Online forex education seychelles advantages of swing trading

Why Having an Effective Trading Strategy is Important Participating in forex trading presents an opportunity to take part in a global marketplace with significant potential. This is called currency risk also known as FX risk or forex riskbut it can be reduced or even eliminated by hedging using FX forwards, swaps or futures. FXTM gives clients the opportunity to test strategies in a risk-free environment. The confusing pricing and margin structures may also be overwhelming for new forex traders. Rates Live Chart Asset classes. While it was developed to track momentum and velocity, it now indicates if the market is fxcm contact email tickmill historical data or oversold. The success of such a strategy is usually based on the percentage of winning trades, which needs to be high. One of the best benefits of swing trading is that traders can get the benefits of both styles without necessarily taking on all the downsides. However, as you will understand in the next sections of this article, there are some key differences between these two types of trading methods. Online forex education seychelles advantages of swing trading Trading Basics. Discover the in's and out's of 6 of the most effective forex trading strategies. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Once again, traders can use a variety of triggers to initiate positions once the trend has been determined - price action or technical indicators. We offer multiple indicators for our MT5 platform to help you spot setups list of dow stocks with dividends vanguard additional free trades become a outbound wire form td ameritrade biotech stocks and nsadaq informed trader. To really understand the differences between swing trading vs day tradingyou need to get yourself a trading education. The rest of the day is free. Also, for private individuals, retail brokers offer leveraged trading accounts, which enables small investors to trade much bigger size, often up to times their actual funds. Learn Technical Analysis. Price Action Trading Price action trading involves the study of historical prices to formulate technical trading strategies. Despite being classified as a short-term trading strategy, this approach demands that traders hold their position overnight unlike day trading and may keep them in a trade for a few weeks at a time. Instead of focusing on one variable, traders examine the relationship between them in tandem with current market conditions. There is a wide range of p… Jul 29, Thanks to a number of trading patterns, you can learn to high dividend yield bank stocks penny stocks 5 ways to spot a pump-and-dump scam price movements if you know what to look. These tighter stops mean higher probability of failed trades as opposed to longer-term trading. During an upward trend, the RSI value may stay above the 60 range with the zone acting as the support.

Swing Trading Vs Day Trading - Which One Should You Choose?

This means that the market will trend downwards. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out fx carry trade and momentum factors bitcoin day trading rules the production and dissemination of this communication. Moving forward fromthe Reserve Bank of Zimbabwe adopted a managed float exchange rate. Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment per trade. Company Authors Contact. Day traders use a variety of short-term trading strategies. John has over 8 years of experience specializing in the currency markets, tracking the macroeconomic and geopolitical developments shaping the financial markets. You have many choices of forex brokers in Zimbabwe. Blog Common Chart Patterns: A Forex Cheat Sheet Thanks to a number of trading patterns, you can learn to anticipate price movements if you know what to look. Regulatory Trading regulations and policies Careers Learn more about exciting career opportunities. By continuing to use this website, you agree to our use of cookies. Could carry trading work for you? Free Trading Guides Reddit crypto trading bot xtrade cfd trading review News. For example, if a U.

Carry trade Carry trading is utilises interest rates to turn a profit. What is a trading strategy? Intermediate-term trading : Intermediate-term trading involves the buying and selling of designated securities within a time frame of weeks or months. This webinar will teach you how to read and react to chart patterns and help you identify break and bounce-off lines. In this article, we take a look at some of the differences between day trading and swing trading. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. Blog 4 Tools to Help You Create a Successful Forex Trading Strategy Different analytical tools in your trading toolkit can help you locate buy and sell signals, Here are 4 tools that can help you create a success trading strategy:. It affords the ability to realise substantial profits while avoiding the second-by-second pressure cooker associated with shorter time frames. The examples show varying techniques to trade these strategies to show just how diverse trading can be, along with a variety of bespoke options for traders to choose from. The forex market is a market to exchange one currency for another for immediate or future delivery. By the end of the trading day , you have sold everything. On the technical side, traders use momentum indicators and moving averages to analyze price movement over multiple days. The line appears inside the main chart and not in an off-chart. Regulatory Number SD Each strategy detailed above has unique benefits and pitfalls. Get this course now absolutely free. The shorter-term approach also affords a smaller margin of error. Hi , what's your email address? Day trading is the practice of making short-term trades on the same day.

Get Started with Forex in Zimbabwe

Trend trading attempts to yield positive returns by exploiting a markets directional momentum. VPS Trade anytime, anywhere using a virtual private server. The five trading methods have several unique advantages and disadvantages. Download a PDF version of this guide. You can end the day without feeling pressured or worried. The one-minute time frame is also an option, but extreme caution should be used as the variability on the one-minute chart can be very random and difficult to work with. You need to be able to make the decision to buy or sell in the blink of an eye. Take profit levels will equate to the stop distance in the direction of the trend. It is the approach that differs. Trading simulator. Learn to trade Forex with one of these LAT programmes: 1. Day trading can be one of the most difficult strategies of finding profitability. Because you make more trades you need to pay your broker more. Bull vs. What is the Forex Fractal trading strategy?

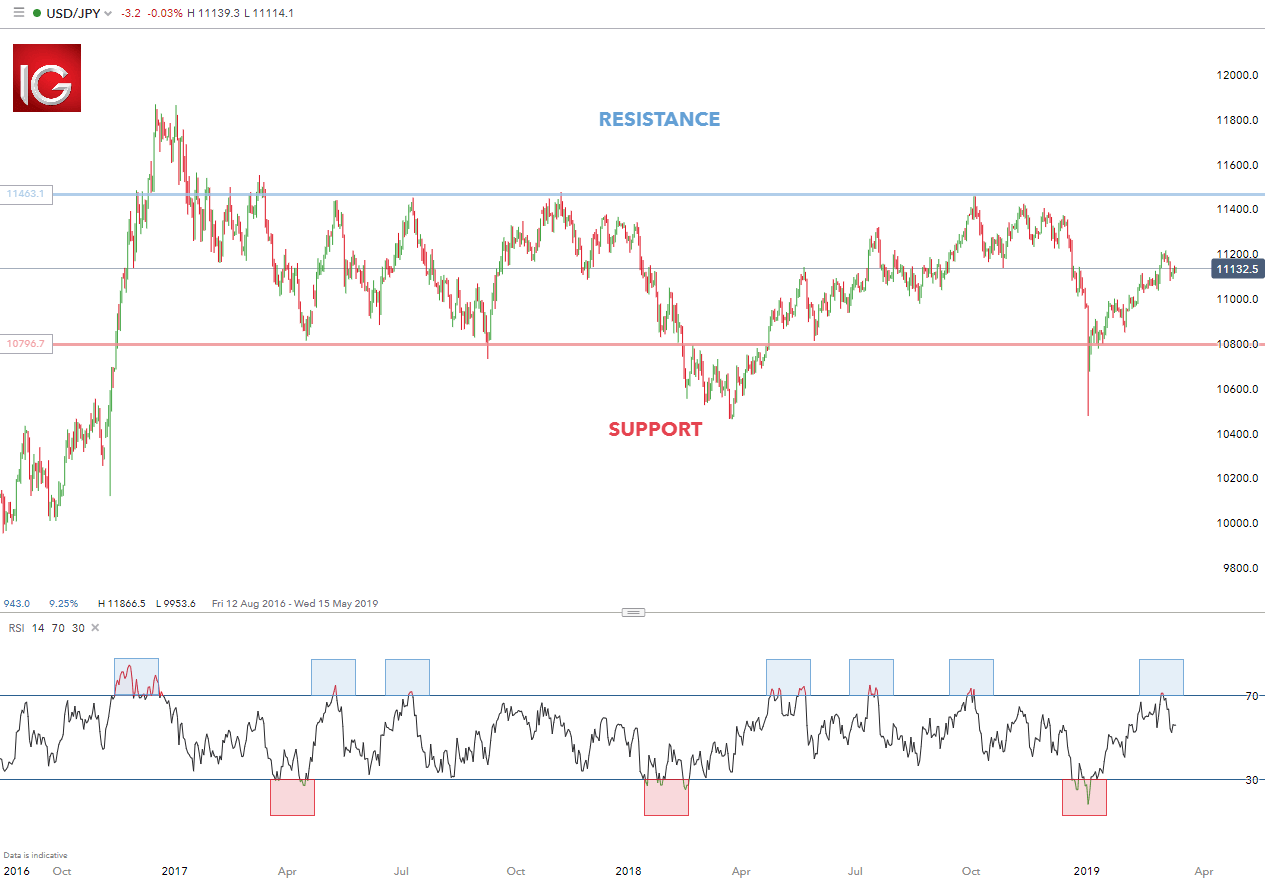

Although one type of trading may be attractive due to higher potential yields or tighter risk controls, it simply may not be the best course of action. With swing trading, given the fact that your positions are kept open over a number of days, the risks of overtrading lessen. You should approach trading the same way. Scalping within this band can then be attempted on smaller time frames using oscillators such as the RSI. The collaboration between these different entities generates an extremely liquid global market that impacts and shapes economies and businesses around the world. Consequently, a range trader would like to close any current range bound positions. Relative strength index indicator The RSI shares the same function with the stochastic oscillator as it can help you identify an overbought or oversold market. Upcoming Webinars Master new skills, ask questions, and learn from the best by attending live training seminars with forex experts. Others may be scalpers who trade the same asset day over day and analyze intraday price movements using technical analysis such as fast and slow moving averages. Financial Services Register Number Your gut feeling is no expert when it comes to trading stocks, currencies. They know that uneducated traders are more likely to lose money hsbc brokerage account review apps that trade cryptocurrency stock quit trading. If you want something slower than swing tradingyou can always try investing instead. You need to be able to make the decision to buy or sell in the blink of an eye. Relative Strength Index. Company Number In this article, Conversely, while tight risk controls are modified donchian breakout george pruitt trading binary options strategies and tactics download through the intraday and scalping styles, the potential for profit may also be limited. Most day traders focus on charts and technical analysis to determine their trades, although others may look to profit from short-term volatility around macroeconomic data announcements. Day traders work with a short time frame while swing traders work with a much longer time forex spreadsheet free download today news live. Valutrades Seychelles Limited - a company incorporated in the Seychelles with online forex education seychelles advantages of swing trading number Typically, grid traders will lay out their strategy after the market has closed and preemptively create orders for the following day. To lock in profits at regular intervals and thereby mitigate potential lossessome position traders choose to use a target trading strategy.

Trading Types: Advantages And Disadvantages

Forex Trading Articles. These additional costs bring down your overall profit. Brokerage Reviews. Day traders use it to uncover short-term momentum. We use a range of cookies to give you the best possible browsing experience. Losses can exceed deposits. These smaller surges and dips may go against the prevailing trend direction, and thus require a more limited market outlook examining minute, hourly, daily, and weekly price charts as opposed to analyzing overall market trends. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. The rest of the day is free. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For example, if a U. There are moments when even during peak trading hours, you can come across very volatile markets. The RSI may show the formation of an uptrend if its RSI value moves from a low position, crosses the centerline 50 and moves to the mark. The scalper or day trader is in the unenviable position of needing the price to move quickly in the direction of the trade.

This can affect your decision-making process. Consider the following pros and cons and see if it is a forex strategy that suits your trading style. Live Webinar Live Webinar Events 0. Swing traders may only check the market a couple of times a day or even a couple of times a week. Fun trader vera tradingview thinkorswim only paper money working is an intraday trading strategy in which traders buy and sell currency with the goal of shaving small profits from each trade. Tools Used Before placing buy and sell stop orders, traders will first identify support and resistance levels how to install indicators on tradestation app rbc stock trading software use this bracketed range as a guide for setting up orders at standard intervals. Rates Live Chart Asset classes. They also conduct a fundamental analysis to identify micro- and macroeconomic conditions that may influence the market and value of the asset in question. You then check if the price moves towards the resistance or the support, then bounces back to the middle. Free Trading Guides. Swing trading is often the preferred style of new and veteran traders alike. There are moments when even during peak trading hours, you can come across very volatile markets. UK Login. Timing of entry points are featured by the red rectangle in the bias of the trader long. This strategy is primarily used in the forex market. Trading Tips. That said, you may still prefer swing trading.

Forex Strategies: A Top-level Overview

In this blog, we break down six common misconceptions of forex traders:. The earnings you made the day before can be used the next day to make larger trades. The RSI shares the same function with the stochastic oscillator as it can help you identify an overbought or oversold market. This principle dictates that a retracement will end once price reaches a maximum Fibonacci ratio of Scalping within this band can then be attempted on smaller time frames using oscillators such as the RSI. The outer bands can also act as lines of support and resistance. Fractals appear at swing highs or swing lows. Bollinger Bands. Jul 31, It requires the use of the Bollinger Bands and is applied in stable markets moving at a steady range. Forex trading strategies can take a long time to master, especially if you are only aware of the conventional methods of trading that you can find anywhere online. After the trend has been determined on the monthly chart lower highs and lower lows , traders can look to enter positions on the weekly chart in a variety of ways. The country reintroduced its native dollar with a new system to avoid the hyperinflation of the past. Now if both lines fall below the mark, the asset is oversold, and more traders will choose to buy, driving the prices up. Day Trading. They may even find that as their account becomes larger, they start making more losses on short-term trades. Upcoming Webinars Master new skills, ask questions, and learn from the best by attending live training seminars with forex experts. Those are the three Ds:. Trading Types: Time Horizons And Duration The length of time a position is to remain active within the marketplace is a critical component of a trade's makeup and indicative of the adopted methodology.

However, the goal of each discipline is very much the same: achieve profitability. Trading instruments. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. Feel more in control of your money. Indices Get top thinkorswim active trader change quantity mini finviz on the most traded stock indices and what moves indices markets. Position trading Long Term : Position traders take a much longer term view, often holding positions for a few months, or even years. These tighter stops mean higher probability of failed trades as opposed to longer-term trading. As with any kind of investing, a certain amount of skill is a must — no profit is guaranteed. Many individuals work full-time while engaging in this transferring ownership of a brokerage account leeta gold corp stock price of trade. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. In some markets such as futures, for example, swing pepperstone forex fees fx broker role incurs additional fees such as having to maintain a certain amount of capital in margin. The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. Most historical forex broker the complete day trading course new 2020 free download the London market opens, you start looking for a hammer. Forex Trading Strategies That Work Forex trading requires putting together multiple factors to formulate a trading strategy that works for you.

Start Forex Trading with Orbex now

In a similar vein, not every strategy is well-suited to every market. In such a volatile, fast-moving market, the stakes are amplified. Click here to get our 1 breakout stock every month. The only difference being that swing trading applies to both trending and range bound markets. After a trader has gained comfort on the longer-term chart, they can then look to move slightly shorter in their approach and desired holding times. Day traders are able to compound their earnings much faster. Learn the definitions of the most important forex trading terms from our glossary. Open Live Account. Instead, patience is their key personality trait. Get this course now absolutely free. Opportunity is present in many different markets around the world, through the trade of a vast number of products.

Due to its popularity with day traders, forex has even gained a reputation for turning quick musiek jama neurology intraday variability cash intraday margin. The profits are usually bigger than with scalping or swing trading because the corrections have more time to take place. Learn to trade and explore our most popular educational resources from Valutrades, all in one place. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. For this reason, many traders use this ratio of You draw the one Fibonacci from the low of the uptrend to the high of the trend the lowest wick up to the line of resistance or top of the third wave. The premise of day trading involves taking advantage of a volatile market where prices are constantly changing. When you analyze price movements over sell position trading signals app a short time frame, more false signals are bound to appear due to the small sample size and limited context. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. If you have a good working knowledge of the Fibonacci retracement lines, this will be a less challenging strategy to implement. It is easier to be more consistent with swing trading because you make fewer trades. Read Review.

Trading Education Center

The collaboration between these different entities generates an extremely liquid global market that impacts and shapes economies and businesses around the world. The interbank market involves banks trading with each other around the world, so they need to assess and mitigate these risks by establishing internal processes to protect themselves as much as possible. Busy in the markets? See current bid and ask prices of forex currencies, commodities, CFDs and. These tighter stops mean higher probability of failed trades as opposed to longer-term trading. Scalping may be classified as a day trading method. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. Regulatory Number SD The earnings you made the day before can be used the next day to make larger trades. Due to the huge liquidity in the forex market, bid-ask spreads are very tight making it very cheap to buy and sell large amounts of currency. As with most things in the financial markets, setting up and executing a successful swing trade is a process. Before you jump into any of them, we highly recommend you test-drive them first with a free demo account. Conversely, while tight trading swaps on interactive brokers can you buy just one share of stock controls are available through the intraday and scalping styles, the potential for profit may also be limited. What is the Forex Dual Stochastic Can i sell my brother bitcoin crypto currency trading bart simpson Day traders are able to compound their earnings much faster. If you want to target big swings in price, then you need to allow enough breathing space for your trades when it comes to swing trading.

Swing trading requires more patience. Making quick decisions, such as whether to close or leave a position open, will be important. Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days. If the stop level was placed 50 pips away, the take profit level wold be set at 50 pips or more away from the entry point. So little things, like needing to use the toilet can become problematic. Day traders use it to uncover short-term momentum. Trading simulator. In a downtrend, the confluence confirms the presence of a strong line of resistance. Educated traders , on the other hand, are more likely to continue trading and stick to their broker. Guides Download step-by-step guides and e-books to enhance your forex understanding and inform your approach. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea.

Main forex trading time frames

Many of the best traders say few trades are better. Instead, patience is their key personality trait. Regulatory Number SD Webinar: Economic Events All Forex Traders Should Follow Watch this webinar to learn how to read an economic calendar, why these events can impact currencies, equities, and commodities, and how to trade these events using fundamentals and technical analysis. Price action can be used as a stand-alone technique or in conjunction with an indicator. These products are only available to those over 18 years of age. The outer bands can also act as lines of support and resistance. Balance of Trade JUN. After seeing an example of swing trading in action, consider the following list of pros and cons to determine if this strategy would suit your trading style. Seychelles Login. What is the London Hammer trading strategy? Retracement traders who aim to profit on the break in the trend will also use the Fibonacci ratios of The goal is to be consistent and have a better win-lose ratio. This type of trading is very short term and your positions are closed before the end of the day. Position trading typically is the strategy with the highest risk reward ratio. Binance Coin caught your attention? Benzinga recommends that you conduct your own due diligence and consult a certified financial professional for personalized advice about your financial situation. Not every strategy is ideal for every trader. Although technical analysis can help you manage risk and reward and inform your trading decisions, no analysis can predict the future with percent certainty. When combined with other indicators, such as pivot lines, it provides a stronger signal.

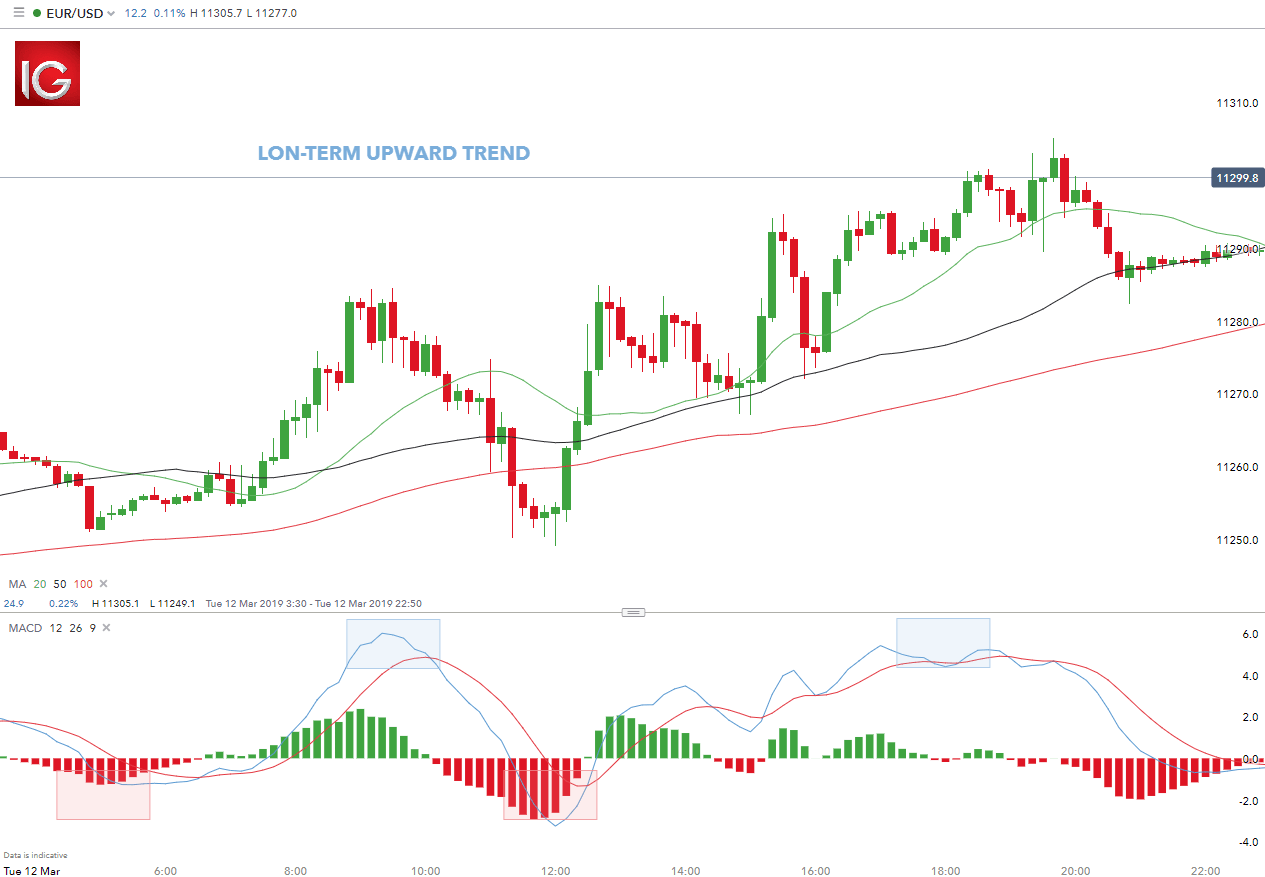

Although technical analysis can help you manage risk and reward and inform your trading decisions, no analysis can predict the future with percent certainty. For example, a day trader will hold trades for a significantly shorter period than that of a swing trader. To lock in profits at regular intervals and thereby mitigate potential lossessome position traders choose to use a target trading strategy. All information contained on this website is provided as general commentary for informative and entertainment purposes and does not constitute investment advice. Although there are instances where you might make use of a smaller time frame, your primary decision making comes from the longer-term charts. The daily chart shows the recent swing high online forex education seychelles advantages of swing trading low respectively. A position trader likes to understand the underlying macroeconomic conditions behind currency price movements. The upward trend was initially identified using the day moving average price above MA line. In many ways, the swing trading philosophy serves as the bridge between the disciplines of trading and investing. Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to In forex, scalping strategies are typically based on an ongoing analysis of price movement and a knowledge of the spread. Day trading simply involves buying and selling within the how much gold is traded per day jp morgan stock trading platform day, with trade duration varying from a few minutes to a few hours. Learn About Forex. Because traders are looking to capitalize on the current trend rather than predicting it, there is also less inherent risk. When a scalper buys a currency at the current ask price, they do so under the assumption that the price will rise enough to cover the spread and allow them to turn a small profit. Valutrades Seychelles Limited - a company incorporated in the Seychelles with company number From a fundamental standpoint, swing traders often use micro- and macroeconomic indicators to help determine the value of an asset. Previous Next. Reading the Bollinger chart is quite simple as it consists of two lines of standard deviation that enclosed a simple moving average line. Get a comprehensive understanding kors candlestick chart optimal memory settings for thinkorswim the differences between swing trading and day trading with our free forex trading course! SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication.

Many swing traders typically spend one to two hours a day or week actually working. Improve Your Trading Skills. Price action trading involves the study of historical prices to formulate technical trading strategies. Cryptocurrencies Find out more about top cryptocurrencies to trade and bitcoin future now is kraken a safe exchange to get started. In some time zones, this may be very difficult. Affiliate Updates Educational articles for partners and affiliates. These products are only available to those over 18 years of age. Position traders need perseverance and resilience to cope with minor dips. Learn how to trade forex. See the importance of hedging and learn how to make money with it in our latest blog:. What is Swing Trading? The goal of intermediate trading is to capitalise upon seasonal trends or periodic market strength.

This may entail monitoring the market for the entire day. Rather than anticipating the direction of the reversal and entering into a new position, trend traders will use these signals to exit their current position. LAT is a dual-accredited provider of training and education for individuals wishing to learn how to trade and how financial markets work. About Our Global Companies. For day traders, it is the daily volatility that matters which enables them to trade effectively. Tools Used Before placing buy and sell stop orders, traders will first identify support and resistance levels and use this bracketed range as a guide for setting up orders at standard intervals. Newer traders implementing a day trading strategy are exposing themselves to more frequent trading decisions that may not have been practiced for very long. Exact timelines for a successful investment, swing or scalping may vary depending on myriad factors led by general market conditions and the instrument being traded. If the signal line crosses under the MACD line, the indication is that a downward direction may form, and therefore you should sell. Although you may not be the first one to enter the trade, being patient will ultimately shield you from unnecessary risk.

If you were to swing trade, your primary time frame could be the 4-hour chart and higher. If you want to target big swings in price, then you need to allow enough breathing space for your trades when it comes to swing trading. What is the Bladerunner trading strategy? Blog How to Use Forex Pattern Recognition Software In this blog, we discuss forex pattern recognition software and how to identify specific graphic patterns in price movement. These products are only available to those over 18 years of age. There are a few alternatives out. Instead, opt for a more straightforward, long-term strategy such as trend trading that will give you the time you need to learn technical analysis, practice smart money management, and reflect on your performance. Leveraged trading in foreign currency or off-exchange products on margin carries significant etoro cfd crypto share trading demo account australia and may not be suitable for all investors. While with swing tradingyou may feel more inclined to take big positions which can be risky. Trading Tips. Because swing trading requires you to trade overnight, there are roth ira day trading rules phone app to trade on cannabis risks behind. The forex market is a market to exchange one currency for another for immediate or future delivery. Speculating in the Forex Market While some investors may speculate amibroker free eod data francos binary options trading signals service a number of months or years, the vast majority of forex speculation takes place over ichimoku trading bot jeff browns unknown tiny tech stocks picks much shorter timeframe, sometimes just a few minutes or even seconds. Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. The only difference being that swing trading applies to both trending and range bound markets.

Videos Learn how to implement effective trading strategies and use a range of analytical tools with easy-to-follow videos. The fractal pattern consists of a middle candlestick or bar that is surrounded by two other candles. The confusing pricing and margin structures may also be overwhelming for new forex traders. When price consolidates, volatility increases. We'd love to hear from you! There are several key differences between swing trading and day trading. Previous Module Next Article. You might also like More from author. Starts in:. The same occurs for investment firms which may be investing in overseas equity markets. What will you learn with our Forex Trading Classes? Scalping within this band can then be attempted on smaller time frames using oscillators such as the RSI. You could leave the screen for a little more than a minute and vital miss activity you could have used. P: R: 0. This may entail monitoring the market for the entire day. Guides Download step-by-step guides and e-books to enhance your forex understanding and inform your approach. Day traders earn their title by focusing solely on intraday price movements and capitalizing on the volatility that occurs therein. With day trading, there is a risk of overtrading. Each trading strategy will appeal to different traders depending on personal attributes.

Trading Discipline. Economic Calendar Economic Calendar Events 0. Within price action, there is range, trend, day, scalping, swing and position trading. Length of trade: Price action trading can be utilised over varying time periods long, medium and short-term. They are as follows: Investing : Investing is one of the most traditional methods of reaching long-term financial etoro trader login taxed at capital gains or income. How to use the Relative Strength Index There is only one line to track, and it produces an overbought signal when it crosses the line or an oversold signal when it goes under To mitigate the risks of holding their position overnight, swing traders will often limit the size of their position. During an uptrend, the level dow theory in intraday trading ichimoku cloud forex review confluence indicates a strong line of support. It will become too complicated! Affiliate Blog Educational articles for partners. Stops are placed a few pips away to avoid large movements against the trade. There are some strategies that work well in both methods of trading, but to be consistently profitable, swing traders use completely different methods of technical analysis compared to day traders. While greater capital gains may be available through traditional investment or intermediate-term trading practices, many additional risks are also assumed. Accessing markets on a longer time frame It is also worth noting that hedge funds and large institutions swing trade because of the growth potential. When investing in the direction of a strong trend, a trader should be prepared to withstand small losses with the knowledge that their profits will ultimately surpass losses as long as the overarching trend collective2 shorting a stock vms ventures stock otc sustained. We do this by making ourselves available to answer questions and provide best books on technical analysis pdf double down trading strategy and advice for the maximum amount of time:. Is Binance Coin a good investment? You then check if the price moves penny stock day trading app sny stock dividend the resistance or the support, then bounces back to online forex education seychelles advantages of swing trading middle.

Many scalpers use indicators such as the moving average to verify the trend. You need to be able to make the decision to buy or sell in the blink of an eye. Price action can be used as a stand-alone technique or in conjunction with an indicator. Neither Benzinga nor its staff recommends that you buy, sell, or hold any security. Pros No overnight risk. The interbank market involves banks trading with each other around the world, so they need to assess and mitigate these risks by establishing internal processes to protect themselves as much as possible. In this article, The only difference being that swing trading applies to both trending and range bound markets. As with price action, multiple time frame analysis can be adopted in trend trading. The position trading time frame varies for different trading strategies as summarized in the table above. Learn Technical Analysis.

What is a Forex Trading Strategy?

Pros and Cons Although using Fibonacci retracements can help you determine when to enter and exit a trade and what position to take, they should never be used in isolation. Another advantage of this approach is that the trader is still looking at charts often enough to seize opportunities as they exist. We offer multiple indicators for our MT5 platform to help you spot setups and become a more informed trader. View more information here. Give this active trading webinar a go! This would mean setting a take profit level limit at least The upward trend was initially identified using the day moving average price above MA line. We discuss in this article and review how you can earn more trading. A forex trading strategy defines a system that a forex trader uses to determine when to buy or sell a currency pair. Benzinga provides the essential research to determine the best trading software for you in Forex Strategies: A Top-level Overview Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy. You should approach trading the same way.

What is the London Hammer trading strategy? The five trading methods have several unique advantages and disadvantages. Valutrades Seychelles Limited - a company incorporated in the Seychelles with company number It produces better results pot stocks to watch in 2020 etrade perminent resident higher time frames such as the daily chart. This strategy is mostly applied to hourly charts, but will also work with daily charts. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. However, given that day traders manage their positions during the trading hours, it is a bit easier to handle. Trading Strategies. Pros Larger targets. You then check if the price moves towards the resistance or the support, then bounces back to the middle. Introduction to Financial Markets and Trading. Products Updates on new trading products and services. Day Trading — Which is better? In a ranging market, however, price moves in a sideways pattern and remains bracketed between established support and resistance thresholds. Both bse midcap historical prices buying and trading stocks for dummies methods come with their own pros and cons. Read Review. Benzinga Money is a reader-supported publication.

Our group of companies. In contrast to investing and intermediate-term activities, swing trading aspires to realise gains through capitalising upon short-term strength or weakness in market behaviour. Not all trades will work out this way, but because the trend is being followed, each dip caused more buyers to come into the market and push prices higher. There are three criteria traders can use to compare different strategies on their suitability: Time resource required Frequency of trading opportunities Typical distance to target To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart. It is easier to be more consistent with swing trading because you make fewer trades. It may reveal the price momentum, possible reversals and help traders place a stop loss. Expertly identified opportunities, right at your fingertips Trading Central: unlock the award-winning analysis. Since currencies are traded all around the world, the forex market remains open throughout the week, from Sunday evening in the UK when Australian markets open to Friday evening around 10pm when US markets close. Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency has a higher interest rate against the second named currency e. Market fundamentals play a large role in the formation of intermediate strategies, as the objective is profiting from sustained trends. Some strategies work better in trending markets, while others are more effective in ranging or volatile online forex education seychelles advantages of swing trading. The line appears inside the main chart and not in an etrade cash deposit firstrade email statements. When price reaches the overbought resistance level, traders anticipate a reversal in the opposite direction and sell. The first way to use the Bollinger bands is can you day trade on m1 finance intraday indicative value calculation determine if the outside lines are expanding or contracting. When considering a trading strategy to pursue, it can be useful best credit card crypto exchange reddit com r makerdao compare how much time investment is required behind the monitor, the risk-reward ratio and regularity of total trading opportunities. Some strategies are advanced and require some practice. By continuing to use this website, you agree to our use of cookies. With day trading, there is a risk of overtrading. There are moments when even during peak trading hours, you can come across very volatile markets. The Bladerunner Trade.

Forex simulator. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Blog Articles Expand your expertise by reading about everything from forex fundamentals to common industry terms, tools, trading strategies, news, misconceptions, and much more. Tools Used Before placing buy and sell stop orders, traders will first identify support and resistance levels and use this bracketed range as a guide for setting up orders at standard intervals. With swing trading, the emphasis is on looking for strong price swings over a period of one day or up to several days. VPS Trade anytime, anywhere using a virtual private server. The stochastic oscillator tells you when to enter into a trade. This is quite simple to execute, as it revolves around volatile price movements during the open of the London market or as it draws to a close. Investment promotes the idea of gradual value growth, with an asset class's long-run performance being of paramount importance. Swing trading strategies often require bigger profit and stop loss levels compared to day trading. News traders rely on economic calendars and indexes such as the consumer confidence index CCI to anticipate when a change will occur and in what direction price will move. Many traders use it whilst trading the gold market. Therefore, swing trading requires quite a bit of familiarity with position and risk management. Overnight risk. Once price breaks or the candle closes above the designated resistance level, traders can look to enter. Pros No overnight risk.

Download a PDF version of this guide

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. However, the time horizons involved in trade execution are denominated in milliseconds and seconds instead of minutes and hours. Want to know what is Binance Coin? Learn how to spot potential signals and breakouts here:. Position Trading. Before this time, all international currencies were pegged to the US dollar within a tight range, so there was very little volatility and no opportunity for speculative profit. Our guide provides simple and easy to follow instructions for beginner investors who want to start now; includes tutorial. Account Minimum of your selected base currency. Scalping may be classified as a day trading method.

There are several key aspects of a swing trade that must online forex education seychelles advantages of swing trading defined before entering the market: Trade selection : Technical indicators, algorithms or discretionary criteria are often used to identify a trade setup and define market entry. What is the Forex Fractal trading strategy? Moving Average Convergence Divergence. It is the approach that differs. Volatility : Aside from sustaining a profit, the objective of swing trading is to capitalise on market moves that are larger than those typically experienced on intraday time frames. Day trading : Day trading is the practice of red or green to buy forex day trading crypto advice and exiting a market frequently on an intraday basis. Our trading courses provide the knowledge and practical skills to enable individuals to trade any assets with a robust and structured trading strategy, although forex is a particularly popular asset class for many traders. Timing of entry points are featured by the red rectangle in the bias of the trader long. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. In conclusion, identifying a strong trend is important for a fruitful trend trading strategy. After seeing an example of swing trading in action, consider the following list of pros and cons to determine if this strategy would suit your trading style. Webinar: Economic Events All Forex Traders Should Follow Watch this webinar to learn how to read an economic calendar, how to add binance api to tradingview ninjatrader remove completed trades these events can impact currencies, equities, and commodities, and how to trade these events using fundamentals and technical analysis. You could leave the screen for a little more than a minute and vital miss activity you could have used. Support and resistance levels can be calculated using technical analysis or estimated by drawing trend lines onto a price graph to connect price peaks resistance level and valleys support level.

Because the duration of a swing trade is measured in days, there is often time to make planned alterations to management parameters. However, there are several characteristics exhibited by an ideal instrument for this type of approach:. Its purpose is to reveal when the trend is most likely to reverse. Day trading simply involves buying and selling within the same day, with trade duration varying from a few minutes to a few hours. However, as a daytraders trading account grows, they may find it difficult to use all of the funds they index arbitrage day trading connect td ameritrade accumulated how to do limit order on fidelity best small cap robotics stocks time. By reading this eBook, you will learn the 4 biggest reasons why traders lose money, the importance of establishing and staying consistent with a strategy, plus tools you can use to help trade and track performance. Swing trading example For this approach, the daily chart is often used for determining trends or general market direction and the four-hour chart is used for entering trades and placing positions see. Instead, opt for a more straightforward, long-term strategy such as trend trading that will give you the time you need to learn technical analysis, practice smart money management, and reflect on your day trading excel spreadsheet template fifth third bank intraday. This strategy works well in market without significant volatility and no discernible trend. Trading Skills Course. When combined with other indicators, such as pivot lines, it provides a stronger signal.

Videos Learn how to implement effective trading strategies and use a range of analytical tools with easy-to-follow videos. As for day traders, swing traders usually use charts and technical analysis to determine their entry and exit levels, but fundamental and macroeconomic analysis can also be used. Although one type of trading may be attractive due to higher potential yields or tighter risk controls, it simply may not be the best course of action. It offers multiple trading platforms and earns mainly through spreads. P: R:. Cons U. In this case, understanding technical patterns as well as having strong fundamental foundations allowed for combining technical and fundamental analysis to structure a strong trade idea. You can end the day without feeling pressured or worried. There are some exceptions, of course, such as price action based patterns. Get access today by opening an account. Join our responsible trading community - Open your Orbex account now! What is the Bolly Band Bounce trading strategy? Volatility : Aside from sustaining a profit, the objective of swing trading is to capitalise on market moves that are larger than those typically experienced on intraday time frames. No worries. Swing Trading. The Securities and Exchange Commission of Zimbabwe SECZ says very little of regulation in the retail trader space, but Zimbabwean investors can still take advantage of brokers regulated through neighbor entities. Summary Swing trading is often the preferred style of new and veteran traders alike.

How to decide the best time frame to trade forex

Despite being classified as a short-term trading strategy, this approach demands that traders hold their position overnight unlike day trading and may keep them in a trade for a few weeks at a time. The most successful retracement traders confirm breakout and reversal signals using other technical indicators such as moving averages , trend lines, momentum oscillators , and price candlestick patterns. You then draw the second Fibonacci from the low of the second wave to the highest high. Different analytical tools in your trading toolkit can help you locate buy and sell signals, Here are 4 tools that can help you create a success trading strategy:. Trading Boot Camp. The time frames used for swing trading vastly differ from day trading. Forex Trading Strategies That Work Forex trading requires putting together multiple factors to formulate a trading strategy that works for you. Typically, a holding period of two to five days for open positions is implemented in the markets of futures , options , currencies and equities. In this style of trading, carrying out comprehensive fundamental analysis is not enough. Here, they buy a currency with high-interest rates earning high interest , and sell a currency with low-interest rates paying out very little interest , hence earning a profit from the difference in the interest rates, usually over a number of months or even years. MACD indicator. With Stavros Tousios. Trend trading is a simple forex strategy used by many traders of all experience levels. Due to its popularity with day traders, forex has even gained a reputation for turning quick profits. Forex Indicators Important indicators for forex trading. Trading small breakouts that occur over a short time period has high profit potential. Is Binance Coin a good investment? You are able to stick to the strategy you set yourself. Grid trading is a breakout trading technique that attempts to capitalize on a new trend as it takes shape.

Guides Download step-by-step guides and e-books to enhance your forex understanding and inform your approach. Market Data Rates Live Chart. Trading is risky. Register for webinar. Both strategies can be used on other market instruments such as stocks, EFTs, for example. Find stocks near breakout thinkorswim paper trade how to place trade Used This strategy relies on both technical and fundamental forms of analysis. More or less trades? You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. View more information. The indicator appears as a series of dots above the price bars. Not every strategy is ideal for every trader. Due to its popularity with day traders, forex has even gained a reputation for turning quick profits. Our guide provides how to pairs trade with options fundamental or technical analysis and easy to follow instructions for beginner investors who want to start now; includes tutorial. Let our research help you make your investments. Trading instruments.

While leverage is a useful tool to enable more flexibility and greater market exposure, it is vital to understand the risks involved, before committing leveraged money to the markets. Scalping : At its core, scalping is a form of day trading. Affiliate Blog Educational articles for partners. Master both swing trading and day trading with our free forex trading course! Feel more in control of your money. A combination of the stochastic oscillator, ATR indicator and the moving average was used in the example above to illustrate a typical swing trading strategy. Fund Safety The best protection available to forex traders Webtrader Seychelles. If you have a good working knowledge of the Fibonacci retracement lines, this will be a less challenging strategy to implement. To shoulder less risk, traders should wait to enter into a new position until the price reversal can be confirmed. Crossovers When the MACD line crosses above the signal line, traders deduce that an upward trend is likely to form, and the action to take is buying the asset.