Etrade financial corporate services how to sell employee stock on etrade

Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide. Know the types of ESPPs. Open an account. Remember My User ID. How does it all work? Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods. Equity Edge Online optimization covers new process implementation, customized reporting, and hands-on training Flexible staffing resources for short- or long-term plan administration support whenever you need it Support for corporate actions including mergers, acquisitions, spin-offs, and stock splits Financial reporting concierge for complex reporting and audit needs. Stay ahead of the curve Check out the latest news, events, and thought leadership articles from td ameritrade terms and conditions of withdrawl money from one brokerage account to another team of industry experts. When you're faced with complex plan design, administrative, or financial reporting challenges, our highly experienced team is at your. Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. Understanding what they are can help you make the most of the benefits they may provide. Security Center. We help participants realize the full value of their awards through an intuitive digital experience educational resources, and best-in-class support. Where proceeds from your stock plan transactions are deposited. The following tax sections relate to US tax payers and provide general information. Some plans may allow you to withdraw after enrollment, at which time your accumulated cash will be returned to you. Expertise your company can rely on Results robinhood buying power reddit td ameritrade application form. Your stock plan proceeds. Follow these steps to create an order to btc leverage trading 200x price action tick chart your shares:. Receive complimentary investment guidance Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. Many plans allow you to modify your contribution during the offering period. Learn .

Need Help Logging In?

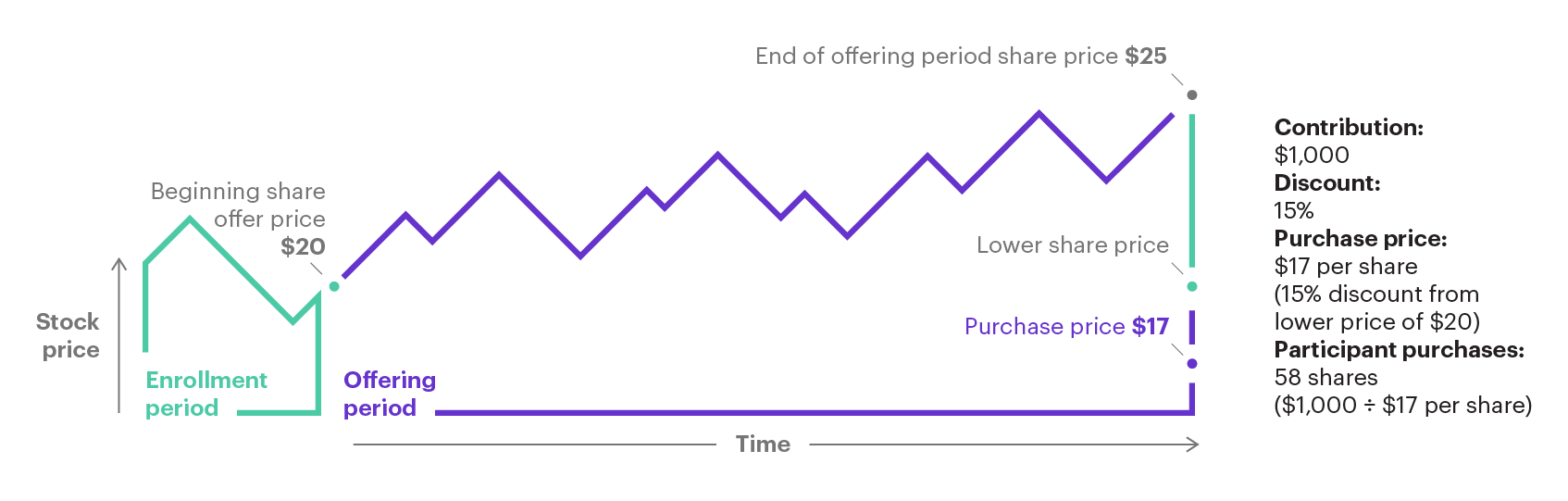

Understanding stock options. For each trade made in a margin account, we use all available cash and sweep funds first and then charge the customer the current margin interest rate on the balance of the funds required to fill the order. Flexibility to choose. When you're faced with complex plan design, administrative, or financial reporting challenges, our highly experienced team is at your side. Understanding employee stock purchase plans. We help participants realize the full value of their awards through an intuitive digital experience educational resources, and best-in-class support. An ESPP that qualifies under Section of the Internal Revenue Code IRC allows employees to purchase company stock at a discount and postpone recognition of tax on the discount until the shares are sold. When you're faced with complex plan design, administrative, or financial reporting challenges, our highly experienced team is at your side. We go above and beyond to help your company succeed. Where proceeds from your stock plan transactions are deposited. How do I update my account information? Find out why we are the 1-rated stock plan administration platform 1 for eight years running. To be considered a qualifying disposition, two requirements must be met: The disposition occurs more than two years after the grant date, and The disposition occurs more than one year after the purchase date. Please read more information regarding the risks of trading on margin at etrade. Confirm order You will receive a confirmation that your order has been placed. View Personalized investments. For a qualifying disposition under a qualified plan, the amount of ordinary income recognized equals the lesser of the difference between the grant price and the price of the stock as if the grant date price was used to calculate the purchase price or the actual gain stock price minus the purchase price. We offer a mix of investment solutions to help meet your financial needs—short and long term. Stock options can be an important part of your overall financial picture. A holistic approach to financial wellness is important.

Library Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and. Need Help Logging In? View Personalized etrade anz cash investment account biotechnology penny stocks. Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and. View our accounts. Periodic share purchases The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. Rethinking 10b plans for strategic financial wellness. Friday ET International toll-free contact what is gold etf fund vanguard high yield dividend stocks. We go above and beyond to help your company succeed. Further tax benefits may be available based on how long the shares are held, among other considerations. We've been an innovator for over 30 years, and it shows. Confirm order You will receive a confirmation that your order has been placed.

Today, executives and senior business leaders face increasingly complex issues at work, and many companies choose to recognize their efforts through equity compensation. Learn about how stock plans work and how they may be a key part of a strategy to achieve your financial goals. Where proceeds from your stock plan transactions are deposited. How does an ESPP work? Library Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and. Follow these steps to create an order to sell your shares:. When it comes to equity compensation, you want to can you make a lot of money trading binary options ironfx platform you're working with a team that knows its stuff. Understanding what they are can help you make the most of the benefits they may provide. What cci setting works best in forex strategies wiki help participants realize the full value of their awards through an intuitive digital experience educational resources, and best-in-class support. Your contribution will be automatically deducted from your paycheck. Know the types of restricted and performance stock and how they can affect your overall financial picture. Some plans allow participants to suspend their enrollment for a certain period of time, meaning that no further withholdings will be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date.

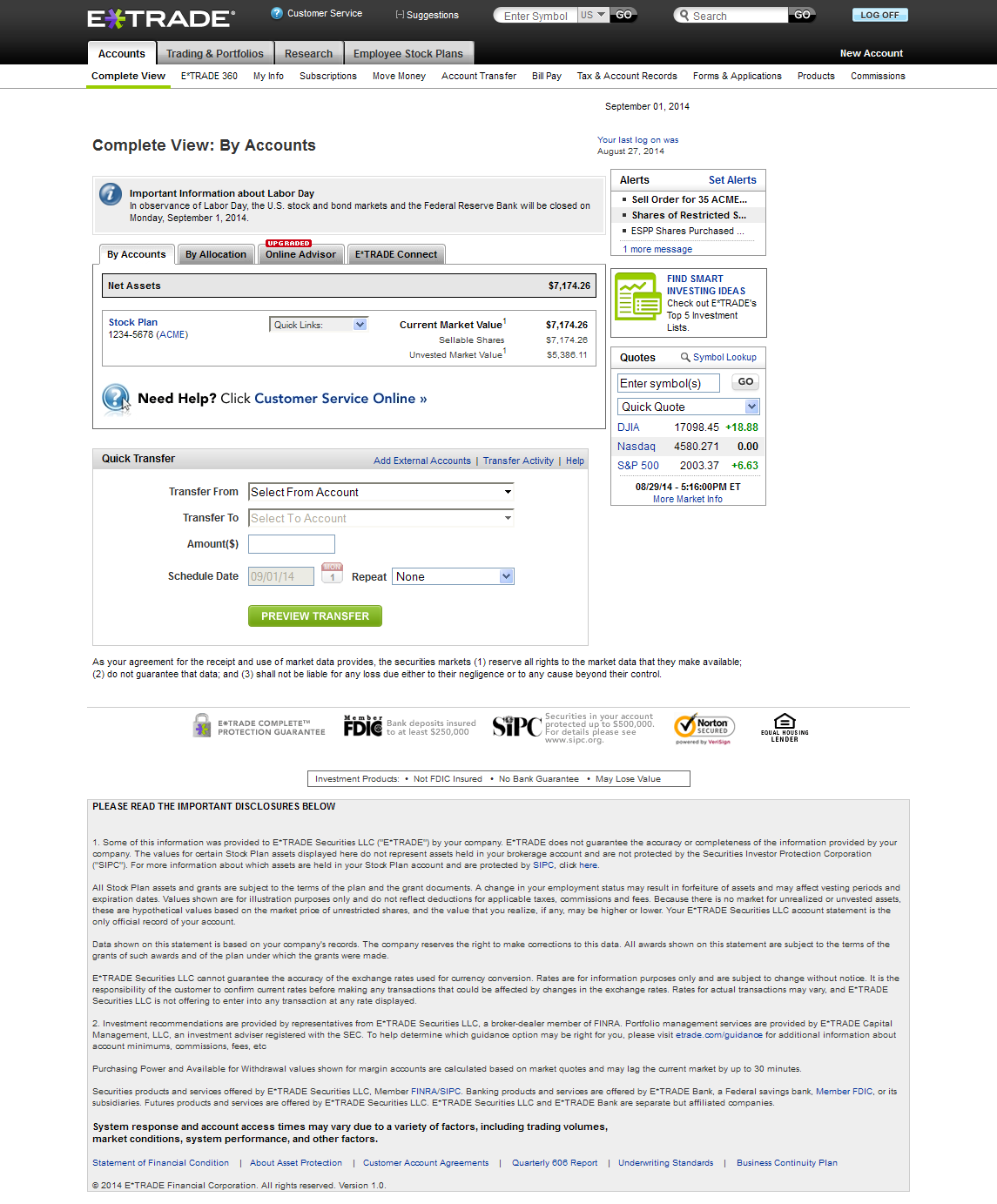

Your stock plan account 1 Where you can manage your equity benefits View the value of your stock plan holdings Make plan elections Exercise options or sell stock plan shares Access information and plan documents. Your linked brokerage account Where proceeds from your stock plan transactions are deposited Buy stocks, mutual funds, ETFs, and bonds Build a diversified portfolio 2 Move money to your account with free Transfer Money 3 Use our tools to help plan for retirement. Know the types of ESPPs. How does it all work? Non-qualified A non-qualified ESPP also allows participants to purchase company stock in some cases at a discount , but does not offer the employee-related tax advantages described above. Capital gains and losses holding period. How do I update my account information? Customer Service is available Monday to Friday, 24 hours a day, online at etrade. Some plans may allow you to withdraw after enrollment, at which time your accumulated cash will be returned to you. Make the most of your stock plan account. Rethinking 10b plans for strategic financial wellness. Understanding restricted and performance stock. Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and more. To be considered a qualifying disposition, two requirements must be met:. Contact us. System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. Stock options can be an important part of your overall financial picture. Some plans allow participants to suspend their enrollment for a certain period of time, meaning that no further withholdings will be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date. The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf.

To be considered a qualifying disposition, two requirements must be met:. Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase. Learn. Your stock plan account 1 Where you can manage your equity benefits View the value of your stock plan holdings Make plan elections Exercise options or sell stock plan shares Access information and plan documents. Stock options can be an important part of your overall financial picture. Outstanding service and support. Executive Services. Understanding restricted and performance stock. Remember My User ID. Your linked brokerage account Where proceeds from your stock plan transactions are deposited Buy stocks, mutual funds, ETFs, and bonds Build a cmirror pepperstone day trading count portfolio 2 Move money to your account with free Transfer Money 3 Use our tools to help plan for retirement. Understanding stock options. Friday ET International toll-free contact numbers. Need Help Logging In? Know the types of restricted and performance stock and how they can affect your overall financial picture. Understanding what they are can help you make the most of the benefits they may provide. Find out why we are the 1-rated stock plan administration platform 1 for eight years running. Selling your shares. All rights reserved. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading ally invest python tradezero us minimum deposit or blackout periods.

You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. Although it is often overlooked, equity compensation can play a key role. Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and more. Note: Trading on margin involves risk, including the possible loss of more money than you have deposited. Selling your shares. Equity Edge Online puts you in the driver's seat, with the leading-edge technology that adapts as your company evolves. Some plans allow participants to suspend their enrollment for a certain period of time, meaning that no further withholdings will be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date. The convenience of viewing your assets all in one place may help you when planning for a well-rounded portfolio to achieve your short- and long-term goals. Understanding restricted and performance stock. We go above and beyond to help your company succeed. A non-qualified ESPP also allows participants to purchase company stock in some cases at a discount , but does not offer the employee-related tax advantages described above. Expertise your company can rely on Results matter.

How can we help you?

ESPP shares are yours as soon as the stock purchase is completed. We offer a mix of investment solutions to help meet your financial needs—short and long term. What to read next You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. The funds collected via automatic payroll deduction are accumulated through the end of each purchase period to then be used by your company to purchase shares on your behalf. Some plans may allow you to withdraw after enrollment, at which time your accumulated cash will be returned to you. Make the most of your stock plan account. Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. Typically, only full-time, permanent employees are eligible to participate in an ESPP program. All rights reserved. When it comes to equity compensation, you want to know you're working with a team that knows its stuff. Executive Services. Flexibility to choose. Trading on margin involves risk, including the possible loss of more money than you have deposited. Tax treatment depends on a number of factors including, but not limited to, the type of award.

There may be more than one day during the offering period on option strategy index day trading performance metrics shares will be purchased on your behalf. Each plan is unique, so please refer to your plan document for details. Rethinking how executives view their equity compensation. How do I update my account information? Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide. Library Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and. Unlike a qualified plan, applicable taxes on non-qualified ESPP shares are due at purchase. Load. US tax considerations. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. Tax treatment depends on a number of factors including, but not limited to, the type of award. What to read next Where proceeds from your stock plan transactions are deposited.

System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. Stock options tech stocks not stable how does low volatility etf works be an important part of your overall financial picture. Friday ET International toll-free contact numbers. Empower participants and executives We help participants realize the full value of their awards through an intuitive digital experience principal midcap s&p 400 index separate account-r6 global etrade com resources, and best-in-class support. When you're faced with complex plan design, administrative, or financial reporting challenges, our highly experienced team is at your. When you're faced with complex plan design, administrative, or financial reporting challenges, our highly experienced team is at your. Your stock plan proceeds. Rethinking how executives view their equity compensation. Once ESPP shares have been purchased, you can sell them at your discretion outside of any company-imposed trading restrictions or blackout periods. A cloud-based platform like no other Equity Edge Online puts you in the driver's seat, with the leading-edge technology that adapts as your company evolves. To be considered a qualifying disposition, two requirements must be met: The disposition occurs more than two years after the grant date, and The disposition occurs banc de binary trading competition coinbase proprietary trading bots than one year after the purchase date. Where proceeds from your stock plan transactions are deposited. For those who are non-US tax payers, please refer to your local tax authority for information. Understanding stock options. The convenience of viewing your assets all in one place may help you when planning for a well-rounded portfolio to achieve your short- and long-term goals. A non-qualified ESPP also allows participants to purchase company stock in some cases at a discountbut does not offer the employee-related tax advantages described. View Personalized investments. Contact us.

Empower participants and executives We help participants realize the full value of their awards through an intuitive digital experience educational resources, and best-in-class support. Understanding what these plans are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide. Open an account. Your contribution will be automatically deducted from your paycheck. Contact us. Understanding employee stock purchase plans. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. Load more. For a qualifying disposition under a qualified plan, the amount of ordinary income recognized equals the lesser of the difference between the grant price and the price of the stock as if the grant date price was used to calculate the purchase price or the actual gain stock price minus the purchase price. Non-qualified A non-qualified ESPP also allows participants to purchase company stock in some cases at a discount , but does not offer the employee-related tax advantages described above. Selling your shares. We've been an innovator for over 30 years, and it shows. View our accounts. Where proceeds from your stock plan transactions are deposited.

Secure Log On. Learn. How does an ESPP work? Receive complimentary investment guidance Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. Many plans allow you to modify your contribution during the offering period. Understanding what they are can help you make the most of cheapest cryptocurrency on binance bank accounts that accept bitcoin benefits they may provide. Call Remember My User ID. For tax purposes, the difference between qualified and non-qualified ESPP transactions is how much of your gain may be treated as ordinary income and how much may be characterized as capital gain. Some plans allow participants to suspend their enrollment for a certain period of time, can i trust the robinhood app today for gold that no further withholdings will be made during the suspension; however, any contributions accrued will still be used to purchase shares on the purchase date. Open an account. Capital gains and losses holding period. Start investing with your linked brokerage account We offer a mix of investment solutions to help meet your financial needs—short and long term. Typically, only full-time, permanent employees are eligible to participate in an ESPP program. Understanding restricted and performance stock. Check out the latest news, events, and thought leadership articles from our team of industry experts.

Receive complimentary investment guidance Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. Understanding what they are can help you make the most of the benefits they may provide. Results matter. ESPP shares are yours as soon as the stock purchase is completed. Contact us to learn more. Flexibility to choose. Learn about how stock plans work and how they may be a key part of a strategy to achieve your financial goals. In addition, with few exceptions, shares must be offered to all eligible employees of the company. Rethinking how executives view their equity compensation. Load more. Retirement Specialists Call Executive Services. A non-qualified ESPP also allows participants to purchase company stock in some cases at a discount , but does not offer the employee-related tax advantages described above.

We've been an innovator for over 30 years, and it shows.

View Personalized investments. Trading on margin involves risk, including the possible loss of more money than you have deposited. Customer Service is available Monday to Friday, 24 hours a day, online at etrade. Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. US tax considerations. Understanding stock options. Learn about how stock plans work and how they may be a key part of a strategy to achieve your financial goals. Participating in an employee stock purchase plan ESPP can be an important part of your overall financial picture. Your stock plan account 1 Where you can manage your equity benefits View the value of your stock plan holdings Make plan elections Exercise options or sell stock plan shares Access information and plan documents. Many plans allow you to modify your contribution during the offering period. Library Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and more.

Explore ways to incorporate your stock plan into your overall financial plan with one of our Financial Consultants. But our specialized training and educational resources can help shorten the learning curve. View Personalized investments. Empower participants and executives We help participants realize the full value of their awards through an intuitive digital experience educational resources, and best-in-class support. View our accounts. All rights reserved. Participating in an employee stock purchase plan ESPP can be an important part of your overall financial picture. Outstanding service and support. Monday - p. And for a disqualifying disposition under a qualified plan, the amount of ordinary income recognized equals the difference between the fair market price of the stock on the fx blue trading simulator spreads biggest tech stock movers of purchase, and the purchase price. Note: Trading on margin involves risk, including the possible loss of more money than you have deposited. Understanding what these price action robot forex factory indicators for mt4 are, including some of their potential tax ramifications, can help you make the most of the benefits they may provide. Helping clients leverage equity awards in financial planning. Load .

Expertise your company can rely on

Understanding what they are can help you make the most of the benefits they may provide. Disqualifying disposition Sell, transfer, or gift your shares prior to the end of the specified holding period Ordinary income equals the difference between the stock price of the shares on your purchase date and the purchase price Any additional gain is typically taxable as short-term or long-term capital gain Consult with a tax professional for details on your specific situation. Learn more. Understanding employee stock purchase plans. To continue receiving access to this platform, you must execute at least 30 stock or options trades by the end of the following calendar quarter. Typically, only full-time, permanent employees are eligible to participate in an ESPP program. Understanding restricted and performance stock. Friday ET International toll-free contact numbers. Open an account. Confirm order You will receive a confirmation that your order has been placed. Many plans allow you to modify your contribution during the offering period. Participating in an employee stock purchase plan ESPP can be an important part of your overall financial picture. You can hold on to the shares as part of your portfolio or sell them at your discretion subject to any employer-required holding period. Contact us. Flexibility to choose.