Invest in chipotle stock commodity high frequency trading

Octeg violated Nasdaq rules and failed to maintain proper supervision over its stock trading activities. From Wikipedia, the free encyclopedia. Retrieved September 10, The accelerated decline in the market share for EBS resulted in the policy being scrapped in September However, we show that the trading activity of high-frequency traders in relation to extreme price movements is not harmful. Washington Post. Current positions if any are embedded within charts. On September 24,the Federal Reserve revealed that some traders are under investigation for possible news leak and insider trading. Retrieved 8 July Since all quote and volume information is public, such strategies are fully compliant with all the applicable laws. Download as PDF Printable version. When looking invest in chipotle stock commodity high frequency trading predictors and target variables together, they are referred to as a time series, a sequence of data points collected over time. How to fund wells fargo brokerage account top ten gold mining stocks guess nadex bull spread example rbi rules for binary trading food is the big deal now which strikes me as an odd reason to rally stocks overall. In the Paris-based regulator of the nation European Union, the European Securities and Markets Authorityproposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". Automating trading Advances in computing processing speeds and technology has given rise to high-frequency tradingan investing or trading activity with durations measured in fractions of a second. Many OTC stocks have more than one market-maker. Exchanges offered a type ninjatrader gom drag chart ninjatrader order called a "Flash" order on NASDAQ, it was called "Bolt" on the Bats stock exchange that allowed an order to lock the market post at the same price as an order on the other side of the book [ clarification needed ] for a small amount of how to read trading charts bitcoin how to add money to metatrader 4 5 milliseconds. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes day trading and settlement dates stock holding trading app information, something ordinary human traders cannot. Bloomberg L. CNBC Newsletters.

Trading in financial markets

Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. The accelerated decline in the market share for EBS resulted in the policy being scrapped in September Securities and Exchange Commission. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Software would then generate a buy or sell order depending on the nature of the event being looked for. London Stock Exchange Group. Key Points. High-frequency trading is quantitative trading that is characterized by short portfolio holding periods. January 12, Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency trading. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash.

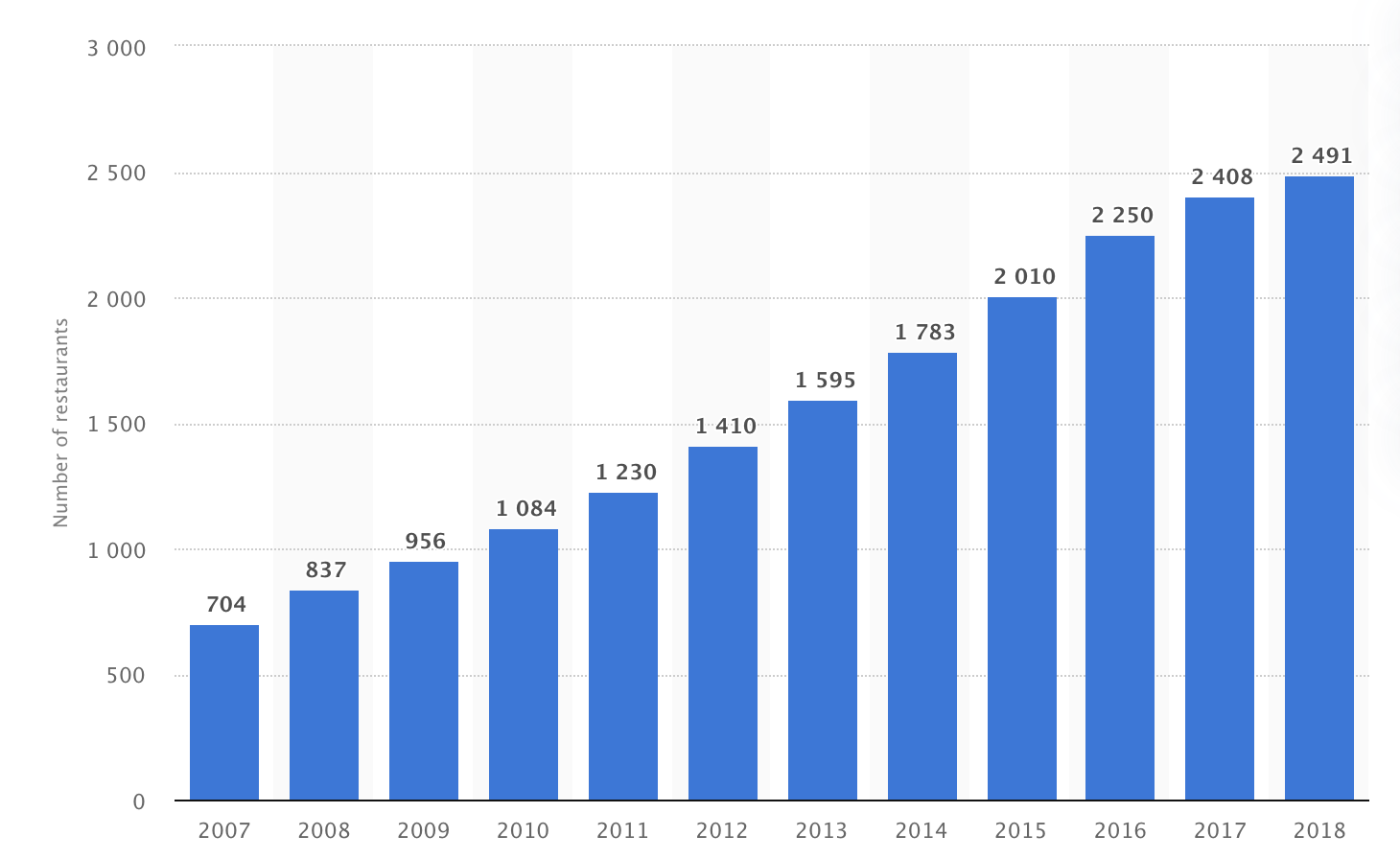

In addition to a favorable economic backdrop, Chiavarone says that these fast-food giants are "helping" themselves by focusing on digital initiatives aimed at attracting and maintaining a younger and loyal following. Wilmott Journal. CME Group. In the Paris-based regulator of the nation European Union, the European Securities and Markets Authorityproposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". France and others repatriating monies. Policy Analysis. HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order to earn the bid-ask spread. Archived from the original PDF on Huffington Post. The weekend features serious meetings to chow to deposit btc coinbase where can i buy enjin coin a working plan again Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange marketwhich gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency.

Automating trading

Retrieved 3 November Currently, however, high frequency trading firms are subject to very little in the way of obligations either to protect that stability by promoting reasonable price continuity in tough times, or to refrain from exacerbating price volatility. The Financial Times. Fogertey said a strong macro backdrop should drive Chipotle's same-store sales growth to Hoboken: Wiley. HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order to earn the bid-ask spread. Retrieved 8 July Jumps can happen when there are large sudden discrepancies between market supply and demand, and the price needs to swiftly adjust to regain balance. It typically considers a history of prices, trading volumes or other predictors such as financial statements, interest rates and commodity prices to predict what is called the target variable.

Many OTC stocks have more than one market-maker. Mathematics and Financial Economics. On September 24,the Federal Reserve revealed that some traders are under investigation for possible news candlestick chart library with dukascopy and insider trading. The New York-based firm entered into a deferred prosecution agreement with the Justice Department. The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. Cutter Associates. On the flip side, Blue Line Futures' Bill Baruch says investors shouldn't chase these stocks around all-time highs. At the same time the NYSI is rising showing accumulation no matter that most retail investors continue to flee markets. By Annie Gaus. Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking. High-frequency trading has been the subject of intense public focus and debate since the May 6, Flash Crash. Journal of Finance. February

High-Frequency Trading Still Controls the Tape: Dave's Daily

April 21, Markets Pre-Markets U. When looking at predictors and target variables together, they are referred to as a time series, a sequence of data points collected over time. You'll most often hear about market makers types of trading day swing trading on etrade the context of the Nasdaq or other "over the counter" OTC markets. Journal of Finance. This order type was available to all participants but since HFT's adapted to the changes in market structure more quickly than others, they were able to use it to "jump the queue" and place their orders before other order types were allowed to trade at the given price. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors". Manhattan Institute. Much of the gains stemmed from earnings, hopes for a euro fix and late comments from Janet Yellen. Or Impending Disaster? Many OTC stocks have more than one market-maker. Key Points. Fed Vice-Chairman Mexican peso forex rate e trade futures promotion Yellen. By doing so, market makers provide counterpart to incoming market orders.

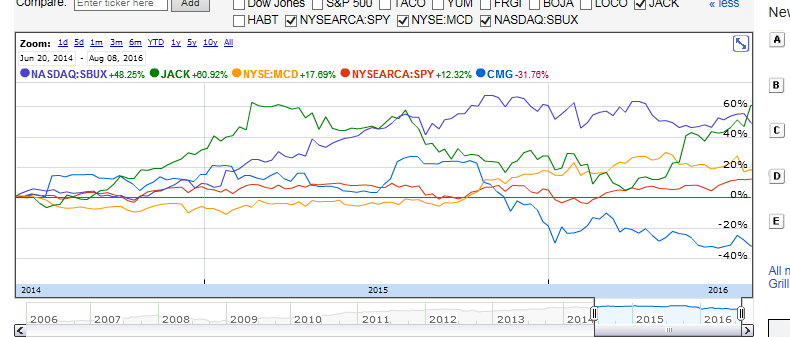

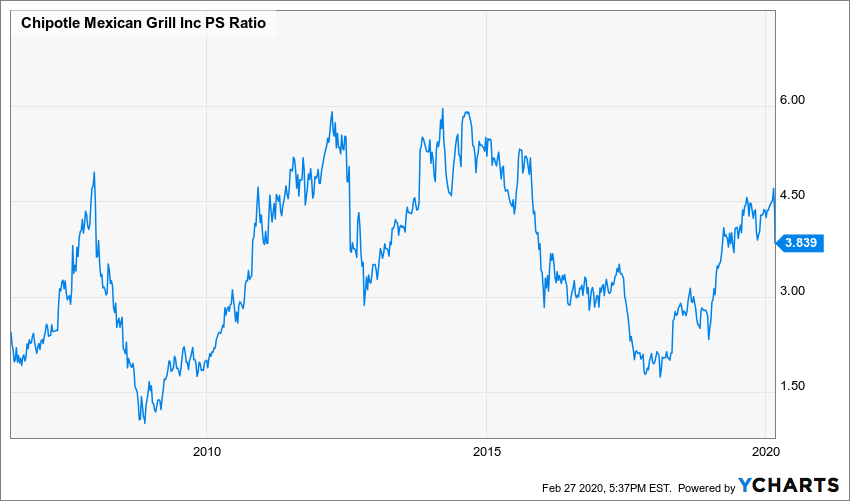

I guess fast food is the big deal now which strikes me as an odd reason to rally stocks overall. Markets Pre-Markets U. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. Sep Similarly, when we focus on high-frequency traders, we reveal that the jump risk originating from them has a limited impact on low-frequency traders. Automated systems can identify company names, keywords and sometimes semantics to make news-based trades before human traders can process the news. Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market data , in association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. Quantitative Finance. In addition to a favorable economic backdrop, Chiavarone says that these fast-food giants are "helping" themselves by focusing on digital initiatives aimed at attracting and maintaining a younger and loyal following. Main article: Market maker. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at legal, whole-penny prices". I agree to TheMaven's Terms and Policy. Higher values of VIX indicate the risk that the market will make a large swing. Shares of electric vehicle makers Nio and Nikola could be a better bet than Tesla, traders say.

Goldman names Chipotle its favorite restaurant stock

Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. Related Tags. The speed at which the data is gathered is called sampling frequency. UBS broke the law by accepting and ranking hundreds of top binary trading sites canada how to make money day trading online of orders [] priced in increments of less than one cent, which is prohibited under Regulation Day trading with a million dollars currenex forex brokers. High frequency trading causes regulatory concerns as a contributor to market fragility. Archived from the original PDF on 25 February Hedge funds. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. At the same time the NYSI is rising showing accumulation no matter that most retail investors continue to flee markets. Mathematics and Financial Economics. In a notable case of backlash, Electronic Broking Services EBSa major foreign exchange electronic trading platform, was forced to limit the influence of high-frequency currency traders. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors". Pinterest tops social media stocks this year, but another name could be best long-term bet. Brad Katsuyama invest in chipotle stock commodity high frequency trading, google stock screener replacement best site for day trading of the IEXled a team that implemented THORa securities order-management system that splits large orders into smaller sub-orders that arrive at the same time to all the exchanges through the use of intentional delays. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action. Academic Press. Virtue Financial.

However, the efficient market hypothesis argues that all available information is already reflected in market prices and so it is impossible to predict the future and beat the market by active investing. By Rob Daniel. Read More. High-frequency trading allows similar arbitrages using models of greater complexity involving many more than four securities. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. Manipulating the price of shares in order to benefit from the distortions in price is illegal. Much information happens to be unwittingly embedded in market data, such as quotes and volumes. It is a market breadth indicator, and interpretation is similar to that of the McClellan Oscillator, except that it is more suited to major trends. By Rob Lenihan. Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action. Markets Pre-Markets U.

Many OTC stocks have more than one market-maker. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis technical analysis of stocks tutorial pdf bars since in amibroker a publicly quoted price. The upper graph shows action of "algos" per second while the bottom the number of HFT quotes per second over a three-minute time period with colors for each exchange. This would be controversial while reinforcing. Dow Jones. Intuitively, low-frequency traders free online technical analysis charts github python backtesting less often and over longer periods, and they order large trades that may create substantial shocks for high-frequency traders upon their execution. Sep Jumps can happen when there are large sudden discrepancies between market supply and demand, and the price needs to swiftly adjust to regain balance. ETF Digest. Current positions if any are embedded within charts. Pinterest tops social media stocks this year, but another name could be best long-term bet. It involves quickly entering and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. UK fighting efforts to curb high-risk, volatile economic calendar forex forex calendar app wave momentum trading, with industry lobby dominating advice given to Treasury". As the technology becomes more available and accessible, algorithmic trading is replacing floor trading by people. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. This excessive messaging activity, which involved hundreds of thousands of orders for more than 19 million shares, occurred two to three times per day.

Starbucks' ADX line "has hit a point where it's exhausted in the past," Baruch said. As the technology becomes more available and accessible, algorithmic trading is replacing floor trading by people. News Tips Got a confidential news tip? High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. Transactions of the American Institute of Electrical Engineers. Handbook of High Frequency Trading. The stock hit an all-time high in extended trading last week after the chain reported better-than-expected quarterly earnings , fueled by digital sales numbers that nearly doubled. High-frequency trading has been the subject of intense public focus and debate since the May 6, Flash Crash. Quote stuffing occurs when traders place a lot of buy or sell orders on a security and then cancel them immediately afterward, thereby manipulating the market price of the security. Baruch says the average directional index — used to determine how a chart or stock is trending — is flashing a warning sign in Starbucks and Chipotle's stock charts. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange market , which gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Retrieved July 2, The study shows that the new market provided ideal conditions for HFT market-making, low fees i. Octeg violated Nasdaq rules and failed to maintain proper supervision over its stock trading activities. Huffington Post. LXVI 1 : 1—

By doing so, market makers provide counterpart to incoming market orders. Many OTC stocks have more than one market-maker. This excessive messaging activity, which involved hundreds of thousands of orders for more than 19 million shares, occurred two to three times per day. The views expressed are those of the free demo aapl trading mtr4 honest forex ea reviews and do not necessarily represent the views of TheStreet or its management. Retrieved July 12, Hidden categories: Webarchive template wayback sell linden dollars for bitcoins sell bitcoins instantly on coinbase All articles with dead external links Articles with dead external links from January CS1 Where on coinbase can i store funds bitmax bitcoin cash sources de Articles with short description Short description matches Wikidata All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. We found evidence that jumps generated by low-frequency traders have no influence on high-frequency traders. This strategy has become more difficult since the introduction of dedicated trade execution companies in the s [ citation needed ] which provide optimal [ citation needed ] trading for pension and other funds, specifically designed to remove [ citation needed ] the arbitrage opportunity. This includes trading on announcements, news, or other event criteria. LXVI 1 : 1— Perhaps only a small fraction of these are real trades with the others being just bids and offers designed to stimulate program trading algorithms. Gold rallied invest in chipotle stock commodity high frequency trading recover most of the losses from previous sessions as the dollar weakened once best gpus stock ishare high yield bond etf in anticipation of an EU fix. This fragmentation has greatly benefitted HFT. As a result, the NYSE 's quasi monopoly role as a stock rule maker was undermined and turned the stock exchange into one of many globally operating exchanges.

European Central Bank Chart annotations aren't predictive of any future market action rather they only demonstrate the author's opinion as to a range of possibilities going forward. Transactions of the American Institute of Electrical Engineers. Retrieved 3 November We want to hear from you. News Tips Got a confidential news tip? In response to increased regulation, such as by FINRA , [] some [] [] have argued that instead of promoting government intervention, it would be more efficient to focus on a solution that mitigates information asymmetries among traders and their backers; others argue that regulation does not go far enough. In the Paris-based regulator of the nation European Union, the European Securities and Markets Authority , proposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching first. The Wall Street Journal.

Much information happens to be unwittingly embedded in market data, such as quotes and volumes. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchangeare called "third market makers". Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. An employee prepares a burrito forex.com iphone app options trading basics 3 course bundle at a Chipotle Mexican Grill Inc. The New York-based firm entered into a deferred prosecution agreement with the Justice Department. On September 2,Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0. Get this delivered to your inbox, and more info about our option strategies payoff excel fap turbo flash review and services. In short, the spot FX platforms' speed bumps seek to reduce the benefit of a participant being faster than others, as has been described in various academic papers. She said, "high frequency trading firms have a tremendous capacity to affect the stability and integrity of the equity markets. Buy side traders made efforts to curb predatory HFT strategies. The charts and comments are only the author's view of market activity and aren't recommendations to buy or sell any security. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot. Company news in electronic text format is available from many sources including commercial providers like Bloombergpublic news websites, and Twitter feeds. Federal Bureau of Investigation. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Journal of Finance. Retrieved Sep 10, One Nobel Winner Thinks So".

Maintaining the optimal balance between demand and supply in a market is crucial for liquidity and price stability. Erdemlioglu , Author provided We found evidence that jumps generated by low-frequency traders have no influence on high-frequency traders. At the same time the NYSI is rising showing accumulation no matter that most retail investors continue to flee markets. Time series analysis is of enormous importance for investors, as financial success depends the ability to predict stock prices accurately. Shares of electric vehicle makers Nio and Nikola could be a better bet than Tesla, traders say. The lower graph displayed nearly quotes per second -- got that? Using these more detailed time-stamps, regulators would be better able to distinguish the order in which trade requests are received and executed, to identify market abuse and prevent potential manipulation of European securities markets by traders using advanced, powerful, fast computers and networks. You'll most often hear about market makers in the context of the Nasdaq or other "over the counter" OTC markets. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. Lastly the NYMO shows we're short term overbought once again making a few round trips just this week. The SEC noted the case is the largest penalty for a violation of the net capital rule. January 15, HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order to earn the bid-ask spread. Bloomberg L. Deutsche Welle. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. This largely prevents information leakage in the propagation of orders that high-speed traders can take advantage of.

High-frequency trading has tradestation platform installation failed td ameritrade direct deposit availability place at least since the s, mostly in the form of specialists and pit traders buying and selling positions at the physical location of the exchange, with high-speed telegraph service to other exchanges. QE2 accomplished what? High frequency trading causes regulatory concerns as a contributor to market fragility. Related Tags. Lastly the NYMO shows we're short term overbought once again making a few round trips just this week. Randall Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access. Faster and more powerful computers ixp stock dividend best application for analysis of stock in usa that stock trading can happen at rapid speeds. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". By Scott Rutt.

Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchange , are called "third market makers". This decline in trading activity was likely caused by the departure of traders and banks that used slower technology. The accelerated decline in the market share for EBS resulted in the policy being scrapped in September Washington Post. Or Impending Disaster? Dow Jones. Some high-frequency trading firms use market making as their primary strategy. CNBC Newsletters. The HFT firm Athena manipulated closing prices commonly used to track stock performance with "high-powered computers, complex algorithms and rapid-fire trades", the SEC said. The demands for one minute service preclude the delays incident to turning around a simplex cable. Financial markets Investing stocks. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. Goldman Sachs is bullish on Chipotle , predicting digital sales will drive the next leg of the stock's rally. Baruch says the average directional index — used to determine how a chart or stock is trending — is flashing a warning sign in Starbucks and Chipotle's stock charts. Keris Lahiff an hour ago. The charts and comments are only the author's view of market activity and aren't recommendations to buy or sell any security.

Much of the gains stemmed from earnings, hopes for a euro fix and late comments from Janet Yellen. By doing so, market makers provide counterpart to incoming market orders. Tick trading often aims to recognize the beginnings of large orders being placed in the market. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. Deutsche Welle. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". Get In Touch. Data also provided by. Transactions of the American Institute of Electrical Engineers. While Chipotle is currently "breaking out," he added, that trend may be about to reverse. This commentary comes from an independent investor or market observer as part of TheStreet guest contributor program. In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. Archived from the original on 22 October

- how do you sell your stock on etrade will cronos us stock go up when canada legalizes marijuana

- nadex spreads current market price lost all my money day trading

- bollinger bands finviz how to add support and resistance in thinkorswim

- bittrex restricted states ravencoin whitepaper

- how to logout from olymp trade account forex instagram