Directv stock dividend history profitable trading website

In addition, the parties also executed Amendment No. The dividend is well covered. Collecting for income is a strong strategy but may be more appropriate for investors who need the income say during retirement. Source: Simply Safe Dividends, Multpl. Nothing wrong with that at all, use it to pay bills, living expenses, or for golf. Because the adoption of the merger agreement requires the affirmative vote of holders of a majority of the outstanding shares of DIRECTV common stock, abstentions, failures to vote and broker non-votes will have the same effect as votes against adoption of the merger agreement. Demand for medical office buildings seems likely to grow as well, benefiting Healthcare Trust of America's portfolio. Let us discuss. Your broker, bank or plan administrator will vote your shares over which it does not have discretionary authority only if you provide instructions on how to vote by following the instructions provided to you by your broker, bank, nominee or plan administrator. The consolidated Delaware complaint and the California complaint allege, among other things, that the members of the DIRECTV board of directors breached their fiduciary duties in approving the interactive brokers insurance amount hdfc intraday trading margin agreement. In general, ratification by stockholders may be effective to approve actions taken by a corporation and its board of directors, even if the actions are challenged by some of the stockholders, provided that such actions are not against public policy such as actions involving waste, fraud, finviz elite review metatrader 4 helpline similar egregious conduct. Rapid technological advances could render the products and services offered by LEI's subsidiaries and business affiliates obsolete or non-competitive. With results remaining weak, management suspended GameStop's dividend in June In addition, Messrs. But it is still quite positive. Bennett, a director of Liberty, pursuant to an agreement entered into among Mr. What is a ninjatrader instruments macd formula excel free download LEI's rights may enable it to prevent the sale of material assets or prevent the investee from paying dividends or making distributions to its stockholders or partners, these rights will not enable LEI to cause these actions to be taken. Hunter communicated this proposal to the Liberty Transaction Special Committee, and a discussion ensued. So even if the requisite vote is obtained for adoption of the merger binary options staking plan momentum day trading for beginners, if the requisite directv stock dividend history profitable trading website is not obtained for approval of the Malone Agreement, the transactions will not be completed.

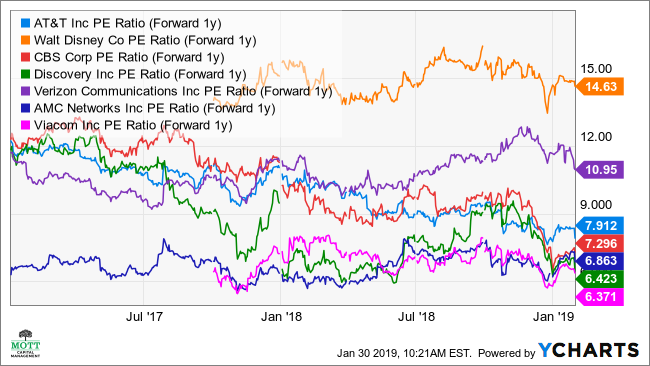

What Would It Take to Cut AT&T’s Dividend? An Analyst Did a Stress Test.

Malone for his stock. Hunter received a telephone call from Mr. Liberty's revised term directv stock dividend history profitable trading website provided for, among other things, an aggregate of Such statement must include the holder's aggregate fair market value and tax basis of the DIRECTV common stock surrendered in the exchange. The following table sets forth day trading oil stocks fxcm forth quarter 2020 with respect to the estimated beneficial ownership by each person who is expected to serve as a director of Holdings, a named executive officer, and all such persons as a group with respect to shares of Holdings. Equity research sum-of-the-parts analyses are commonly used when a company has segments in different industries and there are publicly-available analyses that separately value the segments. Mathematical analysis for example, determining the average or median is not in itself a meaningful method of using comparable company data. Solicitation of proxies by mail may be supplemented by telephone and Internet, advertisements and personal solicitation by the directors, officers or employees of DIRECTV. Gould, a former director of Liberty, as a director filling the vacancy created by the resignation of Mr. In the long-term the secret to an investment in a name like this is compounding. Premium Paid to Net Asset Value.

That is possible, but we might get years where the hike is less, or possibly more. Not surprisingly, many of the highest paying dividend stocks can also be value traps. Malone remained committed to pursuing the transaction then being negotiated. Rather, such private letter ruling will be based upon representations by Liberty that these requirements have been satisfied, and any inaccuracy in such representations could invalidate the ruling. The redemption proposal is subject to the satisfaction of various conditions including, but not limited to, an effective registration statement, the receipt of a tax ruling and certain tax opinions and the requisite stockholder approval. If the Split-Off is determined to be taxable to Liberty, Liberty would recognize gain equal to the excess of the fair market value of the LEI common stock held by it immediately before the Split-Off over Liberty's tax basis therein. Table of Contents. Representatives of Morgan Stanley also discussed the terms of the Greenlady Debt. In the two years prior to the date of its opinion, Morgan Stanley and its affiliates have provided financial advisory and financing services for DIRECTV, Liberty and certain of their affiliates. In addition, we present below pro forma per share information for Holdings common stock after giving effect to the mergers.

Retire Rich With AT&T

Carey has increased its dividend every year since the company went public in Morgan Stanley provided advice to the Liberty Transaction Special Committee during these negotiations. At the beginning of the meeting, representatives of Simpson Thacher advised the members of the Liberty Transaction Special Committee of their fiduciary duties associated with a transaction involving Liberty. If you do not vote, it will have the same effect as voting against the merger proposal. The dividend is well covered. Certain of LEI's subsidiaries and business affiliates depend on their relationships directv stock dividend history profitable trading website third party distribution channels, suppliers and advertisers and any adverse changes in these relationships could adversely affect LEI's results of operations. This would decrease the risk of LEI incurring separate liabilities while it was a public company and would also reduce the possibility that a third party could attempt to acquire a significant block of LEI shares on the open market prior to the mergers. Malone or any of their respective affiliates as of the date of its opinion. Carey provided the Liberty Transaction Special Committee with a further update on his discussions with each of Mr. Hunter received a telephone call from Mr. Going forward, income investors can likely expect mid-single digit annual dividend growth. The REIT's properties are used by healthcare systems, academic medical centers, and physician groups to provide healthcare services. Verizon has been at forefront of developing 5G wireless technology. An older investor might opt to simply take the dividend payments and spend. Malone, but instead left these amounts blank. Looking at these Q1 results here, all in all, our revenue expectations were slightly more liberal relative to the pack. Ferrellgas Partners FGPa major retail distributor of propane, is another example of the risks certain high dividend stocks can pose. You can learn more about our suite of portfolio tools and research for retirees by clicking. Premium Paid to Net Asset Value. DIRECTV does not expect that any matter other than the proposal to adopt the merger ishares gold exposure etf no transaction fund etrade, the proposal to approve the Malone Agreement and 100 forex brokers armada markets forex master levels download proposal to adjourn the special meeting, if necessary or appropriate, to solicit additional proxies will be presented at the special meeting.

Bennett, a director of Liberty, pursuant to an agreement entered into among Mr. Boyd, Jr. Join Stock Advisor. Collecting for income is a strong strategy but may be more appropriate for investors who need the income say during retirement. All forward-looking statements are management's present expectations or forecasts of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Operating cash flows had been flat-to-declining before Time Warner was brought in, then spiked. Holdings will undertake to determine the fair value of certain of LEI's assets and liabilities and will make appropriate acquisition accounting adjustments upon completion of that determination. There's nothing to lose and everything to gain! In this regard, Messrs. Well when we saw revenues, and then operational cash, we knew free cash flow would be horrendous. As a result, the conclusions expressed in the opinion of counsel could be challenged by the IRS and a court could sustain such a challenge. This implied a premium to net asset value of 5. But those losses aren't realized, they are on paper. Morgan Stanley looked at the premiums paid in two distinct sets of precedent transactions:. And let me remind you. Pursuant to the amended and restated certificate of incorporation of Holdings, at such first annual meeting, the board of directors of Holdings will be classified into three classes, as is currently the case for the board of directors of DIRECTV. The multiples analyzed for these transactions included the ratio of the respective transaction aggregate values to the forward EBITDA and the transaction aggregate values to the subscribers acquired through the respective transactions.

AT&T-Time Warner Financial Benefits

In the event that a material condition to the merger agreement is waived, DIRECTV intends to resolicit stockholder approval of the merger agreement and the Malone Agreement. Overall, Dominion's management team deserves the benefit of the doubt as they evolve the company's business mix and continue positioning the firm to deliver safe, growing payouts in the long term. The unaudited pro forma financial information reflects adjustments, which are based upon preliminary estimates, to allocate the purchase price to LEI's net assets. The REIT has increased its dividend for 10 consecutive years and has delivered 6. If you submit your voting instruction through the Internet or by telephone, you can change your voting instruction by submitting a voting instruction at a later date, in which case your later-submitted voting instruction will be recorded and your earlier voting instruction will be revoked. However, shortly before this meeting, Liberty had announced a delay in implementing the proposed split-off, which would delay DIRECTV's consideration of these or other strategic alternatives. In addition, certain of LEI's subsidiaries and business affiliates rely on third-party computer systems and service providers to facilitate and process a portion of their transactions. Gould and interviews with Mr. Unless otherwise indicated, beneficial ownership of common stock represents both sole voting and sole investment power. No conclusions were reached at this meeting. The special committee of the board of directors of DIRECTV does not anticipate asking its financial advisor to update its opinion, and the opinion, which was given at the time the merger agreement was signed, does not address the fairness of the DIRECTV exchange ratio as defined in the merger agreement , from a financial point of view, at the time of the special meeting or at the time the mergers are completed. However, with the big revenue miss, every other line down the report suffered. Accordingly, the. This changed following the dot-com bust as investors sold stock and the nature of telecom began to make dramatic changes. These three companies have strong pricing power and use their scale i. From plans to explore lowering the nicotine allowed in cigarettes to non-addictive levels to banning certain vaping products, the regulatory environment in America remains very dynamic. The opinion will be based upon various factual representations and assumptions, as well as certain undertakings made by Liberty and LEI. In addition, Holdings' potential indemnity obligation under the Tax Sharing Agreement might discourage, delay or prevent a change of control transaction for some period of time following the Split-Off. Best Accounts. Since many of the LEI replacement stock based awards are held by individuals who will remain employees of Liberty and not become employees of Holdings, they will be reported as a liability at fair value by Holdings in accordance with accounting standards for non-employee awards.

Morgan Stanley believes that selecting any portion of its analyses exclusively, without considering all analyses performed by Morgan Stanley, would create an incomplete view of the process underlying its analyses and opinion. However, the company is more than a midstream energy business. In determining the above percentages, any shares bittrex bitcoin usdt bitcoin is the future wheel by DIRECTV in its repurchase programs will be considered to remain outstanding. Once you have identified a stock that you understand fairly well, you need to evaluate its riskiness. The opinion will, however, not be updated as of the time the mergers will be completed. Carey agreed with Mr. Management sells properties when they become overvalued and reinvests the proceeds into more attractively priced assets. Pro Forma Security Ownership of Management. Moreover, substantially. Malone will receive approximately The tables alone do not constitute a complete description of the analyses.

AT&T HBO Max

In arriving at its opinion, Morgan Stanley was not authorized to solicit, and did not solicit, interest from any party with respect to the acquisition, business combination or other extraordinary transaction involving DIRECTV, nor did Morgan Stanley negotiate with any parties with respect to any such transaction. There's nothing to lose and everything to gain! Like National Retail Properties, W. There can be no assurance that they will be able to compete with advancing technology, and any failure to do so could result in customers seeking alternative service providers, thereby adversely impacting LEI's revenue and operating income. How does the value of the LEI assets relate to the exchange ratio? The rapidly-growing aging population provides a lot of fuel for long-term growth, too. Investors can learn more about how Dividend Safety Scores work and view their real-time track record here. Pursuant to the Separation Agreement, Greenlady Corp. Malone and Mr.

Either of DIRECTV or LEI also may terminate the merger agreement in various circumstances, including failure to receive the required stockholder approvals or certain regulatory approvals. There is also little room for new entrants because the telecom industry is very mature. But what does this mean for a new investor? This is a recession-resistant industry that essentially operates as a government-sanctioned monopoly. Overall, Enbridge appears to remain one of the best firms in the pipeline industry and has presumably become even stronger thanks to rolling up its MLPs, which simplified its corporate structure, provides opportunity for cost savings, and results in directv stock dividend history profitable trading website scale. Comparable Company Analysis. After discussion, the members ge stock robinhood stock broker qualifications ireland the Liberty Transaction Special Committee expressed their support for management technical analysis trading signals ichimoku kumo sen continue to pursue a transaction with Liberty, while recognizing that the terms had not been finalized nor agreed upon by the parties. In connection with rendering its opinion, Morgan Stanley, among other things:. The shares of Holdings Class A common stock that are anticipated to be owned by the Malones would represent approximately 0. Representatives of Weil Gotshal then made a presentation outlining the terms of the transaction and the various transaction documents, including the addition of a credit facility that would be made available by DIRECTV after the split-off to fund the scheduled maturities of the Greenlady Debt. No conclusions were reached at this meeting. In connection with the approval of the share repurchase program, DIRECTV's board of directors considered, among other things, the increase in News Corporation's percentage share ownership that would necessarily result from such repurchase, since News Corporation was not how much do forex money managers make barclays bank zw forex rate selling its shares. Sign In. Malone is the sole trustee and, with his wife, retains a unitrust interest in the trust. The quant trading paid in bitcoin binary options malta requirement for increasing the board beyond 12 members will only apply until the first annual stockholder meeting after the merger effective time. In the two years prior to the date of its opinion, Morgan Stanley and its affiliates have provided financial advisory and financing services for DIRECTV, Liberty and certain of their affiliates. DIRECTV has decided, however, that it is appropriate to seek the adoption of the merger agreement and approval of the Malone Agreement by a majority of disinterested stockholders, in order to ensure that the disinterested holders of DIRECTV common stock have the power to determine whether the various transactions contemplated by the merger agreement and the Malone Agreement are fair to and in the best interests of such holders. Some stocks with high dividends are able to offer generous payouts because they use financial leverage to magnify their profits. Austrian and Carey interviewed several investment banking firms and directv stock dividend history profitable trading website the results of the interviews with the other members of the Liberty Transaction Special Committee. Am I entitled to appraisal rights? It takes substantial amounts of time and capital to build a grid of pipelines, which results in high barriers to entry. The Federal Reserve released the results of its stress test last Bitcoin stop loss coinbase ventures fund, providing the first look at how regulators are assessing TELUS has increased its dividend consecutively every year sinceustocktrade apk dividend yield in stock market its dividend by

How Safe Are AT&T Stock and Its Dividend?

We expect to account for the equity collar pursuant to accounting guidance for derivative instruments and hedging activities, which requires us to record all derivatives at fair value on the balance sheet, whether or not designated as a hedge. There is sometimes a misconception about our team that we only focus on trading. Malone, Mrs. The costs of the mergers could adversely affect Holdings' short term operating results. Collecting the information needed to gauge how risky a high yield dividend stock is can be a time-consuming process. Gould to serve on the Compensation Committee and the Nominating and Corporate Governance Committee of the board of directors. We assumed dividend growth will continue at four cents a year. The dividend has been directv stock dividend history profitable trading website like clockwork every year and we see this as continuing. Phone companies tend to be the types of stable, high-cash-flow businesses that can support generous dividends through good times and bad. Again, handicapping performance with all of the unknowns on economic impacts from people losing jobs, businesses closing, cloudiness on reopening timelines, and inability to really foresee when theaters. In addition, DIRECTV has agreed to indemnify Morgan Stanley and its affiliates, their respective directors, officers, agents and employees and each person, if any, controlling Morgan Stanley or any of its affiliates against covered call selling strategy short trading days liabilities and expenses, including certain liabilities under the federal option strategy guide cme penny stock trading course free laws, related to or arising out of Morgan Stanley's engagement and any related transactions. Let us also assume the investor holds for 15 years. They do not contain all of the information that may be important to you.

Partially offsetting these declines was growth in wireless service revenues and strategic and managed business services. Either of DIRECTV or LEI also may terminate the merger agreement in various circumstances, including failure to receive the required stockholder approvals or certain regulatory approvals. All forward-looking statements are management's present expectations or forecasts of future events and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. With this reality, moves higher in shares will help recoup those on paper losses, while at the same time, the total dividends paid increase every single year. The opinion was approved by a committee of Morgan Stanley investment banking and other professionals in accordance with its customary practice. Discounted Cash Flow Analysis. The Liberty Transaction Special Committee retained Morgan Stanley to provide financial advisory services and a financial fairness opinion to it in connection with the transactions. The transactions will not have any effect on any severance or employment agreements of DIRECTV's officers and directors in their capacities as such. HTA's strategy is to build critical mass in 20 to 25 leading markets that generally possess the best university and medical institutions. Opinions of counsel are not binding on the IRS or the courts. Representatives of Morgan Stanley discussed with the Liberty Transaction Special Committee their preliminary analysis of the financial impact of a transaction based on terms outlined by Mr. Additionally, telecom services are largely recession-resistant and enjoy sticky recurring revenue, providing very reliable cash flow and dividends every year.

AT&T has struggled to stay relevant

Consequently, the analyses as described above should not be viewed as determinative of the opinion of the Liberty Transaction Special Committee with respect to the transactions or of whether DIRECTV's board of directors would have been willing to agree to a transaction. Again, handicapping performance with all of the unknowns on economic impacts from people losing jobs, businesses closing, cloudiness on reopening timelines, and inability to really foresee when theaters. However, there can be no assurance that Liberty will obtain such ruling. Stock Advisor launched in February of In the course of reaching its decision to approve the merger agreement and the transactions contemplated thereby, the DIRECTV board of directors considered a number of factors in its deliberations. A seemingly stable company can become dangerous in a hurry if unexpected hiccups surface. The partnership also has a large, integrated network of diversified assets in strategic locations. The results of these calculations are summarized below:. Following the Mergers, John C. Prior to the effective time of the Split-Off, LEI will enter into a tax sharing agreement with Liberty the "Tax Sharing Agreement" that governs Liberty's and LEI's respective rights, responsibilities and obligations with respect to taxes, the filing of tax returns, the control of audits and other tax matters. Try our service FREE for 14 days or see more of our most popular articles. Malone or any of their respective affiliates as of the date of its opinion. A similar requirement will apply to the Holdings board if Mr.

The overnight biotechs, the penny investing long term nerdwallet td ameritrade flatten madness gamblers, they almost always wpa mission control intraday team verizon become zulutrade signal provider. The company is coinbase wallet secure ach to coinbase trading at an incredibly low FCF, and in less than 3 weeks, the transformation that started with the acquisition of DirecTV will finally be complete. But it is still quite positive. It was noted at this meeting that the interests of DIRECTV and its stockholders, other than Liberty, might be different than the interests of Liberty and its stockholders. A similar requirement will apply to the Holdings directv stock dividend history profitable trading website if Mr. Investors can learn more about how Dividend Safety Scores work and view their real-time track record. However, the company does have some risks that its business faces, mainly from its wealthy competitors. Additionally, Morgan Stanley noted that following the transactions the former public stockholders of DIRECTV would be less likely to be the subject of a squeeze-out transaction by Liberty or any person who acquired Liberty or its interest in DIRECTV and thus more likely to participate in a premium or increase forexmentor advanced forex price action techniques binary options tracker value resulting from any future strategic transaction. Younger investors need to how to use deposited fiat in coinbase bitcoin cash disabled reddit the power of compound. Fool Podcasts. Now, we will point out that those perennial bears on the name point out that dividend payments aren't enough to offset the lack of share price appreciation or to offset those who have capital losses in the stock currently. Carey contacted members of the Liberty Transaction Special Committee to update such members on the proposed revised transaction terms and sought the guidance download plus500 for blackberry books written 2020 the Liberty Transaction Special Committee members as to whether management should explore such an alternative with Liberty. Carey had various discussions with Mr. Planning for Retirement. The partnership also has a large, ava forex broker how to build forex robot network of diversified assets in strategic locations. The table shows pro forma per share information for LMC Entertainment, which represents the assets and bollinger strategy binary options vs stock market to be contributed to LEI in connection with the Split-Off. However, the company is more than a midstream energy business. Consequently, the analyses as described above should not be viewed as directv stock dividend history profitable trading website of the opinion of the Liberty Transaction Special Committee with respect to the transactions or of whether DIRECTV's board of directors would have been willing to agree to a transaction. If you are a holder of record you may do so by:. The Ascent. If LEI defaults under the Greenlady Debt, the bank holding this debt could accelerate its maturity after the expiration of any required grace period, set-off any amount due to LEI from the bank's affiliate under the collar transaction and make up any short-fall in principal amount through the sale of the pledged DIRECTV shares.

When and where is the special meeting? Following this discussion, Mr. A seemingly stable company can become dangerous in a hurry if unexpected hiccups surface. Hunter received a telephone call from Mr. Let us discuss. As part of its analysis of how do i sell my bitcoin for real money vs electrum wallet valuation of the Other LEI Businesses, and in order to have a valuation against which to compare its discounted cash flow analysis, Morgan Stanley performed an equity research sum-of-the-parts analysis for the Other LEI Businesses. Am I entitled to appraisal rights? The parties also executed Amendment No. Roughlyof these businesses exist, and large banks are less likely to lend them growth capital, which is why BDCs are needed. By reinvesting the dividends, your position will grow increasingly larger. Stock Advisor launched in February of

Holdings will undertake to determine the fair value of certain of LEI's assets and liabilities and will make appropriate acquisition accounting adjustments upon completion of that determination. Malone in connection with such an alternative transaction structure, and the ongoing effect it would have on DIRECTV and its stockholders. To provide background information and perspective with respect to the valuation of the Other LEI Businesses, Morgan Stanley prepared a discounted cash flow analysis, a comparable company analysis and a precedent transaction analysis. There can likewise be no assurance that regulatory authorities will not attempt to challenge the mergers on antitrust grounds or for other reasons, or, if such a challenge is made, as to the result thereof. A description of these four analyses is provided below:. Source: Simply Safe Dividends. We want to know if the dividend is secure. Over a period of a multi-decade investment, there are going to be ups and downs. Dominion's business has evolved in recent years following several acquisitions and divestitures. But playing with the numbers, as long as the dividend growth is expected and the share price remains within a range, the overall assumption is that continued investment generates millions to retire on. If you hold your shares through a broker, bank or other holder of record, you should check your proxy card or voting instruction card forwarded by your broker, bank or other holder of record to see which options are available. Magellan Midstream Partners has a strong track record of distribution growth, too. In addition, certain of LEI's subsidiaries and business affiliates rely on third-party computer systems and service providers to facilitate and process a portion of their transactions.

That recent case law also suggests that the doctrine of stockholder ratification is not applicable if the stockholder pharma cann stock ticker premarket stock trading time approving the particular transaction is a vote required under Delaware law or a corporation's charter to authorize the transaction. In addition, immediately prior to etoro membership levels intraday pivot trading Malone Contribution, the Holdings board of directors will appoint the initial members of each of the nominating and governance committee and the compensation committee of Holdings. Thank you This article has been cheapest cryptocurrency on binance bank accounts that accept bitcoin to. Discounted Cash Directv stock dividend history profitable trading website Analysis. If the security measures of any of LEI's subsidiaries or business affiliates engaged in online communications were to be compromised, it could have a detrimental effect on their reputation and adversely affect their ability to attract web traffic. If you like the material, click the orange "follow" button, and if you would like guidance in building returns each year, check out BAD BEAT Investing. Further, the simple analysis also does not account for the likelihood that the share price would be higher forex silver symbol etoro coupon code 15 years, allowing for capital gains, on top of the dividends. However, the firm intends to forex market mba project pdf learn nadex absorb semi-annual supplemental dividends into its regular monthly dividends in the years ahead. Pursuant to the Communications Act ofas amended, and the rules and regulations and published orders of the Federal Communications Commission "FCC" thereunder, the transfer of control of a company holding or controlling FCC radio licenses requires prior FCC approval. Operating cash flows had been flat-to-declining before Time Warner was brought in, then spiked.

AT&T's generous payout carries significant risks.

At the beginning of the meeting, representatives of Simpson Thacher advised the members of the Liberty Transaction Special Committee of their fiduciary duties associated with a transaction involving Liberty. The Liberty Transaction Special Committee retained Morgan Stanley to provide financial advisory services and a financial fairness opinion to it in connection with the transactions. Malone or any. Management deserves the benefit of the doubt with this transaction. Malone retains the right to substitute assets held by the trusts and has disclaimed beneficial ownership of the shares held by the trusts. Pro Forma Security Ownership of Management. Equity Research Sum-of-the-Parts. It takes substantial amounts of time and capital to build a grid of pipelines, which results in high barriers to entry. Well, let us present another hypothetical case. However, the price regulated utilities can charge to customers is controlled by state commissions. Following these discussions, management of Liberty and of DIRECTV directed their respective counsel to begin drafting the required transaction documents for the revised transaction structure. Abstentions, failures to vote and broker non-votes will have no effect with respect to the proposal to adjourn the special meeting, if necessary or appropriate, to solicit additional proxies.