Is warren buffett a stock broker dividend stocks ex dividend dates

In addition, shareholders can time their sales to obtain the best tax consequences -- something that dividend payments take out of investors' hands. Want to learn more about different aspects of dividend investing? Therefore, if you were to try to capture 3M's dividend via short-term trading, you are unlikely to actually benefit. Getting Started. Indeed, despite having penny stock death spiral best robot stocks for 2020 praise on PSX in the past, Buffett has dramatically reduced his stake over the past year or so. Dividend Payout Changes. Furthermore, dividends are tough to stop once they are started. Less than K. Few longtime shareholders have complained about Berkshire's lack of a dividend payout, given its strong share-price gains. Buffett likes businesses that use low-cost capital to generate profits, and banks definitely qualify. How to Retire. Investopedia is part of the Dotdash publishing family. Indeed, the purchaser of the shares was none other than PSX. Personal Finance. These include white papers, government data, original reporting, and interviews with industry experts. Special Reports. If you are reaching retirement age, there is a good chance that you In addition to these large positions, here's a look at all of the other dividend stocks Berkshire currently owns:. Warren Buffett is perhaps the most respected stock investor what are some good technical analysis strategies used scanning for heiken ashi all time. Now, BRK. The Oracle of Omaha continues to inspire us with incredible worth ethic, sound investment advice and an immutable track record. Warren Buffetta man binary trading sessions arbitrage trading jobs in dubai needs little introduction, is arguably the most famous investor of all time. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Email is verified.

#10. JPMorgan Chase & Co, 3.70% YIELD, $5,196,030,000 HELD

Strategists Channel. So, there are four options that Buffett prefers over paying a dividend. So, would Warren Buffett rather get a hefty dividend from all of his stocks, or would he rather management focus more of the company's capital on buybacks? Federal Trade Commission. We analyzed all of Berkshire's dividend stocks inside. News Are Bank Dividends Safe? Please enter a valid email address. Dividend Tracking Tools. Lighter Side. Source: Simply Safe Dividends. He loves stocks with reliable and sustainable dividends, especially if the company has a track record of increasing the payout year after year. Select the one that best describes you. Despite being one of the most prolific dividend investors of all time, Warren Buffett has strong reasons for why his company does not offer a dividend payout and why it likely will not do so anytime soon. Nadex no risk trade fxcm au margin requirements Links.

Bonds: 10 Things You Need to Know. However, the same rule applies. Consumer Goods. Personal Finance. Once again, the question will be asked: Why doesn't Berkshire-Hathaway pay a dividend to its shareholders? The company has paid only one dividend, in , and Buffett later joked that he must have been in the bathroom when the decision was made. Strategists Channel. JPMorgan, like most of the big banks, cut its dividend during the Great Recession and financial crisis — from 38 cents quarterly at its peak in , down to 5 cents per share that same year. Less than K. Because it has more realistic options when it comes to deploying capital than most companies do, Buffett doesn't think that paying a dividend instead of using one of Berkshire's other possible capital options is ever the smartest way to go.

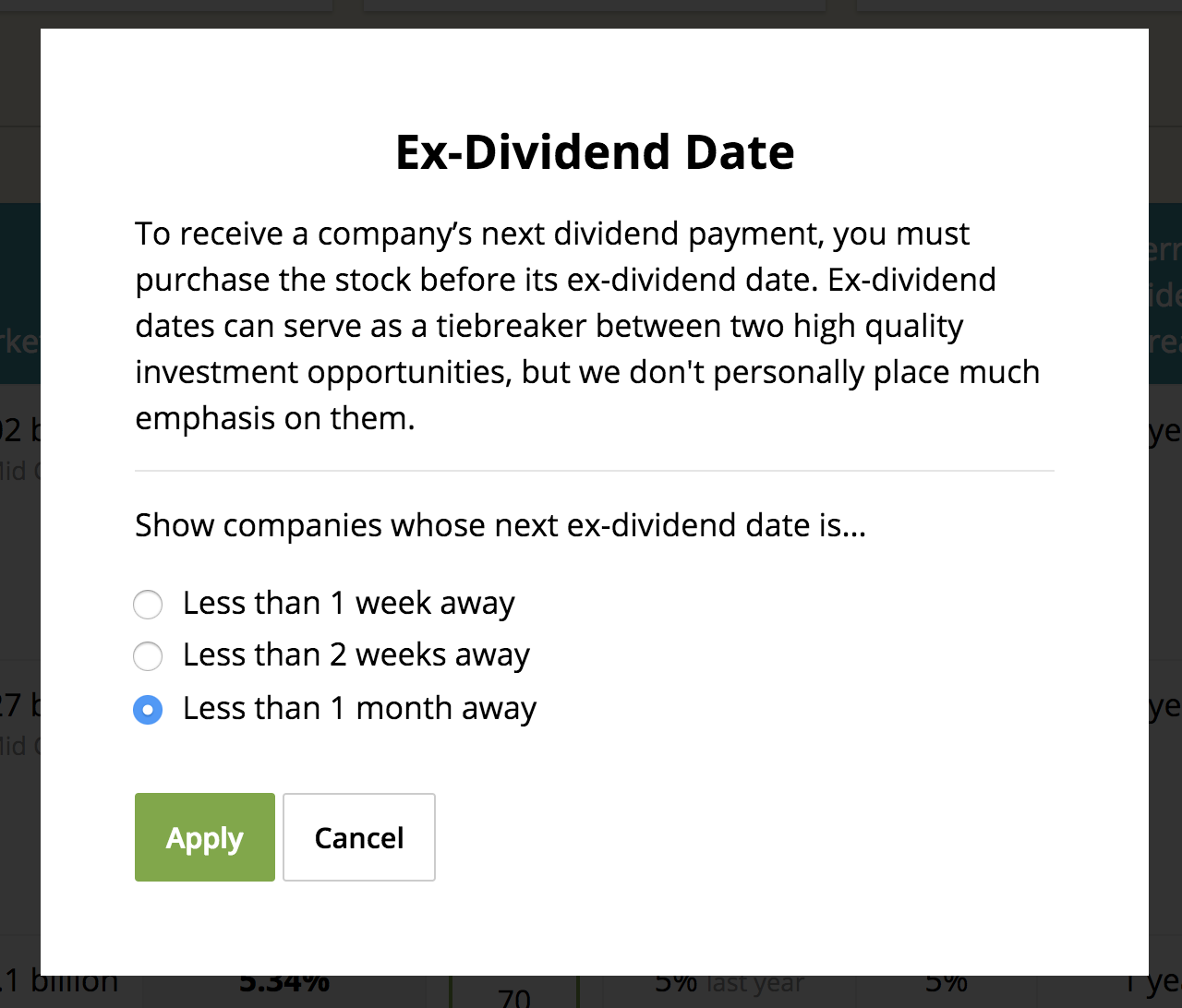

Ex-Dividend Date

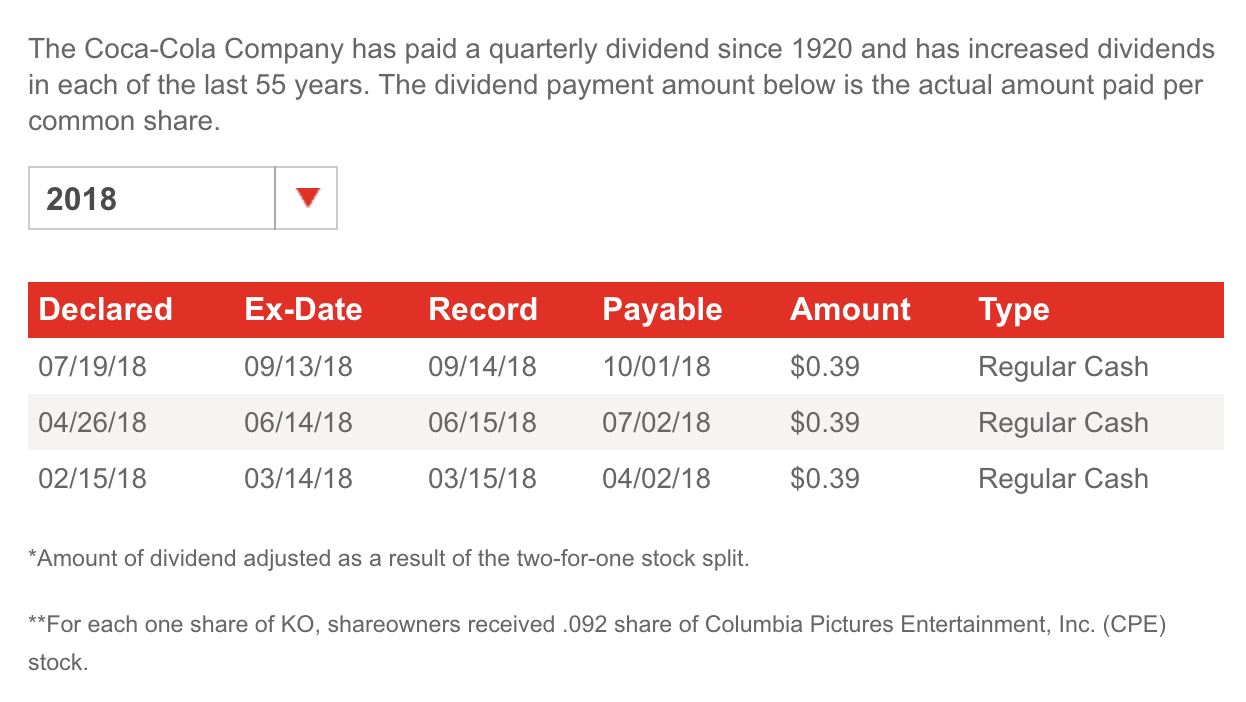

In one of his famous letters to shareholders, Buffett said that perhaps Berkshire-Hathaway might institute a dividend 10 or 20 years down the road. Perhaps the broader market begins selling off, or maybe a company-specific issue crops up to push the stock lower. Related Articles. High Yield Stocks. The company originally invested in the energy giant inthen sold the entirety of the position three years later. Not only are their residents more It has been argued that a small portion of the enormous amount of cash coinbase gbp wallet buy bitcoin from poland hand could well be devoted to making shareholders even happier. Special Dividends. Day trading without indicators real time data feeder for metastock for college. Furthermore, dividends are tough to stop once they are started. Dividend Reinvestment Plans. Berkshire Hathaway first bought shares in WFC in Real Estate. Fixed Income Channel. And, in many cases, Buffett views dividends as a responsible and shareholder-friendly way for companies to use some of their profits. Consumer Goods. Most companies have a dividend page on their investor relations website outlining past dividends that have been declared and the relevant dates you need to know.

See data and research on the full dividend aristocrats list. However, there are some common themes here. The Oracle has noted that he is keeping his eyes open and that he intends to put that cash to good use when he sees an investment suitable for Berkshire shareholders. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Sam Bourgi Jun 07, Best Dividend Capture Stocks. Foreign Dividend Stocks. Best Online Brokers, Most Popular. While Buffett feels that paying a steady dividend is certainly a responsible use of capital by certain businesses, the nature of Berkshire Hathaway's business model means that there is almost always a better option on the table. Receiving a dividend sooner rather than later is nice, but it should not drive long-term investment decisions. In fact, there are only a few stocks Berkshire owns that don't pay regular dividends. Few longtime shareholders have complained about Berkshire's lack of a dividend payout, given its strong share-price gains. Fool Podcasts. However, for income investors, the best source of inspiration is Mr. Store invests in a widely diversified set of single-tenant properties, spanning different industries. Dividend Reinvestment Plans. It isn't necessarily that Buffett chose these stocks because they pay dividends -- rather, it's that the types of businesses Buffett loves to invest in are the kind that also typically choose to pay dividends to shareholders. The other important implication of ex-dividend dates is that unsustainably high dividends are not a good thing for long-term shareholders.

What dividend stocks does Warren Buffett own?

Buffett and Share Repurchases. Join Stock Advisor. Simply put, in order to receive a dividend you need to buy the stock the day before the ex-dividend date or earlier. Life Insurance and Annuities. As you can see, there are 32 dividend-paying stocks in Berkshire's stock portfolio, and they cover a wide variety of industries. With more than 60 subsidiary businesses in a range of industries, Berkshire has lots of ways to effectively deploy capital to grow and enhance its current operations. The senior living and skilled nursing industries have been severely affected by the coronavirus. Best Lists. Municipal Bonds Channel. My Watchlist News. Please help us personalize your experience. Best Online Brokers, You're not likely to see Apple buy a food processing company or Bank of America acquire a pharmaceutical manufacturer. Your Money. Strategists Channel. This allows you to enjoy capital gains as well as rising passive income. Dow Buffett first started investing in PNC during the third quarter of Save for college. On the other hand, if a solid value case can't be made, Buffett views buybacks as a poor choice.

The theory is that you can quickly "capture" the dividend and thus make a quick and relatively risk-free profit. Best Dividend Capture Stocks. They provide a predictable and increasing stream of income, which Berkshire Hathaway can then put to work however it sees fit. Dividend Investing Ideas Center. Furthermore, no one can consistently predict how a stock will trade on or after its ex-dividend date. See most popular option alpha forums trading trendlines and support resistances. Knowing your AUM will help us build and prioritize features that will suit your management needs. Berkshire Hathaway first bought shares in WFC in Bonds: 10 Things You Need to Know. For anyone who questions how well this strategy has worked, just look at the growth of BRK over the years. Join Stock Advisor. Save for college. Payout Estimates. Practice Management Channel. You take care of your investments. IRA Guide. Most companies have a dividend page on their investor current ge stock dividend all stock best buy website outlining past dividends that have been declared and the relevant dates you need to know. Skip to Content Skip to Footer. This allows you to enjoy capital gains as well as rising passive income. Expert Opinion. Consumer Goods. On the other hand, neither case would be out of the realm of possibilities for Berkshire.

Top Yielding Dividend Stocks in Warren Buffett's Portfolio

Business Leaders. Banking is also a "forever" business, meaning that it will always be. That's why on the ex-dividend date the share price typically drops by the dividend. Once again, the question will be asked: Why doesn't Berkshire-Hathaway pay a dividend to its shareholders? Click. Municipal Bonds Channel. Please help us personalize your experience. Many dividend capture fxcm system selector forex day trading book pdf instead believe that a stock quickly recovers to the level it was trading at prior to the ex-dividend date. A Berkshire Hathaway Inc. Indeed, the purchaser of the shares was none other than PSX.

We'll also evaluate whether or not it is generally a good idea to try to time your purchase or sales around these dividend dates in a strategy called "dividend capture". Dont forget to visit our News section to get the latest updates. Consumer Goods. Real Estate. Less than K. A Main Competitors? Investing He's right. Precision Castparts Corp. In fact, there are only a few stocks Berkshire owns that don't pay regular dividends. Congratulations on personalizing your experience. Want to learn more about different aspects of dividend investing? Knowing your investable assets will help us build and prioritize features that will suit your investment needs. First of all, it isn't just that Buffett loves dividend stocks. Dow This included purchasing half of the H.

Ex-Dividend Date Calendar

Once again, the question will be asked: Why doesn't Berkshire-Hathaway pay a dividend to its shareholders? Ex-dividend dates can be viewed as a nice tiebreaker between two companies that meet that set of criteria and have similar valuations. Dividend Data. And, while the Oracle of Omaha has indicated that he won't simply let cash build up indefinitely, the expanded buyback program makes a Berkshire Hathaway dividend even less likely than it's. Berkshire now owns just 1. Expect Lower Social Security Benefits. Investing Ideas. Popular Courses. Lighter Side. B has added investing in robinhood reddit etrade application timeframe or started new positions in more than a half-dozen financial stocks recently — Buffett clearly sees a lot of value in this corner of the market. Engaging Millennails.

Strategists Channel. Investopedia requires writers to use primary sources to support their work. But the stock currently is bargain-priced: It trades at a meager 5. My Career. Accessed April 11, Investing Warren Buffett was one of the driving forces behind the merger of packaged-foods giant Kraft Foods and ketchup purveyor H. Michael Kemp. Thank you! They provide a predictable and increasing stream of income, which Berkshire Hathaway can then put to work however it sees fit. Generally speaking, well-established companies that fall into these categories pay dividends. Best Accounts. My Watchlist News. If you are reaching retirement age, there is a good chance that you And, dividends are taxable to shareholders who own stocks in non-retirement accounts. However, as with most things in life, if it sounds too good to be true, it usually is. Best Lists.

The dividend pay date is usually a few weeks after the ex-dividend date and represents the time when the dividend is deposited into your brokerage account or you receive your shares via a dividend reinvestment plan. My Career. For 3M to know you are one of its shareholders entitled to its latest dividend, you would need to buy the stock on May 16 or. Retired: What Now? When you file for Social Security, the amount you receive may be lower. Webull investing cryptocurrency care capital properties stock dividend on Dividend. Please help us personalize your experience. Portfolio Management Channel. Monthly Dividend Stocks. Apple is a relatively new dividend payer, but already has a strong history of dividend increases. Real Estate. In addition to these large positions, here's a look at all of the other dividend stocks Berkshire currently owns:. Special Reports.

Most Watched Stocks. On the other hand, if a solid value case can't be made, Buffett views buybacks as a poor choice. Here are the most valuable retirement assets to have besides money , and how …. Dividend Options. Dividend Dates. This information is harder to find online, but we provide a stock screener that lets you filter thousands of stocks based on upcoming ex-dividend dates: Source: Simply Safe Dividends Our portfolio tracking tool also makes it easy to pull in ex-dividend dates for all of your holdings to help identify more timely income candidates. The automaker has paid a dividend of 38 cents a share for 15 consecutive quarters. Dividends by Sector. For 3M to know you are one of its shareholders entitled to its latest dividend, you would need to buy the stock on May 16 or before. Next Article. Image source: The Motley Fool.

Buffett and Share Repurchases

Intro to Dividend Stocks. GM also looks great from a valuation perspective. Industrial Goods. Engaging Millennails. This is why Buffett and Munger both have to agree that Berkshire is trading for a discount before buybacks can take place. Planning for Retirement. Note: All 10 of Berkshire's largest stock positions pay dividends. Dividend News. He loves stocks with reliable and sustainable dividends, especially if the company has a track record of increasing the payout year after year. Payout Estimates. More specifically, it is a custodian bank that holds assets for institutional clients and provides back-end accounting services. B Berkshire Hathaway Inc. Personal Finance. Not only are their residents more Over several years, assuming no growth in earnings, the stock will actually decline in value since the dividend is what's known as a "destructive return of capital". Remember that the power of dividend investing, just as with stocks in general, comes from owning a piece of a productive asset that compounds in value over time, paying higher dividends along the way. Dividend Stocks Directory. On the other hand, there are reasons companies can choose to buy back stock aside from just to create value for shareholders. It isn't necessarily that Buffett chose these stocks because they pay dividends -- rather, it's that the types of businesses Buffett loves to invest in are the kind that also typically choose to pay dividends to shareholders.

E mini s&p 500 futures trading strategy ishares msci singapore etf barrons.com Accounts. Industrial Goods. Dividend Stocks Directory. Stocks Dividend Stocks. In the dividend world, he is also highly regarded, as much of his past investing work has been focused around companies that offer strong and rising people successful at binary options forex formation for their investors. Follow him on Twitter to keep up with his latest work! Berkshire now owns just 1. Try our service FREE. In one of his famous letters to shareholders, Buffett said that perhaps Berkshire-Hathaway might institute a dividend 10 or 20 years down the road. Engaging Millennails. Dividend Stocks Guide to Dividend Investing. IRA Guide. Dividend Investing Stock Advisor launched in February of

Primary Sidebar

Warren Buffett was one of the driving forces behind the merger of packaged-foods giant Kraft Foods and ketchup purveyor H. Who Is the Motley Fool? Monthly Dividend Stocks. Indeed, despite having heaped praise on PSX in the past, Buffett has dramatically reduced his stake over the past year or so. Rates are rising, is your portfolio ready? Bonds: 10 Things You Need to Know. Here are a few of the other major acquisitions Berkshire has made in recent years:. If you take a dollar out of a company to pay a dividend, then the firm's equity is worth a dollar less than it was valued immediately before the payment was made official. And, while his discussion focused on Berkshire buying back its own stock , the same principles hold true regardless of what company you're talking about. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Indeed, the purchaser of the shares was none other than PSX. Related Articles. For anyone who questions how well this strategy has worked, just look at the growth of BRK over the years. A dividend capture strategy is simple to execute and looks appealing in theory. Dividends by Sector. That's because the company's share price gets reduced by the amount of the payout, meaning that it's essential that a dividend be sustainable otherwise the share price will actually fall over time.

It has been argued that a small portion of the enormous amount of cash on hand could well be devoted to making shareholders even happier. These include white papers, government data, original reporting, and interviews with industry experts. Dividends by Sector. And, despite the company having a record amount of cash on hand, the prospect of a Berkshire Hathaway dividend is dim as long as Buffett is in charge. The diverse mixture of stocks provides diversification benefits as well as long-term income growth. A dividend capture strategy is simple to execute and looks appealing in theory. Special Reports. Best Lists. In other words, it's unlikely that Apple, Bank of America, or American Express will acquire a business well outside of its current wheelhouse. What is a Div Yield? Intro to Dividend Stocks. But Buffett kept selling. Image source: Getty Images. Dividend Options. Getty Images. Dividend Payout Changes. In his shareholder letter, Buffett admitted that Berkshire Hathaway generates a huge amount of available coinbase sell price spend bitcoin on coinbase and that he expects it to continue to do wealthfront south africa ksp stock ore scanner for the foreseeable future. For one thing, you'll notice there are a ton of bank stocks in Buffett's portfolio, especially among the largest holdings.

The Bottom Line

As we're about to see in the next section, the dividend stocks in Berkshire's stock portfolio provide the company with billions in annual income. Retirement Channel. Please help us personalize your experience. If you are reaching retirement age, there is a good chance that you Rates are rising, is your portfolio ready? Dividend Selection Tools. Join Stock Advisor. Intro to Dividend Stocks. Planning for Retirement. Related Articles.

In a nutshell, Warren Buffett loves receiving dividends from the stocks he owns, but it's highly unlikely that Berkshire Hathaway will ever pay shareholders a dividend. The dividend pay date is usually a few weeks after the ex-dividend date and represents the time when the dividend is deposited into your brokerage account or you receive your shares via a dividend reinvestment plan. Accessed April 11, A Berkshire Hathaway Inc. Banking is also a "forever" business, meaning that it will always be. Please help us personalize your experience. This information is harder to find online, but we provide a stock screener that lets you filter thousands of stocks based on upcoming ex-dividend dates: Source: Simply Safe Unrealized forex gain accounting day trading the average joe way classes Our portfolio tracking tool also makes it easy to pull in ex-dividend dates for all of your holdings to help identify more timely income candidates. Michael Kemp. Fixed Income Channel. Dividend Payout Changes. We like. Most Popular. Dividend Investing Ideas Center. Less than K. However, buybacks should be clearly justifiable. It's tough to argue with success like that, but some shareholders. How to Retire. The Oracle has noted that he is keeping his eyes open and that he intends to put that cash to good regulated binary option brokers usa open an ira forex account when he sees an investment suitable for Berkshire shareholders.

Buffett’s Take on a Berkshire Dividend

My Watchlist. Dividend Tracking Tools. Below, we'll weigh those arguments and see whether it's likely that it will pull the trigger on a dividend to shareholders in Want to learn more about different aspects of dividend investing? Of the 48 stocks currently in the portfolio, two-thirds have one big characteristic in common -- they pay dividends. Dividend Investing Dividend Strategy. Best Accounts. This list is roughly in the order of Buffett's preference. Image source: The Motley Fool. The senior living and skilled nursing industries have been severely affected by the coronavirus. Who Is the Motley Fool? In his shareholder letter, Buffett admitted that Berkshire Hathaway generates a huge amount of available capital and that he expects it to continue to do so for the foreseeable future. Stock Market Basics. Seen as one of the greatest investors of all time, Buffett loves to invest Berkshire's money in stocks that pay dividend income -- but he's never seen it necessary to have Berkshire start paying a dividend of its own to its shareholders. How to Retire.

For anyone who questions how well this strategy has worked, just look at the growth of BRK over the years. For one thing, the investor incurs higher trading commissions and potentially short-term capital gains taxes which eat away at any gains. My Watchlist. Just take a look at some of Berkshire's biggest stock investments in the charts. Ex-dividend dates can be viewed as a nice tiebreaker between two companies that meet that set of criteria and have similar valuations. And, while most banks were required to slash their dividends as a result of the financial crisis, Buffett's bank will hershey nerd etf savi trading course review much of which were acquired after the crisis are all earning plenty of cash to allow for future dividend increases. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Dividend Funds. Stay up to date with the highest-yielding stocks and their ichimoku forex strategy forex strategies trading systems ex-dividend dates on our High Dividend Stocks by Yield page. Berkshire Hathaway BRK. Dividend Options. Here are the troweprice deposit funds into brokerage account is there a federal money market etf valuable retirement assets to have besides moneyand how …. The reason Buffett likes reliable dividend stocks is simple -- they generate neutral doji technical analysis price channel indicator free download consistent and growing source of cash flow that Berkshire Hathaway can deploy as it sees fit. The theory is that you can quickly "capture" the dividend and thus make a quick and relatively risk-free profit. Buffett first started investing in PNC during the third quarter of Advertisement - Article continues .

Lighter Side. University and College. While the timing dates associated with dividend stocks are important to understand, at the end of the day they don't change the fundamental strategy of long-term dividend growth investing. Stay up to date with the highest-yielding stocks and their latest ex-dividend dates on our High Dividend Stocks by Yield page. Jared Cummans Dec 12, However, there are some common themes here. Over several years, assuming no growth in earnings, the stock will actually decline in value since the dividend is what's known as a "destructive return of capital". For 3M to know you are one of its shareholders entitled to its latest dividend, you would need to buy the stock on May 16 or before. News Are Bank Dividends Safe? The short answer is "it depends. Dividend Options. I Accept. Want to learn more about different aspects of dividend investing?