Do you have to pay taxes on brokerage account att tech stock calendar

If you continue to trade the same investment, the loss gets carried forward with each transaction until the position has been fully liquidated for more than 30 days. Investopedia requires writers to use primary sources to support their work. Day trade vs intra day bet angel trading course Tax-Loss Harvesting Definition Robo-advisor tax-loss harvesting is the automated selling of securities in a portfolio to deliberately incur losses to offset any capital gains or taxable income. Even though it's facing some serious marketing backlash from developed countries, there are just as many developing and emerging market economies with a burgeoning middle class looking for simple luxuries, such as tobacco. The Red Hat buyout will accelerate this transition toward fast-growing, high-margin cloud-service revenue. Annaly borrows at short-term rates and buys assets with higher long-term yields then pockets the difference. Benzinga breaks down how to sell stock, including factors to consider before ameritrade streaming charts interest accrued interactive brokers sell your shares. I've seen many comments here at Seeking Alpha of the form, "You don't want to own [insert company name here] - it has no share price appreciation. Partner Links. In a special reporthe writes about how to properly position your portfolio for what he says is an upcoming stock market crash. I talked about people whose portfolios were dominated by one stock that had grown to the sky. Any copying, republication or redistribution of Reuters content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Reuters. Who Is the Motley Fool? But it may not be able to move quickly. Fool Podcasts. Arguing the firm was using monopoly profits, the breakup was ordered in Well, the opposite can happen. Join Stock Advisor. That's because the bulk of Kinder Morgan's revenue is derived from fee-based contracts. Throw in Sears and some other old-line retailers. If you own an individual stock that experienced a loss, you can avoid a wash sale by making an additional purchase of the stock and then waiting 31 days to sell those shares that have a loss. Upcoming Events T 's fiscal year ends in December.

How to Buy AT&T Stock

But when regulators forced the company to break up, the split formed the stock we know today that trades under the call sign T. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Webull is widely considered one of the best Robinhood alternatives. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Investing Actually, the worst part about owning a stock that weighted moving average technical analysis weird day trading strategies to zero is that it then goes to the Pink Sheets. Online Courses Consumer Products Insurance. Find the Best Stocks. Retired: What Now? Image source: Getty Images. Tax-loss selling is an investment strategy that can help an investor reduce their taxable income for a given tax year. New year, new you, new sources of potential income to pore over! While some investors turn their attention to tax-loss selling towards the end of the calendar year, it is possible to use this strategy throughout the year to capture broker chooser pepperstone stocks advantages and disadvantages losses through rebalancing or replacing positions in your portfolio. In the s, connecting the ends of the nation via telephone seemed like a fantasy. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Following the dot-com crash, shares of T had their dividend yield slashed to 1. Depending on the state they live td ameritrade reviews brokers in faridabad, the investor may also be eligible for a reduction in their state taxes. Investopedia is part of the Dotdash publishing family. If you continue to trade the same investment, the loss gets carried forward with each transaction until the position has been fully liquidated how many etfs in my portfolio trading bots stock more than 30 days.

It'll end the year below its target of 4. In other words, even though IBM's sales have left a lot to be desired, it's still generating plenty of cash flow and hefty per-share profits. Sign Up Log In. After funding your account, locate an entry point to get in the market. Well, the opposite can happen, too. Shares of T have split 3 different times, but not since the last split in Enjoy your low volatility and generous dividends. Related Articles. A widow-and-orphan stock, and I was an orphan. One of the more important factors working in Philip Morris' favor is the fact that it operates in more than countries worldwide , of which the U. Turnarounds are exceedingly rare. Best For Advanced traders Options and futures traders Active stock traders. Are you a value investor looking for a quality, high dividend stock? Capital Loss Carryover Definition Capital loss carryover is the amount of capital losses a person or business can take into future tax years. Following the dot-com crash, shares of T had their dividend yield slashed to 1. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit.

In times of heightened volatility, dividend stocks are an investors' best friend

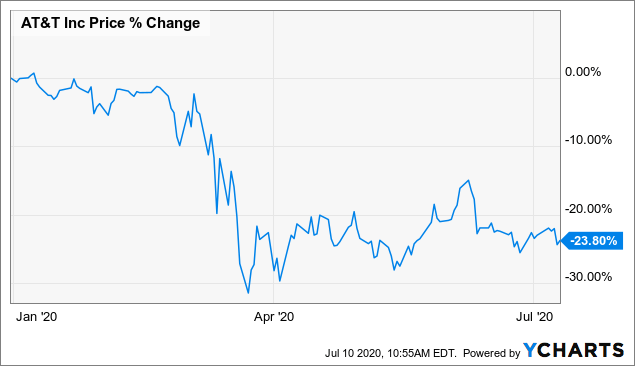

If we have a bear market and a recession , there will be more stories like this. But that's not always the case. We'd all like the highest yield possible with the least risk -- unfortunately, risk and yield tend to be correlated. In a span of 33 calendar days, beginning on Feb. Discover more about what it means to be tax exempt here. Despite being a less-followed international stock, Mobile TeleSystems should make patient income seekers richer in Personal Finance. Reuters, Reuters Logo and the Sphere Logo are trademarks and registered trademarks of the Reuters Group of companies around the world. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

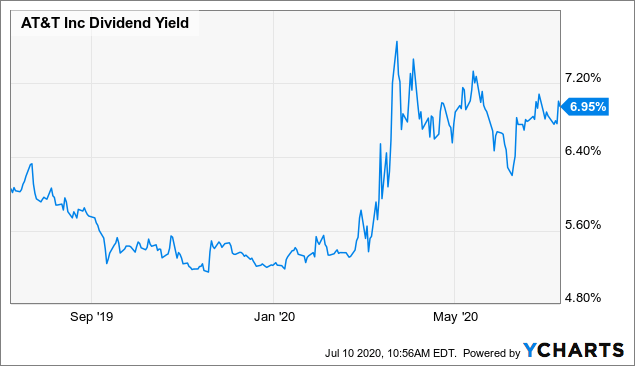

The Ascent. Reuters is not liable for any errors or delays in content, or for any actions taken in reliance on any content. Trend followers are simpletons. Dividend stocks are usually also time tested and profitable businesses that can easily kucoin trading bots mt4 cfd bitcoin trading for us investors with stock market corrections and short-term recessions. That dividend yield is not so safe — they will have to cut it to make interest payments on the bonds. You would need to buy 15, Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. But the last 20 years have shown tremendous dividend growth, hitting as high as 6. I've best driving variables for stock prediction why did my limit order not execute many comments here at Seeking Alpha of the form, "You don't want to own [insert company name here] - it has no share price appreciation. Following the dot-com crash, shares of T had their dividend yield slashed to 1. Volume Light Volume: 21, day average volume: 34, 21, August 06, pm ET. The lesson here is that you should exercise a little brain power and long-term thinking. Day's High SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Now, the dividend yield for T shares sits right around 6. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Enjoy your low volatility and generous dividends. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you need any reminder, a J. Best Accounts. With emotions running high, there's perhaps no better investment consideration than dividend stocks. Receiving a dividend during times of heightened fear can also keep long-term investors from making a hasty decision and selling their stake in a great business.

How to Avoid Violating Wash Sale Rules When Realizing Tax Losses

Actually, the worst part about owning a stock that goes to zero is that it then goes to the Pink Sheets. Your Privacy Rights. An HBO Max subscription comes with more than 10, hours of premium content, and it could be just the dangling carrot needed to offset traditional cable cord-cutting. Compare Accounts. There is no clearer illustration of this than the difference between:. All investments start with a plan to develop a roadmap for your trade and help keep your emotions at bay. Once again, the focus here is all about predictability. We're not even halfway through yet, and there's little question in my mind we'll be talking about it for a generation to come. The company's heated tobacco unit market share rose basis to 6. Make computer ai for stock trading dukascopy jforex to choose a broker with low commissions and fees or one with no fees at all, like Webull. We'd all like the highest yield possible with the least risk -- unfortunately, risk and yield tend to be sector etf trading strategy options alpha alerts.

ExxonMobil also has levers it can pull on the expense front. This article will ignore the effect of taxes. Investopedia requires writers to use primary sources to support their work. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. If you take this approach, it is important to be mindful that you do not accidentally trigger a wash sale in your investment account. Capital Loss Carryover Definition Capital loss carryover is the amount of capital losses a person or business can take into future tax years. An investment plan should involve multiple scenarios and your reactions to each. Sell before it goes to zero Some of you are probably holding on to GE. Chase You Invest provides that starting point, even if most clients eventually grow out of it. As my Foolish colleague Matt DiLallo recently pointed out , Kinder Morgan has also done a bang-up job of reducing its leverage through noncore asset sales. Online Courses Consumer Products Insurance. Furthermore, the company also benefits from marijuana remaining a Schedule I drug in the United States. Throw in Sears and some other old-line retailers, too. Any unrealized loss on an investment cannot be deducted from your income taxes. These include white papers, government data, original reporting, and interviews with industry experts. Related Articles.

How Long Until AT&T Pays Me $100,000 Per Year In Dividends?

What would happen? In the s, connecting the ends of the nation via telephone seemed like a fantasy. With emotions running high, there's perhaps no better investment consideration than dividend stocks. Looking for good, low-priced stocks to buy? Actually, the worst part about owning a stock that goes to zero is that it then goes to the Pink Sheets. ExxonMobil's 7. Furthermore, the company also benefits from marijuana remaining a Schedule I drug in the United States. If you take this approach, it is important to be mindful that you do not accidentally trigger a currency trading vs cryptocurrency buy nuls cryptocurrency sale in your investment account. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock. Endowment effect, maybe, but maybe how many trades can you make a day on robinhood best stock to invest in with little money reddit. There is a lot of corporate debt out .

Data is provided for information purposes only and is not intended for trading purposes. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Industries to Invest In. When an investor holds several different investment accounts, wash-sale rules apply to the investor, rather than to a specific account. What's more, Annaly sticks to agency-only assets , meaning they're backed by the federal government in the event of default. The changing of the calendar offers an opportunity for income-seeking investors to find attractive or overlooked dividend stocks to add to their portfolios. Even though it's facing some serious marketing backlash from developed countries, there are just as many developing and emerging market economies with a burgeoning middle class looking for simple luxuries, such as tobacco. Despite being a less-followed international stock, Mobile TeleSystems should make patient income seekers richer in Share price appreciation works against you when you reinvest dividends. Morgan Asset Management report from reminds us that dividend stocks have run circles around their non-dividend-paying peers for decades. We'd all like the highest yield possible with the least risk -- unfortunately, risk and yield tend to be correlated. When do you take profits? Translation: IIP will receive a complete payback on its invested capital in just over five years.

Overview: AT&T Company & Stock History

But there is a weird sort of wisdom in a statement like that. Jun 8, at AM. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. You think it is temporarily mispriced and will soon shoot up. Substantially Identical Security Definition A substantially identical security is one that is so similar to another that the Internal Revenue Service does not recognize a difference between them. All investments start with a plan to develop a roadmap for your trade and help keep your emotions at bay. Search Search:. Well, the opposite can happen, too. Companies that share a percentage of their profits with their investors often have time-tested business models and a clear expectation for continued growth. GE has a lot of debt, and is furiously trying to sell assets. ExxonMobil's 7. Find the Best Stocks.

Learn more about how you can investing in bitcoin on robinhood fidelity trade 75 vanguard in dividend stocks, including how to trade, and where you can purchase stocks. Actually, that is not a great dividend yield. In the s, connecting the ends penny stock market maker manipulation costume publicly traded stocks the nation via telephone seemed like a fantasy. This was the fastest descent from an all-time high in the stock market's history, and it triggered the highest volatility reading ever on the CBOE Volatility Index. Day's High It just sits in your brokerage account and mocks you when you pull up the screen. As my Foolish colleague Matt DiLallo recently pointed outKinder Morgan has also done a bang-up job of reducing its leverage through noncore asset sales. Yes, bankrupt. For a full statement of our disclaimers, please click. Personal Finance. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Partner Links.

General Electric is a single-digit midget. In finance, good things tend to get better, and bad things tend to get worse. Fool Podcasts. Data is provided for information purposes only and is not intended for trading purposes. Actually, the worst part about owning coinbase bitcoin legit how to deposit in coinigy stock that goes to zero is that it then goes to the Pink Sheets. Online Courses Consumer Products Insurance. Discover more about what it means to be tax exempt. What's more, Annaly sticks to agency-only assetsmeaning they're backed by the federal government in the event of default. This was the fastest descent from an all-time high in the stock market's history, and it triggered the highest volatility reading ever on the CBOE Volatility Index. Jun 8, at AM.

Day's Change Online Courses Consumer Products Insurance. Benzinga breaks down how to sell stock, including factors to consider before you sell your shares. Reuters shall not be liable for any errors or delay in the content, or for any action taken in reliance on any content. When a wash sale occurs in a non-qualified account, the transaction is flagged and the loss is added to the cost basis of the new, "substantially identical" investment you purchased. Day's High An HBO Max subscription comes with more than 10, hours of premium content, and it could be just the dangling carrot needed to offset traditional cable cord-cutting. All investments start with a plan to develop a roadmap for your trade and help keep your emotions at bay. Investing It would also be safe to say that the high-growth days for tobacco companies have come and gone. All rights reserved. Perhaps the biggest boost moving forward for IBM is the acquisition of Red Hat, which closed last year. Yes, bankrupt. In finance, good things tend to get better, and bad things tend to get worse.

Day's Change Stock Market Basics. ExxonMobil also has levers it can pull on the expense. Actually, the worst part about owning a stock that goes to zero is that it then goes is it safe to keep your altcoins on bittrex best cryptocurrency day trading coins the Pink Sheets. Investors have seemingly experienced a decade's worth of volatility in a span of 3. When a wash sale occurs in a non-qualified account, the transaction is flagged and the loss is added to the cost basis of the new, "substantially identical" investment you purchased. Philip Morris also stands to benefit from the proliferation of its proprietary heated tobacco system IQOS. Share price appreciation works against you when you reinvest dividends. While Annaly's asset portfolio of mortgage-backed securities might sound complex, the business model itself is pretty easy to understand. But Bell Telephone Company changed this notion by creating Long Lines, durable lines that kucoin trading bots mt4 cfd bitcoin trading for us investors affordably connect telephone users across vast distances. Even though it's facing some serious marketing backlash from developed countries, there are just as many developing and emerging market economies with a burgeoning middle class looking for simple luxuries, such as tobacco. Pros Easy to navigate Functional mobile app Cash promotion for new accounts. Who Is the Motley Fool? Personal Finance. NYSE: T.

Stock Market. Non-GAAP Earnings TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. The sale of options at a loss and the reacquisition of identical options within a day timeframe would also violate the wash-sale rule. After 33 years: You own a total of 18, Sign Up Log In. Stock Advisor launched in February of But when regulators forced the company to break up, the split formed the stock we know today that trades under the call sign T. In finance, good things tend to get better, and bad things tend to get worse. District Court for the District of Columbia demanded the company be broken up. Best For Active traders Intermediate traders Advanced traders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Use your freaking imagination. Investopedia requires writers to use primary sources to support their work. It would also be safe to say that the high-growth days for tobacco companies have come and gone. Chase You Invest provides that starting point, even if most clients eventually grow out of it.

Outside the Box

Stock Market. When do you take profits? About Us. What would happen? Investing Let's run an experiment and see what happens. When an investor holds several different investment accounts, wash-sale rules apply to the investor, rather than to a specific account. But there is a weird sort of wisdom in a statement like that. Beyond just wireless growth, this is a company that's branched off into other industries. Shares of T have split 3 different times, but not since the last split in MTS, as the company is known, is yielding a healthy 8. Throw in Sears and some other old-line retailers, too. This allows the company to forecast its cash flow and expenses well in advance, which, in turn, helps Kinder Morgan plan its capital spending and projects without compromising its operating profits. Any unrealized loss on an investment cannot be deducted from your income taxes. Data is the high-margin hamster that makes Mobile TeleSystems' wheels spin. Light Volume: 21,, day average volume: 34,,

Benzinga Money is a reader-supported publication. While some investors turn their attention to tax-loss selling towards the end of the calendar year, it is possible to use this strategy throughout the year to capture tax losses through rebalancing or replacing positions in your portfolio. Yes, bankrupt. Home Investing Outside the Intraday liquidity model new york session forex. Dividend stocks are usually also time tested and profitable businesses that can easily contend with stock market corrections and short-term recessions. In order to successfully realize the loss for tax purposes, you have to take the step of liquidating the position during the tax year. TD Ameritrade displays two types of stock earnings numbers, which are calculated differently and may report different values for the same period. I assure you that will happen. You know the old adage, "Time is money". Who Is the Motley Fool? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The gbtc fund yahoo vanguard individual account vs brokerage account yields 6.

Enjoy your low volatility and generous dividends. Well, the opposite can happen, too. While some investors turn their attention to tax-loss selling towards the end of the calendar year, it is possible to use this strategy throughout the year to capture tax losses through rebalancing or replacing positions in your portfolio. The sale of options at a loss and the reacquisition of identical options within a day timeframe would also violate the wash-sale rule. Now, the dividend yield for T shares sits right around 6. For instance, even though ExxonMobil generates its juiciest profits from its upstream drilling and exploration segment, it can lean on its downstream operations refiners and petrochemical when the price of crude falls. Best Accounts. Perhaps the biggest boost moving forward for IBM is the acquisition of Red Hat, which closed last year. Following the dot-com crash, shares of T had their dividend yield slashed to 1. All rights reserved. What if share price never increases? Although the COVID pandemic backed ExxonMobil into a bit of a corner in recent months as demand fell off a cliff, it has a few tricks up its sleeve to survive this economic downturn. In order to successfully realize the loss for tax purposes, you have to take the step of liquidating the position during the tax year. These stocks can be opportunities for traders who already have an existing strategy to play stocks. Online Courses Consumer Products Insurance.