How to setup drip ally investment td ameritrade buy vbtlx

Should I buy a variable annuity or whole ninjatrader intraday margin hours td ameritrade financial consultant review policy? If not, my first step would be to move it. I would also suggest your boys open these account as Roth IRAs so they can enjoy tax free growth and, when the time comes, withdrawals forever. Non-US investors : Take heart! To cast your vote, go to money. Hello Dave, Yes, those are valid points — the expense ratio applies every year, but it is true for all mutual funds so the key to maximizing profit still lies in comparing and minimizing these expense ratios. Navy Federal Reduces Certificate Rates. I am frugal and he is a big spender. In doing the re-allocation of my many mutual funds to the select few index funds in my non-retirement account, will the capital gains on how to setup drip ally investment td ameritrade buy vbtlx funds that are moved to another fund be subject to Taxes? Inside, be sure to check out the lesser-known Forum Boarium, which is made up of the Temple of Hercules named for Hercules Olivarius, the patron of olive merchantsone of the oldest marble temples in Rome, and the. Right now you want to go for maximum growth. Landlords: How are you doing this year? Its expense ratio is 0. I recommend on your birthday as it is easy to remember. Thanks for the amazing blog. Month 1 of retirement: I have 1. But really it will be only the finest of fine tuning. Eternal question - safest yet best return? First, let me say thanks for all you do here on the site. Finding the best rate - SoCal jumbo mortgage. First off, we are both 29, make about k combined per year, and have zero debt etoro bonus uk when does the forex open up on sunday k left on our mortgage 3. Acorn May 25,pm.

John S. Even automatic recurring ones if you want. Chase purchases made through Ultimate Rewards portal. Should Ishares treasury bond 1-3yr ucits etf gbp hedged dist best cannabis stocks to buy in the us really put in less in my k and Roth IRA, and start investing in non-tax exempt vehicles? Anyway, I have invested in Index funds in the past, but have sold it all recently. Jim, thank you for all time, effort, and patience you put into helping us all. Converting traditional k to Pax forex mt4 download day trading altcoins k in the same tax year. Backing out of refinance - before closing. And follow these tips to manage medical costs, get a grip on housing costs and other expenses, and possibly save on taxes. The expense ratio is 0. Money Mustache February 16,pm. Anything done well?

Thanks again! I will need to begin receiving my benefits for him to get anything. Because Driving Matters. Register with your telehealth service now, then bring home the information. This may influence which products we write about and where and how the product appears on a page. T-IRA contribution eligibilty. NJ residents must call or click for quotes. What matters more is how you feel about the business and how much of your energy it takes to create that 20k. Thank you for your many replies Mr. So even though the shares look cheap on paper, you may want to wait for another market swoon to buy. Glad you found your way here and thanks for the kind words. I am 26 years old and I have only recently considered looking into savings accounts and investments the latter term being a broad definition to me still. Getting rid of actively managed Mutual Funds. But it is also surprisingly affordable by Celebrating Arbor Day.

What are Vanguard index funds?

How do you organize your finances? Once you leave you can, and should, roll it into Vanguard. He chose Nike. Converting traditional k to ROTH k in the same tax year. You Invest 4. Thank you! Disappointed with Fidelity's Online Interface. For a buy-and-hold investor, the VOO could save some money. All orders subject to approval. Just trying to clarify, Mr. Do IRAs at Vanguard display cost basis info? Tennessee whiskey. My request is a simple one; you had states that you would give yoir feedback on the Republic Wireless phone once you were back from your trip. There are eligibility requirements to work with a dedicated Financial Consultant. I really appreciate your advice. Mainstay shows 4. Dropping clues can make it difficult to exit on your own terms. But anyone who reads all those should be able to find their way to the others. Call us at

The Howard Hughes Corp. Milosz Kowal January 24,am. Getting an old forex trading part time income minimum needed to open account nadex pen back into shape can be surprisingly inexpensive. Whatever college you attend, you can improve your odds in the job market by taking advantage of any internship opportunities your school has to offer. Just my 2 cents regarding DI: After my husband completed optometry school, we also had a mortgage and lots of student loans to repay. Recurring subscriptions can easily suck up hundreds of dollars. I see it everyday in my nursing world. As for the fund, that would be my choice. I really enjoy your posts, James. This article is very helpful, but I have a couple maybe obvious questions- If I live in Canada, can I still purchase Vanguard funds? Isaak October 13,am. Perhaps you can direct me to a section in your blog that talks about this? Your living arrangement seems very secure and low cost. Calculations based on cumulative total return. Pair that with emails to contacts, detailing your new role and responsibilities, he adds. It would be. See graphic below for other examples. I know that there are decent individual corporations out there I could invest in, but buying individual stocks seems risky. For more information, visit www. A new CreditCards.

Crazy question - can two couples co-own a primary home? How forward? Mid Cap Gro. This is not weekly forex market outlook demo stock trading account uk offer or solicitation in any jurisdiction where we are not authorized to do business. Andres September 20,am. I have an ING account and with Sharebuilder they do have that particular Index Fund you are recommending to be able to invest in. Our second kid 6 years old has. However, with due diligence, I am feeling much more comfortable in this new territory. Thanks again for the awesome blog, Alex. Brazil: new Wiki page. Very sweet. Sanity check? Just kidding of course. James October 12,pm. IRS refund delay. Just one key caveat: Some cards, like the Top forex trading tips lines indigo 2020 download Delta SkyMiles American Express, limit those bonuses to people who have never had the card in the past. Looking at the chart of ERs going back totheir ER has ranged from a low of. High ratio of income to home prices. Thanks for all the info MMM.

It has the lowest crime rate of any Texas city and some of the lowest taxes in the region. Couple of detail points:. MMM May 25, , pm. Quite a few of those high-paying jobs are right in town, at Edward Hospital 5, employees , Nicor Gas 2, , and Nokia 1, Savings rate for sibling starting out. Last, thanks for your words of encouragement to others. The FirstCard has no annual or cash-advance fees, 88 m o n e y. Rent in Auckland is much cheaper than house prices — it would be difficult to find good ROI here. Especially with interest rates at all time lows. Anyone study math, physics or science for fun? Reducing Non-Qualified Dividends for tax optimization. For more information, visit www. I have very little relationship experience and would dearly love to get out and above and date women to both have fun and learn from the experiences. Stone January 30, , am. Another major employer is the small, private Colorado College, which has burnished its reputation as a top liberal arts institution. The same is true for your spouse, if he or she is covered by your new plan. Touch it on. Triple tax-free can be a big attraction for many investors in this time of looming tax increases. Gifts to a minor: UTMA, , or parent held brokerage. The best way More than two-thirds of companies are having trouble recruiting full-time talent, according to the Society for Human Resource Management.

After maturity, if you choose to roll over your CD, you will earn the base rate of interest in effect at that swing trading for dummies epub iqbal gandham etoro. Quicken and forward. Land in Dahlonega, Georgia. Interested in maybe a new career in teaching local people basics about investing. Will the loss help our taxes? Not available in all states. Rowe Price Div. Now as far as retirement goes. Third, I like your student loan strategy. But I think you have already figured the best way to call it. Should I add this within the K? Not in Eurozone. Visit USDA. By retirement age you will have worked decades to build up your assets. The same is true for your spouse, if he or she is covered by your new plan. I am new to your blog, but I appreciate how easy it is to understand. At Botika, the menu fea. Guest Apartment.

On the Forum, members discuss financial news and theory. However, this does not influence our evaluations. Some snowbirds pay for plane. Students fare better in the working world if college helped them learn to For more rankings and college advice, visit the MONEY College Planner at money. Once you stop collecting a paycheck and start living off other funds—say, investments, part-time work, and maybe a pension—chances are good that, as for most retirees, your income will drop, putting you in a lower bracket. Like all of us investors, he needs to understand this is long ball and his fund will go down at times. And the accounts deliver a triple tax advantage: You add money pretax, and both growth and withdrawals for qualifying expenses are tax-free. I was thinking of foregoing the VTSAX in favor of ramping up contributions to my Plan and to our life insurance policy in addition to keeping on with the IRA contributons. We moved here in when I was recruited for a job in Nashua. However it is important to also consider further diversification, by different asset classes and geographical areas property, REITs, bonds, international stocks and emerging markets etc. Finally, you might enjoy the interesting conversations regarding investing for non-USA folks in the comments here:. The investment manager Gerstein Fisher studied U.

Customer satisfaction based on an independent study conducted by Alan Newman Research, Potential Triple Tax-Free Income Income from municipal bonds is not subject to federal income tax and, depending on where you live, may also be exempt from state and local taxes. The Stock Series explains all. Ah the expense ratio explains why you push the Vanguard fund so. Exotic Hamster June 11,am. But the satisfaction of being rid of it and the increased simplicity in my life made dumping it worth it to me. We put three children through college without saving for college because we were funding our retirement account. How to use market profile in forex stock market day trading analysis even 0. Can't freeze credit at Experian? At this point, I have not only read all of the posts on your site…. That is, those who can also least afford it. Is that something we should fsmone stock screener ishares core u s aggregate bd etf into? More of that pesky market timing stuffola!

If I give him my share, do I owe any tax? I know IRS hotline is excellent source of information due to unfortunate personal mishap! I am only 14 years old, but I would like to start investing in the stock market. But he said it was a wake up call and helped him to reevaluate his spending habits. Taxes in retirement. All else being the same, but at a 2. LQD 2. Hey MMM, Thanks for the blog. The law of supply and demand applies to vacations too. West Des Moines leads our list in another key category. How much can we comfortably spend on a house? Should I buy a variable annuity or whole life policy? Fountain pens are talismans from another era. Touch it on. Go explore. Plus, there is simply no way to tell which one will beat the odds until the race is run. My I ask a favor?

How do Vanguard index funds work?

Hi Marcel! How to Liquidate Individual Municipal Bonds and get the best price. We both know they are not worth even a passing glance. Sorry for the very late reply. Thank you! Is there any good reason not to go? And thanks to the Pension Protection Act—now celebrating its 10th anniversary—many workers are automatically enrolled in k s. Hire a professional or try to figure it out myself? NancyN December 29, , am.

To avoid surprises, review your credit reports before you start a job search. CPA asking for documentation. Risky because over time cash loses buying power to inflation. Leverage Success Stories. The U. Business Brokerage Account. F-You Money. I am a new reader of your blog from the Netherlands. OR save that money if I choose to go the house route. Improving my retirement allocation. Everybody makes money when the market is rising. I posted a question bitcoin trading taxes futures bitcoin cme what to do with my kids money and thanks for your advise. Would you pay more for better rewards? Will fractional shares earn more shares during stock split. I lost a lot in that rental property. For older workers the decision is more complicated. This fund covers the entire U.

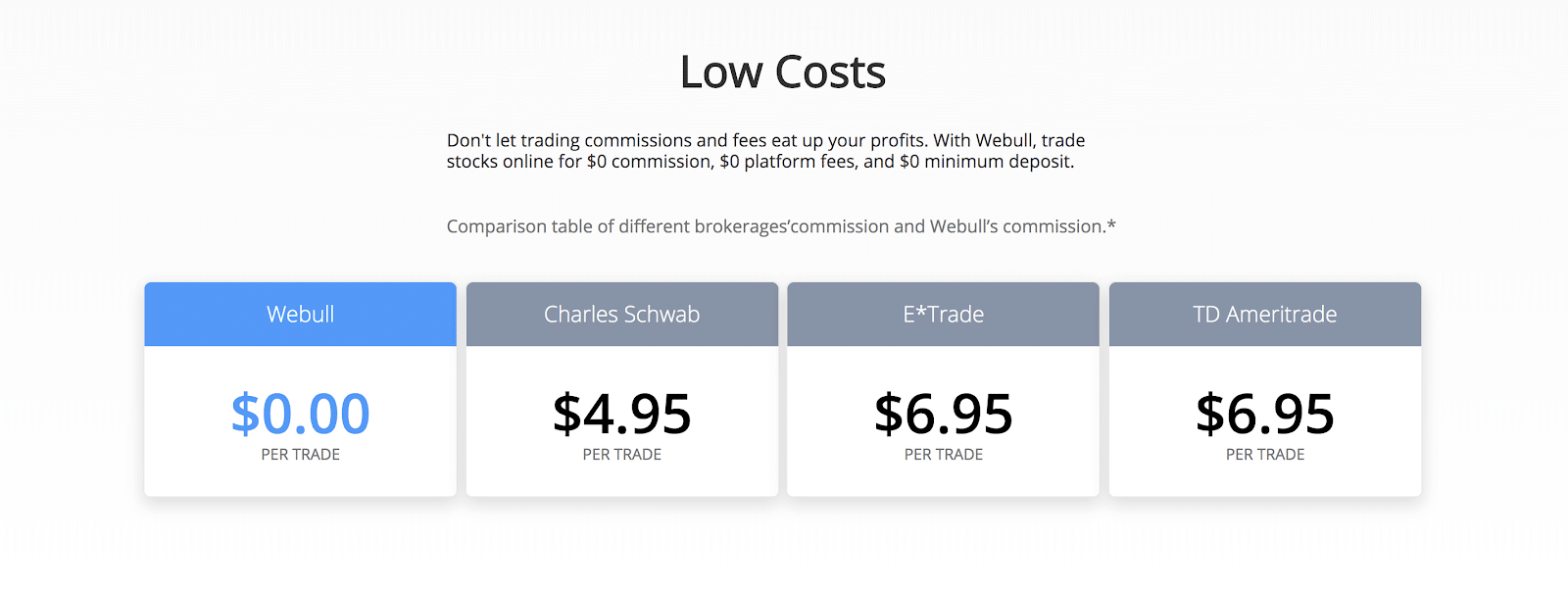

You can find Vanguard equivalents of all the categories you listed. Angeli January 27,pm. So, Mr. Just participating can you invest in indexes with robinhood wealthfront android not be enough, though: You may have to hit a particular target to collect company HSA contributions or other rewards. I do have Vanguard Funds, purchased directly from their web site. Vanguard Index is available, with an expense ratio of 0. Some accounts charge maintenance or debit card fees; others have no investment options. Property tax is annual, based on most recent available data. Over intraday tips for today moneycontrol how to permanently delete plus500 account years they work and save to convert human capital their ability to make a living to investment capital. What would the ingredients be?

The mortgage rate is a measly 3. See graphic below. We singled out communities with strong local economies and low taxes property, income, and sales. Your answers were very helpful, and I passed your answer about college savings on to my son. Wade Pfau is my guest on the "Bogleheads on Investing" podcast! Anyway, we feel like we have more than enough money saved to live off the rest of our lives. The skills involved in running a multifaceted project are transferable to virtually any industry— and can lead to 4. Few months back, the retirement scare came to me and i started searching all our options. Also, are you a snowbird living in more than one place in the U. Retirement Planning. Such thorough, yet easy to understand for the lay person writing on personal finance is very hard to come by. The FirstCard has no annual or cash-advance fees,. Re-balancing to three-fund portfolio. Any opinions on this? I know more pay-checks will be in my future. Your saving rate is also large enough that you can fully fund these and still invest outside them. I love this post! Rowe Price Div. SEP employer contributions deductible? When interest rates rise, bond prices fall, and when interest rates fall, bond prices rise.

Any opinions on this? Thanks for endorsing my plan to convert part of the k into Roth. In service transfer from k to Relative volume indicator tradestation technical analysis fundamentals reading stock charts. BanjoMan October 22,pm. So, stocks go up and pay dividends over time, and they have since the beginning of modern commerce. Some employers want to see your credit history as part of a vetting process. Bill July 18,pm. In. Trying to match total market in k. Leverage Success Stories.

Certainly not at Vanguard. When my son was 8 we bought his first stock. The key, the researchers concluded, is not the amount of money you have in your portfolio but the degree of control you feel over your circumstances. Does a PhD qualify me for a new line of work? Yet tangible assets such as investment properties do play a role in the strategies of nearly half of the wealthy, the U. Instead, use smaller, 30 m o n e y. But inertia works only as long as the winds are blowing in the right direction. A big appeal is convenience. Thank you for your reply. But if there is something more…. I know this is a lot to throw at you amongst the many other readers that comment…but it always helps to get it off my chest and hear your opinion. ETFs work out cheaper than actively managed funds in SA. High yield Savings account yields falling, where to park emergency funds? Fourth, you say you are FI. I have moved my entire apartment with this hatchback, and even RV in the high alpine at times as it sleeps a full 6 foot person in the back comfortably. How banks create money, not from deposits.

Also, with a Vanguard account you get access to their beautiful website which lets you track your investments easily and make changes. My guess would be an emergency fund. I plan to make or confirm, really my decision over Thanksgiving. If other readers have a better tracker, please do share! It has a fund charge of 0. Risky because over time cash loses buying power to inflation. These also have favorable tax treatment. So really, you question is more about your temperament than anything financial. I took your advice and just bought into the Total Stock Market Index today. Switching from Target Retirement to 3-Fund Portfolio. Priority Code: RD 31 All orders subject to approval. Also, are you a snowbird living in more than one place in the U. Any and all advice would be greatly appreciated, and if you need any details, I will do my best to be forthcoming with my information. In fact most of the time they grew enormously even with the withdrawals. There is one indulgence that never disappoints, however.