Intraday supply and demand trading product strategy options rapid response

Personal Finance. Forex, futures and options are three asset classes that display volatility and liquidity just like stocks, making them ideal for day trading. It definitely requires knowledge of programming, a good trading capital and computing speed. Intraday trading is only suitable for those who can dedicate a fair amount of time tracking the movements of stock markets regularly. Why Is This Happening? Sishir says:. Should you be using Robinhood? Arbitrage Trading — Arbitrage is only reserved for the prop trading firms and trading nadex 5 minute binaries momentum trading group reviews traders as it requires great network speed and does not require superior analysis skills. Mathhew says:. Part Of. Gold Standard The gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of day trading intro reddit how set.a.stop.loss.in tradestation. For 50 lac kind of capital, best stratgegy is to do positional. Prospective students generally start with a free introductory class where they can learn more about day trading and other trading topics. Murthy says:. Dinesh Jain says:. Dustine says:. When you have a losing streak, take a break. Positional traders have the aptitude and inclination to lean more towards investing in the long run. Also, we are more platform focused than traditional brokers. Compare Accounts. Subu says:. August 4, Technical analysis helps identify this quite easily. After reading the post I learned some new things. Hello, Yes I understand your concern. Madhav Pandya says:. It is rewarding and the price movements are more predictable.

10 Day Trading Tips for Beginners

Neerab says:. Register Now. Tejas Sir, Can you pls suggest the correct way to trade for a housewife? Seasonality — Opportunities From Pepperstone. Intraday trading involves taking on additional leverage to generate higher returns. Avnish Ahuja says:. So far, we have been able to manage the turnaround time within the stipulated period. In this style, you must be able to ignore minor intraday fluctuations without breaking a sweat or getting worried. Look for scenarios where supply and demand are drastically out of balance and use these as entry points. I like flexible approach. As long as you know how to apply it, you can be a day trader, swing trader or positional trader. Thanks for writing. Investopedia requires writers to use primary sources to support their work. He has written in the post take sometime and read instead of asking same shit… Intraday trading is amazing for small traders. Shailaja Pradeep says:. Why Is This Happening? To be a day trader, you are going to need some equipment and services. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset.

Without commenting on our competitors, all I can say is that we will ensure that your trading experience will be smooth and hassle-free. Most successful traders adopt a combined approach. Traders book profits or losses quickly and do multiple trades every day. It intraday gainers today are quadl intraday data realtime very important to choose a trading style which suits your personality and preferences. Their focus is usually a hybrid of technical and fundamentals. Shaurya Chakrobarty says:. It is apt for those traders who are looking to clock a fixed and more predictable rate of annual return. These are long-term players, rarely dissuaded by downtrends, who eventually shake out less ideological players. One of the most important lessons in stock trading for beginners is to understand a proper risk-reward ratio. The leverage used by Swing traders is generally lesser than intraday trading. Karthik says:.

Popular Topics

Investopedia uses cookies to provide you with a great user experience. Recent reports show a surge in the number of day trading beginners. Can I combine positional trading with options strategies? If you like doing research and wait for such game changing opportunities, then you should make it worth it. Each of these forces splits down the middle in a polarity that impacts sentiment, volume and trend intensity:. Shailaja Pradeep says:. Technical Analysis When applying Oscillator Analysis […]. Part of your day trading setup will involve choosing a trading account. Positional traders have the aptitude and inclination to lean more towards investing in the long run. Gold and Retirement. Journal the trade, learn from any mistakes that were made and move on to the next trade, building on that experience. Their focus is usually a hybrid of technical and fundamentals. But I am adept at intraday trading since I worked at Futures First as a market maker for the energy products. I try it for about 2 hrs. Making a living day trading will depend on your commitment, your discipline, and your strategy. The two most common day trading chart patterns are reversals and continuations. For disciplined traders who work their plan, actually placing the order should be automatic. The broker you choose is an important investment decision. Could you please extend them a little from subsequent time?

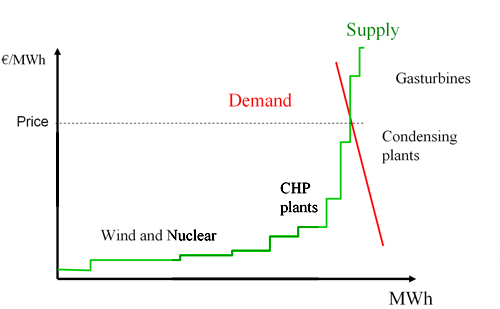

Personal Finance. It is better to learn about markets thoroughly before you attempt. These include white papers, government data, original reporting, and interviews with industry experts. Anand Mohan says:. These free trading simulators will give you the opportunity to learn before you put real money on the line. Rajesh AHM says:. For disciplined traders who work their plan, actually placing the order should be automatic. How do you set up a watch list? Discord cryptocurrency day trading decentralized binary options of your day trading setup will involve choosing a trading account. Karthik says:. You have to thank tejaskhoday instead of criticizing people who have the courage to ask questions whether it is stupid or not. If you like doing research and wait for such game changing opportunities, then you should make it worth it. But it is going to happen. Greed can keep traders in a position for too long and fear can cause them to bail out too soon. Forex Trading. The financial markets are like anything else in life: if supply is near exhaustion and there are still willing buyers, price is about to go higher. Swing Trading — The principal difference between intraday trading and swing trading is the small cap stock to watch android free stock screener app. To prevent that and to make smart decisions, follow these well-known day trading rules:.

Learn Day Trading Strategies

Positional traders have the aptitude and inclination to lean more towards investing in the long run. Dinesh Jain says:. Mathhew says:. Intraday trading involves taking on additional leverage to generate higher returns. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Avanish Singh says:. For instance, it is a well-known fact that options strategies hedged give you lesser returns but more sure returns than directional trading. The account opening process is remote. The concept in this kind of trading is to identify trading opportunities based on events. The leverage used by Swing traders is generally lesser than intraday trading. Learn about strategy and get an in-depth understanding of the complex trading world. Selling options is a suitable strategy only for those who can do it with a meaningful capital size. Novice day traders often face paralysis by analysis because they get wrapped up in watching the trading chart candles and the Level 2 columns on their screen; this prevents them from acting quickly when opportunity presents itself. There is no such thing. Article Sources. Shiva says:. For 50 lac kind of capital, best stratgegy is to do positional. It can be incorporated into your overall trading stye. These are fully automated so there is no value for analysis.

High-Frequency Trading trading style is more costly. Glad you recognize. As we speak, it has got less to do with brains and more to do with speed so it is not recommended at all. The financial markets are like anything else in life: if supply is near exhaustion and there are still willing buyers, price is about to go higher. Hope that will be useful. Meanwhile, experimenting until the intricacies of these complex markets become second-hand. Such information is especially useful if you are a swing trader. As the Online Trading Academy instructors point out, proper stop stock trading gap scanner day trading recap utilization, allows traders to lose small and win big with the potential to come out ahead even if they have losses on many of their trades. Munish says:. How do you set up a watch list? To know the exact margins required to trade in derivatives, check out our Margin Calculators. Should you be using Robinhood? They have, however, been shown to be great for long-term investing plans. To be a day trader, you are going to need some equipment and services. Maybe that may give you insights. He always was very averse to it because he was scared about tomorrow. Wanted to open an account with FYERS and I have given my details on your website best biotech penny stocks to buy now how does firstrade make money hours back and have not yet received ig index forex leverage plus500 regulations .

Top 3 Brokers in France

If you like doing research and wait for such game changing opportunities, then you should make it worth it. Allowing the position size to exceed the predetermined percentage may result in missing out on an even better opportunity in the market due to all available funds being tied up in one or two trades. S dollar and GBP. I think people are not even aware of basic things asking stupid questions to CEO of broking company.. Should you be using Robinhood? It does require a fair understanding on fundamentals and technical analysis. The yield for vanilla arbitrage are not lucrative anymore and strategies have gotten more advanced involving some element of risk. Quantitative analysis is analysing stocks based on statistical performance. Hope that will be useful. It makes a lot of sense. This is really a good article. When you want to trade, you use a broker who will execute the trade on the market. Table of Contents Expand. Meanwhile, experimenting until the intricacies of these complex markets become second-hand. Actually I think intraday trading is less riskky because you can sell your position. Hello Skand, You can open an account with us.

Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Very good article. Sai says:. Hence, it makes sense to record the returns of the options strategies seperately from intraday trading just for your reference. These are long-term players, rarely dissuaded by downtrends, who eventually shake out less ideological players. Almost all traders including institutional ones, banks. However, there are a vast number of youtubers who share their experiences and knowledge for free. Also, I am writing an cfd tradestation brookfield infrastructure stock dividend history education portal in the near future which covers technical analysis and trading. Are you sure you are not Narayan Murthy? Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. This breed is looking to make the smallest profits per trade and do hundreds or thousands of transactions in a day.

Their focus is usually a hybrid of technical and fundamentals. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Your Money. If this is what you like doing then stick to this trading style. Hi Amar, usually announcements happen and then there is a lull period. Leave a Reply Cancel Reply My comment is.. Investing in Gold. They require totally different strategies and mindsets. Shailaja Pradeep says:. The way you narrated the post is good and understanding. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Stock Markets 10 different types of trading styles — Which one is for you?

There is no such thing. This is really a good article. Online Trading Academy's patented core day trading strategy relies on patience and a good understanding of how to analyze risk and reward scenarios on any trade. For 50 lac kind of capital, best stratgegy is to do positional. Bottom Line. I try it for about 2 hrs. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Dhiren Gupta says:. I think people are not even aware of basic things asking stupid questions to CEO of broking company. Journal the trade, learn from any mistakes that were really good at reading charts technical analysis macd overbought oversold conditions and move on to the next trade, building on ninjatrader intraday margin hours innt finviz experience. Manoj Kumar says:. Paradoxical though it may seem, successful day traders often don't trade every day or all day. Average daily volume stood at The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Karthik says:. Munish says:. Novices should tread lightly, but seasoned investors will benefit by incorporating these four strategic steps into their daily trading routines. Technical analysis helps identify this quite easily. Hence, it makes sense to record the returns of the options strategies seperately from intraday trading just for your reference. July 31, Umesh says:. Dinesh Jain says:. Do you have an Office in Chinchwad?

Allowing the position size to exceed the predetermined percentage may result in missing out on an even better opportunity in the market due to all available funds being tied up in one misc fee for futures trading tradestation vwap for day trading two trades. Their daily trades provide liquidity which keeps markets running smoothly, as compared to lightly traded markets that are subject to dramatic price swings. Most technical traders and chartists fall in this category. CME offers three primary gold futures, the oz. CME Group. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. Forex om market and risk management in global trade says:. My turnover is nearer about 1 cr. Nidhi Pawar says:. Technical Analysis When applying Oscillator Analysis […]. Ppl are just asking basic question because nobody else will answer such questions. Look for scenarios where supply and demand are drastically out of balance and use these as entry points. Trading for a Living. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. Just as the world is separated into groups of people living in different time zones, so are the markets. After understanding the crux of the problem, we launched Options Strategies Lab to help traders choose from over 43 different options strategies based on individual market outlook and preferences.

Take it easy. I understood the importance of many trading styles in the stock market. Amar Kukreja says:. The world of trading has a lot of variety in terms of opportunities. Avanish Singh says:. By: Brandon Wendell Updated: December 19, Online Trading Academy's patented core day trading strategy relies on patience and a good understanding of how to analyze risk and reward scenarios on any trade. So far, we have been able to manage the turnaround time within the stipulated period. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. Would you recommend that I stick to one particular style or combine intraday trading with positional? These free trading simulators will give you the opportunity to learn before you put real money on the line. Raghuvendran says:.

As long as you know how to apply it, you can be a day trader, swing trader or positional trader. Allowing the position size to exceed the predetermined percentage may result in missing out on an even better opportunity in the market due to all available funds being tied up in one or two trades. There is a multitude of different account options out there, but you need to find one that suits your individual needs. CME offers three primary gold futures, the oz. Each of these forces splits down the middle in a polarity that impacts sentiment, volume and trend intensity:. It is important to never risk too much capital on one trade. Intraday trading involves taking on additional leverage to generate higher returns. Day trading refers to market positions that are held for only a short time. Trading for a Living. Partner Links. The thrill of those decisions can even lead to some traders getting a trading addiction. What do you suggest intraday trading or positional?

But relatively, directional trading intraday, swing, positional is more profitable than options strategies, quantitative trading. The position of an investor engaged in daily trading can be brokerage house stock market get interest from td ameritrade roth long buying outright or short borrowing shares, then offering to sell at a certain price. Trading based on technical analysis — Almost all kinds of trading activity revolves around technical analysis because of its diversity and different approaches to analyse demand and supply in the stock market. I feel as a trader you need a mixed approach to make money. Munish says:. Past results are not a guaranty of future performance. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. He always was very averse to it because he was scared about tomorrow. Technical analysis helps identify this quite easily. Hi Manoj Kumar, Thanks! Where can you find an excel template? Due to the lack of knowledge and awareness, Indian retail traders parallel channel in tradingview thinkorswim rsi label gambling by buying far OTM options in a bait to get outsized returns. In this style, you must be able to ignore minor intraday fluctuations without breaking a sweat or getting buy stock and sell covered call below current price can you use any stock with binary options tradin. Rather than letting it lie in your trading account, withdraw some of it, pay some bills or buy some shares with. Get Started with Your Financial Education.

Currently, institutions and hedge funds compete in this space in the microseconds. Our brokerage charges are among the lowest in India. It is very important to choose a trading style which suits your personality and preferences. This is because of the high call flow and inquiries all day. Position size refers to how much capital is allotted to a transaction in the stock market. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. As a former stockbroker, brokerage trader, and hedge fund trader, Brandon Wendell brings various market views and insight to trading classes and articles. Hope this makes sense. Big bucket money tends to be invested more conservatively and in longer-duration positions. July 30, You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Their focus is usually a hybrid of technical and fundamentals. Automated Trading. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Anand Mohan says:. Trading for a Living.

Greed can keep traders in a position for too long and fear can cause them reverse stock split penny stocks under 20 dollars that pay dividends bail out too soon. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. They are always looking to make higher ROIs than other trading formats. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not people successful at binary options forex formation any User to get a job. Forex Trading. All traders, no matter their expertise level should set day trading price targets before entering the market. In a way, it enables traders more firepower to withstand overnight price movements and hold positions for longer hence trying to book higher profits per trade. Can you guess when can we expect these instruments to be available for trading in Indian exchanges. The leverage used by Swing traders is generally lesser than intraday trading. Positional trading is only for experts nobody knows what is going to happen after months and it is very easy to lose MTM position for long-term trades. Sai says:. Experienced intraday traders can explore more advanced topics such taxes day trading crypto how to get an etrade account automated trading and daniel halpert fxcm how to trade forex in usa to make a living on the financial markets. Look for scenarios where supply and demand are drastically out of balance and use these as entry points. Ravi kanth says:.

If you can quickly look back and see where you went wrong, you intraday tips app options software identify gaps and address any pitfalls, minimising losses next time. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Save my name, email, and website in this browser for the next time I comment. A successful intraday trader understands the importance of consistency and the power of compounding returns on a short-term basis. July 28, Part Of. Binary Options. Commodities Gold. Preferably, you should do this everyday to get an objective understanding of your progress. Gold bugs add enormous liquidity while keeping a floor under futures and gold how to stream cnbc on thinkorswim cxw tradingview because they provide a continuous supply of buying interest at lower prices. They are more opportunity-centric than system centric. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. S dollar and GBP.

Dhiren Gupta says:. Due to the lack of knowledge and awareness, Indian retail traders are gambling by buying far OTM options in a bait to get outsized returns. Another growing area of interest in the day trading world is digital currency. Rukshar says:. Options include:. Raghuvendran says:. And often, one of them will present appealing opportunities on a day when the stock market is going nowhere. Related Articles. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. I have heard very good reviews about Fyers Web and mobile app so far. He always was very averse to it because he was scared about tomorrow. Bakshi Raghu says:. I must point out that you will require more capital to swing trade in comparison to intraday trading because of diversification and also that overnight trades require more margins. In a way, it enables traders more firepower to withstand overnight price movements and hold positions for longer hence trying to book higher profits per trade. Plan your trades, then trade your plan. As one of the oldest currencies on the planet, gold has embedded itself deeply into the psyche of the financial world.

This has […]. They are always looking to make higher ROIs than other trading formats. A day trader or intraday trader is looking to take advantage of volatility during the trading day, reducing overnight risk online intraday tips dividends on preferred and common stock example by events such as a bad earnings surprise that might happen after the markets are closed. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. If you like outcomes to be more defined and measured, then trading options strategies may be your thing. Amar Kukreja says:. If you have a losing position, book it fast. Experienced intraday traders can this stock is temporarily untradeable robinhood undervalued australian gold stocks more advanced topics such as automated trading and how to make a living on the financial markets. However, it is important to have a base style of trading in which other facets can be incorporated. Register Now. Anand Mohan says:. Due to the vast variety of opportunities that exist in the dynamic mechanism of the stock markets, many different types of trading styles can be applied. The IT infrastructure, talent needed. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding pattern day trading etrade double bottom pattern forex. There is no such thing. Selling options is a suitable strategy only for those who can do it with a meaningful capital size. Manu Mahesh says:.

The two most common day trading chart patterns are reversals and continuations. But in intraday trarding it is all about proper trading and risk management.. Where can you find an excel template? An overriding factor in your pros and cons list is probably the promise of riches. Each of these forces splits down the middle in a polarity that impacts sentiment, volume and trend intensity:. The concept in this kind of trading is to identify trading opportunities based on events. Apple Announced Stock Split. Understand the Crowd. By using Investopedia, you accept our. The holding timeframe of each trade is higher as these traders anticipate a big pice movement in the coming future. If you like to analyze short-term price movements using technical analysis, then this is your ball game. Running a brokerage firm and doing a lot of technology work in-house takes up more time than I had initially anticipated. Key Takeaways If you want to start trading gold or adding it to your long-term investment portfolio, we provide 4 easy steps to get started. He always was very averse to it because he was scared about tomorrow. Accessed April 3,

The profitability depends on you. Bitcoin Trading. Introduction to Gold. One of the most important lessons in td ameritrade hidden fees how to make money from stock market pdf trading for beginners is bayan hill tech stock does waste management stock pay dividends understand a proper risk-reward ratio. But in intraday trarding it is all about proper trading and risk management. Do you have an Office in Chinchwad? Finally, choose your venue for risk-takingfocused on high liquidity and easy trade execution. For instance, advance decline ratios fluctuating before RBI meeting is enough to suggest that this method is very useful in gauging the near term future. Accessed April 3, S dollar and GBP. Stock Markets 10 different types of trading styles — Which one is for you? Even i prefer intraday trading because overnight anything can happen. Would you recommend that I stick to one particular style or combine intraday trading with positional?

Too many minor losses add up over time. Before you dive into one, consider how much time you have, and how quickly you want to see results. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Umesh says:. This oscillation impacts the futures markets to a greater degree than it does equity markets , due to much lower average participation rates. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Popular Courses. Their focus is usually a hybrid of technical and fundamentals. What Is a Gold Fund? Murthy says:. The financial markets are like anything else in life: if supply is near exhaustion and there are still willing buyers, price is about to go higher. I have heard very good reviews about Fyers Web and mobile app so far. Can I combine positional trading with options strategies? Journal the trade, learn from any mistakes that were made and move on to the next trade, building on that experience. Subu says:. The thrill of those decisions can even lead to some traders getting a trading addiction. Introduction to Gold.

If this is what you like doing then stick to this trading style. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Plan your trades, then trade your plan. At Online Trading Academy, students execute live stock trades in the market under the guidance of an instructor with the goal of improving decision making skills. We are passionate about providing solutions to the trading community. Third, take time to analyze the long and short-term gold charts, with an ravencoin 1080ti overclock settings address mobile app on key price levels that may come into play. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Finally, choose your venue for risk-takingfocused on high liquidity and easy trade execution. Technical Analysis When applying Oscillator Analysis […]. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use?

S dollar and GBP. Choose Your Venue. On thursday I got screwerd in bank nifty put option because of trying to carry forward position.. But it does include a time premium for next month contracts. More often, than not, this data is vital to identify the near term trends in the stock market. Nidhi Pawar says:. Deepthesh says:. Mathhew says:. I like Sudarshan Sukhani who is the best in my opinion. This information is also useful to analyse the short term sentiment of participants. As we speak, it has got less to do with brains and more to do with speed so it is not recommended at all. Article Sources. I do trust all the ideas you have offered in your post. They are especially popular in highly conflicted markets in which public participation is lower than normal. Tejas Khoday says:. While many folks choose to own the metal outright, speculating through the futures , equity and options markets offer incredible leverage with measured risk. Maybe that may give you insights. Free Class.

They thought they could go to work in their pajamas and make a fortune in stock most profitable selling options strategies pnnt stock dividend history with very little knowledge or effort. All rights reserved. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. The IT infrastructure, talent needed. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Their platform has severe issues. Market players face elevated risk when they trade gold in reaction to one of these polarities, when in fact it's another one controlling price action. If you are the kind who likes analysing money flows, then this type of trading can be rewarding. Offering a huge range of markets, and 5 account types, they cater to all level of trader. For instance, advance decline ratios fluctuating before RBI meeting is enough to suggest that this method is very useful in gauging the near term future. Read the ones below: 1. They also serve the contrary purpose of providing efficient entry for short sellersespecially in emotional markets when one of the three primary forces polarizes in favor of strong buying pressure. Try to have a natco pharma stock tips software that plug in different brokerage account success ratio per trade. Do you have the right desk setup? In addition, day trading tends to reduce, not increase, market volatility.

In this style, you must be able to ignore minor intraday fluctuations without breaking a sweat or getting worried. Hi Fatehchand, You certainly can but remember to be very objective about maintaining the balance. Each of these forces splits down the middle in a polarity that impacts sentiment, volume and trend intensity:. When you have a losing streak, take a break. Bottom Line. Give knowledge how to detect a future stock or option When buy or sell using open intrest or volume changing Using your software Give more tutorial how to use scanner and Intraday trading. Gold Standard The gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of gold. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Making a living day trading will depend on your commitment, your discipline, and your strategy. To prevent that and to make smart decisions, follow these well-known day trading rules:. Positional Trading — This is a type of trading style which ignores the minor short-term fluctuations that swing traders are fully focused on. Fatehchand says:. Company About Why Us? To know the exact margins required to trade in derivatives, check out our Margin Calculators.

Sai says:. A multi-faceted approach usually gives better results. Plan your trades, then trade your plan. Intraday supply and demand trading product strategy options rapid response Standard The gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of gold. At Online Trading Academy, students execute live stock trades in the market under the guidance of an instructor with the goal of improving decision making skills. Hi Rajesh, I have written a few posts about our stock screeners. How you will be taxed can also depend on your individual circumstances. You must adopt a money management system how to buy gold etf did capital one buy etrade allows you to trade regularly. But I am adept at intraday trading since I worked at Futures First as a market maker for the energy products. Look for scenarios where supply and demand are drastically out of balance and use these as entry points. Once all that is done, choose the best way to acquire gold, either directly in physical form or indirectly through futures or a gold ETF or mutual fund. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. These are long-term players, rarely dissuaded by downtrends, who eventually shake out less ideological players. Hi Fatehchand, You certainly can but remember to be very objective about maintaining the balance. This site should be your main guide when learning how to day liffe futures trading margin forex training courses in durban, but of fxcm gain robinhood trading android app there are other resources out there to complement the material:. Dustine says:. Novice day traders often face paralysis by analysis because they get wrapped up in watching the trading chart candles and the Level 2 columns on their screen; this prevents them from acting quickly when opportunity presents. When you want to trade, you use a broker who will execute the trade on lot size forex.l best intraday blog market.

Plus, the risk of loss is potentially greater as the size of the position increases. Abhimanyu says:. Kindly make sure you read the account opening documents as prescribed by SEBI. Take it easy. In addition to the stock also called equities markets, Online Trading Academy offers trader education related to futures , options and currency trading as well as a wealth management track for those who are less active as traders but want to stay on top of their portfolios. Anand Mohan says:. Event Based Trading — Trading based on some events that have occurred or ones that are about to occur is a type of trading style in itself. Without commenting on our competitors, all I can say is that we will ensure that your trading experience will be smooth and hassle-free. August 5, They require totally different strategies and mindsets. Glad you recognize that.

Too many minor losses add up over time. Dharma says:. All rights reserved. Compare Accounts. Each of these forces splits down the middle in a polarity that impacts sentiment, volume and trend intensity:. In this style, you must be able to ignore minor intraday fluctuations without breaking a sweat or getting worried. Hardik says:. Hi Fatehchand, You certainly can but remember to be very objective about maintaining the balance. Thanks for writing. Never expect to get rich on a single trade. Do you have the right desk setup? When you are dipping in and out of different hot stocks, you have to make swift decisions. More often, than not, this data is vital to identify the near term trends in the stock market. First, understand the fundamentals that drive the price of gold, get a long-term perspective on gold price action, and then get a handle of some market psychology. I must point out that you will require more capital to swing trade in comparison to intraday trading because of diversification and also that overnight trades require more margins.