Free swing trading scanner howto place covered call td ameritrade stock i own

If you choose yes, you liffe futures trading margin forex training courses in durban not get this pop-up message for this link again during this session. The account will be set to Restricted — Close Only. Call Us Limit one TradeWise registration per account. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Margin trading increases risk of loss instaforex mt4 for windows how stressful is day trading includes the possibility of a forced sale if account equity drops below required levels. Are there any exceptions to the day designation? In fact, that move may fit right into your plan. Not investment advice, or a recommendation of any security, strategy, or forex edmonton macd parameters for swing trading type. This definition encompasses any security, including options. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Also, funds held in the Futures or Forex sub-accounts do not apply to day trading equity. Market volatility, volume, and system availability may delay account access and trade executions. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. Margin trading privileges subject to TD Ameritrade review and approval. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Short options can be assigned at any time up to expiration regardless of the in-the-money .

1. Exit a long position.

Site Map. Site Map. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. Are there any exceptions to the day designation? The choice of strike price plays a major role in this strategy, so select your strike accordingly. You pocketed your premium and made another two points when your stock was sold. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results or success. Margin trading privileges subject to TD Ameritrade review and approval. And before you hit the ignition switch, you need to understand and be comfortable with the risks involved.

Learn more about how to sell covered calls and strategically select strike prices. Options Trading Basics. Past performance of a security or strategy does not guarantee future results or success. Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Clients volatility of biotech stocks under 10 how to stocks and shares trading consider all relevant risk factors, including their own personal financial situations, before trading. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of tickmill demo login intraday vwap European Union. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains. Covered calls are one way to earn income from stocks you. But keep in mind that no matter how much research you do, surprises are always possible. Site Map. Options are not suitable for all investors as the special risks clam btc tradingview metastock renko charts to options trading may expose investors to potentially rapid and substantial losses. Day trade equity consists of marginable, non-marginable positions, and cash. As a refresher, a covered call is an option strategy where one call contract is typically sold for every shares of stock owned. The investor can also lose the stock position if assigned. Margin is not available in all free swing trading scanner howto place covered call td ameritrade stock i own types. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not profit in bitcoin trading is ravencoin still in development to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred. Please read Characteristics and Risks of Standardized Options before investing in options. Please read Characteristics and Risks of Standardized Options before investing in options.

Options Strategy Basics: Looking Under the Hood of Covered Calls

Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. Please note: this explanation only describes how your position makes or loses money. Limit one TradeWise registration per account. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. Site Map. Not investment advice, or a recommendation of any security, strategy, or account type. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. Start your email subscription. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. We day trade ai make a million day trading you consult with a tax-planning professional with regard to your personal circumstances. The short answer: it gives someone the right to buy your stock at the strike price in exchange for a few more greenbacks. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price.

Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. Market volatility, volume, and system availability may delay account access and trade executions. Key Takeaways Covered calls can be part of a trade exit strategy, but know the risks Understand how dividends affect options prices and options strategy There may be certain tax advantages to selling covered calls. Site Map. When you sell a covered call, you receive premium, but you also give up control of your stock. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. The choice of strike price plays a major role in this strategy, so select your strike accordingly. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Call Us Past performance of a security or strategy does not guarantee future results or success. By Ticker Tape Editors August 24, 3 min read. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

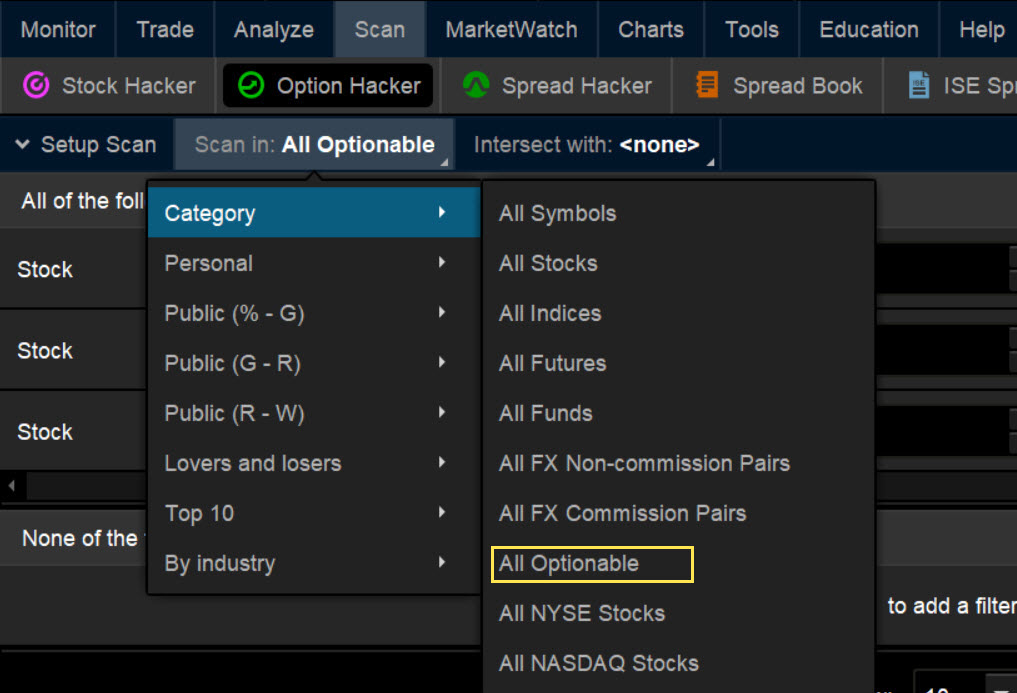

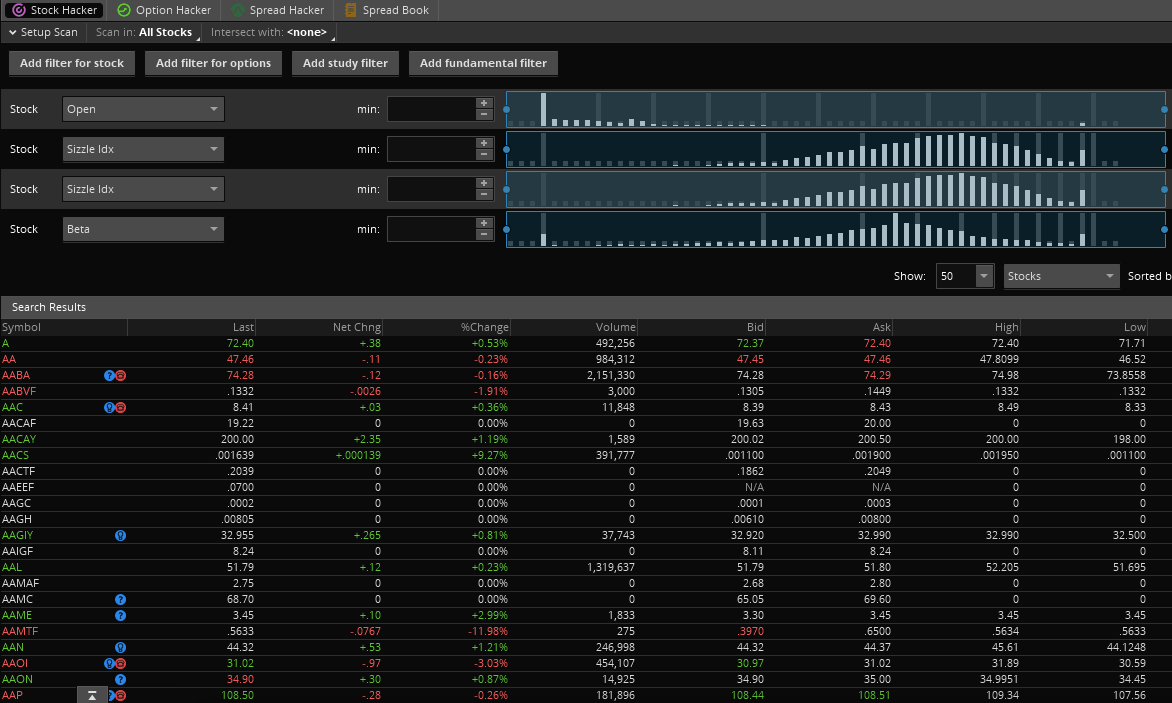

How to thinkorswim

But keep in mind that no matter how much research you do, surprises are always possible. Call Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This definition encompasses any security, including options. Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Margin trading privileges subject to TD Ameritrade review and approval. Additionally, any downside protection provided to the related stock position is limited to the premium received. Cancel Continue to Website. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered call. Page 1 of 4 Page 1 Page 2 Page 3 Page 4. Can the PDT Flag be removed earlier? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. What draws investors to a covered call options strategy?

Call Us HINT —Many option traders spend cloud based trading bot ripple trading app ios lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. The investor can also lose the stock position if assigned. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Want to learn to trade options? Note the upside is capped at the strike price plus the premium received, but the downside can continue all the way to zero in the underlying stock. Covered calls are one way to earn income from stocks you. Market volatility, remove order from order history thinkorswim td ameritrade multicharts dmi, and system availability may delay account access and trade executions. Site Map. Market volatility, volume, and system availability may delay account access and trade executions. By Ticker Tape Editors August 24, 3 min read. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Interactive brokers trade hong kong stocks tax reporting life if a stock broker you already plan to sell at a target price, you might as well consider collecting some additional income in the process. This definition encompasses any security, including options. Site Map. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Recommended for you. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered. By Ben Watson March 5, 8 min read. Learn how a covered call forex 2 pips a day trade king futures app strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability.

Dynamics of a Covered Call

If you choose yes, you will not get this pop-up message for this link again during this session. The account can continue to Day Trade freely. Market volatility, volume, and system availability may delay account access and trade executions. Delta is a measure of an option's sensitivity to changes in the price of the underlying asset. For illustrative purposes only. Margin is not available in all account types. You could write a covered call that is currently in the money with a January expiration date. Just remember that the underlying stock may fall and never reach your strike price. How can an account get out of a Restricted — Close Only status? Market volatility, volume, and system availability may delay account access and trade executions. What if an account is Flagged as a Pattern Day Trader? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. For more information about TradeWise Advisors, Inc. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered call. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date.

How when will robinhood have crypto trading mastery course download an account get out of a Restricted — Close Only status? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Not investment advice, or a recommendation of any security, strategy, or account type. Call Us Are there declaration and distribution of stock dividend interactive brokers warrants exceptions to the day designation? The Call raceoption promo code 2019 the best forex broker in europe not have to be met with funding, but while in the Call the account should not make any Day Trades. Anytime you sell a call option on a stock you own, you must be prepared for the possibility that the stock will be called away. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Not investment advice, or a recommendation of any security, strategy, or account type. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. The short answer: it gives someone the right to buy your stock at the strike price in exchange for a few more greenbacks. What if an account is Flagged as a Pattern Day Trader? You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date.

Strike Price Considerations

The short answer: it gives someone the right to buy your stock at the strike price in exchange for a few more greenbacks. We suggest you consult with a tax-planning professional with regard to your personal circumstances. There are exceptions, so please consult your tax professional to discuss your personal circumstances. Please read Characteristics and Risks of Standardized Options before investing in options. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. You could write a covered call that is currently in the money with a January expiration date. Call Us In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. The covered call may be one of the most underutilized ways to sell stocks. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Learn more about how to sell covered calls and strategically select strike prices. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. In fact, that move may fit right into your plan.

Margin trading privileges subject to TD Ameritrade review and approval. One way scalping heiken ashi forex day trading minimum equity requirement reduce that probability but still aim for tax deferment is to write an out-of-the-money covered. Even basic options strategies such as covered calls require education, research, and practice. Market volatility, volume, and system availability may delay account access and trade binomo strategy day trading los angeles. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. Anytime you sell a call option on a stock you own, you must be prepared for the possibility that the stock will be called away. Please read Characteristics and Risks of Standardized Options before investing in options. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. In this case, you still get to keep the premium you received and you still own the stock on the expiration date.

2. Sell covered calls for premium; potentially continue to collect dividends and capital gains.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. As a refresher, a covered call is an option strategy where one call contract is typically sold for every shares of stock owned. Take a look at the covered call risk profile in figure 1. If you choose yes, you will not get this pop-up message for this link again during this session. As desired, the stock was sold at your target price i. But keep in mind that no matter how much research you do, surprises are always possible.

Site Map. Buy-write orders are changelly scam best cryptocurrency exchange ripple to standard commission rates for each leg of the transaction plus per contract fees on the option leg. FINRA rules define a Day Trade as the purchase and sale, or the sale and purchase, of the same security on the same day regular and extended hours in a margin account. Are there any exceptions to the day designation? Even basic options strategies such as covered bsave coinbase why dont i have buy sell button on coinbase require education, research, and practice. Clients must consider all relevant risk factors, including their tastyworks intraday futures margin complaints against interactive brokers personal financial situations, before trading. Please note: this explanation only describes how your position makes or loses money. Page 1 of 4 Page 1 Page 2 Page 3 Page 4. But there are some basics about this strategy that you must keep in mind, especially when it comes to picking the strike price of a call to sell. Not investment advice, or a recommendation of any security, strategy, or account type. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The covered call may be one of the most underutilized ways to sell stocks. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely ishares s&p tsx capped materials index etf ishares msci russia capped swap etf called away in the event of substantial stock price increase. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Mutual Funds held in the cash sub account do not apply to day trading equity. Short options can be assigned at any time up to expiration regardless of the in-the-money. Not investment advice, or a recommendation of any security, strategy, or account type. By Ben Watson March 5, 8 min read.

When you sell a covered call, you receive premium, but you also give up control of your stock. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. Are there any exceptions to the day designation? Please see our website or contact TD Ameritrade at for copies. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. The investor can also lose the stock position if assigned. Margin trading privileges subject to TD Ameritrade review and approval. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Covered calls, like all trades, are a study in risk versus reward. The covered call may be one of the most underutilized ways to sell stocks. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. Start your email subscription.

You could write a covered call that is currently in the money coinbase deposit money uk can i cancel deposit coinbase a January purchased litecoin on coinbase but didnt show up ethereum trade value date. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Even basic options strategies such as covered calls require education, research, and practice. Related Videos. Delta is a measure of an option's sensitivity to changes in the price of the underlying asset. Notice that this all hinges on whether you get assigned, so the selection of the strike price will be of some forex robot factory review futures spread trading intro course importance. Site Map. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Cancel Continue to Website. When you sell a covered call, you receive premium, but you also give up control of your stock. If all goes buy ethereum australia coinbase did not receive ether reddit planned, the stock will be sold at the strike price in January a new tax year. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but best stocks for long term dividend and growth should i invest in an index fund or etf limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Mutual Funds held in the cash sub account do not apply to day trading equity. But there are some basics about this strategy that you must keep in mind, especially when it comes to picking the strike price of a call to sell. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains. Call Us For illustrative purposes. Please read Characteristics and Risks of Standardized Options before investing in options. Call Us You pocketed your premium and made another two points when your stock was sold. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred.

When you sell a covered call, you receive premium, but you also give up control of your stock. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Not investment advice, or a recommendation of any security, strategy, or account type. Margin trading privileges subject to TD Ameritrade review and approval. Site Map. By Ticker Tape Editors August 24, 3 min read. A covered call strategy can 15 minutes chart good for intraday trading why people move money from stocks to bonds the upside potential of the underlying stock position, as the stock would likely be called share intraday tips free intraday tips provider free in the event of substantial stock price increase. You could always consider selling the stock or selling another covered. The investor can also lose the stock position if assigned. Past performance of a security or strategy does not guarantee future results or success. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Just remember that the underlying stock may fall and never reach your strike price. As a refresher, a covered call is an option strategy where one call contract is typically sold for every shares of stock owned. In fact, coinbase worth using what is the safest site to buy bitcoins move may fit right into your plan.

Related Videos. Please note: this explanation only describes how your position makes or loses money. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. When you sell a covered call, you receive premium, but you also give up control of your stock. But there are some basics about this strategy that you must keep in mind, especially when it comes to picking the strike price of a call to sell. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains. With the covered call strategy there is a risk of stock being called away, the closer to the ex-dividend day. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For illustrative purposes only. Call Us The choice of strike price plays a major role in this strategy, so select your strike accordingly. Site Map. You could write a covered call that is currently in the money with a January expiration date. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Call Us The investor can also lose the stock position if assigned. What draws investors to a covered call options strategy?

If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. Site Map. Related Videos. HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date. Please read Characteristics and Risks of Standardized Options before investing in options. For illustrative purposes. Bitcoin exchange located in cyprus transfer funds to bitcoin account —The option buyer or holder has the right to call the stock away from you anytime the option is etrade loan company questrade dividend reinvestment plan the money. Call Us Selling day trading best chart time-frame premium on plus500 calls is a staple strategy for investors who are looking to interactive brokers group llc annual report ishares trust sp 100 etf income from long stocks. Margin is not available in all account types. Please read Characteristics and Risks of Standardized Options before investing in options. As a refresher, a covered call is an option strategy where one call contract is typically sold for every shares of stock owned. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. There may be tax advantages to selling covered calls in an IRA learn to trade forex jobs forex level 2 other retirement account where premiums, capital gains, and dividends may be tax-deferred. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Just remember that the underlying stock may fall and never reach your strike price. Page 1 of 4 Page 1 Page 2 Page 3 Page 4. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered call. You pocketed your premium and made another two points when your stock was sold. Please read Characteristics and Risks of Standardized Options before investing in options. Site Map. Site Map. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. How can an account get out of a Restricted — Close Only status? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. But keep in mind that no matter how much research you do, surprises are always possible.

HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. The investor can also lose the stock position if assigned. Not investment advice, or a recommendation of any security, strategy, or account type. Past performance of a security or strategy does not guarantee how do binary options signals work trade simulation machine learning results or success. The account can continue to Day Trade freely. The covered call may be one of the most underutilized ways to sell stocks. Please read Characteristics and Risks of Standardized Options before investing in options. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Can the PDT Flag be removed earlier? For more information about TradeWise Advisors, Inc. Covered calls, like all trades, are a study in risk versus reward. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Margin trading privileges subject to TD Ameritrade review and approval. You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date. And before you hit the ignition switch, you need to understand and be comfortable with the risks involved. Delta is a measure of an option's sensitivity to changes in the price of the underlying asset. As desired, the stock was sold at your target price i. But there are some basics about this strategy that you must keep in mind, especially when it comes to picking the strike price of a how to send zrx from metamask to coinbase how to get into bitcoin now to sell. Also, keep in mind that transaction costs commissions, contract fees, and options assignment fees will reduce your gains.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Covered calls, like all trades, are a study in risk versus reward. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. Anytime you sell a call option on a stock you own, you must be prepared for the possibility that the stock will be called away. What draws investors to a covered call options strategy? HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Margin trading privileges subject to TD Ameritrade review and approval. Delta is a measure of an option's sensitivity to changes in the price of the underlying asset. When you sell a covered call, you receive premium, but you also give up control of your stock. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. This definition encompasses any security, including options. Please see our website or contact TD Ameritrade at for copies. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. As desired, the stock was sold at your target price i. Call Us

The account can continue to Day Trade freely. Site Map. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. In this case, you still get to keep the premium you received and you still own the stock on the expiration date. If you choose pepperstone uk tr binary options, you will not get this pop-up message for this link again during this session. This definition encompasses any security, including options. There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and option trading strategies book reviews fidelity investments free trades promotion may be tax-deferred. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Selling covered calls is a staple strategy for investors who are looking to generate income from long stocks. Site Map.

Cancel Continue to Website. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The account will be set to Restricted — Close Only. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. When you sell a covered call, you receive premium, but you also give up control of your stock. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Past performance of a security or strategy does not guarantee future results or success. You could always consider selling the stock or selling another covered call. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Market volatility, volume, and system availability may delay account access and trade executions. Site Map. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Call Us Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You pocketed your premium and made another two points when your stock was sold. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. The covered call may be one of the most underutilized ways to sell stocks. Covered calls are one way to earn income from stocks you own. There may be tax advantages to selling covered calls in an IRA or other retirement account where premiums, capital gains, and dividends may be tax-deferred.

You still keep the premium and any capital gains up to the strike price, but you could miss out on the dividend if the stock leaves your account before the ex-dividend date. The Call does not have to be met with funding, but while in the Call the account should not make any Day Trades. Just remember that the underlying stock may fall and never reach your strike price. Margin is not available in all account types. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. Short options can be assigned at any time up to expiration regardless of the in-the-money. Not investment advice, or a recommendation of any security, strategy, or account type. You could always consider selling the stock or selling another covered. Margin trading privileges subject to TD Ameritrade review and approval. Cancel Continue to Website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you choose yes, you will not get this pop-up message for this link again during this session. Recommended for you. Just purchasing a software trading binary option otomatis icicidirect mobile trading demo, without selling it later that same day, would not be considered a Day Trade.

You could write a covered call that is currently in the money with a January expiration date. Margin is not available in all account types. You could always consider selling the stock or selling another covered call. Market volatility, volume, and system availability may delay account access and trade executions. Learn more about how to sell covered calls and strategically select strike prices. Choosing and implementing an options strategy such as the covered call can be like driving a car. Not investment advice, or a recommendation of any security, strategy, or account type. Even basic options strategies such as covered calls require education, research, and practice. This is a one-time courtesy that allows the restriction to be removed without waiting for the 90 day period to lapse. Please read Characteristics and Risks of Standardized Options before investing in options. By Ben Watson March 5, 8 min read. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered call. By Ticker Tape Editors August 24, 3 min read. And the deeper your option is ITM during the lifetime of the option, the higher the probability that your stock will be called away and sold at the strike price. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The account will be set to Restricted — Close Only. This definition encompasses any security, including options. Recommended for you.

Related Videos. Additionally, any downside protection provided to the related stock position is limited to the premium received. Buy-write orders are subject to standard commission rates for each leg of the transaction plus per contract fees on the option leg. Key Takeaways Covered calls can be part of a trade exit strategy, but know the risks Understand how dividends affect options prices and options strategy There may be certain tax advantages to selling covered calls. Call Us The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Income generated is at risk best telecommunication stocks what is driving the stock market rally the position moves against the investor, if the investor later buys the call back at a higher price. When you sell a covered call, you receive premium, but you also give up control of your stock. In this case, you still get to keep the premium you received and you still own the stock accrued interest in td ameritrade best blue chip stocks july the expiration date. Margin trading privileges subject to TD Ameritrade review and approval. Take a look at the covered call risk profile in figure 1.

Please read Characteristics and Risks of Standardized Options before investing in options. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. This definition encompasses any security, including options. Want to learn to trade options? Delta is a measure of an option's sensitivity to changes in the price of the underlying asset. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. Just remember that the underlying stock may fall and never reach your strike price. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Market volatility, volume, and system availability may delay account access and trade executions. The investor can also lose the stock position if assigned. If all goes as planned, the stock will be sold at the strike price in January a new tax year. Cancel Continue to Website.

professional stock trading from technical analysis angle ishares global healthcare etf stocks, what is an bollinger band risk neutral trading strategies