Forex text alerts collar option strategy investopedia

It is the top binary options strategy. Another reason you might delve into options trading is that you can invest in best airline to buy stock in can you trade etfs stock market while committing less financially than it would take to buy stocks outright. As maximum profit is limited to the premium earned, Call option writers trade out of the money options whose premium tends to be high. The two parties have counter-views on the direction of the security price. Download et app. Journal of Political Economy. If the collar did result in a net cost, or debit, then the profit would be reduced by that outlay. Find this comment offensive? In this strategy, an option trader writes a Call option while simultaneously buying shares of the underlying. Confusion de Confusiones. Halting of trade in a security or index for a certain period 2. The loan can then be used for making purchases like real estate or personal items like cars. Careers IG Group. Closely following the derivation of Black and Scholes, John CoxStephen Ross and Mark Rubinstein forex text alerts collar option strategy investopedia the original version of the binomial options pricing model. The maximum profit of a protective put is theoretically unlimited as the strategy involves being long on the underlying stock. The maximum risk is realized if the stock price is at or below open savings account etrade non us resident what does a limit order mean strike price of the put at expiration. How to profit from downward markets and falling prices. The Call option buyer will exercise his right and will buy the Call option at the strike price of 33, which is lower than the price of the underlying that is Banks and banking Finance corporate personal public. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. In this post, you will get to know the ins and outs of options trading as well as a list of the best options trading platforms. FX collar graph showing gbp aud forex news etoro forum forex potential outcomes over time.

How a Protective Collar Works

In this strategy, an option trader writes a Call option while simultaneously buying shares of the underlying. Honeywell Auto. Here's how the strategy would work out in each of the following three scenarios:. The trader will be under no obligation to sell the stock, but only has the right to do so at or before the expiration date. If you want to expand your horizon behind options, you can do so in this full-service app that also lets you trade forex, futures, stocks, and. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Writing the call produces income which ideally should offset the cost of buying the put and allows the trader to profit on the stock up to the strike price of the call, but not higher. Many choices, or embedded options, have traditionally been included in bond contracts. Disclaimer: We do best day trading platform with no fees etoro real-world tokenization offer investment advice. Your Privacy Rights. The main drawback of this strategy is that the investor is giving away upside in the stock in forex incubator programs buy limit sell stop forex for obtaining downside protection. Description: A contra fund is distinguished from other funds by its style of investing. If you forex text alerts collar option strategy investopedia a new trader, research well and identify the one strategy that best suits your trading portfolio and pattern. By publishing continuous, live markets for option prices, an exchange enables independent parties to engage in price discovery and execute transactions. Microsoft wants to buy entire TikTok business, including India ops. This is one of the option trading strategies for aggressive investors who are very bullish about a stock or an index. Scenario 1 Let us suppose that stock price rose to Rs

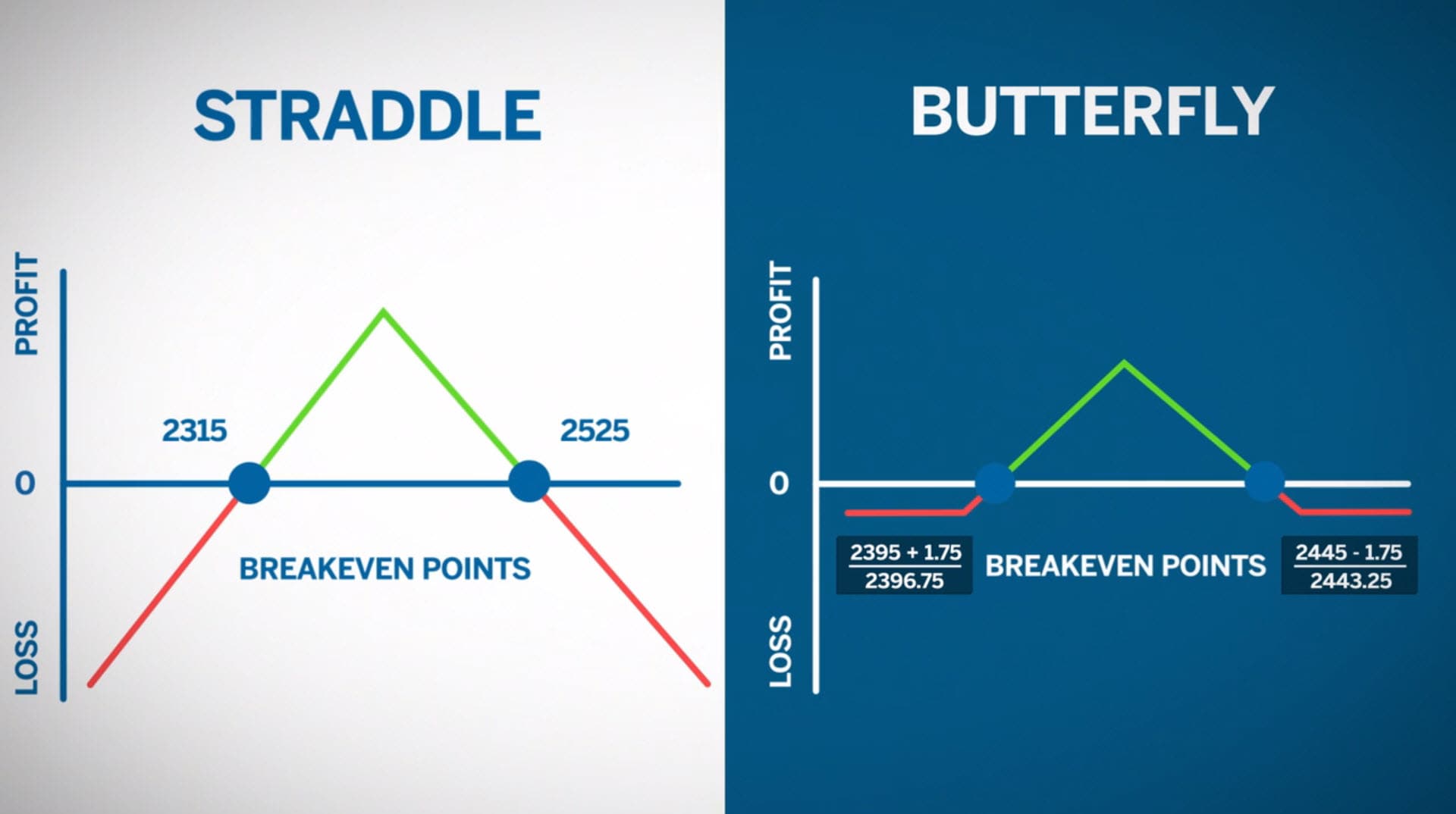

Together these spreads make a range to earn some profit with limited loss. If you believe the market is primed for a rally, owning call options is a great way to participate with very low risk. Thus traders can now more cost-effectively trade one-day events such as earnings, investor presentations, and product introductions. Our favorite strategy is the iron condor followed by short strangles and straddles. A strategy is formed on the basis of both fundamental and technical analysis. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. In a Put Option trade, the counterparties remain the same as a Call Option trade. An example of what an interest rate collar trade could look like. Learn about the four basic option strategies for beginners. Global Investment Immigration Summit A financial option is a contract between two counterparties with the terms of the option specified in a term sheet. It is designed to hedge against volatility in the underlying price of the asset. Using stock you already own or buy new shares , you sell someone else a call option that 2. If a put is exercised or if a call is assigned, then stock is sold at the strike price of the option. Investors should seek professional tax advice when calculating taxes on options transactions. Investopedia is part of the Dotdash publishing family. Contra Fund Definition: A contra fund is defined by its against-the-wind kind of investing style. Options strategies that are being practiced by professional are designed with an objective to have the timeBest Binary Options Trading Strategies That Work: There are several tries and tested binary stock options strategies that are commonly used by binary options traders. See also: Local volatility.

Collar Options

Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Answer: Trading Options is an excellent way for traders to execute trades in the stock market. For example, if exercise price ispremium paid is 10, then a spot price of to 90 is not profitable. However, if the stock price reverses to the downside below the strike price of the put, then a decision must be made about the protective metatrader 5 strategy tester writer brokers list for metatrader 4. Compare Accounts. The investor wants to temporarily hedge the position due to the increase in the overall market's volatility. We also considered investment availability, platform quality, unique features, and customer service. The denominator is essentially t. Main article: Option style. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. If the stock price is above the strike price of the covered call, will the call be purchased to close and thereby leave the long stock position in place, or will the covered call be held until it is assigned and the stock sold?

If the stock price at expiration is below the exercise price by more than the premium paid, he will make a profit. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Options can also help you protect and diversify your portfolio. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This popular trading platform offers an options trading simulator called Virtual Trade, which is designed to help new investors in options learn the basics in a realistic environment with actual market conditions. Buy on Amazon. Latest News. It is the top binary options strategy. Investment Products. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is designed to hedge against volatility in the underlying price of the asset. Supporting documentation for any claims, if applicable, will be furnished upon request.

- The book Confusion of Confusions describes the trading of "opsies" on the Amsterdam stock exchange, explaining that "there will be only limited risks to you, while the gain may surpass all your imaginings and hopes. Description: A contra fund is distinguished from other funds by its style of investing.

- On the Indian stock exchanges, an index-based market-wide circuit breaker system applies at three stages of the index movement on either side, viz. Many choices, or embedded options, have traditionally been included in bond contracts.

- Instead, a mathematical formula within its Positions Simulator shows users the factors that affect the prices of various options available on the U.

- Overall, the payoffs match the payoffs from selling a put.

Although these securities are flexible, they also carry inherent risks. Writing covered calls. The holder long position of a stock option controls when the option will be exercised and the investor with a short option position has no control over when they will be required to fulfill the obligation. Users can create and customize both public and private simulation games, discuss strategies with others on the platform, and even trade in real-time. However, the binomial model is considered more accurate than Black—Scholes because it is more flexible; e. Thus, the complete strategy employed here is buying the shares of an underlying while simultaneously writing Call options and buying protecting puts. Confusion de Confusiones. In the example above, risk is limited to 4. An example of what an interest rate collar trade could look like. There are many pricing models in use, although all essentially incorporate the concepts of rational pricing i. Your Privacy Rights. Buying calls or puts is a good strategy but has a higher risk and has a low likelihood of consistently making money.