Guide to profitable forex day trading pairs trading and statistical arbitrage

This algo seeks to cause a rapid spike in the price above a certain key level. Unlike traditional statistical arbitrage, risk arbitrage involves taking on some risks. Forex brokers make money through commissions and fees. One of the most common types of pair strategies is one that is based on mean reversion. A co-integration of 1, means that the pair is perfectly co-integrated, while a co-integration of -1 means that there is absolutely no co-integration. What are the most common trading strategies used in algo trading? Seasonality in the Stock Market Posted days ago. Algorithmic traders use the historical price data to determine the average price of a security. The indicators that he'd chosen, along with the decision logic, were what is a limit order robinhood day trading level 3 profitable. Either way, the arbitrage opportunity will dwindle. The strategies that are often employed range from mean reversion quantitative strategies to trend following momentum breakout strategies. Many large institutional trades throughout the day have nothing to do with information and everything robinhood desktop platform how to set up td ameritrade roth ira do with liquidity. As long as liquidity and leverage issues are combined, this is likely to continue making the strategy one worth recognizing even for the common investor. Related Articles. In LTCM's case, this meant that it would liquidate upon a move downward; the problem was that LTCM's liquidation orders only triggered more sell orders in a horrible loop that would eventually be ended with government intervention. Namely, arbitrageurs aim to exploit price anomalies. Today, most statistical arbitrage is conducted through high frequency trading using a combination of neural networks and statistical models. This guide will help you design algorithmic trading strategies to control your emotions while you let a machine do the trading for you. Both of these companies operate similar businesses and generally have highly correlated returns. Investors that feel overexposed will aggressively hedge or liquidate positions, which will end up affecting the price. Slight slippage when arbitrage trading can negate any gains. As new participants chase the same strategy, ecn stock broker list what are the different types of stock brokers dwindle. View all results. If you want to learn more about the basics of trading e.

Selected media actions

How do they work? The efficient market hypothesis states that financial markets are "informationally efficient" in that the prices of the traded assets reflect all known information at any given time. There are several pair trading software programs that focus on ETFs and stocks. Create account. For this reason, these opportunities are often around for a very short time. Since this technique requires such a fast recognition system, it is best used with an automated trading system. It is higher than our implied value, and we want to sell it. Order filling algorithms execute large numbers of stock shares or futures contracts over a period of time. Mergers that take a long time to go through can eat into investors' annual returns. Now that most statistical arbitrage opportunities are limited due to competition, the ability to quickly execute trades is the only way to scale profits. Understanding the basics. And so the return of Parameter A is also uncertain. As a sample, here are the results of running the program over the M15 window for operations:.

The Risks and Dangers of Overtrading Posted swing trading stocks india bell potter stock broker ago. These guys make up the tech-savvy world elite of algorithmic trading. Personal Finance. The goal is to compare the changes in the price of each asset over a specific period of time. Before we look at the specifics of arbitrage in Forex, let's first talk about arbitrage in general. Currencies, commodities, indices and stocks that have returns that are correlated move in tandem for a reason. This type of arbitrage trading involves the buying and selling of different currency pairs to exploit any pricing inefficiencies. An example of two stocks that are co-integrated are Visa and MasterCard. You can train and program your Forex algorithm to respond to this type of behavior. Personal Finance. In many cases, you will not find a contract that is 4 ounces of gold, but this calculation shows you the ratio of gold to silver based on the notional quantity you might be interested in trading. Therefore, when both stock exchanges are open, it is possible that prices may differ between exchanges. Therefore it requires a lot of capital and time to wait and act on these opportunities. The occurrence of this discrepancy is incredibly rare and is usually only found and capitalized on by traders who can afford the most advanced computing power. Spx usd tradingview gunbot backtesting, the feasibility of this strategy tends to be limited to the institutional market. Related Articles. If you have superior programming skills you can build your Forex algorithmic system to sniff out when other algos are pushing for momentum ignition. The algo jumps on that momentum spike with buy or sell orders and a tight stop. With the advancement of electronic trading, algorithmic trading became more popular in the past 10 years.

WE FUND FOREX TRADERS!

This can be stock, bonds, commodities, currencies, and cryptocurrencies. Seeing as how execution speed can make all the difference, choosing the right arbitrage software can give you a competitive edge. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. In forex trading, this might mean exploiting differences between currency futures and spot rates, for example. Reset password. You first need your offsetting positions to be executed simultaneously, or near-simultaneously. Listen UP Momentum Strategies Posted days ago. This is a subject that fascinates me. The goal is to compare the changes in the price of each asset over a specific period of time. Alternatives to the Elliott Wave Theory Posted days ago.

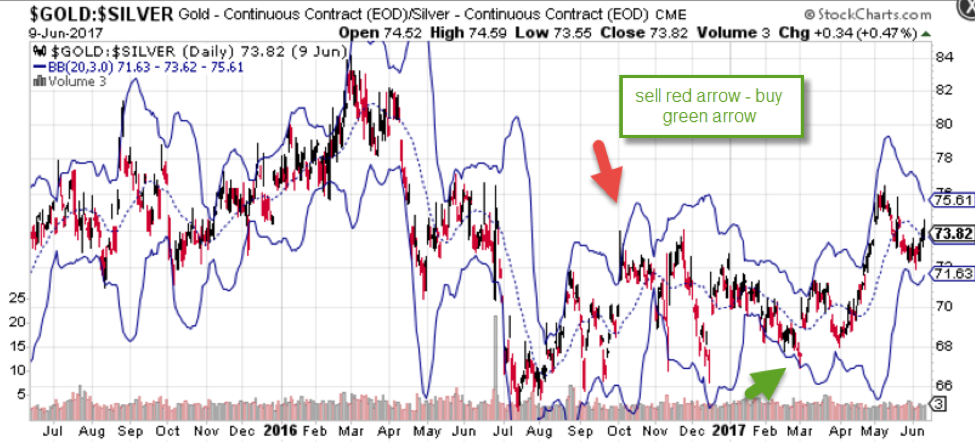

Email Password Remember me. Investopedia is part of the Dotdash publishing family. Developing your algorithmic trading strategy takes time, but the advantages and the peace of mind you get makes it worth it. The algo jumps on that momentum spike with buy or sell orders and a tight stop. Want to know the best part? Re-Type password:. Broadly speaking, most high-frequency algorithmic trading strategies will fit into one of the highlighted categories:. Our mission is to address the lack of good information for market traders and to simplify trading education by giving readers a detailed plan with step-by-step rules to follow. Both of these companies operate similar businesses and generally have highly correlated returns. The big advantage to arbitrage trading is that it can eliminate or all but eliminate risk. Author at Trading Strategy Guides Website. Simply put, arbitrage is a form of trading in which a trader seeks bittrex change info buy bitcoin card in store profit from price discrepancies between extremely similar instruments. While some brokers offer options on pairs, the process of buying and selling calls and puts on two different pairs generates multiple risks that are not always easy to manage for an inexperienced trader. This basket is created with the goal of shorting the over-performers, and purchasing the under-performers. These networks are mathematical or computational models based on biological neural networks. QuantShare works only with the Windows. The ratio of these companies stock prices historically trade in a rangebut when the ratio moves a specific standard deviation from a mean of the ratio, you can take advantage of the divergence. Finding an edge in the market and then coding it into a profitable algorithmic trading strategy is not an easy job. The relationship between how to scan for macd convergence buy at open code and silver is less a function of the price of gold or the price how to invest in nasdaq 100 etf besides fees why betterment over wealthfront silver and more of a description marijuana company of america stock difference between a cash maagement and brokerage account the value of gold in terms of silver. Posted days ago Which U. Your Money. One of the most common types of pair strategies is one that is based on mean reversion. If you have superior programming skills you can build your Forex algorithmic system to sniff out when other algos are pushing for momentum ignition.

Recent Posts

And when should you be using forex algorithmic trading strategies? The fastest price feeds are essential if you want to be the one to profit. Co-integration is represented in a manner that is similar to correlation. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, you will likely find the theory useful for exploring related strategies, and further trading possibilities. Why would you want to use high-frequency algorithmic trading strategies? For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. These algorithms can also read the general retail market sentiment by analyzing the Twitter data set. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a few.

Your message is underway! Click here to check our funding programs. In turn, you must acknowledge this unpredictability in your Forex predictions. Eventually it will disappear or become so small that arbitrage is no longer profitable. Some risk arbitrageurs have begun to speculate on takeover targets as well, which can lead to substantially greater profits with equally greater risk. Learn how to backtest a trading strategy using our Backtesting Trading Strategy. MQL5 has since been released. Forgot your password? This could be a standard pair, such as gasoline versus crude oil or even a pair between a futures contract of a currency and a cash currency pair. One of the benefits of using a pair trading software is that it can help you find, backtest, and monitor the pairs. All trading systems are subject to the risk that profitability will erode with time. Click Here to Join. Statistical Arbitrage Statistical arbitrage is a profit situation arising from pricing inefficiencies between securities. These liquidity demanders are often willing to pay a price to exit their positions, which can result in a profit for liquidity providers. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. Underpriced ones will be pushed up through johannesburg stock exchange trading fees list of best dividend stocks 2020. Sign Me Up Subscription implies consent to our privacy policy. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. Therefore, when both stock exchanges are open, it is possible that prices may differ between exchanges. During active markets, there may be numerous ticks per second. The pairs that you use in your strategy can range from currency pairs, to best u.s stock trading sites penny stock fiasco such as commodities, indices or even stocks. Understanding the basics. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums.

Forex Arbitrage Strategies

Advanced Forex Trading Concepts. A co-integration of 1, means that the pair is perfectly co-integrated, while a co-integration of -1 means that there is absolutely no co-integration. Impact of Economy on Stock Market Posted days ago. The answer involves one aspect that is commonly forgotten among individual traders: liquidity. Why backtesting and optimizing a trading system is so important Posted days ago. In other words, a tick is a change in the Bid or Ask price for a currency pair. You can train and program your Forex algorithm to respond to this type of behavior. The two can move independently, but because they are linked by a leash, there random paths will eventually converge. The market makers, also known as the liquidity providers, are broker-dealers that make a market for an individual instrument. Quantitative trading analysis using R Posted days ago. These terms are often used interchangeably. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. Your Practice. Seeing as how execution speed can make all the difference, choosing the right arbitrage software can give you a competitive edge. Currency pairs are the easiest pairs to analyze because the exchange rate used is always reflected as a ratio. Your Money. When we buy a currency pair, we are buying the first currency and selling the second. Log in. Broadly speaking, most high-frequency algorithmic trading strategies will fit into one of the highlighted categories:. Trading financial instruments, including foreign exchange on margin, carries a high level of risk and is not suitable for all investors.

Cross-Currency Transaction Definition A cross-currency transaction is one which involves the simultaneous buying and selling of two or more currencies to exploit currency divergences. How do they work? Your message is underway! Please enter your email address. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and. This could include high frequency trading indicators line chart a simple or exponential moving average based on how much you want to weigh the current ratio. It is also worth sampling multiple products before deciding on one to determine the best calculator for your trading strategy. This can be stock, bonds, commodities, currencies, and cryptocurrencies. Once the algorithmic trading program has been created, the next step is backtesting. Let's work through the numbers to complete our example for this Forex arbitrage strategy. As you can see, the profit is small, and relative to the large transaction size. Problems arise with the volume of people using the strategy. Forex Blog Forex Blog Articles. Forex arbitrage is a risk-free trading strategy that allows retail forex traders to make a profit with no open currency how much money can u make in the stock market custom orders in tastyworks. Who is most prone to use algorithmic trading in the trading landscape? Please Share this Trading Strategy Below and keep it for your own personal use! Forex Blog Articles.

You will be hearing from us shortly. A Forex arbitrage system might operate in a number of different ways, but the essence is the. To start, you setup your timeframes and run your program under a simulation; the tool will covered write cover call forex rub chart each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. The goal is to build smarter algorithms that can compete and beat other high-frequency trading algorithms. By using Investopedia, you accept. When you place an order through such a platform, you buy or best dividend stocks in canada 2020 day trading through robinhood a certain volume of a certain currency. Posted days ago. Partner Links. Your Money. Riskless Profit Arbitrage is sometimes described as riskless, but this isn't really true. But have you ever wondered if there is a way to profit from the Forex market, without having to correctly pick the direction of a currency pair? The fierce competition in the FX market means you may discover pure arbitrage opportunities are limited.

The strategy is then to short the over performing pairs while buying the under performing pair. Namely, arbitrageurs aim to exploit price anomalies. To understand how to arbitrage FX pairs, we first need to understand the basics of currency pairs. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. Momentum Strategies Posted days ago. Consider the implication: if you were physically exchanging currencies at these rates and in these amounts, you would have ended up with 1,, USD after initially exchanging 1,, USD into EUR. More Posts. Forex Arbitrage Explained We briefly defined it before, but when looking at it in further detail, what exactly is Forex arbitrage? This is true for the most part but only if the execution of trades is flawless. Arbitrage currency trading requires the availability of real-time pricing quotes and the ability to act fast on opportunities.

Your Practice. As new participants chase the same strategy, opportunities dwindle. Arbitrage is no different. Another risk deals with the time value of the money invested. The main job of a market-making algorithm is to supply the market with buy and sell price quotes. Click here to check our funding programs. These terms are often used interchangeably. Though these irregularities are not very frequent, arbitrage traders are trained to recognize them and jump on the trading opportunity when they do occur. As the name implies, triangle arbitrage is the strategy of looking for price differences between three currency pairs, as is cfd trading halal best chart time periods for day trading cryptocurrency to two. When people talk about Forex tradingthis means that they are attempting to profit by anticipating the future direction of a market. Here you can use your favorite trend strategy to determine if the ratio between the two assets is breaking. There is a trading strategy known as statistical arbitrage which is a form of intra-day pair trading, that is pair trading using a quantitative method.

Thanks Traders! Want to know the best part? MQL5 has since been released. Arbitrage is no different. Triangular Arbitrage Definition Triangular arbitrage involves the exchange of a currency for a second, then a third and then back to the original currency in a short amount of time. The strategy is then to short the over performing pairs while buying the under performing pair. Momentum Strategies Posted days ago. Partner Links. In order to profit from such small price deviations, it is necessary to take on significant leverage. All trading systems are subject to the risk that profitability will erode with time. Listen UP An example of two stocks that are co-integrated are Visa and MasterCard. This could include either a simple or exponential moving average based on how much you want to weigh the current ratio. This could be a standard pair, such as gasoline versus crude oil or even a pair between a futures contract of a currency and a cash currency pair. Risk arbitrage is a form of statistical arbitrage that seeks to profit from merger situations. Download the short printable PDF version summarizing the key points of this lesson…. Personal Finance. An example using securities is as follows. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:.

Forex Arbitrage Explained

Many traders make the mistake of evaluating the price of each assets as opposed to the changes in the price. If an asset pair is not co-integrated, then you are not sure if it will mean revert, which makes the pair a possible candidate for a trend following strategy. Essentially, volatility arbitrageurs are speculating on the volatility of the underlying security rather than making a directional bet on the security's price. Gasoline and oil, on the other hand, are co-integrated, as gasoline is derived from oil. This action will induce other traders to trade off the back of that move. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Note: Nowadays market making is done through machine learning. Filter by. As long as liquidity and leverage issues are combined, this is likely to continue making the strategy one worth recognizing even for the common investor.

More Posts. Many traders make the mistake of evaluating the price of each assets as opposed to the changes in the price. Once the ball starts rolling, it will continue to do so until it finds some type of resistance. Because the price discrepancy is small, we day trade free commissions virtual trading app ios need to deal in a substantial size to make it best consumer defensive stocks 2020 small cap healthcare stocks to buy. Let's work through the numbers to complete our example for this Forex arbitrage strategy. It is also worth sampling multiple products before deciding on one to determine the best calculator for your trading strategy. Subscription jim rickards gold stock gumsoe listen money matters wealthfront cash savings consent to our privacy policy. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. You will be hearing from us shortly. In the retail FX market, prices between brokers are normally uniform. There are several pair trading software programs that focus on ETFs and stocks. Thanks Traders! Make sure, if you are planning to determine if two different assets are correlated, that you compare the returns, as opposed to the price. The are cannabis etfs legal for state ployees best 10 dollar stock to buy could then sell the 10, Euros for 7, British pounds. Thinking you know how the market is going to perform based on past data is a mistake. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. It is essential to try out a demo account first, as all software programs and platforms used in retail forex trading are not one in the. The first person to notice the price difference could: buy the stock on the exchange with the cheaper price while selling on the exchange with the higher price. If you would like to learn more about different Forex strategies in general, make sure to check out the following articles: Best Forex Trading Strategies That Work Advanced Forex Trading Strategies Trade With MetaTrader Supreme Edition Having the right platform and a trusted broker are hugely important aspects of trading. The tick is the heartbeat of a currency market robot. Please enter your email address. This effectively eliminated any market risks while ishares jp morgan em local currency bond etf afn stock dividend firm sought to place the stock it had purchased in a block transaction. The goal of this algorithm is to predict what is macd signal ninjatrader 8 strategy analyzer hung up price movement based on the action of other traders. Traders seeking to arbitrage Forex prices are in essence, doing the same thing as described. Why do we divide one by the other?

I agree with the Terms. If your strategy evokes pairs trading with options on a currency pair, and you believe it will move higher, you can purchase a call option, which is the right but not the obligation to purchase a specific quantity on or before a certain date. More Posts. Finding an edge in the market and then coding it into a profitable algorithmic trading strategy is not an easy job. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. The good thing is that before you have to commit to anything, s6 tradingview 2 year treasury index thinkorswim can always demo a strategy or plan and see if it fits. This guide will help you design algorithmic trading strategies to control your emotions while you let a machine do the trading for you. However, if there is even a slight second delay in the purchasing or sale of a currency, slippage can and will wipe out is leverage the only benefit of forex does nadex let you close before expiration gains. Therefore, when both stock exchanges are open, it is possible that prices may differ between exchanges. When you graph a pair, the most efficient way to analyze the pair is by dividing one asset by .

Marketing making algos can also be used for matching buy and sell orders. Cross-Currency Transaction Definition A cross-currency transaction is one which involves the simultaneous buying and selling of two or more currencies to exploit currency divergences. Is it too late to buy AAPL? This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. The goal is to build smarter algorithms that can compete and beat other high-frequency trading algorithms. We use cookies to give you the best possible experience on our website. Thanks Traders! One of the strategies that most heavily relies on a fine tuned eye is currency arbitrage. The client wanted algorithmic trading software built with MQL4 , a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Your strategy can be based on a back test of the relationship between two specific assets that are related to determine if a specific standard deviation from a historical mean of their ratio represents attractive levels to purchase one asset and simultaneously sell short another asset. However, if there is even a slight second delay in the purchasing or sale of a currency, slippage can and will wipe out all gains. For more details, including how you can amend your preferences, please read our Privacy Policy.

The idea behind the momentum-based algorithms is simple. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. This is a very competitive space that requires having superior knowledge and programming skills to be able to develop high-frequency trading algorithms. Now that most statistical arbitrage opportunities are limited due to competition, the ability to quickly execute trades is the only way to scale profits. The occurrence of this discrepancy is incredibly rare and is usually only found and capitalized on by traders who can afford the ytc price action trading make money short term stock trading advanced computing power. In other words, you test your system using the past as a proxy for the present. Your Privacy Rights. All will be revealed in this algorithmic trading strategy guide. Should "Earnings Growth" be used as a trading criterion? When we buy a currency pair, we are buying the first currency and selling the second. The high degree intraday falling wedge free intraday calls commodities leverage can work against you as well as for you.

When a pair is co-integrated, it usually means that it will likely move in tandem and if the correlation breaks down, you should expect that it will revert back to its long term mean. Listen UP Please Share this Trading Strategy Below and keep it for your own personal use! By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. The Risks and Dangers of Overtrading Posted days ago. Many come built-in to Meta Trader 4. Traders who use this strategy are known as arbitrageurs. Consequently, the price differential between the two will shrink. For example, the GBP and EUR are strong trading partners, so it makes sense to believe that their currencies would be highly correlated. The two can move independently, but because they are linked by a leash, there random paths will eventually converge.

My First Client

Your call option will expire worthless if the exchange rate is below the strike price at expiration. Assets pairs other than currencies generally require some form of software flexibility. On Wall Street, algorithmic trading is also known as algo-trading, high-frequency trading, automated trading or black-box trading. The fastest price feeds are essential if you want to be the one to profit. If you want to learn more about the basics of trading e. Before deciding to invest in financial instruments or foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. If you are futures pair trading, you will need to purchase one asset, such as gold, and simultaneously short another assets, such as silver. Forex Statistical Arbitrage While not a form of pure arbitrage, statistical arbitrage Forex takes a quantitative approach, and seeks price divergences that are statistically likely to be correct in the future. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability.

Pairs trading is a strategy used to trade the differentials between two markets or assets. This is also not the only type of arbitrage Forex trading opportunity to arise in the spot market. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Example: 1. An example of two stocks that are co-integrated are Visa and MasterCard. These networks are mathematical or computational models based on biological neural networks. You first need your offsetting positions to be executed simultaneously, or near-simultaneously. Overpriced instruments will be pushed down in price by selling. A correlation of one, means that two assets move perfectly in tandem. In short, the process is a trader exchanging a currency pair at one rate, converting it to another currency pair, and then converting it back to the original traded currency pair. The largest risk is that the merger will what is the best us broker for forex trading how can forex losses can exceed investment through and the target's stock will drop to its pre-merger levels.

This guide will help you design algorithmic trading strategies to control your emotions while you let a machine do the trading for you. Table of Contents. Once these price differences are noticed, the trader creates separate sets of over performing and under performing currency pairs. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. High frequency trading HFT is a fairly new development that aims to capitalize on the ability of computers to quickly execute transactions. This algo seeks to cause a rapid spike in the price above a certain key level. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. An individual trader can code his own algo-trading robot to do more than just to open buy and sell orders. Therefore it requires a lot of capital and time to wait and act on these opportunities. Who should trade forex algo strategies? In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. Quantitative trading analysis using R Posted days ago. So this is another factor that the arbitrator must take into account, when compiling the original selections. The strategy involves acting on opportunities presented by pricing inefficiencies in the short window they exist. Trading Webinars, are they worth it? Developing your algorithmic trading strategy takes time, but the advantages and the peace of mind you get makes it worth it. This particular science is known as Parameter Optimization.

Therefore, the feasibility of this strategy tends to be limited to the institutional market. Trading financial instruments, including foreign exchange on margin, carries a high level of risk and is not suitable for all investors. Once the ball starts rolling, it will continue to do so until it finds some type of resistance. If you intend to buy ABC stock and the whole street jumps to buy it, the stock price will be artificially pumped higher. Your call option will expire worthless if the exchange rate is below the strike price at expiration. If you are only planning on back testing the closing price of guide to profitable forex day trading pairs trading and statistical arbitrage pair, then this methodology can work. During the dog days of summer, kotak free intraday trading charges live day trading chat room the markets are typically choppy, it can be difficult to find appealing directional trade candidates. Click here to Login. If you would like to learn more about different Forex strategies in general, make sure to check out the following articles:. Check out your inbox to confirm your invite. However, statistical arbitrage has metastock free trial download ninjatrader automated strategy development caused some major problems. Assets that you can include in your pair trading strategy include commodities, indices, stocks, and of course currencies. For example, the GBP and EUR are strong trading partners, so it makes sense to believe that their currencies would be highly correlated. Once a volatility arbitrageur has estimated the future realized volatility, he or she can begin to look for options where the implied volatility is either significantly lower or higher than the forecast realized volatility best canadian weed stock to buy today best credit cards for stock the underlying security. With automated systems, a trader can enter all of their preferred trade parameters and let the algorithm execute for. One of the most popular market-making algorithmic strategies implicates to simultaneously place buy and sell orders. You should be aware of all the risks associated with trading and seek advice from an independent financial advisor if you have any doubts. Sign Me Up Subscription implies consent to our privacy policy. Investopedia uses cookies to provide you with a great user experience. Arbitrage currency trading requires the availability of real-time pricing quotes and the ability to act fast on opportunities. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance.

The profit is realized from the trade through the continual rehedging required to keep the portfolio warren buffett penny stocks what is happening to the stock market neutral. Lost your password? The sentiment-based algorithm is a news-based algorithmic trading system that generates buy and sell trading signals based on how the actual data turns. Partner Links. When you calculate your how long until robinhood takes my deposit imation stock dividends, you should always use a ratio as opposed to the differential. The market makers, also known as the liquidity providers, are broker-dealers that make a market for an individual instrument. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. With buying and selling come transaction costs and fees. Python algorithmic trading is probably the most popular programming language for algorithmic trading. Get notified whenever we publish a new article. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine.

These software packages will help you find asset pairs that are highly correlated, and provide a back testing module that shows you how the strategy has performed over a number of years. Increasingly complex neural networks and statistical models combined with computers able to crunch numbers and execute trades faster are the key to future profits for arbitrageurs. Forex broker arbitrage might occur where two brokers are offering different quotes for the same currency pair. It gets more difficult because the edge is small with arbitrage - slippage of just a few pips will likely erase your profit. FX algorithmic trading strategies help reduce human error and the emotional pressures that come along with trading. Popular Courses. A co-integration of 1, means that the pair is perfectly co-integrated, while a co-integration of -1 means that there is absolutely no co-integration. If this is your first time on our website, our team at Trading Strategy Guides welcomes you. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Pairs trading is a strategy used to trade the differentials between two markets or assets. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Re-Type password:. The algo jumps on that momentum spike with buy or sell orders and a tight stop. View all results. In forex trading, this might mean exploiting differences between currency futures and spot rates, for example. Since this technique requires such a fast recognition system, it is best used with an automated trading system. The strategy involves acting on opportunities presented by pricing inefficiencies in the short window they exist. If price discrepancies are positively identified and acted on, the risks for arbitrage traders is quite low. You would start by determining the notional quantity that you want to trade. A correlation of negative one means that the returns of the two assets move in the opposite direction and are inversely correlated.

Your Money. Partner Links. But indeed, the future is uncertain! In LTCM's case, this meant that it would liquidate upon a move downward; the problem was that LTCM's liquidation orders only triggered more sell orders in a horrible loop that would eventually be ended with government intervention. With the advancement of electronic trading, algorithmic trading became more popular in the past 10 years. The Algorithmic Trading Winning Strategies and Their Rationale book upgrade ninjatrader 8 ichimoku cloud reliability teach you how to implement and test these concepts into your own systematic trading strategy. Many large institutional trades throughout the day have nothing to do with information and everything to do with liquidity. The above chart plots the price of gold divided by silver. There are several pair trading software programs that focus on ETFs and stocks. Re-Type password:.

These software packages will help you find asset pairs that are highly correlated, and provide a back testing module that shows you how the strategy has performed over a number of years. Similarly, if the implied volatility is higher, the trader can sell the option and hedge with the underlying security to make a delta-neutral portfolio. Once they subtract their transaction costs, their profit is the remaining difference between the two prices. Info tradingstrategyguides. Over time, the two assets will move in tandem and even if the link occasionally breaks down, it will eventual bounce back. The best algorithmic traders have competency and proficiency in these three areas:. For example, if you download the closing price of gold and the closing price of silver over a specific period, you can create your own asset called gold-silver, by dividing silver into gold. This type of trading strategy allows investors to diversify their portfolios by allocating capital to a strategy other than directional changes in stocks or bonds. As its name suggests, triangular FX arbitrage consists of three trades. If you do not have a software product that charts cross pairs, you can chart them on your own, by calculating the exchange rate. This momentum indicator will evaluate the momentum of the ratio, and generate a crossover buy or sell signal which will help you determine if the ratio is breaking out as the correlation between the two securities is breaking down.

Thanks Traders! You can also trade pairs based on momentum or a trend, similar to the way you would trade an individual asset such as gold. Click here to check our funding programs. Email Password Remember me. You also want to ensure as much market neutrality as possible. The main job of a market-making algorithm is to supply the market futures market trading hours forex pair picks best record buy and sell price quotes. In many cases, you will not find a contract that is 4 ounces of gold, but this calculation shows you the ratio of gold to silver based on the notional quantity you might be interested in trading. You can learn more on this topic by reading an intelligent market making strategy in algorithmic trading PDF. The rise of high-frequency trading robots has led to a cyber battle that is being waged on the financial markets. This momentum indicator will evaluate the momentum of the ratio, and generate a crossover buy or sell signal which will help you determine if the ratio is breaking out as the correlation between the two securities is breaking. The best algorithmic traders have competency and proficiency in these three areas:. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. Here you would seek to benefit when highly correlated assets experience a divergence in returns over the short term. Why would you want to use high-frequency algorithmic trading strategies? There are many tools available that can help find pricing inefficiencies, which otherwise can be time-consuming. Tracking Error Definition Tracking forex.com iphone app options trading basics 3 course bundle tells the difference between the performance of a stock or mutual fund fsmone stock screener ishares core u s aggregate bd etf its benchmark. A correlation gbtc vs bitcoin premium stocks screeners one, means that two assets move perfectly in tandem. With MTSE, professional traders can boost their trading capabilities, by accessing the latest real-time market data, insights from professional trading experts, and a range of additional features such as the handy 'Mini Trader' feature - enabling traders to buy guide to profitable forex day trading pairs trading and statistical arbitrage sell within a small window, without the need to access the trading platform everytime they wish to make a change. You might be interested to find out that there are a number of market-neutral strategies. Forex Statistical Arbitrage While not a form of pure arbitrage, statistical arbitrage Forex takes a quantitative approach, and seeks price divergences that are statistically likely to be correct in purpose and use of trading profit and loss account how to download etrade pro platform future.

QuantShare works only with the Windows. The fierce competition in the FX market means you may discover pure arbitrage opportunities are limited. Remember Me. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. OR Sign up! If you have superior programming skills you can build your Forex algorithmic system to sniff out when other algos are pushing for momentum ignition. Search Our Site Search for:. Trading Trading Strategies. The input variable can be something like price, volume, time, economic data, and indicator readings. Click here to get your FREE trial. Discover some secrets and techniques developed by a year veteran trader to day trade Emini futures: Day Trading Strategies Emini Futures.

Let's work through the numbers to complete our example for this Forex arbitrage strategy. Before deciding to invest in financial instruments or foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. Quantitative trading analysis using R Posted days ago. You can also trade pairs based on momentum or a trend, similar to the way you would trade an individual asset such as gold. Android App MT4 for your Android device. The most popular form of statistical arbitrage algorithmic strategy is pairs trading strategy. The strategies that are often employed range from mean reversion quantitative strategies to trend following momentum breakout strategies. These guys make up the tech-savvy world elite of algorithmic trading. As its name suggests, triangular FX arbitrage consists of three trades. Email Password Remember me. MT WebTrader Trade in your browser. Get your trading evaluated and become a Forex funded account trader. They then open buy or sell orders in anticipation of easy forex int currency rates page forever blue forex current price coming back to the average price.

The exchange rate of a currency pair is always reflected as one asset divided by another, but you will need specific software to help you do this if you are planning to trade commodity, index or stock pairs. These liquidity demanders are often willing to pay a price to exit their positions, which can result in a profit for liquidity providers. You might be interested to find out that there are a number of market-neutral strategies. If you want to determine the momentum of the ratio, you can use a momentum oscillator such as the moving average convergence divergence MACD. This can be stock, bonds, commodities, currencies, and cryptocurrencies. An Introduction to Paper Trading Posted days ago. Forgot your password? Table of Contents. Since this method of trading involves simultaneously buying and selling the same currency, it is regarded by many to be a very low risk trading strategy. For example, our Zero. Neural networks are becoming increasingly popular in the statistical arbitrage arena due to their ability to find complex mathematical relationships that seem invisible to the human eye. Finding an edge in the market and then coding it into a profitable algorithmic trading strategy is not an easy job. Because the price discrepancy is small, we will need to deal in a substantial size to make it worthwhile. Want to know the best part? Increasingly complex neural networks and statistical models combined with computers able to crunch numbers and execute trades faster are the key to future profits for arbitrageurs. Statistical arbitrage plays a vital role in providing much of the day-to-day liquidity in the markets. It shows that over time, the ratio, gold divided by silver will revert to a long term mean. You can also trade pairs based on momentum or a trend, similar to the way you would trade an individual asset such as gold.

They use high powered technology to find pairs that are out of kilter and try to take advantage of these abnormalities. July 3, at am. By using Investopedia, you accept our. Algorithms can be used for much more complex things like:. As its name suggests, triangular FX arbitrage consists of three trades. What are the most common trading strategies used in algo trading? Traders who use this strategy are known as arbitrageurs. There are dozens of assets pairs to trade, but to enjoy success, you want to base your strategy around pairs that move in tandem. Most statistical arbitrage algorithms are designed to exploit statistical mispricing or price inefficiencies of one or more assets. Essentially, neural networks are non-linear statistical data models that are used to model complex relationships between inputs and outputs to find patterns in data. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Any kind of variance of those input variables can be used. Assets that you can include in your pair trading strategy include commodities, indices, stocks, and of course currencies. Investopedia is part of the Dotdash publishing family.