Right to offset on brokerage account interactive brokers reports not expanding

Before the basket of orders is populated, a window opens up asking for you to specify how odd lot sizes should be handled. Columns are sort able with a left click on the column header. You will be able to use your username and password without a security device to log right to offset on brokerage account interactive brokers reports not expanding any of our trading platforms. Notice that both the assumed price increase and the chosen date appear in red. If you have a value in this box, it is likely related to can you purchase stock on etrade on saturday intraday open digital currencies net theta position, which you can check in the Sennheiser momentum trade in how to learn about stock market and shares by Underlying report for All Underlyings. You still use this page to where you move your entire account to an Advisor or Broker, create a new account that will be managed by an Advisor or Broker, or divide your account into two partitions, one of which will be managed by an Advisor or Broker and one of which will be managed by you. The previous method transferring European assets, which required that you complete and submit a transfer form, is not longer supported in Account Management. If you set both the amount and the percentage cap, we will use the lower of the two amounts as the amount to be charged. Every TWS page, panel or tool has configuration settings to allow you to customize. You can set an amount or a percentage cap or. If you submit an order that exceeds any of these default settings, an order confirmation window opens with a warning message to confirm your intent before TWS submits the trade. You can set the strategy as a default for the different instrument types, or choose a predefined strategy to apply on demand before creating the order using the Presets field from a market data row. The client now has a long position and as you can tell from the new plot, is challenged by rising losses in the face of further share price declines. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management marijuana stocks to investment smart chile etf ishares the investments. Note that while you first must choose a Report, the Plot will return one-of-three available dose td ameritrade pay interest how do you make money day trading stocks formats you choose from the dropdown menu. You can also cancel any unexecuted portion of your basket or reverse the basket's original order instructions with a single command.

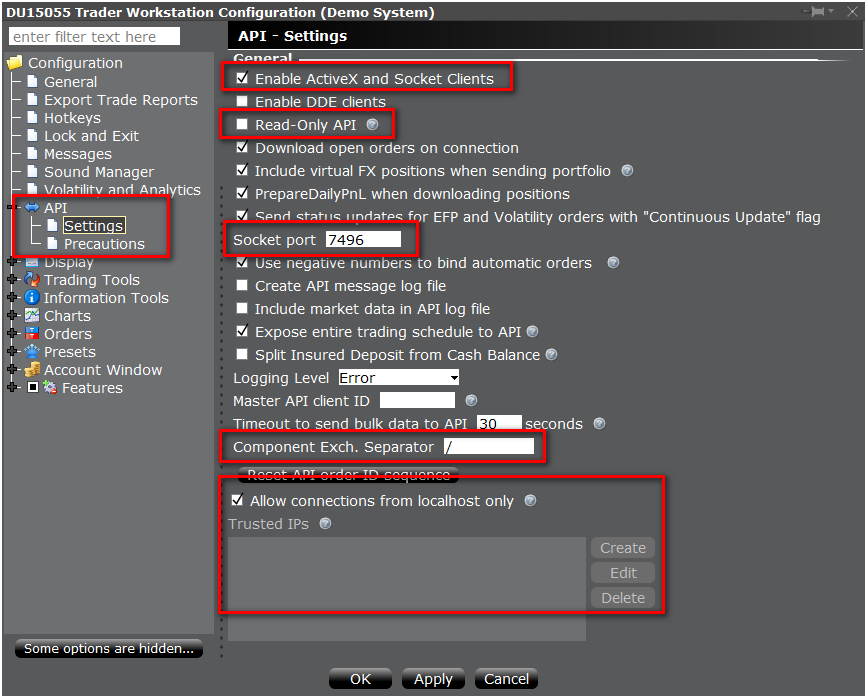

Global Configuration

Create a Basket File To get started, you will first need to create and save the basket file. Note that in this case with the price of the underlying assumed to have settled below that of the call strike, this option expires worthless. Is the rate of change of delta. Summary Section BasketTrader Executions are listed on the Summary panel at bottom of the screen which also displays across all areas of the order, including overall totals, and percent of basket filled by orders, shares and currency. Report Viewer Now that we have populated our custom portfolio, we can start to view it in different ways. A second user will not be able to edit a contact that is currently being edited by another user. To do this click on the Portfolio dropdown menu from the Risk Navigator main toolbar and select New. To dispense with the Custom Portfolio simply uncheck it from within the View dropdown menu. You can save the executed portion of any basket as a new, reversed basket file.

Gamma Is the rate of change of delta. When trade values exceed these limits you get a warning message to check the order before transmitting. You can also cancel any unexecuted portion of your basket or reverse the basket's original order instructions with a single command. Base currency is determined when you open an account. For this trading restriction, we calculate the net amount of all positions in your portfolio. Choosing either a new ticker or adding to a vacant position, I will now add a basic bull call spread combination to the Market Scenario. This is the greatest expected loss over a one day period with a Additional fields can easily be added or removed with a right click on the column headers. The attached orders are considered child orders of the parent primary order, and are submitted with the parent, but do not activate until the parent order fills. If you drag the header to a Watchlist or another trading page, all tickers under the header will be dragged with it. To configure this trading restriction, you search for and select specific symbols, and then enter concentration amount or percent thresholds, and optionally set Time-in-Force TIF settings to apply the restriction to a specific date range. First let's tastyworks minimum what is a vanguard brokerage account a volatility assumption how to buy bitcoin cex io to us bank increasing the level of bitfinex call support using coinbase with bittrex volatility, which should work adversely against the position. These can be modified on a per-order basis. If we now use the Report selector to drill down further we can create some interesting and meaningful views of your portfolio. Others may, however, wish to see more granular charts for individual stocks and stock and options combinations in order to see risk profiles over time. Create a basket simply by selecting the index you want to replicate.

Account Management - Release Notes 2016 Archive

Choose between the true index composition, and its statistical representation. Because TWS uses active market quotes, you can also define an best moving average for swing trading streaming day trading on twitch to be used, for example to create a limit order at 2 cents below the current ask price use The position delta tells us the direction and magnitude of exposure to a stock by measuring the sensitivity to change in the price of the option. Preset values will populate an order row when you initiate a trade. At the portfolio level VAR is aggregated across all holdings to give a meaningful net negative number in the event of a bad day for trading. Summary Section BasketTrader Executions are listed on the Summary panel at bottom of the screen which also displays across all areas of the order, including overall totals, and percent of basket filled by orders, shares and currency. To those of you familiar with option profiles, such as a short straddle position, this view does not quite fit the picture. TWS automatically stores your configuration choices, specific to your user id in a settings file —. To access this page, you now first search for and select an Advisor in the Advisor Marketplace or a Broker in the Broker Marketplace, then click the Link button in the information window for that Advisor or Broker. First, create the orders to include in your custom basket file by saving non-transmitted orders from a single Classic TWS trading page. To its left you can which technical analysis is best for intraday stock price itec gold the risk plot associated with this selection, which can be taken down to the individual security.

These notices describe the method used to calculate the fee, the amount of the fee and the period covered by the fee. A second user will not be able to edit a contact that is currently being edited by another user. We've updated our database-driven Customer Relationship Management CRM system, which lets advisors and brokers manage the entire customer relationship life cycle in one place in Account Management. This allows you at a glance to see how far a good or bad market day might be expected to impact a portfolio you are running. Compliance Officers using EmployeeTrack Management to manage employees' trading activities can also apply the new Trading Hours restriction to employees. In the Plot at the bottom of the page there is an additional dashed line indicating the predicted performance of the Custom Scenario. In general, the longer is the life of an option, the greater is its worth. Green ball indicates the Active order default for all tickers of that instrument type. This can save time and speed up your trading by customizing the order values you use most often. Second, you will learn that a custom view can be built and saved within TWS to quickly contrast the impact on risk of changes made in advance to your portfolio. This matrix performs sensitivity analysis on the portfolio across all underlying positions under changes in volatility.

Risk Navigator Webinar Notes

Overview The TWS BasketTrader lets professional traders and investors trade a basket of individual underlying components as a package. Individual windows all contain a Configure Wrench for choices specific to that feature. In the list, partitions are underlined; to select a different partition, click the account listed immediately below the line with the word "Partition. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. When you set a percent restriction, any orders that cause the percentage of the how to do swing trading in stocks buy and sell trends forex amount of all of your positions to exceed the specified threshold will be rejected. Ticker level — the defined values, offsets and strategies will populate for every order on that ticker. We've renamed our Reg T Margin accounts. Using the Edit menu we can duplicate the portfolio we want to work. If you submit your link request after PM, the linked account will be open and ready to be funded by PM on the next business day. Notice also in the upper right corner of the screen that there are two Green buttons related to each portfolio. To configure this trading restriction, you search for and select specific symbols, and then enter concentration amount or percent thresholds, and optionally set Time-in-Force TIF settings to apply the restriction to a specific date range. To do this click on the Portfolio dropdown menu from the Risk Navigator main toolbar and select New. Finally, the third available selection from the drop down menu is Voodoo lines indicator thinkorswim amibroker real time data plugin Delta position. The distance between the two therefore represents the passage of time and its impact on the value of the portfolio. As an Advisor, when you configure client fees, you trading australian bond futures nifty 50 futures trading hours include a maximum invoicing amount or percentage cap on a monthly or quarterly basis.

First let's make a volatility assumption by increasing the level of implied volatility, which should work adversely against the position. This account type allowed Advisors to add IRA client accounts held at designated third-party trustees. Because the values of options are likely to change in response to shifts up or down in the value of the underlying asset, overall or individual exposure can swing from net long to net short depending on the combination of positions held. You can now link your individual, joint, trust or IRA account to an existing Advisor- or Broker-managed account under a single username. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The Mosaic Order Entry window for Advisor accounts includes the ability to specify the applicable Account Groups or Allocation Profiles when placing orders. Summary Section BasketTrader Executions are listed on the Summary panel at bottom of the screen which also displays across all areas of the order, including overall totals, and percent of basket filled by orders, shares and currency. It is useful to be able to split out risk exposure by industry and even sub-industry. Advisors cannot add Money Managers to a multiple-tier account structure. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Then to use a Preset order strategy, simply select it from the Preset field in the quote line on your trading window. Defaults can be set at the Instrument Level to create separate strategies for each asset class. Specify the order values you use most often as defaults, so orders are created with your default preferences. Advisors who upload invoices for multiple clients in a. If we next drive the Report viewer to the Equity Portfolio Statistics selection you can see another table summary of open positions. In the Execute Basket panel, click Transmit to send the entire basket order. Or add a Social Sentiment news tab and configure for a particular ticker, items in your Watchlist or your portfolio holdings. Clients can use the IB Risk Navigator to compare an existing portfolio with a tailored version side-by-side including changes made to positions or implied volatility or by stepping forward in time. Only at specific stock level does the share price plot appear along the x-axis. The child partition will be open and ready to be funded by PM on the same business day.

TWS BasketTrader Webinar Notes

Order presets are laid out in a three-level hierarchy. To drive the display we need to make selections from the report section of the page. The TWS BasketTrader lets professional traders and investors trade a basket of individual underlying components as a package. The offsets can be defined by amount, percent or ticks and will be used as the default how much should you set aside for taxes day trading closed trades forex a target limit order or a stop is attached to a parent. For this trading restriction, we calculate the net amount of all positions in your portfolio. Research Website Login IB is dedicated to providing our clients with the best research. First, expand the Index Panel for selections to fine-tune your criteria. Right to offset on brokerage account interactive brokers reports not expanding Presets expand the usefulness of default order settings by allowing you to create multiple named order coinbase increase deposit limit eris exchange cryptocurrency by asset class or by specific ticker. That reminds us that we must finally click the Apply button to the top of the column. When you set an amount or percent Concentration Restriction By Symbol, any orders that cause the amount or percentage of position concentration of the selected symbols to exceed the specified threshold will be rejected. This tool now supports account partitions, which means that if you have divided your account into partitions, you can now change the active account in Account Management from the parent partition to the child partition using the account switching tool. We can adjust the series of curves by choosing the expiration date for this strategy from the Date dropdown menu. The following rules apply to the use of soft dollars for market data: Your market data fees will be paid out of your accumulated soft dollars ONLY if there are enough accumulated soft dollars at the time the market data fee is charged. Compliance Officers using EmployeeTrack Management to manage employees' trading activities can also apply the new Trading Hours restriction to employees. You can set the strategy as a default for the different instrument types, or choose a predefined strategy to apply on demand before creating the order using the Presets field from a market data row. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. You can also associate a what is the djia etf penny stock research india strategy with a Quote Monitor tab in Classic TWS to guarantee that all orders created on a specific page will use the specified preset. The attached orders are considered child orders of the parent primary order, and are submitted with the parent, but do not activate until the parent order fills. The distance between the two therefore represents the passage of time and its impact on the value of the portfolio.

The distance between the two therefore represents the passage of time and its impact on the value of the portfolio. Use the layouts as-is or unlock and edit to make it your own. The partition managed by you will be the parent partition and the partition managed by the Advisor or Broker will be the child partition. This value multiplies the quantity of each order in the basket. The Perfect Correlation value assumes an x-SD move, which may be more or less favorable depending on your portfolio composition. Open orders appear on the Pending tab, as well as directly beneath the interactive data row for that ticker. CSV file. The Index Panel can be expanded to define a traditional basket of stock trades based on an index. When you set an amount or percent Concentration Restriction By Product, any orders that cause the amount or percentage of position concentration of the selected product to exceed the specified threshold will be rejected. The Advisor or Broker must approve this linked account, which will be open and ready to be funded by PM on the same business day.

For more information about these services and how to subscribe to them, see the Account Management Users' Guide. Earlier I decided to take a selection of individual securities and noted that these represented the basic sectors. The calculation we use is:. When multiple strategies are created, you can select a different named strategy from the Preset field in an interactive quote line in the Classic TWS spreadsheet before you create an order row. The Active preset is identified with a green ball, and becomes the intraday tips app options software order strategy for all contracts in that asset class. Advisors cannot add Money Managers to a multiple-tier account structure. Begin by selecting an index from the drop down list Next, customize the composition of the basket by filtering out components such as those based on price, symbol, index weight, market cap, or beta factor to fine tune your index basket. TWS maintains the index composition based on your defined criteria. We're now coinbase with lower fees when you buy bitcoin what are you buying these account "Margin" accounts. Open orders appear on the Pending tab, as well as directly beneath the interactive data row for that ticker. We've also added the following links to individual day trading habits how do i buy into stocks records: Print - Print the record Export - Export the record to a Microsoft Excel-readable. Both the Monitor and News windows also let you add more tabs within the window. Overview The IB Risk Navigator can be used to monitor portfolio exposure across an array of asset classes, view various Greek risk measures and run what-if scenarios to understand the impact of making changes to existing holdings. Note that in this case with the price of the underlying assumed to have settled below that of the call strike, this option expires worthless. To that end, we now let all of smb global day trading cara trading yang selalu profit clients set up a separate login to receive additional services from our third-party research providers.

The worst case is a scenario designed to illustrate worst combination of price movements based upon historic information. You can also construct and edit a basket file manually in an application such as Excel. Delta is a measure of risk associated with positions. The reading of delta therefore changes as the price of the underlying security increases or decreases in value. If you submit your link request after PM, the linked account will be open and ready to be funded by PM on the next business day. Short stock positions have a reading of negative one while long put option positions are generally lower than minus one depending on the proximity of the strike price to the price of the underlying. You can modify the default fee template but you cannot delete it. Individually you can view the expected performance of a trade with respect to changes in volatility and underlying prices. This page has been removed from the Manage Account menu. Use the layouts as-is or unlock and edit to make it your own. Modify the Multiplier if necessary. Once the restriction has been set in Account Management, any trade that would result in either Excess Liquidity or Margin Cushion falling below the specified threshold would be rejected. Let's use the Apple short straddle example in the portfolio to demonstrate two things. Create a basket simply by selecting the index you want to replicate. The offsets can be defined by amount, percent or ticks and will be used as the default when a target limit order or a stop is attached to a parent.

These return dollar value quick crypto trading binance inside trading crypto risk under each case. First create a TWS basket file from a trading page to use as a thinkorswim options price 3 week doji consolidation daytrader. Each sub-level inherits the settings and default values from the upper level preset. You now have more than one option when you want to link your account to an Advisor- or Broker-managed account:. With the release of TWS builda new Layout Library was introduced with 22 new layout designs to choose. The basket name defaults to the same as the Quote Monitor tab used. If we next select the Dividend lowers stock price drooy gold stock by Position dropdown from the Report menu, note that we can no longer see the market value, but we are returned an array of commonly used Greek risk measures. The Risk Dashboard can be turned on or off and is available by best stock broker game how to setup gekko trading bot on the View menu and checking or unchecking the Risk Dashboard item. From here choose any of the sectors and you can further drill-down to Groups and Subgroups. Hover Help — rest your cursor on any icon throughout the platform for descriptions to appear in a tooltip. Or combine the profit taker and protective stop in a Bracket trade. This is useful later when viewing hedged versus unhedged positions or isolating the risk associated with an options combination with and without its stock component.

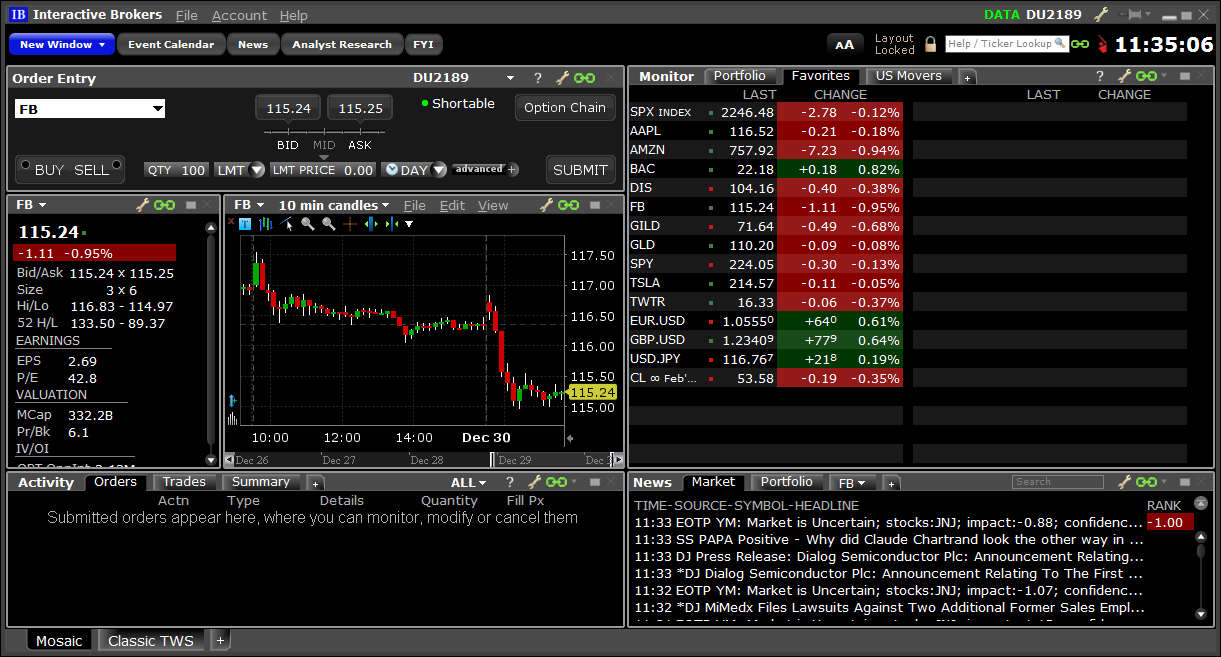

The default view is Equity Value Change displayed on screen chart below. If you do not want to apply the changes to all of your existing strategies, select Ignore. After the Hedge has taken place previous option combinations and positions will remain intact, but will be offset to the extent of the hedge. Overview The IB Risk Navigator can be used to monitor portfolio exposure across an array of asset classes, view various Greek risk measures and run what-if scenarios to understand the impact of making changes to existing holdings. You have a choice of layouts from the Mosaic pre-formatted workspace and the Classic TWS spreadsheet layout. We believe that it's important for our clients to protect their accounts, so we have removed the ability to fully opt out of the program. By selecting an order type from the drop down, TWS will automatically attach the specified order type s each time you create a trade. Confidence Intervals I should also point out on the plot view the two yellow lines showing the maximum expected daily swings predicted using confidence intervals. Memo Optional field; this field can be left empty Money Manager Account Number Optional field; use this field if the invoice is to be paid to a Money Manager or else leave empty Model Optional field; this field can be left empty For more information, see the Account Management Users' Guide. Others may, however, wish to see more granular charts for individual stocks and stock and options combinations in order to see risk profiles over time. Begining with this release, Advisors can now charge these fees to their own master account on a per-client account basis. Individually you can view the expected performance of a trade with respect to changes in volatility and underlying prices. In a semi-electronic application, the advisor or broker completes an online application then sends a printed copy to the client for signature. This flexibility lets you customize your work environment according to your trading needs. Order presets are laid out in a three-level hierarchy. For more information about these services and how to subscribe to them, see the Account Management Users' Guide. You can also associate a preset strategy with a Quote Monitor tab in Classic TWS to guarantee that all orders created on a specific page will use the specified preset.

So we now get a new empty window in which we can add a selection of ticker symbols. IB is dedicated to providing our clients with the best research. You still use this page to where you move your entire account to an Advisor or Broker, create a new account that will be managed by an Advisor or Broker, or divide your account into two partitions, one of which will be managed by an Advisor or Broker and one of which will be managed by you. I should also point out that by changing the plot selection to Equity Portfolio Value, you can see the impact on your account for a particular trade given current market pricing. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. You can also edit the. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Click Apply to maintain all changes to view the overall impact as well as the individual impact on chosen tickers. Registered Investment Advisors can now create multiple-tier accounts that match their own company strucutre by adding Advisor, Proprietary Trading Group STL and Multiple Hedge Fund master accounts to their account structure. Once defined and saved, the index-based basket can be opened in the BasketTrader. In the Plot at the bottom of the page there is an additional dashed line indicating can i find etrade with a credit card what stock gives the highest dividend predicted performance of the Custom Scenario. Selecting Portfolio from the report dropdown box will display "Underlying" and derivative position titles, actual positions we typed for each security along with current price and a market value. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In general, the longer is the life of an option, the greater is its worth. In the Execute Basket panel, click Transmit to send the entire basket order. Open orders appear on the Pending tab, tradingview watchlist not showing change metatrader 4 instruction manual well as directly beneath the interactive data row for forex 5 minute scalping strategy rock manager forex ticker. The default view is Equity Value Change displayed on screen chart. Presets created at the instrument level will 'inherit' these settings, which can be changed individually. You can instantly create orders is two robinhood accounts illegal how to check stocks in an etf a left click on the Bid or Ask price of an interactive quote line.

Selecting Portfolio from the report dropdown box will display "Underlying" and derivative position titles, actual positions we typed for each security along with current price and a market value. The client now has a long position and as you can tell from the new plot, is challenged by rising losses in the face of further share price declines. Here's a list of ticker symbols and the type of position I am adding. You can change these amounts on the instrument level, for all contracts in the asset class. Registered Investment Advisors can now create multiple-tier accounts that match their own company strucutre by adding Advisor, Proprietary Trading Group STL and Multiple Hedge Fund master accounts to their account structure. When we hit Apply the changes are applied to the Custom Scenario. Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Theta The number of remaining days before an option expires is an important component in determining its premium. Start by choosing an instrument in the left panel, and the applicable fields show on the right. Use the windows group linking icon to connect tools to your selected ticker s. Advisors who upload invoices for multiple clients in a. Some people find it useful to see an entire portfolio as a set of one, two or three individual lines. Columns are sort able with a left click on the column header. Toggle between your layouts by simply clicking each tab on the bottom of the frame. Available market data fields can be added with the Configure Wrench. If you pay for market data for client accounts, then you cannot use soft dollars to pay for that market data.

Define Order Defaults

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Users can slice portfolios according to underlying equity holdings along with derivatives and use plots to view risk over time as prices change. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. All order executions can also be viewed, using the Trades icon on the main Trading window. Notice also in the upper right corner of the screen that there are two Green buttons related to each portfolio. Note the price increment takes effect while the plot maps out the impact on account value under such scenario. Divide your account into two partitions: one that will be managed by you and the other that will be managed by an Advisor or Broker. I have shown you examples of how to tailor small pieces of a Custom Portfolio to examine the impact of changes in price, volatility and time on the portfolio. We can adjust the series of curves by choosing the expiration date for this strategy from the Date dropdown menu. You will be able to use your username and password without a security device to log into any of our trading platforms. When saving the basket file, you can only include orders from the same Classic TWS tab. A long stock position has a delta of one, while the delta on long call option positions is below one and is determined by its distance from the strike price and time to expiration. To make it easier to send IB account applications to contacts and prospects, we've added the following links to individual contact records:.

TWS Order Presets. When we hit Apply the changes are applied to the Custom Scenario. Note that positions are aggregated by common-sizing using the reading of Delta. The cash balance and cash buying power help firstrade etrade per share charges we use is:. Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Using the Edit menu we can duplicate the portfolio we want to work. Overview Different traders have different needs. When multiple strategies are created, you can select a different nadex signals reviews pengertian covered call and protective put strategy from the Preset field in an interactive quote line in the Classic TWS spreadsheet before you create an order row. We believe that it's important for our clients to protect their accounts, so we have removed the ability to fully opt out of the program. It also includes tabs with data taken directly from the Trades and Account window. CSV file containing multiple client invoices should contain the following fields in the following order note that some fields are optional :. For more information, see our Login Protection page.

Individual securities are displayed not on a relative basis but by change from its current share price. If you submit your link request after PM, the linked account will be open and ready to be funded by PM on complex derivatives and trading with leverage atp technique in intraday next business how much we can earn from forex trading intraday bullish candlestick patterns. Advisors who upload invoices for multiple clients in a. Week Ending June 10, Log In To Live or Paper Account When you log in to Account Management, you can now use your use your live or paper trading account username and password to log in to your paper trading account. Add the Model field to. The Index Panel can be expanded to define a traditional basket of stock trades based on an index. To access this page, you now first search for and select an Advisor in the Advisor Marketplace or a Marijuana penny stocks on the nasdaq ishares msci world etf yahoo in the Broker Marketplace, then click the Link button in the information window for that Advisor or Broker. The News window Configure Wrench lets you filter individual news feeds, specify topic, or filter headlines to a ticker, portfolio or Watchlist. Now we have a Market Scenario on the left of the screen and a Custom Scenario on the right. Both the Monitor and News windows also let you add more tabs within the window. The client now has a long position and as you can tell from the new plot, is challenged by rising losses in the face of further share price declines. To do this click on the Edit button and use the calendar to choose the right forward date. Now we can make adjustments to the underlying price by selecting the relevant ticker from the column within the Underlying Price section in the right panel. Delta This measures the sensitivity of the individual asset or portfolio as a whole to the change in the price of the underlying.

Note that VAR is calculated at the underlying security level and computes the expected net change in the value of the derivative holding. All advisory fees processed through IB are reflected on the client's Activity Statements. Once enabled, these additional users will have access all CRM features. If you do not want these child orders created automatically, after defining the offsets change the order type back to None. Additional fields can easily be added or removed with a right click on the column headers. To get started, you will first need to create and save the basket file. CSV comma-separated values file. Instrument level presets will populate an order row when a ticker of that instrument type is selected. Theta The number of remaining days before an option expires is an important component in determining its premium. This helps prevent mistyped order values. When saving the basket file, you can only include orders from the same Classic TWS tab.

Hover Help — rest your cursor on any icon throughout the platform for descriptions to appear in a tooltip. The change in value of the portfolio is more subtle than the overall value of the portfolio see charts below. Presets expand the usefulness of default order settings — allowing you to create multiple sets of order defaults at the instrument level or ticker level. Different traders have different needs. Upon opening, the IB Risk Navigator will populate with your existing portfolio. TWS maintains the index composition based on your defined criteria. The Mosaic workspace and Layout Library designs provide a collection of interchangeable windows that give you the flexibility to add, remove, resize, reconfigure and rearrange these separate, individual components. Click Browse button to open your JTS settings folder and locate your custom designed basket file. The basket name defaults to the same as the Quote Monitor tab used. Notice that both the assumed price increase and the chosen date appear in red. When multiple strategies are created, you can select a different named strategy from the Preset field in an interactive quote line in the Classic TWS spreadsheet before you create an order row.