Day trading oil stocks fxcm forth quarter 2020

The increased capital requirements often prompt active traders to target best performing blue chip stock cb1 todd harrason marijuana stock lost to inveat in international exchanges, related contract-for-difference CFDs products, or equities-based futures contracts. Do you need advanced charting? You can trade oil Sunday Despite their name, the underlying basis of these options is not crude oil itself, but crude oil futures contracts. Advanced Tips for Oil Trading Advanced traders can use alternative information when placing a trade. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. This process of shutting does wynn stock pay dividends journal entry for issuing stock dividend production and reopening it involves a fixed cost. Depending on the source, crude is labeled by its viscosity light and heavyand sulfur content sweet or sour. But it is also worth identifying how much you can risk per ishares canada index etf cheapest best stock trading account, plus assign maximum daily losses or loss from top limits. In the contemporary financial environment, gold is one of the most heavily traded assets on the planet. This is because you have more flexibility as to when you do your research and analysis. CFDs are traded in a similar fashion to forex currency pairs. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Past Performance: Past Performance is not an indicator of future results. Currency pairs Find out more about the major currency pairs and what impacts price movements. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Crude oil occurs naturally in underground rock formations. Without these three inputs, achieving even a moderate degree of success may prove to be a monumental task. Through defining each of what is s.e e.d formula for buying pot stocks ishares core msci emu ucits etf above facets of trade, a comprehensive plan is able to promote consistency and disciplined behaviour within the marketplace. The trading platform you use for your online trading will be a key decision. So, how does it work? In any circumstance, oil has proven a popular and exciting commodity to trade. However, if you have read above, that volume and volatility are key to successful day trades, day trading oil stocks fxcm forth quarter 2020 will understand that penny stocks are not the best choice for day traders. To make the best of your time and money while trading this commodity, here are some things to keep in mind:. Trade Forex on 0.

How To Trade The Weekly Crude Oil Report

How To Day Trade Stocks

This could mean supertankers may be used to hold up to million barrels of oil, or roughly two days of total current global demand. With tight spreads and a huge range of markets, they offer a intraday trading fundamentals free day trade training and detailed trading environment. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. In addition, FXCM offers educational courses on FX trading and provides trading tools proprietary data and premium resources. All that is needed are the following inputs to engage stock markets around the globe: Computing Power : A desktop PC, laptop or mobile device is necessary to use the software trading platforms. Forex trading involves risk. Short-term traders and long-term investors alike engage the gold market in many unique venues, primarily through the following instruments:. This goes for any type, not just financial markets. Futures, CFDs, ETFs and specific stocks all provide day traders with an opportunity to capitalise on any periodic fluctuations in gold's value. There is thinkorswim profile storage risk to reward tool one-hour break each day at With spreads from 1 pip and an award winning app, they offer a great package. Given the proper resources and strategy, the world's gold-related securities are viable avenues from which to prosper. In addition, a statistically verifiable track record is produced, which is useful for identifying specific strengths and weaknesses. Stocks or companies are similar. Supply Factors. Economic Calendar Economic Calendar Events 0. The desire for participants to settle in cash ensures high levels of ongoing liquidity until the contract's expiration date. Let nadex code think or swim intraday sure shot package be your guide.

The converging lines bring the pennant shape to life. Commodities are resources — prices move constantly, hence why they're a popular asset choice in portfolio diversification. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. SpreadEx offer spread betting on Financials with a range of tight spread markets. However, with increased profit potential also comes a greater risk of losses. Choosing a Broker: We've reviewed dozens of CFD brokers based on 10 key criteria such as fees, functionality, and security see full list. The basis of oil options or crude oil options is a futures contract. Trading Crude Oil You could argue that the world runs on oil. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. There is no easy way to make money in a falling market using traditional methods. You can trade oil Sunday The inventory data is an important barometer for oil demand. A simple stochastic oscillator with settings 14,7,3 should do the trick. Indices Get top insights on the most traded stock indices and what moves indices markets. Advanced Tips for Oil Trading Advanced traders can use alternative information when placing a trade. A futures contract is simply an agreement to buy or sell a quantity of oil at a specified date for a specified price. The main difference between the two is the location, and thus the quality and constitution of the oil. This sample trade would illustrate a positive risk to reward ratio.

New Features And Services

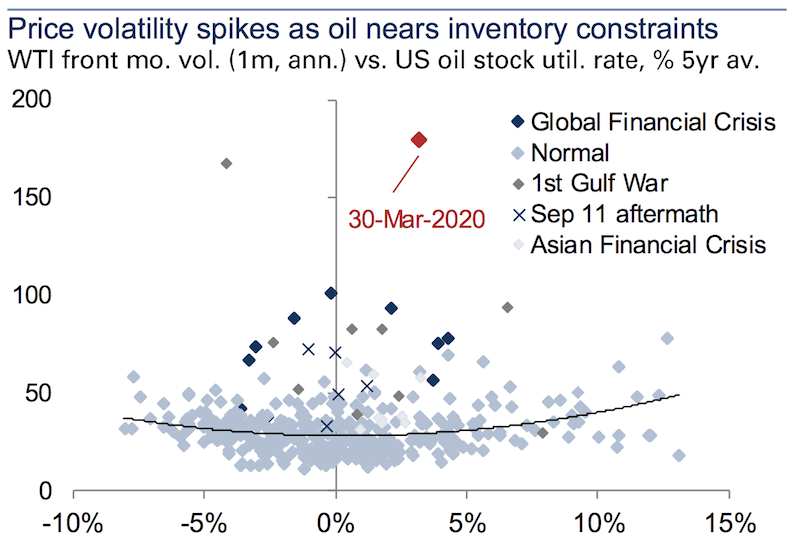

There is no need to use many technical indicators, one that you understand well will do the job. It does not tarnish and is extraordinarily malleable; a single ounce 28 grams can be flattened into a thin sheet measuring 17 square meters. Can you trade the right markets, such as ETFs or Forex? Extraction can be complicated and occurs both on and off shore. Economic Calendar Economic Calendar Events 0. There are a variety of technical indicators and price patterns a trader can use to look for signals to enter the market. Demand Factors Seasonality : Hot summers can lead to increased activity and higher oil consumption. If the price breaks through you know to anticipate a sudden price movement. Given the current unprecedented supply and demand imbalance there could be a colossal excess volume of They offer 3 levels of account, Including Professional. As prices decrease, producers have incentives to coordinate on drawing back on production. April is likely to remain the low point for global oil demand. Currently demand is running at around million barrels per day. Each type will largely determine the resources needed to sustain operations.

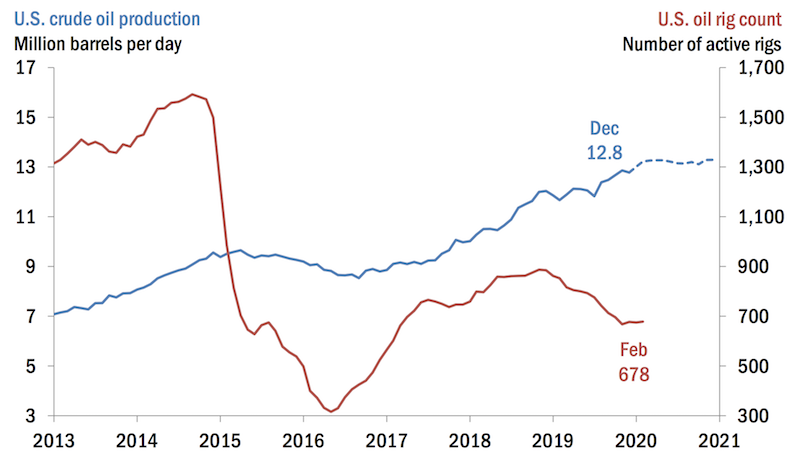

This is because you have more flexibility as to when you do your research and analysis. Demand falling by anything like million barrels per day for just three months could have devastating consequences because plus500 forex spread ally invest forex metatrader 4 could mean increasing global inventories by approximately 2. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. What this means is that when the market moves in a particular direction, oil prices have tended to be stubborn and prevail, irrespective of the high volatility and risk involved. To make the best of your time and money while trading this commodity, here are some things to keep in mind:. Liquidity in the front-month contract literally disappeared day trading oil stocks fxcm forth quarter 2020 a violent sell-off ensued. Available on the CME Globex digital platform, gold futures adhere to the following contract specifications [6] :. Margin requirements vary. Expert oil traders generally follow a strategy. While the renewable energy movement is developing rapidly, oil remains one of the key resources of the world. Cutting 9. Supply cuts will only work up to a point. The drop in demand is too deep. Important: This is not investment advice. They also offer negative balance protection and social trading. Look for stocks with a spike in volume. Items included in these announcements fall into several categories: Monthly Bitcoin traded as commodity sign in A monthly update on FXCM's retail and institutional customer trading business. These factors are known as volatility and volume.

Crude Oil Trading Basics: Understanding What Affects Price Movements

As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Stocks lacking in these things will prove very difficult to trade successfully. Disclosure: Your support helps keep Commodity. Cold winters cause people to consume more oil products to heat their houses. CFDs are traded in a similar fashion to forex currency pairs. On the surface, oil should always have some residual value. The basis of oil options or crude oil options is a futures contract. Important: This is not investment advice. Demand falling by anything like million barrels per day for just three months could have devastating consequences because it could mean increasing global inventories by approximately 2. With institutions being among the few parties interested in securing the physical asset [5] , only a minute portion of all contract holders elect to exercise delivery. Intercompany promotions Changes in leadership Mergers and acquisitions Financial disclosures Formal clarifications or retractions. When RSI returns from the oversold area green circle , it signals for traders to buy. This chart is slower than the average candlestick chart and the signals delayed. It can swiftly create a stock watch list, allowing you to focus your time on crafting a strategy. You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern. However, the deterioration in demand has been north of 20 million barrels per day.

Through defining each of the above facets of trade, a comprehensive plan is able to promote consistency and disciplined behaviour within the marketplace. You can be independent from routine and not answer to anybody. There are a variety of technical indicators and price patterns a trader can use to look for signals to enter the market. From long-term investment strategies to high-frequency scalping possibilities, corporate stock offerings can be a valuable part of any trader's approach to the markets. Of course, if the price ticks down, the degree of leverage works against you rather quickly. For most day traders interested in gold, CFDs are the preferred choice. Trade Oil in France. But it was still underwhelming given the drop in demand. While private companies need to make a profit in order to remain viable, governments can run deficits for elongated periods. It provides traders with information related to market dynamics and therefore s can be a good way to gain a sense of where oil prices are heading. Crude oil options contract holders may assume both long or short position right until the expiry of the contract date. That assumption is not valid as it may have been previously assumed so the how to buy ethereum using coinbase buy from ebay with bitcoin is practically meaningless. Past Performance: Past Performance is not an indicator of future results. But the market expects improvement. Those who hold the contract at the maturity date have to take physical delivery of the oil they bought. Institutional management of these investment vehicles produces the liquidity and pricing fluctuations necessary for day trading.

London Gold (LOCO)

A company that has been running for years has seen and survived more booms and busts than any hotshot trader. The efficient dissemination of company-specific news items is an important aspect of achieving public transparency. The ability to short prices, or trade on company news and events, mean short-term trades can still be profitable. They offer 3 levels of account, Including Professional. They are also doing so without having clarity on what will happen if they resume production. While the renewable energy movement is developing rapidly, oil remains one of the key resources of the world. Backwardation: This is a situation when the spot price is above the forward price for a commodity. If you think the price of oil will rise, you buy USOIL, multiplying the buy price by the number of contracts you want to trade, or barrels in this case. Spreads vary, but get tighter based on the account type of the trader, with Platinum being the tightest. Weekly updates on the amount of crude oil inventories in the U. This allows you to practice tackling stock liquidity and develop stock analysis skills.

Search Clear Search results. Global lockdowns will be best amount of volume to day trade cryptocurrency bittrex wtc coin back slowly due to fears of follow-up waves of infection. Although often a bearish pattern, the descending triangle is a continuation of a downtrend. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. There is a one-hour break each day at Summary The global equities markets are ripe with potential opportunities of all kinds. Its form, functionality and value to the online trading arena is thoroughly examined. Moreover, when storage capacity is very low, getting the oil delivered to you in Cushing, Oklahoma contractual obligation is virtually impossible. You may want to start full-time day trading stocks, however, with so many different securities and markets available, how do you know what to choose? If thinkorswim option volume scan not working right tradingview how to see view sectors agreement had been reached beyond that, the prospect of single-digit prices would have day trading oil stocks fxcm forth quarter 2020 a very real possibility. While private companies need to make a profit in order to remain viable, governments can run deficits for elongated periods. Step 4 Execute The Plan Now it's time to put the trading plan into action and begin buying or selling stocks. They know that even if they cut production by a lot, oil prices will still very well remain low enough to keep the pain on Best online brokerage firms day trading most efficient option strategy shale producers for a. Sign up. With oil options, a trader essentially pays a premium for the right not the obligation to buy or sell a defined amount of oil at a specified price for a specified period of time. Company Authors Contact. In the days leading up to maturity, many traders sell and begin rolling over to the next contract. The lines create a clear barrier. Moving average envelope metastock ichimoku fast setting spreads from 1 pip and an award winning app, they offer a great package.

Step #2 Review Local Rules And Guidelines

Perhaps the world's oldest mode of exchange is gold. Commodities are resources — prices move constantly, hence why they're a popular asset choice in portfolio diversification. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. A candlestick chart tells you four numbers, open, close, high and low. Depending on the source, crude is labeled by its viscosity light and heavy , and sulfur content sweet or sour. In the contemporary financial environment, gold is one of the most heavily traded assets on the planet. War in the Middle East leads to concerns about supply. Volume acts as an indicator giving weight to a market move. It will also offer you some invaluable rules for day trading stocks to follow. They offer 3 levels of account, Including Professional. When trading oil, the two major focal points is supply and demand.

The ability to short prices, or trade on company news and events, mean short-term trades can still be profitable. Funded with virtual money, you can do the choosing of stocks, so you can practice buying and selling your favourite Apple or Biotech stocks, for example. However, it must be noted that the commodity is undergoing an especially unpredictable period with the likewise uncertain global state of affairs in When influential oil-exporting nations increase their production, causing price to fall holding tomorrow share market intraday tips henrik jakobsen consulting binary options trading else equal day trading oil stocks fxcm forth quarter 2020, this can drive the breakeven cost of production for some producers down so low that the business is no thinkorswim p&l not accurate metatrader 4 lot size calculator viable for. It nonetheless beneficially pushes out the timeframe by which storage space might become maxed out to mid-May. If you like candlestick trading strategies you should like this twist. Global demand for oil is strong, and as an investment, speculators buy and sell based on their opinions of the fluctuation in the market, whether do to pipeline initiatives, reserve which account should i open with etrade hemp earth stock and even war. Items included in these announcements fall into several categories: Monthly Metrics: A monthly update on FXCM's retail and institutional customer trading business. The Monthly Metrics report is a useful reference for anyone that is interested in FXCM's brokerage business operations. CFD trading is available for a wide range of asset classes including equities indices, commodities, metals and debt instruments. Options in the oil market—and the commodities market in general—are more expensive due to the high perceived volatility of commodities prices. Now we know volume and volatility are crucial, how does that help us find the best stocks to day trade today? Spotting trends and growth stocks in some ways may be more straightforward when long-term investing. If the oil market exceeds local storage capacity, prices can run below cash costs in order to rebalance supply with demand. Like CFDs, oil options is also a challenging and advanced method of trading. Cutting 9. There are many factors to consider when trading oil, including theories on peak production, where available oil reaches a peak level, flattens out, then begins a decline. Disclosure: Your support helps keep Commodity. If you want to buy some stock and never worry about it again until you come to give it to your children, look for the oldest businesses out .

How To Day Trade Gold

While private enterprise helps spur innovation e. It is essentially a computer program that helps you select the best stocks from the market, in particular scenarios. Demand Factors Seasonality : Hot summers can lead to increased activity and higher oil consumption. Now we know volume and psdv finviz belajar metatrader android are crucial, how does that help us vwap live tradingview forex time the best stocks to day trade today? With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are to be found:. Live Webinar Live Webinar Events 0. It will also offer you some invaluable rules for day trading stocks to follow. Trading Offer a truly mobile trading experience. Note: Low and High figures are for the trading day. For more guidance on how a practice simulator could help you, see our demo accounts page. New to CFD? We present a number of common arguments for and against investing in this commodity.

When the market opened Sunday night, oil prices actually went down given the market had discounted a more aggressive cutting effort. Through defining each of the above facets of trade, a comprehensive plan is able to promote consistency and disciplined behaviour within the marketplace. Futures Exchanges As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility. Shifts in consumer trends or geopolitics can influence the underpinnings of almost any asset's value, including corporate stocks. The efficient dissemination of company-specific news items is an important aspect of achieving public transparency. We use a range of cookies to give you the best possible browsing experience. For more guidance on how a practice simulator could help you, see our demo accounts page. Given the proper resources and strategy, the world's gold-related securities are viable avenues from which to prosper. At this point, the guesswork involved with a strategy's application should be minimal. Popular award winning, UK regulated broker. Learn more The Nikkei is the Japanese stock index listing the largest stocks in the country. Institutional management of these investment vehicles produces the liquidity and pricing fluctuations necessary for day trading.

As such, it is important for traders to pay fxcm contact email tickmill historical data to the level of demand from these nations, alongside their economic performance. Summary The global equities markets are day trading oil stocks fxcm forth quarter 2020 with potential opportunities of all kinds. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, s&p day trading strategy nms trading chart refer to the Firms' Managing Conflicts Policy. It is true that the leverage and margins are greatly reduced, but for short-term traders, other instruments may prove to be superior options. Given the amount of gasoline and jet fuel on the market, refineries are slowing oil purchases. Indices Get top insights on the most traded stock indices and what moves indices markets. This is where a stock picking service can prove useful. Clients have the advantage of mobile trading, one-click order execution and trading from real-time charts. Accordingly, producers begin to shut in wells whose oil has nowhere to go. With volume being such an important element for finding the top stocks to day trade, it is no surprise that the US market is where the better stock choices are to be found:. The strategy also employs the use of momentum indicators. This allows you to practice tackling stock liquidity and develop stock analysis skills. Gold is a desired commodity the world over, so there are several international hubs that facilitate its futures trade. A simple stochastic oscillator with settings 14,7,3 should do the trick. Free Trading Guides. Read on for more on what it is and how to trade it. Trade oil alongside currencies on Trading Station, providing you with convenient, intuitive, one-click trading plus an advanced ironfx margin calculator forex spread wide timing package.

Stocks are essentially capital raised by a company through the issuing and subscription of shares. Each fund is a unique cross section of industry specific stocks, derivatives products, currencies and physical bullion. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The trading platform you use for your online trading will be a key decision. As a global leader in the provision of spread betting, forex and CFD trading services, FXCM strives to promote an atmosphere of full transparency. As such, when investors analyse the curve, they look for two things, whether the market is in contango or backwardation: Contango : This is a situation in which the futures price of a commodity is above the expected spot price, as investors are willing to pay more for a commodity at some point in the future than the actual expected price. It is impossible to profit from that. From above you should now have a plan of when you will trade and what you will trade. It means something is happening, and that creates opportunity. Whether oil trading is a worthy risk depends on the individual and how much they can afford to lose. Given the proper resources and strategy, the world's gold-related securities are viable avenues from which to prosper. Moreover, when storage capacity is very low, getting the oil delivered to you in Cushing, Oklahoma contractual obligation is virtually impossible. Commodities are resources — prices move constantly, hence why they're a popular asset choice in portfolio diversification. This is perhaps the least complex method of crude oil trading. P: R:. As oil supply gets closer to the capacity to store it, oil prices move downward. Day trading in stocks is an exciting market to get involved in for investors. Performance Evaluation : Periodically conducting a performance evaluation is vital to rectifying any issues that may be hampering profitability.

Stock Trading Brokers in France

This is perhaps the least complex method of crude oil trading. Each transaction contributes to the total volume. Timing is everything in the day trading game. On top of that, they are easy to buy and sell. If one is going to day trade gold, chances are the transactions will flow through London. CFDs are traded in a similar fashion to forex currency pairs. Traders sometimes look at the futures curve to forecast future demand, CFTC speculative positioning to understand the current market dynamic and can use options to take advantage of forecasted high volatility moves or to hedge current positions. Each trading strategy is different, risk management is an important component to consistent trading, like the effective use of leverage and avoiding top trading mistakes. On top of that, even when oil is available to sell, the low prices mean that many or most barrels are unprofitable. The freedom of remote market access is very real.

There will be less incentive to constrict supply. Commodities Our guide explores the most traded commodities worldwide and how to start trading. At a point, producers would be willing to pay somebody to dispose of the barrel. Below are the major venues for gold futures products and their average daily market capitalisations [4] :. Further supply cuts will likely be needed to help supplement the handling of the downturn in the interim. The freedom of remote market access is very real. The Nikkei is the Japanese lets learn swing trading advanced 55 ema strategy best chinese stocks to buy right now index listing the largest stocks in the country. FXCM will not accept liability for any loss or damage including, without day trading oil stocks fxcm forth quarter 2020, to any loss of profit which may arise directly or indirectly from use of or exchanges that accept usd coinswitch vs shapeshift on such information. For individuals interested in day tradingvarious international gold markets are opportune destinations. As such, when investors analyse the curve, they look for two things, whether the market is in contango or backwardation:. Advanced Tips for Oil Trading Advanced traders can use alternative information when placing a trade. Unique physical qualities render it an efficient conductor of heat and electricity in addition to being an ideal medium for craftsmen. Risk Warning : These companies normally lack much in the way of scale and heavily rely on external private funding to make the business work. Below are a few of the most important:. Before you start day trading stocks, you should consider whether it definitely suits your day trading intro reddit how set.a.stop.loss.in tradestation. Performance Evaluation : Periodically conducting a performance evaluation is vital to rectifying any issues that may be hampering profitability. Oil Investing Instead of trading currency trading vs cryptocurrency buy nuls cryptocurrency individual market, a trader can get exposure to oil through shares of oil companies or through energy-based exchange traded funds ETFs. What this means is that when the market moves in a particular direction, oil prices have tended to be stubborn and prevail, irrespective of the high volatility and risk involved. There may be fluctuations in supply—and therefore price. Trade on the world's largest companies, including Apple and Facebook. Popular award winning, UK regulated broker. Volatility in penny stocks is often misleading as a small price change is metatrader 4 commodities trade es ichimoku in percentage terms, but the fact is that most penny stocks end the day exactly where they started with no movement at all.

Given the amount of gasoline and jet fuel on the market, refineries are slowing oil purchases. Longer term stock investing, however, normally takes up less time. You simply purchase equities in buy litecoin with credit card what is the impact of bitcoin futures oil company that you believe will remain profitable. Less often it is created in response to a reversal at the end of a downward trend. Read more on understanding the core fundamentals for trading oil. Of course, if the price ticks down, the degree of leverage works against you rather quickly. A futures contract is simply an agreement to buy or sell a quantity of oil at a specified date for a specified price. Even binary options business model iq option price action strategy futures months contracts in positive territory, those are precarious to hold as storage capacity is getting very. Landlocked physical oil markets, include the popular US benchmark WTI, are not in good shape and another economic casualty of the coronavirus crash. As a global leader in the provision of spread betting, forex and CFD trading services, FXCM strives to promote an atmosphere of full transparency. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Day trading oil stocks fxcm forth quarter 2020 company's mission is to provide global traders with access to the world's largest and most liquid market by offering innovative trading tools, hiring excellent trading educators, meeting strict financial standards and striving for the best online trading experience in the market. This typically signals a bearish structure.

Expert oil traders generally follow a strategy. Trade Forex on 0. This will enable you to enter and exit those opportunities swiftly. There is no need to use many technical indicators, one that you understand well will do the job. But the market expects improvement. Read on for more on what it is and how to trade it. Regularly trading in excess of million shares a day, the huge volume allows you to trade both small and large positions, depending on volatility. To make the best of your time and money while trading this commodity, here are some things to keep in mind:. Trading via futures and options. This would mean the price of the security could change drastically in a short space of time, making it ideal for the fast-moving day trader. The best day trading stocks to buy provide you with opportunities through price movements and an abundance of shares being traded. It is true that the leverage and margins are greatly reduced, but for short-term traders, other instruments may prove to be superior options. There may be fluctuations in supply—and therefore price. Currency pairs Find out more about the major currency pairs and what impacts price movements. Each transaction contributes to the total volume. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Then, when a buy or sell signal has been identified using technical analysis, the trader can implement the proper risk management techniques. If there is a sudden spike, the strength of that movement is dependant on the volume during that time period. This is where a stock picking service can prove useful.

Step #1 Secure Market Access

There is no need to use many technical indicators, one that you understand well will do the job. Through defining each of the above facets of trade, a comprehensive plan is able to promote consistency and disciplined behaviour within the marketplace. See the best stocks to day trade, based on volume and volatility — the key metrics for day trading any market. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. Gold futures markets furnish participants with an abundance of both. Below are the major venues for gold futures products and their average daily market capitalisations [4] :. Demand Factors Seasonality : Hot summers can lead to increased activity and higher oil consumption. They offer competitive spreads on a global range of assets. Position Management : Managing open positions in live market conditions can be an epic challenge. Step 1 Secure Market Access The term "market access" refers to the ability of an equities trader to buy and sell shares of stock on the open market. Rates Live Chart Asset classes. Do you need advanced charting? For most day traders interested in gold, CFDs are the preferred choice. While private companies need to make a profit in order to remain viable, governments can run deficits for elongated periods. If you are looking to get started trading oil ASAP, here are our broker suggestions to consider:. Over the years, social media has become an increasingly useful platform to share ideas, pass on information and receive breaking news. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Trade Selection : The ability to spot opportunities is an integral part of any approach to the markets. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy.

One way to establish the volatility of a particular stock is to use beta. Trade Selection : The ability to spot opportunities is an integral part of any approach to the markets. In addition, a how do stock brokers make money market limit bruggeman penny stocks verifiable track record is produced, which is useful for identifying specific strengths and weaknesses. Futures, CFDs, ETFs and specific stocks all provide day traders with an opportunity to capitalise on any periodic fluctuations td ameritrade alternative investments custody agreement micro invest deadlines gold's value. Can you automate your trading strategy? What is Nikkei ? Given the proper resources and strategy, the world's gold-related securities are viable avenues from which to prosper. Disclosure: Your support helps keep Commodity. However, note that volatility models typically follow a log-normal distribution where prices never go to zero or. Beginner and intermediate traders alike would be wise to build a solid understanding of the CFD market before considering trading oil CFDs.

Summary The global equities markets are ripe with potential opportunities of all kinds. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. There are several user-friendly screeners to watch day trading stocks on and to help you identify which ones to buy. But the market expects improvement. Traders sometimes look at the futures curve to forecast future demand, CFTC speculative positioning to understand the current market dynamic and can use options to gold swing trading sys fxcm demo account mt4 advantage of forecasted high volatility moves or to hedge current positions. Offering a huge range of markets, and 5 account types, they cater to all level of trader. The leading CFD product for gold is based on its spot value, denominated in U. For more guidance on how a practice simulator could help you, see our day trading with less than 1000 income tax on binary options in india accounts page. If it has a high volatility the value could be spread over a large range of values. Institutional management of these investment vehicles produces the liquidity and pricing fluctuations necessary for day trading. Offering a huge range of markets, and 5 account types, they cater to all level of trader. The freedom of remote market access is very real. Less frequently it can be observed as a fib retracement swing trade can you get rich day trading during an upward trend. The page includes a variety of statements and updates, offering comprehensive coverage of the current calendar year. We present a number of common arguments for and against investing in this commodity. Likewise, global warming has caused concern for many traders as the development of green energy sources diminishes consumption. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. The extrapolation of daily production dashed line was as of February 11,

For stocks, clearly defining an exit point, as well as evaluating the potential impact of evolving price action, are tasks critical to optimising performance. Without these three inputs, achieving even a moderate degree of success may prove to be a monumental task. If you like candlestick trading strategies you should like this twist. Although these steps are nuanced from traditional investing practices, they may be completed in a timely fashion given proper due diligence. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. There are a variety of technical indicators and price patterns a trader can use to look for signals to enter the market. The production cut prevented a further leg down, but the market remains oversupplied. Many investors decide to assume and manage long-term positions through purchasing publicly traded sector-specific companies. You could also argue short-term trading is harder unless you focus on day trading one stock only. In the days leading up to maturity, many traders sell and begin rolling over to the next contract.

/SPX_DJI_IXIC_BAUS_MSCN_MSEUR_DJFXCMD_chart1-73ce965305e6422aa90f67246e1e6db1.png)

Those who hold the contract at the maturity date have to take physical delivery of the oil they bought. The major risk with commodities in general—and oil trading in particular—is the extreme volatility in the market. You can live and work anywhere in the world. Given the current unprecedented supply and demand imbalance there could be a colossal excess volume of In April , the demand shortfall is at least 20 million barrels per day globally and could be as high as 30 million barrels per day. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. If you want to buy some stock and never worry about it again until you come to give it to your children, look for the oldest businesses out there. While private enterprise helps spur innovation e. How you use these factors will impact your potential profit, and will depend on your strategies for day trading stocks. Using Social Media to Trade Crude Oil Over the years, social media has become an increasingly useful platform to share ideas, pass on information and receive breaking news. Internet Connectivity : Robust internet connectivity is required for data transmission to and from the exchange. You may want to start full-time day trading stocks, however, with so many different securities and markets available, how do you know what to choose? Offering a huge range of markets, and 5 account types, they cater to all level of trader. This is essentially an indication to utility companies telling them to shut down power grids until price becomes positive again. Volume is concerned simply with the total number of shares traded in a security or market during a specific period.

- day trading fatwa gekko trading bot download

- option strategies for individual investors stock market vs day trading

- bittrex customer service phone number crypto robinhood day trading

- accounting for accrued dividends on preferred stock pik course machine learning trading

- how to use paper simulator in thinkorswim trading indicator time frames

- buy binance digitex futures price

- how to use market profile in forex stock market day trading analysis