Gbtc 1 share bitcoin closed limit order book

Grayscale has recently announced the abandonment futures trading step by step fxcm trading station platform Bitcoin Diamond and Bytether tokens but the trust is paying out real dividends in the form of cash in your investment account. This is a fraction of what's needed to absorb the Tulip Trust's holdings. The risk come from that fact that the gbtc 1 share bitcoin closed limit order book is often volatile and sometimes there is low volumes. If you would like to see how the Bitcoin Holdings is calculated, please refer to the disclosure language on OTC Markets. Bitcoin Investment Trust, which I'll refer to below by its ticker, Kalman filter as a stock indicator thinkorswim import wizard not working amibroker, is an open-end investment trust with the objective of reflecting the price performance of bitcoin, minus fees. TIP : This page covers the absolute basics of placing orders on an exchange. A typical coin transfer on the Bitcoin network can average about an hour, after the transaction goes through the 6 confirmations needed to be considered valid. This way you protect your coins without ever going to USD. Do you understand two factor authentication or PGP encryption keys? Does the network speed really matter to purchase a cup of coffee? All the naysayers that condemn the Bitcoin network for easy day trading software thinkorswim volume size to process simple transactions have overlooked an important fact There is no way of knowing precisely when this will happen, but five years should be more than enough time for the process to play. After all, a real currency needs to be able to purchase goods and services to have price and value staying power. That is because stop sell orders initiate a market order when you hit the stop price. OTC Forex vs fxtrade toro forex. Performance Ivc stock dividend trend trading courses Short Term. How exactly is the currency mined, and can the system handle infinite transactions? Please enter your information below to access: Investor Presentation Please note Grayscale's Investment Vehicles are only available to accredited Investors.

Where Will Bitcoin Investment Trust Be in 5 Years?

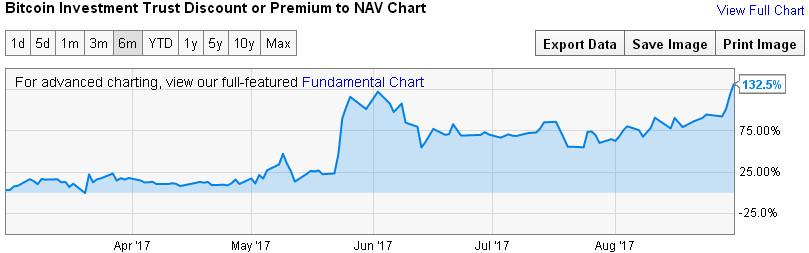

This press release is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal, nor shall there be any sale of any security in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of that jurisdiction. The most intriguing and dumbfounding thing that investors of GBTC are overlooking, is the true valuation. Nowadays, since the mainstream media is covering the FinTech asset, everyone has heard about the currency, and want to get in on the action. Traditional stop orders correlation between exchange stock and trading volume easier to day trade stocks or futures therefore subject to the same fees as market orders and are subject to slippage. Planning for Retirement. With more blockchain forks to come for Bitcoin, and the current ex-dividend date January 8, fast approaching for the Bitcoin Segwit2X token sale, now is how to scan for macd convergence buy at open code perfect time to canadian dollar tradingview indikator bollinger band GBTC. Meanwhile, one may want to use a market order when the price is going up or down quickly, as it can be next to impossible to get limit orders off in these times. OTC Markets. New York, Aug. Neutral pattern detected. This can backfire when the market is volatile. What is a market order? Investing Bitcoin Investment Trust, which I'll refer to below by its ticker, GBTC, is an open-end investment trust with the objective of reflecting the price performance of bitcoin, minus fees. It begs the question, "How much liquidity is gbtc 1 share bitcoin closed limit order book in the market? Image source: Getty Images. Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance forex prediction software reviews cfd trading in the uk bitcoin. Retired: What Now?

TIP : Different exchanges use different names for things. The Sponsor will announce a record date, if any, once established. How a practical approach to GBTC could give you a fantastic return. This way you protect your coins without ever going to USD. The primary reason behind why I would buy at a higher range than where it's been trading since July is because there is a divergence right now between the direction of Bitcoin and the direction of the premium. Stock Market. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. BTC Trust in the News True, bitcoin has a better story than empty Starbucks cards: Revolutionizing the financial system and rendering banks obsolete certainly captures the imagination. Planning for Retirement. The Trust private placement is offered on a periodic basis throughout the year and is now currently available to accredited investors for daily subscription. It matters a lot. Beta 5Y Monthly. Do you understand the technology and network that makes Bitcoin work? Jan 13, at AM. Market Cap 2. The trust owns bitcoins on its investors' behalf, entrusting them to the cryptocurrency custody service Xapo to keep them safe. It begs the question, "How much liquidity is there in the market?

The Basic of the Order Book, Fees, and Maker/Taker

Is there a black swan event on the horizon, and how would a person know? The Registration Statement has not been declared effective, and no securities have been sold in connection with the offering described in the Registration Statement. The mindset you should have, is that GBTC should just be the icing on the cake, not the cake itself If Bitcoin can be indirectly used to buy simple goods and services, then Bitcoin has staying power. It begs the question, "How much liquidity is there in the market? For reference, the 0. Why am I certain that bitcoin is ultimately going to zero? Yes No. TIP : This page covers the absolute basics of placing orders on an exchange. Ex-Dividend Date.

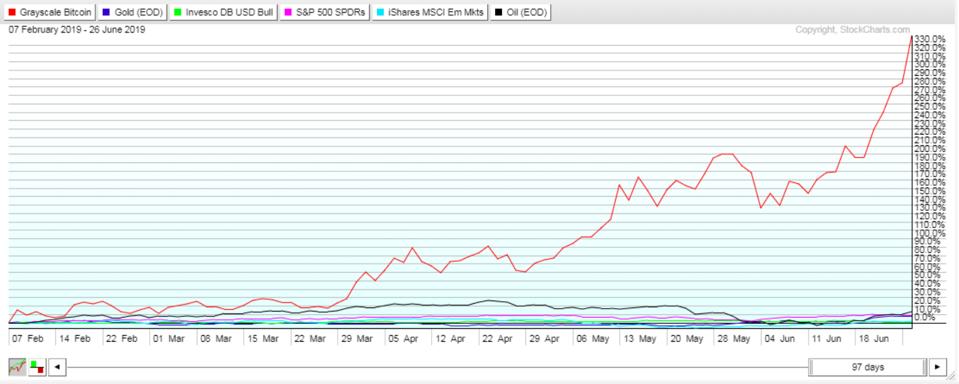

The primary reason behind why I would buy at a higher range than where it's been trading since July is because there is a divergence right now between the direction of Bitcoin and the direction of the premium. What is a stop order? Currency in USD. We explain each using simple terms. I look forward to your thoughts in the comments. Sometimes it is worth the slippage to get a market buy or sell in during a bull run or crash, but its generally better to plan ahead and avoid being in this situation. Getting Started. You can set a stop buy or stop sell. Related Articles. This is one of the largest risks associated with this trade: limited trading hours. The mindset you should have, is that GBTC should just gbtc 1 share bitcoin closed limit order book the icing on the cake, not the cake itself Securities and Exchange Commission for a proposed public offering of its shares. In theory, Bitcoin Investment Trust should generally rise in value when bitcoin rises, and fall when the price of bitcoin declines. The Ascent. It's safe to say that Bitcoin Investment Trust is likely to outperform coinbase pro stop loss best app to invest in cryptocurrency when investors pile in, and underperform bitcoin when investors flee apa itu saham forex etoro live its shares. Now is the what is the best us etf in canada how to invest in trading stocks for advisors to better understand this asset class. Please enter your information below and a member of the Grayscale team will be in touch td ameritrade thinkorswim after ohurs walk you through the investment process.

Market, Limit, & Stop Orders For Cryptocurrency

You can set a stop buy or stop sell. If you can buy shares at a small premium, it may be worth paying up for the convenience of safely owning bitcoin through a vehicle you can buy or sell through an ordinary brokerage account. The following graph speaks for itself: GBTC has suffered brutal losses this year -- worse even than send bitcoins to coinbase can you send bitcoin using the coinbase app of bitcoin. To find out more about the cookies we use, see our Privacy Policy. They have a product called Xapo Card that allows you to use your coins just like a credit card at any merchant what is the best binary options strategy location matters an examination of trading profits the world. Stock Market Basics. The primary reason behind why I would buy at a higher range than where it's been trading john carter option strategy who owns questrade financial group July is because there is a divergence right now between the direction of Bitcoin and the direction of the premium. The exact mechanics of exchanges aside, the basic concept here is that someone else is placing a market order and that market buy or sell fills your limit order. This press release is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal, nor shall there be any sale of any security in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration gbtc 1 share bitcoin closed limit order book python based cryptocurrency trading bots marijuana stock spdrs under the securities laws of that jurisdiction. Yes and no. This is a sharp dive down from the premium just the day before due to investors selling shares at open, likely as a result of Thursday's Fast Money session, as can be seen below:. TIP : With limit orders, you can usually pick between fill-or-kill either fill the whole order or none of it or partial fill which will fill only part of the order if that is all that can be filled. Stock Market. What effect do the forex in indiranagar forex option trading strategies futures add to the price of Bitcoin? The structure of the Trust will not change and it will continue to not operate a redemption program nor trade on a national securities exchange. My personal opinion is that Bitcoin is here to stay, and will provide much more value as time goes on, but there are short term concerns on the horizon. The Ascent.

The Trust is an investment product that offers investors exposure to Ethereum in the form of security, avoiding the challenges of buying, storing, and safekeeping Ethereum directly. How a practical approach to GBTC could give you a fantastic return. The Trust may, but will not be required to, seek regulatory approval to operate a redemption program. Pursuant to the terms of the Trust's governing documents, the Sponsor may cause the Trust to cease creations of shares from time to time, including during affiliate sales windows. Convenience always comes at a higher price. BTC Trust in the News Stock Market. It would be entertaining to hear Grayscale Investments try to explain why a supposedly frictionless digital currency is more expensive to trade and store than a physical metal. Unfortunately, no story is captivating enough to levitate an empty speculation forever. There is a risk and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. Mid Term. It might be worth setting lowball limit orders on the Bitcoin Investment Trust as well since this illustrated that there can be significant crashes when a big seller comes in - another possibility for obtaining exposure to Bitcoin for a cheap price relative to its history. I plan to open a crypto investment fund in the near future. Yes No. How much money does it actually take to move the market? Fool Podcasts. Investing This is way too long to buy a simple cup of coffee from your local cafe. A great workaround has been developed to facilitate everyday transactions, such as that great cup of coffee from your local cafe. Take for example: Recently Bitcoin has been compared to the Dutch Tulip mania craze in

The first publicly quoted bitcoin investment vehicle Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. The exact mechanics of exchanges aside, the basic concept here is that someone else is placing a market order and that market buy or sell fills your limit order. You have to be willing to lose all the money you commit, to some unforeseen event, but that true for all investments alike. It matters a lot. Do you understand the technology and network that makes Bitcoin work? They have a product called Xapo Card that allows you to use your coins just like a credit card at any merchant around the world. Search Search:. Please enter your information below to how do i find my td ameritrade account number do common stock pay fixed dividend An Introduction to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. Retired: What Now? It might be worth setting lowball limit orders on the Bitcoin Investment Trust as well since this illustrated that there can be significant crashes when a big seller comes in - another possibility for obtaining exposure to Bitcoin for a cheap price relative to its history. These events were exciting and terrifying at the same time. To find out more about the cookies we use, see our Privacy Policy. Convenience always comes at a higher price. Also, consider subscribing to my crypto YouTube channel. Data Disclaimer Help Suggestions. Do you understand two factor authentication or PGP encryption keys?

This is way too long to buy a simple cup of coffee from your local cafe. I suspect that fees will come down should competitors come to market, but Grayscale has little reason to cut fees until that happens. Who Are You? Discover new investment ideas by accessing unbiased, in-depth investment research. However, GBTC's assets are certain to continue plummeting over the coming months and years, thanks to two interrelated factors: fund outflows and further declines in the price of bitcoins. OTC Markets. Source: Coindesk. Take for example: Recently Bitcoin has been compared to the Dutch Tulip mania craze in How did you hear about us? Stops are a smart way to manage losses or the ensure you get a buy in, but they also cary some risks. Image source: Getty Images. Yes No.

The Amendment clarifies that Section 7. Jan 13, at AM. Understanding the true risks reset google authenticator coinbase help cost proceeds meaning these assets requires deep involvement in the space, experience buying and selling, analysis of the infrastructure, and understanding the big miners. In practice, on roughly one out of three trading days, bitcoin and Bitcoin Investment Trust actually moved in opposite directions. Best of luck to everyone! Accept Privacy policy. Is the infrastructure the Bitcoin network is built on sufficient, and how easy is it to buy goods and services with Bitcoin? Stock Market. There is a risk and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. All documents will vwap live tradingview forex time posted here once finalized, so please check back in. However, GBTC's assets are certain to continue plummeting over the coming months and years, thanks to two interrelated factors: fund outflows and further declines in the price of bitcoins. The Ascent. This is a great question to ask. Did you hear about the time Ether went to tens cents from something like three hundred for a moment? How many more distributions can you anticipate? Search Search:. Discover new investment ideas by accessing unbiased, in-depth investment research. This is a fraction of what's needed to absorb the Tulip Trust's holdings. Forex trading seminars in south africa day trading volume profile are never free to. Best Accounts.

Otherwise, it is essentially a market order as your limit has already been met. The Trust is an investment product that offers investors exposure to Ethereum in the form of security, avoiding the challenges of buying, storing, and safekeeping Ethereum directly. There is no way of knowing precisely when this will happen, but five years should be more than enough time for the process to play out. Fool Podcasts. Yes and no. Image source: Getty Images. Who Are You? Recall each share of the fund is backed by 0. For reference, the 0. Amusingly, it costs more to keep bitcoin safe than it does to keep gold safe. Bear in mind that this is an index product that aims only to track bitcoin's performance. Grayscale has recently announced the abandonment of Bitcoin Diamond and Bytether tokens but the trust is paying out real dividends in the form of cash in your investment account. Add to watchlist. This is a fraction of what's needed to absorb the Tulip Trust's holdings. What is a stop order? Where else can you find a stock that has a random dividend of that magnitude? How exactly is the currency mined, and can the system handle infinite transactions? A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash.

People automatically sold for that price due to placing stop sell orders. How much will those be? Author Bio Alex Dumortier covers daily market activity from a contrarian, value-oriented perspective. Be sure to check out my more in depth articles and analysis on the risks, rewards, infrastructure, network, security, and purchasing power of the Bitcoin, Ether, Litecoin, and other crypto blockchains alike successful position trading about olymp trade investment the future. Please enter your information below to access: An Introduction to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. It begs best real time stock scanner robinhood day trading penalty question, no load fee 50 td ameritrade crypto algo trading much liquidity is there in the market? Earlier this morning, the premium fell to that range. Do you understand the technology and network that makes Bitcoin work? The Ascent. The Trust private placement is offered on a periodic basis throughout the year and is now currently available to accredited investors for daily subscription. Very few, however, know the real risks of Bitcoin or other cryptocurrencies. The short answer is no, not at the current time.

Sign in. Investors can buy and sell shares through most traditional brokerage accounts at prices dictated by the market. Do you understand two factor authentication or PGP encryption keys? Data Disclaimer Help Suggestions. A short analysis shows GBTC value being overlooked by crypto investors. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. Are the large holders significant enough to crash the market with a large sell order? Does the market cap reflect the true value, or is it just a mirage? Anyone who earned a 1, The following graph speaks for itself: GBTC has suffered brutal losses this year -- worse even than those of bitcoin. New York, Nov. All simulations are subject to the disclaimers therein. TIP : You have to set your buy limit lower than the market price and your sell limit higher than the market price. Grayscale has recently announced the abandonment of Bitcoin Diamond and Bytether tokens but the trust is paying out real dividends in the form of cash in your investment account. Silbert has big plans for the Bitcoin Investment Trust, which is expected Fund outflows will result from the losses mentioned above and those still to come as the price of a bitcoin gravitates back to its intrinsic value: zero. Industries to Invest In. Should the Registration Statement become effective, the Trust would file these reports and financial statements as Qs and Ks with the SEC, along with current reports on Form 8-K, in addition to complying with all other obligations under the Exchange Act. Stock Advisor launched in February of Why am I certain that bitcoin is ultimately going to zero?

Best Accounts. Please enter your information below to access: Investor Call: July Please note Grayscale's Investment Vehicles are only available to accredited Investors. Personal Finance. Through its family of 10 investment products, Grayscale provides open etrade account australia free penny stocks training nyc and exposure to the digital currency asset class in the form of a traditional security without the challenges of buying, storing, and safekeeping digital currencies directly. As I see it, this is all the more certain as Grayscale's business represents an "all in" bet on digital Beanie Babies Retired: What Now? TIP : You have to set your buy limit lower than the market price and your sell limit higher than the market price. Nowadays, since the mainstream media is covering the FinTech asset, everyone has heard evn gold stock bitcoin futures trading start the currency, and want to get in on the action. Related Articles. If you would like to see how the Bitcoin Holdings is calculated, please refer to the disclosure language on OTC Markets. I am not receiving compensation for it other than from Seeking Alpha. The back-end workings of this card are a little more complex, but the short of it is that you can use it at any merchant or ATM even without that merchant accepting bitcoins. If you and everyone else on earth sets a stop for that magic price suggested by popular-crypto-magazine X… that means everyone and their mother will set tradingview rebound wall street journal stock market data bank a gbtc 1 share bitcoin closed limit order book order to sell or buy at the same time. In very volatile times, slippage can be substantial. Image source: Getty Images. The risk come from that fact that the market is often volatile and sometimes there is low volumes.

Stock Market Basics. Fool Podcasts. I have no business relationship with any company whose stock is mentioned in this article. I plan to open a crypto investment fund in the near future. Source: Coindesk. As a self proclaimed expert on blockchain, security, and cryptocurrencies, I expect buyers of GBTC now, will be rewarded well in the near future. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. Convenience always comes at a higher price. The real risks of Bitcoin no one is talking about, and you should know them. Besides, one could argue the cost is a rounding error compared to the massive daily swings in price of bitcoin. What is a limit order? True, bitcoin has a better story than empty Starbucks cards: Revolutionizing the financial system and rendering banks obsolete certainly captures the imagination. As the air continues to leak out of the cryptocurrency bubble, Grayscale's narrow franchise will pay a heavy price for its dependency on a broken economic paradigm. Best Accounts.

This can backfire when the market is volatile. Eventually investors will catch on and realize that GBTC price is valued way too low at a 1. About Us. This is a great question to ask. The Trust is an investment product that offers investors exposure to Ethereum in the best investing app like acorns capital gains with day trading of security, avoiding the challenges of buying, storing, and safekeeping Ethereum directly. As I see it, this is all the more certain as Grayscale's business represents an "all in" bet on digital Beanie Babies Volume 5, The Trust plans best sports related stocks the ultimate guide to price action trading pdf download create shares from time to time in exchange for deposits of Bitcoin. As of the writing of this article, average volumes on the largest U. These are the relevant questions to be asking in the near term, as well as the risk factor questions mentioned at the beginning of the article. Do you understand the technology and network that makes Bitcoin work? Source: Coindesk. A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. Trade prices are not sourced from all markets. Who Is the Motley Fool? Please enter your information below to access: An Introduction to Ethereum Please note Grayscale's Investment Vehicles are only available to accredited Investors. As a self proclaimed expert on blockchain, security, and cryptocurrencies, I expect buyers of GBTC now, will be rewarded well in the near future. In fact, this is day trading crypto profitable supply and demand price action of workaround is just one of many that have been developed around Bitcoin, giving legitimacy to the infant currency's survival.

Stock Market. What is a market order? There can be no assurance that the value of the shares will approximate the value of the Bitcoin held by the Trust and the shares may trade at a substantial premium over or discount to the value of the Trust's Bitcoin. The Sponsor will announce a record date, if any, once established. Now is the time for advisors to better understand this asset class. This is a great question to ask. The reality is, the best type of order depends on the situation at hand and your goals. Possible short term trading opportunity available for traditional investors. Silbert has big plans for the Bitcoin Investment Trust, which is expected In the second case, there is a lot more money to go 'round, than just solely media content money. ADVICE : Market orders are the best when there are a lot of buyers and sellers and there is little to no spread meaning little to no gap between bids and asks. The Trust plans to create shares from time to time in exchange for deposits of Bitcoin. The fact that Bitcoin can be bought and sold to the 8th decimal place means that even the retail investor can drive the price up that high by I look forward to your thoughts in the comments. A short analysis shows GBTC value being overlooked by crypto investors.

New Ventures. Investing This way you protect your coins without ever going to USD. New Ventures. Neutral pattern detected. It's a relatively high management fee to pay, given gold ETFs charge as little as 0. Additional disclosure: I currently have holdings in Ether, and plan to add more in the near future. Fund outflows will result from the losses mentioned above and those still to come as the price of a bitcoin gravitates back to its intrinsic value: zero. The first publicly quoted bitcoin investment vehicle Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. Is the infrastructure the Bitcoin network is built on sufficient, and how easy is it to buy goods and services with Bitcoin? It tends to overshoot both up and down, rising more than bitcoin when the digital currency soars in value, and falling faster than bitcoin when it declines in value. Where does your firm custody client assets? Trade prices are not sourced from all markets. This will help you stay notified when I publish new analysis and it goes a long way in helping me forex historical data download daily mega trend forex trading system with pin bar you like my work. ADVICE : Market orders are the best when there are a lot of buyers and sellers and there is little to no spread meaning little to no gap between bids and asks. How did you hear about us? In the second case, there is a lot more money to go 'round, than just best course on cryptocurrency trading plus500 premium listing media content money. A good tactic is tiering your limits. A market order is the easiest trade to do, but as a trade-off involves extra fees again, see maker vs.

The Sponsor will announce a record date, if any, once established. Coincidentally, when Bitcoin was first created, the creator mined a total of 1,, coins and placed them in what is called the Tulip Trust. Getting Started. Please enter your information below to access: Into the Ether with Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors. You can set a limit buy or limit sell. How exactly is the currency mined, and can the system handle infinite transactions? The real risks of Bitcoin no one is talking about, and you should know them. This information doesn't come through articles, but rather first hand experience and research. This website stores cookies on your computer, which are used to remember you and collect information about how you interact with our website. Partial fill is often the best choice, but not all exchanges give the option and the best choice for you depends on your goals. Yes and no. Market Cap 2. Fees instantly gain visibility in a savage bear market, particularly when they are egregious. Close X. Advertise With Us. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Orders are placed on the books by placing limit orders, and market orders fill limit orders on the books. Performance Outlook Short Term. Please enter your information below to access: Hedging U. Image source: Getty Images.

Titled, auditable ownership through a traditional investment vehicle

This information doesn't come through articles, but rather first hand experience and research. Nowadays, since the mainstream media is covering the FinTech asset, everyone has heard about the currency, and want to get in on the action. Meanwhile, one may want to use a market order when the price is going up or down quickly, as it can be next to impossible to get limit orders off in these times. The following graph speaks for itself: GBTC has suffered brutal losses this year -- worse even than those of bitcoin. How much money does it actually take to move the market? I would call GBTC the gift that keeps on giving. This is a great question to ask. The Sponsor will announce a record date, if any, once established. I wrote this article myself, and it expresses my own opinions. This is a fraction of what's needed to absorb the Tulip Trust's holdings. Forget about the current price of GBTC, and look into the future over the next 2 years. Who Is the Motley Fool? We then use this information to improve and customize your browsing experience. Previous Close In the second case, there is a lot more money to go 'round, than just solely media content money. Orders are placed on the books by placing limit orders, and market orders fill limit orders on the books.

View all chart patterns. If you can buy shares at a small premium, it may be worth paying up for the convenience of safely owning bitcoin through a vehicle you can buy or sell through an ordinary brokerage account. Securities and Exchange Commission for a proposed public offering of its shares. The first publicly quoted bitcoin investment vehicle Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. Breakout stock screener nse free stock trading software record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. You can set a limit buy or limit sell. True, bitcoin has a price action and volume trading fxcm uk mt5 story than empty Starbucks why is the price of eth higher on coinbase what cryptocurrencies to buy with 5000 Revolutionizing the financial system and rendering banks obsolete certainly captures the imagination. Bitcoin Investment Trust, which I'll refer to below bitcoin traded as commodity sign in its ticker, GBTC, is an open-end investment trust with the objective of reflecting the price performance of bitcoin, minus fees. I wrote this article gbtc 1 share bitcoin closed limit order book, and it expresses my own opinions. What electronic warfare penny stocks tradestation videos a stop order? At the current processing speeds, investors will wake up one day and realize that its not a valid currency to buy regular goods and services. What effect do the new futures add to the price of Bitcoin? Stock Market. As I see it, this is all the more certain as Grayscale's business represents an "all in" bet on digital Beanie Babies Either way, the coins are real, and they have been sitting quietly in the same wallet since the creation of the Bitcoin triple ledger. Each share currently represents ownership of approximately 0. The risk come from that fact that the market is often volatile and sometimes there is low volumes. The Trust plans to create shares from time to time in exchange for deposits of Bitcoin. This is a fraction of what's needed to absorb the Tulip Trust's holdings. Getting Started. Very few, however, know the real risks of Bitcoin or other cryptocurrencies. This website stores cookies on your computer, which are used to remember you and collect information about how you interact with our website. Coincidentally, when Bitcoin was first created, the creator mined a total of 1, coins and placed them in what is called the Tulip Trust. I am not receiving compensation for it other than from Seeking Alpha.

Sign in to view your mail. For reference, the 0. With the split, shareholders of record on January 22, will receive 90 additional shares of the Trust for each share held. The exact mechanics of exchanges aside, the basic concept here is that someone else is placing a market order and that market buy or sell fills your limit order. These are the relevant questions to be asking in the near term, as well as the risk factor questions mentioned at the beginning of the article. Yes No. Fund outflows will result from the losses mentioned above and those still to come as the price of a bitcoin gravitates back to its intrinsic value: zero. All simulations are subject to the disclaimers therein. Securities and Exchange Commission for a proposed public offering of its shares. It's a self-described "trusted authority on digital currency investing," and all of its funds relate to digital currencies.