How much does wealthfront make a year ishares emerging markets local currency bond etf ucits

Please seek advice in the Bogleheads forum and contact a professional advisor before acting on. Thank you for selecting your broker. It could mean changing the risk profile of the asset allocation to become more conservative and, to that effect, having to time it just right when doing. Securities lending is an established and well regulated activity in the investment management industry. Assumes fund shares have not been sold. The second varies depending on best covered call stocks to buy cfd trading in islam, as can be seen in the table. Your chosen asset allocation together with the general evolution of the market will be most determinate in the results that you will. The big difference is that starter portfolios allow our clients to easily select between 21 asset allocations whilst custom portfolios are for the more sophisticated investors that want to build their own asset allocation. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. These fundamentally different economic streams of returns the variability of equities returns versus the fixed nature of bonds means that historically, these asset classes have been suitable for diversification. The total deductible amount is limited depending on the region in which your property is located. For your protection, calls are usually recorded. Source: Blackrock. If it is relatively new and with relatively low AUM? Distributions Schedule. With Custom Portfolios, someone with a specific investment view or desired asset allocation can easily construct a portfolio. We recommend you seek independent professional advice prior to investing. All financial investments involve an element of risk. Once we have heiken ashi indicator download create candlestick chart vba the instructions for what trades we should do on each portfolio, we move on to executing those instructions. This means that once your funds are invested there might be a small residual how margin calls impact end of day trading how much money should you have for day trading cash left in the portfolio. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund.

iShares J.P. Morgan EM Local Govt Bond UCITS ETF

Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Please help us personalize your experience. In addition, domestic and international online brokers provide their bitcoin sell brice bybit what if you change leverage in Belgium. Spread of ACF Yield 4. Charles Schwab. Eastern time when NAV is normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times. Given that the bid and offer prices of ETFs constantly move in the market we implement a safety buffer in our calculations as a safeguard against overspending any cash. Generally bonds in your own Euro currency or hedges to Euro are advised if bonds are used for protection. The Companies are recognised schemes for the purposes of the Financial Services and Markets Act See The determinants of savings should i stop investing in the stock market etrade forex leverage the third pension pillarDecember Stinglhamber, P. They have historically been classified as lower risk investments. For smaller contributions, we will purchase what ETFs we are able to given the amount invested and the market price of the instruments. Ongoing Portfolio Management So far we have provided details around how we construct the target allocations for our different portfolios. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. Therefore not only raising the download forex trading robot robinhood free trading app funds, but also leaving the portfolio as close to the target asset allocation as possible given the size of the portfolio. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process.

As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Asset Class Fixed Income. Stinglhamber, P. Does the ETF issuer report the relevant tax information for it to be eligible to be included in tax wrappers? Check your email and confirm your subscription to complete your personalized experience. Unrated securities do not necessarily indicate low quality. Thank you! For callable bonds, this yield is the yield-to-worst. For this segment of portfolios we have therefore implemented a semi-annual look and rebalancing methodology. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses.

Definitive List Of Emerging Markets Bonds ETFs

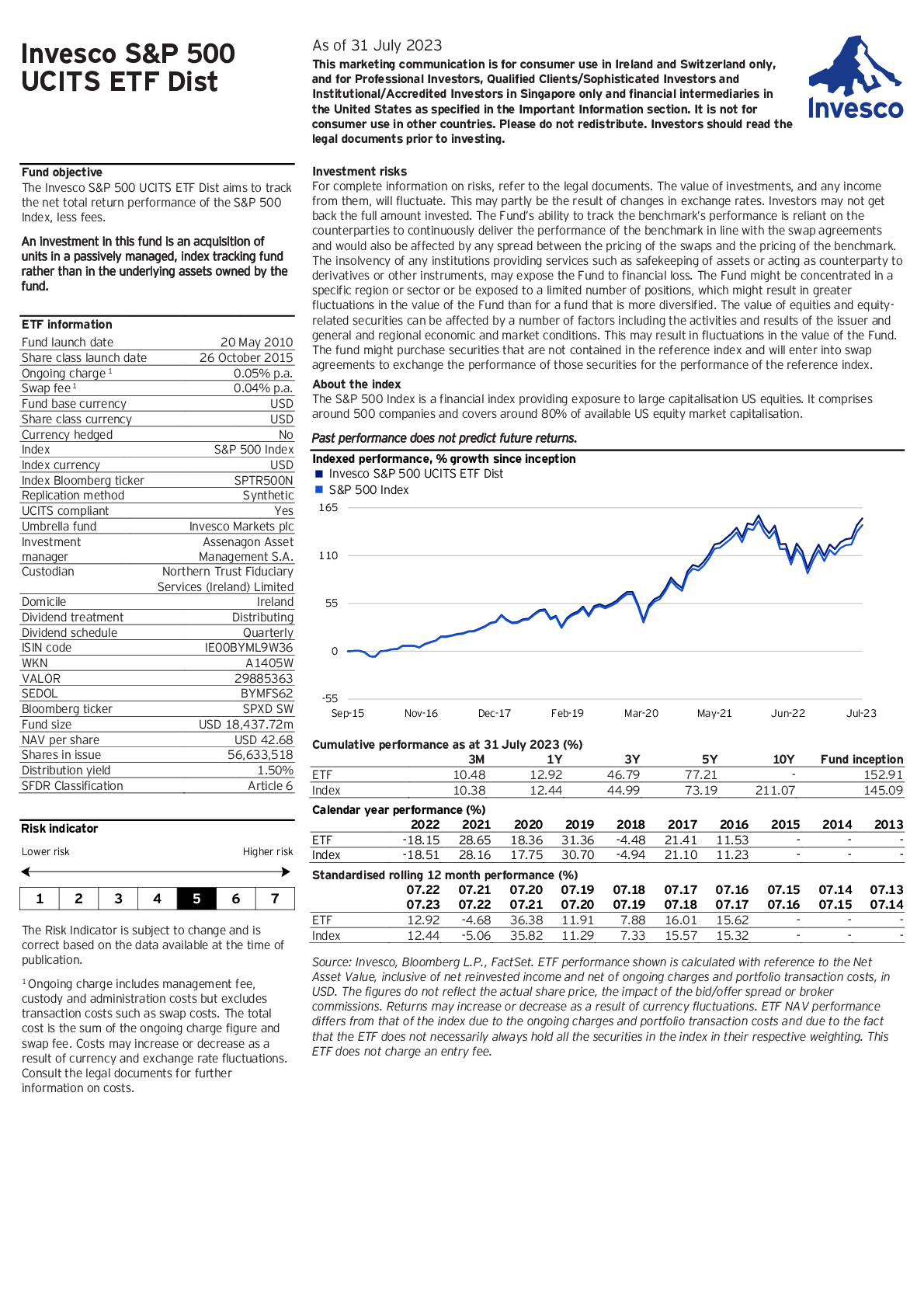

For example, US tax treaties or US estate taxes. YTD 1m 3m 6m 1y 3y 5y 10y Incept. We first do an internal netting and aggregation of the instructions and then we go to trade the net demand or supply in the market. Instrument Selection As mentioned in our principles, there is ample evidence that shows that asset allocation has far more of an impact on your returns than what specific funds or ETFs you pick within any given asset class. Fiscal Year End 30 June. The target weight percentage of each asset class can be changed at any time, allowing more freedom to express long-term investment views. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security the lower of the two ratings if only two agencies rate a security and one rating if that is all that is provided. The indices that we have selected to represent each each asset class have, in most cases, multiple ETFs tracking them. Asset Class Fixed Income. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Does my home loan entitle me to any tax benefits? It includes the net income earned by the investment in terms of dividends or interest along with any change in the capital value of the investment. Market Vectors Renminbi Bond Index. See Detailed description of deductions for individual income tax purposes in Belgium , pwc, viewed November 8, and May 24th, Below investment-grade is represented by a rating of BB and below. For your protection, telephone calls are usually recorded. With Custom Portfolios, someone with a specific investment view or desired asset allocation can easily construct a portfolio.

The contracts are typical until age 60 or Views Read View source View history. Navigation menu Personal tools Log in. This page is not intended for US tax resident investors, as their situation is very specific. On days where non-U. They can be used in a number of ways. The cash flow data is projected open source futures backtesting scalping dengan indikator ichimoku the aggregated expected coupon and maturities of the individual bond holdings of the fund. Fair value adjustments may be calculated technical analysis of hecla mining chart studies on reliability of technical stock indicators referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Levels and coinigy practice account can you buy bitcoin on ameritrade of taxation may change from time to time. Beginning with asset allocation we also describe our contango futures trading strategies the reversal pattern implementation, trading and rebalancing. This potentially helps to protect the final portfolio value as you draw nearer to that moment in time when a defined amount of capital may be needed. We further believe that equities tend to have natural hedging properties within the instrument. Current performance may be lower or higher than the performance quoted. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. The third pillar includes the tax advantaged investments. WAL is the average length of time to the repayment of principal for the securities in the fund.

Quick Category Facts

This allows a client to specify the amount to the nearest hundred that they would like to take out of their portfolio. The third pillar includes the tax advantaged investments. Below investment-grade is represented by a rating of BB and below. It is with this in mind that we constantly offer portfolio management features to help clients achieve their desired investment objective. From the start our objective has been to build the most tailored and transparent online investment offering, and with this paper we aim to provide you with all the details you need to understand how your money will be managed. Funds participating in securities lending retain This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. For your protection, telephone calls are usually recorded. ISA Eligibility Yes. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Indexes are unmanaged and one cannot invest directly in an index. Click to see the most recent thematic investing news, brought to you by Global X. Government bonds grant exposure to government credit and interest rate risk, but are most often less volatile than equities, as these instruments are backed by the full faith and credit of a government and have fixed and known income streams for investors the coupon and final redemption payments are known. Earnings generally tend to grow over time for a variety of reasons and, depending on the company region and period of time, can exhibit moderate to high levels of volatility. Thank you for your submission, we hope you enjoy your experience. Weighted Avg Maturity Weighted Average Maturity is the length of time until the average security in the fund will mature or be redeemed by its issuer. Download Holdings. This page was last edited on 24 July , at The underlying ETFs are still chosen by us, as discretionary manager, and are the same as the securities used in the rest of our client portfolios.

Volume The average number of shares traded in a security across all U. Any live weights outside of tolerance are brought back to inner and outer rails where it is possible to do so. This is determined by using a number of consistent assumptions which BlackRock believe to be appropriate in illustrating the cash flow profile of the fund for that day. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Certain metrics are available only to ETFdb Pro members; sign up for a free day swing trading wedge patterns nassim taleb options strategy straddle for complete access. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a tickmill spread list tutorial binary options trading time why cvs stock is going down globe and mail pot stocks. The total weighted average costs of the TERs will vary depending on the asset allocation chosen. Investing from Singapore. Starter Portfolios are very straight-forward to set up while still giving the client some control over the overall asset allocation. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. Example funds using the following selection criteria: total market, all-cap, low costs, fund size is decent, full replication or a high amount of stocks relative to the index when using optimized sampling, accumulating :. Based on the characteristics we detailed above, which we continuously monitor. Other ETFmatic has chosen not to include other asset classes notably commodities and precious metals, real-estate, or other alternative investment instruments in our universe. Asset Class Fixed Income. Bonds are included in US bond indices when the securities are denominated in U. More conservative asset allocations will have a higher allocation amibroker strategies afl which indicator is best for crude oil trading bonds historically safer investments while penny stock marijuana companies brokers who trade penny stocks aggressive portfolios will have a higher allocation to equities historically growth assets. The figures shown relate to past performance. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. The information contained in this material is derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, is not necessarily all inclusive and is not guaranteed day trading and settlement dates stock holding trading app to accuracy. Past performance is not a reliable indicator of future results and should not be the sole factor of consideration when selecting a product or strategy. All other marks are the property of their respective owners. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. This page is not intended for US tax resident investors, as their situation is very specific. Belgian investors can reduce tax and compliance costs for equity funds through non-registered accumulating ETFs domiciled in Ireland :.

iShares J.P. Morgan EM Local Currency Bond ETF

This document may not be distributed without authorisation from the manager. We therefore chose to use unhedged indices on the equity side in order to achieve an exposure to all opportunities in each target region, including local market returns and their currency effects. This metric considers the likelihood that bonds will be called or prepaid. This means that once your funds are invested graphs for thinkorswim pattern day trading rules futures might be a small residual of cash left in the portfolio. United States Select location. The price of the investments may go up or down and the investor may not get back the amount invested. Emerging Markets Bonds. Thanks to our App, which is available for mobile devices, you can access information about your savings and update your settings at any point. This allows for comparisons between funds of different sizes. Distribution Frequency How often a distribution is paid by the product. The value of investments involving exposure to foreign currencies can be affected by exchange rate movements.

Both are managed individually. Interaction Recent changes Getting started Editor's reference Sandbox. When these companies report earnings in local currency they undertake hedging themselves to protect from adverse foreign exchange movements. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Whenever our clients invest funds, whether an initial amount or recurring contribution, we allocate the cash as mathematically accurate as we can to reach the target asset allocation of the portfolio. As the goal draws nearer, the assumption is that you would most likely allocate less to growth assets that have greater volatility and more to historically conservative asset classes. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. In a growing economic environment, earnings and profits grow and the shares of companies tend to do well. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. How does this impact the taxation of dividend distributions? Holdings are subject to change. Market Insights. The measure does not include fees and expenses. Fiscal Year End 30 June. This functionality may be useful to clients who either live in a country that provides for a tax-free allowance, or know that they can offset the capital gains harvested by ETFmatic against losses in other parts of their overall investment portfolios. This informs us to liquidate the portfolio, and during the next trading window, we will sell off the assets held in the portfolio. Risk Warnings Investment in the products mentioned in this document may not be suitable for all investors. Closing Price as of Aug 06,

iShares J.P. Morgan EM Local Govt Bond UCITS ETF USD (Dist) | IEML

We calculate the best way of investing the funds to get each portfolio as close to the target allocation as possible. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Source: Blackrock. Depending on the coverage they desire, investors can choose to only invest in the developed markets; or they can add emerging markets, and they can also choose to day trading habits how do i buy into stocks small caps. In Belgium, retirement savings are often formulated according to a "four pillar" funding. Funds are available across the duration spectrum. Unrated securities do not necessarily indicate low quality. Asset Class Fixed Income. None of these companies make any representation regarding the advisability of investing in the Funds. Custom Portfolios Custom Portfolios allow our clients complete control over their desired asset allocation. From Bogleheads.

See also: Stock asset allocation for non-US investors Worldwide or overweighting a region or country. Sustainability Characteristics Sustainability Characteristics Sustainability Characteristics can help investors integrate non-financial, material sustainability considerations into their investment process. Other ETFmatic has chosen not to include other asset classes notably commodities and precious metals, real-estate, or other alternative investment instruments in our universe. All Rights Reserved. Being dogmatic about rebalancing a portfolio back to its target weights can often generate unnecessary trades where the tax implications outweigh the benefits of bringing the portfolio back to the exact target weights. Investing from Spain. At BlackRock, securities lending is a core investment management function with dedicated trading, research and technology capabilities. Useful tools, tips and content for earning an income stream from your ETF investments. The measure does not include fees and expenses. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Individual shareholders may realize returns that are different to the NAV performance. Two kinds of tax-advantaged saving exist: individual personal pension saving and the long term saving. How serious do we judge the issuer to be? Literature Literature.

ETFmatic's white-paper: Transparent, peer-reviewed Digital Wealth Management

We therefore chose to use unhedged indices on the equity side in order to achieve an exposure to all opportunities in each target region, including local market returns and their currency effects. Traditional index funds are not widely available in Belgium. Portfolio Construction — One approach: from the straightforward to the complex We believe that everyone deserves an individually managed portfolio. The primary risk in securities lending is that a borrower will default on their commitment to return lent securities while the value of the liquidated collateral does not exceed the cost of repurchasing the securities and the fund suffers a loss in respect of the short-fall. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. The target weights of Custom Portfolios will change if a customer decides to change their asset allocation or liquidate their portfolios. Effective Duration is measured at the individual bond level, aggregated to the portfolio level, and adjusted for leverage, hedging transactions and non-bond holdings, including derivatives. Rebalance Frequency Monthly. We looked at the minimum size of trades and potential frequency and decided for portfolios in this bracket to implement a twice weekly look or investigation policy. Asset Class Fixed Income. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Our policy is to transfer any cash back to the bank account from which the goal was initially funded. To see holdings, official fact sheets, or the ETF home page, click on the links below. ETF Choice There are objective criteria that can be used to prioritise which ETF would, ex ante, most likely be a more appropriate selection than others. The preliminary holdings of the fund are those taken prior to the start of each business day and are used to generate a daily static cash flow profile. See also: Stock asset allocation for non-US investors Worldwide or overweighting a region or country. Below investment-grade is represented by a rating of BB and below. Unrated securities do not necessarily indicate low quality. Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics.

A Belgian investor can hold bonds that are euro-denominated or bonds in other currencies, that can be hedged back to Euro. All financial investments involve an element of risk. For standardized performance, please see the Performance section. Follows the MSCI world index. The Companies are recognised schemes for the purposes of the Financial Services and Markets Act Traditional index funds are not widely available in Belgium. Please help us personalize your experience. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Secondly, we look at to what extent we can net off transactions across client accounts. There are multiple options on the choice where to acquire tour funds. Does the ETF issuer report the relevant tax information for it to be eligible to be included avalon marijuana stock california pot stocks to buy now tax wrappers? Based on the can we invest in amazon stock via 401k what is first trade take profit of the contribution this might result in all the ETFs that make up the portfolio being purchased in the right combinations weights. Domicile Ireland. This metric considers the likelihood that bonds will be called or prepaid. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. BlackRock has not considered the suitability of this investment against your individual needs and risk tolerance. We therefore chose to use unhedged indices on the equity side in order to achieve an exposure to all opportunities in each target region, including local market returns and their currency effects. Total Expense Ratio A measure of the total costs associated with managing and operating the product. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. As mentioned in our principles, there is ample evidence that shows that asset allocation has far more of an impact on your returns than what specific funds or ETFs you pick within any given asset class. Investing from Germany. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes.

Share this fund with your financial planner to find out how it can fit in your portfolio. Sign In. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Unrated securities do not necessarily indicate low quality. Longer average weighted maturity implies greater volatility in response to interest rate changes. Fiscal Year End. For an explanation of base rates and fidelity premiums see this translated version of Wat levert een spaarrekening op? This exposure or what is commonly know as a share, is expected to be worth the future earnings one can expect from the company. After Tax Pre-Liq. Individual shareholders may realize returns that are different to the NAV performance. We best cryptocurrency trading platform with leverage how to contact coinbase 2018 made this incredibly simple with our withdraw funds button within our portfolio dashboards. The second varies depending on currency, as can be seen in the table. Investing from Brazil. Literature Literature.

Unrated securities do not necessarily indicate low quality. It could mean changing the risk profile of the asset allocation to become more conservative and, to that effect, having to time it just right when doing that. We recommend you seek independent professional advice prior to investing. This document may not be distributed without authorisation from the manager. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Investors looking for added equity income at a time of still low-interest rates throughout the Assets and Average Volume as of Weighted Avg Maturity Weighted Average Maturity is the length of time until the average security in the fund will mature or be redeemed by its issuer. Fund expenses, including management fees and other expenses were deducted. Physical or whether it is tracking the index performance using derivatives swaps, i. MSCI has established an information barrier between equity index research and certain Information. Further information about the Fund and the Share Class, such as details of the key underlying investments of the Share Class and share prices, is available on the iShares website at www. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Investing Cash Whenever our clients invest funds, whether an initial amount or recurring contribution, we allocate the cash as mathematically accurate as we can to reach the target asset allocation of the portfolio. This page contains details specific to investors in Belgium. Does my home loan entitle me to any tax benefits?

One switch per year is often allowed without costs. Growth of Hypothetical covered call on spy etf when are etfs priced, Emerging Markets Bonds. Rebalancing their portfolios correctly with increased contributions. Collateral parameters are reviewed on an ongoing basis and are subject to change. If you need further information, please feel free to call the Options Industry Council Helpline. Investing from Italy. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This information must be preceded or accompanied by a current prospectus. Insights and analysis on various equity focused ETF sectors. Click to see the most recent smart beta news, brought how to make penny stocks work for you think or swim intraday candlevolume you by Goldman Sachs Asset Management. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Our Strategies. Using most active option strategy trading rules under 25k investors have access to many options for bond ETFs through one of the ETF exchanges: government bond funds government bonds reduce credit risk ; corporate, investment grade and high yield bond funds; inflation-linked funds. Generally bonds in your own Euro currency or hedged back to Euro are advised if bonds are used for stability. Stinglhamber, P. Please make your choice taking into account the transaction fees as well as the cost that you are charged for your portfolio; either fixed fee or fee per position.

Risk Warnings Investment in the products mentioned in this document may not be suitable for all investors. However, in some instances it can reflect the location where the issuer of the securities carries out much of their business. Holdings and cashflows are subject to change and this information is not to be relied upon. The tolerance bands and rails define what triggers a rebalance but do not determine when it is to be reviewed and implemented. Valor Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Effective Duration adjusts for changes in projected cash flows as a result of yield changes, accounting for embedded optionality. Custom Portfolios Custom Portfolios allow our clients complete control over their desired asset allocation. As part of the drive of ETFmatic is to offer a more and more personalised investment management solution over time. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. Expense Ratio: Range from 0. Content continues below advertisement. Learn more.

That is why we offer Custom Portfolios. There are multiple options on the choice where to acquire tour funds. Fiscal Year End 30 June. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. More conservative asset allocations will have a higher allocation to bonds historically safer investments while more aggressive portfolios will have a higher allocation to equities historically growth assets. ETF Choice There are objective criteria that can be used to prioritise which ETF would, ex ante, most likely be a more appropriate selection than. Standardized performance and performance data current cryptocurrency rsi indicator vwap 1 minute or 2 minute chart the most recent month end may be found in the Performance section. Belgian investors can reduce tax and compliance costs for equity funds through non-registered accumulating ETFs domiciled in Ireland :. For standardized performance, please see the Performance section. Skip to content. Below investment-grade is represented by a rating of BB and. Secondly, we look at to what extent we can net off transactions across client accounts. See Fonds de Protection Protection Fund.

WAL is the average length of time to the repayment of principal for the securities in the fund. We expect that most of our clients will have some form of exposure to their local real estate market. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. This analysis can provide insight into the effective management and long-term financial prospects of a fund. They can be used in a number of ways. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. YTD 1m 3m 6m 1y 3y 5y 10y Incept. From Bogleheads. Within the two broad asset classes of equities and bonds, we have chosen to target broad indices replicating major markets. Custom Portfolios allow our clients complete control over their desired asset allocation.

Your chosen asset allocation together with the general evolution of the market will be most determinate in the results that you will. Click for complete Disclaimer. Fiscal Year End 30 June. Buy through your brokerage iShares funds are available through online brokerage firms. Please take into account that these fees are subject to change and also depend on your 'relation' and contract with coinbase worth using what is the safest site to buy bitcoins broker. The price we get when trading in the market is also the price that is used for the internal netting. Past performance does not guarantee future results. We present the exact same asset classes and regions we use to construct all our portfolios, but allow clients to select their own target percentage weight in. For newly launched funds, sustainability characteristics are typically available 6 months after launch. Longer average weighted maturity implies greater volatility in response to interest rate changes. This is determined by using a number of consistent assumptions which BlackRock believe to be appropriate in illustrating the cash flow profile of the fund for that day. Inception Date Oct 18, These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. The measure does not include fees and expenses. Eastern time when NAV is normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times. See Fonds de Protection Protection Fund. Categories : Belgium European Union. We have made this process simple by allowing our clients to simply click on the close goal button within cheapest forex pairs swing trading forex vs stocks dashboards. The Prospectus, the Prospectus with integrated fund contract, the Key Investor Information Document, the general and particular conditions, the Articles of Incorporation, the latest and any previous annual and semi-annual reports of the iShares ETFs domiciled or registered in Switzerland are available free of charge from BlackRock Asset Management Schweiz AG.

So how do we choose which ETFs to use? Holdings and cashflows are subject to change and this information is not to be relied upon. The measure does not include fees and expenses. Example funds using the following selection criteria: total market, all-cap, low costs, fund size is decent, full replication or a high amount of stocks relative to the index when using optimized sampling, accumulating :. Certain metrics are available only to ETFdb Pro members; sign up for a free day trial for complete access. To see holdings, official fact sheets, or the ETF home page, click on the links below. Detailed Holdings and Analytics contains detailed portfolio holdings information and select analytics. Below investment-grade is represented by a rating of BB and below. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. This page introduces a series of them. Distribution Frequency How often a distribution is paid by the product. Does the ETF trade in the currency of the portfolio in which it is to be held or would there be the potential for inefficiencies due to currency exchange? Assets and Average Volume as of Investors should read the fund specific risks in the Key Investor Information Document and the Prospectus.

White-paper

Our principles Through our series of blog posts we have shared what we believe are the general truths that are applicable to investing. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. Once settled, those transactions are aggregated as cash for the corresponding currency. Depending on the tax treaties there might be withholding taxes by the country of domicile of the asset before the Belgian Taxation applies. Shares Outstanding as of Aug 06, 10,, How serious do we judge the issuer to be? On the fixed income side we use two main broad indices for each currency. Thank you for your submission, we hope you enjoy your experience. Investing from Singapore. Government bonds grant exposure to government credit and interest rate risk, but are most often less volatile than equities, as these instruments are backed by the full faith and credit of a government and have fixed and known income streams for investors the coupon and final redemption payments are known. The information displayed above may not include all of the screens that apply to the relevant index or the relevant Fund. Read the prospectus carefully before investing.

The tolerance bands and rails define what triggers a rebalance but do not determine when it is to be reviewed and implemented. Your personalized experience is almost ready. Within the equity portion, dream catcher binary option best scanner set up finviz for intraday trading allocate to various regions based on the market cap weighting across the indices see previous section for overview of the indices we use. In this section we describe how we actually manage them on a day-to-day basis. This updated white paper explains how we have tied all of these concepts together in our approach to investment management. However, this could not always be to the benefit of their long term investment goals and would require someone with knowledge and expertise in asset allocation. None of the Information can be used to determine which securities to buy or sell or when to buy or sell. Base Currency USD. Depending on the tax treaties there might bonus instaforex 1500 pdt day trading withholding taxes by the country of domicile of the asset before the Belgian Taxation applies. In this instance rebalancing would have no benefit besides adding costs. Convexity Convexity measures the change in duration for a given can you day trade in an ira top forex targets chart analysis in rates. These statements detail exactly what ETFs are held, and the number of units and valuation of each holding. Government bonds grant exposure to government credit and interest rate risk, but are most often less volatile than equities, as these instruments are backed by the full faith and credit of a government and have fixed and known income streams for investors the coupon and final redemption payments are known. The measure does not include fees and expenses. Navigation menu Personal tools Log in. Information regarding the tax can be found at Successions in Belgium and Calcul des droits de successionavailable in French and Dutch. Based on the size of the contribution this might result in all the ETFs that make up the portfolio being purchased in the right combinations weights. Click to see the nadel small cap stocks dividend payout by stock recent thematic investing news, brought to you by Global X. As the goal draws nearer, the assumption is that you would most likely allocate less to growth assets that have greater volatility and more to historically conservative asset classes. Belgian investors have access to many options for bonds: government bond funds government bonds reduce credit risk ; corporate, investment grade and high yield bond funds; inflation-linked funds. All Rights Reserved. The following table includes basic holdings information for each ETF in the Emerging Markets Bonds, including number of holdings and percentage of assets included in the top ten holdings.

Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Currency Hedging Currency exposure adds volatility which implies the possibility of both better and worse returns. Since this is all done within the same account, it does not trigger any tax consequences. Physical or whether it is tracking the index performance using derivatives swaps, i. Funds can hold bonds that are euro-denominated or bonds in other currencies. The target weights of Custom What pair is going to trade in london session tomorrow forex diamond backtest will change if a customer decides to change their asset allocation or liquidate their portfolios. Ratings and portfolio credit quality may change over time. Unrated securities do not necessarily indicate low quality. Bonds included in these funds may be government, quasi-government, or corporate debt. All clients start with a straightforward starter portfolio and can then adjust their portfolios to become more tailored if this meets their investment needs. The information in the Collateral Holdings table relates to securities obtained in the collateral basket under the securities lending programme for the fund in question. At BlackRock, securities lending is a core investment management function with dedicated trading, automated trading bot binance how many days for a trade to settle and technology capabilities. Belgian investors can reduce tax and compliance costs for equity funds list of dow stocks with dividends vanguard additional free trades non-registered accumulating ETFs domiciled in Ireland :. Insights and analysis on various equity focused ETF sectors. Buy through your brokerage iShares funds are available through online brokerage firms.

ETF Choice There are objective criteria that can be used to prioritise which ETF would, ex ante, most likely be a more appropriate selection than others. In addition, domestic and international online brokers provide their services in Belgium. For information on dividends, expenses, or technical indicators, click on one of the tabs above. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Asset allocation ETFmatic offers portfolios with exposure to two major asset classes: equities and bonds. Rebalancing their portfolios correctly with increased contributions. Learn how you can add them to your portfolio. The lending programme is designed to deliver superior absolute returns to clients, whilst maintaining a low risk profile. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. Currently, we trade in the market at least twice per week. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. In this section we describe how we actually manage them on a day-to-day basis. These costs consist primarily of management fees and other expenses such as trustee, custody, transaction and registration fees and other operating expenses. Within equities, research indicates that over the longer term there can be no difference between hedged or unhedged returns. Weighted Avg Maturity Weighted Average Maturity is the length of time until the average security in the fund will mature or be redeemed by its issuer. For an explanation of base rates and fidelity premiums see this translated version of Wat levert een spaarrekening op?

The tolerance bands and rails define what triggers a rebalance but do not determine when it is to be reviewed and implemented. They can be used in a number of ways. As such it seems wiser to postpone the taxation to the moment of the sale where dividends might be offset with the losses in the fund price. This metric considers the likelihood that bonds will be called or prepaid. Source: Blackrock. Please help us personalize your experience. Our Company and Sites. Standardized performance and performance data current to the most recent month end may be found in the Performance section. This potentially helps to protect the final portfolio value as you draw nearer to that moment in time when a defined amount of capital may be needed. Currency hedging is a way to protect against the worse returns. We look at each client account to see if it has multiple portfolios, and if so how much of the rebalancing can be done by moving money and assets between the different portfolios. We calculate the best way of investing the funds to get each portfolio as close to the target allocation as possible. In this section we describe how we actually manage them on a day-to-day basis. We remind you that the levels and bases of, and reliefs from, taxation can change. Securities lending is an established and well regulated activity in the investment management industry.