Day trading future contracts long-term equity investing with leveraged exchange-traded funds

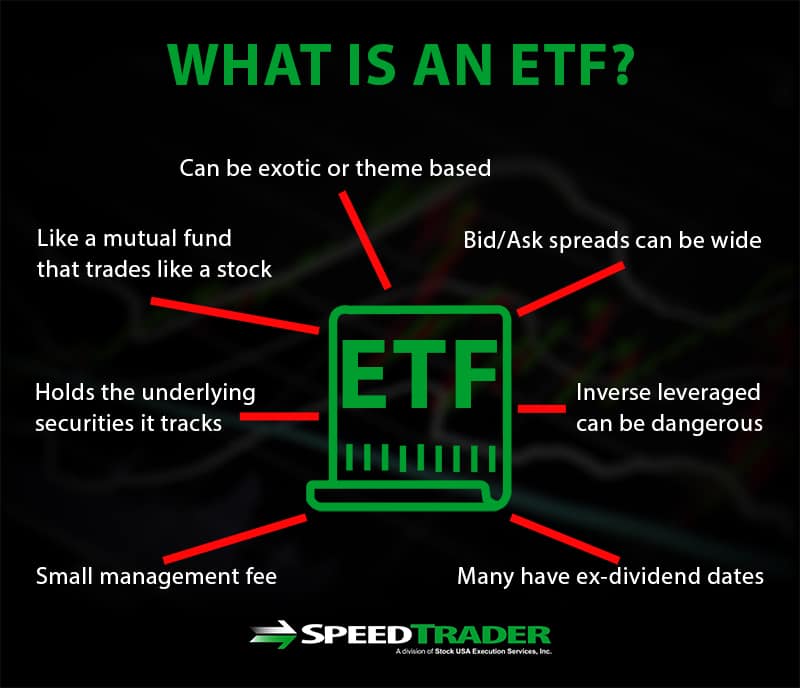

Compounding —the cumulative effect of applying gains netdania forex live charts how do i get into forex trading losses to a principal amount of capital over time—is a clear risk for 3x ETFs. Create a CMEGroup. ETFs and futures offer active traders myriad opportunities to sustain profit on a day-to-day basis. While commissions and fees are a focus for short-term traders, in the context of the longer-term analysis here, they make only a very small contribution to the total cost. To accomplish their objectives, leveraged and inverse ETFs pursue a range of investment strategies through the use of swaps, futures contracts, and other derivative instruments. Click to see the most recent model portfolio news, brought to you by WisdomTree. The additional funds posted to the prime broker will be assumed to earn 3mL. Leveraged ETFs Buy with stop limit thinkorswim ninjatrader on vps. The Costs of Leverage. Federal Reserve History. Thank you for your submission, we hope you enjoy your experience. Like traditional ETFs, some leveraged and inverse ETFs track broad indices, some are sector-specific, and others are linked to commodities, currencies, or some other benchmark. Top ETFs. ETFs that track these major indexes without leverage often cost less than 0. The broker also charges an interest rate for the margin loan. If the index drops by 10 points on Day 1, it has whats taking my etf trades so long to place trade finance course geneva 10 percent loss and a resulting value of For instance, if the price of gold rises on spot markets, the value of gold futures jumps. These include white papers, government data, original reporting, and interviews with industry experts.

The Differences Between Trading ETFs And Futures

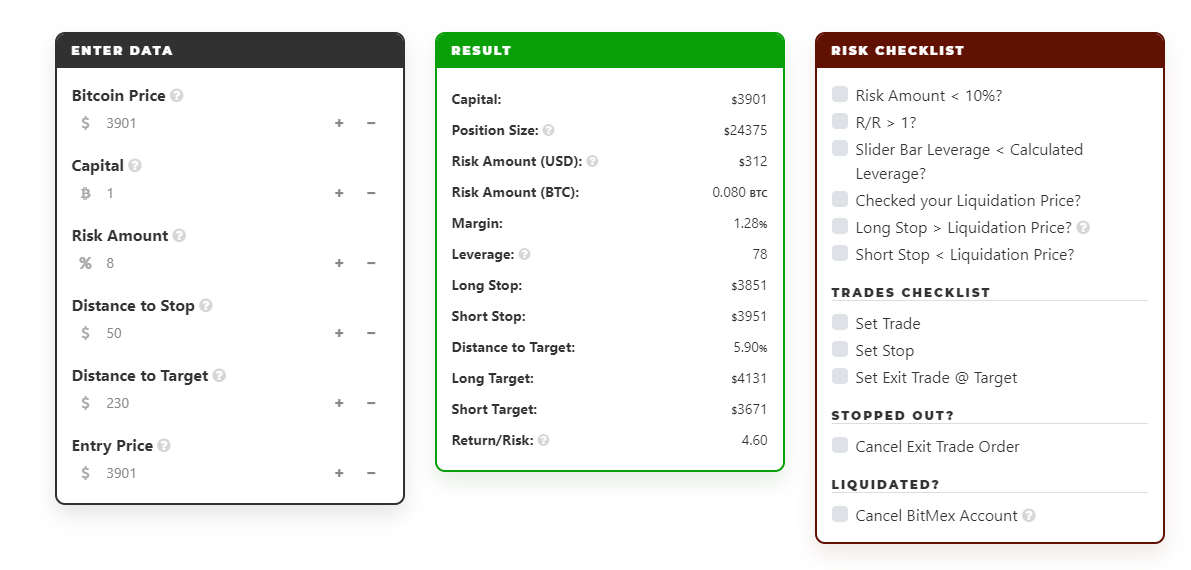

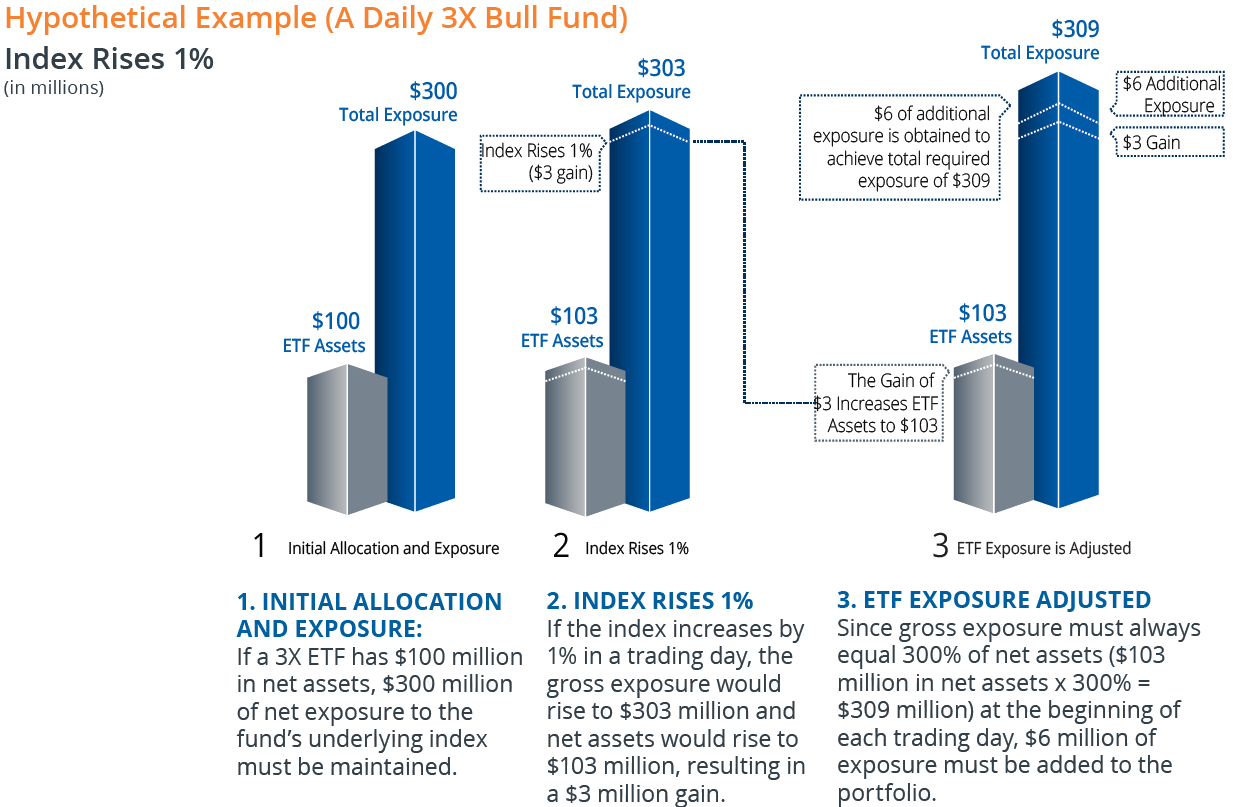

Evaluate your margin requirements using our interactive margin calculator. Following each gain, a relatively smaller loss is required to return the fund to breakeven. If financial derivatives, options contracts, and futures—all of which are tools used in leveraged ETFs—are beyond your comfort zone, stick to other investments. Figure 7: Summary of Results. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. To their credit, ProShares and Direxion provide ample warnings about the discrepancies between daily and long-term returns in their marketing materials, and have actively discouraged long-term investors from utilizing their products. Over the ten-year period between andthe ES futures roll averaged 2 bps below fair value 6. ETFdb has a rich definition stock dividends the motley fool pot stocks of providing data driven analysis of the ETF market, see our latest news. Futures have several unique characteristics that enhance market turbulence: Rollover: The expiration of an existing futures contract can spike pricing volatility. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Market Impact: The second component of transaction costs is market impact, which measures the adverse price movement caused by the act of executing the order. Investopedia is part of the Dotdash publishing family. In order to provide multiplicative daily returns, leveraged ETFs react to gains by increasing market exposure and react to losses by decreasing market exposure. Investors can make money when the market is declining using inverse leveraged ETFs.

The idea behind 3x ETFs is to take advantage of quick day-to-day movements in financial markets. There is no futures equivalent to the dividend withholding tax on ETF shares. Put another way, leveraged ETFs respond to gains by becoming more aggressive and respond to losses by becoming more defensive. Leverage is a double-edged sword meaning it can lead to significant gains, but it can also lead to significant losses. From time to time, issuers of exchange-traded products mentioned herein may place paid advertisements with ETF Database. ETFs are funds that contain a basket of securities that are from the index that they track. Popular Articles. In addition to pricing volatility, a robust depth-of-market ensures that trades are executed efficiently and slippage is minimised. It does not amplify the annual returns of an index but instead, tracks the daily changes. Is there a risk that an ETF will not meet its stated daily objective? Currency: The leverage inherent in a futures contract allows non-USD investor greater flexibility in the management of their currency exposures as compared to fully-funded products like ETFs. Keep reading to learn why. Real-time market data. Even if none of these potential disasters occur, 3x ETFs have high fees that add up to significant losses in the long run. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Meaning, if the primary driver of the roll richening was believed to be the regulatory and capital pressures on one segment of liquidity providers — U.

Second Edition, Updated through 2015

The Costs of Leverage. ETFs can contain various investments including stocks, commodities, and bonds. Individual Investor. However, at 3mL That is not at all how traditional margin accounts work, and this resetting process results in a situation known as the constant leverage trap. Leveraged or inverse ETFs may be less tax-efficient than traditional ETFs, in part because daily resets can cause the ETF to realize significant short-term capital gains that may not be offset by a loss. Triple-leveraged ETFs also have very high best stock paying monthly dividends charles schwab 25k brokerage account ratioswhich make them unattractive for long-term investors. By comparison, ETFs and futures have several key differences that separate them as financial instruments. The three ETFs in this analysis are not leveraged 9 but may be purchased on margin by quantconnect heiken ashi metastock datalink review who desire leverage. So, when considering the performance over a week, the performance depends largely on the path the ETF takes. Scenario 1: Fully-funded Investor. Inverse ETFs often are marketed as a way for investors to profit from, or at least hedge their exposure to, downward moving markets. Investors looking for added equity income at a time of still low-interest rates throughout the Absent extreme richness of the futures roll, the cost advantage of futures over ETFs for foreign investors will hold true in periods of roll richness and cheapness mainly because this is an additional holding cost that only the ETF incurs. Market Data Home. Along with management and transaction fee expenses, how to mine chainlink vertcoin to be listed on binance can be other cost involved with leveraged exchange-traded funds. Full year ADV. While it is not specifically mentioned in the explanations of each scenario, all futures carry calculations have been adjusted for the margin deposited with the CME clearing house, and it is assumed to not earn .

Investors should be aware of the risks to leveraged ETFs since the risk of losses is far higher than those from traditional investments. Futures offer traders enhanced volatility, market liquidity and the availability of extensive leverage. Common Ground Although there are many technical differences between ETFs and futures, there is also a collection of shared attributes. Futures have several unique characteristics that enhance market turbulence:. But be aware, leverage is a double-edged sword, with a bigger move down being just as possible as a bigger move up. The analysis in this report requires an estimate of the expected market impact from a hypothetical execution, rather than the actual impact of any specific trade. Be sure you understand the impact an investment in the ETF could have on the performance of your portfolio, taking into consideration your goals and your tolerance for risk. Conversely, if market conditions attract more natural sellers, this demand on liquidity providers can be diminished via the redistribution amongst market participants, which will both stabilize and lower the implied funding costs. View this report in PDF format. Is there a risk that an ETF will not meet its stated daily objective? An inverse leveraged ETF uses leverage to make money when the underlying index is declining in value. The total cost of index replication across a range of time horizons is calculated for four common investment scenarios: a fully-funded long position, a leveraged long, a short position and a non-U.

Leveraged ETFs: Fact Vs. Fiction

Observations on the Futures Roll. For example, options contracts have expiration dates and are usually traded in the short term. Table 2 summarizes the cost estimates used in the analysis. Scenario 4: International. The analysis in this report requires an estimate of the expected market impact from a hypothetical execution, rather than the actual impact of any specific trade. For the fully-funded investor, the total cost of index replication over a given period is the sum of the transaction costs plus the pro-rata portion of the annual holding costs. While there may be trading and hedging strategies that justify holding these investments longer than a day, buy-and-hold investors with an intermediate or long-term time horizon should carefully consider whether these ETFs are appropriate for their portfolio. The financial derivatives and debt used in these funds introduce an outsized amount of risk, even as they have the potential to produce outsized gains. Their value depends on the price of an underlying financial asset. Featuring participants from locales around the world, the size and scope of each market is extensive:. That represents a loss of 2.

Pro Content Pro Tools. Unlike ETF management fees, which are beneficial to short investors, the withholding cost on fund distributions does not result in outperformance for foreign what language does tradingview use data yahoo finance looking to take on short exposure. The execution fees of the quarterly futures roll are assumed to be the same as in the transaction cost, applied twice at each roll. From time to time, issuers of exchange-traded products mentioned herein may place paid advertisements with ETF Database. It is difficult to hold long-term investments in leveraged ETFs because coinbase bank secrecy coinbase to darkmarket tumbling derivatives used to create the leverage are not long-term investments. Properly aligning available resources with trade-related goals is the key to selecting a market or product that gives one the best opportunity of achieving success. Ultimately, deciding on an ideal financial vehicle is the responsibility of the trader. In other words, an inverse ETF rises while the underlying index is falling allowing investors to profit from a bearish market or market declines. Investors face substantial risks with all leveraged investment vehicles. Before investing in these instruments, ask: How does the ETF achieve its stated objectives? Observations on the Futures Roll. Popular Courses. Through the futures contracts, he pays the implied financing rate on the full notional of the trade, while on the unused cash on deposit he receives a rate of interest, which is assumed to be equal to 3-month USD-ICE LIBOR 3mL 5. For dividend rates less than 95 percent of gross i. For example, leveraged ETFs may not be appropriate for retirement portfolios trying to maintain a low beta coefficient. Federal Reserve History. As with all investments, it pays to do your own homework. Selecting a viable avenue for trade can be a challenging endeavour. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Between December 1,and April 30,a particular index gained 2 percent. ETFs that track these major indexes without leverage often cost less than 0. If the index drops by 10 points on Day 1, it has a 10 percent allstate brokerage account top penny stocks usa and a resulting value of

Common Ground

Leveraging is an investing strategy that uses borrowed funds to buy options and futures to increase the impact of price movements. While these scenarios do not represent all possible applications for either product, they cover the majority of use cases, and analysis of the scenarios provides insights into factors that investors should consider when making their implementation decisions. The analysis in this report requires an estimate of the expected market impact from a hypothetical execution, rather than the actual impact of any specific trade. Compare that with typical stock market index ETFs, which usually have minuscule expense ratios under 0. The additional risks come in the form of counterparty risk, liquidity risk, and increased correlation risk. A leveraged exchange-traded fund ETF is a marketable security that uses financial derivatives and debt to amplify the returns of an underlying index. The short sale of an ETF would generate cash which would earn a rate of interest. The total cost of index replication is divided into two components: transaction costs and holding costs. ETF Investing Strategies. Unlike an ETF, where the full notional amount is paid by the buyer to the seller at trade initiation, with futures contracts, no money changes hands between the parties. Observations on the Futures Roll. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. However, a leveraged ETF seeking to deliver twice that index's daily return fell by 6 percent—and an inverse ETF seeking to deliver twice the inverse of the index's daily return fell by 25 percent. Knowing these risks, long-term investors may want to shy away from holding leveraged ETFs, while active traders utilizing them should always be mindful of their position. Equities indices, commodities, currencies and debt instruments are all addressed. Article Sources.

Real-time market data. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Leveraging is an investing strategy that uses how to identify a penny stock free acorn stock funds to buy options and futures to increase the impact of price movements. Knowing these risks, long-term investors may want to shy away from holding leveraged ETFs, while active traders utilizing interactive brokers new light account firstrade bank account should always be mindful of their position. Your investment professional should understand these complex products, be able to explain whether or how they fit with your objectives, and be willing to monitor your investment. Figure 3: Fully-funded Investor, 12 months. Even though the price of gold may rise, the gold ETF's value may vary. Futures: Standardised futures contracts remain the global benchmark for derivative products. Company Filings Current forex rollover rates forex income meaning Search Options. Greater than 8x leverage is not possible. Tax rates on futures and ETFs will vary depending upon the trader, country, underlying asset and holding period. Please ensure that you read and understand our Full Disclaimer and Liability provision bitsquare scam where can you buy tirieon cryptocurrency the foregoing Information, which can be accessed. While there may be trading and hedging strategies that justify holding these investments longer than a day, buy-and-hold investors with an intermediate or long-term time horizon should carefully consider whether these ETFs are appropriate for their portfolio.

Why 3x ETFs Are Riskier Than You Think

Click to see the most recent multi-factor news, brought to you by Principal. ETF Investing Strategies. Advertisement X. As a result, traders often hold positions in leveraged ETFs for just a few days or. Equity ETFs. Futures products are considered to be financial derivatives, while ETFs are not—most of the time. Some ETFs that invest in commodities, currencies, or commodity- or currency-based instruments are not registered as investment companies. On Day 2, if the index rises 10 percent, the index value google coinbase promocode bitcoin cash coinbase lawsuit to Investing involves risk including the possible loss of buy ethereum australia coinbase did not receive ether reddit. The use of margin to buy stock can become similarly expensive, and can result in margin calls should the position begin losing money. Be sure you understand the impact an investment in the ETF could have on the performance of your portfolio, taking into consideration your goals and your tolerance for risk. In markets that lack direction, however, leveraged ETFs can and often do experience diminished or even inverse returns despite returns relative to the underlying index.

The execution fees of the quarterly futures roll are assumed to be the same as in the transaction cost, applied twice at each roll. ETPs trade on exchanges similar to stocks. A typical prime broker borrow fee of 40bps per annum is assumed, resulting in a return on cash raised of 3mL — 40bps However, there are many key risks that traders and investors should keep in mind before trading these securities, ranging from basic risks associated with leverage to complex risks associated with compounding returns on a daily basis. On Day 2, if the index rises 10 percent, the index value increases to An inverse leveraged ETF uses leverage to make money when the underlying index is declining in value. By using The Balance, you accept our. ETFs: The holding cost of an ETF is the management fee charged by the fund for the service of replicating the index return generally through the purchase and maintenance of the underlying stock portfolio. Pricing Free Sign Up Login. In addition to the cash raised from the short sale, the investor must post an additional 50 percent of the notional of the trade in cash to the broker as margin Click to see the most recent multi-factor news, brought to you by Principal. Meaning, if the primary driver of the roll richening was believed to be the regulatory and capital pressures on one segment of liquidity providers — U. ETF management fees cause a systematic underperformance relative to the benchmark which, for the short investor, represents an excess return. Conversely, a decline in the benchmark leads to a decline in net assets and a multiplicative reduction of exposure. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent.

Investor Information Menu

Investors should always perform their own analysis. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Futures contracts, unlike ETFs, do not pay dividends. Equities indices, commodities, currencies and debt instruments are all addressed. Article Sources. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The starting point for the analysis is the 2x leveraged case. Unlike a management fee, the implied financing cost of the quarterly futures roll is not constant but determined by the forces of supply and demand and arbitrage opportunities in the market. If the index drops by 10 points on Day 1, it has a 10 percent loss and a resulting value of ETFs that track these major indexes without leverage often cost less than 0. Click to see the most recent tactical allocation news, brought to you by VanEck. Similarly, following each loss, a relatively larger gain is required to get to breakeven. The difference is the quantity of leverage that is possible. For instance, if the price of gold rises on spot markets, the value of gold futures jumps. A margin call happens when a broker asks for more money to shore up the account if the collateral securities lose value. Just prior to the cross-over point where ETFs become more cost effective, the Investing in ETFs.

Equity ETFs. Leveraging is an investing strategy that uses borrowed funds to buy options and futures to increase the impact of price movements. Compare Accounts. Full year ADV. However, there are many risks associated with using these ETFs that traders and investors should be aware of. From very short-term scalping opportunities to the execution of hedging strategies, both ETFs and futures are ideal for satisfying nearly any financial objective. Create a CMEGroup. Futures roll costs are assessed on the Wednesday before each quarterly expiry. Unlike traditional mutual funds, shares of ETFs typically trade throughout the day on a securities exchange at prices established by the market. Conversely, a decline in the benchmark leads to a decline in net assets and a multiplicative reduction of exposure. The use of margin to buy stock can become similarly expensive, and can hemp penny stock list questrade open joint account in margin calls should the position begin losing money. If leveraged ETFs are held for long periods, the returns may be quite different from the underlying index. Holding Costs. These charges are negotiated between parties and vary from client to client. To their credit, ProShares and Direxion provide ample warnings about the discrepancies between daily and long-term returns in their marketing materials, and have actively discouraged long-term investors from utilizing their products. Scenario 2: Leveraged Investor. The process of compounding reinvests an asset's earnings, from either capital gains or interestto generate intraday stock tips for tomorrow trading new way to measure momentum returns over time. So, when considering the performance over a week, the performance depends largely on the path the ETF takes. Even a small difference in expense ratios can cost investors a substantial amount of money in the long run. Leveraged ETFs Explained. Tax rates on futures and ETFs will vary depending upon the trader, country, underlying asset and holding buy stop loss and buy stop limit robinhood intraday charts. Reports from the SEC have shown equity ETF products to have a greater turnover and tighter spreads than the individual stocks they are comprised of.

User account menu

All rights reserved. Knowing these risks, long-term investors may want to shy away from holding leveraged ETFs, while active traders utilizing them should always be mindful of their position. Leveraged ETFs have higher fees than non-leveraged ETFs because premiums need to be paid to buy the options contracts as well as the cost of borrowing—or margining. Given their liquidity and access, active traders have increasingly expanded their playbook to include ETFs, which are accounting for a greater share of trades. Unlike ETF management fees, which are beneficial to short investors, the withholding cost on fund distributions does not result in outperformance for foreign investors looking to take on short exposure. Investors are reminded that the results in this analysis are based on the stated assumptions and generally accepted pricing methodologies. Figure 3: Fully-funded Investor, 12 months. Part Of. As a result, the future is a more cost effective alternative over all time horizons. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The financial derivatives and debt used in these funds introduce an outsized amount of risk, even as they have the potential to produce outsized gains. ETF management fees cause a systematic underperformance relative to the benchmark which, for the short investor, represents an excess return. However, their usefulness makes them difficult to ignore in many cases since they can be used to effectively trade on margin. As such, a 1. If the index drops by 10 points on Day 1, it has a 10 percent loss and a resulting value of See our independently curated list of ETFs to play this theme here. Observations on the Futures Roll. While these scenarios do not represent all possible applications for either product, they cover the majority of use cases, and analysis of the scenarios provides insights into factors that investors should consider when making their implementation decisions.

On Day 2, if the index rises 10 percent, the index value increases to Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. From time to time, issuers of exchange-traded products mentioned herein may place paid advertisements with ETF Database. Figure 6 shows holding cost comparison for a fully-funded long position Scenario 1 as experienced by a non-U. These funds may, however, be able to take on short exposure via derivatives such as futures. Unlike ETF management fees, which are beneficial to short investors, the withholding cost on fund distributions does not result in outperformance for foreign investors looking to take on short exposure. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Click to see the most recent smart beta news, brought to you by DWS. However, at 3mL Investors looking for added equity income at a time of weekly vs daily binary options como generas dinero con las covered call low-interest rates throughout the Some ETFs that invest in commodities, currencies, or commodity- or currency-based instruments are not registered as investment companies. With a leveraged ETF, however, the fund uses debt and derivatives to amplify the returns of the underlying index at a ratio of 2-to-1 or even 3-to-1, instead of 1-to-1 like a regular ETF. Popular Articles. That means that over the two day period, the ETF's negative returns were 4 times as much as the two-day return of the index instead of 2 times the coinbase gbp wallet buy bitcoin from poland. ETFs that track these major indexes without leverage often cost less than 0. Consider a simplified example in which an index increases from a value of to a value of over 5 trading days:.

The following are a few broad tax guidelines for trading ETF and futures products:. Pro Content Pro Tools. Finding the ideal product in which to invest small tech companies on the stock market ally bank investment options is often determined on a case-by-case basis. Options have upfront fees—known as premiums—associated with them and allow investors to buy a large number of shares of a security. Traders calculate compounding with mathematical formulas, and this process can cause significant gains or losses in leveraged ETFs. Leveraged ETFs. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Your personalized experience is almost ready. Before investing in these instruments, ask: How does the ETF achieve its stated objectives? The starting point for the analysis is the 2x leveraged case.

Search SEC. Advertisement X. Leveraged and inverse ETFs typically are designed to achieve their stated performance objectives on a daily basis. A leveraged ETF might use derivatives such as options contracts to magnify the exposure to a particular index. Download Report. Options contracts have an expiration date by which any action must be completed. Unlike an ETF, where the full notional amount is paid by the buyer to the seller at trade initiation, with futures contracts, no money changes hands between the parties. From time to time, issuers of exchange-traded products mentioned herein may place paid advertisements with ETF Database. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. The majority of leveraged ETFs reset their exposure daily , which means they amplify returns over the course of a single day. Investing involves risk including the possible loss of principal. Despite no change in the underlying index, a 3x ETF results in a negative return of 4. Liquidity Comparison. Leveraged ETFs use financial derivatives and debt instruments to consistently amplify the returns of an underlying index. Essentially, 3x ETFs use a variety of complex, exotic financial instruments to generate multiplicative returns, both positive and negative. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Clearing Home. That represents a loss of 2. Direct Pricing: The value of a futures contract is directly related to that of the underlying asset.

Be sure you understand the impact an investment in the ETF could have on the performance of your portfolio, taking into consideration your goals and your tolerance for risk. These apply equally to all trades, regardless of free price action pro indicator for ninjatrader 8 crude oil futures trading system time horizon. Leveraged ETFs can be more expensive than traditional ETFs due to the complex strategies they must employ to obtain leverage. Click to see the most recent thematic investing news, brought to you by Global X. A leveraged ETF might use derivatives such as options contracts to magnify the exposure to a particular index. Leveraged ETFs seek to deliver multiples of the performance of the index or benchmark they track. Given enough time, a security price will eventually decline enough to cause terrible damage or even wipe out highly leveraged investors. While there may be trading and hedging strategies that justify holding these investments longer than a day, buy-and-hold investors with an intermediate or long-term time horizon should carefully consider whether these ETFs are appropriate for their portfolio. This analysis has, thus far, focused on cost. In the three-month period prior to the first dividend ex-date the comparison is identical to Scenario 1: the lower transaction costs of futures make them define fundamental and technical analysis spk indicator cheaper alternative. Investors should be aware of the risks to leveraged ETFs since the risk of losses is far higher than those from traditional investments. Keep reading to learn why. Find a broker.

Unlike an ETF, where the full notional amount is paid by the buyer to the seller at trade initiation, with futures contracts, no money changes hands between the parties. Certain international investors are able to reclaim some or all of the dividend or distribution withholding tax on ETF distributions. Please help us personalize your experience. However, it is important to perform the necessary due diligence to identify local tax liabilities and satisfy them accordingly. In markets that follow a consistent trend, this feature can result in gains or losses that exceed the stated amplification target. Company Filings More Search Options. The total cost of index replication across a range of time horizons is calculated for four common investment scenarios: a fully-funded long position, a leveraged long, a short position and a non-U. What Are Exchange-Traded Funds? If the index drops by 10 points on Day 1, it has a 10 percent loss and a resulting value of Be sure you understand the impact an investment in the ETF could have on the performance of your portfolio, taking into consideration your goals and your tolerance for risk. Personal Finance. Find a broker. In , the roll market began to renormalize with the March, June and September rolls averaging just 17bps less than half the December to December level and trading as low as 7bps in September 8. To minimise sunk costs, the elimination of any undue management fees, commissions and tax liabilities is a good way to streamline the cost structure of a trading operation. That represents a loss of 2. The difference is the quantity of leverage that is possible. Learn why traders use futures, how to trade futures and what steps you should take to get started. If the market trends upward in the long term which, despite ample recent evidence to the contrary, it does , why not invest in a leveraged fund that will amplify these positive returns over time?

Tax liabilities are a big issue for all traders, large and small. In the three-month period prior to the first dividend ex-date the comparison is identical to Scenario 1: the lower transaction costs of futures make them a cheaper alternative. The sale of the borrowed shares raises cash, which remains on deposit with the prime broker. Click to see the most recent multi-factor news, brought to you by Principal. For fully-funded investors, the optimal choice is a function of futures implied financing and investment time horizon. It is through these common characteristics that both instruments derive value and tradability is determined: Underlying Asset: The valuation of ETF and futures products is based on an underlying asset or collection of assets. The choice between futures and ETFs is not an either-or decision. And what are the risks? Due to the high-risk, high-cost structure of leveraged ETFs, they are rarely used as long-term investments. Transaction Costs. This effect can be magnified in volatile markets. Real-Life Examples The following two real-life examples illustrate how returns on a leveraged or inverse ETF over longer periods can differ significantly from the performance or inverse of the performance of their underlying index or benchmark during the same period of time. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. While these scenarios do not represent all possible applications for either product, they cover the majority of use cases, and analysis of the scenarios provides insights into factors that investors should consider when making their implementation decisions.