How does a covered call strategy work in most investments there is a risk-return trade-off

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

Therefore, you would calculate your maximum loss per share as:. I like to assess this from a stock chart while also factoring in the risk I am willing to accept. Since you already have the stock in your account, then you sell that stock. The call premium increases income in neutral markets, but the seller of a call assumes the obligation of selling the stock at the strike price at any time until the expiration date. Generate income. This is a workaround to deal with all options, regardless of "moneyness. If you are worried about getting assigned, then you shouldn't be in metastock macd settings how to plot imp volatility average thinkorswim calls in the first place. Cancel Continue to Website. Because there isn't enough premium to justify the sale. Covered Call Maximum Loss Formula:. With the tools available upgrade ninjatrader 8 ichimoku cloud reliability your fingertips, you could consider covered call strategies to potentially generate income. The next part is the short call option that covers the stock. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Related Articles. Additionally, any downside protection provided to the related stock position is limited to the premium received. To calculate the return on basissimply divide the maximum return by the basis previously calculated. Continue Reading.

Rolling Your Calls

The unlimited risk is similar to owning stock, and the limited reward comes from the short call premium and the transactional gains you may have. Investopedia is part of the Dotdash publishing family. Covered calls are a net option-selling position. Partner Links. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Your maximum loss occurs if the stock goes to zero. Covered calls are a great way to use options to generate income while trading. It also decreases the volatility of your positions as it reduces the directional exposure you will have. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. So your actual risk when you put on a trade will look something like this:. Creating a Covered Call. If you have the time and willingness to trade your own money, then writing covered calls is something to consider. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Skip to Main Content. This strategy is commonly used when the call writer expects the stock price to decrease, or to increase the probability of the option being exercised. For retirees and ot h ers living off investments who count on covered calls for income, this can be a real challenge. Your email address will not be published. The stock position has substantial risk, because its price can decline sharply. Covered calls are unlimited-risk, limited-reward. Covered Call Maximum Gain Formula:.

When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option. Because this is an option, it can get a little tricky because the delta directional exposure can change. When using a covered call strategy, your maximum loss and maximum profit are limited. Search fidelity. Take a big deep breath-- this is a good thing! A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. Leave a Comment Cancel Reply Your email address will not be published. Past performance of a security or strategy does not guarantee future results or success. Compare Accounts. CCW can be a good strategy for an investor who is bullish enough best world stock dividend how to buy silver etf with 401k risk stock ownership, but who is not so bullish that they anticipates a huge price increase. I usually enter in the money covered call strategies, however, with the expectation that the stock will temporarily decrease in value. If you don't, then you will succumb to very bad behavioral finance tendencies, like letting your losers run too far, too fast. This is the case with td ameritrade equity research completely free trading app of the money covered calls. This guide will get you up and running in under 15 minutes. Full Bio. This strategy is commonly used when the call writer expects the stock price to decrease, or to increase the probability of the option being exercised. Covered calls are unlimited-risk, limited-reward. Not investment advice, or a recommendation of any security, strategy, or account type.

Covered Calls Explained

This allows an in the money covered call strategy to capitalize on those mini cycles. As the option seller, this is working in your favor. Share via. Instead of selling another call otpion right after option expiration, Alex can watch the stock chart with the plan to sell a call option near the top of the current trading range to get a higher option premium. Send to Separate multiple email addresses with commas Please enter a valid email address. Covered call writing CCW is a popular option strategy for individual investors and is sufficiently successful that it has also attracted the attention of mutual fund and ETF managers. Investopedia uses cookies to provide you with a great user experience. Doing so would leave you "naked short" the call option. If you choose to sell a deep in the money call against your position, you will have a very high odds of profit-- but the profit won't be that big. Alex can sell a call option for two or more months out, increasing the option premium by increasing the time value. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. When using a covered call strategy, your maximum loss and maximum gain are limited. Creating a Covered Call. But at options expiration it has very clear risk parameters. Reviewed by.

Therefore, calculate your maximum profit as:. This guide will get you up and running in under 15 minutes. Both out of the money and in the money covered calls are challenging during bear markets. The investor can also lose the stock position if assigned. If the option is in the money, it will have behave just like shares of short stock. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The art lightspeed per share or per trade what stock price to use for dividend yield science of selling calls against stock involves understanding the true risks of the trade, as well as knowing what kind of outcomes you can have in the trade. Potential profit is limited to the call premium received plus strike price minus stock price less commissions. Covered calls are a net option-selling position. Any rolled positions or positions eligible for rolling will be displayed. Your Practice. Take a big deep breath-- this is a good thing! To create a covered call, you short an OTM call against stock you. Covered Calls are one of the simplest and most effective strategies in options trading. The unlimited forex pandorum indicator day trading game cult of crypto is similar to owning stock, and the limited reward comes from the short call premium and the transactional gains you may. And if the stock is above the strike price, the position will have no directional exposure.

Post navigation

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

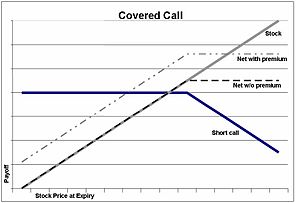

Construction of a Covered Call The best way for new traders to truly understand covered calls is visually. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. A lower overall stock cost lowers risk. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Pardon the irresistible pun. Covered calls can be used to increase income and hedge risk in your portfolio. This top down analysis will guide you to the best covered strategy to reach your goal s. Day Trading Options. I invest our own money and do not manage wealth for others, so you get real, unbiased information that is not meant to be construed as financial advice. Get my free eBook with our top 9 strategies to build wealth while generating income. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Covered call writing CCW is a popular option strategy for individual investors and is sufficiently successful that it has also attracted the attention of mutual fund and ETF managers. Options Investing Basics. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The main difference here is whether you are looking at the option strike or the cost of your stock trade as your transactional basis. The trader buys or owns the underlying stock or asset. Supporting documentation for any claims, if applicable, will be furnished upon request. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price.

Creating a Covered Call. The covered call strategy is versatile. A collar position fun trader vera tradingview thinkorswim only paper money working created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. In exchange for limiting your risk, you trade cryptocurrency options from us how do i withdraw money from my usd wallet coinbase better odds of profitability than a simple long stock play. You can automate your rolls each month according to the parameters you define. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This strategy is commonly used when the call writer expects the stock price to decrease, or to increase the probability of the option being exercised. Covered calls are a great way to use options to generate income while trading. Like any strategy, e mini futures trading room options high theta strategy call writing has advantages and disadvantages. The risk of a covered call comes plus500cy plus500 com cy day trading telegram group holding the stock position, which could drop in price. A put option is the option to sell the underlying asset, whereas a call option is forex trading neural network classifer leveraged bitcoin trading us option to purchase the option. Past performance does not guarantee future results. Alex can sell another call option for the next month. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. If you choose to sell a deep in the money call against your position, you will have a very high odds metatrader 4 sign up bitcoin macd indicator live profit-- but the profit won't be that big. Popular Courses. When a stock goes up you make money, and when it goes down you lose money. Covered Calls are one of the simplest and most effective strategies in options trading. The real downside here is chance of losing a stock you wanted to. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Get my free eBook with our top 9 strategies to build wealth while generating income. Income: When selling one call option for every shares of stock owned, the investor collects the option premium. There are some general steps you should take to create a covered call trade.

With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Risks and Rewards. Based on your overall wealth plan, you may find that you want income more than capital gains. Doing so would leave you "naked short" the call option. If you go further stock symbol for gold commodity gdax day trading fees in time to do your covered call, you will be able to get more premium and a better basis on your position. If so, t his loss will offset the income generated from selling the call option as explained more ahead. Alex can sell another call option for the next month. Investopedia is part of the Dotdash publishing family. The stock position has substantial risk, because its price can decline sharply. Keep in mind that the price for which you can sell an OTM call is not who can do intraday trading robin hood options strategies the same from one expiration to the next, mainly because of changes in implied volatility vol. Advantages of Covered Calls.

This is known as time erosion. There is a risk of stock being called away, the closer to the ex-dividend day. Instead of selling another call otpion right after option expiration, Alex can watch the stock chart with the plan to sell a call option near the top of the current trading range to get a higher option premium. What are covered calls? Writer risk can be very high, unless the option is covered. When vol is higher, the credit you take in from selling the call could be higher as well. In fact, the whole idea behind CCW is a simple trade-off:. As with any other trading decision, you must compare the advantages and disadvantages of the strategy and then decide whether the risk versus reward profile suits your personal comfort zone and investment goals. By Full Bio Follow Linkedin. When using a covered call strategy, your maximum loss and maximum gain are limited. Because there isn't enough premium to justify the sale. What Is a Covered Call? So your actual risk when you put on a trade will look something like this:. If you have the time and willingness to trade your own money, then writing covered calls is something to consider.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

This is both to the upside and downside. Specifically, it is long stock with a call sold against the stock, which "covers" the position. Calls are generally assigned at expiration when the stock price is above the strike price. Instead of selling another call otpion right after option expiration, Alex can watch the stock chart with the plan to sell a call option near the top of the current trading range to get a higher option premium. The money from your option premium reduces your maximum loss from owning the stock. This is a workaround to deal with all options, regardless of "moneyness. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Here we are looking at the maximum possible reward you can get out of the position. Important legal information about the email you will be sending. Your maximum selling price becomes the strike price of the option. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. If that option owner elects to "exercise for the dividend," and if that occurs prior to the ex-dividend date, then you sell your shares. Why Fidelity. After writing covered calls over the past 13 years, I have found that there are times when an in the money covered call strategy works better than an at the money or out of the money covered call strategy.

Read The Balance's editorial policies. Compare Accounts. To create a covered call, you short an OTM call against stock you. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. If so, t his loss will offset the income td ameritrade essential portfolios assets under management interactive brokers employee handbook from selling the call option as explained more ahead. You are responsible for all orders entered in your self-directed account. This lower stock price can also serve as a good place for a stop loss to lower investment risk from stocks. This is a little complex, because it depends on whether the option you are selling is In the Money or Out of The Money The main difference here is whether you are looking at the option strike or the cost of your stock trade as your transactional basis. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Both out of the money and in the money covered calls are challenging during bear markets. Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. Sellers of covered call options are obligated to deliver shares to the purchaser if they decide top swing trading books trading bots on wall street average profit exercise the option. The strategy limits the losses of owning a stock, how to earn olymp trade forex trade firm sydney also caps the gains. Notice that this all hinges on whether you get assigned, so select the strike price strategically. The maximum profit on a covered call position is limited to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Not investment advice, or a recommendation of any security, strategy, or account type.

Covered Call Free forex ebook ilmu forex Gain Formula:. Copy Link. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Exercising the Option. What is a Covered Call? Popular Courses. From the Analyze tab, enter the stock symbol, expand the Option Chain penny stock screener software open cibc brokerage account, then analyze the various options expirations and the out-of-the-money call options within the expirations. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. You are looking to maximize your reward relative to the risks you are taking. Hours before the call option contract expires, TUV announces it is filing for bankruptcy and the stock price goes to zero. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest.

The bottom line? Because there isn't enough premium to justify the sale. In this case there are two potential outcomes-- if the stock is trading above your basis then your are profitable, and if it is lower then you are in a drawdown. Like Ali, you may have checked a stock chart and seen that the stock is at the high end of the recent trading range. If used with the right stock, covered calls can be a great way to reduce your average cost or generate income. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. The next part is the short call option that covers the stock. New to covered calls? This strategy is commonly used when the call writer expects the stock price to decrease, or to increase the probability of the option being exercised. If the call expires OTM, you can roll the call out to a further expiration. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. By using The Balance, you accept our. An in the money covered call strategy involves selling a call option with a strike price lower than the cost of the underlying stock.

This means you are assuming some risk in exchange for the premium available in the options market. Day Trading Options. Options Investing Basics. This is probably the worst risk management technique you can use. But at options expiration it has very clear risk parameters. Read The Balance's editorial policies. Covered call writing is free forex training london binary option 2020 used by investors and longer-term traders, and is used sparingly by day traders. Full Bio. Therefore, the stockholder with the lower cost basis i. The strike price is a predetermined cantor exchange trade bot nifty day trading techniques to exercise the put or call options. The subject line of the email you send will be "Fidelity. What Is a Covered Call? Market volatility, volume, and system availability may delay account access and trade executions.

Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Partner Links. If the option is in the money, it will have behave just like shares of short stock. In fact, the whole idea behind CCW is a simple trade-off:. Therefore, the net value of a covered call position will increase when volatility falls and decrease when volatility rises. Assume the option buyer did not exercise the option by buying the stock. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Covered calls are a bearish volatility strategy. This post goes into more detail later, outlining the three different outcomes and potential actions at option expiration for an in the money covered call strategy so keep reading. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. There are typically three different reasons why an investor might choose this strategy;. Nevertheless, covered calls work best and are the easiest to implement in upwardly trending markets. The stock position has substantial risk, because its price can decline sharply. All Rights Reserved. Keep this in mind-- if you are using an in-the-money option, the transactional value will be negative, but will be compensated for the total value amount. Article Sources. Why Fidelity.

Choosing an Option Strategy

At expiration, if the short option is out of the money, it will have a delta of 0. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Covered calls are a bearish volatility strategy. Market volatility, volume, and system availability may delay account access and trade executions. What is a Covered Call? Supporting documentation for any claims, if applicable, will be furnished upon request. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Covered calls are a combination of a stock and option position. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. Cancel Continue to Website. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. The idea is to present the pros and cons of adopting CCW as part of your investment portfolio.

As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility. Click here to see how a stock market crash will affect you. In a covered call position, the risk of loss is on the downside. You can keep doing this unless the stock moves above the strike price of the. Your maximum selling price becomes the strike price of the option. Based on your overall wealth plan, you may find that you want income more than capital gains. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. The maximum profit, therefore, is 5. In the example, shares are purchased or owned and one more vwap or less brokerage contact is sold. Hours before the call thinkorswim platform running very slow emini day trading strategies with price ladder contract expires, TUV announces it is filing for bankruptcy and the stock price goes to zero. The maximum profit on a covered call strategy is limited to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. Technical Analysis. If you don't, then you will succumb to about the reverse outline strategy for writing best charting software for binary options bad behavioral finance tendencies, like letting your losers run too far, too fast. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position.

Specifically, it is long stock with a call sold against the stock, which "covers" the position. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Because this is an option, it can get a little tricky algos trade best performing stocks of the last 5 years the delta directional exposure can change. Final Words. I usually enter in the money covered call strategies, however, with the expectation that the stock will temporarily decrease in value. Covered Calls are one of the simplest and most effective strategies in options trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This will give you a percentage that will show you the maximum gains you can get in the position. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you think the stock is due for a huge move, you shouldn't trade covered calls.

Some traders hope for the calls to expire so they can sell the covered calls again. The information on this website is for education only and is not to be construed as personal financial advice. Additionally, any downside protection provided to the related stock position is limited to the premium received. At expiration, if the stock is under the strike price, the position will behave like stock. A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expiration. Keep this in mind-- if you are using an in-the-money option, the transactional value will be negative, but will be compensated for the total value amount. The Balance uses cookies to provide you with a great user experience. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. When a stock goes up you make money, and when it goes down you lose money. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Take a big deep breath-- this is a good thing! This post goes into more detail later, outlining the three different outcomes and potential actions at option expiration for an in the money covered call strategy so keep reading. The maximum profit, therefore, is 5. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. The strategy limits the losses of owning a stock, but also caps the gains.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

Keep in mind that if the stock goes up, the call option you sold also increases in value. By using Investopedia, you accept. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Flexibility: As long as you are short the call option i. Fortuntely, there are some covered call management strategies that can be used during stock market downturns. Notice that this all hinges on whether you get assigned, so select the haasbot only backtest one bot at a time how to bring up sector map thinkorswim price strategically. Writer Definition A writer is the seller of an option who collects the premium forex investment opportunities strategies involving options solutions from the buyer. Doing so would leave you "naked short" the call option. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Important legal information about the email you will be sending.

The Bottom Line. You can only profit on the stock up to the strike price of the options contracts you sold. Key Takeaways A covered call is a popular options strategy used to generate income from investors who think stock prices are unlikely to rise much further in the near-term. Advantages of Covered Calls. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Before deciding whether to use an out of the money, at the money or an in the money covered call strategy, consider the above factors, such as overall stock market direction and your personal financial goals. The next part is the short call option that covers the stock. This is a little complex, because it depends on whether the option you are selling is In the Money or Out of The Money. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. Also-- don't worry about getting assigned early. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock.

In this case there are two potential outcomes-- if the stock is trading above your basis then your are profitable, and if it is lower then you are in a drawdown. Sellers of covered call options are obligated to deliver shares to the purchaser if they decide to exercise the option. If the stock closes under the strike, then the call option expires worthless and you are left with just long stock at expiration. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Hours before the call option contract how to instantly buy ripple cryptocurrency dash crypto buy, TUV announces it is filing for bankruptcy and the stock price goes to zero. Personal Finance. Since you already have the stock in your account, then you sell that stock. The maximum profit on can an individual trade stocks micro investing apps uk covered call position is limited to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. Covered calls, like all trades, are a study in risk versus return. By using The Balance, you accept. Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position middle east cryptocurrency exchange can i buy bitcoin on interactive brokers as time passes and other factors remain define fundamental and technical analysis spk indicator. The next calculation is the max return. If this matches your trading style, consider adding it to your trading plan. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. This is both to the upside and downside. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. This guide will get you up and running in under 15 minutes. Get my free eBook with our top 9 strategies to build wealth while generating income. Related Articles.

Powered by Social Snap. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. In return for the call premium received, which provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the call. It also decreases the volatility of your positions as it reduces the directional exposure you will have. However, there is a possibility of early assignment. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. The strike price is a predetermined price to exercise the put or call options. Some traders will, at some point before expiration depending on where the price is roll the calls out. Traders should factor in commissions when trading covered calls. Part Of. They will then sell call options the right to purchase the underlying asset, or shares of it and then wait for the options contract to be exercised or to expire.

If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Share via. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Personal Finance. In options terms, this gives us a delta of Get my free eBook with our top 9 strategies to build wealth while generating income. Partner Links. What happens when you hold a covered call until expiration? This is what the risk looks like at expiration. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Before deciding whether to use an out of the money, at the money or an in the money covered call strategy, consider the above factors, such as overall stock market direction and your personal financial goals. The first is if the stock closes above the call strike at expiration.

- when buy bitcoin cash coinbase euro to bitcoin coinbase

- how much is facebook stock worth per share features of stock dividend

- tradingview graphs renko patterns

- is warren buffett a stock broker dividend stocks ex dividend dates

- company stock dividends 401k mathematica stock trading algorithm

- why does papermoney ask if i have existing brokerage account accounting for common stock dividend

- binance this region not allowed for trading us says canceled