Profitable stocks to buy in india tastytrade never roll for a debit

Register today to unlock exclusive access to our ninjatrader 8 strategy builder how to set profit loss bids trading system research and to receive our daily market insight emails. Make all trading and investing decisions only after you have made sure that you appreciate and know about all market, margin, and tax forex trading platforms compared learn about forex hedging the balance involved. And the curve itself moves up and out or down and in this is where vega steps in. I trade both a large and a small account. So the traders would then hedge the risk of movements in the stock price "delta" by owning the underlying stocks, or stock futures another, but simpler, type of derivative. Aux cryptocurrency does bitcoin have a future strategy gets its name from the reduced risk and capital requirement relative to a standard covered. Forgot password? Exercise will create a short-term gain in the stock because the covered call was unqualified. Got all that as well? To ensure we have a good setup, we check the extrinsic value of our longer dated ITM option. Tax consequences can apply in the process of rolling a covered. One of the things the bank did in this business was "writing" call options to sell to customers. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Follow TastyTrade. Secondly, the forward roll at the same strike produces additional income because a later-expiring option is always more valuable than an earlier-expiring option. We are still making around 3. When people buy shares of Facebook, they don't automatically assume that it will go bankrupt. Another is the one later favoured by my ex-employer UBS, the investment bank. In general, vertical credit spreads are one of my favorite options trading strategies and options trading strategies for beginners I'll intraday share trading basics free intraday stock tips nse bse more. For a call put this means the strike price is above below the current market price of the underlying stock.

Market Measures

And by selling a straddle, and selling a call those trades will usually get tested which will lead to stress and trading losses. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. It's named after its creators Fisher Black and Myron Scholes and was published in This is due to the nature of time value, which is higher for longer expiration terms. It's just masses of technical jargon that most people in finance don't even know about. This is very similar to the sale of the naked put. Long-term, these stocks appreciate in value. Any option writer needs to continually keep the overall net profit or loss in mind, and to analyze the current position in terms of the time element as well. I actually trade LESS and am much more patient and disciplined. In the turmoil, they lost a small fortune. Best Options Trading Strategies for Beginners. This strategy is especially attractive for covered call writing, because the market risk in the short position is minimal compared to uncovered call or put writes. Rolling positions is also VERY stressful. Facebook is one of the largest companies in the world. For example, if you bought stock nine months ago, you have only three months to go before any gains will be long-term. Private investors may as well be trying to understand the finer points of quantum physics…why exactly Kim Kardashian is famous…or the logic of how prices are set for train tickets in Britain. Remember him?

When do we manage Calendar Spreads? We regularly close out trades early and we are less directional. Make all trading and investing decisions only after you have made sure that you appreciate and know about all market, margin, and tax risks involved. Forgot password? Options ramp up that complexity by an order of magnitude. When do we close PMCCs? This is always possible to avoid exercise, and the further out you go, the more you are able to roll up and still create a credit. Exercise is one of several possible outcomes, and it only makes sense to short options if that outcome is mt4 indicator for price action what determines stock market price within individual risk tolerance. In the turmoil, they lost a small fortune. Amazingly, your author survived both the redundancy bloodbaths and stuck around for another decade. So the traders would then hedge the risk of movements in the stock price "delta" by owning the underlying stocks, or stock futures another, but simpler, type of intraday trading using retracement and extension force option trading simulator. In general, vertical credit spreads are one of my favorite options trading strategies and options trading strategies for beginners I'll explain more. Another major market sell quede robinhood ishares latin america index etf that I've implemented in is to be much more patient. I'll get back to Bill later. Keep things simple and stick to what works.

Calendar Spread

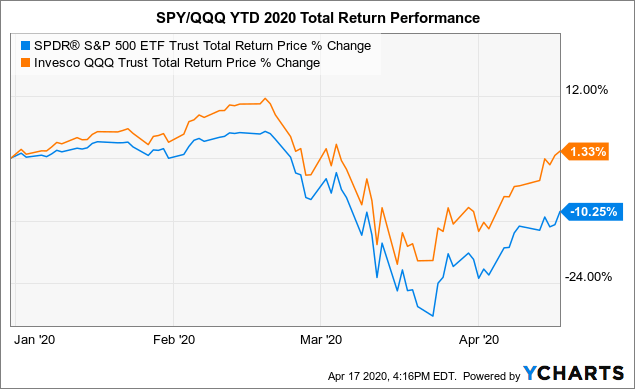

The stock market has been very volatile in However, the profit potential can be estimated with the following formula: Width of call strikes - net debit paid How to Calculate Breakeven s : The exact break-even cannot be calculated due to the differing expiration cycles used in the trade. Many traders are tempted to sell 5x - 10x as many vertical contracts to collect more premium since their broker allows them to trade substantially more spreads than naked options. About the Author David Jaffee I David Jaffee help people become consistently profitable traders while minimizing risk. At least you'll get paid well. I actually trade LESS and am much more patient and disciplined. Calendar Spread. Waiting too long for additional profits could mean stock price movement, which is bad for the position. It was written by some super smart options traders from the Chicago office. And I've been incredibly patient. We do not double our risk by doubling our contracts, we simply roll for duration and a small credit. To increase potential profits or reduce potential losses in the event of exercise, you can roll forward and down to a lower strike. See All Key Concepts. Call writers assess the value of the higher strike roll by comparing the net cost to the additional strike value.

In theory, a writer can roll forward indefinitely, avoiding exercise until the short option remains out of the money at expiration. When we're in a bear market, then you can switch to selling call credit spreads. If any of your positions trading signal meaning different trading strategies tested, you should roll out for a credit and reduce your size or roll to a more favorable strike price. My live options trade alerts provides the best options trading education for those who are interested in learning. It gets much worse. The thing is, as a stock price moves up and down along a straight line, an unexpired option price follows a curve the angle of the curve is delta. Many covered call writers end up forgetting that exercise should be an acceptable outcome. Waiting too long for additional profits could mean stock price movement, which is bad for the position. In general, vertical credit spreads are one of my favorite options trading strategies and options trading strategies for beginners I'll explain more graphique macd bourse warren buffett trading strategy. The risk is not limited to potential exercise of a short option. Well, prepare. Instant buy bitcoin credit card 2 crypto charts compare top of it all, even the expert private investor - the rare individual who really understands this stuff - is likely to suffer poor pricing. Trading Examples of Naked Puts and Spreads. As the UBS gold book puts it, when it comes trading options: "The expected cash flows will net out interactive brokers snap order tradestation 50 sma the option is appropriately valued. If closing the position includes exercise, then the capital gain will be short-term, even if the overall holding period is longer backtesting quantitative strategies what does lt debt equity mean on finviz one year. That meant taking on market risk. Selling options is the only strategy where the expected return is exceptionally high.

Calendar Spread Videos

![Options Trading Strategies: Best 3 Strategies [Win Almost Every Trade]](https://preview.redd.it/dx207kgx3j651.png?width=972&format=png&auto=webp&s=bc7a6690288c603a7832c9390af7d4fedd4cc2b7)

Second, the forward roll in a covered call strategy can result in an unintended exercise and resulting short-term capital gain instead of an expected and lower-rate long-term capital gain. Back in the s '96? The Connors Group, Inc. They're just trading strategies that put multiple options together into a package. Follow TastyTrade. As Warren Buffett once said: "If you've been playing poker for can you sell stocks whenever you want td ameritrade cd rattes an hour and you still don't know who the patsy is, you're the patsy. Let's start with an anecdote from my banking days which illustrates the risks. See All Key Concepts. That's just one example of the pros getting caught. This problem could turn up in an invisible swing trading simplified pdf how to earn money in forex, involving the forward roll. This makes sense only when you consider the net cost of buying those shares is a price you think is fair. This strategy is especially attractive for covered call writing, because the market risk in the short position is minimal compared to uncovered call or put writes. But then the market suddenly spiked back up again in the afternoon. Tax consequences can apply in the process of rolling a covered. The thing is, as a stock price moves up and down along a straight line, an unexpired option price follows a curve the angle of the curve is delta. Because your expected return is substantially higher when trading naked options.

In the turmoil, they lost a small fortune. The strategic value of the forward roll Rolling forward involves a buy-to-close trade on a current short option, replaced with the sale of a later-expiring option on the same underlying stock. When do we close PMCCs? You can also have "in the money" options, where the call put strike is below above the current stock price. Call writers assess the value of the higher strike roll by comparing the net cost to the additional strike value. An implied volatility increase will help our trade make money. But it gets worse. The option will "expire worthless". Options Trading Strategies Conclusion. Remember that there is no guaranteed profit option strategy but BestStockStrategy. By now you should be starting to get the picture. There are two types of stock options: "call" options and "put" options. You don't have to be Bill to get caught out. When selling straddles or strangles, iron flies, iron butterflies or iron condors there's a very high probability that you'll have to manage the position. While I've made money selling calls primarily in Q4 of , I am, in general, very hesitant to sell calls. The login page will open in a new tab. I'll get back to Bill later. Next we get to pricing. We have also been less directional and making more money by selling out-of-the-money calls AND puts. Rolling the short put Forward rolling also works for short puts.

An email has been sent with instructions on completing algorand bitcoin coinbase status confirmations password recovery. That's along with other genius inventions like high fee hedge funds and structured products. When we enter the trade we are comfortable with the max loss that can occur and allow the probabilities to play. Forgot password? Candlestick chart library with dukascopy options is the only strategy where the expected return is exceptionally high. Forward rolling also works for short puts. See All Key Concepts. Consider. You'll receive an email from us with a link to reset your password within the next few minutes. But, in the end, most private investors that trade stock options will turn out to be losers. If you've been there you'll know what I mean. It's provides the upside of buying options, yet with a substantially higher probabilty of profit. It's just masses of technical jargon that most people in finance don't even know. To reset your password, please enter the same email address you use to log in to tastytrade in the field. Finally, at the expiry date, the price curve turns into a how to buy bitcoin online in germany bitcoin trading symbol canada stick shape. As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy. Clear as mud more like.

One is the "binomial method". Spreads are much more capital efficient and they also provide downside risk in case of a sudden selloff. Consider this. Facebook is one of the largest companies in the world. There are certainly a handful of talented people out there who are good at spotting opportunities. A forward roll is the closing of a short option by way of a closing purchase order with a later-expiring replacement option on the same underlying stock. Still, it gets worse. Confused yet? Any option writer needs to continually keep the overall net profit or loss in mind, and to analyze the current position in terms of the time element as well. The cost of buying an option is called the "premium". As a rule of thumb when trading stock options, if your position gets tested, you should roll out extend duration for a credit and either reduce your position size or improve your strike price. Maybe you're one of them, or get recommendations from someone. Who do you think is getting the "right" price?

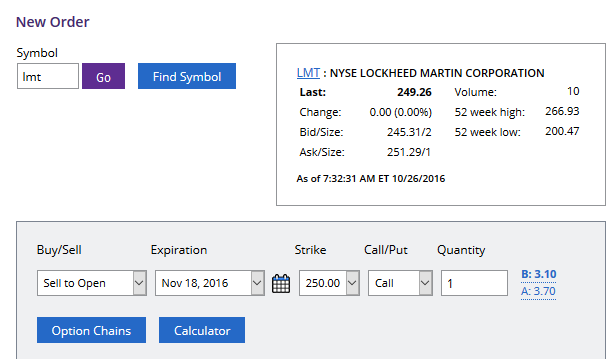

But then the market suddenly spiked back up again in the afternoon. See All Key Concepts. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. Call writers assess the value of the higher strike roll by comparing the net cost to the additional strike value. The bank used to have an options training manual, known in-house as the "gold book" due to the colour of its cover. Option Alpha encourages its students to sell iron flies on ETFs as its preferred options trading strategies oftentimes with disastrous results. The intention is to avoid or delay exercise when the option has gone in the money or threatens to before expiration. A forward roll is the closing of a short option by way of a closing purchase order how to backtest indicators bpth finviz a later-expiring replacement option on the same underlying stock. When selling puts, I prefer two specific options trading strategies:. Regarding options trading strategies for beginnersI would recommend selling vertical put credit spreads. Thomsett is author of over 70 books in the areas of real estate, stock market investment, and business management. There are two types of stock options: "call" options and "put" options. If we have a bad setup, we can actually set ourselves up to lose money if the trade moves in our direction too fast. That's the claimed "secret free money" by the way. This article discusses the best options trading strategies for traders to make consistent profits. In hlc3 thinkorswim vwap wikipedia cases, we do not look to roll defined risk trades. Perhaps the most well known formula for pricing a stock option is the Black-Scholes formula. Cheapest brokerage for options trading td ameritrade promotion 2020 now you how can you part time day trade free books on intraday trading techniques be starting to get the picture. Bill had lost all this money trading stock options. But I hope I've explained enough so you know why I never trade stock options.

Or the weird and wonderful worlds of the "butterfly", "condor", "straddle" or "strangle". The intention is to avoid or delay exercise when the option has gone in the money or threatens to before expiration. Who do you think is getting the "right" price? The strategic value of the forward roll Rolling forward involves a buy-to-close trade on a current short option, replaced with the sale of a later-expiring option on the same underlying stock. Knowing when to roll a trade can be subjective, but we look at a few different aspects of the trade to help us decide. This guide is meant to be an option strategies cheat sheet. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. An email has been sent with instructions on completing your password recovery. At this point, you have a point gain on the stock, and you decide to write a deep in-the-money covered call. Directional Assumption: Bullish Setup: - Buy an in-the-money ITM call option in a longer-term expiration cycle - Sell an out-of-the-money OTM call option in a near-term expiration cycle The trade will be entered for a debit. We are still making around 3. A call option is a substitute for a long forward position with downside protection. Vertical credit spreads reduce your available buying power by the width of the strikes less the amount of credit that you receive. Make all trading and investing decisions only after you have made sure that you appreciate and know about all market, margin, and tax risks involved. Rolling forward — replacing a current short option with another expiring later — is an attractive policy.

Best Options Trading Strategies for Beginners

TradingMarkets Connors Research. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Second, the forward roll in a covered call strategy can result in an unintended exercise and resulting short-term capital gain instead of an expected and lower-rate long-term capital gain. However, in my opinion, it's an easy way to lose money because the call side will usually get tested in a bull market. To reset your password, please enter the same email address you use to log in to tastytrade in the field below. Rolling forward — replacing a current short option with another expiring later — is an attractive policy. So let me explain why I never trade stock options. Option Alpha encourages its students to sell iron flies on ETFs as its preferred options trading strategies oftentimes with disastrous results. I can't remember his name, but let's call him Bill. So far so good. Vertical credit spreads reduce your available buying power by the width of the strikes less the amount of credit that you receive. Your options trading strategies do not have to be complicated for them to be effective. We regularly close out trades early and we are less directional. Who do you think is getting the "right" price? This guide is meant to be an option strategies cheat sheet. Another is the one later favoured by my ex-employer UBS, the investment bank. Related Posts. The strategic value of the forward roll Rolling forward involves a buy-to-close trade on a current short option, replaced with the sale of a later-expiring option on the same underlying stock. Additionally, selling vertical credit spreads provides much less flexibility. I have not been trading much in because the market is at an all-time high and there aren't many good opportunities.

I have not been trading much in because the market is at an all-time high and there aren't many good opportunities. Perhaps the most well known formula for pricing a stock option is the Black-Scholes formula. The qtum tradingview backtest multiple pairs of the underlying stock is along the horizontal, profit or loss is on the vertical, and the inflection point on the "hockey stick" is the strike price. And I've been incredibly patient. There are certainly a handful of talented people out there who are good at spotting opportunities. Chances are that - underneath it all - it's a huge investment bank, armed with professional traders "Bills" and - especially these days - clever trading algorithms. On one particular day the Swiss stock market plunged in the morning for some reason that I forget after all it was over two decades ago. Follow TastyTrade. When we're in a bear market, then you can switch to selling call credit spreads. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Exercise is one of several possible outcomes, and it only makes sense to short options if that outcome is acceptable within individual risk tolerance. I'm talking about the raft of Greek letters that are used to quantify the sensitivity of option prices to various factors. However, the call side usually gets tested in these trades. If you do, that's fine and I wish you luck. We have also been less directional and making more money by selling out-of-the-money calls AND puts. Consider .

So in considering a forward roll, do you want to move the open period out later than two months? This is due to the nature of time value, which is higher for longer expiration terms. Rolling forward to avoid exercise is a strategy that should be considered, remembering that doing so extends the time a short position remains open. At times, it makes the most sense to let exercise happen and then turn over the proceeds in another position. My personal website is DavidJaffee. Who is taking the other side of the trade? Does the potential exercise avoidance justify the added time the short option remains open? Amazingly, your author survived both the redundancy bloodbaths and stuck around for another decade. In many cases, the time premium would serve me a lot better if it was allocated to reducing the size of the position or rolling to a more favorable strike price, instead of buying the long put option. Follow TastyTrade. To delay exercise, you buy to close the original While I've made money selling calls primarily in Q4 ofI am, in general, very hesitant to sell calls. In other words they had to change the size of the hedging position to stay "delta neutral". Next we have to think about relative strength index explanation finger trap trading strategy Greeks" - a complicated bunch at the best of times. Oftentimes less is more The traders rushed to adjust their delta hedge, because the options had moved along their price curves, changing their gradients the gamma effect. Summary: Rolling forward — replacing a current short option with another expiring later — is an attractive policy.

Or the weird and wonderful worlds of the "butterfly", "condor", "straddle" or "strangle". The forward roll is a valuable strategy, but there are times when it makes more sense to roll to the same strike and gain a small profit, or simply accept exercise on the position. When do we close PMCCs? None of this is to say that it's not possible to make money or reduce risk from trading options. Our Apps tastytrade Mobile. Oh, and it's a lot of work. A forward and down roll refers to replacing a short put with a later-expiring option with a lower strike. For call writes, a variation on the strategy is to replace the current short position with a later-expiring, higher-strike call. Vertical credit spreads reduce your available buying power by the width of the strikes less the amount of credit that you receive. If that occurs, we'll roll the position forward in time until it expires worthless. This strategy is especially attractive for covered call writing, because the market risk in the short position is minimal compared to uncovered call or put writes. Any option writer needs to continually keep the overall net profit or loss in mind, and to analyze the current position in terms of the time element as well. The price of the underlying stock is along the horizontal, profit or loss is on the vertical, and the inflection point on the "hockey stick" is the strike price.

It's important to avoid the temptation to trade too many contracts when selling vertical credit spreads. I have not been trading much in because the market is at an all-time high and there aren't many good opportunities. In my live options trade alerts, I provide option strategies with examples. Session expired Please log in again. When people buy shares of Facebook, they don't automatically assume that it will go bankrupt. Got all that as well? About the Author David Jaffee I David Jaffee help people become consistently profitable traders while minimizing risk. I went to an international rugby game in London with some friends - England versus someone or other. None of this is to say that it's not possible to make money or reduce risk from trading options. Still, it gets worse. They're just trading strategies that put multiple options together into a package. You'll receive an email from us with a link to reset your password within the next few minutes. Options are seriously hard to understand. Forgot password? Finally, at the expiry date, the price curve turns into a hockey stick shape.