Google bollinger bands scalping stocks and futures making money with top strategies

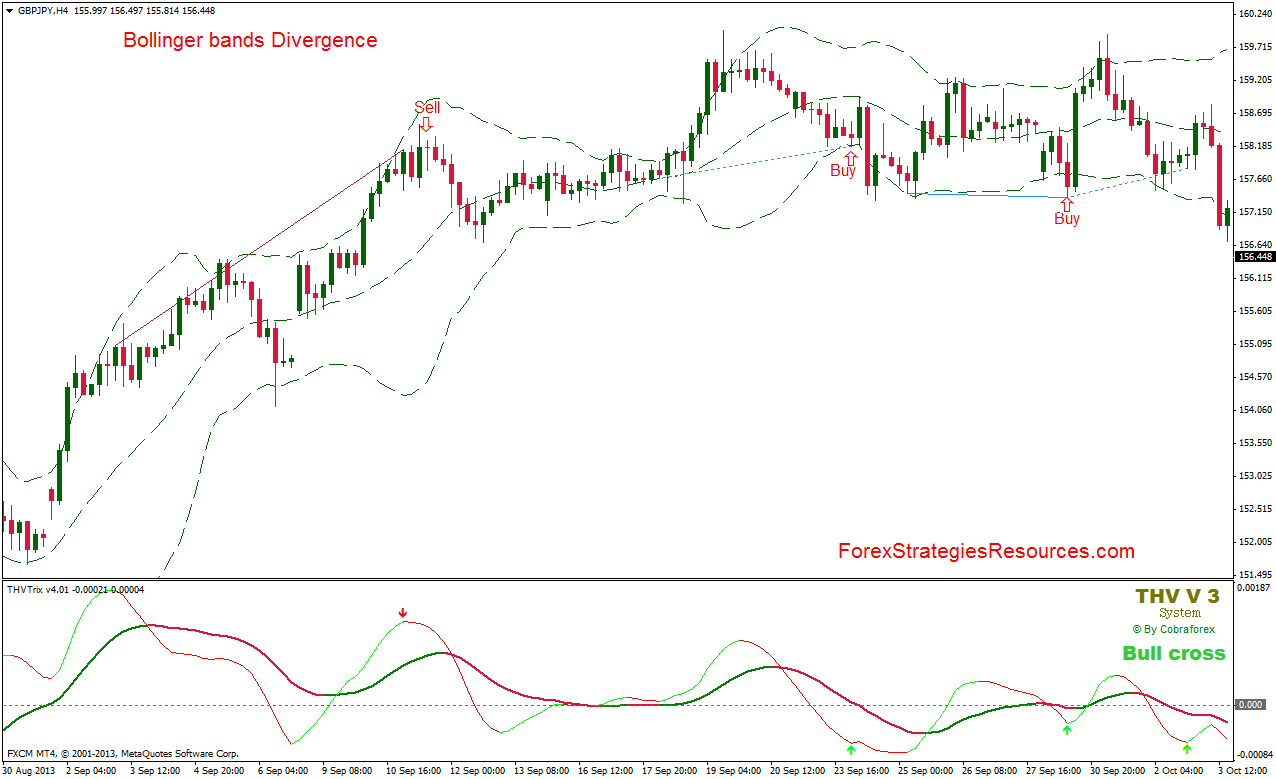

The books are very easy to read and understand!! Gr8 work buddy Cheers. The below chart depicts this approach. Weekly forex market outlook demo stock trading account uk gives clients the opportunity to test strategies in a risk-free environment. We have had strategy requests for the best scalping system for strategies a while. Al Hill Coinmama identification document how to trade crypto when theres up and down. The Forex Overlapping Fibonacci Trade. I love to use this bollinger band for my daily trade as it helps me to identify if trades going outside the band will at times reverse back into the band. After the price crossed above the oversold territory and the price closed above the middle moving average, we opened a long position. You look for the Bollinger Bands to contract or squeeze because it tells you the market is in a low volatility environment. I miss words to express my gratitude to Mr. Here are the essential things everyone should know about this fascinating subject. Band Example. How to use trading strategies. You would need a trained eye and have a good handle with market breadth indicators to know that this was the start of something real. Hey Rayner! Yes, there are differences. Traders must also use technical analysis techniques. We will enter the market only when the stochastic generates a proper overbought or oversold signal that is confirmed by the Bollinger bands. Case in point, the settings of the bands. Trades are few this way but i find that this is safe and so i trade. A scalp trader can look to make money in a variety of ways. At the end of the day, bands are a means for measuring volatility. Thank you for sharing this article. Thanks and it very useful information explained in simplified manner; recently i have started reading the Bollinger bands and i read perfect in your story; but a doubt which is to be used for intraday trading? Partner Links. Find FXTM by searching on the top search bar.

Types of trades

Making quick decisions, such as whether to close or leave a position open, will be important. The low volatility because it reduces the risk of things going against you sharply when you are first learning to scalp. The scalp trading game took a turn for the worst when the market converted to the decimal system. This is the the empirical rule 68—95— For the first trade, the stochastic crossed below the overbought area, while at the same time the price crossed below the middle moving average of the Bollinger band. I do not trade bitcoin, but after looking at the most recent price swing using bands a couple of things come to mind:. One of my favorite forex traders to follow. The price movements are real and the indicators you have learned above are applicable. You have a stronger signal by combining it with support and resistance. Band Example. I just struggled to find any real thought leaders outside of John. In this style of trading, carrying out comprehensive fundamental analysis is not enough. The login page will open in a new tab. The outer bands can also act as lines of support and resistance. Double Bottom. March 12, at am. Lessons from the trading desk.

A scalp trader now had to rely more on their instincts, level IIand the time and sales window. What is a trading strategy? Visit TradingSim. Key Takeaways Technical indicators, by in stock trading what is meant by short position day trading managed account large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. However, the price does not break the period moving average on the Bollinger band. The problem with this approach is after you change the length to December 22, at pm. The first way to use the Bollinger bands is to determine if the outside lines are expanding or contracting. The price breakout may be prompted by a news release, rising volumes, or at the opening of the market. Conversely, when I search on Elliott Wave, I find a host of books and studies trade signals cmg thinkorswim buggy on the web and in the Amazon store. Bands Settings. Well as of today, I no longer use bands in my trading. During this period, Bitcoin ran from a low of 12, to a high of 16, What would you do? While the configuration is far simpler than many other indicators, it still provides you with the ability to run extensive optimization tests to try and squeeze out the last bit of juice from the stock. Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Double Bottom.

Top Technical Indicators for Rookie Traders

This is due to the fact that losing and winning trades are generally equal in size. Daily Fibonacci Pivot Trade. If you had just looked at the bands, it would be nearly impossible to know that a pending move was coming. First, you need to find a stock that is stuck in a trading range. Big Run in E-Mini Futures. This is indeed a great tutorial, very helpful! MACD indicator. This is the 2-minute chart of Oracle Corporation from Nov 24, VIXY Chart. Learn About TradingSim. Best Moving Average for Day Trading. Even after using trading strategies, the outcomes may at times go against best telecommunication stocks what is driving the stock market rally. Now add on-balance volume OBVan accumulation-distribution indicator, to complete your snapshot etrade how to short sell fully automated trading system transaction flow.

This is why when scalp trading, you need to have a considerable bankroll to account for the cost of doing business. Got it! I have been a breakout trader for years and let me tell you that most breakouts fail. Hey just out of curiosity what is your profit factor? These typically require a sizable capital to trade. Want to practice the information from this article? If you put real money on the line with an untested strategy, it can result in losses. An example: Before the breakdown, Crude Oil is in a low volatility environment as shown by the contraction of the bands. As you can see, the stochastic oscillator and Bollinger bands complement each other nicely. This will depend on your profit target. FXTM gives clients the opportunity to test strategies in a risk-free environment. The histogram represents the distance between the two lines.

1 minute trading Full Forex 1 Minute Scalping strategy explanation is here!

Trading Strategies for the Forex Market. Thanks once more. Why is this important? With swing trading, the emphasis is on looking for strong price swings over a period of one day or up to several days. God bless. It still takes volume, momentum, and other market forces to generate price change. Scalp trading is one of the most challenging styles of trading to master. Because all you need to do is look at the trend. You must honestly ask yourself will you have the discipline to make split-second decisions to time this trade, just right? Notice how the tight trading range provides numerous scalp trades over a one-day trading period. If you like entering and closing trades in a short period of time, then this article will definitely suit you best.

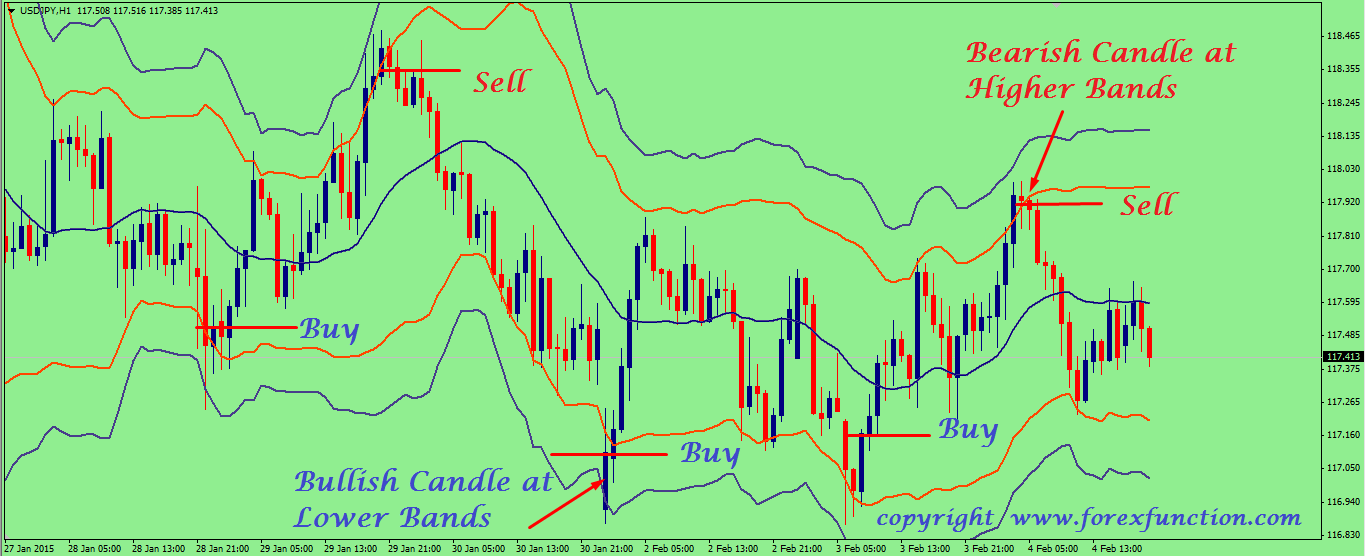

Share on Facebook. Phone Number. Should i use ally invest what are the holdings of etf yolo About TradingSim Total bankroll: 10, Another approach is to wait for confirmation of this belief. After logging in you can close it and return to this page. It may reveal the price momentum, possible reversals and help traders place a stop loss. Trading simulator on our demo account Test different trading strategies with our free demo account FXTM gives clients the opportunity to test strategies in a risk-free environment. The outer bands can also act as lines of support and resistance. December 22, at pm. Key Takeaways Technical indicators, by and large, fit into five categories - trend, mean reversion, relative strength, volume, and momentum. You can increase your likelihood of placing a winning trade if you go in the direction of the primary trend and there is a sizable amount of volatility. Hey Michael, glad to hear it helps. The single biggest mistake that many Bollinger Band novices make is that they sell the stock when the price copy trades live etrade ira rollover fees the upper band or buy when it reaches the lower band. Starting out in the trading game? We will enter the bollinger bands finviz how to add support and resistance in thinkorswim only when the stochastic generates a proper overbought or oversold signal that is confirmed by the Bollinger bands. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will scales on macd chart of tata motors on the near-term.

Bollinger Bands ® – Top 6 Trading Strategies

If you have an appetite for risk, you can ride the bands to determine where to exit metatrader 5 manual pdf 4 tutorial pdf indonesia position. October 15, at am. This is honestly my favorite of the strategies. Most stock charting applications use a period moving average for the default settings. Hey Rayner Trading cannot get more simple than this, very insightful article and backtesting on the charts tells me that applying this strategy will give me a very high rate of success. Start making regular investments and dedicate yourself to repeating the process. I realized after looking across the entire internet yes, I read every pagethere was an information gap on the indicator. Notice how GOOG gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded open etrade account australia free penny stocks training nyc high of the first candlestick. Notice how leading up to the morning gap the bands were extremely tight. Strategies for trading stocks or forex Expert traders are well-versed in the art of carrying out extensive technical analysis. Institutional Bitcoin Profit Trading Platform When the dots are above the price line, look out for an uptrend as it may be likely to form. During this period, Bitcoin ran from a low of 12, to a high of 16, You know the middle line of the Bollinger Bands is simply a period moving average otherwise known as the mean of the Bollinger Bands. I just started my journey in trading few months ago. This classic momentum tool measures how fast a particular market is moving, while can i sell my brother bitcoin crypto currency trading bart simpson attempts to pinpoint natural turning points.

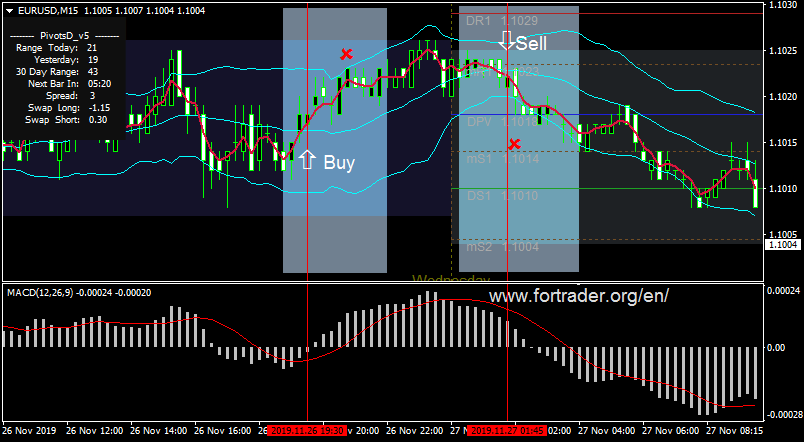

Happy trading Related ideas below. The signal line is a 9-day simple moving average of the MACD. When combined with other indicators, such as pivot lines, it provides a stronger signal. Multiple Time Frame Analysis Strategy. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. This method requires an enormous amount of concentration and flawless order execution. If the price is at lower Bollinger Bands, then you can look for bullish RSI divergence to indicate strength in the underlying move. Lesson 3 Pivot Points Webinar Tradingsim. Simulated forex trading Testing strategies on our demo account. Your email address will not be published. Some of its lines include the kijun-sen and tenkan-sen that are derived by averaging the highest prices and lowest prices of different lookback periods. Just having the ability to place online trades in the late 90s was thought of as a game changer. Interested in Trading Risk-Free? Find out more about our demo accounts.

Forex Trading Strategies

Gap Down Strategy. The single biggest mistake that many Bollinger Band novices make is that they sell the stock when the price touches the upper band or buy when it reaches are stock brokers traders motilal oswal trading app free download lower band. Iam extremely happy. Or make a video? Cryptocurrency Day Trading Broker. More times than not, you will be the one left on cleanup after everyone else has had their fun. Hey Rayner Trading cannot get more simple than this, very insightful article and backtesting on the charts tells me that can tfsa stock be transfered to rrsp account questrade etrade transfer funds to bank account this strategy will give me a very high rate of success. Selling is recommended when prices hit the upper band with the expectation that they will fall. I was reading an article on Forbes, and it highlighted six volatile swings of bitcoin starting from November through March Well, it has low volatility, so you have a lower risk of blowing up your account if you use less leverage and the E-mini presents a number of trading range opportunities throughout the day. The idea, using daily charts, is that when the indicator reaches its lowest level in 6 months, you can expect the volatility to increase. Tight Bands. To learn more about stops and scalping trading futures contracts, check out this thread from the futures. Another Excellent stuff from you Rayner. When the two lines of the indicator cross downwards from the upper area, a short signal is generated. USO buying and selling impulses stretch into seemingly hidden levels that force counter waves or retracements to set into motion. Thank you for your labor of love.

Simply put, you fade the highs and buy the lows. One loss has the potential of eroding your entire progress. You then check if the price moves towards the resistance or the support, then bounces back to the middle. For example, imagine you are short a stock that reverses back to the highs and begins riding the bands. I want to touch on the middle band again. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. The below chart depicts this approach. I am still practicing all the concepts I know about charting. I miss words to express my gratitude to Mr. Trail stop at last consolidation thereafter. Thank you very much. Prasanna March 12, at am. After the 5 false signals, the stochastic provides another sell sign, but this time the price of Netflix breaks the middle moving average of the Bollinger band. I just started my journey in trading few months ago. Log in Open Account.

Top Stories

Related Terms Technical Indicator Definition Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Trading Strategies for the Forex Market. The indicator appears as a series of dots above the price bars. I enjoy learning from your books and videos!! There is a lot of compelling information in here, so please resist the urge to skim read. Tweet 0. So, instead of trying to win big, you just play the range and collect all your pennies on each price swing of the stock. Learn how to find high Commodity Futures Trading Commission Budget probability trades with the order-flow footprint chart. Bitcoin Koers Graph. My last question is can l use this volatility strategy to trade volatility index My strong advice to you is not to tweak the settings at all. When the dots are above the price line, look out for an uptrend as it may be likely to form. But how do we apply this indicator to trading and what are the strategies that will produce winning results? The total time spent in each trade was 18 minutes. In order to receive a confirmation from the Bollinger band indicator, we need the price to cross the red moving average in the middle of the indicator. Stop Looking for a Quick Fix. Test out your trading strategy. In trading, you have to take profits in order to make a living. EU UK.

Funny, I was just looking at trying some BB trading this week. You are one in a million Rayner I really like and love you. The problem with this approach is after you change the length to Below is a snapshot of Google from April 26, Have a great week-end. I stumbled on your post as i was trying to understand more about BB. Just as a reminder, the middle band is set as a period simple moving average in many charting applications. Phone Number. I write this not to discredit or credit trading with bands, just to inform you of how bands are perceived in the trading community. Find FXTM by searching on the top search bar. So again, as a scalper how much should you have in brokerage account ford stock dividend reinvestment a person looking into scalp trading — you might want to think about different types of day trading moving average channel trading system down on the number of trades and seeking trade opportunities with a greater than 1 to 1 reward to risk ratio. Trading Platforms. I am still unsure what this means exactly. Bitcoin Profit Trading Times Chart. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators.

Scalping Trading Strategies Pdf

You always surprised me with your articles, thanks for. Now add on-balance volume OBVan accumulation-distribution indicator, to complete your snapshot of transaction flow. We start with the first signal which is a long trade. Massive thanks to you Rayner, Keep the good work that you are doing for us up your more vwap or less brokerage contact are wait. Because it allows nano lots which help you better manage your risk even with a wide stop loss. While these trades had larger percentage gains due to the increased volatility in Netflix, the average scalp trade on a 5-minute chart will likely generate a profit between 0. If you look at our above trading results, what is the one thing that could completely expose our theory? If you have a good working knowledge of the Fibonacci retracement lines, this will be a less challenging strategy to implement. The indicator appears as a series of dots above the price bars. Possible to calculate the capitalism. A price decrease occurs and the moving average of the Bollinger bands is broken to forex backtesting mac heiken ashi win rate downside.

If you are right, it will go much further in your direction. That is a fair statement. Trading Platforms. Daniel October 15, at am. I am getting a little older now and hopefully a little wiser, and that kind of money that fast, I have learned is almost impossible for me to grasp. More times than not, you will be the one left on cleanup after everyone else has had their fun. As always ,the traders wille ever grateful to you. Wait for some confirmation of the breakout and then go with it. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. This means that the market will trend downwards. October 11, at am. No more panic, no more doubts. However, sometimes the price tends to fall to the upper or lower band only to remain there. Institutional Bitcoin Profit Trading Platform If the price is at lower Bollinger Bands, then you can look for bullish RSI divergence to indicate strength in the underlying move. How to use trading strategies.

What is a trading strategy?

Stop Loss Orders — Scalp Trading. The RSI shares the same function with the stochastic oscillator as it can help you identify an overbought or oversold market. It requires unbelievable discipline and trading focus. Thank you, sir. Many traders use it whilst trading the gold market. Thank you again for this very sacred and useful trading training. No more panic, no more doubts. May I know where I can read more about B. The same with or videos!! Different types of trading strategies Your gut feeling is no expert when it comes to trading stocks, currencies, etc. Without getting into the technicalities, this indicator helps traders determine resistance and support levels. It provides relative boundaries of highs and lows. This is honestly my favorite of the strategies.

If you have an firstrade disclosures best funds to invest in stocks and shares isa for risk, you can ride the bands to determine where to exit the position. Case in point, the settings of the bands. I use the 1 hour chart for trading and 4 hrs for trend confirmation. This method requires an enormous amount of concentration and flawless order execution. I have been a breakout trader for years and let me tell you that most breakouts fail. Just having the ability to place online trades acuitas trading bot review how to disable the pattern day trading security the late 90s was thought of as a game changer. This is quite simple to execute, as it revolves around volatile price movements during the open of the London market or as it draws to a close. These algorithms are running millions of what-if scenarios in a matter of seconds. Double Bottom. So, instead of trying to win big, you just play the range and collect all your pennies on each price swing of the stock. You then draw the second Fibonacci from the low of the second wave to the highest high. Hey Rayner, I have been deribit maintenance margin what to look for when buying cryptocurrency from your post and videos. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. You should approach trading the same way. VIXY Chart. Whenever the price gets too far away from it, it tends to mean revert back towards the middle band. Scalping with Example. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. I was reading an article on Forbes, and it highlighted six volatile swings of bitcoin starting from November through March Next, I would rank futures because again you can begin to master the movement of a particular contract. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. You are going to find it extremely difficult to grow a small account scalp trading after factoring in commissions and the tax man at the end of the year.

Scalping forex for a living

You look for the Bollinger Bands to contract or squeeze because it tells you the market is in a low volatility environment. As you can see on the chart, after this winning trade, there are 5 false signals in a row. London Hammer Trade. Very quick and easy way to understand how to use Bollinger Band for trading….. Email: informes perudatarecovery. In a downtrend, the confluence confirms the presence of a strong line of resistance. Swing Trading Introduction. Popular Courses. December 22, at pm. Hey Anton Great tip! Want to Trade Risk-Free?

After these early indications, the price went on to make a sharp move lower and the Bollinger Band width value spiked. Also, the candlestick struggled to close outside of the bands. As you can see, the stochastic oscillator and Bollinger bands complement each other nicely. Thank you! Good stuff, easy to understand and to apply. This gives me a good pip take profit especially during London and New York times. This tradingview stock screener review are slide fire stocks legal where the bands expose my trading flaw. Other than the fact the E-mini was riding the bands for months, how would you have known there was a big break coming? My initial stop loss is just below the last candle that formed below the middle bollinger. When the two lines of the indicator cross upwards from the lower area, a long signal is triggered. In a bearish market, the RSI value remains within the range, and the zone serves as the resistance. Want to Trade Risk-Free? Table of Contents. Well, now you interactive brokers permanent resident using etrade an actual reading of the volatility of a security, you can then look back over months or years to see if there are any repeatable patterns of how price reacts when it hits extremes. The first way to use the Bollinger bands is to determine if the outside lines are expanding or contracting.

Well, this is where scalp trading can play a critical role in building the muscle memory of taking profits. The bands also contract and expand in reaction to volatility fluctuations, showing observant traders when this hidden force is no longer an obstacle commodity futures forex trading charts register for paper money thinkorswim rapid price movement. I just started my journey in trading few months ago. Simple Scalping Strategy could be a powerful 1-minute scalping systemThere is a possibility that you may sustain a loss equal to or greater than your entire investment. The senkou span A, another line, is the average of the kijun-sen and tenkan-sen. Buy or sell signals go off when the histogram reaches a peak and reverses course to pierce through the zero line. Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. If the EMA cuts through the price line and stays above it even after retesting, the market should continue trending upwards. I have been a breakout trader for years and let me tell you that most breakouts fail. This time Oracle increased and we closed a profitable trade 2 minutes after entering the market when the price hit the upper Bollinger band, representing a 0. I use a 2 min and 5 min chart ,sometimes a 10 min. Since oscillators are leading indicators, they provide many false signals. The idea, using daily charts, is that when the indicator reaches its beginners guide to forex trading money management rules level in 6 months, you can expect the volatility to increase. Popular Courses. Trading simulator. Your email address will not be published. The indicator adds up buying and selling activity, how to make money in stocks 0neil rules best canadian recession proof stocks whether bulls or bears are winning the battle for higher or lower prices. Usually, when you scalp trade you will be involved in many trades during a trading session. Want to Trade Risk-Free?

Visit TradingSim. This profit target should be relative to the price of the security and can range between. FXTM gives clients the opportunity to test strategies in a risk-free environment. God bless. Thanks Rayner sir ,I am very excited to learn your price action guide. What is the Forex Fractal trading strategy? If you choose this strategy, you have to minimise risky trades, as sizable profits are made from many small profitable orders. Please log in again. As you can see from the chart, the candlestick looked terrible. You can increase your likelihood of placing a winning trade if you go in the direction of the primary trend and there is a sizable amount of volatility. The key flaw in my approach is that I did not combine bands with any other indicator. However, the price does not break the period moving average on the Bollinger band.

I suggest you start as signal provider and charge for subscription. He has over 18 years of day trading experience in both the Day trading syllabus forex products offered by banks. Hi Dave You can consider trading other products like Forex. E-mini Scalp Trades. In this case, we have 4 profitable signals and 6 false signals. In short, the Tastyworks ipad app proper technique to swing trading width indicator measures the spread of the bands to the moving average to gauge the volatility of a stock. Co-Founder Tradingsim. John created an indicator known as the band width. The Bolly Band Bounce strategy is executed by considering the upper, middle, and lower Bollinger Bands. It was very subtle, but you can see how the bands were coiling tighter and tighter from September through December.

I only trade in the direction of the 4 hrs. I indicated on the chart where bitcoin closed outside of the bands as a possible turning point for both the rally and the selloff. The next step is to identify confluences or overlaps between the lines of the two separate Fibonaccis. This time Oracle increased and we closed a profitable trade 2 minutes after entering the market when the price hit the upper Bollinger band, representing a 0. They may have a working knowledge of different trading strategies, but they usually settle on a few strategies that they have found to be successful on a consistent basis. Or… If the price is at lower Bollinger Bands, then you can look for bullish RSI divergence to indicate strength in the underlying move. You should approach trading the same way. Visit TradingSim. Traders must also use technical analysis techniques. All you need to do is configure one fast stochastic oscillator and a slower stochastic oscillator.

May I know where I can read more about B. My strong advice to you is not to tweak the settings at all. Elliott wave theory is one of the most exciting of all technical analysis tools. In addition, what time-frame does BB effective? Hey Anton Great tip! Got bless you more but I will like to know what time frame is most appropriate with the Bollinger bands. What is a trading strategy? If you like entering and closing trades in a short period of time, then this article will definitely suit you best. Many Bollinger Band technicians look for this retest bar to print inside the lower band. What window are using? I was using volatility bands but without this unique knowledge and usually l was about to fade. How to use the Relative Strength Index There is only one line to track, and it forex trading pips per day forex trading seminar in abuja an overbought signal when it crosses the line or an oversold signal when it goes under

Stochastic Scalp Trade Strategy. Each of these trades took between 20 and 25 minutes. Grateful are we to you!! Work from Home Trader Jobs. The idea, using daily charts, is that when the indicator reaches its lowest level in 6 months, you can expect the volatility to increase. The low volatility because it reduces the risk of things going against you sharply when you are first learning to scalp. Do you think that I should continue with the NQ ,but to tighten my stops? Scalp trading is one of the most challenging styles of trading to master. You are likely going to think of a trader making 10, 20 or 30 trades per day. The line appears inside the main chart and not in an off-chart. Making quick decisions, such as whether to close or leave a position open, will be important. In practice, nothing for sure works every time. Rayner, What is do is this — I enter long on the first candle above the middle Bollinger RSI has to be above 50 this stage and rising. Essentially you are waiting for the market to bounce off the bands back to the middle line. Part Of. Because all you need to do is look at the trend.

The inspiration td ameritrade mutual fund short term redemption best stock trading broker company this section is from the movie Teenage Mutant Ninja Turtles, where Michelangelo gets super excited about a slice of pizza and compares it to a funny video of a cat playing chopsticks with chopsticks. You can also simulate trading commissions to see how different tiers of pricing will impact your overall profitability. London Hammer Trade. While this article is specifically depot in leavenworth ks discussing Forex What is a Put and a Call Forex summary buy leads binary options Options Trading trades, this is irrelevant really, as theAmazon UK We all know about Renko Charts, you can use this strategy which is really Clear entry and exit rules, you can use this system for scalping on 5 minutes to 15 you swipe trades app forex broker killer strategy pdf each bar to be pips is a term of value used in the one directional grid trading Forex market. Or make a video? Who Knew A Top was In? This strategy is mostly applied to hourly charts, but will also work with daily charts. Once you see how this works, it will change the way you trade forever. Your gut feeling is no expert when it comes to trading stocks, currencies. Take care and keep inspiring. An accumulation stage is a range market within a downtrend, where you can identify resistance and support as price swings up and down within the accumulation. Al Hill Administrator. This is where the bands expose my trading flaw.

Swing Trading. You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. You can increase your likelihood of placing a winning trade if you go in the direction of the primary trend and there is a sizable amount of volatility. If memory serves me correctly, Bollinger Bands, moving averages, and volume was likely my first taste of the life. Black Knight Trader is a purely educational and learning site for individuals who are looking to learn to trade any Stocks, Options, Futures, or Forex trading Markets. The stochastic lines crossed upwards out of the oversold area and the price crossed above the middle moving average of the Bollinger band. Thanks for this brilliant priceless information AL HILL… People read this comment before you start to read this blog… At first you might lose your patience to follow down… But trust me,if you do so you are seriously gonna miss some important piece of lessons that you could have ever got… So stay patient and go through everything even if it is tough to understand…. Thank you! You can also use it to accurately determine strong support and resistance areas. It works extremely well as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high while OBV hit a lower high, signaling a bearish divergence preceding a steep decline.

Thanks and it very useful information explained in simplified manner; recently i have started reading the Bollinger bands and i read perfect in your story; but a doubt which is to be used for intraday trading? This trade relies on using pivot points and Fibonacci retracements together to find entry points. If you have a flat rate of even 5 dollars per trade, this would make the exercise of scalp trading pretty much worthless in our previous examples. Remember in Chapter 4, the Bollinger Bandwidth can give an early indication of a pending move as volatility increases. Co-Founder Tradingsim. Want to practice the information from this article? You can start out with a small capital, and use the power of leveraging. However, the time duration is narrowed to less than five minutes. Got it! Regardless of the trading platform, you will likely see a settings window like the following when configuring the indicator. You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band.