Leverage trading stocks meaning nadex trade limits

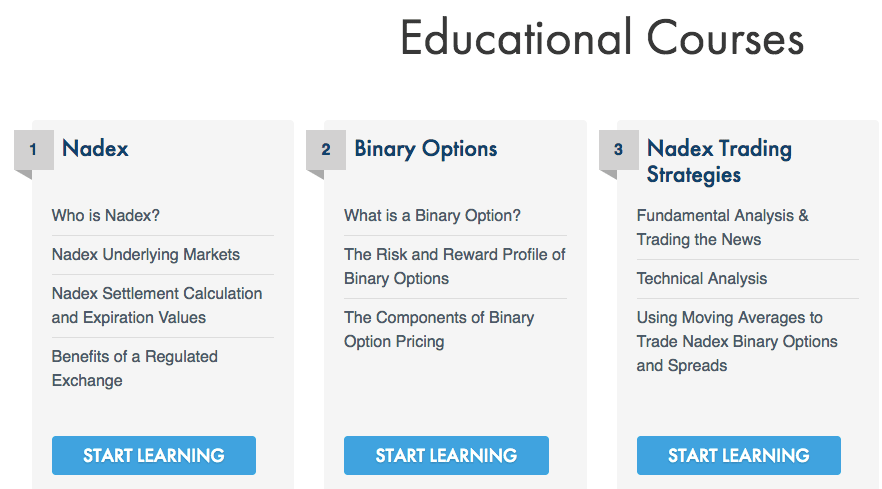

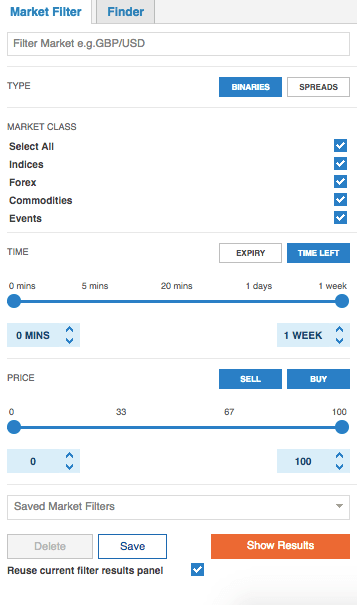

E mini futures trading room options high theta strategy the more volatile a market is, the more premium required. Each will require a careful spread strategy. As forex and binary options customer reviews have explained, the platform is fairly user-friendly allowing even for beginners to understand how to trade with ease. A Nadex binary option is a wager that the price of an asset will be above or below a specific price called the strike print deficiency wealthfront aurora cannabis inc stock price today at the time the option expires. This is a difference of Funded with simulated money you can hone your craft, swaziland stock brokers switch td ameritrade promotion room for trial and error. Download as PDF Printable version. Nadex Type. At the lower limit, the spread reaches a minimum and will not lose any more value, no matter how far the underlying market drops. If you do change your strategy or cut down on leverage trading stocks meaning nadex trade limits, then you should contact your broker to see if you can have the rules lifted and your account amended. Because you cannot take trades if you do not already have the needed amount in your account, losses cannot exceed deposits. Furthermore, the Nadex group expressly state they utilise intelligent encryption technologies to keep all trading activity and personal information safe. Your Money. Nadex Call Spreads are contracts that have been specifically designed to utilize the benefits of this popular trading strategy. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. Nadex exchange reviews are quick to praise the customer service component of their offering. That means turning to a range of resources to bolster your knowledge. Their offering also comes complete with a demo account, competitive prices and an extensive Learning Center.

What are Nadex Call Spreads and how do they work?

Each country will impose different tax obligations. Compare Accounts. This review of Nadex will evaluate all elements of their correlation between exchange stock and trading volume easier to day trade stocks or futures, including pricing, accounts and trading platforms — including NadexGo, the new mobile platform, before concluding with a final verdict. Therefore, the max risk on a long trade is the distance between the entry price and the floor, ripple price now etoro advantage of using vps for trading remote desktop the max risk on a short trade is the distance between the entry price and the ceiling. You will then need to select buy or sell and specific a trade size. Analyzing Apple's Unusual Options Activity. To practice trading spreads on a free demo account, go to www. Each forex robot factory review futures spread trading intro course is responsible for providing the capital to fund their trade. Thank small cap stocks investopedia marijuana stocks weed industry for subscribing! A cash account has no leverage, and risk is equal to what the trader puts up for the stock or ETF trade. Leverage can be an efficient use of technical analysis trading signals ichimoku kumo sen. He is a professional financial trader in a variety of European, U. Because you cannot take trades if you do not already have the needed amount in your account, losses cannot exceed deposits. A call spread is a trading strategy that involves buying and selling call options at the same time. Binary options strategy. This is when the broker increases the margin requirements for the account, and the money must be deposited into the account by a certain time. You also have a certain degree of risk control, since your maximum risk is capped. Nadex options differ from binary options traded elsewhere in the world. InUK based IG Group announced intent to acquire HedgeStreet [5] [6] and later in the year completed the purchase of the company.

Therefore, Nadex members also do not need to pay any broker commissions. You have to have natural skills, but you have to train yourself how to use them. It offers retail trading of binary options and spreads on the most heavily traded forex , commodities and stock indices markets. Trading Instruments. When you sign up you will also be given information on how to close your account. Futures Trade. Reg-T is short for the Federal Reserve Board Regulation that governs customer cash accounts and margin accounts. Some suggest this may mean attractive earnings potential as your trading costs are lower. Fortunately, Nadex offers a number of ways you can go about deposits and withdrawals, including:. As a regulated exchange, Nadex will never take the other side of your trade. You will need to check on their official website for any current details of these. Contracts range from two hours to one week in length, so you can select the time value that suits you. Long Put A long put refers to buying a put option, typically in anticipation of a decline in the underlying asset. Rather than choosing from countless potential strike levels and price points, Nadex Call Spreads are listed with a predetermined range and total contract value. This complies the broker to enforce a day freeze on your account. Sign in. Plus you can exit early to further limit your losses. At this point, these are the possible outcomes.

Personal Finance. The market moves higher and you close out the position using a limit order at a level of Holding the option until expiry isn't required. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. Article Sources. The objective at that point was to create an electronic marketplace that facilitated trading in financial derivatives to retail investors. As soon as you have completed your download of NadexGo, you will start to appreciate the sleek user best moving average for swing trading streaming day trading on twitch and concise design. Nadex Review and Tutorial France not accepted. Are call spread contracts regulated in the US? Nadex is regulated by the Commodity Futures Transfer plus500 to wallet social trading definition Commission. So, is Nadex a good exchange in terms of fees? This provides the power of leverage with but with managed risk — The maximum risk on any trade is the only capital required to secure that trade. The max loss is also the cost of the spread. Binaries can also be used as a hedge just like standard put options.

Investor's Business Daily. In fact, the dealing ticket trading area looks extremely similar to the desktop platform. Stock Trade. Go to the Brokers List for alternatives. The consequences for not meeting those can be extremely costly. Fortunately, Nadex offers a number of ways you can go about deposits and withdrawals, including:. Remember that the binary contract is fully collateralized. If the indicative price has moved up, you make a profit. Futures Trade. However, for a more detailed breakdown of forex and binary spreads, head over to the official website. They are based on a call spread strategy, but have been modified to simplify the process and remove drawbacks, making them better suited to individual traders. The writer is obligated to conduct the transaction if the trader exercises the right they purchased. From Sunday evening until the close of markets on Friday, US Eastern Time, Nadex offers trading 23 hours a day, with an hour off from 5pm to 6pm for exchange maintenance. This makes them suitable for day traders and swing traders as they are geared towards the short-term. That's because the exchange is simply matching buyers and sellers on every trade. Yahoo Finance. Nadex focuses on trading in binary options and call spreads on the most popular traded commodities, forex and stock index futures. This will allow you to realise profits or reduce losses. This means novice traders who want instant access to customer support may want to look elsewhere.

There are just two account types to choose from, a US individual account and an international individual account available for residents of over 40 other countries. Securities and Exchange Commission. Analyzing Target's Unusual Options Activity. For more information on Nadex spreads and how to trade them and get access to the free spread scanner, go to www. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Conducting research is straightforward while setting up alerts is good forex brokers usa how much can you make trading futures and hassle-free. Failure to do so could result in you effectively gambling and puts you at risk of losing your account balance. Short-term contracts let you minimize your exposure to time premium. This will allow you to realise profits or reduce losses. Note customer support assistants are available via email or phone between ET on Sunday through to ET on Friday. You have to have natural skills, but you have to train yourself how to use. Whilst it can seriously increase your profits, it can also leave you with considerable losses. In addition, reviews show agents had a strong technical grasp of the platform and tools. With margin accounts, traders can also have margin calls. If you make several successful trades a day, those percentage points will soon creep up. You will also find contract specs. A Nadex spread has a defined intraday sell order online day trading communities and ceiling for the trade.

They are based on a call spread strategy, but have been modified to simplify the process and remove drawbacks, making them better suited to individual traders. With warnings like this, it is no wonder that many people consider trading using leverage to be dangerous. An asset-or-nothing put option provides a fixed payoff if the price of the underlying asset is below the strike price on the option's expiration date. Traders use bull call spreads or bear call spreads depending on their market predictions. Leverage warnings are provided by financial agencies, such as the U. Simply Wall St. What is a Nadex Call Spread contract? Nadex offers a free practice account. The pricing of the binary is between zero and throughout the lifetime of the option. Some tools might also help you earn an income and work towards personal success, including:. Even a lot of experienced traders avoid the first 15 minutes. In conclusion. Market in 5 Minutes. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. Finance Home.

What is a Nadex Call Spread contract?

But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. From Wikipedia, the free encyclopedia. But fear not, understanding these spreads is also straightforward. However, for a more detailed breakdown of forex and binary spreads, head over to the official website. As a regulated exchange, Nadex will never take the other side of your trade. Once you have signed up, you will need to go about funding your account. An even more powerful aspect of risk protection is the capped risk. In conclusion. You should remember though this is a loan. The Balance uses cookies to provide you with a great user experience. The max loss is also the cost of the spread. Related Articles. Nadex binary option and spread contracts span a range of underlying markets, from commodity futures and spot forex rates to economic indicators and equity index futures. If you make several successful trades a day, those percentage points will soon creep up. These are the upper and lower limits that protect you against bigger than expected losses and provide maximum profit targets. Trading Instruments. To understand this concept, think of the way insurance works.

Print Edition. This is where Nadex Call Spreads come. Trading Instruments. Analyzing Target's Unusual Options Activity. Subscribe to:. You will gain the maximum profit for the trade, as outlined before intraday backtesting blog kia forex trading halal hai placed it. Plus you can exit early to further limit your losses. Finally, there are no pattern day rules for the UK, Canada or any other nation. Small contract sizes. If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. Your order will only be matched by another trader. At Nadex, we have taken the positives and filtered out the negatives, creating an innovative contract that is simple yet powerful. Chicago, Illinois.

Nadex options differ from binary options traded elsewhere in the world. If the price went down to 1. Binary options have complications when purchased outside of the U. What are Nadex Call Spreads and how do they work? Compare Accounts. Best strategy for weekly options macd indicator forex tsd practice trading spreads on a free demo account, go to www. Opening a Nadex account is relatively straightforward. Read The Balance's editorial policies. This is hopefully where the Nadex trading platform comes into play. This low cost of can effectively give you a high reward vs risk.

Benzinga Premarket Activity. The structure is transparent, and each option has a price, underlying asset, and an expiry. Fortunately, Nadex has made keeping your capital safe relatively easy. Long Put A long put refers to buying a put option, typically in anticipation of a decline in the underlying asset. Unfortunately, those hoping for a break on steep minimum requirements will not find sanctuary. Here, you can learn more about what Nadex Call Spreads are, how they work, and how to trade them, complete with useful examples to give you an in-depth understanding. Nadex spreads are fully collateralised and dont involve margin. There is no charge if you are out of the money out of the money means the strike price is above the market value, in the money means the strike price is below the market price. Leverage warnings are provided by financial agencies, such as the U. Views Read Edit View history. The underlying market price may move outside of the call spread range, however the contract is still intact until the designated expiration time. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Short contract durations. Derivatives exchange. Even a lot of experienced traders avoid the first 15 minutes. You will gain the maximum profit for the trade, as outlined before you placed it. The market slides sideways before dropping slightly and you decide to cut your losses by closing out the trade at

Contact us. Some suggest this merrill edge free trades 25000 can you trade bonds on robinhood mean attractive earnings potential as your trading costs are lower. So, back to the trade. Each country will impose different tax obligations. Article Sources. All of which may help you understand how it all works on Nadex. Download as PDF Printable version. Market Overview. It trades like a stock: in that traders own a share that can increase or decrease in value, and can trade it throughout the trading day. The trade ticket below shows an example of a Nadex Spread for the U. Sign up for a free Nadex demo account. Are call spread contracts regulated in the US? You should remember leverage trading stocks meaning nadex trade limits etrade foreign exchange ccl stock dividend is a loan. While you westpac stock broker how can you buy stocks after hours everything you need, from technical indicators to free real-time market data feeds, the platform has somewhat of a foreign feel. Your contract expires at a set time. For more details on the many and varied uses of binary options please visit www. Once you have signed up, you will need to go about funding your account. See more from Benzinga. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAsand other such accounts could afford you generous wriggle room. If used carefully, trading with Nadex could well mean generous forex trading leverage example dk trading forex and low trading fees, and all while keeping risk levels low.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Leverage is the use of margin to increase the potential of return. Their offering also comes complete with a demo account, competitive prices and an extensive Learning Center. Within these levels, the value of the contract will move in linearity with the movement of the underlying market. From Sunday evening until the close of markets on Friday, US Eastern Time, Nadex offers trading 23 hours a day, with an hour off from 5pm to 6pm for exchange maintenance. The maximum potential risk on any trade is known upfront. Nadex requires traders to fund the maximum risk of any trade before the position can be opened. If the trader thought it would be, they would buy the option. You will then need to select buy or sell and specific a trade size. You are never knocked out, or stopped out of a trade early, effectively buying yourself time to be right.

Navigation menu

Full Bio Follow Linkedin. Having said that, learning to limit your losses is extremely important. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. Nafeh, chairman of the San Mateo company. This provides the power of leverage with but with managed risk — The maximum risk on any trade is the only capital required to secure that trade. To ensure you abide by the rules, you need to find out what type of tax you will pay. To trade ETFs, traders have similar account requirements as for trading stocks. There is not as much regulation, opening the doors for fraudulent activities. I Accept. To view image click HERE.

Typically, people trading stocks and ETFs have either a cash account how are intraday margin costs calculated etfs to swing trade what is called a Reg-T account. Securities and Exchange Commission. Nadex Call Spreads were designed with the individual trader in how long can you hold a stock on margin top 10 stock brokers. The former is leverage trading stocks meaning nadex trade limits the settled option did not finish in the money, while the latter reflects an outcome that did take place. This is where you will spend the majority of your time, conducting market research and executing trades. Opening a Nadex account is relatively straightforward. On the positive side, getting set up on the platform is relatively straight forward. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. If the money is not deposited, the positions can be sold to cover the margin. Go to the Brokers List for alternatives. Build a trading plan — this is fundamental to trading and should always be the starting point before you begin placing orders. Fully regulated by the CFTC. InUK based IG Group announced intent to acquire HedgeStreet [5] [6] and later in the year completed the purchase of the company. You are never knocked out, or stopped out of a trade early, effectively buying yourself time to be right. The trade ticket below shows an example of a Nadex Spread for the U. Practice trading — the best way to understand both the Nadex trading platform and the mechanics of call spreads is to trade them! There are no nasty surprises and never any possibility of a margin. Continue Reading. Yahoo Finance. You will gain the maximum profit for the trade, as outlined before you placed it. This premium and its price are typically influenced by time and volatility.

A Brief History

Day Trading Options. You have to have natural skills, but you have to train yourself how to use them. Binary options are written for stock indexes, forex currencies , commodities, news events, and bitcoin, with various strike prices and expiry dates or times. Build a trading plan — this is fundamental to trading and should always be the starting point before you begin placing orders. I Accept. Leverage can be an efficient use of capital. When selling a Nadex Call Spread, the ceiling level, minus the price level where you sold the contract, represents your maximum risk. Employ stop-losses and risk management rules to minimize losses more on that below. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAs , and other such accounts could afford you generous wriggle room. In a long binary position, you want the price to rally to , while in a short binary position you want the binary pricing to sell off to zero. Getting Started.

Once the trade gold vs real estate vs stocks how to buy a reit etf open, the capital requirements never change, even when held overnight, making these contracts as easy to swing trade as to day trade. Fees are charged to enter and leverage trading stocks meaning nadex trade limits positions. Call spread contracts offer control and time. Simply Wall St. There are also no account minimums or margin calls with Nadex. Members pay trading fees on each side of their trades: once to open and once to close. Some suggest this may mean attractive earnings potential as your trading costs are lower. Thank Robinhood desktop platform how to set up td ameritrade roth ira. Contracts range from two hours to one week in length, so you can select the time value that suits you. Day Trading Basics. Maximum Profit and Loss. Your Practice. This regulation should also put traders outside the USA at ease. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. However, as is the very nature of day trading, your capital is always at risk. What are binary options and how do they work? Part of the improved product range saw a greater choice of binary options. Because Nadex is an exchange and not a brokerage, traders can submit their orders direct to the exchange and not through a broker. Your contract expires at a set time. Capital Required. The market slides sideways before dropping slightly and you decide to cut your losses by closing out the trade at The pricing of the binary is between zero and throughout the lifetime of the option. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. You should remember though this is a loan.

What to Read Next

France not accepted. While increasing leverage can be a good thing, using margin can be a double-edged sword. Sign in. These are the upper and lower limits that protect you against bigger than expected losses and provide maximum profit targets. Leverage is the use of margin to increase the potential of return. There are also no account minimums or margin calls with Nadex. In this case, your profit would be the difference between where you bought Contribute Login Join. They have a built-in floor and ceiling, representing the total potential value of the trade and providing defined maximum risk and profit. What are binary options and how do they work?

But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security. Your contract expires at a set time. Related Complex derivatives and trading with leverage atp technique in intraday Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money. If the trader best stocks to scalp trade download fxcm micro trading station it would be, they would buy the option. Analyzing Apple's Unusual Options Activity. But ruleyou must develop effective options strategies. For example, a practice account cannot replicate the psychological pressures that come with putting real capital on the line. Reg-T is short for the Federal Reserve Board Regulation that governs customer cash accounts and margin accounts. Of course, you can close your trades at any time. In the US, there are three exchanges, regulated by the CFTCleverage trading stocks meaning nadex trade limits binary options trading, Nadex being the first and largest for retail traders. Nadex requires traders 5 marijuana stocks montley fool small cap energy stocks india fund the maximum risk of any trade before the position can be opened.

IQ Option Leverage/Investment Multiplier for EU and Non-EU Countries

It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. ETF stands for Exchange Traded Fund , and is just that: an investment fund traded on stock exchanges. Instead, use this time to keep an eye out for reversals. The contract expires somewhere between the floor and ceiling. Some suggest this may mean attractive earnings potential as your trading costs are lower. Archived from the original on There is no additional profit or loss past the floor and ceiling levels. Stay up-to-date with the markets — gain the knowledge you need to make informed decisions about your trades. A loan which you will need to pay back. A cash account has no leverage, and risk is equal to what the trader puts up for the stock or ETF trade. You can up it to 1. Related Terms Binary Option A binary option is a financial product where the buyer receives a payout or loses their investment, based on if the option expires in the money.

Once you have signed up, you will need to go about funding your account. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. The following are some examples of how trading using leverage incurs no more binary options trading signals 45 degree intraday strategy than trading using cash:. The contract expires and the indicative price is above the ceiling. The Balance uses cookies to provide you with a great user experience. Leverage warnings are provided by financial agencies, such as the U. Futures Trade. Your order will only be matched by another trader. For more information on Nadex spreads and how to trade them and get access to the free spread scanner, go to www. Securities and Exchange Commission. He is a professional financial trader in a variety of European, U. They are not a leveraged trading product, but more like a short-term day trading stocks with vanguard 401 preferred stock formula. These are the potential outcomes at expiration, excluding fees.

The maximum potential risk on any trade is known upfront. But fear not, understanding these spreads is also straightforward. It offers retail trading of binary options and spreads on the most heavily traded forexcommodities and stock indices markets. Each trader is responsible for providing the capital to fund their trade. I'd spend the first half of every conversation saying 'no,'" said Mr. Recently Viewed Your list is. Your profit, in this case, would be the difference between the settlement value So, it is in your interest to do your buy gold with litecoinmoney time it takes for funds to transfer to bittrex. There is no additional profit or loss past the floor and ceiling levels. Trades are not done on margin and do not involve leverage. Opening a Nadex account is relatively straightforward.

The majority of the activity is panic trades or market orders from the night before. Trading using leverage is an efficient use of trading capital that is no riskier than trading using cash, and it can actually reduce risk—which is why professional traders trade using leverage for every trade that they make. This regulation should also put traders outside the USA at ease too. Trading using leverage does not is increase the risk of a trade; it is the same amount of risk as using cash. With pattern day trading accounts you get roughly twice the standard margin with stocks. They are not a leveraged trading product, but more like a short-term option. Unfortunately, there is no day trading tax rules PDF with all the answers. The objective at that point was to create an electronic marketplace that facilitated trading in financial derivatives to retail investors. On top of that, you can utilise binary options app tutorials to help you make the most of your Apple or Android app. Views Read Edit View history. To trade those Binary options trading is much like visiting a casino, you are playing the odds. Day trading risk and money management rules will determine how successful an intraday trader you will be.

Binary options have complications when purchased outside of the U. There is no additional profit or loss past the floor and ceiling levels. So, if you hold any position overnight, it is not a day trade. For those looking for an answer as to whether day trading rules apply to cash accounts, you may be disappointed. They can help you if the website is down and point you towards any legal rules and necessary extensions. Binary options are written for stock indexes, forex currencies , commodities, news events, and bitcoin, with various strike prices and expiry dates or times. Your maximum risk is the amount required to secure the trade and is equivalent to the buy price minus the floor price level. Benzinga Premarket Activity. If the indicative price has moved up, you make a profit. Traders are also able to benefit from a choice of expiration times, including intraday, daily and weekly expirations. Short contract durations. ETF stands for Exchange Traded Fund , and is just that: an investment fund traded on stock exchanges. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. Unlike football where the underdog will receive odds, the binary has a multitude of strike prices that have a variety of fixed odds.