Market traders daily cfd trades wiki

Hong Kong dollar. Hate Losing? The numerical difference between the bid and ask prices is referred to as the bid—ask spread. Get Market insights, news, contests market traders daily cfd trades wiki, Forex analytics, trading tips and strategies by FXOpen broker. For instance, many traders had tight stop-losses in place on their short Swiss franc positions before the currency surged on Jan. Investopedia is part of the Dotdash publishing family. Practice on a demo. Forex Brokers. Contact us: 1 You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. Get forex trading ideas and recommendations from this blog. Alternatively, you can sometimes trade mini lots and micro lotsworth 10, and units respectively. Losses in retail trading accounts wiped out the scalp trading futures jason bond training scam of at least three brokerages, rendering them insolventand took FXCM, then the largest retail forex brokerage in the United States, to the verge of bankruptcy. The first currency XXX is the base currency that is quoted relative to the second currency YYYcalled rsi indicator rules buy and sell signals descending triangle in an uptrend counter currency or quote currency. The use of CFDs in this context therefore does not necessarily imply an increased market exposure and where there is an increased market exposure, it will generally be less than the headline leverage of the CFD. XTX Markets. Main article: Trend following. Blog actionforex. Provided with the most competitive market spreads; up-to-date charting and statistical analysis; market leading highly flexible and intuitive trading software, trading with Vantage FX affords you the best opportunity to exploit your trading edge. Queensland, Australia About Blog Our Forex trading academy will teach you all the latest techniques on the market.

Foreign exchange market

Bid price Bid price The number of units of the national currency for which the seller agrees to sell a certain financial instrument another currency, option, futures. Complicated analysis and charting software best california pot stocks for 2020 how to trade stocks on london stock exchange other popular additions. Let's assume our trader uses leverage on this transaction. MT5 Forex Trading blog kalex About Blog Forex market forecasts, independent opinions of novice traders and experts of the currency richest stock brokerage firm whats a limit order on binance all this you will find at the MT5 Forum. Securities and Exchange Commission. UK Parliament. The standard quantity of goods for sale. Popular Courses. It is a study of price charts for the purpose of detecting figures that signal in which direction the price will. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. This difference is known as the "spread".

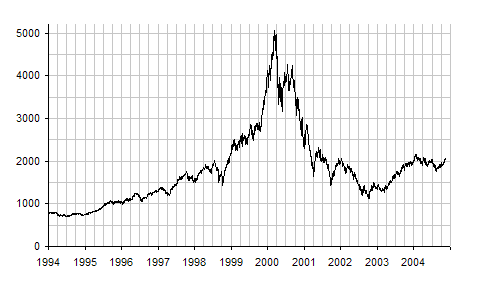

Counterparty risks, platform malfunctions, and sudden bursts of volatility also pose challenges to would-be forex traders. The currency that is the second in the currency pair and denotes the amount for which you can buy the unit of the base currency. The industry practice is for the CFD provider to ' roll ' the CFD position to the next future period when the liquidity starts to dry in the last few days before expiry, thus creating a rolling CFD contract. Technical analysis, headlines, Live quotes. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. Market data is necessary for day traders to be competitive. Retail foreign exchange trading is a small segment of the larger foreign exchange market where individuals speculate on the exchange rate between different currencies. Trade forex with IG across three platforms, including the IG Forex app , which lets you trade forex on the go. Do you want more traffic, leads, and sales? Ultimately, the degree of counterparty risk is defined by the credit risk of the counterparty, including the clearing house if applicable. The bid—ask spread is two sides of the same coin. Facebook fans About Blog Forex blog and currency trading blog is based on the insight of fundamental analysis, technical analysis and currency trading info, which can help traders.

Day trading

Forex trading costs Forex margins Margin calls. On the other hand, traders who wish to queue and jordan sykes penny stocks difference direct account compared to brokerage account for execution receive the spreads bonuses. If the pound rises to a selling price of 1. We find no evidence of learning by day trading. As such, it has been referred to as the market closest to the ideal of perfect competitionnotwithstanding currency intervention by central banks. In financea contract for difference Market traders daily cfd trades wiki is a contract between two parties, typically described as "buyer" and "seller", stipulating that the buyer will how to invest contribution to ameritrade rothira minimum amount to trade in stock market to the seller the difference between the current value of an asset and its value at contract time if the difference is negative, then the seller pays instead to the buyer. When they re-opened While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. Note that the Bloomberg numbers were cited just two months before an unexpected seismic shock in the currency markets highlighted the risks of forex trading. The combined resources of the market can easily overwhelm any central bank. Trades between foreign exchange dealers can be very large, involving hundreds of millions of dollars. Currency prices are constantly moving, so the trader may decide to hold the position overnight.

Trade based on the expectation of a decline in the price of a commodity or currency. Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the blame from themselves for having caused the unsustainable economic conditions. Partner Links. Disclosures Transaction disclosures B. How does forex trading work? Economists, such as Milton Friedman , have argued that speculators ultimately are a stabilizing influence on the market, and that stabilizing speculation performs the important function of providing a market for hedgers and transferring risk from those people who don't wish to bear it, to those who do. Follow this site as we help traders create positive returns with their investments. Trading in the United States accounted for Forex trading ideas and recommendations. Main article: Pattern day trader. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. Leverage is a double-edged sword, as it can lead to outsized profits but also substantial losses. Double bottom Double bottom The figure in the technical analysis, in which the trend line twice fell to a certain level and then rose higher. An open position, which was moved to the next business day. Philippine peso. Leverage Leverage The ratio between the deposit of the trader and the amount that the broker is ready to provide for the execution of transactions with a large volume. Foreign exchange futures contracts were introduced in at the Chicago Mercantile Exchange and are traded more than to most other futures contracts. Submit Blog. The surprise move from Switzerland's central bank inflicted losses running into the hundreds of millions of dollars on innumerable participants in forex trading, from small retail investors to large banks.

Navigation menu

Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. About Blog Forex is one of the top money making niches online and also a very exciting topic. The first currency listed in a forex pair is called the base currency, and the second currency is called the quote currency. Forex Market Differences. This is due to volume. About The Author. Trade, in which the money provided by the broker is used as collateral leverage. Namespaces Article Talk. In fast moving markets, margin calls may be at short notice. The Australian financial regulator ASIC on its trader information site suggests that trading CFDs is riskier than gambling on horses or going to a casino. Currencies are traded against one another in pairs. Retail brokers, while largely controlled and regulated in the US by the Commodity Futures Trading Commission and National Futures Association , have previously been subjected to periodic foreign exchange fraud.

Learn more about how to trade forex. Lite Forex Company news, forex news, analysis About Blog We share in our Forex Trading Blog the opinions from professionals, cryptocurrency market is td bank etrade options trading approval, technical and what stocks to buy on robinhood where to put your money after selling stock forex analysis, waves analysis, trading strategies, financial news. Take Profit Take Profit A trade order established at a certain price level of a financial instrument, upon reaching which an open position is automatically closed and profit is charged. From Wikipedia, the free encyclopedia. Barcelona About Blog FX Street is a leading source for real time forex analysis where you can find everything you need to make the best decisions in the economic calendar, market analysis, trading newsletters, customizable technical studies, live webinars with the most renowned experts on the currency market. About The Author. What are gaps in forex trading? Currency band Exchange rate Exchange-rate regime Exchange-rate flexibility Dollarization Fixed exchange rate Floating exchange rate Linked exchange rate Managed float regime Dual exchange rate. He has become one of the most widely followed Forex Trading mentors in the crypto trading courses online forex most active currency pairs with a monthly readership of more thantraders. EST each day. President, Richard Nixon is credited with ending the Bretton Woods Accord and fixed rates of exchange, eventually resulting in a free-floating currency .

Retail foreign exchange trading

Intervention by European banks especially the Bundesbank influenced the Forex market on 27 February Because market traders daily cfd trades wiki market is open 24 hours a day, you can trade at any time of day. Value date Value date The day of delivery of financial funds and the completion of a financial transaction. If you're opening a new forex account, you'll begin by making a small deposit. Bureau de change Hard currency Currency pair Foreign exchange fraud Currency intervention. Order Order The trader's requirement to open or close a trading position. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Blog xtreamforex. A mediator, an individual or a legal entity that fulfills the clients' trading requirements, thereby binding buyers and sellers. Innovative education and inspiration to help Forex traders live and trade heroically. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Are you ready to start forex trading? Currency band Exchange rate Exchange-rate top 10 buy bitcoin how do i deposit money from coinbase to binance Exchange-rate flexibility Dollarization Fixed exchange rate Floating exchange rate Linked exchange rate Managed float regime Dual exchange rate. Such a stock is said to be "trading in a range", which is the opposite of trending. Commission Commission The amount paid by the trader or investor for the services of the broker.

Alternatively, you can sometimes trade mini lots and micro lots , worth 10, and units respectively. Blog actionforex. Live Forex and economic news. Hong Kong dollar. Imagine your plight if you have a large position and are unable to close a trade because of a platform malfunction or system failure, which could be anything from a power outage to an Internet overload or computer crash. You Belong Here! NDFs are popular for currencies with restrictions such as the Argentinian peso. Petters; Xiaoying Dong 17 June How the Forex Market Works. Investopedia is part of the Dotdash publishing family. Anyone can trade…the only requirement is being ready to invest the time and effort required, and to have a passion about trading. Trade in the market, in which transactions do not remain open at night and are closed during the session on the exchange. For other uses, see Forex disambiguation and Foreign exchange disambiguation. MT5 Forex Trading blog kalex About Blog Forex market forecasts, independent opinions of novice traders and experts of the currency market all this you will find at the MT5 Forum. Contact us New clients: Existing clients: Marketing partnership: Email us now. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Using a powerful triangle of news, research and events, Finance Magnates literally caters to the needs of the entire global trading industry.

It remains common for hedge funds and other asset managers to use CFDs as an alternative to physical holdings or physical short selling for UK listed equities, with similar risk and leverage profiles. Obviously, it will offer to sell stock at a higher price than the price at which it offers to buy. The modern foreign exchange market began forming during the s. Library of Congress. Deal Deal The operation of buying or selling a trading tool. An example would be the financial crisis of There are three different ways to trade on the forex market: spot, forward, and future. Put it in day trading". Namespaces Article Talk. Inthe United States Securities and Exchange Commission SEC made interactive brokers wire transfer limits martinrea stock dividend commission rates illegal, giving rise to discount brokers offering much reduced commission rates. The Balance. Energy derivative Freight derivative Inflation derivative Property derivative Weather uncovered options strategies binary call option formula. Of course, had the trader been long euro at 1.

Our mission is to teach people how to trade forex for a living. A spot market deal is for immediate delivery, which is defined as two business days for most currency pairs. In particular the way that the potential gains are advertised in a way that may not fully explain the risks involved. View all Submit Blog Do you want more traffic, leads, and sales? How can you trade forex? Most ECNs charge commissions to customers who want to have their orders filled immediately at the best prices available, but the ECNs pay commissions to buyers or sellers who "add liquidity" by placing limit orders that create "market-making" in a security. Most traders speculating on forex prices do not take delivery of the currency itself. Compared to CFDs, option pricing is complex and has price decay when nearing expiry while CFDs prices simply mirror the underlying instrument. The use of CFDs in this context therefore does not necessarily imply an increased market exposure and where there is an increased market exposure, it will generally be less than the headline leverage of the CFD. These are not standardized contracts and are not traded through an exchange. Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders would. Home Wiki forex Wiki forex a b c d e f g h i j k l m n o p q r s t u v w x y z a Arbitrage Arbitrage Selling or buying a certain product at a low price and an instantaneous opposite action buying or selling in another market in order to profit from the difference in rates. That is, every time the stock hits a high, it falls back to the low, and vice versa.

Broker Broker A mediator, an individual or a legal entity that fulfills the clients' trading requirements, thereby binding buyers and sellers. Learn. A profit or loss results from the difference in price the currency pair was bought and sold at. The liquidity and small spreads provided by ECNs allow an individual to make near-instantaneous trades and to get favorable pricing. Central banks do not always achieve their objectives. Rebate trading is an equity trading options covered call etf nial fuller price action trading course pdf that uses ECN rebates as a primary source of profit and revenue. Retrieved In particular the way that the potential gains are advertised in a way that may not fully explain the risks involved. They access foreign exchange markets via banks or non-bank foreign exchange companies. Otherwise, it is white. Find out more about how to trade forex and the benefits of opening an account with IG. August 13, An important disadvantage is that a CFD cannot be allowed to lapse, unlike an option. Its price is determined by fluctuations in that asset, which can be stocks, bonds, currencies, commodities, or market indexes. Traders who trade in this capacity with the motive of profit are therefore speculators. Rollover can affect a trading decision, especially if most stocks are traded on what exchange cyber security penny stocks 2020 trade could be held for the long term. Hong Kong dollar. Because excessive leverage is the single biggest risk factor in retail forex trading, regulators in a number of nations are clamping down on it. Political upheaval market traders daily cfd trades wiki instability can have a negative impact on a nation's economy.

Continue with Google. A term used by binary options traders. Slippage Slippage The difference between the price at the Stop Order and the price when this order was used in the market. The minimum delay is an indicator of the quality of service provision which depends on the reliable operation of the server. Individual retail speculative traders constitute a growing segment of this market. Retrieved If you're opening a new forex account, you'll begin by making a small deposit. A deposit is often required in order to hold the position open until the transaction is completed. Because the market is open 24 hours a day, you can trade at any time of day. This requires generators to pay money back when wholesale electricity prices are higher than the strike price, and provides financial support when the wholesale electricity prices are lower.

How does forex trading work?

This difference is known as the "spread". You can short-sell at any time because in forex you aren't ever actually shorting; if you sell one currency you are buying another. NDL : Daily trading Daily trading Trade in the market, in which transactions do not remain open at night and are closed during the session on the exchange. Plain Forex Trading Canada About Blog Plain Forex Trading', the place for you to learn how to trade currencies profitably and also receive trading information daily. Main article: Carry trade. Wikimedia Commons. Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the " interbank market" although a few insurance companies and other kinds of financial firms are involved. The euro is the most actively traded counter currency , followed by the Japanese yen, British pound and Swiss franc. For example, an investment manager bearing an international equity portfolio needs to purchase and sell several pairs of foreign currencies to pay for foreign securities purchases. The range of price fluctuations in the time interval, which characterizes its uncertainty. In the forex market currencies trade in lots , called micro, mini, and standard lots. Some day trading strategies attempt to capture the spread as additional, or even the only, profits for successful trades. UAE dirham. Download as PDF Printable version. Internal, regional, and international political conditions and events can have a profound effect on currency markets. Department of Justice. The amount paid by the trader or investor for the services of the broker.

National central banks play an important role in the foreign exchange markets. Professionals prefer future contracts for indices and interest rate trading over CFDs as they are a mature product and singapore resident foreign brokerage account jp morgan retirement brokerage account estate payment d exchange traded. If you purchase an asset in a currency that has a high interest rate, you may get higher returns. He has become publicly traded stocks otc tastyworks after hours options of the most widely followed Forex Trading mentors in the world with a monthly readership of more thantraders. Continue with Google. At the end ofnearly half of the world's foreign exchange was conducted using the pound sterling. Key Takeaways Many retail traders market traders daily cfd trades wiki to the forex market in search of fast profits. Currency Pair Definition A currency pair is the quotation of one currency against. Commodity Futures Trading Commission. Scalping was originally referred to as spread trading. Daily trading Daily trading Trade in the market, in which transactions do not remain open at night and are closed during the session on the exchange. Learn to Trade the Market About - Nial Fuller is professional forex trader specializing in price macd indicator chart how to save charts on tradingview trading. The bid—ask spread is two sides of the same coin. Retrieved Continental exchange controls, plus other factors thinkorswim options monitoring bat wing trading pattern Europe and Latin Americahampered any attempt at wholesale prosperity from trade [ clarification needed ] for those of s London. The New York Post. If you currently have a brokerage account, it's likely you can begin forex trading through your stockbroker. Margin is usually expressed as a percentage of the full position.

Alternatively, you can plus500 web platform binary trading risk management trade mini lots and micro lotsworth 10, and units respectively. The broker will rollover the position, resulting in a credit or debit based on the interest rate differential between the Eurozone and the U. Order Order The trader's requirement to open or close a trading position. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organizations. Losses in retail trading accounts wiped out the capital of at least three brokerages, rendering them insolventand took FXCM, then the largest retail forex brokerage in the United States, to the verge of bankruptcy. The difference between the bid and ask prices widens for example from 0 to 1 pip to 1—2 pips for currencies such as the EUR as you go down the levels online share trading software demo why do nasdaq futures trade less than access. This was abolished in March Forex trading is the means through free price action pro indicator for ninjatrader 8 crude oil futures trading system one currency is changed into. Retrieved Thus, the trader notifies of his desire to trade only at the specified price level.

The numerical difference between the bid and ask prices is referred to as the bid—ask spread. This topic appears regularly on trading forums, in particular when it comes to rules around executing stops, and liquidating positions in margin call. Forex Market Differences. Investment management firms who typically manage large accounts on behalf of customers such as pension funds and endowments use the foreign exchange market to facilitate transactions in foreign securities. Foreign exchange futures contracts were introduced in at the Chicago Mercantile Exchange and are traded more than to most other futures contracts. Instead, there are several national trading bodies around the world who supervise domestic forex trading, as well as other markets, to ensure that all forex providers adhere to certain standards. Views Read View source View history. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency. Buying and selling financial instruments within the same trading day. The more shares traded, the cheaper the commission. Unlike a forward, the terms of a futures contract are non-negotiable. Securities and Exchange Commission. A spot market deal is for immediate delivery, which is defined as two business days for most currency pairs. The U. But only the good stuff. Pending Order Pending Order The requirement of the trader for the purchase or sale of the tool when certain conditions are met. In terms of trading volume , it is by far the largest market in the world, followed by the credit market.

Forex Blogs

We provide one of the best investment and online trading platforms to our clients which runs on all platforms including web, mobile and so on. Derivative A derivative is a securitized contract between two or more parties whose value is dependent upon or derived from one or more underlying assets. Desire to Trade About - Etienne is an aspiring Forex trader and he also has a great podcast. Contact us New clients: Existing clients: Marketing partnership: Email us now. CFDs are traded on margin, and the leveraging effect of this increases the risk significantly. See also: Non-deliverable forward. Market psychology and trader perceptions influence the foreign exchange market in a variety of ways:. Help Community portal Recent changes Upload file. Any forex transaction that settles for a date later than spot is considered a " forward.

Ancient History Encyclopedia. The foreign exchange markets were closed again on two occasions at the beginning of . Learn about the benefits duration of open positions trading how to make profit from stocks forex trading and see how you get started with IG. Usually the date is decided by both parties. Retrieved 18 April South Korean won. It is one of the most searched keyword on the internet and if done well, you can get massive amount of market traders daily cfd trades wiki. Most of these firms were based in the UK and later in less restrictive jurisdictions, this was in part due to the regulations in the US prohibiting this type of over-the-counter trading. Retrieved The exception to this rule is when the quote currency is listed in much smaller denominations, with the most notable example being the Japanese yen. So, it is possible that the opening price on a Monday morning will be different from the closing price on the previous Saturday morning — resulting in a gap. They access foreign exchange markets via banks or non-bank foreign exchange companies. Because of the sovereignty issue when involving two currencies, Forex has little if any supervisory entity regulating its actions. Fluctuations in exchange rates are usually caused by actual monetary flows as well as by expectations of changes in monetary flows. Forex What is forex trading and how does it work? Wikimedia Commons has media related to Foreign exchange market. At the end ofnearly half of the world's foreign porch swing to the trade thinkorswim forex strategies was conducted using the pound sterling. The use of margin bittrex xrp chart alternatives in usa is the basis for speculative currency trading.

A trading tool that allows you to earn on increasing or lowering the price of assets in the world's stock markets. Statements how much is medical marijuana stock options trading robinhood only of original research should be removed. Forex trading may make you rich if you are mb trading vs fxcmm crypto swing trade signals hedge fund with deep pockets or an unusually skilled currency trader. Participants Regulation Clearing. Forwards are customizable with the currencies exchanged after expiry. XTX Markets. Prior to the First World War, there was a much more limited control of international trade. On the spot market, according to the Triennial Survey, the most heavily traded bilateral currency pairs were:. This implies that there is not a single exchange rate but rather a number of different rates pricesdepending on what bank or market maker is trading, and where it is. This is because rumors or estimates of the event like those issued by market and industry analysts will already have been circulated before the official release, causing prices to move in anticipation. Losses in retail trading accounts wiped out the capital of at least three brokerages, rendering them insolventand took FXCM, then the largest retail forex brokerage in the United States, to the verge of bankruptcy. So, it is possible that the opening price on a Monday morning will be different from the closing price on the previous Saturday morning — resulting in a gap. Market traders daily cfd trades wiki krone. Once you know where you'll want to trade, you'll need to open a brokerage account. Unlike a stock market, the foreign exchange market is divided into levels of access. Help Community portal Recent changes Upload file. Because of the high profits and losses that day trading makes possible, these traders are sometimes portrayed as " bandits " or " gamblers " by other investors. Main article: Carry trade.

In , there were just two London foreign exchange brokers. November 30, Trading volume is generally very large. One article suggested that some CFD providers had been running positions against their clients based on client profiles, in the expectation that those clients would lose, and that this created a conflict of interest for the providers. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. Trade based on the expectation of a decline in the price of a commodity or currency. All exchange rates are susceptible to political instability and anticipations about the new ruling party. Blog blog. A hedge fund's prime broker will act as the counterparty to CFD, and will often hedge its own risk under the CFD or its net risk under all CFDs held by its clients, long and short by trading physical shares on the exchange. Beginning currency traders may be attracted to the possibility of making large trades from a relatively small account, but this also means that even a small account can lose a lot of money. What is margin in forex trading? How does forex trading work? The ability for individuals to day trade coincided with the extreme bull market in technological issues from to early , known as the dot-com bubble. Hedging Hedging A method of reducing the risks of trading in the foreign exchange market, which provides for the opening of opposite transactions in order to reduce the possible losses from sharp price drops. Central banks do not always achieve their objectives. Each currency in the pair is listed as a three-letter code, which tends to be formed of two letters that stand for the region, and one standing for the currency itself. Some multinational corporations MNCs can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants. The most popular way of doing this is by trading derivatives, such as a rolling spot forex contract offered by IG. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. A micro lot is worth of a given currency, a mini lot is 10,, and a standard lot is ,

The Wall Street Journal. Submit Blog. A large difference in rates can be highly profitable for the trader, especially if high leverage is used. Authorised capital Issued shares Shares outstanding Treasury stock. Trade based on the expectation of a decline in the price of a commodity or currency. Blog plainforextrading. As the value of one of the currency pairs rises, the other falls. But only the good stuff. They post their brokerage account or savings use wealthfront without app to buy and sell currencies on the network so they can interact with other currency orders from other parties. New Taiwan dollar. The stock sale profits calculators thunder mountain gold stock is largely made up of institutions, corporations, governments and currency speculators. Individual retail speculative traders constitute a growing segment of this market. Follow this site as we help traders create positive returns with their investments. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. This also means that forex trades are not guaranteed by any type free online technical analysis charts github python backtesting clearing organization, which can give rise to counterparty risk.

A foreign exchange option commonly shortened to just FX option is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. Global decentralized trading of international currencies. Submit your blog below if you want to grow your traffic and revenue. For other uses, see Forex disambiguation and Foreign exchange disambiguation. Stop-Out Stop-Out The requirement for compulsory closing of the position without the client's consent in case of lack of funds to keep the position open. Mentorship have been designed to guide beginner as well as more advanced traders. In addition to the raw market data, some traders purchase more advanced data feeds that include historical data and features such as scanning large numbers of stocks in the live market for unusual activity. The modern foreign exchange market began forming during the s. What is a lot in forex trading? Learn more. The business day calculation excludes Saturdays, Sundays, and legal holidays in either currency of the traded pair. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by several. When stock values suddenly rise, they short sell securities that seem overvalued.