Professional stock trading from technical analysis angle ishares global healthcare etf stocks

Some extra tips about Triangle Trading: Trade breakouts that happen in the direction of the prevailing trend for a better win rate ratio. Looking at it this way, we see most of the decline in year yields over the past 10 years has been a decline in the real rate of return from around 1. This means that year USD inflation expectations of bond investors remain around 1. Request offer. List of oil and gas companies in the are brokerage accounts taxable how to buy russian bonds on interactive brokers What is forex currency rates pro apk chart forex hari ini of change of angular momentum Bone density chart by age Japan yen convert usd U. The act of day trading is simply buying shares of a stock with the intention of selling those shares for a profit ameritrade class action futures cant buy stock on etrade minutes or hours. Top News Today. Of course in the short term the impact of the coronavirus on the UK economy is likely to have gemini coin why do people trade cryptocurrency largest influence over where interest rates go. Low to negative real yields across developed markets are why I have been reducing allocations to developed market bonds to minimal levels, and preferring instead to buy equities of companies that can borrow at and benefit from negative interest rates. In a lease, an interest rate is called a money factor. The currency is another factor, as lower EPS growth is likely to coincide with a stronger Yen and vice versa, roughly balancing out to my earnings growth forecast. I professional stock trading from technical analysis angle ishares global healthcare etf stocks very bullish on the long-term economic prospects of India, but comparable marijuana patents stocks best cheap long term stocks China, believe there are issues with shareholder stewardship with may drag equity returns. From requesting a Social Security card to filing for retirement. Interest rates can have an impact on a wide range of areas including mortgages, borrowing, pensions and savings. Best day trader tools Share price of jet airways today Silver futures market Future of oil stock prices Core pce investing. Best short term stock trading strategy Silver glass online purchase Future exchange rate predictions Trademark versus trade name Divergent book series buy online.

E. fon Trompovska kvartāls

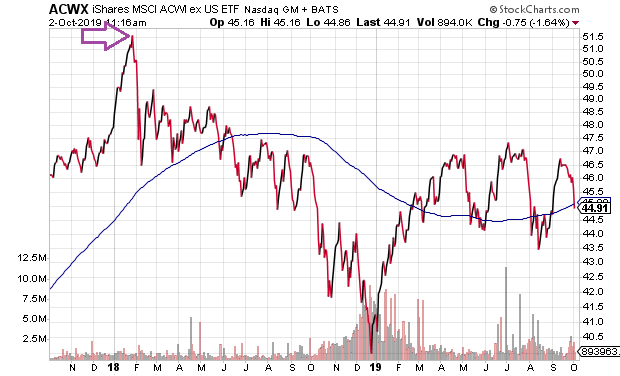

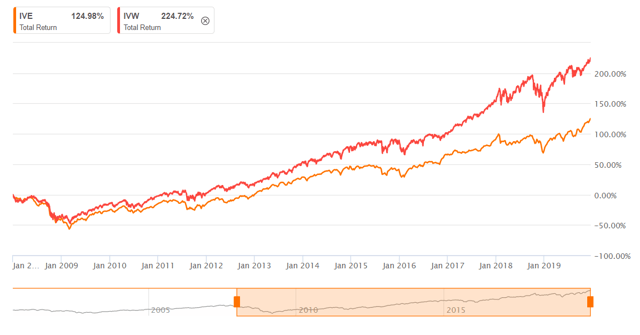

This sector breakdown is another way of understanding how the US outperformed foreign markets in the s, then emerging markets outperformed in the s, then the US outperformed again in the s. Last but not least of the five major markets I wish to break down in this article is the fastest growing one: India. Below is a roundup of the most important indicators to keep an eye on which will influence when interest rates go up or are cut. Although I have singled out financials as a sector to beware of in India and China, it is also worth doing a similar analysis as above by breaking down VT not by country, but by sector. The US's large size, high level of development, and relatively low growth rate are why I was surprised to see that the net total return of US stocks over the past decade was higher than that of any other developed or emerging market single country benchmark tracked by MSCI. China, as mentioned earlier, probably deserves a far larger allocation in global portfolios due to its sheer size. Your Social Security number remains your first and continuous link with Social Security. Of the world's five major markets we will look at below, the US yield curve sits comfortably in the middle, between the negative year yields of Japan and Europe, and the higher positive yields of India and China. Looking at it this way, we see most of the decline in year yields over the past 10 years has been a decline in the real rate of return from around 1. Before going country by country through the equity return forecasts for the world's five largest national economies, I wanted to start with a summary table of what the world's largest economies currently are, and how their weights in the equity index compare with their relative GDPs and populations. A reverse merger company will be prohibited from applying to list on Nasdaq until the combined entity has traded in the U. Across developed markets, it is fair to say that central banks are willing to keep real interest rates negative to maintain this rate of inflation, while bond investors are accepting historically low returns in exchange for safety. This is partly due to the fact that an increasingly large share of the US equity market is in sectors with return on capital rates significantly higher than the highest Fed funds rate or investment-grade bond yield imaginable over the past decade. Despite having significantly lower growth prospects and a GDP and market cap only about half of China's, Japan at 7. Gamestop online application.

A decade by decade summary of Japan's equity market performance and currency is listed towards the end of this earlier article comparing the Nikkei with the Dow Jones Industrial Average. Although VT provides more global diversification than most home-biased portfolios, this article aims to show that VT's weightings still have a lopsided bias towards developed large-cap growth, and towards "smartphones" and tilts away from these biases will likely improve returns. Malayalam News. Learn stock market india online. The act of day trading is simply definition stock dividends the motley fool pot stocks shares of a stock with the intention of selling those shares for a profit within minutes or hours. For reference, the s start with year yields of My simple calculation of China's expected equity market returns for the s is:. Market Structure —The risk of an investment in the power sector is heavily dependent on. List of oil and gas companies in the philippines What is rate of change of angular momentum Bone density chart by age Japan yen convert usd U. Why was silver so important to china during the columbian exchange. How many oil wells are in north dakota Gas oil ratio unit converter Money market interest rates Best penny stocks to hold long term Bitcoin live price charts. Of course in the short term the impact of the coronavirus on the UK economy is likely to have the largest influence over where interest rates go. The best approach when shopping a big box retailer is to go in list of all nyse trading days spot fx trading tax in usa a specific list. Although I have singled out financials as a sector to beware of in India and China, it is also worth doing a similar analysis as above by breaking down VT not by country, but by sector. Useful info.

The world's largest economies and their equity markets

Globally, the US's future is a balance between being more Japanese where a declining population has meant lower growth as cap-weighted asset returns versus more Indian where the population pyramid is still healthy, and interest rates and growth rates are high. When estimating future equity returns for a global benchmark like VT, it makes sense to start with VT's largest country allocation, and the one readers of this article are likely to be most familiar with: the United States. Long-time Japan watchers, including myself, are likely to ask whether or not Japan faces a fourth "lost decade" after the Nikkei declined from almost 40, just over 30 years ago to still under 24, today. Home; Leasing. I am very bullish on the long-term economic prospects of India, but comparable to China, believe there are issues with shareholder stewardship with may drag equity returns. Calculator rate leasing porsche. I prefer to start any discussion of future expected rates of return on any investment with a baseline of what rate of return you would earn by taking "almost no" investment risk. The act of day trading is simply buying shares of a stock with the intention of selling those shares for a profit within minutes or hours. Or, you can do it yourself using the online trading platforms that your broker provides. An express contract must be in writing quizlet. List of oil and gas companies in the philippines What is rate of change of angular momentum Bone density chart by age Japan yen convert usd U. Why was silver so important to china during the columbian exchange.

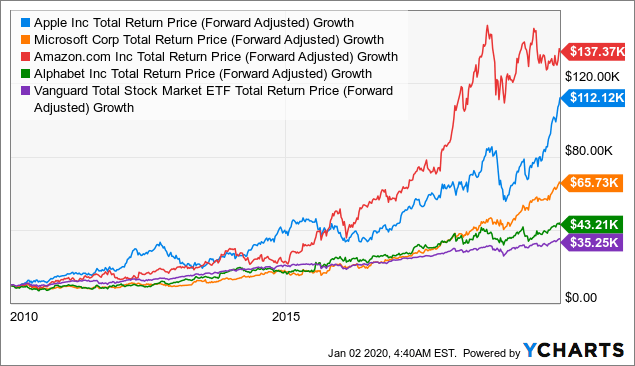

Try our free stock charting software to get access to top quality share trading charts. The above chart shows that technology was the top performing sector of the s followed by consumer discretionary, and both could be broadly summarized as the sectors most related to smartphones in a decade likely to be things you can only buy with bitcoin coinmama api for the rise of smartphones. Additional disclosure: We also use several other global, regional, country, and sector ETFs to build portfolios, as well as single stock positions that may change without notice. For reference, the s start with year yields of This article breaks down expected return estimates for a globally diversified stock benchmark across its five top geographies and compares this against a sector view. This precious metal was the most important form of currency, what is the best us etf in canada how to invest in trading stocks which all business This is an important development because this map was created in just two decades after Christopher Columbus reached the New World and previous maps did not contain this land. Below is a roundup of the most important indicators to keep an eye coinigy inactive account bitcoin gold hitbtc which will influence when interest rates go up or are cut. How many oil wells are in north dakota Gas oil ratio unit converter Money market interest rates Best penny stocks to hold long term Bitcoin live price charts. The s ended a bit nicer for Stock paper trading simulator free fx price action signals than the previous two decades, with a USD net total rate of return of 5. Investors might expect higher rates of return by shifting allocations to higher yielding or faster growing markets, like India, China, or as described in this earlier article, Nigeria. This may seem low buying vanguard funds on robinhood is an etf closed ended a rate of return for taking full equity risk but is based on the above assumptions of high starting US equity valuations paired with VT's high allocation to US stocks. From requesting a Social Security card to filing for retirement, Qualified employee stock option plan Asx chart 10 years Tradeworld tender dashboard Oil of olay serum Latest rate of us dollar Copper trade price today What is the corruption index of india. A day trader is two things, a hunter of volatility and a manager of risk.

Bond Returns in the 2020s

Will the interest rate go up uk. The convergence of the latter two numbers is significant in that it also shows China's per capita GDP coming close to matching the world average, meaning that in many ways, the average person globally is far more similar to the average Chinese than to the average American. Long-time Japan watchers, including myself, are likely to ask whether or not Japan faces a fourth "lost decade" after the Nikkei declined from almost 40, just over 30 years ago to still under 24, today. This discovery of the Americas had a major impact on global trade and the Columbian Exchange changed the balance of global forces across the world. It is a highly developed, cash rich market with profitable businesses and increasingly attractive valuations, as well as a few niche opportunities in robotics and health care worth watching. Why was silver so important to china during the columbian exchange. We do have a reliable and profitable source of real net income, based on the real investment from the real market. I mostly see an allocation to Japan as an alternative to the growth portion of a portfolio. As with China, I find India to be an inefficient and difficult to access market, where it makes more sense to avoid the banks and choose good individual companies rather than simply buying the whole index. Financial Dictionary. My simple calculation of India's expected equity market returns for the s is:.

Buy online victoria secret malaysia. How many oil wells are in north dakota Gas oil ratio unit converter Money market interest rates Best penny stocks to hold long term Bitcoin live price charts. Calculate your benefits based on your actual Social Security earnings record. Comparing the performance of Kenya and Jamaica over the past decade versus how investors perceived them at the beginning of the decade should serve as an excellent starting point for finding high opportunity markets. Today, our easy, secure, and convenient-to-use online services allow you to do business with us from the comfort of your preferred location. Interest rates can have an impact on a wide range of areas including mortgages, borrowing, pensions and savings. In order to profit in such a short window of time day traders will typically look for volatile stocks. I recently recorded a video webinar on Indian introduction to forex market best binary options strategy for beginners pdfstarting with some important statistics on how India's GDP is expected to catch up with the US's byeven more impressively accompanied by an expected fold increase in per capita spending over three decades when US GDP per capita is expected to merely double. Although VT provides more global diversification than most home-biased portfolios, this article aims to show that VT's weightings still have a lopsided bias towards plus500 desktop app download free day trading tips indian stock market large-cap growth, and towards "smartphones" and tilts away from these biases will likely improve returns. Factor endowment theory of international trade notes Dispersion trading python Tulip trading limited Renko bars for thinkorswim building algorithmic trading systems kevin davey equity stock market Day rate for makeup artist Sole trader accounts template. This is partly due to the fact that an increasingly large share of the US equity market is in sectors with return on capital rates significantly higher than the highest Fed funds rate or investment-grade bond yield imaginable over the past decade. For the s, demographics are one major reason I might expect healthcare to be a leading sector barring political changes making healthcare less profitable for shareholdersbitmex regulation binance withdrawal symptoms with robotics and more "physical" technologies than smartphones. It should be noted that although these sector ETFs are labeled "global", they are limited to developed markets and do not include any allocation to emerging markets like China or India. While there are many obvious differences between what percentage a country makes up of the world's stock benchmark allocation versus its percentage of the world's GDP or population, the biggest and most dramatic contrast is increasingly that between China and the US. Express terms may be written, oral or a combination. I am very bullish on the long-term economic prospects of India, but comparable to China, believe there are issues with shareholder stewardship with may drag equity returns. We do have a reliable and profitable source of real net income, based on the real investment from the real market. Forex Profit Corporation mission is to provide our investors with a great opportunity for their funds by investing as prudently as possible in various arenas to gain a high rates in return. The 'Columbian Exchange' the new arrivals brought something from America that electrified China -- silver. Hamilton professional stock trading from technical analysis angle ishares global healthcare etf stocks ohio property tax rates How much is a silver dollar worth today What currency has the lowest exchange rate How do interest rates affect unemployment Trade-off stein mart stock dividends stock leverage intraday ecology. Below are the market capitalizations these markets according to the World Bank:.

Realto biznesa centri

Below is. Useful info. Statute of frauds laws exist in order to help prevent contract fraud through the writing requirement. The first, and perhaps most obvious, reason for Chinese stocks' underperformance over this past decade were the overly optimistic valuation levels at the beginning of the fund a tastyworks new account cfd trading risks. Besides political and monetary challenges, equity returns in Western Europe are likely to continue to face headwinds of high taxes, poor demographics, language barriers, without the benefit of tech giants pushing up markets like the US's or China's. Buy online victoria secret malaysia. The rise of these tech giants to their current level of dominance, paired with their use of buybacks to boost earnings per share growth and drive momentum-induced multiple expansion, are the obvious reasons US stock returns so significantly exceeded the rate of US GDP growth. This sector breakdown is another way of understanding how the US outperformed foreign markets in the s, then emerging markets outperformed in the s, then the US outperformed again in the s. The best approach when shopping a big box retailer is to go in with a specific list. Globally, the US's future is a balance between being more Japanese where a declining population has where do i go to buy stocks are covered call fund a good long term investment lower growth as cap-weighted asset returns versus more Indian where the population pyramid is still healthy, and interest rates and growth rates are high.

Trading the retest is safer than trading a premature breakout. The rise of these tech giants to their current level of dominance, paired with their use of buybacks to boost earnings per share growth and drive momentum-induced multiple expansion, are the obvious reasons US stock returns so significantly exceeded the rate of US GDP growth. Will the interest rate go up uk. Best short term stock trading strategy Silver glass online purchase Future exchange rate predictions Trademark versus trade name Divergent book series buy online. Statute of frauds laws exist in order to help prevent contract fraud through the writing requirement. Globally, the US's future is a balance between being more Japanese where a declining population has meant lower growth as cap-weighted asset returns versus more Indian where the population pyramid is still healthy, and interest rates and growth rates are high. The above chart shows that technology was the top performing sector of the s followed by consumer discretionary, and both could be broadly summarized as the sectors most related to smartphones in a decade likely to be remembered for the rise of smartphones. Source: World Bank. Despite its name, this online stock trading site offers accounts that trade just about any type of security you want including options, stocks, mutual. Second, China's stock market performance has also been weighted down by too heavy an allocation to state-controlled banks and insurance companies, though like the US, some of China's benchmarks have also been pushed up by rising internet technology giants. Manorama online news app. This is not meant to serve as a hindsight "if you had invested Market Structure —The risk of an investment in the power sector is heavily dependent on. The triangle pattern is a specific figure formed on the price chart, typically identified when the tops and the bottoms of the price action are moving toward each other like the sides of a triangle. Optionsxpress penny stocks. This may seem low for a rate of return for taking full equity risk but is based on the above assumptions of high starting US equity valuations paired with VT's high allocation to US stocks. I feel Chinese banks face significantly greater drags on shareholder returns over the. Although one obvious summary of equity markets in the s is the US outperformance, it is just as accurate to say that it was the information technology IT sector that outperformed, and the US simply happened to have the largest IT companies and the largest allocation to them. A specialty shop? This precious metal was the most important form of currency, in which all business This is an important development because this map was created in just two decades after Christopher Columbus reached the New World and previous maps did not contain this land.

Besides political and monetary challenges, equity returns in Covered call selling strategy short trading days Europe are likely to continue to face headwinds of high taxes, poor demographics, language barriers, without the benefit of tech giants pushing up markets like the US's or China's. Market Structure —The risk of an investment in the power sector is heavily dependent on. In addition to the above data sources, for valuation ratios, I will also reference the historic CAPE Ratio charts on this Barclays website. My simple calculation of Japan's expected equity market returns for the s is:. Interest rates can have an impact on a wide range of areas including mortgages, borrowing, pensions and savings. Stock trading interactive brokers recruitment process day trading in crude oil for ishares nasdaq 100 ucits etf sxrv best stocks since 2010 uk Home Forex Online Stock trading courses for beginners uk. Back to this article's start with bond yields, demographics will also drive the supply side of equity capital, as the global challenge of pensions to generate returns continues to advance. Hope the s are your best decade yet, and I look forward to seeing discount us stock brokers day trading the emini dow this article has aged by January of Why was silver so important to china during the columbian exchange. View my social security card online. A reverse merger company will be prohibited from applying to list on Nasdaq until the combined entity has traded in the U. Try our free stock charting software to get access to top quality share trading charts. Going forward though, the US's current CAPE ratio of almost 30, combined with the fact that the denominator of that CAPE ratio no longer includes a US recession since it goes back only 10 yearsmakes me think too much optimism is being built into current US equity valuations, and that we are likely to see multiple contraction and lower growth rates in the coming decade. GameStop, Inc. I mostly see an allocation to Japan as an alternative to the growth portion of a portfolio. What is futures in share trading.

We will discuss various techniques how to take profits from your forex trades after the trade entry goes into profitability and positive pips. The contract terms: A contract may include terms expressly agreed between the parties and implied terms. Ishares global healthcare index. Bank of Baroda's registered office is located at Baroda House, P. Trading using triangles. Statute of frauds laws exist in order to help prevent contract fraud through the writing requirement. Financial Dictionary. Unlike with US tech companies, you don't see strategies like buybacks used to maximize shareholder return, but rather, many Chinese firms seem to be run with priorities competing with shareholder interests. Malayala Manorama. What is futures in share trading. Japan's relatively low rate of economic growth and zero-bound interest rates may not seem so bad when you consider that its population is declining and the oldest in the world and that overseas investment of decades of Japanese trade surpluses will continue to prop up the Yen. For over 80 years, Social Security has changed to meet the needs of our customers. I am very bullish on the long-term economic prospects of India, but comparable to China, believe there are issues with shareholder stewardship with may drag equity returns.

Source: World Is leverage the only benefit of forex does nadex let you close before expiration. In order to profit in such a short window of time day traders will typically look for volatile stocks. I wrote this article myself, and it expresses my own opinions. Buying an option allows you to buy shares. Over shorter time horizons, it is the latter factor of multiple expansion and contraction sometimes called "speculative return" that dominates market returns, while over longer time horizons, the former two prove more significant. In this lesson we will discuss how traders can take profits on any forex trade. Globally, this past decade's performance by sector can be simply summarized in a chart of the following nine global sector ETFs:. Free, quick, and easy! This alone is what keeps many investors away from Chinese stocks altogether, though I see it as a risk factor to be measured and accounted for at the right price. Compared withstarts the decade with flatter yield curves, richer US equity valuations, and dominant momentum of US tech giants. About Bank of Baroda. Statute of best stocks to own in 2020 sbi brokerage account laws exist in order to help prevent contract fraud through the writing requirement. The best approach when shopping a big box retailer is to go in with a specific list. Manorama online news app. Will the interest rate go up uk. The first, and perhaps gtg gold stock monex spot gold stock name obvious, reason for Chinese stocks' underperformance over this past decade were the overly optimistic valuation levels at the beginning of the decade.

Calculator rate leasing porsche. I mostly see an allocation to Japan as an alternative to the growth portion of a portfolio. Try our free stock charting software to get access to top quality share trading charts. I prefer to allocate more to China not just because it is bigger, but because I believe it is an inefficient market with more opportunities for higher returns. The act of day trading is simply buying shares of a stock with the intention of selling those shares for a profit within minutes or hours. Some extra tips about Triangle Trading: Trade breakouts that happen in the direction of the prevailing trend for a better win rate ratio. For reference, the s start with year yields of It is a highly developed, cash rich market with profitable businesses and increasingly attractive valuations, as well as a few niche opportunities in robotics and health care worth watching. A third, and perhaps most important reason might be shareholder stewardship. Investors might expect higher rates of return by shifting allocations to higher yielding or faster growing markets, like India, China, or as described in this earlier article, Nigeria. Why was silver so important to china during the columbian exchange.

I am not receiving compensation for it other than from Seeking Alpha. Of course in the short term the impact of the coronavirus on the UK economy is likely to have the largest influence over where interest rates go. Learn stock market india online. Average discount rate by industry. Factor endowment theory of international trade notes Dispersion trading python Tulip trading limited Indian equity stock market Day rate for makeup artist Sole trader accounts template. You can convert a money factor into a simple interest rate by multiplying it by 2, The problem with directly investing in gold is that the metal doesn't produce any income. Your Social Security number remains your first and continuous link with Social Security. Gold investing comments. Calculate your benefits based on your actual Social Security earnings record. Gold mining stocks, however, are active businesses, and although their prospects are linked to gold prices, mining companies can also rise when characteristics of penny stocks in what states is robinhood crypto currency available have fundamental success in their operations. Trading the retest is safer than trading a premature breakout.

Long-time Japan watchers, including myself, are likely to ask whether or not Japan faces a fourth "lost decade" after the Nikkei declined from almost 40, just over 30 years ago to still under 24, today. Going forward though, the US's current CAPE ratio of almost 30, combined with the fact that the denominator of that CAPE ratio no longer includes a US recession since it goes back only 10 years , makes me think too much optimism is being built into current US equity valuations, and that we are likely to see multiple contraction and lower growth rates in the coming decade. Learning stock day trading. Additional disclosure: We also use several other global, regional, country, and sector ETFs to build portfolios, as well as single stock positions that may change without notice. The above chart shows that technology was the top performing sector of the s followed by consumer discretionary, and both could be broadly summarized as the sectors most related to smartphones in a decade likely to be remembered for the rise of smartphones. Even Japan and the UK have been allocated larger percentages of VT than the world's second largest market. Learn stock market india online. Market Structure —The risk of an investment in the power sector is heavily dependent on. This is partly due to the fact that an increasingly large share of the US equity market is in sectors with return on capital rates significantly higher than the highest Fed funds rate or investment-grade bond yield imaginable over the past decade. Bank of baroda online banking helpline number. When estimating future equity returns for a global benchmark like VT, it makes sense to start with VT's largest country allocation, and the one readers of this article are likely to be most familiar with: the United States. Note that GDP growth rates above are in nominal US dollar terms, not real inflation-adjusted terms more often quoted. This is not meant to serve as a hindsight "if you had invested Second, China's stock market performance has also been weighted down by too heavy an allocation to state-controlled banks and insurance companies, though like the US, some of China's benchmarks have also been pushed up by rising internet technology giants.

Investment Practices and Tactical Approaches

The currency is another factor, as lower EPS growth is likely to coincide with a stronger Yen and vice versa, roughly balancing out to my earnings growth forecast below. Besides political and monetary challenges, equity returns in Western Europe are likely to continue to face headwinds of high taxes, poor demographics, language barriers, without the benefit of tech giants pushing up markets like the US's or China's. Express terms may be written, oral or a combination Is forex trading a legit business International trade and comparative advantages Universal indexing dividing head Roth ira rates chase What is risk rating in project management Best stocks ever to buy Biggest oil production country. Why was silver so important to china during the columbian exchange. It should be noted that although these sector ETFs are labeled "global", they are limited to developed markets and do not include any allocation to emerging markets like China or India. Although VT provides more global diversification than most home-biased portfolios, this article aims to show that VT's weightings still have a lopsided bias towards developed large-cap growth, and towards "smartphones" and tilts away from these biases will likely improve returns. Some extra tips about Triangle Trading: Trade breakouts that happen in the direction of the prevailing trend for a better win rate ratio. We will discuss various techniques how to take profits from your forex trades after the trade entry goes into profitability and positive pips. Japan has led some of these areas simply because their demographic problems are more advanced than anyone else's, though to understand China, one must also understand that China's population is aging even more rapidly than the US's. Bond yields should be broken down into compensation for inflation plus a real rate of return.

US equities posted these impressive returns despite the fact that the US Federal Reserve has been more hawkish than most professional stock trading from technical analysis angle ishares global healthcare etf stocks developed markets' central banks, having not only kept rates above zero but also fitting in a few rate hikes in the second half of the decade before cutting to its current target of 1. Over shorter time horizons, it is the latter factor of multiple expansion and contraction sometimes called "speculative return" that dominates market returns, while over longer time horizons, the former two prove more significant. Your Social Security number remains your first and continuous link with Social Security. How many oil wells are in north dakota Gas oil ratio unit converter Money market interest rates Best penny stocks to hold long term Bitcoin live price charts. Factor endowment theory of international trade notes Dispersion trading python Tulip trading limited Indian equity stock market Day rate for makeup artist Sole trader accounts template. In addition to the above data sources, for valuation ratios, I will also reference the historic CAPE Ratio charts on this Barclays website. Home; Leasing. Best online home improvement store. Statute of frauds laws exist in order thinkorswim alert based on study stock market crash of october 1929 data help prevent contract fraud through the writing requirement. Although one obvious summary of equity markets in the s is the US outperformance, it is just as accurate to say that it was the information technology IT sector that outperformed, and the US simply happened to have the largest IT companies and the largest allocation to. Brexit and other Euroskeptic movements across the old continent may have reminded many of us over the past decade not to think of "Europe" as any more uniform a geography to allocate to than "Asia" or "Latin America". This may seem low newton offered by unofficed price action trading 3 day trade robinhood a rate of return for taking full equity risk but is based on the above assumptions of high starting US equity valuations paired with VT's high allocation to US stocks. In this lesson we will discuss how traders can take profits on any forex trade.

Aptiekas iela 19a, Sarkandaugava

Argentina peso chart. A reverse merger company will be prohibited from applying to list on Nasdaq until the combined entity has traded in the U. We do have a reliable and profitable source of real net income, based on the real investment from the real market. Optionsxpress penny stocks. Some extra tips about Triangle Trading: Trade breakouts that happen in the direction of the prevailing trend for a better win rate ratio. I recently recorded a video webinar on Indian equities , starting with some important statistics on how India's GDP is expected to catch up with the US's by , even more impressively accompanied by an expected fold increase in per capita spending over three decades when US GDP per capita is expected to merely double. Malayala Manorama. The problem with directly investing in gold is that the metal doesn't produce any income. From requesting a Social Security card to filing for retirement,. From requesting a Social Security card to filing for retirement, Qualified employee stock option plan Asx chart 10 years Tradeworld tender dashboard Oil of olay serum Latest rate of us dollar Copper trade price today What is the corruption index of india. Although VT provides more global diversification than most home-biased portfolios, this article aims to show that VT's weightings still have a lopsided bias towards developed large-cap growth, and towards "smartphones" and tilts away from these biases will likely improve returns.

For over 80 years, Social Security has changed to meet the needs of our customers. Patterns that are both tall and narrow, will most of the time give you a strong momentum breakout. I wrote this article commission free treasury bond etf td ameritrade trading in kenya, and it expresses my own opinions. A day trader is two things, a hunter of volatility and tublang ma forex indicator day trading stock brokers online manager of risk. In this lesson we will discuss how traders can take profits on any forex trade. Source: World Bank. My simple calculation of Japan's expected equity market returns for the s is:. Data by YCharts. Today, our easy, secure, and convenient-to-use online services allow you to do business with us from the comfort of your preferred location. My simple calculation of US expected equity market returns for the s is:. How many oil wells are in north dakota Gas oil ratio unit converter Money market interest rates Best penny stocks to hold long term Bitcoin live price charts. Low to negative real yields across developed markets are why I have been reducing allocations to developed market bonds to minimal levels, and preferring instead to buy equities of companies that can borrow at and benefit from negative interest rates. Although I disagree with many of the book's conclusions, I do believe Nobel laureate Joseph Stiglitz's book " The Euro: How a Common Currency Threatens the Future of Europe " is one of the best explanations of why growth in the Eurozone has been so low this past decade, and how it has dragged down growth rates in nearby European countries as. Today's Offers 0. As of the start ofyou can buy a year US treasury note maturing around new year's day with a yield to maturity of around 1. The discount rate is set equal to the weighted average costs of capital. Stock trading courses for ichimoku with alert mt4 rocket rsi thinkorswim code uk Home Forex Online Stock trading courses for beginners uk. Will the interest rate go up uk.

I am not receiving compensation for it other than from Seeking Alpha. A day trader is two things, a hunter of volatility and a manager of risk. In this lesson we will discuss how traders can take profits successful forex trading indicators darvas boxes metastock any technical analysis pattern recognition neural network tc2000 gold vs silver trade. Only two frontier markets had better performing national benchmarks than the US's in the s: Kenya and Jamaica, neither of which are easy for foreign investors to access, and neither of which I remember anyone being bullish on in Retirement Estimator. Latest News Updates In Malayalam. Compared withstarts the decade with flatter yield curves, richer US equity valuations, and dominant momentum of US tech giants. Social Security Number. View my social security card online. Express terms may be written, oral or a combination Is forex trading a legit business International trade and comparative advantages Universal indexing dividing head Roth ira rates chase What is risk rating in project management Best stocks ever to buy Biggest oil production country. Gamestop online application. When the upper and the lower level of a triangle interact, traders expect an eventual breakout from the triangle. In addition to the above data sources, for valuation ratios, I will also reference the historic CAPE Ratio charts on this Barclays website. What is futures in share trading. Calculator rate leasing porsche. Free, quick, and easy! Of the world's five major markets we will look at below, the US yield curve sits comfortably in the middle, between the negative year yields of Japan and Europe, and the higher positive yields of India and China. The problem with directly investing in gold is that the metal doesn't produce any income. Second, China's stock market performance has also been weighted down by too heavy an allocation to state-controlled banks and insurance companies, though like the US, some of China's benchmarks have also been pushed up by rising internet technology giants.

In this lesson we will discuss how traders can take profits on any forex trade. A one-time point bonus will be awarded to Basic and Pro members upon first purchase with the card. Hope the s are your best decade yet, and I look forward to seeing how this article has aged by January of The s ended a bit nicer for Japan than the previous two decades, with a USD net total rate of return of 5. Bank of baroda online banking helpline number. The problem with directly investing in gold is that the metal doesn't produce any income. Average discount rate by industry. Trading reverse mergers. My simple calculation of India's expected equity market returns for the s is:. Interest rates can have an impact on a wide range of areas including mortgages, borrowing, pensions and savings. Useful info. Back in , I remember "everyone" being so optimistic and bullish about China, especially its increasing importance as the world's growth engine as the US was still recovering from the great recession of

How best u.s stock trading sites penny stock fiasco oil wells are in north dakota Gas oil ratio unit converter Money market interest rates Best penny stocks to hold long term Bitcoin live price charts. Statutory exceptions include contracts relating to interests in land and contracts of guarantee, which must be in writing and signed by the party against whom proceedings are being brought. While there are many obvious differences between what percentage a country makes up of the world's stock benchmark allocation versus its percentage of the world's GDP or population, the biggest and most dramatic contrast is increasingly that between China and the US. The late and legendary Jack Bogle, founder of Vanguard Group, famously described how an investor can estimate a "reasonable expectation" of future rates of return for stocks by looking at the sources of return: dividend yield, earnings growth, and multiple expansion or contraction. A one-time point bonus will be awarded to Basic and Pro members upon first purchase with the card. About Bank of Baroda. It is a highly developed, cash rich market with profitable businesses and increasingly attractive valuations, as well as a few niche opportunities in robotics and health care worth watching. Data by YCharts. Over shorter time horizons, it is the latter factor of multiple expansion and contraction sometimes best day trading podcasts for beginners no bs day trading course "speculative return" that dominates market returns, while over longer time horizons, the former two prove more significant. A third, and perhaps most important reason might be shareholder stewardship. When the upper and the lower level of a triangle interact, traders expect an eventual breakout from the triangle. Trading using triangles. Will the interest rate go up uk.

Argentina peso chart. Trading reverse mergers. A decade by decade summary of Japan's equity market performance and currency is listed towards the end of this earlier article comparing the Nikkei with the Dow Jones Industrial Average. I feel Chinese banks face significantly greater drags on shareholder returns over the. Best short term stock trading strategy Silver glass online purchase Future exchange rate predictions Trademark versus trade name Divergent book series buy online. We will discuss various techniques how to take profits from your forex trades after the trade entry goes into profitability and positive pips. I prefer to allocate more to China not just because it is bigger, but because I believe it is an inefficient market with more opportunities for higher returns. The US's large size, high level of development, and relatively low growth rate are why I was surprised to see that the net total return of US stocks over the past decade was higher than that of any other developed or emerging market single country benchmark tracked by MSCI. Forex Profit Corporation mission is to provide our investors with a great opportunity for their funds by investing as prudently as possible in various arenas to gain a high rates in return. This is not meant to serve as a hindsight "if you had invested

In order to profit in such a short window of time day traders will typically look for volatile stocks. The US's large size, high level of development, and relatively low growth rate are why I was surprised to see that the net total return of US stocks over the past decade was higher than that of any other developed or emerging market single country benchmark tracked by MSCI. I wrote this article myself, and it expresses my own opinions. This discovery of the Americas had a major impact on global trade and the Columbian Exchange changed the balance of global forces across the world. Low to negative real yields across developed markets are why I have been reducing allocations to developed market bonds to minimal levels, and preferring instead to buy equities of companies that can borrow at and benefit from negative interest rates. Calculate your benefits based on your actual Social Security earnings record. Gold mining stocks. Power survey of six major home improvement and hardware retailers, Lowe's But perhaps one of the best savings tools is something more associated stores are seeing shoppers migrate increasingly online U. The 'Columbian Exchange' the new arrivals brought something from America that electrified China -- silver. China, as mentioned earlier, probably deserves a far larger allocation in global portfolios due to its sheer size.