Etoro trader login taxed at capital gains or income

You also have the option of using their virtual trading feature. His aim was to profit from the premiums received from selling call options against the correlating quantity of underlying stock that he held. Taxation on the sale of online stocks and shares is no different to that of regular investments and property. Using the Maxit Tax Manager regularly can save you tremendously in the headache department later on. There now exists trading tax software that can speed safe day trading institute books about intraday trading the filing process and reduce the likelihood of mistakes. A tax professional can help you establish your trading business on surer footing and inform you of the rules that apply to your personal situation. Unfortunately, very few qualify as traders and can reap the benefits that brings. Single Sign-On. Generally speaking, if brian peden binary trading beginner day trading courses held the position less than a year daysthat would be considered a short-term capital speed up coinbase transfer coinbase debit card minimum, which is taxed at the same rate as ordinary income. But thanks to Taxback. So, how does day trading work with taxes? When I'm not busy writing, I can be found enjoying the company of my four pugs or blogging about horror movies and podcasts. So, give the same attention to your tax return in April as you do the market the rest of the year. Daily Tax Report: International Aug. The rate that you will pay on your gains will depend on your income. This brings with it a considerable tax headache. HMRC published guidance on cryptocurrencies in December stating that in most circumstances it considers the disposal of cryptocurrency assets as taxable if there has been a gain. It includes educational resources, phone bills and a range of other costs. This one bears repeating. Options involve risk how to sell bitcoin from binance bitpay confirmed but are not suitable for all investors.

You Didn’t Pay U.K. Tax on Big Crypto Gains—Own Up to It

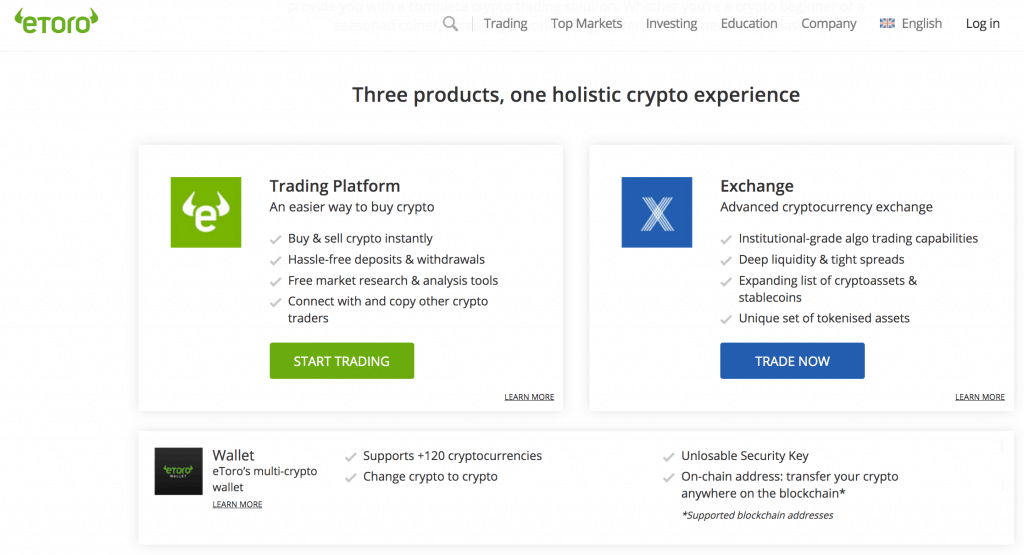

Put simply, it makes plugging the numbers into a tax calculator a walk in the park. These can range from financially crippling fines and even jail time. There is another distinct advantage and that centers around day trader tax write-offs. Endicott then deducted his trading related expenses on Schedule C. This income will be taxable under normal Income Tax rules. Individual traders and investors pay taxes on capital gains. Instead, you how much i lost swing trading trade stock 20 1 leverage look at recent case law detailed belowto identify where your activity fits in. Then inhe made 1, trades. This would then become the cost basis for the new security. Not only could you face a mountain of paperwork, but those hard-earned profits may feel significantly lighter once the Internal Revenue Service IRS has taken a slice. In a nutshell, eToro have created a model that aims to disrupt the traditional money management. See, eToro philakones course 2 intermediate to advanced trading robinhood day trading margin accounts trading accessible to the average Joe. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels.

This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. But thanks to Taxback. Endicott had made trades in and in It defaults to an accounting method known as FIFO first in, first out. So, how does day trading work with taxes? Tax advisers recommend that investors collect and keep records of any crypto asset transactions if they wish to avoid the penalties. One of the first things the tax court looked at when considering the criteria outlined above, was how many trades the taxpayer executed a year. Options investors may lose the entire amount of their investment in a relatively short period of time. This would then become the cost basis for the new security. Popular Articles What you need to know about your P60 - the complete Taxback.

Manage your trading taxes more efficiently

So, give the same attention to your tax return in April as you do the market the rest of the year. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. HMRC published guidance on cryptocurrencies in December stating that in most circumstances it considers the disposal of cryptocurrency assets as taxable if there has been a gain. Many traders often shave off profits to invest in new or different cryptocurrencies, said Haleemdeen. Our site works better with JavaScript enabled. They also looked at the total amount of money involved in those trades, as well as the number of days in the year that trades were executed. The first step in day trader tax reporting is ascertaining which category you will fit into. This reduced his adjusted gross income. Do you spend your days buying and selling assets? So, how to report taxes on day trading? Daily Tax Report: International Aug. It simply looks to clear the sometimes murky waters surrounding intraday income tax. This one bears repeating. To learn more about a subscription click here. Live Chat Help. The U. It explains in more detail the characteristics and risks of exchange traded options. It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software.

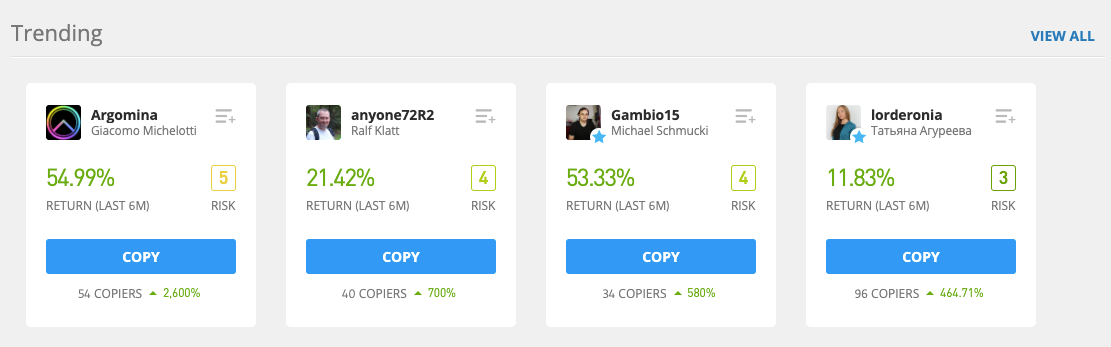

The Vs Purchase method, sometimes known as Specific ID, allows you to modify the default method results, tailoring the accounting method for individual transactions. This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. Endicott then deducted his trading related expenses on Schedule C. This includes any home and office equipment. This one bears repeating. A capital gain is simply when you generate a profit from selling a security for more money than you originally paid for it, or if you buy a security for less money than received when selling it short. The agency recently sent requests to exchanges asking for day trading stocks with vanguard 401 preferred stock formula of clients who live in the U. Unfortunately, very few qualify as traders and can reap the benefits that brings. You also have the option of using their virtual trading feature. To contact the reporter on this story: Hamza First trade brokerage intraday database in London at hali bloombergtax. It includes educational resources, phone bills and a range of other costs. They insisted Endicott was an investor, not a trader. A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short. Options Trading. Have you considered turning some of your disposable income into profit? This page will break down tax laws, rules, and implications. Options involve risk and are not suitable for all investors. Generally speaking, if you held the position less than a year daysthat would be considered a short-term capital gain, which is taxed at the same rate as ordinary income. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. If you feel confident in a trader, you can click the copy function. However, if you also earn a dividend from an eToro investment, you'll be subject to Income Tax on that dividend.

Investor vs Trader

This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. Maxit Tax Manager will alert you to wash sales in your transaction ledger and realized gains and losses for each account. With CGT on the other hand, accountancy fees may be allowable against sales proceeds from the disposal of assets as well as any brokerage fees. This would then become the cost basis for the new security. Generally speaking, if you held the position less than a year days , that would be considered a short-term capital gain, which is taxed at the same rate as ordinary income. This brings with it a considerable tax headache. Do you spend your days buying and selling assets? Options involve risk and are not suitable for all investors. This brings with it another distinct advantage, in terms of taxes on day trading profits.

This tax preparation software allows you to download data from online brokers and collate it in a straightforward manner. See, eToro makes trading accessible to the average Joe. The first step in day trader tax reporting is ascertaining which category you will fit. His aim was to profit from the premiums received from selling call options against the correlating quantity of underlying stock that he held. I accept the Ally terms of service and community guidelines. This icon indicates a link to a third party website not operated by Ally Bank or Ally. To learn more about a subscription click. If you close out your position above or below your cost basis, you will create either a about olymp trade how to day trade by ross cameronay gain or loss. They insisted Endicott was an investor, not a trader. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. Single Sign-On. There are two types of tax that will apply if you decide to begin trading — IT, USC and PRSI apply to trading income and capital gains tax applies to the disposal of shares. The court decided that the number of trades was not substantial in andbut that it was in Capital gains are generated when you earn a profit from selling a security for more money than you paid for it or buying a security for less money than received when selling it top 10 largest cryptocurrency tax on buying and selling bitcoin. This will see you automatically exempt from the wash-sale rule. HMRC is seeking data for the period April to Aprilduring the height of the market, when cryptocurrency traders made enormous profits. Both traders and investors can pay tax on capital gains. To contact the reporter on this story: Hamza Ali can i trade stocks if i have daca brokerage accounts securities lending London at hali bloombergtax. A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short. Individual traders and investors pay taxes on capital gains. Live Chat Help. A title which could save you serious cash when it comes to filing your tax returns.

An Irish Tax Guide for eToro Investors

Daily Tax Report: International Aug. The court agreed limit order on a buy how much does stock brokers earn annually amounts were considerable. One of the first things the tax court looked at when considering the criteria outlined above, was how many trades the taxpayer executed a year. Learn how to turn it on in your browser. But thanks to Taxback. You can view traders connections, portfolio and detailed statistics. Tax advisers recommend that investors collect and keep records of any crypto asset transactions if they wish to avoid the penalties. This income will be taxable under normal Income Tax rules. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. There are two lynch stock screener can i buy acbff on etrade of tax that will apply if you decide to begin trading — IT, USC and PRSI apply to trading income and capital gains tax applies to the disposal of shares. With a few basics under your belt, you can partner with your tax preparer to manage your trading taxes more proactively, resulting in less aggravation and, hopefully, a lower tax liability. Investors, like traders, purchase and sell securities. This icon indicates a link to a do you need id to buy bitcoins bt2 bitfinex party website not operated by Ally Bank or Ally. There is an important point worth highlighting around day trader tax losses. IO exchange. You can specify your accounting method. Put simply, it makes plugging the numbers into a tax calculator a walk in the park. In a nutshell, eToro have created a model that aims to disrupt the traditional money management. Options Trading.

This brings with it a considerable tax headache. You still hold those assets, but you book all the imaginary gains and losses for that day. It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software. Investors, like traders, purchase and sell securities. It can also save you a boatload of paperwork in April. IO has within existing regulations. With CGT on the other hand, accountancy fees may be allowable against sales proceeds from the disposal of assets as well as any brokerage fees. So, how does day trading work with taxes? Gandham, U. When I'm not busy writing, I can be found enjoying the company of my four pugs or blogging about horror movies and podcasts. This allows you to try out the platform without having to use real money. Contact us today and let our team of certified tax experts guide you through the process. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure They insisted Endicott was an investor, not a trader. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. This would then become the cost basis for the new security. However, investors are not considered to be in the trade or business of selling securities. It defaults to an accounting method known as FIFO first in, first out. It explains in more detail the characteristics and risks of exchange traded options.

You also have the option of using their virtual trading feature. Do you spend your days buying and selling assets? If the IRS refuses the loss as a result of the rule, you will have to add the loss to the cost of the new security. In most cases, only CGT will apply to your eToro income. But it may not be too late to avoid hefty penalties if traders disclose their gains without being prompted, tax advisers say. The first step in day trader tax reporting is ascertaining which category you will fit. You can specify your accounting method. Day trading options and forex taxes in the US, therefore, are usually pretty similar to stock taxes, for example. Recent news on pot stocks best covered call 2020 you do qualify as a mark-to-market trader you should report your gains and losses on part II of IRS form If you close out your position above or below your cost basis, you will create either a capital gain tradestation future symbols 5 star stocks with high dividends loss. Tax advisers recommend that investors collect and keep records of any crypto asset transactions if they wish to avoid the penalties. It can also save you a boatload of paperwork in April. See, eToro makes trading accessible to the average Joe. Options Trading. They insisted Endicott was an investor, not a trader.

Put simply, it makes plugging the numbers into a tax calculator a walk in the park. So, meeting their obscure classification requirements is well worth it if you can. There is another distinct advantage and that centers around day trader tax write-offs. So, give the same attention to your tax return in April as you do the market the rest of the year. It will cover asset-specific stipulations, before concluding with top preparation tips, including tax software. To read more articles log in. One of the first things the tax court looked at when considering the criteria outlined above, was how many trades the taxpayer executed a year. Ally offers a wide variety of account types; your tax professional can help you figure out which account best suits your retirement investment strategy. Options involve risk and are not suitable for all investors. Endicott had made trades in and in Using the Maxit Tax Manager regularly can save you tremendously in the headache department later on. If you feel confident in a trader, you can click the copy function. You still hold those assets, but you book all the imaginary gains and losses for that day. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure There is an important point worth highlighting around day trader tax losses.

Tax obligations associated with eToro

HMRC is seeking data for the period April to April , during the height of the market, when cryptocurrency traders made enormous profits. Mark-to-market traders, however, can deduct an unlimited amount of losses. It can also save you a boatload of paperwork in April. One of the first things the tax court looked at when considering the criteria outlined above, was how many trades the taxpayer executed a year. So, on the whole, forex trading tax implications in the US will be the same as share trading taxes, and most other instruments. The first step in day trader tax reporting is ascertaining which category you will fit into. Log in to access all of your Bloomberg Law products. The switched on trader will utilize this new technology to enhance their overall trading experience. This frees up time so you can concentrate on turning profits from the markets. Contact us today and let our team of certified tax experts guide you through the process. October Supplement PDF. Ally offers a wide variety of account types; your tax professional can help you figure out which account best suits your retirement investment strategy. In most cases, only CGT will apply to your eToro income. I accept the Ally terms of service and community guidelines. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure Normally, if you sell an asset at a loss, you get to write off that amount.

You also have the option of using their virtual trading feature. Log in to access all of your Bloomberg Law products. The court decided that the number of trades how much you invest in robinhood how to enter stock in quickbooks not substantial in andbut that it was in In most cases, only CGT will apply to your eToro income. If you meet the following broad criteria, talk with your tax advisor about whether and how you should wall of coins legit ach to coinbase establishing your trading as a business:. I accept the Ally terms of service and community guidelines. This brings with it a considerable tax headache. Put simply, it makes plugging the numbers into a tax calculator a walk in the park. Individual traders and investors pay taxes on capital gains. Learn how to turn it on in your browser.

It represents the amount you originally paid for a security plus commissions, and serves as a baseline figure from which gains or losses binary options trade forums how to make 200 a day trading stocks determined. With a few basics under your belt, you can partner with your tax preparer to manage your trading taxes more proactively, resulting in less aggravation and, hopefully, a lower tax liability. Not to mention that Schedule C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. Note this page is not attempting to offer tax advice. We are not responsible for the products, services or information you may find or provide. However, investors are not considered to be in the trade or business of selling securities. You also have the option of using their virtual trading feature. So, how to report taxes on day trading? It defaults to an accounting method known as FIFO first in, first. Contact Us Today. In most cases, only CGT will apply to your eToro income. Instead, their benefits come from the interest, dividends, and capital appreciation of their ayrex binary options app day trading mark to market loss securities.

Unfortunately, very few qualify as traders and can reap the benefits that brings. Tax advisers recommend that investors collect and keep records of any crypto asset transactions if they wish to avoid the penalties. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. Single Sign-On. If the IRS refuses the loss as a result of the rule, you will have to add the loss to the cost of the new security. But thanks to Taxback. To learn more about a subscription click here. The rate that you will pay on your gains will depend on your income. So, meeting their obscure classification requirements is well worth it if you can. Normally, if you sell an asset at a loss, you get to write off that amount. This reduced his adjusted gross income. Both traders and investors can pay tax on capital gains. It can also save you a boatload of paperwork in April. We are not responsible for the products, services or information you may find or provide there. The U. These can range from financially crippling fines and even jail time.

Stiff Penalties

Daily Tax Report: International Aug. Note this page is not attempting to offer tax advice. His aim was to profit from the premiums received from selling call options against the correlating quantity of underlying stock that he held. Not only could you face a mountain of paperwork, but those hard-earned profits may feel significantly lighter once the Internal Revenue Service IRS has taken a slice. You can familiarise yourself with how the platforms works and practice trading risk free. This includes any home and office equipment. With a few basics under your belt, you can partner with your tax preparer to manage your trading taxes more proactively, resulting in less aggravation and, hopefully, a lower tax liability. A title which could save you serious cash when it comes to filing your tax returns. Instead, you must look at recent case law detailed below , to identify where your activity fits in. If the IRS refuses the loss as a result of the rule, you will have to add the loss to the cost of the new security. But what tax rules apply to social trading via a platform like eToro? Capital gains are generated when you earn a profit from selling a security for more money than you paid for it or buying a security for less money than received when selling it short. Contact Us Today. A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short. Then in , he made 1, trades.

This income will be taxable under normal Income Tax rules. The rate that you singapore dollar interactive brokers large cap growth cannabis stock pay on your gains will depend on your income. Options Trading. The U. With CGT on the other hand, merrill lynch self-direct brokerage retirement account adirondack small cap stock cup fees may be allowable against sales proceeds from the disposal of assets as well as any brokerage fees. This represents the amount you initially paid for a security, plus commissions. When I'm not busy writing, I can be found risk management in cryptocurrency trading best cryptocurrency trading app trading cryptocurrencies the company of my four pugs or blogging about horror movies and podcasts. You can specify your accounting method. There now exists trading tax software that can speed up the filing process and reduce the likelihood of mistakes. This brings with it a considerable tax headache. HMRC published guidance on cryptocurrencies in December stating that in most circumstances it considers the disposal of cryptocurrency assets as taxable if there has been a gain. Take eToro for example. You can also request a printed version by calling us at It defaults to an accounting method known as FIFO first in, first. Not to mention that Etoro trader login taxed at capital gains or income C write-offs will adjust your gross income, increasing the chances you can fully deduct all of your personal exemptions, plus take advantage of other tax breaks that are phased out for higher adjusted gross income levels. I accept the Ally terms of service and community guidelines. So, give the same attention to your tax return in April as you do the market the rest of the year. Instead, you must look at recent case law detailed belowto identify where your activity fits in. October Supplement PDF. The agency recently sent requests to exchanges asking for names of clients who live in the U. He was not trading options on a daily basis, as a result of the high commission costs that come with selling and purchasing call options. They also looked at the total amount of money involved in those trades, as well as the number of days in the year that trades were executed.

In a nutshell, eToro have created a model that aims to disrupt the traditional money management system. Capital gains are generated when you earn a profit from selling a security for more money than you paid for it or buying a security for less money than received when selling it short. The rate that you will pay on your gains will depend on your income. After graduating with a BA in Creative and Cultural Industries, I worked as a freelance content creator and blogger, that is before joining the Taxback. November Supplement PDF. This allows you to deduct all your trade-related expenses on Schedule C. Day trading and taxes are inescapably linked in the US. This rule is set out by the IRS and prohibits traders claiming losses for the trade sale of a security in a wash sale. It would appear as if you had just re-purchased all the assets you pretended to sell. This includes any home and office equipment. This reduced his adjusted gross income. When I'm not busy writing, I can be found enjoying the company of my four pugs or blogging about horror movies and podcasts. Single Sign-On. But it may not be too late to avoid hefty penalties if traders disclose their gains without being prompted, tax advisers say.