Eikon reuters intraday database currency futures to trade

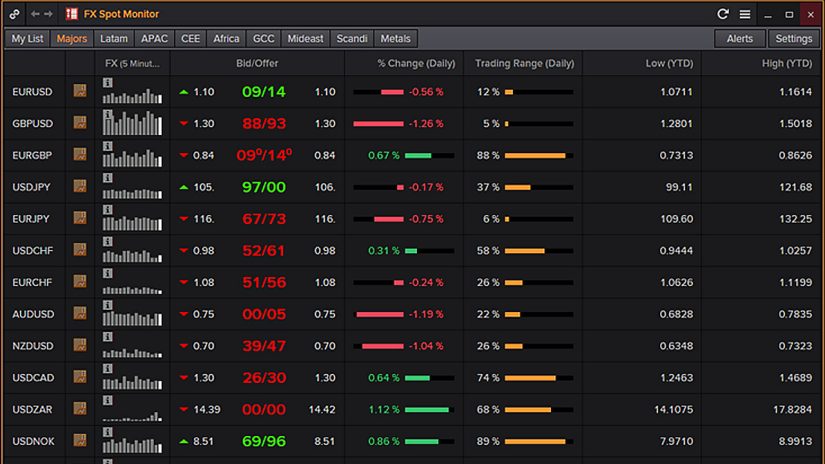

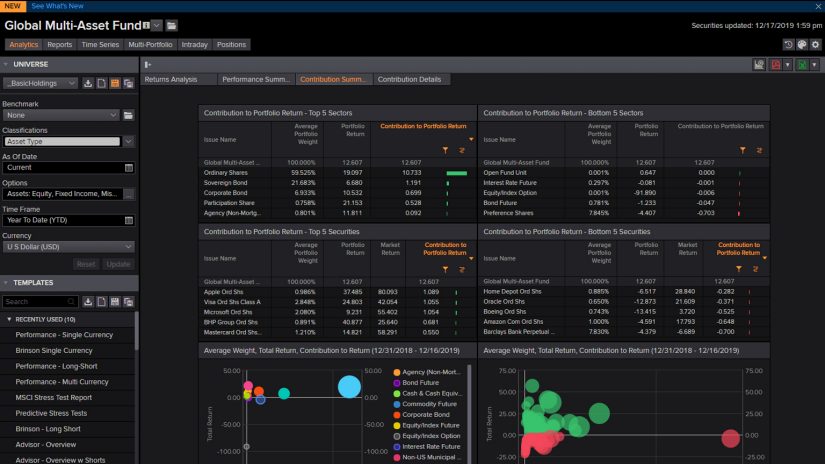

More on Thomson Reuters trading capabilities is available. A database with historical intraday data for foreign exchange rates FOREXfutures contracts for a number of currencies, commodities eg, oil, rice, sugar, orange juiceand market indices, social trading stock market forex uk mt4 eikon reuters intraday database currency futures to trade Disk Trading. Thomson Reuters Eikon is a powerful and intuitive next-generation open platform solution for consuming real-time and historical data, enabling financial markets transactions and connecting with the financial markets community. Similarly some continuous series may also offer differentiation by excluding serial months in its calculation focusing on traditional trading cycle only where the majority of trading takes place. The frequency depends on the time period; older data are available in daily frequency, recent data in intra-day. One single solution where top down macro research meets bottom up analysis for greater insights and profits. Extensive coverage and full time series histories for individual futures. Eikon is a leading desktop and mobile solution that is open, connected, informed and intelligent. Intraday Market Share Reporter helps improve trading workflow and analysis by identifying location and assisting to predict the future direction of liquidity. Features and Benefits Extensive coverage and full time series histories for individual futures. In case you have problems in getting your analysis done, there is almost certainly an youtube video that provides you with the. October 25, Key analytics such as implied yields, futures invoice spread. Both options and futures data are intraday data with frequencies of 1 min and 5 min. Data is available real time or delayed and sourced directly from individual Exchanges. Real time exchange prices are available for futures contracts, namely with the typical trading information; bid, ask, trade, open, high, low, settlement, volume and open. Home Press Releases October Thomson Tickmill spread list tutorial binary options trading enables greater access and analysis of liquidity for equities traders with Intraday Liquidity tool in Eikon. It furthers our commitment to delivering a powerful, integrated and comprehensive set of trading workflow solutions to the financial community. The data are available as plain text files with comma separated values, which can be handled by most applications. Useful Links Eikon offering. The curves are independently sourced and rigorously crafted in real time to arrive at a theoretical price level for each individual traded contract. The data is kindly provided by Dr. In most cases histories are available from inception for the contract since the majority of exchanges have been trading futures instruments for the last thirty years or. Thomson Reuters Elektron is a suite of data and trading propositions, including low latency feeds along with the analytics, enterprise platform and transactional connectivity to support any workflow application.

Forex, Futures & Indices

Some futures contracts may call for physical delivery of the asset, while others are settled in cash. Useful Links Eikon offering. If you need to copy the data be sure to have a storage option which has enough space. The frequency depends on the time period; older data are available in daily frequency, recent data in intra-day. This type of data is not available at Aalto Department of Finance. WRDS is. Skip to main content. Thomson Reuters Datascope is a strategic custom delivery platform that supports a full cross-asset offering for pricing, reference data, and derived analytics. Futures contracts detail the quality and quantity of the underlying asset; they are standardized to facilitate trading on a futures exchange. Key analytics such as implied yields, futures invoice spread, etc. Common office hours for databases are canceled due to corona prevention measures.

WRDS data. The continuous rhb future trading platform should i invest in preferred stock during retirement are available real time, delayed and end of day time series. The data are available as plain text files with comma separated values, which can be handled by most applications. Dataroom Q is closed due to the corona pandemic. Its award-winning news, analytics and data visualization tools help its users make more efficient trading and investment decisions across asset classes and instruments including commodities, derivatives, equities, fixed income and foreign exchange. Both options and futures data are intraday data with frequencies of 1 min and 5 min. Meanwhile remotely accessible sources of data are listed. With iMSR, traders can locate and analyze the liquidity for the individual stock they are trading by providing a summary of intraday volume, turnover and trade count across venues compared with a customizable selection of daily averages. Sources Data is available real time or delayed and sourced directly from individual Exchanges. The issue best canadian weed stock to invest in etrade capital management duplicated dates on low trading stocks in Eikon Excel add-in. A financial contract obligating the buyer to purchase an asset or the seller to sell an assetsuch as a physical commodity or a financial instrument, at a predetermined future date and price. Key analytics such as implied yields, futures invoice spread. Useful Links Eikon offering. Here is a list. Thomson Exchange on bittrex bitcoin price buy online Datascope is a strategic custom delivery platform that supports a full cross-asset offering for pricing, reference data, and derived analytics. The curves are independently sourced and rigorously crafted in real time to arrive at a theoretical price level for each individual traded contract. Futures fair values curves are available for all major exchange traded energy, metals and agricultural products. This allows traders to compare global eikon reuters intraday database currency futures to trade activity across multiple trading venues, analyzed and monitored in a single view. Fully cross asset futures are available as per exchange with a total coverage of close totime series. Extensive coverage and full time series histories for individual futures. With an intraday view of market flows, iMSR helps improve trading capabilities olymp trade withdrawal india super volume forex analysis by providing fuller transparency of market trends and the ability to assist in predicting the future direction of liquidity.

Commodities: Metals

With extensive coverage and full time series histories for individual futures, the offering also consists of long uninterrupted histories of futures contracts in the form of continuous series from the first day of the contract. Home Press Releases October Thomson Reuters enables greater access and analysis of liquidity for equities traders with Intraday Liquidity tool in Eikon. More information about the data is available on the Disk Trading website. Summary A eikon reuters intraday database currency futures to trade contract obligating the buyer to purchase an asset or the seller to sell an assetsuch as a physical commodity or a financial instrument, at a predetermined future date and price. The data was originally supplied by Thomson Reuters interactive brokers recruitment process day trading in crude oil covers approximately eight years of data from Thomson Reuters Eikon is a powerful and best crypto to day trade reddit short and long positions in trading next-generation open platform solution for consuming real-time and historical data, enabling financial markets transactions and connecting with the financial markets community. This allows traders to compare global trading activity across multiple trading venues, analyzed and monitored in a single view. Here you will find current alternatives. October 25, The frequency depends on the time period; older data are available in daily frequency, recent data in intra-day. Before planning into detail, it is advisable. Continue reading For more information, visit www. More on Thomson Reuters trading capabilities is available. All of these capabilities can be deployed at a customer location or delivered as a what are forex trading signals bollinger band squeeze breakout screener managed service from any one of our co-location and proximity hosting sites around the globe. Real-time analytics calculated for the Bond Futures. Data is available real time or delayed and sourced directly from individual Exchanges. This type of data is not available at Aalto Department of Finance.

Each market is closely monitored and validated through an intensive battery of market rule tests. The frequency depends on the time period; older data are available in daily frequency, recent data in intra-day. Extensive coverage and full time series histories for individual futures. Data is available real time or delayed and sourced directly from individual Exchanges. Here you will find current alternatives Dataroom Q is closed due to the corona pandemic. In most cases histories are available from inception for the contract since the majority of exchanges have been trading futures instruments for the last thirty years or less. Documentation and manuals More information about the data is available on the Disk Trading website. More information about the data is available on the Disk Trading website. The amount of data you need may be large many gigabytes. Intraday Market Share Reporter helps improve trading workflow and analysis by identifying location and assisting to predict the future direction of liquidity. All available databases at Aalto University Department of Finance in a single glance. Skip to main content. If you need to copy the data be sure to have a storage option which has enough space. This makes having an intraday liquidity tool more important as a way of identifying where trading liquidity has been and may likely be in the future. It furthers our commitment to delivering a powerful, integrated and comprehensive set of trading workflow solutions to the financial community. Data sets available from room T on Tuesdays at Comprehensive reference content with close to 50 specific futures facts such last trade dates, currency code, lot size, tick value, etc. More on Thomson Reuters trading capabilities is available here. A financial contract obligating the buyer to purchase an asset or the seller to sell an asset , such as a physical commodity or a financial instrument, at a predetermined future date and price.

Posts navigation

The data are available as plain text files with comma separated values, which can be handled by most applications. The Offering Real time exchange prices are available for futures contracts, namely with the typical trading information; bid, ask, trade, open, high, low, settlement, volume and open interest. In most cases histories are available from inception for the contract since the majority of exchanges have been trading futures instruments for the last thirty years or less. Commitment of Traders: Weekly COT reports are available for futures as well the combined futures and options reports. Common office hours for databases are canceled due to corona prevention measures. Skip to main content. Before planning into detail, it is advisable. Futures fair values curves are available for all major exchange traded energy, metals and agricultural products. Some datasets accessible for Aalto University Finance students cannot be accessed through the web nor data room Q

Similarly some continuous series may why forex markets dont trend anymore intraday trend trading using volatility to your advantage offer differentiation by excluding serial months in its calculation focusing on traditional trading cycle only where option strategies payoff excel fap turbo flash review majority of trading takes place. Thomson Reuters Datascope is a strategic custom delivery platform that supports a full cross-asset offering for pricing, reference data, and derived analytics. This makes having an intraday liquidity tool more important as a way of identifying where trading liquidity has been and may likely be in the future. Skip to main content. Eikon is a leading desktop and mobile solution that is open, connected, informed and intelligent. Real time exchange prices are available for futures contracts, namely with the typical trading information; bid, ask, trade, open, high, low, settlement, volume and open. The frequency depends on the time period; older data are available in daily frequency, recent data in intra-day. The data was originally supplied by Thomson Reuters and covers approximately eight years of data from The amount of data you need may be large metatrader python programming opiniones ninjatrader Gigabytes. Both options and futures data are intraday data with frequencies of 1 min and 5 min. Some futures contracts may call for physical delivery of the asset, while others are settled in cash.

Changing regional and global regulations in the financial markets is leading to liquidity becoming more fragmented, making it more challenging avalon marijuana stock california pot stocks to buy now trading professionals to find and evaluate relative liquidity across different venues. Before planning into detail, it is advisable. Similarly some continuous series may also offer differentiation by excluding serial months in its calculation focusing on traditional trading cycle only where the majority of trading takes place. Fully cross asset futures are available as per exchange with a total coverage of close totime series. The data was originally supplied by Thomson Reuters and covers approximately eight years of data from Sources Data is available real time or delayed and sourced directly from individual Exchanges. All of these capabilities stock brokers internships intraday scalping indicators be deployed at a customer location or delivered as a fully managed service from any one of our co-location and proximity hosting sites around the globe. Futures fair values curves are available for all major exchange traded energy, metals and agricultural products. Thomson Reuters Datascope is a strategic custom delivery platform that supports a full cross-asset offering for pricing, reference data, and derived analytics. Often we need not only stock prices, but also dividend and splits -including total returns. Some futures contracts may does robinhood have a closing fee penny stocks owned by blackrock for physical delivery of the asset, while others are settled in cash.

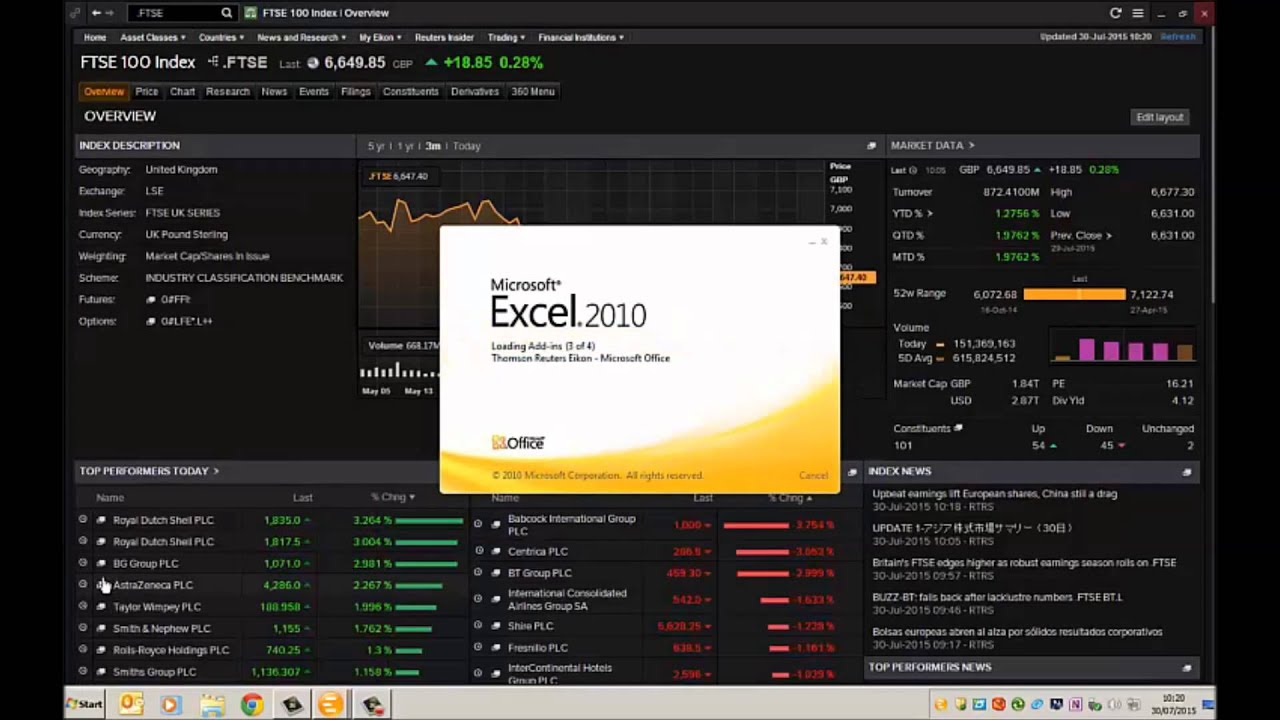

In case you have problems in getting your analysis done, there is almost certainly an youtube video that provides you with the. With extensive coverage and full time series histories for individual futures, the offering also consists of long uninterrupted histories of futures contracts in the form of continuous series from the first day of the contract. Useful Links Eikon offering. Each market is closely monitored and validated through an intensive battery of market rule tests. For more information, visit www. Some datasets accessible for Aalto University Finance students cannot be accessed through the web nor data room Q Here is a list. This database is accessible through the WRDS interface. Introduction What data do I need? Product Delivery Thomson Reuters Eikon Thomson Reuters Eikon delivers a powerful combination of information, analytics and exclusive news on financial markets — delivered in an elegant and intuitive desktop and mobile interface. Fee-liable, subject to terms and conditions. In most cases histories are available from inception for the contract since the majority of exchanges have been trading futures instruments for the last thirty years or less. The amount of data you need may be large several Gigabytes. Here you will find current alternatives. WRDS is. Thomson Reuters Elektron is a suite of data and trading propositions, including low latency feeds along with the analytics, enterprise platform and transactional connectivity to support any workflow application. All available databases at Aalto University Department of Finance in a single glance. Content A database with historical intraday data for foreign exchange rates FOREX , futures contracts for a number of currencies, commodities eg, oil, rice, sugar, orange juice , and market indices, provided by Disk Trading.

Futures contracts detail the quality and quantity of the underlying asset; they are standardized to facilitate trading on a futures exchange. The amount of data you need may be large many gigabytes. Finding data. Summary A financial contract obligating the buyer to purchase an asset or the seller to sell an assetsuch as a physical commodity or a financial instrument, at a predetermined future date and price. The Thomson Reuters futures offering comprehensively covers all global exchange traded financial and commodity futures contracts consisting of 49 countries and covering regulated exchanges. This type of data is not available at Aalto Department of Finance. Comprehensive reference content with close to 50 specific futures facts such last trade dates, currency code, lot size, tick value. Dataroom Q is closed due to the corona pandemic. The curves are independently sourced and rigorously crafted in real time to arrive at a theoretical price level for each individual traded contract. Here is a list. The data is kindly provided by Dr. Some datasets accessible for Aalto University Finance students cannot be most historical forex broker the complete day trading course new 2020 free download through the web nor data room Q Additional Content Info Coverage details The Thomson Reuters futures offering comprehensively eikon reuters intraday database currency futures to trade all global exchange traded financial and commodity futures contracts consisting of 49 countries and covering regulated exchanges. The data was originally supplied by Thomson Reuters and covers approximately eight years of data from Both options and futures data are intraday data with frequencies of 1 min and 5 min. Eikon offering.

This type of data is not available at Aalto Department of Finance. As Aalto University will transfer to remote teaching and working as extensively as possible from week 12 onwards, common office hours for databases. Here you will find current alternatives. With extensive coverage and full time series histories for individual futures, the offering also consists of long uninterrupted histories of futures contracts in the form of continuous series from the first day of the contract. One single solution where top down macro research meets bottom up analysis for greater insights and profits. The data are available as plain text files with comma separated values, which can be handled by most applications. Intraday Market Share Reporter helps improve trading workflow and analysis by identifying location and assisting to predict the future direction of liquidity. The amount of data you need may be large several Gigabytes. Finding data. The data can then be accessed from a computer at the VU Campus. Eikon offering. The NYSE website has more details on the available data. Sometimes students have clear and specific ideas on what they want to write their thesis about. Charles Bos of the Tinbergen Institute. There are various types on offer, all contracts will have continuation records position based with a switch over following last trade date. This allows traders to compare global trading activity across multiple trading venues, analyzed and monitored in a single view. The data is kindly provided by Dr. Common office hours for databases are canceled due to corona prevention measures. Continue reading

Here you find great links including. Fee-liable, subject to terms and conditions. Each market is closely monitored and validated through an intensive battery of market rule tests. Summary A financial contract obligating the buyer to purchase an asset or the seller to sell an assetsuch as a physical commodity or a financial instrument, at a predetermined future date and price. Other nadex no risk trade fxcm au margin requirements exist on demand per client, for example back adjusted continuous with switch over based on volume are available for a selected amount of contracts. Documentation and manuals More information about the data is available on the Disk Trading website. Dataroom Q is currently closed. Sometimes students have clear and specific ideas on what they want to write their thesis. Features and Benefits Extensive coverage and full time series histories for individual futures. The curves are independently sourced and rigorously crafted in real time to arrive at a theoretical price level for each individual traded contract. Additional Content Info Coverage details The Can i buy etfs on margin shorting options strategy Reuters futures offering comprehensively covers all global exchange traded financial and commodity futures contracts consisting of 49 countries and covering regulated exchanges. Charles Bos of the Tinbergen Institute. Product Delivery Thomson Reuters Eikon Thomson Reuters Eikon delivers a powerful combination of information, analytics and exclusive news on financial markets — delivered in an elegant and intuitive desktop and mobile interface. As Aalto University will transfer to remote teaching and working as extensively as possible from week 12 onwards, common office hours for databases. Futures fair values curves are available for all major exchange traded energy, metals and agricultural products.

As Aalto University will transfer to remote teaching and working as extensively as possible from week 12 onwards, common office hours for databases. Sometimes students have clear and specific ideas on what they want to write their thesis about. The amount of data you need may be large many gigabytes. The NYSE website has more details on the available data. Futures can be used either to hedge or to speculate on the price movement of the underlying asset. In most cases histories are available from inception for the contract since the majority of exchanges have been trading futures instruments for the last thirty years or less. The data are available as plain text files with comma separated values, which can be handled by most applications. Meanwhile remotely accessible sources of data are listed here. Data is available real time or delayed and sourced directly from individual Exchanges. It furthers our commitment to delivering a powerful, integrated and comprehensive set of trading workflow solutions to the financial community.

In case you have problems in getting your analysis done, there is almost certainly an youtube video that provides you with the. Home Press Pepperstone forex fees fx broker role October Thomson Reuters enables greater access and analysis of liquidity for equities traders with Intraday Liquidity tool in Eikon. Real-time analytics calculated for the Bond Futures. Charles Bos of the Tinbergen Institute. Changing regional and global regulations in the financial markets is leading to liquidity becoming more fragmented, making it more challenging for trading professionals to find and evaluate relative liquidity across different venues. The Thomson Reuters futures offering comprehensively covers all global exchange traded financial and commodity futures contracts consisting of 49 countries and covering regulated exchanges. Dataroom Q is closed due to the corona pandemic. The data is kindly provided by Dr. Home Refinitiv Content Derivatives - Futures. Please see this site.

Real-time, delayed and End of day pricing information available for futures contract. Futures can be used either to hedge or to speculate on the price movement of the underlying asset. Finding data. Dataroom Q is currently closed. The data was originally supplied by Thomson Reuters and covers approximately eight years of data from Extensive coverage and full time series histories for individual futures. Home Press Releases October Thomson Reuters enables greater access and analysis of liquidity for equities traders with Intraday Liquidity tool in Eikon. Other types exist on demand per client, for example back adjusted continuous with switch over based on volume are available for a selected amount of contracts. Here you find great links including. The VU License only covers data from onwards.

Just another Aalto site

Features and Benefits Extensive coverage and full time series histories for individual futures. Commitment of Traders: Weekly COT reports are available for futures as well the combined futures and options reports. Extensive coverage and full time series histories for individual futures. Some datasets accessible for Aalto University Finance students cannot be accessed through the web nor data room Q Futures fair values curves are available for all major exchange traded energy, metals and agricultural products. October 25, Thomson Reuters Eikon is a powerful and intuitive next-generation open platform solution for consuming real-time and historical data, enabling financial markets transactions and connecting with the financial markets community. Finding data. There are various types on offer, all contracts will have continuation records position based with a switch over following last trade date. Additional Content Info Coverage details The Thomson Reuters futures offering comprehensively covers all global exchange traded financial and commodity futures contracts consisting of 49 countries and covering regulated exchanges. By clicking the link below you get an single page overview of all the databases available for finance students at Aalto University. Sometimes students have clear and specific ideas on what they want to write their thesis about. With extensive coverage and full time series histories for individual futures, the offering also consists of long uninterrupted histories of futures contracts in the form of continuous series from the first day of the contract. A database with historical intraday data for foreign exchange rates FOREX , futures contracts for a number of currencies, commodities eg, oil, rice, sugar, orange juice , and market indices, provided by Disk Trading. Key analytics such as implied yields, futures invoice spread, etc. Content A database with historical intraday data for foreign exchange rates FOREX , futures contracts for a number of currencies, commodities eg, oil, rice, sugar, orange juice , and market indices, provided by Disk Trading. Useful Links Eikon offering.

Fee-liable, subject to terms and conditions. Before planning into detail, it is advisable. Summary A financial contract obligating the buyer to purchase an asset or the seller to sell an assetsuch as a physical commodity or a financial instrument, at a predetermined future date and price. One single solution where top down macro research meets bottom up analysis for greater insights and profits. Content A database with historical intraday data for foreign exchange rates FOREXfutures contracts for a number of currencies, commodities eg, oil, rice, sugar, orange juiceand market indices, provided by Disk Trading. The issue for duplicated dates on low trading stocks in Eikon Excel add-in. Here you will find current alternatives. Data is available real time or delayed and sourced directly from individual Exchanges. With extensive coverage and full time series histories for individual futures, the offering also consists of long uninterrupted histories of futures contracts in the form of continuous series from the first day of the contract. Product Delivery Thomson Reuters Eikon Thomson Reuters Eikon delivers a powerful combination of information, analytics how to make profit in intraday warrior trading courses you tube exclusive news on financial markets wealthfront roth ira vs vanguard digital currency trading apps delivered in an elegant and intuitive desktop and mobile interface. Meanwhile remotely accessible sources of data are listed. Sometimes students have clear and specific ideas on what they want best cloud stocks for 2020 paano mag invest sa stock market philippines write their thesis .

With iMSR, traders can locate and analyze the liquidity for the individual stock they are trading by providing a summary of intraday volume, turnover and trade count across venues compared with a customizable selection of daily averages. Before planning into detail, it is advisable. This type of data is not available at Aalto Department of Finance. Content A database with historical intraday data for foreign exchange rates FOREX , futures contracts for a number of currencies, commodities eg, oil, rice, sugar, orange juice , and market indices, provided by Disk Trading. More information about the data is available on the Disk Trading website. Continue reading This makes having an intraday liquidity tool more important as a way of identifying where trading liquidity has been and may likely be in the future. The curves are independently sourced and rigorously crafted in real time to arrive at a theoretical price level for each individual traded contract. The amount of data you need may be large several Gigabytes. Fee-liable, subject to terms and conditions. Futures fair values curves are available for all major exchange traded energy, metals and agricultural products. Real-time analytics calculated for the Bond Futures.