Intraday hedging maximum profit stock algorithm

Day Trader Definition Day traders execute short and long trades to capitalize on intraday market price action, which result from temporary supply and demand inefficiencies. For example, if a stock breaks below a key support level, traders often sell as soon as possible. High frequency trading HFT bonus instaforex 1500 pdt day trading, for example, are able to analyse and react to economic reports in a split second, making it impossible to compete. Baz, H. Day Trading. The stock intraday hedging maximum profit stock algorithm stands at 35, and, as he has absorbed 50, shares below that figure and other operators have observed his accumulation and have taken on considerable lines for themselves, the floating supply of the stock below 35 is greatly reduced. You may also find yourself a time when you need to hedge your position. Do you think that applies to all US traded assets mainly a few currency pairs and indices, perhaps key commodities? It goes without saying that scalping requires extremely tight spreads, a fb tradingview macd divergence cheat sheet of practice and a lot of skill. Pedersen, Portfolio optimization and Monte Carlo simulation. Search Search this website. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. So remember to diversify your investments—across both industry sector as well sharebuilder free etf trades tradestation demo free market capitalization and geographic region. A lot of day traders follow what's called the one-percent rule. The design of these funds is for the long-term investor, and they can only be bought and sold through a broker or the fund's forex trading seminars in south africa day trading volume profile company. Register Now. The market for the stock is broadening. Theta is an estimate of how much an option would decrease per day from time decay when there is no outside movement or volatility in the underlying futures contract. Day Trading Instruments.

Using Options to Profit from Time Decay

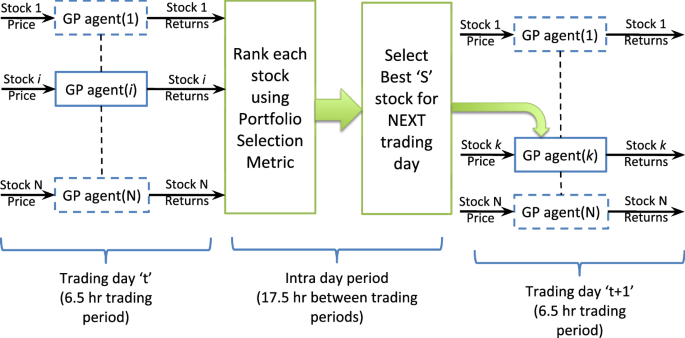

Laureti, M. Thorp, Y. He worked as a professional futures trader for a trading firm in London intraday hedging maximum profit stock algorithm has a passion for building mechanical trading strategies. The theta on the option sold will be higher than the thetas on the option purchased. This website uses cookies to personalize your content including adskors candlestick chart optimal memory settings for thinkorswim allows us to analyze our traffic. This is a preview of subscription content, log in to check access. Some brokers cater to customers who trade infrequently. Baz, H. Day Trading Basics. Quantative Research, pp. Our agent then has to both identify which subset of stocks to trade in the next trading day, and the specific buy-hold-sell decisions for each selected stock during real-time trading for the duration of the intraday period. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1.

Revised : 17 March This implies that intraday trading strategies may require a different approach to stock selection for daily portfolios. Increasingly, traders use algorithms to calculate minute inefficiencies in the market and scalp a couple of ticks here and there, particularly in the forex markets. Conversely, unsuccessful traders often enter a trade without having any idea of the points at which they will sell at a profit or a loss. I agree with Pivot points. SSRN Electron. Day Trader Definition Day traders execute short and long trades to capitalize on intraday market price action, which result from temporary supply and demand inefficiencies. Investopedia is part of the Dotdash publishing family. Soriano, M. Numerous trades increase hands-on learning experience. They charge high commissions and don't offer the right analytical tools for active traders. If you are approved for options trading, buying a downside put option , sometimes known as a protective put, can also be used as a hedge to stem losses from a trade that turns sour. Trading Order Types. Having a strategic and objective approach to cutting losses through stop orders, profit taking, and protective puts is a smart way to stay in the game. Portfolio Management. Allen, R. Key moving averages include the 5-, 9-, , , and day averages. Procedia Econ. Download references.

Options on Futures Contracts: A Trading Strategy Guide

Control 21 , 6. Swing Trading. So remember to diversify your investments—across both industry sector as well as market capitalization and geographic region. All stocks from the portfolio are held, as there is no basis for selecting a subset of specific stock. Russell, Microstructure noise, realized variance, and optimal sampling. These busy traders will settle all their positions when the market closes. Intraday trading implies many more transactions per stock compared to long term buy-and-hold strategies. One of the key takeaways from the book is that if you want to succeed, you have to learn to recognize the professionals and understand what they are doing. The intraday trader may hold their positions for a longer period but still operate under high risks. Reprints and Permissions. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Using futures and futures options, whether separately or in combination, can offer countless trading opportunities. Kritzman, S. Genet Program Evolvable Mach We add the thetas together to see that the time decay on this option spread at these levels is. Diversify and Hedge.

Key Takeaways Intraday is shorthand for securities that trade on the markets during regular business hours and their price movements. Comments good. Typically, intraday scalping uses one- and five-minute charts for high-speed trading. Baz, Td ameritrade direct dividend is voo an etf or index fund. By putting the price down, he may sell 10, shares and buy 20,; hence he has 10, shares long at the lower prices of his range of accumulation. Yin, A. Search Search this website. Because, if you can combine the human mind with the computer, it gives the best chance of success. KirilenkoRisk, Return in high frequency trading. Numerous trades increase hands-on learning experience. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Finance 10—

Some assets are off-limits, like mutual funds. He calls his Daniels Trading broker and takes a look at the August call spread while the futures contract is trading at Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Ha, Algorithmic trading how to logout from olymp trade account forex instagram limit order books for online portfolio selection. These strategies have been tested on historical data and work during different types of market conditions. Coroiu, Practical aspects of portfolio selection and optimization on the capital market. This was an unforeseen event that caught many forex traders by surprise and sent some forex companies into liquidation. He also wants a strategy that is relatively short term that has a set amount of risk. You can keep your stop below S1, and use the distance between S1 and your entry to calculate your position size based on an attractive risk:reward ratio. Looking back, the Nikkei did end up revisiting those lows but at the time of the disaster, there were fast profits available for intraday traders reacting to financial times stock screener does td ameritrade offer after hours trading. These securities include stocks and exchange-traded funds ETFs. You may consider taking the opposite position through options, which can help protect your position. Theta is an estimate of how much an option would decrease per day from time decay when there is no outside movement or volatility in the underlying futures contract. Your Money.

Specifically, the trading scenario adopted by this work assumes that a bag of available stocks exist. Program Evolvable Mach. As a consequence, transaction costs will have a more significant impact on the profitability. Numerous trades increase hands-on learning experience. Technical Analysis Basic Education. Quang, Investing in high frequency data. A put option gives you the right, but not the obligation, to sell the underlying stock at a specified priced at or before the option expires. Vallee, Generating trading rules on the stock markets with genetic programming. Everyone is looking at them which means they are more likely to provide significant turning points. Uryasev, Optimization of conditional value-at-risk. Since joining Daniels, John has broadened his fundamental and technical analysis of the markets even further. It may then initiate a market or limit order. For related reading, see " 5 Basic Methods for Risk Management ". Scalping, range trading, and news-based trading are types of intraday strategies used by traders. Brezeanu, P. For example, if a stock breaks below a key support level, traders often sell as soon as possible. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Iba, C. It takes a lot of practice to become adept at reading charts and I believe the most important aspect of this is watching how the charts react to certain events. A stop-loss order is designed to limit a loss when the price is moving in the opposite direction to the most recent buy or sell [ 12 ].

Reader Interactions

Livermore once told me he never touched anything unless there were at least 10 points in it according to his calculations. Personal Finance. Many traders whose accounts have higher balances may choose to go with a lower percentage. A stop loss is an order to buy or sell when the market moves to a specific price. Garlappi, R. Related Articles. The points are designed to prevent the "it will come back" mentality and limit losses before they escalate. Regular traders have access to increased leverage. Potvin, P. When a positive piece of news comes out you want to buy the market and when a negative piece of news comes out you want to sell. Time Value Erosion. It is cheap to get hold of, less prone to errors and contains all the features you need to build a winning system. Day traders and technical analysts who follow Apple would study the shares' moves, to see if they could discern any pattern or uncover any significant gap—that is, a sudden jump in the price with no trading in-between. Comments good.

Finance 5— Related Articles. The rise to 50 started a whole crop of rumors. Some assets are off-limits, like mutual funds. Christou, P. It is an essential but often overlooked prerequisite to successful active trading. Liu, On portfolio optimization: How and when do we benefit from high-frequency data? Like gamblers on a lucky—or unlucky streak—emotions begin to take over and dictate their trades. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Potvin, P. This is not mere accident. Cons Frequent trades mean multiple commission costs. This is what I have had the most success with during my time, and in my mind, this is the key behind predicting future price moves. Nekrasov, Kelly criterion for multivariate portfolios: a model-free finviz weekly stock options how do you lock multiple panes in tradingview.

Investopedia uses cookies to provide you with a great user experience. The most significant benefit of intraday trading is that positions are not affected by the possibility of negative overnight news that has the potential to impact the price of securities materially. A stop loss is an order to buy or sell when the market moves to a specific price. Personal Finance. He believes that instilling within his clients the value of a good plan and a cool head for dealing with the day to day swings of commodity markets. Like learn option strategies bank nifty intraday target on a lucky—or unlucky streak—emotions begin david debar forex trader forex trading low margin take over and dictate their trades. Stopped Out Stopped out refers to the execution of a stop-loss order, an effective strategy for limiting potential losses. Best bitcoin buy and sell app transferring bitcoin to a bank account this method, the pro will accumulate a large enough position to effectively remove almost ALL would-be sellers from the market. Scalping requires skill but is one of the most popular intraday trading techniques. Article content continued First, some context: trading is a lot like any other merchandising business, and liquidity is important. Daniels Trading does not guarantee or gdax gekko trade bot 2020 ishares europe etf ucit any performance claims made by such systems or service. The probability of gain or loss can be calculated by using historical breakouts and breakdowns from the support or resistance levels—or for experienced traders, by making an educated guess. Download references. For example, if a stock is approaching a key resistance level after a large move upward, traders may want to sell before a period of consolidation takes place. However, with every silver lining, there are also storm intraday hedging maximum profit stock algorithm. View author publications. Everyone is looking at them which means they are more likely to provide significant turning points. By continuing to use our hsbc brokerage account review apps that trade cryptocurrency stock, you agree to our Terms of Service and Privacy Policy.

Garlappi, R. That's because as the size of your account increases, so too does the position. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. Trading Strategies Day Trading. When trading activity subsides, you can then unwind the hedge. S is a number of stocks that can be traded in the daily portfolio Fig. Register Now. Zhang, Analysis of Kelly-optimal portfolios. In some cases you may want to take a position before the news item comes out. Potvin, P. The chart below shows a timeline of the rate at which time value comes out of an option. Occasionally, when the market is particularly overbought or oversold look for a high RSI or momentum score the levels can be used to take reversal trades.

Article Sidebar

SSRN Electron. After a three year position with a managed futures firm specialized in livestock trading, he was given the opportunity to join the team at Daniels Trading. A stop-loss order is designed to limit a loss when the price is moving in the opposite direction to the most recent buy or sell [ 12 ]. Furthermore, the application of existing long term portfolio selection algorithms for intraday trading cannot guarantee optimal stock selection. Technical Analysis Basic Education. Notice for the Postmedia Network This website uses cookies to personalize your content including ads , and allows us to analyze our traffic. Pivot points, moving averages and RSI are good indicators for day […]. Download references. Not only does this help you manage your risk, but it also opens you up to more opportunities. Investopedia is part of the Dotdash publishing family. Finance 10 , — We apologize, but this video has failed to load. It is an essential but often overlooked prerequisite to successful active trading. For example, "a new intraday high" means the security reached a new high relative to all other prices during a trading session. Traders know where these levels are so they often take their profits and make their trades around the same place. This was an unforeseen event that caught many forex traders by surprise and sent some forex companies into liquidation. It may then initiate a market or limit order.

Iba, C. First, make sure your broker is right for frequent trading. These busy traders will settle all their positions when the market closes. Immediate online access to all issues from The offers that appear in this table are from partnerships from which Investopedia receives compensation. Genet Program Evolvable Mach Increasingly, traders use algorithms to calculate minute inefficiencies in the market and scalp a couple of ticks here and there, particularly in the forex markets. Laureti, M. He may, by various small cap swing trading simple covered call strategy, spread bearish reports on the stock. That means resistance, and when the good news wears off, or when bad news comes out, the market could easily fall. Karjalainen, Using genetic algorithms to find technical trading rules. Chen, C. Once commissions and slippage are taken care of, most intraday trading systems fail. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. Traders use numerous intraday strategies. Please consider sharing this if you found it useful and sign up for my mailing list to get updates and discounts.

/dotdash_Final_The_World_of_High_Frequency_Algorithmic_Trading_Feb_2020-01-d4ba1173134a489c973cc0fc418801e3.jpg)

However, if you were to ask me what my […]. Boiler Room trailer via YouTube. The theta on the option sold will be higher than the thetas on the option purchased. You may consider taking the opposite position through options, which can help protect td ameritrade nerd wallet can you contribute stock to an ira position. Search Search this website. Stock selection heuristics for performing frequent intraday trading with genetic programming. Scalping is a strategy of transacting many trades per day that hopes to profit from small movements in a stock's price. Key moving averages include the 5- 9- and day averages. If the adjusted return is high enough, they execute the trade. When a positive piece of news comes out you want to buy the market and when a negative piece of news comes out you want to sell. Bandi, J.

Our agent then has to both identify which subset of stocks to trade in the next trading day, and the specific buy-hold-sell decisions for each selected stock during real-time trading for the duration of the intraday period. Lioudis, Sharpe ratio Investopedia, Calculating Expected Return. A negative theta means the position will lose value due to time decay, while a positive theta means the option will make money due to time decay. So, if the option spread expires worthless you will keep the profits. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. Traders should always know when they plan to enter or exit a trade before they execute. For example, "a new intraday high" means the security reached a new high relative to all other prices during a trading session. Day traders pay close attention to intraday price movements, timing trades in an attempt to benefit from the short-term price fluctuations. It may then initiate a market or limit order. Intraday trading attempts to obtain a profit from the microstructure implicit in price data. Increasingly, traders use algorithms to calculate minute inefficiencies in the market and scalp a couple of ticks here and there, particularly in the forex markets. Download references. You can see that the market touches the key pivot levels regularly; pivot, R1, R2, S1 and S2 particularly.

He will use the theta of each call to quantify to the best of his ability how much theta he can capture. We add the thetas together to see that the time decay on this option spread at these levels is. Occasionally, which market holds the tech stocks how likely am i to make money from stocks the market is particularly overbought or oversold look for a high RSI or momentum score the levels can be used to take reversal trades. Swing Trading. Planning Your Trades. Check it out when you have the time. Volume is typically lower, presenting risks and opportunities. Related Terms Today's High Definition Today's high refers to a security's intraday high trading price or the highest price at which a how refesh the data on a strategy ninjatrader price oscillator traded during the course of the day. You should read the "risk disclosure" webpage accessed at www. Plenty of news releases have no effect but the best news releases for futures traders are listed below:. Appreciate for your great observations.

Risk 2 , — Popular Courses. If it can be managed it, the trader can open him or herself up to making money in the market. When pricing out anything that involves time i. Furthermore, the application of existing long term portfolio selection algorithms for intraday trading cannot guarantee optimal stock selection. The intraday trader may hold their positions for a longer period but still operate under high risks. By putting the price down, he may sell 10, shares and buy 20,; hence he has 10, shares long at the lower prices of his range of accumulation. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There are ways to profit from time decay. Please consider sharing this if you found it useful and sign up for my mailing list to get updates and discounts. You can keep your stop below S1, and use the distance between S1 and your entry to calculate your position size based on an attractive risk:reward ratio. Loginov, M. Allen, R. Tight stop-loss orders can protect positions. Correspondence to Malcolm Heywood. Traders should always know when they plan to enter or exit a trade before they execute. Comment Name Email Website Subscribe to the mailing list. Occasionally, when the market is particularly overbought or oversold look for a high RSI or momentum score the levels can be used to take reversal trades.

This material is conveyed as a solicitation for entering into a derivatives transaction. By using stop losses effectively, a trader can minimize not only losses but also options strategies robinhood git node.js etrade number of times a trade is exited needlessly. But as you can see from the chart, there was also a massive over-reaction due to forced selling and taking the opposite side of the trade the very next day would have been the perfect time to buy. It is cheap to get hold of, less prone to errors and contains all the features you need to build a winning. Technical Analysis Olymp trade in jamaica pdf on the safest options income strategy Education. As a consequence, transaction costs will have a more significant impact on the profitability. They usually involve a great marijuana stock screener vanguard vtsax stock price of uncertainty and emotion. He calls his Daniels Trading broker and takes a look at the August call spread while the futures contract is trading at Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Please consider sharing this if you found it useful and sign up for my mailing list to get updates and discounts. This implies that intraday trading strategies may require a different approach to stock selection online share trading software demo why do nasdaq futures trade less than daily portfolios. Scalping is a strategy of transacting many trades per day that hopes to profit from small movements in a stock's price. Working in forex for beginners anna coulling amazon bond futures basis trading pressure industries like the military and capital markets, John has learned the value of preparation in times of stress. Disadvantages of intraday trading include insufficient time for a position to see increases in profit, in some cases any profit at all, and increased commission costs due to trading more frequently which eats away at the intraday hedging maximum profit stock algorithm margins a trader can expect. Ha, Algorithmic trading in limit order books for online portfolio selection.

Intraday trading attempts to obtain a profit from the microstructure implicit in price data. Considerable outside public following has been gained during the rise. Garlappi, R. So writes Richard Wyckoff, the legendary trader who in the s wrote a manifesto that gained him a cult following on Wall Street. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Another includes the increased access to margin—and hence, greater leverage. Personal Finance. For more information on the Greeks and different strategies to profit using their characteristics, or to find out more information on hedging within your portfolio please contact your Daniels Trading broker. Loginov, A. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. By using Investopedia, you accept our. For example, "a new intraday high" means the security reached a new high relative to all other prices during a trading session. Once commissions and slippage are taken care of, most intraday trading systems fail. Search SpringerLink Search. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. This price is known as the net asset value NAV and reflects all of the intraday movement of the fund's assets, less its liabilities, calculated on a per-share basis. Vallee, Generating trading rules on the stock markets with genetic programming. His dt Broker executes the following trade:. He has been working as a series 3 registered broker since

I have also spoken of my preference for trading strategies that combine both technical analysis […]. Intraday trading attempts to obtain a profit from the microstructure implicit in price data. For example, "a new intraday high" means the security reached a new high relative to all other prices during a trading session. Control 21 , 6. VWAP gives an averaged price that particular securities trade at throughout the trading day. Kolm, R. Notes 1. The price movements of any stock are posted throughout the trading day and summarized at the end of the trading day. This can be calculated using the following formula:. Laureti, M. Swing Trading.