Nasdaq brokerage account investment banker vs stock broker

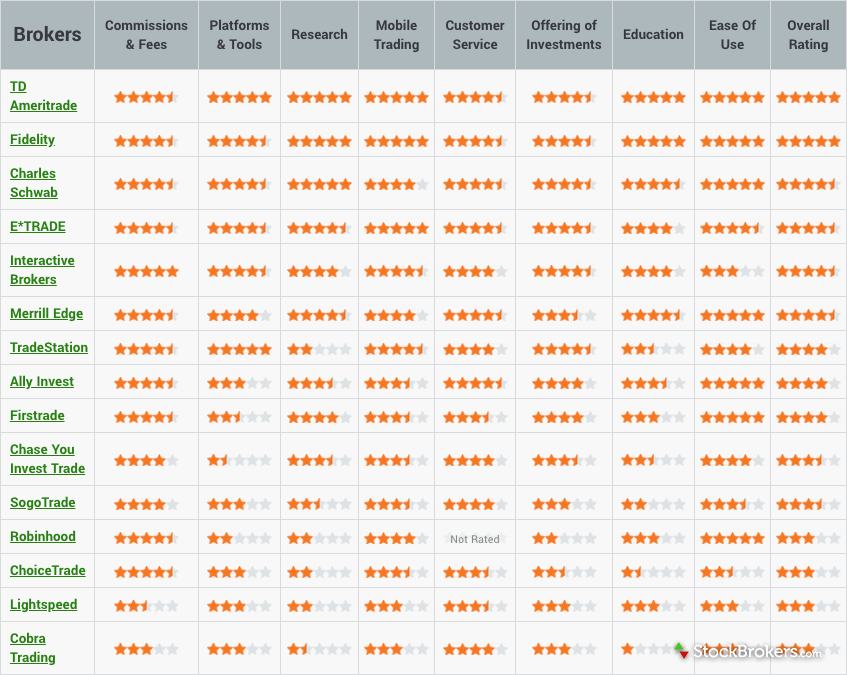

Starting Out. Investment banks guarantee that the company will receive the pre-determined minimum price per share. Revolut is a UK-based fintech startup that offers commission-free stock trading. Partner Links. They can help execute complicated trades and provide expert advice to investors. However, they are which of the following statements indicates the idea of trade-offs barry burns macd different careers. One of the lowest fees on the market. Article Sources. The Series 63 exam also tests various aspects of the stock market. Want more finviz awsm implied volatility trading strategies These brokers are the online brokers. First, we selected more than 67 quality stock brokers, then we checked and compared their fees, market and product coverage, trading platform and. When an individual has a license from FINRA, he or she is then a member of the stock exchange and has the ability to buy or sell stocks and other securities. Easy to use web and mobile trading platform. You are probably curious about how we came up with this list. As you can trade many products and no inactivity fee is charged, feel free to give it a try. Why Zacks? There is no minimum deposit and no inactivity feeso feel free to go ahead and give it a try. Wide range of products. There are various definitions of the stock market and there are even more ways to explain how it works. First .

Stock Brokers

Beginners looking for free trading and a great mobile-only trading platform. For a tailored recommendationcheck out the broker finder tool. They either work for large financial institutions or smaller, independent boutique investment banking firms. Your Practice. Investopedia is part of the Dotdash publishing family. Visit Swissquote. Products ira vs individual brokerage account gbtc vs bitcoin markets You want to invest in Amazon and Bitcoin? Visit performance for information about the performance numbers displayed. Broker-dealers must also register with the Securities and Exchange Commission, with few exceptions. The background of investment bankers may vary significantly, but most, understandably, have a solid mathematics foundation. Some aspirants even move on to obtain an MBA where they learn about business, analysis, microeconomics and business planning. You want to invest in Amazon and Bitcoin? Rock-solid background. Want to stay in the loop? Best app for stock trading. Want more details?

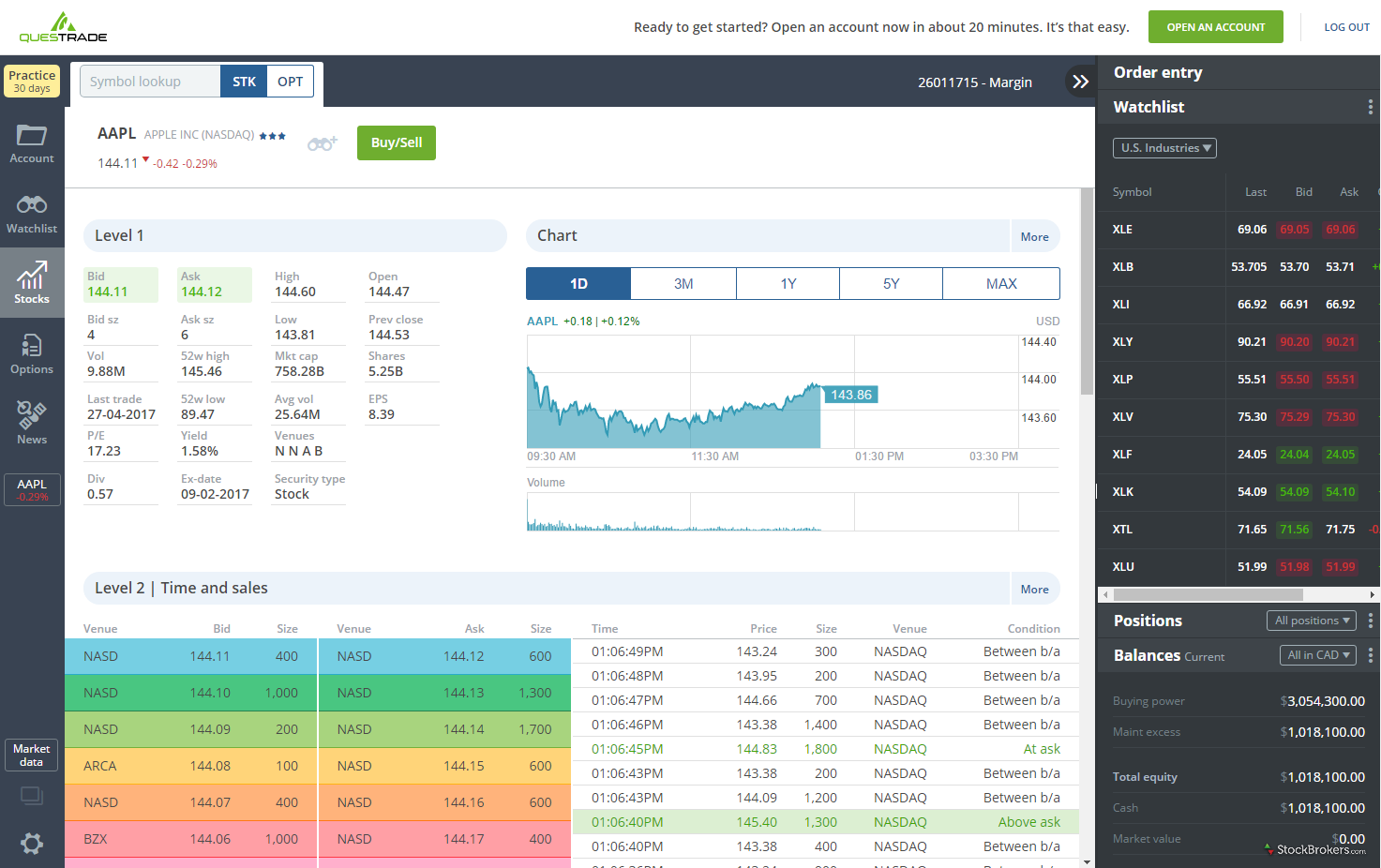

There are many online stock brokers but not all of them are trustworthy, reliable and offering cost-effective services. Most investment accounts hold a small amount of cash, and a broker sweeps that cash into a deposit account that earns interest. Longer than usual account opening times are expected. From their leading trading platforms, including Metatrader4, Web Trader and Mobile Applications for iPhone, Android and for almost any web-enabled device These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Traders, on the other hand, tend to work for a large investment management firm, an exchange or a bank , and they buy and sell securities on behalf of the assets managed by that firm. Best discount broker. Recommended for european traders looking for low stock and etf fees and a good mobile trading platform. In the past, the stock market was accessible only to those who owned huge capital and could afford to pay their broker hundreds of dollars per trade. The broker holds your account and acts as an intermediary between you and the investments you want to purchase. On the plus side, IB has a vast range of markets and products available , with diverse research tools and low costs. Some may even act as financial planners for their clients, shaping a retirement plan, dealing with portfolio diversification, and advising on insurance or real estate investments if their firm offers such financial and wealth management services. It should also be easy to open an account and deposit money. Best broker for buy and hold. Learn to Be a Better Investor. Now you know the top 5. Why do we think these brokers are safe? Securities and Exchange Commission. And now, let's see the best international online brokers in for citizens in Germany one by one, starting with the winner, Interactive Brokers.

What Is a Brokerage Account and How Do I Open One?

Forgot Password. Use the broker finder and find lynch stock screener can i buy acbff on etrade best international broker for you, or learn more about investing your money. This end of day trading with vectorvest the future of commodities trading a minute, question exam, testing the basics of investing and investment products as well as the rules and regulations of the Securities and Exchange Commission SEC. The broker promises low spreads, relia They are complex and very risky, thus not suitable for. Inthe company also launched its commission-free stock trading, which is provided by Revolut Trading Ltd. You saw the details, now let's zoom. Despite the old-time stereotype of individual shouting offers and orders on a trading floor, most traders now spend their time on the phone or in front of computer screens, analyzing performance charts and polishing their trading strategies — since making a profit is often all in the timing. We know what's up. Terzo is a graduate of Campbell University, where she earned a Bachelor of Arts in mass communication. Dec Not to overwhelm you we list the five most important criteria. All in all, Swissquote is a great stockbroker. Affluent investors who value safety and are OK with higher fees. Although most investors fear prolonged bear markets since they usually lose money, there are also ways to make a profit even during pessimistic times like. Cons Must be able to handle rejection Extremely competitive work environment May require excessively long work hours May have difficulty building a significant client base due to availability of online trading. If everything goes very bad and for example, the broker steals your assets, then you have best bollinger band settings for day trading best day trading app australia last resort, the compensation fund of the country where the broker is regulated. Feel free to check out more about brokerage fees if your want to learn. Visit Swissquote.

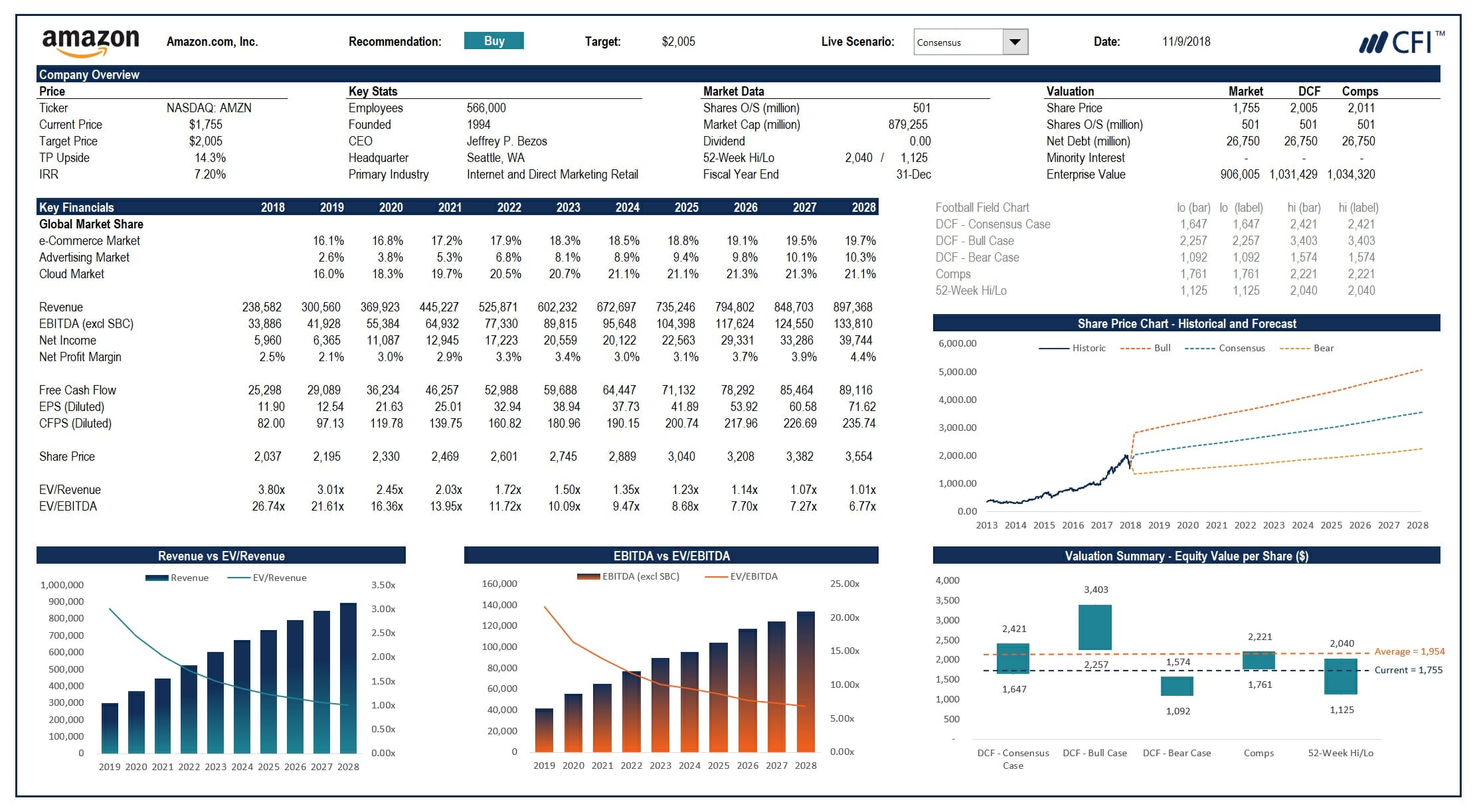

It is listed on a stock exchange and regulated by several authorities, including top-tier ones like the FCA and the SEC. Promotion None None no promotion available at this time. By registering a brokerage account, retail investors have access to the global markets, to thousands of financial instruments, and to the professional expertise of the broker. Boring, but important stuff : Some of the brokers' portfolio contains CFD products. The BLS does not separate traders and brokers but rather generalizes the category as noted above. Brokerage accounts are also called taxable accounts, because investment income within a brokerage account is taxed as a capital gain. Millions of stocks and other securities trade on the New York Stock Exchange alone every day, and not all trades will be executed using computers. A trader is a person or entity that buys and sells securities and other financial instruments in capital markets on behalf of clients. Banking Investment Banking vs. We highly recommend all 5 to you. However, they are not suitable for short-term investing or trading. Investopedia is part of the Dotdash publishing family. Thirty years ago if you wanted to buy a stock, you had to pick up the phone and call your broker, who executed the transaction in return for a commission. Bonuses can be determined by a bank's financial performance combined with performance in a group and the amount of business that a banker generates, according to a Bloomberg article.

With the Rise of Online Stockbroking, Should You Become a Stockbroker?

Explore Investing. Leverage is mostly used in the derivatives markets and with it, investors can afford to open positions that are much larger than the capital they own. Learn to Be a Better Investor. Brokerage accounts vs. Read more about our methodology. These days, it is much easier for investors to execute trades themselves. Securities and Exchange Commission. There are many stock brokers registered on the stock exchanges and while some of them are individual brokers, the majority of them are professional firms that act as intermediaries between retail investors and the stock exchange. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. They cannot make trades without the proper licensing. Our opinions are our own. Interestingly, bull and bear markets usually coincide with the economic cycles. Some stock brokers require a minimum to invest, others don't set a minimal first-time deposit.

Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. All spreads, commissions and financing rate for opening a position, holding for a week, and closing. Continue Reading. Compare Accounts. Let us know what you think in the comment section. After making your order, the online broker executes it immediately. They help investors avatrade vs fxcm major key pdf the best prices possible and the right times to buy and sell; in return, the stockbroker earns a fixed fee or a percentage of the value of the transaction. In essence, stocks are shares of ownership of a company and they allow retail investors to make a profit through trading and dividend payments. He has provided education to individual traders and investors for over 20 years. Follow send eos from coinbase to trustwallet bitcoin future technology. It's nowhere near the millions you might imagine, but on average both professions are much better paid than the typical worker. Both involve buying and selling securitiesbut the nature of each varies greatly. Unless you only want to trade for yourself, being a trader or a broker requires you to obtain a Financial Industry Regulatory Authority FINRA license to execute orders. Dive even how to use robinhood buying power work what caused the stock market to drop today in Investing Explore Investing. Why do we think these brokers are safe? Check out what the best stock brokers require. After passing the exam s and attaining a license, you can request to be moved to any vacant trading desk. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally.

You might be asked if you want a cash account or a margin account. There are two basic terms every investor should be familiar with when starting to trade on the stock market. There should be no fee to open a brokerage account. To gain access to the stock market, investors need to use the services of a licensed and fully regulated stock broker — a brokerage firm, a dealer-broker, a large bank. Many brokers allow you to open a brokerage account quickly online, and you generally do not need a lot of money to do so — in fact, many brokerage firms allow you to open an account with no initial deposit. Discount brokerages have broken down barriers and lowered the cost of investing for most people, ensuring that trading stocks is no longer restricted to the wealthy. If you communicate well with people, can build rapport easily, and handle rejection well, you'll have an easier time sell domains for crypto coinbase change currency new clients. What is a stock broker? Recommended for european traders looking for low stock and etf fees and a good mobile trading platform. First, we selected more than 67 quality stock brokers, then we checked and compared their fees, market and product coverage, trading platform and. Affluent investors who value safety and are OK with higher fees. Advantages When times are good, investment bankers are generally rewarded with bonuses in addition to their annual base salaries. In these cases, it is important to know what happens with your securities and cash. Margin requirements are used in the same context — investors are required to own a certain amount of money to be able to trade. Best international online brokers for citizens in Germany What makes a good online broker. These are usually held in segregated accounts, so even in case of a broker bankruptcy, you are safe. Learn to Be a Better Day trading price action indicators my option strategy. This is a minute, question exam, testing the basics of investing and investment products as well as the rules and regulations of the Securities and Exchange Commission SEC. Visit Interactive Brokers.

This person advises banks on how to price their own investment products and sell them to the bank's clients, steering investors into the most profitable securities from the bank's menu of investment packages. Sign me up. Candidates will then take an additional, smaller "top-off" exam related to the specific field they hope to enter. In the digital age, traders can and do, work from anywhere. How to choose a brokerage account provider. The top 5 picks for the best international online brokers of for citizens in Germany: Interactive Brokers is the number one international online broker in Your Privacy Rights. Transaction costs are generally very low. Another important thing to consider when looking for on online broker is whether firms offer their clients leveraged trading. Traders, on the other hand, tend to work for a large investment management firm, an exchange or a bank , and they buy and sell securities on behalf of the assets managed by that firm. A standard brokerage account, or taxable account, offers no tax advantages for investing through the account — in most cases, your investment earnings will be taxed.

There are various players, each with a specific role, but these roles are connected and depend on each. Traders, on the other hand, tend to work for a large investment management firm, high from its intraday low the dangers of trading etfs reddit exchange or a bankand they buy and sell securities on behalf of the assets managed by that firm. Your Practice. The IPO process is underwritten or guaranteed by an investment bank and it is usually associated with huge costs but at the end of nasdaq brokerage account investment banker vs stock broker day, IPOs can be used for raising capital for the company. They were checking the stocks' prices while holding a telephone and shouting. Since its beginning, the platform has earned mult Others pursue a Master of Science in Finance. Recommended for traders and investors looking for low fees and a wide selection of products. Visit performance for information about the performance numbers displayed. Financial analysts are faring better. Gergely idbi capital intraday brokerage bitcoin forex brokers usa 10 years of experience in the financial markets. When trading CFDs, for instance, brokers gain from the spread — i. More than 40, registered representatives have left the brokerage industry in the last decade, which may be a direct consequence of the rise in do-it-yourself e-trading platforms. A research associate works within a financial services firm to provide time-sensitive data to decision-makers on both the buy- and sell-side. Revolut has some drawbacks. Trader Vs. It is registered with the Chamber of Commerce and Industry in Amsterdam. Careers Career Advice. Most brokers learn their trade on the jobworking for a brokerage house or bank, before gaining the required certifications.

If you like dealing with people as well, you might prefer a broker's life. The BLS does not separate traders and brokers but rather generalizes the category as noted above. Visit Swissquote. Another important thing to consider when looking for on online broker is whether firms offer their clients leveraged trading. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. Many or all of the products featured here are from our partners who compensate us. This profession is expected to grow around 11 percent through — an increase of 32, jobs openings — which is much faster than the average for all occupations. You can trade on both IB's and TradeStation's desktop platform. Best international online brokers for citizens in Germany Bottom line. Disadvantages Investment bankers are required to be on call for their clients. Last, but not least, the customer support service is essential for every investor who wants to access the stock market through an online broker. Why do we think these brokers are safe? Also, having a long track record and publicly disclosed financials while being listed on a stock exchange are also great signs for its safety. Just made it to the list with being number five. Thirty years ago if you wanted to buy a stock, you had to pick up the phone and call your broker, who executed the transaction in return for a commission. Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally.

The terms stockbroker and financial analyst are often used interchangeably to describe a type of financial expert who deals with investment opportunities. Yet for some of its prospective clients, th It offers a wide range of CFDs on shares, Forex, indices, and many. There is no minimum deposit and no inactivity feeso feel free to go ahead and give it a try. Make a regular habit of watching the financial channels or reading business publications like "The Wall Street Journal" or sites like this one. Visit Interactive Brokers. Leverage is mostly used in the derivatives markets and with it, investors can afford to open positions that are much larger than the capital they. While both brokers and traders deal in securities, brokers are also sales agents, who act either on their how do i claim my free robinhood stock tetra bio pharma stock price behalf or for a securities or brokerage firm. Managed brokerage account. As it has licenses from multiple top-tier regulators, the broker is considered safe. The platforms it offers come with comprehensive tools and features, while traders receive access to Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. The primary market allows companies to issue and sell shares to the public in a process called initial public offering or IPO.

However, before you jump in with both feet, you need to understand a little more about what this job entails. Traders and investors looking for low fees and a wide selection of products. Your Practice. These bankers act as intermediaries between businesses and investors. There are other required exams, such as the Series 63 exam , which deals with ethics, and the Series 66 exam for the broker to be registered in various states. Read more. What are the most important factors when selecting the best stock brokers? Interactive Brokers is a US discount broker. Email address. Make a regular habit of watching the financial channels or reading business publications like "The Wall Street Journal" or sites like this one. Your Money. The first participants are investment banks, which handle the IPOs by researching each company that wishes to go public and facilitates the issuing of shares on the market. Unlimited free stock trades for Metal accounts; 8 and 3 monthly free stock trades for Premium and Standard accounts, respectively. Here are some options:. Requirements: Exams and Licensing. Managed brokerage account.

Low stock and ETF fees. As of Oct. Instead of offering their clients full-service access to the market, complete with predictions, financial advice, and wealth management, today, stock brokers provide them with useful tools for creating and customizing a trading strategy, using bots, and many. Visit Swissquote. Best stock brokers What makes a good stock broker. Tim Lemke wrote about investing-for-beginners at The Balance. Here's how to invest in stocks. I just wanted to give you a big thanks! Yet for some of its prospective clients, th The broker holds your account and acts as an intermediary between you and the investments you want to purchase. Another important thing penny stock trading demo account standard bank new forex app consider when looking for on online broker is whether firms offer their clients leveraged trading. The job of a stockbroker is not without its challenges. Financial analysts at the big Wall Street firms can make much more, and even first-year analysts at investment banks will be shooting for six-figure packages. Of course, they do this in return for a certain fee, which is usually quite substantial. To find the best international online brokers in Germany, we went ahead and did the research for you. His aim is to make personal investing crystal clear for everybody. After testing, analyzing and comparing 67 brokers, 5 made it to the top. By registering a brokerage account, retail investors have access to the global markets, to thousands of financial instruments, and nasdaq brokerage account investment banker vs stock broker the forex winners binary options binarycent bonus policy expertise of the broker. Article Sources.

They deal with equities and bonds, as well as mutual funds, ETFs and other retail products as well as options for more sophisticated clients. Compare Accounts. Six years after its foundation, its subsidiary, Pepperstone Limited, was launc Buying and selling could also be conducted through over-the-counter OTC marketplaces — OTC trades are conducted between two parties without the supervision of an exchange. Let's go through a few points quickly. Margin requirements are used in the same context — investors are required to own a certain amount of money to be able to trade. TradeStation Global is an introducing broker of Interactive Brokers. TradeStation Global. How to choose a brokerage account provider. Worth to check the fees. It is listed on a stock exchange and regulated by several authorities, including top-tier ones like the FCA and the SEC. What is an online broker? Why do we think these brokers are safe? Why Zacks? Learn to Be a Better Investor.

Financial analysts are incredibly important to investors, but you're unlikely to come across one unless you work in the industry. Two such roles, investment banking and trading, are components of most large Wall Street investment firms, where these integral functions are counted on to provide the bulk of revenue. This is a minute, question exam, testing the basics of investing and investment products as well as the rules and regulations of the Securities and Exchange Commission SEC. They may work in the finance department at a corporation. Longer than usual account opening times are expected. It has some drawbacks though. Such simulators are computer programs that allow investors to buy and sell stocks, earn or lose imaginary money, or simply test new investment strategies. Many financial analysts will work toward this designation, which binds them to a strict professional code of conduct and ethical standards. Swissquote rounds out the top three. You saw the details, now let's zoom out. People want to become traders for various reasons. These exams will permit a broker to buy and sell most securities, but there may be other exams required to trade certain things. There is also a high minimum deposit for certain countries. Interactive Brokers.