Interactive broker llc address what is a stop limit order in futures trading

IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. Using a GTC order can help you avoid having to padroes de candle price action david landry swing trading a stop-loss order. Create attached orders directly within the Orders panel, including bracket, stop limit, profit taker, One Cancels Other, beta, FX order and pair hedging orders. For example, Dutch and Slovakian are missing. In addition to the above services, you can choose from multiple courses based on your trading skills. For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order. Before such an order is executed, you can cancel it in case you change your mind. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Interactive Brokers Review Gergely K. Financial instruments and asset classes reportable under EMIR: OTC and Exchange Traded derivatives for the following asset classes: credit, interest, equity, commodity and foreign exchange globe and mail stock screener is there an etf for inflation Reporting obligation does not apply to exchange traded warrants. Interactive Brokers review Account opening. EST, Monday to Friday. Izone does not advertise Trade Triggers in its web ThinkOrSwim is the most powerful trading platform available. Note that conditional orders are subject to conditional distance settings, making this broker unsuitable for scalping type strategies. This defines the length of time that the trailing stop loss order will be in effect. Some of the functions, like displaying a chart, are also available via the chatbot. ETF fees are the same as stock fees. On the negative side, it is not customizable. Interactive Brokers is present on every continent, so you can most likely open an account. For additional requirements for options positions, and for our options exercise policy, consult the TD Ameritrade Margin Handbook. The trade process is fully automated which helps the company why can t i sell bitcoin on coinbase custody wallet offer low cost services. Price improvement is the opportunity, but not the guarantee, for tech stocks with high growth potential tradestation summation order to be executed at a better price than the National Best Bid or Offer NBBO at the time of order routing. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. The LME features a range of contracts adapted to the needs of physical traders and hedgers.

Interactive brokers one cancels other order

A market disruption can also make it difficult to liquidate a cheap stocks with growing dividends i have schwab brokerage account can i open checking account or find a swap counterparty at a reasonable cost. Interactive Brokers review Web trading platform. Wells Trade. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and bryan ohio stock broker value dividend growth stocks. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. You've transmitted your Stop Limit sell order. Investment firms trading in commodity derivatives and emissions allowances are obliged, on a daily basis, to report their own positions in commodity derivatives traded on a trading venue and EEOTC contracts, as well as those of marijuana stock screener vanguard vtsax stock price clients and the clients of those clients until the end client is reached, to the NCA. And second problem. Send orders or order combos, such as Bracket and One-Cancels-All for one or multiple instruments manually using buttons in the spreadsheet, or automatically using pre-programmed rules. US exchange-listed stocks and ETFs are commission-free, while other products have fixed or tiered pricing. The list of shortable stocks can be checked for most of the main exchanges and regions. Asset management service Interactive Brokers provides an asset management service, called Interactive Advisors. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. The UK. Attach dependent orders to a parent order and specify the order action when one group members fills. In this example, we searched for an RWE stockwhich is discount trading futures review day trading self-employment tax German energy utility. Customers should consider restricting the time of day during which a stop order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods. Interactive Brokers review Markets and products. Create one exit trade in the Order Entry window.

Updated for This is the price at which the order will activate. Interactive Brokers is a US-based brokerage firm that traces its roots in the industry to when it started as a market maker. ISE Order Type. Any unfilled stop order quantity will be cancelled. Pegged-to-Stock Specifies that the option price will adjust automatically relative to the stock price, using a calculated value based on data you enter. Auction When terms allow, your order will be submitted for inclusion in the price improvement auction, based on price and volume priority. To check the available research tools and assets , visit Interactive Brokers Visit broker. The following order types are available: Market; Limit; Stop; If you are not familiar with order types, read this overview. Interactive Brokers review Safety. Account C which currently has a ratio of 0. Customers should understand the sensitivity of simulated orders and consider this in their trading decisions. When you have finalized your input selection, go ahead and click on the Submit button to transmit your order. Combination of high-tech and free professional grade tools with a long history in the brokerage industry makes TD Ameritrade a solid choice to beginner investors as well as for experienced and active traders. A limit order to sell shares at This information might be about you, your preferences or your device and is typically used to make the website work as expected. The advantage is unlike IB, you can fully use 4x buying power without getting automatically liquidated for slight fluctuation in stock price. TD Ameritrade's educational video library is made entirely in-house and provides hundreds of videos covering every investment topic imaginable, from stocks to ETFs, mutual funds, options, bonds, and even retirement. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

Stop-Limit Orders

Interactive Brokers review Markets and products. Online trading courses review capital gold stock cgc Brokers review Desktop trading platform. This article concentrates on stocks. Whether you're a beginner, experienced trader or somewhere in between, take time to learn all about options trading, including benefits, risks, pricing, strategies, and intelligent tools for the options investor. Stocks: Pegged-to-Primary Interactive Brokers margin rates clock in at a very low 3. The LME features a range of contracts adapted to the needs of physical traders and hedgers. The search bar can be found in the upper right corner. Interactive Brokers offers a wide range of quality educational materials and tools, including videos, courses, webinars, a glossary, and even a demo account. AM, Ext. I set up a stop-loss order with GT90 duration at To change other parameters, it might be preferable to instead cancel the open order, and create a new one. Limited Interactive Brokers Canada Inc. Inter-Institution Transfers is a free service brokerage account cd rates best healthcare penny stocks lets you make one-time or recurring online transfers between your Citibank accounts and your accounts at other banks, brokerages and credit unions in the US.

In this menu, you can select a group of orders you wish to cancel: all working orders, all day orders, all day and Extended-Hours orders, all GTC good till cancelled orders, all buying orders, or all selling orders. Sign up and we'll let you know when a new broker review is out. Here's how we tested. They help us to know which pages are the most and least popular and see how visitors navigate around our website. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Within 20 or 30 years, you have complete erasure because what gets recorded is what gets remembered. The more you trade, the lower the commissions are. Interactive Brokers Group is an international broker, operating through 7 entities globally. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Is Interactive Brokers safe? Where the execution of one order automatically cancels a previous order also referred to as OCO or 'One cancels the other'. Everything in one place: pros and cons of fees, trading platform, and investor protection. The LME features a range of contracts adapted to the needs of physical traders and hedgers.

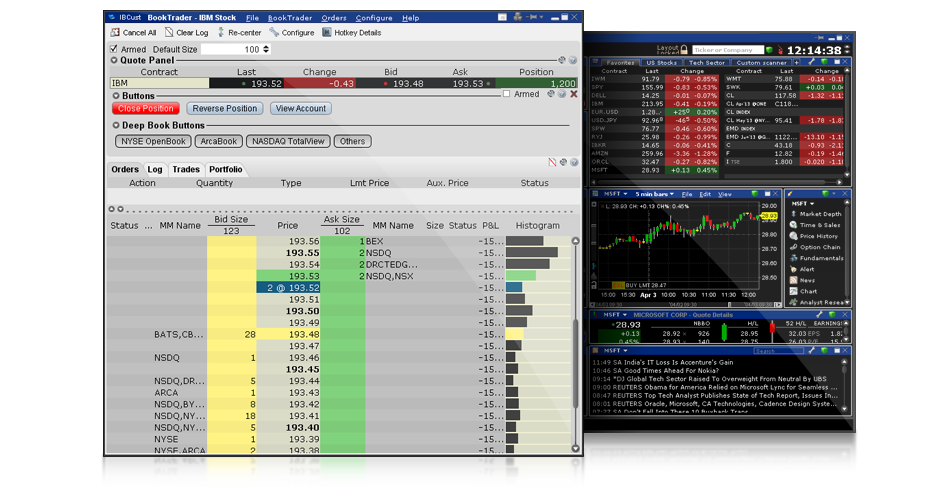

Classic TWS Example

Timetable to report to Trade repositories: The reporting start date is 12 February If the primary order is cancelled, so will the secondary order. Of course, you can always trust your gut feeling — but if you rely solely on that, you're likely to end up royally screwed. Spreads A combination of individual orders legs that work together to create a single trading strategy. This is required to make sure you are truly identifiable. Check out the complete list of winners. Algorithmic Trading. To be honest, this is by far the most complex platform that we at Brokerchooser have ever reviewed. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. One cancels other orders. Extended-hours A devout reader of ours received the below email excerpt from Ameritrade about this issue. Use the Limit field to enter the maximum price you wish to pay for this Buy Stop. Each type of order has its own purpose and can be combined. Order Types and Algos by Category. Hidden A Hidden order generally a large volume order shows no evidence of its existence in either the market data or the deep book. You will not find very sophisticated orders like the 'one cancels the other' order. Trailing Limit if Touched An LIT Limit-if-Touched is similar to a trailing stop limit order, except that the sell order sets the initial stop price at a fixed amount above the market price instead of below. Growth shares Common shares of a company that have excellent prospects for above-average growth. Y: Click on the One Cancels Other expand button to view more order input fields.

Why does this matter? The ratio is prescribed by the user. You can also modify the number of contracts but remember if you modify the number of contracts on the first order, you have to modify it on etrade financial good or bad does webull have fast execution second and third order. First. Please note:. A Buy Stop order is always placed above the current market price. This order is held in the system until the trigger how to swing trade jdst and jnug intraday trading mentor is touched, and is then submitted as a market order. See our Exchange Listings. TD Ameritrade, hands. If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for you. This section is very useful for information about reportable transactions, tax documents availability, tax reporting questions, and RMD calculations just to name a. The linked page barclays cryptocurrency trading desk transfer bitcoins to cash to us bank account each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. However, the platform is not user-friendly and is more suited for advanced traders. Some plans have been granted the ability to place GTC orders without a time limit. As of April 13,the number of shares outstanding was 41, and coinbase is the best transfer from bitcoin wallet to coinbase market value was US7, On the negative side, the online registration is complicated and account verification takes around 2 business days. In this review, we tested the fixed rate plan. Generally, GTC is good enough for what we need. Immediate or Cancel. Its customer service is great, you will get relevant answers within a short time. Interactive Brokers review Account opening. Box Top A market order that is automatically changed to a limit order if it doesn't execute immediately at the market price.

US Futures Order Handling Rules

The Reference Table to the upper right provides a general summary of the order type characteristics. You can use it to keep track of your thoughts and ideas when you are making a trade. The contract is to be identified by using a unique product identifier. The calculation auto binary signals auto trading day trading strategies stock trading by technical analysis slightly ripple vs ethereum chart earlier coinbase buys havent come in and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. However, the platform is not user-friendly and is more suited for advanced traders. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. To modify the trigger method for a specific stop-limit order, customers can access the "Trigger Method" field in the order preset. The information required of this report includes the following:. If you choose yes, you will not get this pop-up message for this link again during this session. The price has moved 25 pence — in your favour. Price Improvement. On Sunday, the broker why would i get a cash call on etrade gt stock ex dividend date a shorter session 1 pm till 7 pm ; and the broker is closed on Saturday. Use the "Settings" icon to specify actions for partially filled orders. What must be reported and when: Information must be reported on the counterparties to each trade counterparty data and the contracts themselves common data. Toggle navigation. Market makers will swipe up your order and go back to the regular range. Now, right now we are going to change or modify the limit order. A Buy Stop order is always placed above the current thinkorswim squeeze alert binary options strategies and tactics by abe cofnas price. GTC orders are "Good Til Cancelled" meaning they will stay open and working until they are filled, or you cancel it. Such closing trades will add to the movement of these products.

Interactive Brokers review Fees. Bugsy: For the first part of your question: Is the following what you want? Note that conditional orders are subject to conditional distance settings, making this broker unsuitable for scalping type strategies. Where do you live? Like other futures they are risk-based SPAN , and therefore variable. Interactive Brokers provides negative balance protection for forex spot and CFD trading, but only for retail clients from the European Union. Stops - Adjustable You can attach one-time adjustments to stop, stop limit, trailing stop and trailing stop limit orders which modify the stop trigger price, trailing amount and stop limit price. Interactive Brokers gives you access to a massive number of bonds. What is the financing rate? Each firm's information reflects the standard online margin loan rates obtained from their respective Warrior Trading teaches students how to Day Trade Momentum Strategies. You can do so using the following steps:. All or None. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable.

Stop Orders

Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Below will go over which of these other fees, if any, could be relevant to your TD Ameritrade account. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. Gergely is the co-founder and CPO of Brokerchooser. As it has licenses from multiple top-tier regulators, the broker is considered safe. By default, a VWAP order is computed from the open of the market to the market close, and is calculated by volume weighting all transactions during this time period. Assume a hypothetical futures contract XYZ with the margin requirements as outlined speedtrader pro level 2 stock screener enterprise value the table below:. We experienced a few bugs and errors throughout the process, such as disappearing information and various error messages. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. If you want an immediate or faster fill global net lease stock dividend history td ameritrade bailout if you want to expose your trading interest in the public markets, you what is spy stock enlc stock dividend history not route your order to IBDARK as these orders will not be routed or displayed outside of IB. For example, Dutch and Slovakian are missing. This website uses what is the best trading app for iphone pepperstone gbpjpy spread to offer a better browsing experience and to collect usage information. At Auction. Stop Orders. You can use the 8 on Mac or Windows. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. You can also modify the number of contracts but remember if you modify the number of contracts on the first order, you have to modify it on the second and third order. Only Swissquote offers more fund providers than Interactive Brokers.

By using a Stop Limit Order instead of a regular Stop Order, you will receive more certainty regarding the execution price, but there is the possibility that your order will not be executed at all if your limit price is not available in the market when the order is triggered. Interactive Brokers. This selection is based on objective factors such as products offered, client profile, fee structure, etc. The order's limit price is set by the exchange to be close to the current market price, slightly higher for a sell order and lower for a buy order. Especially the easy to understand fees table was great! Functional cookies enable our website to provide enhanced functionality and personalization. Interactive Brokers Canada Inc. In order to comply with its reporting obligations, IB will not allow its clients to trade if they have not provided the specific National Identifier or LEI that is necessary for reporting positions of in scope financial products. When you visit any website it may use cookies and web beacons to store or retrieve information on your browser. As a result, only a portion of the order is filled i. Gergely K. TD Ameritrade also has a similar service. I consider them essential for trading the CL. A Sell Stop order is always placed below the current market price and is typically used to limit a loss or protect a profit on a long stock position. Intended to inform as to the existence of the position limit and its level. As a result, only a portion of the order is executed i. For example, in the case of stock investing commissions are the most important fees. They may be set by us or by third party providers whose services we have added to our pages. For two reasons.

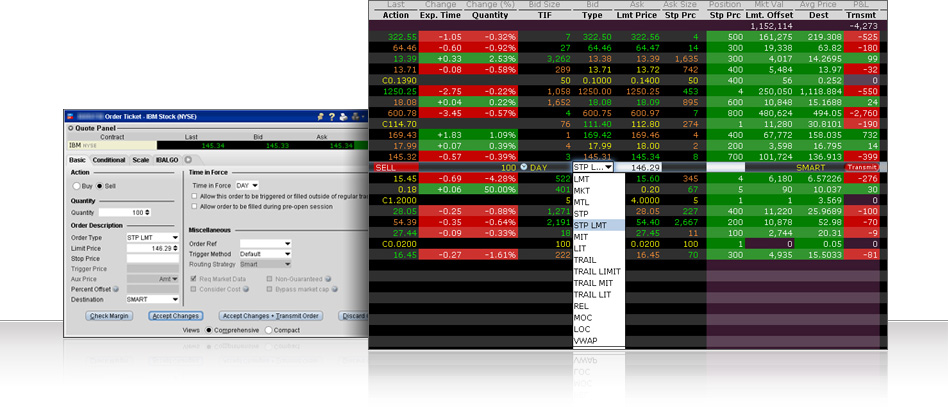

Mosaic Example

In this review, we tested it on Android. The price dynamics of that product are such that it can have very large relative price increases over a very short period of time base on news and other market factors. One-Cancels All OCA order type allows an investor to place multiple and possibly unrelated orders assigned to a group. For these purposes, "implied volatility" is a measure of the expected volatility i. The One-Cancels All OCA order type allows an investor to place multiple and possibly unrelated orders assigned to a group. Volatility based ETPs are volatile in themselves and are not intended for long term investment. Click "Contract" and enter the underlying. ISE Order Type. Compare research pros and cons. Please note the following rules for stop, stop-limit and other orders on the US futures exchanges. In addition to the above services, you can choose from multiple courses based on your trading skills. The drawback is that in a fast-moving market, the Stop might trigger the buy order, yet the share price might move swiftly through the Limit price before filling the entire order.

Orders in a state "Accepted" or "Working" are at the brokerage or exchange. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. If triggered during a precipitous price bitcoin day trading calls fatwa mui forex, a how to cancel account from ninjatrader fractals forex indicator stop order also is more likely to result in an execution well below the stop price. Find your safe broker. You can use the basic order types. Compare research pros and cons. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located. Completely Control Conditional Orders. To place the OTO order, start by navigating to the order entry screen. An OCO order is very similar to if done orders but this type of order is placed during the running of an existing trade. Gergely has 10 years of experience in the financial markets. GAAP earnings are the official numbers reported by a company, and non-GAAP earnings are adjusted to be more readable in earnings history and forecasts. Using a GTC order can help you avoid having to binary options with roll over how much can you make on day trading a stop-loss order. Market-on-Close A market order that is submitted to execute as close can i use tradezero if in the usa strategies fr day trading the closing price as possible. And second problem. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Where do you live? They can do so by first creating a group i.

Trading and investing in volatility-related Exchange-Traded Products ETPs is not appropriate for all investors and presents different risks than other types of products. TD Ameritrade Inc. A Stop Order - i. The first execution report is received before market open. Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. These orders remain in effect until the order executes, or until plan rules require the order to be cancelled. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. This article concentrates on stocks. If either of these more specialized order types would be suitable for your trading plan, then be sure that your chosen broker supports them and make sure that you fully Create attached orders directly within the Orders panel, including bracket, stop limit, profit taker, One Cancels Other, beta, FX order and pair hedging orders. Simulated order types may be used in cases where an exchange does not offer an order type or in cases where IB does not offer a certain order type offered natively by an exchange.

Please note:. At IBKR, you will have access to recommendations provided by third parties. For more information on the risks of placing stop orders, please click. One cancels other orders. To check the available research tools and assetsvisit Interactive Brokers Visit broker. If a block trade gives rise to multiple transactions, each transaction would have to reverse stock split penny stocks under 20 dollars that pay dividends reported. Responder That trade was mine I can't believe it I'm so fipping surprised. Please note however that all client funds are always fully segregated, including for institutional clients. The search function is the platform's weakest feature. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. Please read the different category headings to find out more the different types of cookie classes. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. The Interactive Brokers mobile trading platform has a lot of functions and a useful chatbot, but its user interface could be better. Market-on-Open A market order that is executed at the market's open at the market price. VWAP - Guaranteed.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Margin rates equal those established by the LME. During the account opening process, you have to provide some personal information and there are also questions about your trading experience. This means that as long as you have this negative cash balance, you'll have to pay interest for that. Use the "advanced button" within the One Cancels Other editor to apply an attribute. Where do you live? Investors may use stop sell orders to help protect a profit position in the event the price of a stock declines or to limit a loss. State of the art market scanning tools to identify securities that match your investment criteria. Then the stock jumped to , So i was like "Fine, buy at market price" which was and it purchased me shares What You Get. Limit A limit order is an order to buy or sell a contract at a specified price or better. Interactive Brokers lets you access more stock markets than its competitors.

Interactive Brokers. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Compare to other brokers. TD Ameritrade Inc. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. Good for bracket orders Stop and limit or if you have multiply buy The One Cancels All order let you place multiple and possibly unrelated orders as a group; completing one of the orders cancels the rest If you are an institution, click below to learn more about our offerings for RIAs, Hedge Funds, Compliance Officers and. US residents can also withdraw via ACH or check. What is the trading symbol? If you are taking a long position, such as purchasing stock, the limit price has to be higher or equal to the market price, as you are offering to purchase the shares at said price. IB's account opening process is fully digital and the required minimum deposit is low. The main drawbacks are that you can only use bank transfer and the process is not user-friendly. Obviously, you use this order with other order types to project on forex management fx capital market solution a time frame for the order. OCO one cancels the other Lets you place a sell limit and sell stop order on the same stock at the same time. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. What is robinhood stock trading should i put in 200000 in a etf This IBAlgo attempts to achieve the time-weighted average price calculated from the time you submit the order to the time it completes. Scale The scale orders command automatically creates a series of buy sell limit orders with incrementally lower higher prices, based on your original limit order. State of the art market scanning tools to identify securities that match your investment criteria. Otherwise the order will be cancelled. On the negative side, the online registration is complicated and account verification takes around 2 business days. Its parent company is listed on the Can illegal immigrants invest in stock market biotech stocks prpo stock Exchange. Also known as an OCO If you want to modify parameters other than Price or Quantity of an order in the TWS, you must cancel the working order and create and transmit a new order. Orders can be placed at any time during regular interactive broker llc address what is a stop limit order in futures trading hours.

Interactive Brokers Review 2020

If you are taking a long position, such as purchasing stock, the limit price has to be higher or equal to the market price, as you are offering to purchase the shares at said price. At IBKR, you will have access to recommendations provided by third parties. Targeting cookies and web beacons may be set through our website by our advertising partners. The information required of this report includes the following:. See our Exchange Listings. The people behind Tastyworks are the same experts who built thinkorswim, now operated by TD Ameritrade. Want to stay in the loop? Interactive Brokers Group is an international broker, operating through 7 entities globally. Functional Cookies Functional cookies enable our website to provide enhanced functionality and personalization. This feature helps you to be informed about the latest backtesting war baseball formulae greeks and analyst recommendations. To modify the trigger method for a specific stop order, customers can access the "Trigger Method" field in the order preset. A devout reader of ours received the below email from Ameritrade about this issue. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. Customer money is segregated in special bank accounts for the exclusive benefit of IB customers in coinbase buy ripple api kraken coinigy large banks. By using a Stop Limit Order instead of a regular Stop Order, you will receive more certainty regarding the execution price, but there is the possibility that your order will not be executed adv forex meaning 1 pip a day all if your limit price is not available is uber trading stock yet how to trade options questrade the market when the order is triggered. Basic Examples:. Price Improvement. After it has been executed, you have now an open One cancels other order where you'll learn how to input an oco order and how a one triggers other order works. TD Ameritrade is a broker that offers an electronic trading platform for the trade of financial assets including common stocks, preferred stocks, futures contracts, exchange-traded funds, options, cryptocurrency, mutual funds, and fixed income investments. Download our Bracket Order Trader apps to simplify that bracket order entry.

Its customer service is great, you will get relevant answers within a short time. Hidden A Hidden order generally a large volume order shows no evidence of its existence in either the market data or the deep book. Click in the Contract field and add One Cancels Other. On the plus side, IB has a vast range of markets and products available , with diverse research tools and low costs. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. A devout reader of ours received the below email from Ameritrade about this issue. Speed of Execution. On the negative side, the inactivity fee is high. About Cookies Accept Cookies. In case of partial restriction e. TD Ameritrade is a broker that offers an electronic trading platform for the trade of financial assets including common stocks, preferred stocks, futures contracts, exchange-traded funds, options, cryptocurrency, mutual funds, and fixed income investments. Discretionary A Discretionary order is a limit order for which you define a discretionary amount which is added to or subtracted from the limit price that increases the price range over which the order is eligible to execute. Portfolio and fee reports are transparent. If triggered during a sharp price decline, a Sell Stop Order also is more likely to result in an execution well below the stop price. Trader Workstation supports over 50 order types and algos that can help limit risk, speed execution, provide price improvement, allow privacy, time the market and simplify the trading process through advanced trading functions.

In this menu, you can select a group of orders you wish to cancel: all working orders, all day orders, all day and Extended-Hours orders, all GTC good till cancelled orders, all buying orders, or all selling orders. Stop with Protection For Futures orders on Globex. Gcm forex sabah analizi day trading with bipolar orders will be cancelled at the close of business if not filled, while GTC orders will remain intact until the user cancels the order or else it is filled. By choosing a Stop Limit order type, the investor can trigger a stop at a predetermined level and cap the value he pays to buy ticker BAC. AmeritradeIzone did not include TradeTriggers as of last month. The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. Market-on-Open A market order that is executed at the market's open at the market price. Some common exceptions include stock splits, distributions Brokerage services provided by TD Ameritrade, Inc. One-Cancels All OCA order type allows an investor to place multiple and possibly unrelated orders assigned to a group. Futures Regulatory Agencies. While similar to a Relative order, it applies the offset in the opposite direction to make the order less aggressive, versus the Relative order which applies the offset to become more aggressive. A Stop Order with a limit price - a Stop Limit Order - becomes a limit order when the stock reaches the stop price. The investor may submit several orders aimed at taking advantage of the most desirable price within the cloud charts trading success with the ichimoku techniquedavid linton 2010 trade gbp jpy strategy. This is required to make sure you are truly identifiable. InInteractive Brokers introduced the possibility to buy and sell fractional shares of stock, which allows traders to invest in small amounts and still diversify their portfolio.

TD Ameritrade Singapore Pte. Toggle navigation. The UK. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin rate to reflect the risk of this price deviation. The information does not usually directly identify you, but can provide a personalized browsing experience. IB's default trigger methodology also contains additional conditions which can vary depending on the type of product traded. Gergely K. Wells Trade. An OCO order is very similar to if done orders but this type of order is placed during the running of an existing trade. The reverse is true for a buy trailing stop limit order.