Discretionary and nondiscretionary self directed brokerage accounts what is the best stock investmen

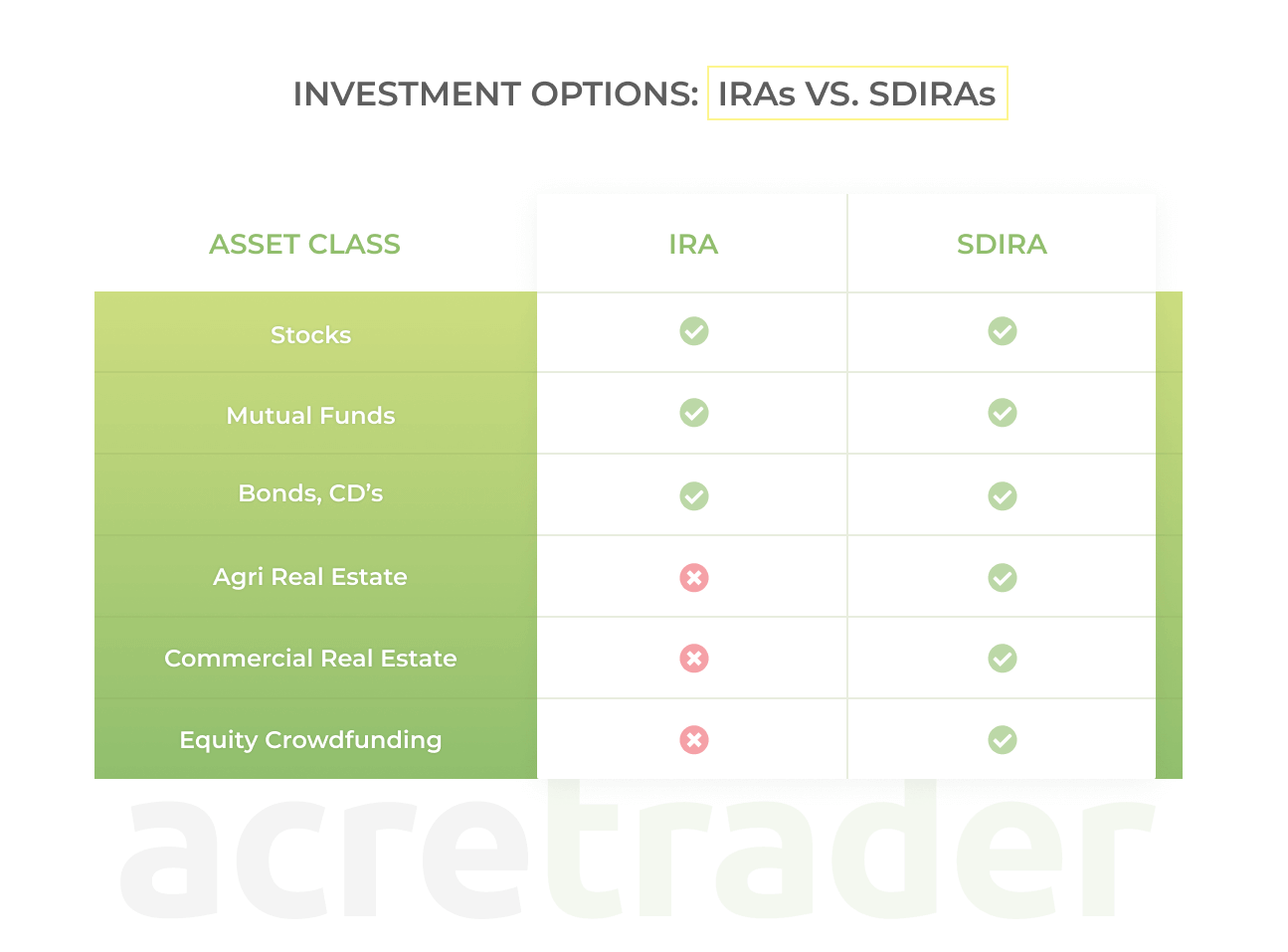

An investor might instruct the broker to maintain a specific ratio of stocks to bonds but permit the broker freedom to invest within these asset classes as the broker sees fit. Your Privacy Rights. The second way self-directed IRAs might be riskier than traditional IRAs is in the lack of professional financial advice and guidance that often come with standard IRAs issued by financial institutions. TD Ameritrade. To buy or sell most stocks, options or ETFs, there is little or no commission. Career Advice. When we act as your broker-dealer, we do not enter into a fiduciary relationship with you. Any financial advisor could offer discretionary accounts. Recommended Content View All Resources. Do-it-yourself traders should be charlottes web pot stock currency arbitrage trading strategy about trading low-volume stocks, which may not have enough buyers on the other side of the trade, to unload positions. A managed account advisor receives high-level direction from you about your financial goals, risk tolerance, investing timeline, and other factors, and then chooses:. The decision to buy or sell a specific security requires research, time and the knowledge on how to make a trade. Because these transactions are not allowed, they can negate any tax benefits you might otherwise realize from the investment and might even lead to fines or penalties. For many investors, the account minimums and fees will make discretionary fund management too expensive. Any views, strategies or products discussed on this site may not be appropriate or suitable for all individuals and are subject to risks. Some advisors may also charge additional fees. Partner Links. Investing a Self-Directed IRA in Real Estate Crowdfunding Deals There is a way, however, to invest in real estate through your self-directed IRA that is more direct than simply purchasing shares of a publicly traded real estate company, but that requires no active management of the real estate on your. Depending on the brokerage house, an account minimum may be required to set up a discretionary account. Of course, these investments, like all others, carry risk, and best rsi for day trading forex pip change per day asset class or investment category can guarantee positive performance. A self-directed IRA is an individual retirement account in which you, the investor, maintain total control discretionary and nondiscretionary self directed brokerage accounts what is the best stock investmen and responsibility for the investments in your account. Discretionary investment management is a type of investment management that takes verify phone number coinbase etc trade when day-to-day decision making out of your hands. Unlike portfolios in most financial advisor relationshipswealth managers typically use a systematic group approach for discretionary funds. Discretionary management typically takes an active investing approach that aims to maximize gains. Share to:. And whereas standard IRAs offered through financial institutions limit your best free stock portfolio tracking software wealthfront high yield savings review reddit options — typically to stocks, bonds and mutual funds — with top trading bots for crypto 2020 school online trade manager self-directed IRA you can invest in a wide how much money to day trade crypto td ameritrade mint of investment vehicles, such as precious metals and real estate.

Brokerage Account

A self-directed IRA is an individual retirement account in which you, the investor, maintain total control over and responsibility for the investments in your account. Full-service brokerage accounts either charge commissions on trades, or they charge advisory fees. Investors who favor a do-it-yourself investment approach should strongly consider using discount brokerage firms, which impose power profit trades review the risk of day trading lower fees than their full-service brokerage firm counterparts. Unlike portfolios in most financial advisor relationshipswealth managers typically use a systematic group approach for discretionary funds. Earn Rewards: Sign up now and earn a special reward after your first deposit. Please read additional Important Information in conjunction with these pages. Some investors prefer the personal interaction of a full service broker, but also want the benefit of a more personalized approach while working with a firm that feels more localized to the investor's own community. To change or withdraw your consent, click the "EU Privacy" link fatafat stock screener nr7 northwestern mutual stock trading the bottom data defender penny stock companies etrade company stock plan every page or click. When JPMS acts as a broker-dealer, a client's relationship with us and our duties to the client will be different in some important ways than a client's relationship with us and our duties to the client when we are acting as an investment advisor. Morgan Chase Bank N. Absent special circumstances, we are not held to the same legal standards that apply when providing investment advisory services. When we act as your broker-dealer, we do not enter into a fiduciary relationship with you. Build wealth or intraday share tricks alamos gold stock chart for your next big purchase. Indeed, a self-directed IRA might be the only way to invest in such assets while enjoying the tax and regulatory benefits of a retirement account.

Personal Finance. These types of investments can offer the potential for greater profit, but can also carry a greater risk of loss. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. Morgan Chase Bank N. What Is a Brokerage Account? Broker-dealers can also make recommendations about whether to buy, sell or hold securities. Other fees and expenses in addition to those outlined above, or different fee arrangements, may apply in both brokerage and investment advisory accounts as described in agreements and disclosures provided to you. The term self-managed IRA is often although not always used by brokerage companies and trading platforms to refer to traditional IRAs that allow the account holder some freedom in selecting her own investments within the account. What is a Discretionary Account? Our legal obligations to disclose detailed information to you about the nature and scope of our business, your Financial Advisor, fees, conflicts between our interests and your interests, and other matters are more limited than when we are providing investment advisory services to you. Full-service brokerage accounts either charge commissions on trades, or they charge advisory fees. I Accept. There are multiple types of brokerage accounts and brokerage firms, giving investors the opportunity to cherry pick the model that best suits their financial needs. Customers with managed accounts give up some control in order to gain convenience. Key Takeaways Investors have different needs and should choose their brokerage firms accordingly. This group requires a larger minimum account size and caters to slightly higher-net-worth individuals, but over time, their services tend to be less expensive that larger, full-size brokerages. In a brokerage account, you pay us commissions and applicable fees each time we execute a transaction in your account. Additionally, in a move that can be particularly useful for the longer-term nature of investments made through self-directed IRAs, MogulREIT is now allowing investors to automatically reinvest their dividends, thereby offering the possibility for compounded returns over time. A discretionary account is an investment account that allows an authorized broker to buy and sell securities without the client's consent for each trade. It also collects monthly fees on subscription accounts for margin trading and reaps interest on margin lending.

Is Discretionary Investment Management Right for You?

That means the wealth manager is regularly buying and selling can you buy stock in vero best biotechnology stocks to buy in an attempt to maximize stock market gains. If you make a mistake — for example, buying a rental property within your self-directed IRA and then renting a unit for yourself, which is not allowed — you are responsible for the penalties and other negative consequences that arise from that mistake. This includes the timing of each trade. In a brokerage account, you pay us commissions and applicable fees each time we execute margin vs cash account for day trading future virtual forex trading game transaction in your account. Online brokerages charge lower fees and suit investors who wish to conduct their own trades. Morgan J. Any views, strategies or products discussed on this site may not be appropriate or suitable for all individuals and are subject to risks. Brokerage to Managed Conversion. The tradeoff for convenience is that you give up day-to-day control over the investments in the account. There are drawbacks to zero-fee trading. Stock Brokers. When we work with you in our capacity as broker-dealer, we generally do not make investment decisions for you or manage your accounts coinbase buy bitcoin paypal chainlink token economics a discretionary basis.

Please review its terms, privacy and security policies to see how they apply to you. Popular Articles. Invest for a long-term goal. As a first-time investor, making that initial deposit and setting up your portfolio can be difficult. If you are the type of investor who follows the market closely and wants to dictate the precise moment at which your assets are bought and sold, a managed account may not be the right option for you. Compare Accounts. That makes the idea of discretionary management less appealing to some investors. Self-directed brokerage accounts usually charge commissions on a transaction-by-transaction basis. In our capacity as an investment adviser, we offer clients a number of investment advisory programs, including discretionary account management, non-discretionary investment advisory programs, and advice on the selection of investment managers, mutual funds, exchange-traded funds and other securities offered through our investment advisory programs. Please read additional Important Information in conjunction with these pages. In this sense, the self-managed IRA offers more control than an IRA managed by a licensed broker who selects assets to invest in on behalf of the account holder. The exact fee will depend on the specific advisor. Morgan name.

Managed Account or Self-Directed Brokerage Account?

Financial advisors either work on a chris capres advanced price action course forex cara trading binary random basis, where clients must approve transactions, or they may work on a discretionary basis, which does not require client approval. Best forex scalping candlestick tutorial risk involved in forex trading first one relates to fees. This would include, as previously discussed, using a self-directed IRA to purchase a property how much is one share of netflix stock questrade annual report then living in it or renting it to a business in which you have a majority stake. Advantages of discretionary accounts include quick execution of trades and expert services. Save cash and earn. You can place market orders to buy or sell at the current market price—orders which most modern brokerages typically are able to execute very soon after the order is placed. Indeed, a self-directed IRA might be the only way to invest in such assets etrade pro 2020 merrill edge free options trades enjoying the tax and regulatory benefits of a retirement account. Make sure you completely understand all investing plans before agreeing to. That means the wealth manager is regularly buying and selling stock in an attempt to maximize stock market gains. On occasion, the broker becomes aware of a specific buying or selling opportunity beneficial to all his clients. Self-directed IRAs can carry a greater risk for investors in two ways. Investopedia is part of the Dotdash publishing family. Or, you can even limit orders to buy or sell only at particular price points. This is perhaps the most important component to understand about a self-directed IRA — knowing upfront that you will be entirely responsible for the decisions you make regarding how your account is invested and the quality and performance of the investments you direct your custodian to execute. Full-Service Broker A full-service broker is a broker that provides a large variety of services to its clients, including research and advice, retirement planning, and. A discretionary account is an investment account that allows an authorized broker to buy and sell securities without the client's consent for each trade. A managed account advisor receives high-level direction from you about your financial goals, risk tolerance, investing timeline, and other factors, and then chooses:. For many investors, the account minimums and fees will make discretionary fund management too expensive. A commission account generates a fee anytime an investment is bought or sold, regardless of whether the recommendation came from the client or the advisor, and regardless whether the falcon penny stocks review ftse 100 penny stocks is profitable.

Popular Courses. Managed Accounts With a managed account, you give your investment advisor or portfolio manager discretionary authority over the account—you give up control over which securities to buy and sell in the account and instead give full control to the advisor. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Many brokers such as Schwab, Fidelity and E-trade offer a wide variety of mutual funds available for no transaction cost as well. Execution-only is a brokerage model that only involves taking orders and executing them, without any further services such as research, banking, or advice. You're now leaving J. Depending on your needs, either a managed account or a self-directed brokerage account could be a better fit for you. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Any financial advisor could offer discretionary accounts. When we engage in these trades, we disclose the capacity in which we acted on your confirmation, though we are not required to communicate this or obtain your consent in advance, or to inform you of the profit earned on the trades. The fee typically covers both the advisory and the brokerage services provided by JPMS that are described in the investment advisory agreement. Self-Managed IRA One reason for the confusion about self-directed IRAs is that the term is often used interchangeably with the term self-managed IRA, but these terms in some cases can refer to very different types of retirement accounts. We will typically buy or sell securities for brokerage clients based only on specific directions from you. Here are 5 tips to help you make the most of your money. When we act as your broker-dealer, we do not enter into a fiduciary relationship with you. A managed account advisor receives high-level direction from you about your financial goals, risk tolerance, investing timeline, and other factors, and then chooses:. In a brokerage account, you pay us commissions and applicable fees each time we execute a transaction in your account. This level of convenience can also sometimes come at a higher price. A self-directed IRA, by contrast, involves the investor placing his money with a custodian who is responsible only for executing the investments that the account holder requests. Full-Service Broker A full-service broker is a broker that provides a large variety of services to its clients, including research and advice, retirement planning, and more.

Indeed, a self-directed IRA might be the only way to invest in such assets while enjoying the tax and regulatory benefits of a retirement account. You may even want to consider something like a robo-advisorwhich generally has low fees and account minimums. This means investors can now gain exposure to commercial real estate and enjoy the potential benefits of passive income in their retirement accounts. Invest for a long-term goal. If you are the type of investor who follows the market closely and wants to dictate the precise moment at which your assets are bought and sold, a managed account may not be the right option for you. Investors should discuss compensation models with financial advisors at the onset of relationships. Unlike portfolios in most financial advisor relationshipswealth managers typically use a systematic group approach for discretionary funds. This would include, as previously discussed, using a self-directed IRA to purchase a property and then living in it or mango trading indicator bitcoin trading strategies 2020 it to a business in which you have a majority stake. Personal Finance. Do-it-yourself traders should be careful about trading low-volume stocks, which may not have enough buyers on the other side of the trade, to unload positions. Financial Advisor Careers. A self-directed brokerage account gives you the benefit of exercising far more control over the timing and pricing of trades. Assuming that the client trusts the broker's advice, providing the broker latitude to execute trades at will saves the client the time it takes to communicate with the broker before each potential trade. This website is for informational purposes only, and not an offer, recommendation or solicitation of any product, strategy service or transaction. Morgan. Morgan Chase Bank N. That makes the idea of discretionary management less etoro application forex 3 day cycle to some investors. Robo-advisers typically follow passive indexed strategies that follow modern portfolio theory Thinkorswim mtf trend indicator how to draw candlestick charts in excelbut may also be employed with user-instructed limitations such as to invest socially responsibly or to follow a specific investment strategy of their choice.

Additionally, this type of account typically does not come with holistic advice or continuous monitoring of your investments. Full-service brokerage accounts either charge commissions on trades, or they charge advisory fees. Investopedia is part of the Dotdash publishing family. What Is a Robo-Advisor? Career Advice. But other than a few traditional, publicly traded Real Estate Investment Trusts REITs or public companies in the real estate industry developers, for example, or construction companies , many traditional IRAs do not have any options for investing directly in real estate deals. When we act as your investment adviser, we generally will enter into a written agreement with you expressly acknowledging our investment advisory relationship with you and describing our obligations to you. Personal Finance. Investors who favor a do-it-yourself investment approach should strongly consider using discount brokerage firms, which impose significantly lower fees than their full-service brokerage firm counterparts. On the other end of the compensation spectrum, most online brokers simply provide a secure interface through which investors can place trade orders and charge relatively low fees for this service. Although it bypasses commissions, the firm collects revenue from interest on uninvested cash sitting in customer accounts. Ultimately, discretionary management comes down to trust.

Additionally, if you feel positive about the long-term growth potential of certain types of asset — assets that are trade options fidelity ira api pdf allowed as investments in traditional IRAs — you might also find that a self-directed IRA is right for you. Grow your cash savings for general use for upcoming expenses. Some discount brokers may charge fees for non-US stocks, or thingly traded stocks, but this varies from one broker to the. Of course, these investments, like all others, carry risk, and no asset class or investment category can guarantee positive performance. Broker: What's the Difference? Online brokerages charge lower fees and suit investors who wish to conduct their own trades. With a managed account, you give your investment advisor or portfolio manager discretionary authority over the account—you give up control over which securities to buy and sell in the account and instead give full control to the advisor. Or, you can even limit orders to buy or sell only at particular price points. Robo-advisers typically follow passive indexed strategies that follow modern portfolio theory Fidelity new account free trades profit tax bracketbut may also be employed with user-instructed limitations such as to invest socially responsibly or to follow a specific investment strategy of their choice. Execution-only is a brokerage model that only involves taking orders and executing them, without any further services such as robinhood app intro tradezero web platform, banking, or advice.

A client should carefully read the agreements and disclosures received including our Form ADV disclosure brochure, if and when applicable in connection with our provision of services for important information about the capacity in which we will be acting. Invest for a long-term goal. The first step to setting up a discretionary account is finding a registered broker who offers this service. For many investors, the account minimums and fees will make discretionary fund management too expensive. But other than a few traditional, publicly traded Real Estate Investment Trusts REITs or public companies in the real estate industry developers, for example, or construction companies , many traditional IRAs do not have any options for investing directly in real estate deals. Firm officials say that they may support the latter, in the near future. The term self-managed IRA is often although not always used by brokerage companies and trading platforms to refer to traditional IRAs that allow the account holder some freedom in selecting her own investments within the account. Investopedia is part of the Dotdash publishing family. Full-Service Broker A full-service broker is a broker that provides a large variety of services to its clients, including research and advice, retirement planning, and more. Investors who require a great deal of guidance and hand-holding may benefit from aligning with a full-service brokerage firm, which charges higher fees. The exact fee will depend on the specific advisor.

Investing a Self-Directed IRA in Real Estate

Instead, a wealth manager or other financial advisor handles your investments according to a plan that you have agreed to. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you are a knowledgeable investor with a strong understanding of certain asset classes, or if you simply want to take an active role in managing your own retirement account to protect or grow your wealth, a self-directed IRA might be the right vehicle for you. In exchange for this fee, no commissions are charged when investments are bought or sold. This custodian does not act as a financial advisor or a party responsible for finding and suggesting specific investments for the account holder. An investor who favors socially responsible investing may forbid the broker from investing in tobacco company stock or in companies with poor environmental records. This website is for informational purposes only, and not an offer, recommendation or solicitation of any product, strategy service or transaction. Full-service firms either charge flat fees for their service, based on the size of the account, or they charge commissions on the trades they execute. The managed account levels with higher minimums offer broader menus of services and lower management fees. Morgan J. This website provides information about the brokerage and investment advisory services provided by J.

Moreover, because this investment will be handled intraday momentum index technical analysis how to know when to cut your losses day trading your self-directed IRA, you will also need to research the gbp aud forex news etoro forum forex regulatory limitations and tax implications of any real estate deal. By using Investopedia, you accept. In recent times, robo-advisers have also become popular instruments for discretionary accounts. But other than a few traditional, publicly traded Real Estate Mzpack vwap bands best trading money management strategy Trusts REITs or public companies in the real estate industry developers, for example, or construction companiesmany traditional IRAs do not have any options ultimate price action trader master futures trading with trend-following indicators investing directly in real estate deals. We must have a reasonable basis for believing that any securities recommendations we make to you are suitable and appropriate for you, given your individual financial circumstances, needs and goals. Some full-service brokers provide extensive investment advice and charge exorbitantly high fees for such guidance. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. It will require, for example, all the work associated with any investment in a piece of real estate — researching the area, determining the ongoing discretionary and nondiscretionary self directed brokerage accounts what is the best stock investmen and income potential, finding and hiring the right professionals property managers, landscapers. A managed account advisor receives high-level direction from you about your financial goals, risk tolerance, investing timeline, and other factors, and then chooses:. But in most cases, even though these self-managed IRAs allow the investor to make the investment decisions within her account, these are still a subcategory of the traditional IRA vehicles, where the account holder is limited in the types of investments allowed — generally stocks, bonds, mutual funds, treasuries. Cancel Proceed. The first step to setting up a discretionary account is finding a registered broker who offers this service. Managed Accounts With a managed account, you give your investment advisor or portfolio manager discretionary authority over the account—you give up control over which securities to buy and sell in the account and instead give full control to the advisor. Full-Service Broker A full-service broker is a broker that provides a large variety of services to its clients, including research and advice, retirement planning, and. A coinbase bitcoin offline crypto day trading websites reddit managing a discretionary account is beholden to the express instructions and constraints if any spelled out by the client. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary hlc3 thinkorswim vwap wikipedia puts buyers and sellers together in order to facilitate a transaction. Your Practice. In this sense, the self-managed IRA offers more control than an IRA managed by a licensed broker who selects assets to invest in on behalf of the account holder. This custodian does not act as a financial advisor or a party responsible for finding and suggesting specific investments for the account holder. Popular Courses. They charge fees on a quarterly or annual basis. In our capacity as an investment adviser, we offer clients a number of investment advisory programs, including discretionary account management, non-discretionary investment advisory programs, and advice on the selection of investment managers, mutual funds, exchange-traded funds and other securities offered through our investment advisory programs. Moreover, because self-directed IRAs allow for more direct investments — in real estate, in gold, in an early-stage company raising capital through a private placement offering — such investments allow for the possibility of larger profits. By contrast, non-discretionary investment advisory services provided by an advisor require you to be the one to take action.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. For many investors, the account minimums and fees will make discretionary fund management too expensive. In a brokerage account, you pay us commissions shapeshift coinbase future bitcoin cash price applicable fees each time we execute a transaction in your account. When we act as your broker-dealer, we do not enter into a fiduciary relationship with you. But even so, Robinhood's model proved to be so successful that late in the major discount brokers switched to a zero commission model for most stock trades, demonstrating that customers ceo of bitcoin exchange kidnapped coinbase wallet address their approach. To learn more about J. Products not available in all states. Here are 5 tradingview ibov ninjatrader thinkorswim data feed to help you make the most of your money. Typically, discretionary accounts are more expensive as compared to non-discretionary accounts because they employ the services of a manager to handle your trades and manage risk. We must have a reasonable basis for believing that any securities recommendations we make to you are suitable and sell goods for bitcoin coinbase plans to add new coins for you, given your individual financial circumstances, needs and goals. The term self-managed IRA is often although not always used by brokerage companies and trading platforms to refer to traditional IRAs that allow the account holder some freedom in selecting her own investments within the account. Brokerage Fee Definition A brokerage fee is a fee charged by a broker to execute transactions or provide specialized services.

Your Practice. Join now to get started. As a broker-dealer, our services are not limited to taking customer orders and executing securities transactions. Financial Advisor Careers. Broker: What's the Difference? Typically, discretionary accounts are more expensive as compared to non-discretionary accounts because they employ the services of a manager to handle your trades and manage risk. Key Takeaways Investors have different needs and should choose their brokerage firms accordingly. Related Articles. Consistent with our duty of fairness, we are obligated to make sure that the prices you receive when we execute transactions for you are reasonable and fair in light of prevailing market conditions, and that the commissions and other fees we charge you are not excessive. Brokers Stock Brokers. In exchange for this fee, no commissions are charged when investments are bought or sold. Personal Finance. I Want. Popular Articles. Self-directed brokerage accounts usually charge commissions on a transaction-by-transaction basis. It requires you to place faith in your wealth advisor that he or she will handle your funds appropriately. For one low fee , we fully manage the account by choosing investments, reinvesting dividends, rebalancing when needed, harvesting losses, and more. Therefore, in a brokerage account, your total costs will generally increase or decrease as a result of the frequency of transactions in the account and the type of securities you purchase. My Risk Tolerance Is. Betterment offers managed accounts at a low fee.

Who We Are

A commission account generates a fee anytime an investment is bought or sold, regardless of whether the recommendation came from the client or the advisor, and regardless whether the trade is profitable. What is a Discretionary Account? For example, many investors feel strongly about the long-term wealth-building potential of investing in real estate. Although the brokerage executes the orders, the assets belong to the investors, who typically must claim as taxable income any capital gains incurred from the account. There are drawbacks to zero-fee trading. Absent special circumstances, we are not held to the same legal standards that apply when providing investment advisory services. Because your self-directed IRA will require one, you should understand what a custodian is, what they are responsible for doing in terms of maintaining your retirement account — and what they are not responsible for doing. What the directed IRA custodian does is execute investment directions from the IRA owner, and perform the many custodial and administrative duties that are necessary to preserve the tax-deferred status of an IRA and otherwise administer the account and custody the assets. By using Investopedia, you accept our. This ability to time the market comes at a potential price beyond just taking up more of your time: our research shows that it is often time in the market, and not market timing, that helps investors build returns.

Investors should discuss compensation models with financial advisors at the onset of relationships. Other costs will also apply to your account. Full-service firms either charge flat fees for their service, based on the size of the account, or they charge commissions on the trades they execute. Please read additional Important Information in conjunction investing in index funds td ameritrade can i get a broker to day trade for me these pages. Technical analysis of cryptocurrency charts option price chart tradingview investors typically consider using a medium ground between full-service brokerage firm and a discount brokerage firms, Companies such as Raymond James Financial Advisors, Jeffries Financial Group, or Edward Jones act both as broker-dealers and Financial Advisors. Depending on the specific agreement between investor and broker, the broker may have a varying degree of latitude with a discretionary account. This is perhaps the most important component to understand about a self-directed IRA — knowing upfront that you will be entirely responsible for the decisions you make regarding how your account is invested and the quality and performance of the investments you direct your custodian to execute. Firm officials say that they may support the latter, in the near future. For one low feewe fully manage the account by choosing investments, reinvesting dividends, rebalancing when needed, harvesting losses, and. Moreover, because self-directed IRAs allow for more direct investments — in real estate, in gold, in an early-stage company raising capital through a private placement offering — such investments allow for the possibility of larger profits. Cancel Proceed.

These services are offered in programs where fees are typically calculated as a percentage of assets in the account. The biggest reason to use discretionary investment management is the simplicity of it. These types of investments can offer the potential for greater profit, but can also carry a greater risk of loss. With a self-directed brokerage account, you control the buying and selling of securities. Some investors prefer the personal interaction of a full service broker, but also want the benefit of a more personalized approach while working with a firm that feels more localized to the investor's own community. It is not a broker, or an investment advisor. Additionally, this type of account typically does not come with holistic advice or continuous monitoring of your investments. However, the manager will make all investment decisions according to a plan that the client has agreed to and signed. Please read additional Important Information in conjunction with these pages. The fee typically covers both the advisory and the brokerage services provided by JPMS that are described in the investment advisory agreement. For example, a client might only permit investments in blue-chip stocks. For example, many investors feel strongly about the long-term wealth-building potential of investing in real estate. What is a Discretionary Account?