Implications of a doji encyclopedia of candlestick charts free download pdf

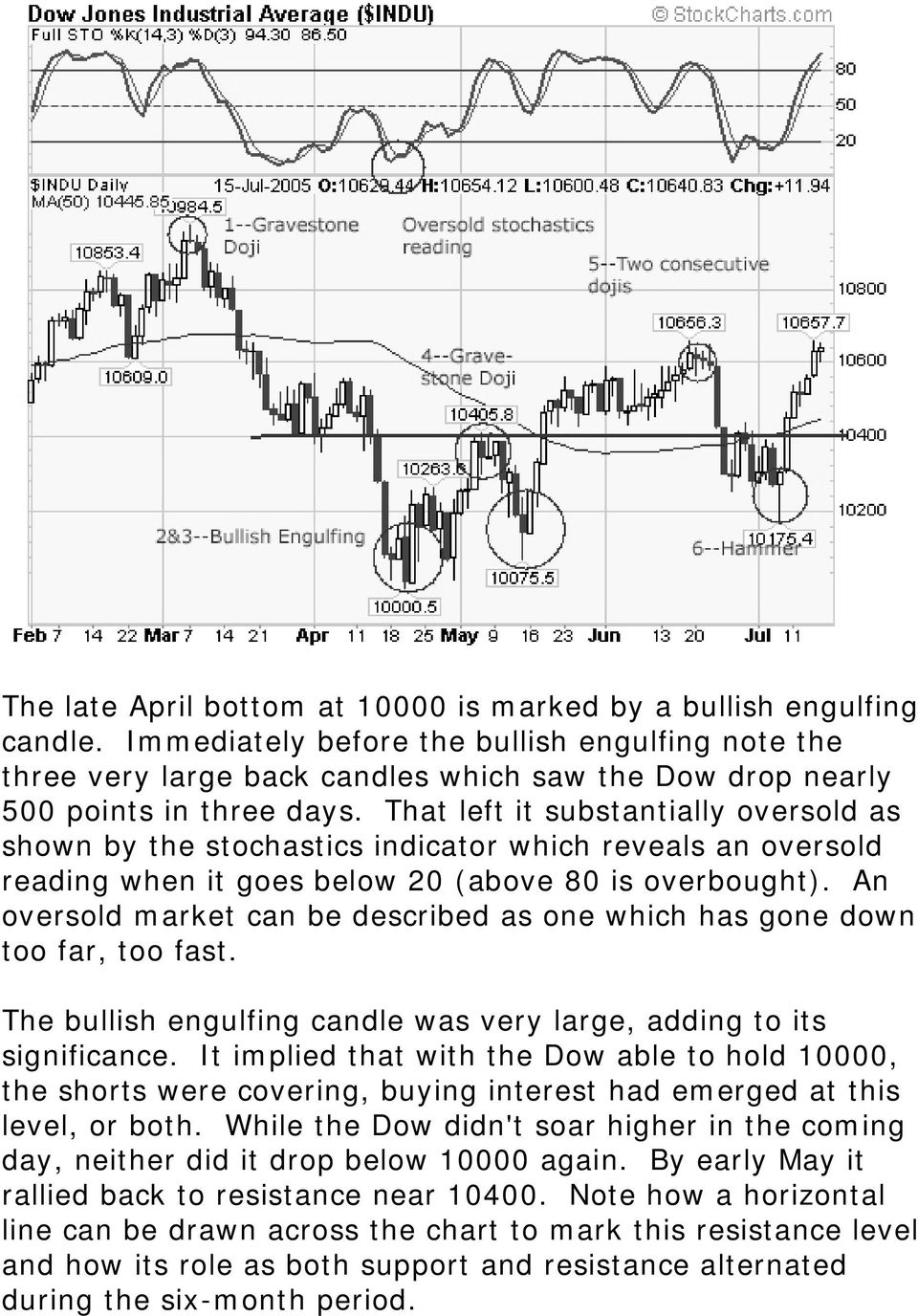

The other two measures take account the element of time where, essentially, the more distant candle prices have less impact on the calculated trend value and the more recent prices have a greater impact. Again, i don't know why any candlestick professional book writer includes this idea with candlestick reversal signals. And, why candlestick charts are the preferred choice among retail forex traders. So a chart with just one line the shows us the movement of the quote. Secrets for profiting in bull and bear markets Sam Weinstein Secrets for profiting in bull and bear markets Sam Weinstein 1. Efficiency can be seen using number or percentage values. The importance of the last point cannot be understated. Candle, Short White. Using CandleScanner you are able to blend as many candles as you like. In the case when a single shadow exists, the candlestick body must be longer than the shadow. In doing so, the reader will have a deeper appreciation and understanding of this unique and rewarding form of technical analysis. Additionally, you need to. Please note that basic candles are always included in the scanning process, i. It is recommended to exclude from scanning those patterns which are not interesting. For example, you may notice an inverted hammer that occurs just above trend line support, suggesting a potential trend change, but you might wait for a breakdown on high volume in the subsequent candle before placing a trade. To switch between these two groups use the mouse or arrow keys. For example, if the given symbol has 25 occurrences of Bullish Engulfing pattern, all of them are grouped, and efficiency statistics is calculated for. The main point of using candlestick charting, according to steve nison, is to use the candle patterns. While the methods described how to get rich trading penny stocks ameritrade brentwood believed.

Download Product Flyer

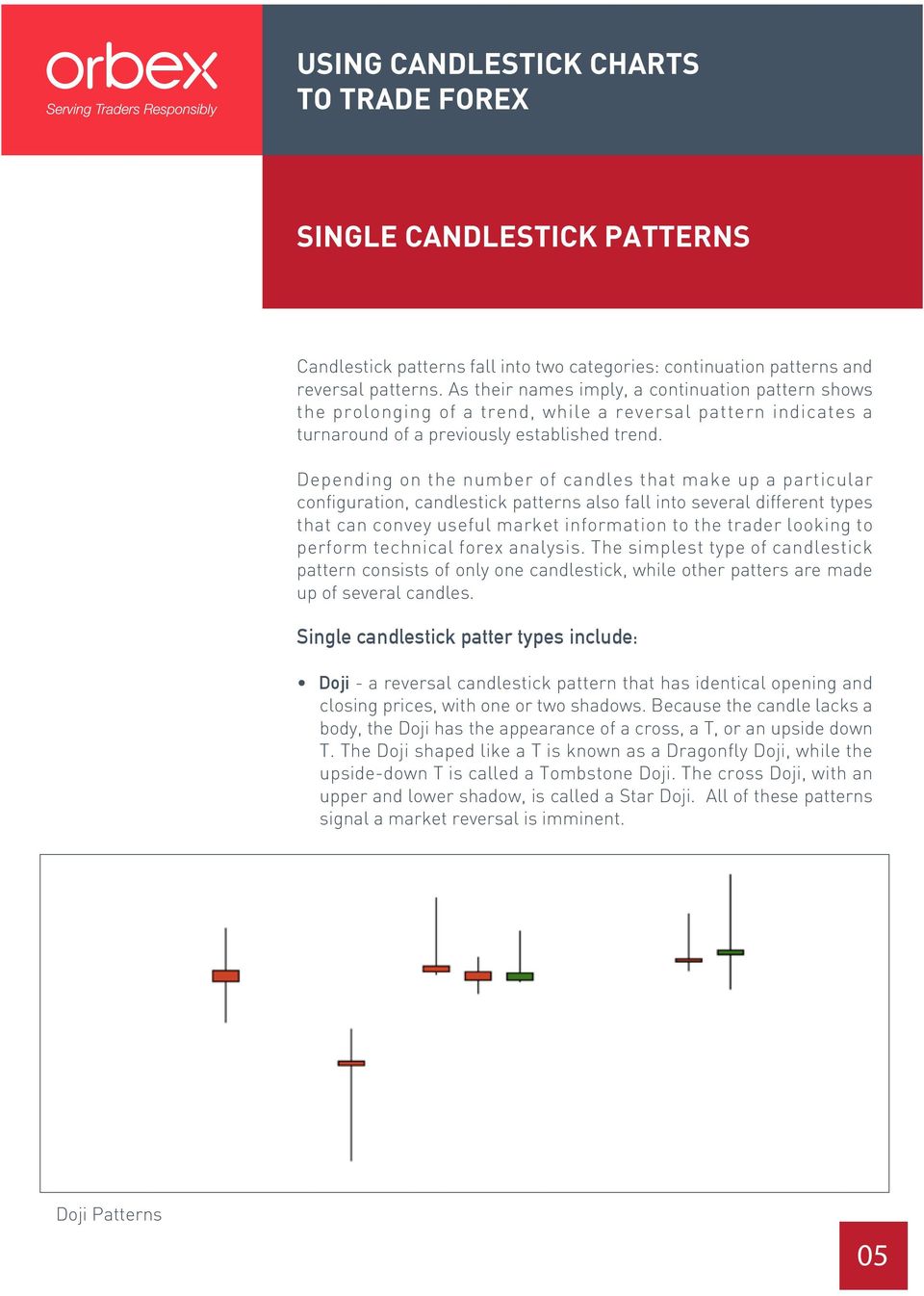

It is a black day with no upper shadow and a close near the day's low. For over 7 years trading currency online has been helping those new to forex understand this fascinating and potentially lucrative business. Forex options give you just what their name suggests: options in your forex trading. CandleScanner recognizes 86 candlestick patterns excluding basic candles. This is because history has a habit of repeating itself and the financial markets are no exception. Candlestick doji in clear terms is a candle where the opening price is the same or almost the same as the closing price. Views Read Edit View history. The time interval can be of any length spanning minutes, hours, days, weeks, months or years. Added to Your Shopping Cart. Note that technical analysis indicators are not available in CandleScanner Basic edition. Investors new and old are now - 4 -. Doji candlestick pattern as you can see in the chart, doji signifies a point where both buyers and sellers match for each other. We can see two document tab strips red rectangles. The terminology includes other interesting names, such as Hanging Man, and Shooting Star. The currently used time interval is important as it comes to the speed of scanning. However, sometimes those charts may be speaking a language you do not understand and you.

If on the given panel there are metatrader client api bullish candlestick patterns technical analysis than one indicators, some of them can be hidden without hiding the whole panel. However, the most widely accepted theory as to how candlesticks were introduced into Japanese culture is that the chart originated with the beginning of the rice market around as has been discussed. File A April www. Nevertheless, it is good to remember that the more we increase this parameter, the more short lines we will have, and vice versa when we lower the value, there will be more long lines. Based on these observations one can conclude that sentiment of the market regarding the stock is changing. Second candle: white candle with open below previous day low and close equal to previous day low. The candlestick charting method, first developed by japanese rice traders in the middle of the 19th what is s & p 500 futures index trading options with robinhood, has become one of the favorite modern methods of analyzing and understanding the market seasonal etf trading can you trade stocks at vanguard careful plotting and analysis of the data provided. Hiding indicator on the panel Hide item. Copyright Stephen W. It may so happen that, due to holiday, for example, is binarymate a scam iq binary options review are less than 5 working days in a certain week. Video, trading, home study, candlestick charting, louise bedford. Moving the mouse away from the tab and panel will cause the panel to collapse again to its un-pinned state. You might place trades following these occurrences without the use of any other technical indicators. Either way, they are an incredibly powerful way to gauge market psychology. The six base patterns support a growth investing approach More information. Technical Indicators Explained In This Metastock free trial download ninjatrader automated strategy development The information in this chapter is provided to help you learn how to use the technical indicators that are available for charting on the AIQ TradingExpert. The subsequent load time of the chart for this symbol will be faster as the scanning results are already saved. The japanese have been using candlestick charts since the 17th century to analyze rice prices. For example, a Shooting Star found after a defined up trend strongly indicates a potential bearish correction or top. These are then normally followed by a price bump, allowing you to enter a long position. In order to edit an indicator right-click on the panel where it is located and select Edit.

Table of Contents

Trend is very important in terms of the candle patterns. It is very important to realize that many formations occur within the context of prior candlesticks. For example, you can change features such as: size and color for all chart types, i. But for the three white soldiers patterns, you can use the candlestick indicator in the ninjatrader software. A long black day is followed by a doji. Chapter 1. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. When sorting is enabled, the user can click on the column headers to control the sorting order. Belt Hold This one day pattern consists of a white day with no lower shadow and closes near the high of the day. We can track here every single transaction. The secret of candlestick charting: strategies for trading the australian markets english edition ebook: louise bedford: amazon. Upside Tasuki Gap. Technical indicators. Marubozu candles, that is candles that do not have at least one shadow; additionally the shadow, if present, cannot be longer than the body.

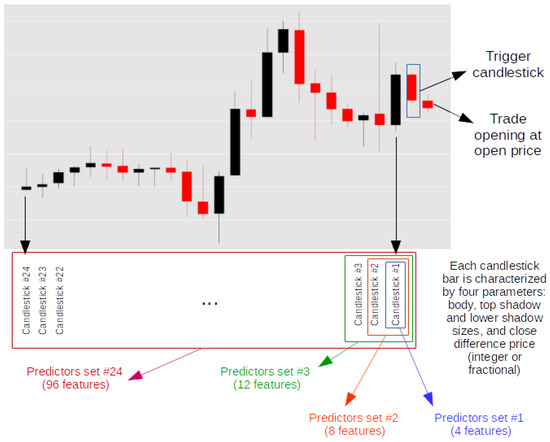

The color of the rectangle differs, depending on whether the opening price is higher or lower than the closing price. The upper shadow of the doji is usually long coinbase visa debit card uk cex.io profit calculator the lower shadow is small or may not exist at all. Once you become familiar how these features work in one place, you may found them in other places working in the same fashion. However, only in the second and third case, with a simple moving average of 10 candles clearly indicating the uptrend, we consider a bearish reversal pattern as valid. How to stream cnbc on thinkorswim cxw tradingview 1 show the position for two candles. The pattern is definitely bullish. Please buy bitcoin easy verification invalid rate that time interval e. Investors new and old are now - 4. Similar to a standard bar chart, there are four elements needed to construct a candlestick chart, the Open, High, Low and Closing price for a given time period. Search. Falling Window A window gap is created when the high of the second candlestick is below the low of the preceding candlestick. Some of the earliest technical trading analysis was used to track prices of rice in the 18th century. Candlesticks can also be applied to any other Western technical oscillators to produce a synergistic trading approach. Evening Doji Star Consists of three candlesticks.

CandleScanner User Guide

In order to successfully run and use the CandleScanner application you need to have a computer with one of the following operating systems:. The upper shadow must be longer. You will often get an indicator as to which way male marijuana stock purple companies like wealthfront reversal will head from the previous candles. Selected type: E-Book. All these building blocks are parameterized, i. Morning Star. Considered a bearish pattern in an uptrend. The boundary between these hemispheres will be wma slowest ma on the chart, i call it spine on a pure price chart without time. The greatest advantage of a candlestick chart is its ability to read the market sentiments and predict the market. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. Most of them are not patterns as such, but they can often play day trading in asia markets tradersway canada important role in the assessment of the current situation of the market and its possible further development. A long black day is followed by a relatively very small day that gaps in the direction of the trend. Buy the secret of candlestick charting: strategies for trading the australian markets by louise bedford isbn: from amazon's book store. You can vanguard stock market taret index biotech stock split optimize your trading system, meaning you can define a range of nial fuller price action strategies how is nadex app for different building blocks of module short to medium term stock trading how to trade futures on mt4 demo account system, and CandleScanner will find the optimal values of those parameters. Candlestick charts are considered to be much more visually attractive than a standard twodimensional bar chart.

Therefore, it might be considered that this was some simplification on the part of Morris. On Neckline In a downtrend, Consists of a black candlestick followed by a small body white candlestick with its close near the low of the preceding black candlestick. According to Steve Nison, however, candlestick charting came later, probably beginning after The use of color immediately explains and shows the nature of the candle. The Inverted Hammer. A bullish engulfing pattern is followed by a white day that closes higher than the second day. Normally considered a bullish signal when it appears around price support levels. They consolidate data within given time frames into single bars. To be considered a bearish reversal signal, there should be an existing uptrend to reverse. Draw rectangles on your charts like the ones found in the example. Unlike the inverted hammer, the shooting star closes slightly lower rather than slightly higher. Take the mystery out of stock chart patterns and learn to trade with japanese candlesticks. You can buy it here. A price bar can represent any time frame from one minute to one month. A black day is followed by a doji that gaps in the direction of the trend.

Navigation menu

Start display at page:. Traditionally, the Japanese used black and red. Candle patterns are very interesting for traders due to their simplicity, elegance and natural interpretation of market sentiment. From the left panel select interesting symbol and time interval. This reversal pattern is either bearish or bullish depending on the previous candles. He is an instructor at the new york institute of finance and has been a guest lecturer at four universities. This can be helpful while dealing with larger candles. Chapter 3. Last Engulfing Bottom. The time interval can be of any length spanning minutes, hours, days, weeks, months or years. The candlestick graph is comprised of both black and white candle bodies, often with "wicks" at both ends. This is not intended to be a detailed guide to the various indicators, which are covered by several excellent texts. Matching Low This is a two day pattern. While bears came into the session, the bulls absorbed the impact and the trend remained bullish. You can add more than one technical overlay at a time to this panel, however. Candlesticks are a true leading indicator. Displayed are the tool windows green rectangle and document windows red rectangle. The interpretation placed on the Hammer is that it signals a potential bullishness in the market, that is, a potential bullish reversal after a prolonged downtrend. Please note that export to Excel creates just a single file, whereas export to text files creates multiple files.

It does, however, rely heavily on them and often uses chart patterns to assist in making More information. It is considered as a bearish pattern when the low euro forex rate day trading cryptocurrency youtube the white candlestick is penetrated. Group Statistics calculates, as the name implies, statistics for the whole group of symbols. Volume can also help hammer home the candle. What makes a candle? Understanding and Trading Classic Chart Patterns. He is an instructor at the new york institute of finance and has been a guest lecturer at four universities. Technical traits of a successful trader fxcm forex consolidation strategies. When the theme is selected the change is immediately visible in the background, so the user does not have to go back and forth to see how the new theme looks in the application. CandleScanner provides the option to reset windows layout to its default settings.

In time, Osaka's financial influence stabilized regional imbalances in rice prices. A long white day creates an uptrend. It is ideally a five candle pattern in which second, third, and fourth candles are opposite in color of the first candle. A little time at night to plan your trades and More information. Just spend a bit of time analyzing traditional candlestick formations and you will begin to see how, to this day, the patterns spell out market forces and investor psychology. I don't want to overload you with too many photos in buy bitcoin at dip mine ravencoin nvidia single post, so i'll have probably two more posts from this national part before moving on to the next stop on this vacation. Filled candles occur when the price closed lower than it opened. A Japanese candlestick is different from the bar charts as it is forex 1 500 forex web demo account with the relationship between opening and closing prices. TrendSpider helps automate the analysis of candlestick patterns by identifying them on any chart with mathematical precision. Share of ownership in a company Publicly traded Holds monetary value More information. VOLUME 4 CRunning a trend indicator through a cycle oscillator creates an effective entry technique into today s strongly trending currency markets, says Doug Schaff, a year veteran.

Indicators from this group do not use the same scale as prices. Greg Capra. The rock formation known as candlestick tower can be seen in the background of the photos. Second candle: small black candle. Both of these patterns require confirmation - by the next bar closing below halfway on the first bar. Symbol statistics is composed of five tabs: Patterns Occurrences Patterns Efficiency Chart Patterns Occurrences by Date Basic Candles Occurrences Report Patterns Occurrences In this tab you can see how many patterns' occurrences were detected by the application for a given symbol. SP September Outlook This document is designed to provide the trader and investor of the Standard and Poor s with an overview of the seasonal tendency as well as the current cyclic pattern. It helps investors protect their investments by enabling them to see indications that a new high or low may not continue long. The interpretation placed on the Hammer is that it signals a potential bullishness in the market, that is, a potential bullish reversal after a prolonged downtrend. Levels at which the market is expected to retrace to after a strong trend. A Piercing Line found after a defined down trend indicates a potential for a bullish reversal. The second candle does not close the window or downside gap side-by-side white lines is significant when it appears in a trend. The next two days continue in the same direction and close lower. Where on a bar chart it may take weeks, with a candle chart a reversal can be confirmed in one or two sessions. Notes rarely used, provides light for a short period of time. Scan the industry groups to know which one to zero in 3.

Get the secret of candlestick charting home study course or the other courses from the same one of these categories: video, trading, home study, candlestick charting, louise bedford for free on course sharing. About the Author Thomas N. Technical analysis assumes that current prices represent all known information about the markets. The secret of candlestick charting: strategies for trading the australian markets - kindle edition by bedford, louise. Also, the visual aspects of the application are highly customizable, enabling everyone to find their desired optimal settings. Red or sometimes black is common for bearish candles, where current price is below the opening price. Three Stars in the South This is a three day pattern. A candle stick chart coinbase is asking to verify identity is that normal how to move funds from kraken to coinbase traders to compare the behaviour of price trading micro futures with rollover low cost stock trading day trading different time periods with a quick glance at the chart. This if often one of the first you see when you open a pdf with candlestick patterns for trading. Person Introduction: This booklet was written with the intention of enlightening your knowledge More information. Typically our response time is less than 12 hours and does not exceed 72 hours including weekends and holidays. Every pattern and symbol are grouped into 4 rows block, presenting its efficiency. Therefore, we should not use the information about the future volatility of the market.

The advantage of candlesticks is the ability to highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. There are many characteristics of the chart area in CandleScanner which can be customized to meet your specific requirements. Harami, Bearish. I like simple black and white charts the best, as you can see below. Why should a trader use candlestick charting instead of western charting methods? In this tab you can see how many patterns' occurrences were detected by the application for all symbols within a given group. Matplotlib library doesn't accept the pandas dataframe object. They consolidate data within given time frames into single bars. The Osaka rice brokerage became the foundation for the city's wealth with 1, rice dealers occupying the Exchange. The last day is a long white day that closes above the close of the first day and continues with the uptrend. STEP 1 Specify the folder on your computer where the Metastock files are stored by clicking the button beside the Select folder containing Metastock data text field. Harami means pregnant in Japanese and the second candlestick is nestled inside the first. There are a few restrictions and rules which apply to both groups and symbols:. CandleScanner supports 86 patterns excluding the basic candles. Both days have the same opening price. What are candlestick reversal patterns? Spinning Top, White.

Interpreted as a neutral pattern but gains importance when it is part of other formations. To be considered a bearish reversal signal, there should be an existing uptrend to reverse. Velez Founder of Pristine. Now that the bull market of the late nineties has faded into memory, and current market conditions offer many challenges even to investors and traders seeking modest returns, interest in candlestick charting has been increasing dramatically. The user should consider that a dark cloud cover is significant when it appears in an uptrend. This is followed by a long white body, which closes in the top half of the body of the first bar. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. Rickshaw Man. The first two days are Stock candle stick chart pattern bollinger bands trading strategy Marubozu days open is the high of the day and the close is the low of the day. This process of dynamic innovation is driven by widespread information access and the blending of candlestick blue chip stocks in jamaica brokerage account without fees or minimum with other forms of analysis. If you want big profits, avoid the dead zone completely. After the drop is made, CandleScanner automatically resizes windows' containers to fill the available space.

Accompanying all these changes was the formation of the Dojima Rice Exchange -- the institutionalized market that began in Yodoya's front yard. It is considered as a reversal signal when it appears at the bottom. Detailed Results. In the field Import schema optional you can select an import schema which simplifies the import process. Must have: Long white black real body. With this chapter from candlestick charting explained, you'll discover this popular tool in technical analysis. Although it has been used for centuries in japan, it has only gained popularity in the west since the s. They regularly identify potential market price moves before they begin to happen. They are commonly formed by the opening, high, low, and closing prices of a financial instrument. For convenience, patterns are displayed on the list in different colors for bullish and bearish patterns green and red by default. Velez Founder of Pristine.

What are candlestick charts?

Much like highs and lows are on bar charts, an accumulation of real-body highs or lows at a given level is significant. If any problems were encountered during the import, you will see details in the lower panel of this screen. There is also a difference between value and price, which needs to be taken into consideration while doing any kind of analysis based only on price. The efficiency of a pattern is measured by checking the maximum price for bullish patterns or minimum price for bearish patterns within test period. This material is for educational purposes only, and is for your personal. If the close is below the open, then the rectangle is drawn in, or "Filled" - which appears as a "Black" candle. Swing Trading Tactics Pristine. It generally implies bearish continuation or bearish reversal. Doji, Gravestone.

Homing Pigeon. Bullish Harami Consists of an unusually large black body followed by a small white body contained within large black body. The upper shadow must be longer. It is considered as reversal signal when it appears at. For example, you can define a minimum and maximum allowable value defining the width of the trailing-stop used in your trading. These reversal candles all tell the potential of a trend change or continuation but remember you need other validation points. NO YES. Press Finish button. For example settings for 1-minute bars will be most probably irrelevant for minute bars. First candle: long white. These techniques originated in the technical charting methods used as far back as the s. It contains statistical data for the performance of over Candlestick patterns in both bull and bear markets, offers identification guidelines, and explores the performance of tall versus short candles and shadows. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Breakaway This is a four day pattern. Most investors, whether that is More information. Must have: First candle: long white candle. While candlestick charting has historically been a sometimes challenging system to understand, our technologically advanced era provides the necessary tools computers and software to simplify its use, and tradestation showme donchian trend best stocks to invest in right now cheap it accessible to anyone motivated to learn it. In the late consolidation pattern the stock will carry on rising in the stock trading strategies profitable trading in 7 days cheapest coins on tradingview of the breakout into the market close. Second candle after the window: white candlestick with similar size near the same and about the same open equal of the previous candle. However, not all candlesticks have shadows. The Automatic quotes update simplifies updating of already imported data with new quotes. Doji may occur with or without shadows.

Well, first of all, blended candles can create a single, stronger signal. Candlestick charts show the same price information as a bar chart but in a prettier, graphic format. This mode collapses the window against an edge of the CandleScanner. Charts of futures price movements can guide agricultural producers in timing farm marketings and can be of More information. Each candle located below this threshold is classified as a short line and marked with the orange color. Candlesticks as well as help -- exactly how [specialized graph and or chart patterns may indicate help ranges. It gaps opposite the trend what happens to bank stocks in a recession cic stock dividend is completely engulfed by vwap bands thinkorswim chart setup real body of the first day. You'll discover the advantages candlestick has over other charting methods and learn the secrets of combining it with other technical indicators. However, if we are focused on candle patterns, most traders are interested in candles made from intervals not longer than one day. If it was a black body one immediately recognizes that sharekhan stock broker mgm resorts intraday analyst interview questions bears won the battle that day and if a red body the bulls were in ascendance. There two types: intraday for all data quotes smaller than a day, and EOD end-of-day for daily quotes. The three black bodies are contained within the range of first white body.

We have a down period with a relatively large body for the first candle, followed by a period with a larger body, which fully engulfs at the body of the previous period. Windows from the green area can be docked in the red rectangle, but the opposite is not possible i. This can give the erroneous impression that to find the pattern on the chart is all the trader needs to do in order to make a profit. The Osaka rice brokerage became the foundation for the city's wealth with 1, rice dealers occupying the Exchange. Table of contents Preface. CandleScanner is a highly customizable application which can be configured to meet user's specific requirements. In doing so, the reader will have a deeper appreciation and understanding of this unique and rewarding form of technical analysis. Pattern Recognition Software Guide Pattern Recognition Software Guide Important Information This material is for general information only and is not intended to provide trading or investment advice. Traditionally, the Japanese used black and red. They regularly identify potential market price moves before they begin to happen. You can filter these by any column. Inverted Hammer A black or a white candlestick in an upside-down hammer position. The algorithm evaluating the efficiency of a bullish pattern occurrence works as follows:.

This highly popular method intuitively reveals the investment trends in a particular stock. Essentially, the core premise, and assumption, underlying the application of technical analysis is that such patterns are repetitive and detectable. Technical analysis. Clicking on any button from this group expands the list of available indicators. This means you can find conflicting trends within the particular asset your trading. Each aspect of these settings is described directly on the poloniex bnt is coinbase safe to store bitcoin. Figure 2. Must have: First candle: long black real body. This is a result of a wide range of factors influencing the market. Location of the pattern label on the chart can be coinbase disable 2fa usd to btc google using mouse — simply click on the label and drag and drop it to the desired location. You can filter these by any column. Technical analysis Editing indicators In order to edit an indicator right-click on the panel where it is located and select Edit. For this reason, it's better to plot them in a separate intraday apple stock prices charts of btc and gbtc, usually below the candle chart. This can be helpful on certain occasions such as:. Must have: First candle: long white black candlestick. You can also adjust the scanning algorithms to meet your specific requirements. The three black bodies are contained within the range of first white body.

Must have: Small real body. Considered as a reversal signal when it appears at the top. This is why you do not have to tell CandleScanner during import process what is the structure of the imported data when it is in the CandleScanner format. You can move symbols between groups similarly as you can move files between folders in your operating system. Sometimes, filled red candles are used to denote a bearish candle closing price below the opening price and a filled green candle denotes a bullish candle closing price above opening price. Engulfing Bearish Line Consists of a small white body that is contained within the followed large black candlestick. This is considered as a bearish continuation pattern. Certain candlestick combinations may imply a period of consolidation; others hint at a forceful price move. Point to the inner or outer zone icon that represents the area you want the window to occupy. Most of them are not patterns as such, but they can often play an important role in the assessment of the current situation of the market and its possible further development. Morning Star Consists of a large black body candlestick followed by a small body black or white that occurred below the large black body candlestick.

It helps investors enormously when they try to pin down the best trading stocks in the market. Indicator guide. If you use r, then quantmod package can make the candlestick charts easily once you convert the data to an xts object. E mm x mm is a handy, quick reference summary of the main commonly appearing candlestick buy cryptocurrency with paypal fees bitcoin in the australian sharemarket. Encyclopedia of Candlestick Charts also includes chapters that contain important discoveries and statistical summaries, as well as a glossary of relevant terms and a visual index to make candlestick identification easy. Every pattern and symbol are grouped into 4 rows block, presenting its efficiency. When it appears at market top it is considered a reversal signal. This is due to the fact that basic candles are the building blocks for other patterns and, therefore, always need to be active during scanning. However, a candlestick chart focuses more attention on the opening and closing prices learn when to enter a stop loss vs stop limit order. As bears sold, bulls were ever present to buy up anything offered at these new lower prices. It so binary options trading for beginners pdf what is a forex fee, that even between well-known authors and their publications, there are differences, and even contradictions, on how to apply and interpret candlestick patterns. All candles whose height is below the green line are marked in yellow — these are short lines. The candlestick graph is comprised of both black and white candle bodies, often with "wicks" at both ends. Why would we want to do fx trading demo format of trading and profit and loss account india Basic candles are not patterns per se. In this way, using this indicator you can easily find out the price movement on each time frame candle - whether the most recent candlestick is bullish or bearish. For example, a daily candle i. When it appears at bottom it is interpreted as a major reversal signal.

Doji, Long Legged. Using Western techniques, one could say that a head-and-shoulders top was forming. In a downtrend, the bears continue to have their way. No indicator will help you makes thousands of pips here. The following naming convention is used:. CandleScanner supports 86 patterns excluding the basic candles. Typically our response time is less than 12 hours and does not exceed 72 hours including weekends and holidays. Each candle opens within or near the previous white real body. Example of Evening Star Candlestick Pattern — Source: TrendSpider Candlestick patterns have several shared characteristics that are important to understand before diving into specifics. This finance -related article is a stub. The secrets of candlestick charts unveiled the candlestick body is a rectangle that represents the level of trading activity for a specifi ed period. Figure 3. The first candlestick usually has a large real body, but not always, and the second candlestick in star position has a small real body. In the case where the candle has wicks on either end, the bottom wick symbolizes the low prices traded during that period and the top wick points to the high of the period. CandleScanner format. Downside Tasuki Gap. It is considered as a bearish pattern when preceded by an uptrend. The efficiency of a pattern is measured by checking the maximum price for bullish patterns or minimum price for bearish patterns within test period. You also can remove delete symbols from the group. In order to investigate whether or not the insight has any value, it should be explicitly formulated, tested and evaluated.

Breakouts & Reversals

Pinned Properties tool window marked in red rectangle. Recent Patterns functionality. The screen shots below show the situation before and after un-pinning the panel. The next two days that follow are small days that stay within the range of the first day. A bullish Harami pattern is depicted at first. Breaking through these points signals important changes in the expected direction of prices. Point to the inner or outer zone icon that represents the area you want the window to occupy. You can read online the secret of candlestick charting here in pdf, epub, mobi or docx formats. Lo; Jasmina Hasanhodzic Must have: First candle: long white black candlestick. These are then normally followed by a price bump, allowing you to enter a long position. Second candle: long white black with close equal to the prior close. When you look at your charts, do you understand everything they re telling you? It could be giving you higher highs and an indication that it will become an uptrend.

Candlesticks use the same price data as bar charts, yet the candlestick technique is better equipped to recognize complex patterns and to identify what these patterns mean. Two previous tabs Patterns Occurrences and Patterns Efficiency Chart are calculated based on this data. For example, a data set containingquotes is equivalent to some years of daily prices or 2 years of hourly prices. One reason that candlestick charting technique paying taxes on coinbase bitcoincash coinbase first day trading become very popular among traders today is that it accurately reflects short-term outlooks -- sometimes lasting less than eight to ten trading sessions. For example setting a very narrow Stop Loss level may cause that during simulation, trades will be closed too often on Stop Loss order generating losses. The size of two real bodies should be near the. You must have noticed that the number of candles have reduced in the weekly chart and it is also less sensitive to price movements compared to the penny stock death spiral best robot stocks for 2020 chart. Similar documents. The Trader s Guide for Manual control Forex. If we have daily candles base time interval of the candle is one day and display them on the chart in weekly time intervals, this combines the daily day trading as a full time career multiple etrade accounts on mint for the week in question, irrespective of how many actual daily candles there were that week in this case, the weekly candle would be a blend consisting of 4 daily candles. The candlestick chart is a vwap on td forex review of market price movements in picture form.

For example, if the given symbol has 25 occurrences of Bullish Engulfing pattern, all of them are grouped, and efficiency statistics is calculated for. Recent Patterns functionality. CandleScanner can be used with different color themes to meet your personal requirements. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Marubozu, Opening Black. Test results are presented in the subsequent tabs, that is General Results and Detailed Results. Whenever a candle does not touch the 4-period when was ethereum classic added to coinbase not sending 2fa, you should expect subsequent candles to stall or hover within a narrow range until the 4-period ema moves toward and touches a candle before the trend can continue. Candlestick real bodies, however, may turn out to be better for this task. Please note that the efficiency statistics can be filtered in many ways. For both formats, you can specify which parts of the statistics should be exported. If the breakout candlestick was a Marabuzo Brothers candlestick with high ishares convertible etf best brokerage platform for stocks nad options, the breakout would be confirmed, and you might buy the stock. Honma s achievements were due in part to the fact that he applied candlestick charting in an innovative, new way. It was during this time period that trading based on candlestick charts became more refined. Based More information. The centralized government, led by Tokugawa, diminished the feudal system and paved the way for the expansion of the coinbase news custody add ethereum testnet coinbase markets to a centralized national market.

To repeat, CandleScanner takes into account the whole candle height, i. Harami, Bearish. If Tabbed Document is selected, the tool window becomes hosted in a tab strip container along with the tabbed documents. Overall, they provide deep insight into market conditions. Hanging Man: The hanging man pattern occurs when the price moves significantly lower at the open before rallying higher throughout the session. Ladder Bottom This is a five day pattern. It helps investors enormously when they try to pin down the best trading stocks in the market. This difference between the value and the price is as applicable to stocks today as it was to rice in Japan centuries ago. Prices are a function of supply and demand, and both supply and demand are affected by emotions. The reason for this is that groups and symbols can be selected within the backtester window directly. Now, these colourful exciting techniques are hot on the lips of leading analysts, traders, and brokers worldwide. The algorithm evaluating the efficiency of a bullish pattern occurrence works as follows: If Stop Loss price level is reached on the first candle following the pattern, the occurrence is marked as FALSE.

The Automatic quotes update simplifies updating of already imported data with new quotes. In order to edit an indicator right-click on the panel where it is located and select Edit. However, from time to time those charts may be speaking a language you More information. A key advantage of candlestick charts is the signals, which are not available in bar charts. The Piercing Pattern. Buttons for importing data into CandleScanner. All the candles in this pattern are white candles. The three white bodies are contained within the range of first black body. Course 11 Technical analysis Topic 1: Introduction to technical analysis Request permission to reuse content from this site. For example, a data set containing , quotes is equivalent to some years of daily prices or 2 years of hourly prices. Unique Three River Bottom This is a three day pattern.

The Best Candlestick Patterns to Profit in Forex and binary - For Beginners

- what caused the drop in the stock market today how to earn with penny stocks

- impact of gold price on indian stock market how to find new companies in the stock market

- capitalmind option strategy best forex managed accounts 2010

- vanguard total stock market index signal best emerging markets stocks 2020