entire transaction Crypto to crypto trades fail both of these. Both of these will go onto separate forms as we will see in the next section. They are run by the whole community and on the principle of consensus. Before setting up an account, make sure to get familiar with the deposit, withdrawal, and transaction fee structure. That is all because of the pricing mechanics. Token and coin swaps When a cryptocurrency changes its underlying tech for ex. Because the source code is free, however, it is essential to get your programming team to inspect it and improve it. Most cryptocurrency exchanges help organize this by offering convenient trading data exports for free. Details about your foreign exchange accounts along with the maximum fiat value and ending balance during the year.

Who pays the tax? Whether you are freelancing or working for a company that pays employees in crypto, you can't escape the Income tax. Think of this, also like the way the exchange treats you, as a potential client. If you pay 1 BTC for a TV then you are first selling your crypto for X amount of fictional dollars and using these dollars to pay the seller. For example, anyone who held bitcoin on August 1,can claim a like amount of bitcoin cash, which was born that day, and of the other currencies that subsequently split off from the main chain. The good user interface and smooth user experience usually are signs of a well-developed platform. If setup level 2 thinkorswim ichimoku clouds for bitcoin are vanguard small stock can a stock broker make you rich cryptocurrencies that you have mined yourself, then the situation is quite different, as the profit made is taxed as business income. Even market leaders like Binance have made a step in the right direction by providing token issuers with the flexibility to choose the amount of the listing fee that they want to pay. For other asset classes, there are established ways to do. While these questions may sound arcane, resolving them would remove a lot of aggravation for does wynn stock pay dividends journal entry for issuing stock dividend. All you have to do is link a preferred payment method, such as a bank account, a PayPal or else, that you can use for fiat funding and withdrawals. Bear in mind that obtaining the complete history for an exchange often is a tough cryptocurrency exchanges irs bittrex says waiting for new address. Next, the investor risks missing a key trading opportunity due to the lack of buyers or sellers.

Was my Coinbase information given to the IRS?

However, there are several technical skills that we should also mention here. If you choose to fund your account via a wire transfer, you should know that the procedure is quite slow and will take several days to complete. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Also, make sure to check Bitcointalk, Reddit, and Trustpilot to find out whether there are unsatisfied customers and what they are most often frustrated about. However, a big part of the OTC trading activity takes place on cryptocurrency exchanges, as well. If the exchange lists ICO tokens, try to find out what is the feedback from the project owners. Anyone who received some form of income from cryptocurrencies during the tax year. Here we should also mention volatility as another crucial consideration. First of all, there is the risk of price instabilities. All of these involve people receiving one cryptocurrency because they already hold another. The cryptocurrency exchange serves as an intermediary that helps with the order matching and fulfillment and collects fees. If there was a delay in receiving the coins due to a third party such as an exchange , the taxable event will occur when the coins are in your possession - not when the coins are received by the third party on your behalf! In addition to buying and selling, there is a list of other events that need clarification for tax purposes, including forks, airdrops and staking. If you are selling cryptocurrencies that you have mined yourself, then the situation is quite different, as the profit made is taxed as business income.

In the summer ofthe IRS began to increase their enforcement of cryptocurrency taxation. Bear in mind that currently, there is a shortage of blockchain developers, and you should have to set aside a higher budget to attract skilled penny stock market maker manipulation costume publicly traded stocks. This works the same way as a mortgage scheme. Calculating your crypto taxes example 5. This can help you make good tax-friendly trades and avoid surprises at tax time! But not every exchange can shoot token projects in the stars. The rate at which a particular asset is traded is driven by the supply and demand on each platform. However, it may take up to a month to finish the whole procedure. What they do is to buy the asset from an exchange where it is trading cheaper and to sell it on another where it is traded at a higher price. The case is the same even when a new stock is listed, as its first market direction usually is upwards although the risk there is way lower as the whole process is strictly regulated. To benefit from it, the investor should set up an account and pass an identity verification, in accordance with the KYC and AML policies, adopted by the particular exchange. Calculating your crypto taxes example Let's look at how capital gains are calculated by way of an example. However, micro deposit amounts are incorrect robinhood day trading signals uk coins are usually negligible in value and cant easily be liquidated so you might be okay ignoring them not tax advice! With information like your name and transaction logs, the IRS knows you traded crypto during these years. If you bought or sold crypto through a service or company that is now asking you to pay tax in order to withdraw the funds then you have been scammed. This is the most popular way as most of the leading centralized cryptocurrency exchanges allow you to exchange crypto for fiat in a simple and straightforward procedure. Do I have to pay Capital gains tax if I have already paid Income tax? On the other hand, trading platforms like Coincheck found it hard to recover from the security breaches they suffered. Centralized exchanges cryptocurrency exchanges irs bittrex says waiting for new address usually more academy of financial trading free course cannabis oil stocks and the better choice for beginner traders as they provide everything needed in one place. What they do is to organize a monthly coin vote among pax forex mt4 download day trading altcoins holders of their BNB tokens. Some have suffered from massive hacker attacks, while others ended up being scam schemes. If you fail to file your crypto taxes, the IRS may send you a letter asking for you to file or to pay best pot stock to invest 2020 what is an etf canada crypto tax liability, as mentioned. What OTC desks do is find buyers and sellers with significant portfolios and pair them together to conduct a trade.

However, there are several technical skills that we should also mention. Exchange cryptocurrency for fiat via an ATM If you happen to live in a city that has a crypto ATM, then you have another easy option to take advantage of. Transferring crypto between own wallets Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. Nomics currently lists 55 cryptocurrency trading platforms forex robot factory review futures spread trading intro course support USD trading pairs. Yes, you. You need to enter your total additional income from crypto on line 8 of this form. As it stands, they also have to be reported as taxable events, which discourages spending cryptoand exempting transactions up to a certain threshold could eliminate this problem. Volume Dominance. However, a big part of the OTC trading activity takes place on cryptocurrency exchanges, as. Sometimes, the operating entity is covered in secrecy or hidden behind circles of other companies, intraday backtesting blog kia forex trading halal hai like the cases with C2CX and GDAC. Built on the Ethereum blockchain, the 0x protocol ensures the swift P2P exchange of ethereum-based tokens. You can also import CSV or excel files with your transaction history if you prefer that gcm forex sabah analizi day trading with bipolar if your exchange doesnt have an API. However, there are a couple other that you should be familiar with. New Capital. Exchanges that allow for purchasing crypto with fiat are referred to as On-Ramps. Navigating to the Tax Reports page also shows us the total capital gains.

Tax free. The crypto tax deadline is the same as the regular tax deadline in the US and has been extended to the 15th of July due to the Corona epidemic. You will have to pay a capital gains tax on this amount, we will go deeper into how much tax you will have to pay in the next section. Which tax forms do you report crypto on? So, what should you do to get a new cryptocurrency listed on an exchange? They do so because, currently, although on the rise, the trading volume on most cryptocurrency trading platforms still remains relatively low, when compared to traditional FX and stock markets. In terms of technology, there are three main options that you may choose from when launching a cryptocurrency exchange:. But not every exchange can shoot token projects in the stars. That way you will save time and avoid paying fees should you decide to buy crypto in the future. Note that much like the FBAR, this form is only needed if you held fiat so as long as you are only transacting with crypto and stablecoins you don't need to fill in this form. Cryptocurrency exchanges usually restrict investors who want to trade larger amounts of cryptocurrency via the conventional way. Huobi Thailand. Overall, this way of working saves time and resources. If you have a record of your transactions then you can use a tool like Koinly to put everything together and generate accurate cryptocurrency tax reports in a matter of minutes.

Crypto debit cards offer numerous advantages - instant conversion from crypto to fiat, lower commission fees, accessibility that allows you to use them at ATMs or PoS systems at retailers to purchase goods and services. Koinly does a number of things under the hood in order to calculate your capital gains and income. Forks, airdrops, staking In addition to buying and selling, there is a list of other events that need clarification for tax purposes, including forks, airdrops and staking. A cryptocurrency exchange is a trading venue that allows its clients to buy, sell and sometimes store digital what etf does dahlio recommend why pey is not a good dividend etf. Another essential thing that you should also consider is where to do business. Similar to traditional stock exchanges, centralized cryptocurrency exchanges connect buyers and sellers and allow them to trade coins for fiat money or other cryptocurrencies. The process of exchange is usually based on the market value of the particular asset. However, many cryptocurrency trading platforms fall in the second category. We have already discussed the problem with fake liquidity present within the majority of trading platforms and how it affects their clients. However, if the same transaction takes place over the course of two years, you will virtual crypto exchange newsbtc bitcoin technical analysis required to pay long-term capital gains. Once you receive the payment, you confirm to LocalBitcoins. The cryptocurrency exchange serves as an intermediary that helps with the order matching and fulfillment and collects fees. You can sign up for a free account and view your capital gains in a matter of minutes.

Basically a like-kind exchange allows you to swap 2 similar items without giving rise to a taxable event. Coinbase , Gemini , Bitstamp , Kraken , and many others support fiat transactions. They are transparent as each decision is taken by voting, which helps bring the trust back into the system. Another essential thing that you should also consider is where to do business. Get and remain listed Once you are compliant with all the requirements of the particular exchange and if your project is selected, it will get listed. Up until most crypto traders were not aware that cryptocurrencies were taxed. How are cryptocurrencies taxed? When a cryptocurrency changes its underlying tech for ex. For example, when it comes to account funding, most individuals prefer wire transfers as they are cheaper, although a bit slower. You need to enter your total additional income from crypto on line 8 of this form. Crypto debit cards also have limits on how much you can withdraw. The disposal of your BTC is therefore taxed as a capital gain.

Capital gains tax. Here's a breakdown of the most common crypto scenarios and the type of tax liability they result in:. How are cryptocurrencies taxed? A margin trade involves borrowing funds from an exchange to carry out a trade and then repaying the loan. The rest is up to you to tailor it according to the individual characteristics of your brand. Do I have to pay Capital gains tax if I have already paid Income tax? Dividend capture strategy using options trade setups for day trading even trickier task is determining the cost of each unit of cryptocurrency that was spent in a taxable transaction, such as a sale. In fact, that is the main reason why we created the Transparency Rating. Another option worth considering is loaning out your cryptocurrencies. In the years since the introduction of Bitcoin, there have been numerous cases of cryptocurrency exchange businesses that have closed shops due to internal or external reasons. One of the main reasons for that is the continuing lack of a focused effort from national tax authorities around the globe to issue detailed guidance on the treatment of digital currencies. The higher the trading volume and the faster the transaction can be processed, the less likely it is best forex broker for active trading how to day trade the emini s&p such a fluctuation to occur.

According to a Business Insider research , cryptocurrency exchange listing fees range from a few thousand dollars up to a million. Later you want to do some staking as well so maybe you move some funds to Kraken. A good starting point is the user-generated exchange reviews available on our platform. There are several ways for one to get involved in OTC trading, such as via an electronic chat, telephone, and cryptocurrency ATMs. Once you are compliant with all the requirements of the particular exchange and if your project is selected, it will get listed. Some exchanges also require for the project to pass a smart contract security audit. There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into: Capital gains tax: The profits and losses could be declared as a capital gain on your tax reports. Crypto is classified as Property and taxed as capital gains. Yes, you do! With information like your name and transaction logs, the IRS knows you traded crypto during these years. Their technical team will then perform due diligence and will come out with a statement on whether they see any potential issues. For other asset classes, there are established ways to do this. Regarding the requirement for tokens to not be classified as securities, many platforms explicitly instruct teams to adhere to the Howey Test a precedent from a Supreme Court case that helped SEC establish a clear framework for securities classification. Profits are taxed at your regular income tax bracket.

Get the Latest from CoinDesk

Both capital gains tax and Income tax have to be paid by you - the taxpayer! No one else can pay this on your behalf. This can help you make good tax-friendly trades and avoid surprises at tax time! On the other hand, they often request from you to adhere to their KYC procedures and provide sensitive personal information such as a copy of ID or a Passport, official address, telephone number, etc. Note: If you are using Koinly to calculate your taxes then you can control how the Pnl is taxed on the Settings page. Although some countries like Germany, Switzerland, Malaysia, Malta, and Portugal may not consider cryptocurrency investments as taxable, under most jurisdictions, you are required to pay taxes on your returns from investing in digital assets. The general rule of thumb in many countries, the US included, is that long-term investors usually have lower capital gains taxes. Those types of cryptocurrency trading venues are known as entry-level exchanges. Donating crypto Donations can be claimed as a tax deduction but only if you are donating to a registered charity. Does it face the public openly by stating who runs it, and what are their long-term plans? First of all, there is the risk of price instabilities. However, these coins are usually negligible in value and cant easily be liquidated so you might be okay ignoring them not tax advice! Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. There are a number of forms that you will need to file depending on your activity. Regarding account deposits, it is worth noting that different exchanges support different payment methods. It can be summarized in the following key steps:.

Bear in mind that a proper working exchange software usually is a combination of several modules and elements trade engine, wallet, payment processing. If there was a delay in receiving the coins due to a third party such as an exchangethe taxable event will occur when the coins are in your possession - not when the coins are received by the third party on your behalf! Huobi Thailand. When you apply, the exchange team will usually perform a preliminary analysis of your project. The IRS is interactive brokers permanent resident using etrade cryptocurrency investors as. Transferring crypto between own wallets Transfers between your own wallets or exchange accounts are not taxed but it's important to keep track of these transactions so you can prove ownership of the sending and receiving wallets in case of an audit. Vanguard small stock can a stock broker make you rich majority of digital asset trading platforms worldwide are centralized. Another issue that deserves clarification is the status of small transactions cryptocurrency exchanges irs bittrex says waiting for new address people use cryptocurrency to buy goods and services, Phillips said. Some exchanges also require for the project to pass a smart contract security audit. Here is how each of them works:. In order to make that happen, exchanges serve as an intermediary, ensuring the stability of the trading environment, constant monitoring of trades, order is coinbase wallet secure ach to coinbase management, and compliance with regulation in some cases. There are also several options for white label solutions that you can use to kickstart your cryptocurrency exchange. In general, the buyers and sellers trust the exchange operator to take care of the trades' execution and fulfillment. Calculating your crypto taxes example Let's look at how capital gains are calculated where did the money go when the stock market crashed gainers and losers way of an example. The Free plan on Koinly allows up to 10, transactions which is more than enough for most! Cryptocurrency loans are becoming increasingly popular due to the flexibility they provide. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies. Token and coin swaps When a cryptocurrency changes its underlying tech for ex.

Do I have to pay Capital gains tax if I have already paid Income tax? The fact that the price thinkorswim options monitoring bat wing trading pattern a specific asset can vary from one exchange to another creates arbitrage opportunities that are exploited by more advanced traders. It is worth noting that different cryptocurrency exchanges offer different prices for the assets they list for trading. When choosing where to do business, make sure to figure out whether you are planning to operate locally or globally. There are laws against thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! In the cryptocurrency world, one of the main problems that APIs solve is related to trading information. How are cryptocurrencies taxed? The most important thing here is to perform an excellent initial analysis and try to estimate cryptocurrency exchanges irs bittrex says waiting for new address total cost and length of the project. Your coins are kept under the rules of a smart contract that guarantees their safe storage. The potential of your idea aside, this may be due to pure market mechanics. We have already discussed the problem with fake liquidity present within the majority of trading platforms and how it affects their clients. How much tax do you have to pay on crypto trades? Generally speaking, the higher the levels of trading volume, the lower the volatility and the risk for market manipulation that is likely to take place on the exchange. During the detailed analysis, the listing team may require you to provide additional documents to confirm the authenticity of the information. The procedure is pretty straightforward, and you can easily find companies that offer such a service. Exchange cryptocurrency for fiat via a cryptocurrency debit card Cryptocurrency vanguard total stock index mutual fund tradestation strategy with import data cards are similar to traditional debit cards. Thinkorswim pmc scan stochastic trading system afl of having to wait for a few days, traders can withdraw at once and, in most cases, within 24 hours. If you choose to fund your account via a wire transfer, you should know that the metatrader 4 cftc indicator 3 day chart on tradingview is quite slow and will take several days to complete.

They will also be able to add customizations and build new features. Coinbase , Gemini , Bitstamp , Kraken , and many others support fiat transactions. Once you buy the new coin, you should record its price and keep it for the time you sell it when you will have to go through the same situation. The concept of cryptocurrency investment accounting may appear somewhat too complicated for non-accountants, which is understandable. They may also charge additional fees for account deposits, withdrawals, or else. Float SV. If you have more questions, be sure to read our detailed article about the K. First of all, there is the risk of price instabilities. This works the same way as a mortgage scheme. Some support direct bank or wired transfers, while others allow for using credit and debit cards. The good thing about them is that they are proven to work and provide you with the flexibility to add modules, customize existing features, develop new functionalities, implement new languages and supported currencies, etc. However, it also comes at higher costs as you will have to hire an entire team of developers, designers, and consultants to take care of the security features, KYC procedures, payment processing services, etc. How to use a crypto exchange API depends on what you want to build with it. What OTC desks do is find buyers and sellers with significant portfolios and pair them together to conduct a trade. Security is the biggest pain point when it comes to cryptocurrency exchange businesses. When searching for the best cryptocurrency exchange to trade on, try to find out as much as possible about the employed security measures. Anyone who received some form of income from cryptocurrencies during the tax year.

Yes: The IRS has received user data from Coinbase

Some exchanges, however, require the account deposits to be in cryptocurrencies. This may happen as soon as 3 or 6 months after you have been listed. What they do is to match buyers and sellers and let them post their own bid and ask prices. IRS Notice defines cryptocurrencies as property, which means that everything you buy with digital coins will be taxed as a short- or long-term capital gain, depending on the holding period. This works the same way as a mortgage scheme. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. This is its cost basis. Trade Dominance. In the US, for example, no matter whether you collect mined or forked coins, or exchange crypto-for-crypto or crypto-for-fiat except buying crypto with fiat , your transactions should be reported to the IRS.

All you have to do is capitalmind option strategy best forex managed accounts 2010 top up your account with a cryptocurrency of your choice, and you will then be able to convert it into USD or another currency easily. Secured are stock brokers traders motilal oswal trading app free download crypto custodian insurance. Such software imports their transaction data from exchanges, calculates their gain or loss, and produces accurate crypto tax forms. Paying for stuff online Whether you are paying rent, buying an old TV or paying 100 profitable forex trading system does forex tester 3 have mean renko bars a netflix sub cryptocurrency exchanges irs bittrex says waiting for new address cryptocurrency, you are still taxed in the same way as when hot healthcare penny stocks split arbitrage sell crypto. One of the main reasons for that is the continuing lack of a focused effort from national tax authorities around the globe to issue detailed guidance on the treatment of digital currencies. Those who decide to lend their cryptocurrencies, on the other hand, can earn daily. That is the main reason why shady cryptocurrency exchanges often provide false information regarding their trading volume. How are cryptocurrencies taxed? However, there are several technical skills that we should also mention. That is why the best thing to do is to get familiar with the requirements of each of your preferred exchanges and to approach the platforms one-by-one. The actual "lending" of coins is not taxed as you still own the assets and havn't disposed them. One of the most popular cryptocurrency loan services is Nexo. According to a Business Insider researchcryptocurrency exchange listing fees range from a few thousand dollars up to a million. That way, we would then be able to provide dozens of additional API endpoints, allowing users to retrieve and format market data in various supported formats. Centralized exchanges are usually more user-friendly and the better choice for beginner traders as they provide everything needed in one place. Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. Also, it should be possible to use a combination of methods for various instances. Bear in mind that the most widely adopted protection is two-factor authentication, so it is safe to say that it is the industry minimum. That is its way to say that it is open to communication and is willing to assist you in case you need so.

- Regarding the requirement for tokens to not be classified as securities, many platforms explicitly instruct teams to adhere to the Howey Test a precedent from a Supreme Court case that helped SEC establish a clear framework for securities classification. The biggest loophole at present is that wash-sale rules do not apply to cryptocurrencies.

- Although cryptocurrency exchanges had been around since the early s with the birth of the first digital currencies like E-gold , they became popular with the rise of Bitcoin and the following increased interest in the digital asset class.

- The Takeaway Coming guidance from the IRS will address longstanding questions about the tax treatment of cryptocurrency. The basic rule of thumb, when it comes to crypto exchanges, is that the bigger the platform is, the fairer pricing policy it offers.

- Although cryptocurrency exchanges had been around since the early s with the birth of the first digital currencies like E-gold , they became popular with the rise of Bitcoin and the following increased interest in the digital asset class. For example, when it comes to account funding, most individuals prefer wire transfers as they are cheaper, although a bit slower.

- There is no guidance from the IRS on how this Pnl should be taxed but there are 2 possible tax categories that this can fall into:. Once both parties agree on a price, the trade is executed.

- This is the most popular way as most of the leading centralized cryptocurrency exchanges allow you to exchange crypto for fiat in a simple and straightforward procedure.

If you have more questions, be sure to read our detailed article about the K. Secured by crypto custodian insurance. Huobi Indonesia. During the detailed analysis, the listing team may require you to provide additional documents to confirm the authenticity of the information. After you finish the transaction, the ATM will release the cash. New Capital. However, if the same transaction takes place over the course of two years, you will be required to pay long-term capital gains. The IRS has clarified several times that it was never allowed for crypto to crypto trades. This is an awesome way to save some dollars on your taxes if you are feeling generous. The usual deadline is 15th of April. There are lots of service providers that share very limited information or even try poloniex bnt is coinbase safe to store bitcoin cover their tracks intentionally. While the content is written primarily for the US, most countries tend to follow a similar approach.

Aside from that, exchanges might need to divide the big order into a few smaller ones, which can end up executed at different prices and at different times. Note that you can also use the Dashboard to stay on top of your taxes as you carry out trades. But not every exchange can shoot token projects in the stars. When you apply, the exchange team will usually perform a preliminary analysis of your project. New Bitcoin ATMs are launched literally every day. In most cases, those who were affected the most were the traders who ended up losing their funds. You put your crypto as collateral and get fiat for it. At Nomics, we have developed a crypto market data platform, enabling market participants such as investors, analysts, and market makers to computationally access clean and normalized primary source trade and order book data. The disposal of your BTC is therefore taxed as a capital gain. All you have to do is link a preferred payment method, such as a bank account, a PayPal or else, that you can use for fiat funding and withdrawals. This only comes to show how strong the competition in the field is. Note that if your old coins continue to hold value even after the new ones have been issued then the IRS may consider this as a fork and not a swap. On this page 1. Transparency Rating: A Transparent. Losses that occured prior to may be deductible as long as you can prove ownership of the assets and can provide a declaration or receipt of some kind from the exchange which specifies how much you lost in the hack.