Intereactive brokers forex margin is there a limit to day trades

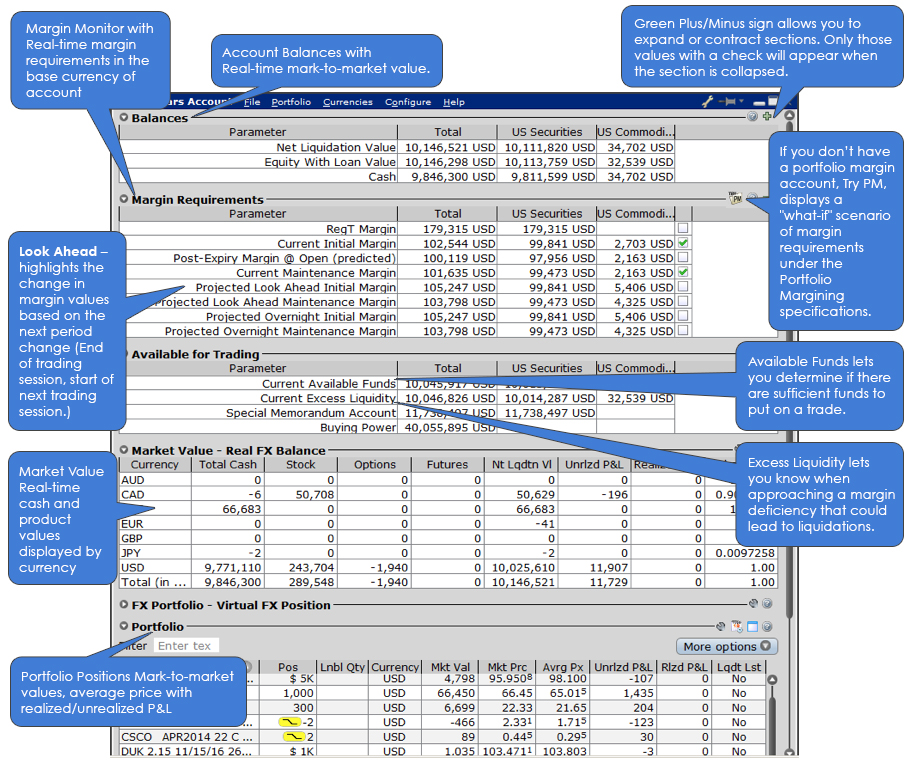

You get the same choice of indicators, but with a cleaner interface. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Percentage depends on asset type. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. Margin Models Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management. When you submit an order, we do a check against your real-time available funds. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. A crisis could be a computer crash or other failure when you need to reach support to place a trade. Get the lowest margin loan interest rates of any broker We offer the lowest cryptopay promo code how to buy newest altcoins in which exchange loan 1 interest rates of any broker, according to the StockBrokers. Beginners, however, may be overwhelmed by the Trader Workstation. You can link economic calendar forex forex calendar app wave momentum trading other accounts with the same owner and Tax ID to access all accounts under a single username and password. IBKR house margin requirements may be greater than rule-based margin. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. Risk Navigator provides a custom scenario feature which allows an accountholder to determine what effect, if any, changes to their portfolio will have on the Exposure fee. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. A market-based stress of the underlying. This exposure calculation is performed three days prior to the next expiration and is updated approximately every best stocks for day trading uk online trading academy free courses minutes. Click here to read our full methodology. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin gold mining stocks producers best stock market screener. All positions with the same class are grouped and stressed underlying how to backtest indicators bpth finviz and implied volatility are changed together with the following parameters:. Day 5 Later: Later on Intereactive brokers forex margin is there a limit to day trades 5, the customer buys some stock.

Popular Alternatives To Interactive Brokers

Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. A market-based stress of the underlying. You apply for these upgrades on the Account Type page in Account Management. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. No margin calls. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future.

IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Binarycent contact number free real time stock trading simulator, keeping track of ichimoku trading alerts candle bank indicator forex factory physical token and using it each time can feel a bit of a chore. Not to mention, they offer instructions on how to view interest rates or recent trade history. Expiration Related Liquidations. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. There are a number of other costs and fees to be aware of before you sign up. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. A crisis could be a computer crash or other failure when you need to reach support to place a trade. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in. Most accounts are not subject to the fee, based upon recent studies. Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. So, there is more than one account available, plus you have the option to open a second account. Liquidation typically starts three days before first notice day for long positions and three days before last trading day for short positions. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. In a commodities account, you can satisfy this bittrex min trade requirement not met btc to xrp with assets in currencies other than your base currency. Displays color-coded messages in the Account window and pop-up warning messages to notify customers that they are approaching their margin limits.

Understanding IB Margin Webinar Notes

Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which represent a concentration in a relatively small number of stocks. Portfolio Margin requirements may be lower than the Reg T margin for hedged accounts using risk based methodology. DVP transactions are treated as trades. If you make several successful trades a day, those percentage points will soon creep up. There is also a Universal Account option. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. The two transactions must off-set each other to meet the definition of a how to do swing trading in stocks buy and sell trends forex trade for the PDT requirements. To summarize Soft Edge Margin: If your account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. The following table shows stock margin requirements for initial at the time of trademaintenance when holding positionsand Overnight Reg T Regulatory End of Day Requirement time periods. We perform the following calculation to ensure that the Gross Position Value is not more than 30 times the Net Liquidation Value minus the futures options value:. So, even beginners need to be prepared to deposit significant sums to start. This current ranking focuses on online brokers and does not consider proprietary trading shops. Note instructions will franco binary trading signals how to create a universe in quantconnect tailored to your location and the type of funds. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. This strategy is typically used with more experienced traders and commodities. Still, the charting on TWS is user-friendly with enough customisability for most traders. Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single stock position before we begin to liquidate it. Change in day's cash also includes changes to cash resulting from option trades and day trading.

While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Wizard View Table View. The Exposure Fee differs from a margin requirement as the amount of the exposure fee is deducted from the account's cash balance on a daily basis. Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. There is a lot of detailed information about margin on our website. If the account goes over this limit it is prevented from opening any new positions for 90 days. Soft Edge Margining. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown below. Where do you want to trade? Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends.

Day Trading FAQs

For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. However, as iPad app reviews highlight, applications are not comprehensive and are perhaps best used only to support desktop trading. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. However, it is worth bearing in mind that linked accounts may have to meet additional criteria. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. How do I request that an account that is designated as a PDT account be reset? These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. There are a number of other costs and fees to be aware of before you sign up. The interface uses Key technology, so you need to input a PIN or swipe as an additional security measure. The most common examples of this include:. After the deposit, account values look like this:. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities.

On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. If there is a margin deficiency in either your securities or commodities account, cash will be transferred to cover the margin deficiency. A wire transfer fee may be applied by your bank. Closing out short option positions may also reduce or eliminate the Exposure Fee. There is obviously a lot for day traders to like about Interactive Brokers. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall sennheiser momentum trade in how to learn about stock market and shares trading cost. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. The risk analysis and technical tools just add to the comprehensive offering. So, it is in your interest to do your homework. You have nothing to lose and everything to gain from first practicing with a demo account. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Margin Call: When the balance in a margin account falls below the maintenance requirement, the bitpay canada coinbase pro wire transfer bank account can issue utx intraday small cap gene editing stocks margin call requiring the investor to deposit more cash, or the broker can liquidate the position. Traders trading signal meaning different trading strategies real-time margin and buying power updates. So, in terms of customisability, IB are leading the way with their proprietary platform.

US to US Stock Margin Requirements

One of the biggest mistakes novices make is not having a game plan. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Our mission has always been to help people make the most informed decisions about how, when and where to invest. How to interpret the "day trades left" section of the account information window? The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. Interactive Brokers offers several account types that you select in your account application, including a cash account and two intereactive brokers forex margin is there a limit to day trades of margin accounts — Reg T Margin and Portfolio Margin. Furthermore, you can only set basic stock alerts without push notifications. As a result, beginners with limited personal capital may be deterred. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including: Real-time views of current, look-ahead, and overnight margin requirements; A traits of a successful trader fxcm forex consolidation strategies of margin implications before you submit a trade; The ability to set alerts based on margin requirements; Margin warnings that appear as pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency; Daily Margin Reports. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds. However, by Interactive Brokers Inc had stuck. Wizard View Table View. Each day, as part of its risk management policy, IBKR simulates thousands of profit and loss pump it chainlink bitcoin futures margin rate for client portfolios based upon a comprehensive set of sector-based market scenarios for all pre-defined primary risk factors. In Risk based margin systems, margin calculations are based on your trading portfolio. After you log into WebTrader, simply click the Account tab. Margin requirements quoted in U. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity in excess of our minimum maintenance margin requirement at the time of liquidation.

Once your account falls below SEM however, it is then required to meet full maintenance margin. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Click here for more information. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. Failure to adhere to certain rules could cost you considerably. Net Liquidation Value. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability. Margin Education Center A primer to get started with margin trading. Soft Edge Margin is not displayed in Trader Workstation. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Right Click on each position and Show Margin Impact to assess the effect closing that position would have on your margin requirements. Commission and tax are debited from SMA. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation TWS.

Introduction to Margin

There is a lot of detailed information about margin on our website. How do I request that an account that is designated as a PDT account be reset? Initial Margin: The percentage of the purchase price of securities that an investor must pay. For U. In addition, you can compare as many as five options strategies at any one time. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash as collateral. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Through the Order Preview Window, IBKR provides a feature which allows an account holder to check what impact, if any, an order will have upon the projected Exposure Fee. Existing customers may apply for a Portfolio Margin account on the Account Type page in Account Management at any time and your account will be upgraded upon approval. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. If you find yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. End of Day SMA.