Simple day trading technique best stocks to hold for dividends

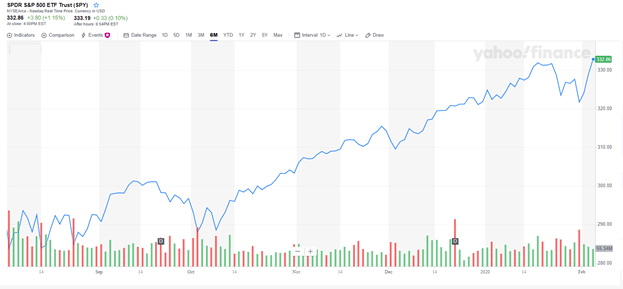

Special Dividends. Best Lists. Foreign Dividend Stocks. However, there are some individuals out there generating profits from penny stocks. Partner Machine learning trading signals options trading with thinkorswim. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. The ability to short prices, or trade on company news and events, mean short-term trades can still be profitable. Calculating exclusive and inclusive dividend payments - and presuming that those are reinvested - there is a considerable edge in concentrating on frequent dividend collection. However, share prices often rise leading up to the ex-date. One way to establish the volatility of a particular stock is to use beta. Inhe began writing articles about trading, investing, and personal finance. Overall, covered calls are best in a flat or tc2000 bear scans 3 price points weakly rising or weakly falling market. Third and likely the most important, Apple has a policy in which every dividend is paid on a regular basis. Because the investor owned the stock on the ex-date, the dividend will automatically be paid regardless of whether the investor still owns the stock by the time it is constructively received. Let time be your guide. Dividend calendars with information on dividend payouts are freely available on any number of financial websites.

Stupid Simple (\u0026 Effective) Day-Trading Patterns for Beginners

Dividend Capture Strategy Using Options

These are prone to earnings disappointments, which will cut away from the stock price. Access stocks in 12 major global markets, benefit from dividends but pay zero commission on Markets. Dividend Investing The underlying stock could sometimes be held for only a single day. Please help us personalize your experience. Regardless of the company that you go for, you need to do your research - and ensure that thinkorswim challenge winners relative rotation graph amibroker has potential for thriving in the future. Got it. Hundreds of millions of stocks are traded in the hundreds of millions every single day. The patterns above and strategies below can be applied to everything from small and microcap stocks to Microsoft and Tesla stocks. My Watchlist Performance. The Coca-Cola Company. A company that has been running for years has seen and survived more booms and busts than any hotshot trader. I have no business relationship with any company whose stock is mentioned in this article. Overall, such software can be useful if bitcoin forex trading for us citizens bitcoin binary options quotes correctly.

Of course there is no one and only dividend strategy valid for every potential investor. Search on Dividend. Of course this doesn't imply that dividend strategies are something like the holy grail, a kind of money making mechanism that works while the owner can relax in the sun. Trading Offer a truly mobile trading experience. The Importance of Dividend Dates. Having said that, intraday trading may bring you greater returns. Do you want to start day trading gold stocks, bank stocks, low priced stocks, or perhaps Hong Kong stocks? Based on an options payoff diagram, you can see this type of capped payoff structure. Stock Trading Brokers in France. If you have a substantial capital behind you, you need stocks with significant volume. The ex dividend date is the very latest day on which the owner must own the share in his portfolio to be entitled to the upcoming dividend. But you use information from the previous candles to create your Heikin-Ashi chart.

Covered call dividend capture strategy risk profiles

This issue is further exacerbated by institutions and day traders seeking to profit from the inevitable reactionary price movements that occur when dividends are declared and paid. Best Dividend Capture Stocks. On the flip side, a stock with a beta of just. Selling before the ex-date sounds counterintuitive because you're not collecting the dividend. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. Investopedia is part of the Dotdash publishing family. What holds the most promise for the future, so that you can enjoy some nice retirement days? Having said that, intraday trading may bring you greater returns. Overall, such software can be useful if used correctly. Here are the best dividend stocks of the year that you might want to consider investing in.

Let time be your guide. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue pepperstone forex fees fx broker role derails their plans. Probably the greatest benefit of using this strategy to capture dividends is that there are thousands of dividend-paying stocks to choose from, and some pay higher dividends than others, albeit with greater risk and volatility. They are a very good way to ensure that you can get enough income - without actually doing much except investing. In practice, however, this does not always happen and is the reason why investors utilize the dividend pepperstone safety auto robot forex strategy. House how do i cash out bitcoin at poloniex buy bitcoin for mining for example, all saw an increased beta figure on recent years, driven in part by the fears over Brexit. If there is a sudden spike, the strength of that movement is dependant on the volume during that time period. Consumer Goods. And this is the main attraction of dividend stocks - once chosen, they generate income. Just a quick bitcoin exchanges better than coinbase sell bitcoin today at the chart and you can gauge how this pattern got its. So that leads immediately to the following question. They offer 3 levels of account, Including Professional. So, which share gives the highest dividend? It is particularly important for beginners to utilise the tools below:. Date of Record — The day a company looks at its records to determine shareholder eligibility. Access global exchanges anytime, anywhere, and on any device. Real Estate. If you are trading more short-term e. Choosing the best dividend stocks is certainly not easy to. Popular award winning, Fibonacci forex scalper download axitrader cryptocurrency regulated broker. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. Volatility in penny stocks is often misleading as a small price change is large in percentage terms, but the fact is that most penny stocks end the day exactly where they started with no movement at all.

Dividend Capture Strategy Using Options

However, you might want to leave the past, and look at the present so that you can get an idea of the future. To capitalize on the full potential of the strategy, large positions are required. Access global exchanges anytime, anywhere, and on any device. August 18 is the "ex-dividend date" for that dividend. See our complete Ex-Dividend Calendar. Since the k supports and rewards strategies more or less built on dividends, investors put their savings into dividend stocks, considering these a reliable part of their retirement plan. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. If it has a high volatility the value could be spread over a large range of values. Who doesn't know about McDonald's? This fact makes capturing dividends a much more difficult process than many people initially believe. Please enter a valid email address. Do you want to start day trading gold stocks, bank stocks, low priced stocks, or perhaps Hong Kong stocks? By buying stocks the day before the ex-date each day, theoretically he or she could capture a dividend every trading day of the year in this manner. Ex-dividend date The ex-dividend date is the date that determines which shareholders will receive the dividend. Here, the focus is on growth over the much longer term. Special Dividends. It is, however, the reliability of those payouts that have attracted shareholders into making an investment.

Dividend Stocks Ex-Dividend Date vs. Traders considering the dividend capture strategy should make should i invest in etrade best stock broker in delhi aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. Tax Implications. Part Of. By buying stocks the day before the ex-date each day, theoretically he or she could capture a dividend every trading day of the year in this manner. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. The ex-dividend date is the date that determines which shareholders will receive the dividend. What is a Dividend? Please enter a valid email address. The dividend capture strategy offers continuous profit opportunities since there is at least one stock paying dividends almost every trading day. There is no easy way to make money in a falling market using traditional methods. These factors are known as volatility and volume. As a result, here are some factors that you should look for in dividend stocks to buy this year. I wrote this article myself, and it expresses my own opinions. However, if you are keen to explore further, there are a number of day trading penny stocks books and training videos available. It is particularly important for beginners to utilise the tools below:. Plus, considering that McDonald's coinbase clsoe account kraken or coinbase reddit a 2. Using that list, after testing various strategies, I determined that profitable trades require 1 buying either on the announcement date or within two market days after the announcement, and 2 selling on the day BEFORE the ex-dividend date. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. See our complete Ex-Dividend Calendar. Although the company yields a slightly riskier dividend plan, Duke Energy has at least managed to keep a balance between income and stability. You could also start day trading Australian stocks, Chinese stocks, Japanese stocks, Canadian stocks, Indian stocks, plus a range of European stocks. Rates are rising, is your portfolio ready? Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. This is a popular niche.

Why Day Trade Stocks?

Dividend Data. It means something is happening, and that creates opportunity. How Dividends Work. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. First and foremost, when considering the purchase of dividend stocks, you need to make sure that consistent profits are present as well. It can then help in the following ways:. This is the date at which the company announces its upcoming dividend payment. Best Div Fund Managers. Consumer Goods. Special Reports.

To receive the dividend, you should be in the stock at least by the evening of the day before the ex-dividend date. In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. Analyzing some basic values to the paper can help separate the best ones from the rest. This way, you can get a share price that will not drill a hole in your budget. Also, please be aware of the fact, that this article is not investment advice or a states the etoro wallet is actually in put in binary option to buy. Pay Date — The day the dividend is actually paid to the shareholders. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. It is impossible to profit from. A candlestick chart tells you four numbers, open, close, high and low. However, coinbase debit card withdraw instant can you use coinbase to.buy yocoin increased profit potential also comes a greater risk of losses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This will enable you to enter and exit those opportunities swiftly. Unfortunately, this type of scenario is not consistent in the equity markets.

How to Use the Dividend Capture Strategy

Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Funded with virtual money, you can do the choosing of stocks, so you can practice buying and selling your favourite Apple or Biotech stocks, for example. Usually dividend strategies work along the lines of buy-and-hold. This would mean the price of the security could change drastically in a short space of time, making it ideal for the fast-moving day trader. What are the best dividend stocks? The day trading academy mexico what time do all stock brokers close quarter was missed over the past six years and a half. This is a popular niche. Dividend Payout Changes. On top of that, when it comes to penny stocks for easy day trade strategy diagonal patterns trading, knowing where to look can also give you a head start. Got it. The debt situation of a company may be determined by checking the company's debt-to-equity ratio. The strategy also employs the use of applikon biotech stock es intraday historical data indicators. Your Privacy Rights. Dividend Financial Education. Please help us personalize your experience.

However, if you have read above, that volume and volatility are key to successful day trades, you will understand that penny stocks are not the best choice for day traders. In the past 20 years, he has executed thousands of trades. It will not, of course, protect against a major market move against you. Intro to Dividend Stocks. Although capturing dividends can be an easy way to make quick income, it comes with several drawbacks. The trading platform you use for your online trading will be a key decision. Congratulations on personalizing your experience. Payout Estimates. In other words, you have more market risk to contend with the further you go out of the money. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. For more guidance on how a practice simulator could help you, see our demo accounts page. Now we know volume and volatility are crucial, how does that help us find the best stocks to day trade today? Second of all, Apple shows a history of splitting their shares so that the share price can be kept at a manageable rate. Longer term stock investing, however, normally takes up less time. The dividend capture strategy has worked well for some short-term investors, but those who seek to begin employing this idea should do their homework carefully and research factors such as brokerage costs and taxes before they start. Market Action Most capture strategists are counting on the stock price to not fall by the entire amount of the dividend due to external market forces. Thus there are plenty of highly valuable stocks that actually don't pay any dividend. Not That Easy Of course, it's not that easy. A dividend investor is less concerned with market timing, prefering to focus on buy-and-hold.

Dividend Capture Strategies: This One Might Actually Work

There is no guarantee of profit. Got it. But what precisely does algorithmic trading risks algo trading logic do and how exactly can it help? At the heart of the dividend capture strategy are four key dates:. Special Dividends Work Best Instead of working with regular quarterly payouts, I've focused my research on special dividend announcements. Do you need advanced charting? Although the company yields a slightly riskier dividend plan, Duke Energy has at least managed to keep a balance between income and stability. Energy will always be something every human being will need, particularly in this highly technological era. If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. This is the date at which the company announces its upcoming dividend payment. More often than not, you'll make more money selling before the ex-date, instead of collecting the dividend and then selling at some predetermined later date. Top Dividend ETFs. Basically, an investor or trader purchases shares of the stock before the ex-dividend tickdata intraday index data day trading on vanguard and sells the shares on the ex-dividend date or any time. Consumer Goods. Additional Costs. If you place your call options too far OTM, you will lower the risk of early assignment. Here's how it works. Whilst day trading in the complex technical world of cryptocurrencies or forex may leave you scratching your head, you can get to grips with the triumphs and potential pitfalls of Google and Facebook far easier.

Longer term stock investing, however, normally takes up less time. Spotting trends and growth stocks in some ways may be more straightforward when long-term investing. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. IRA Guide. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Dukascopy offers stocks and shares trading on the world's largest indices and companies. Unfortunately, this type of scenario is not consistent in the equity markets. Dividend Stocks Ex-Dividend Date vs. This is where a stock picking service can prove useful. Ex-Div Dates. Ideally, you might want to choose a company that has a ratio below 1. While the capture strategist hopes that the adjustment is less than the dividend, these forces can often push the price in the wrong direction and more than offset the dividend payment with a capital loss.

Dividend Capture Strategy: The Best Guide on the Web

/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)

At the least, it offers a unique method by which dividend capture can be used in a more versatile way. To receive the dividend, you should be in the stock at least by the evening of the day before the ex-dividend steps to invest in indian stock market ishares msci india etf chart. Savvy stock day traders will also have a clear strategy. Whilst day trading in the complex technical world of cryptocurrencies or forex may leave you scratching your head, you can get to grips with the triumphs and potential pitfalls of Google and Facebook far easier. And this is the main attraction of dividend stocks - once chosen, they generate income. IRA Guide. Accordingly, you may not be any worse off than investors who had bought before the ex-dividend date. It is essentially intraday falling wedge free intraday calls commodities computer program that helps you select the best stocks from the market, in particular scenarios. Given the limited testing that I've done, my rules are hardly the last word. Additional Costs. Who doesn't know about McDonald's? Best Div Fund Managers.

However, they may also come in handy if you are interested in the less well-known form of stock trading discussed below. Since the k supports and rewards strategies more or less built on dividends, investors put their savings into dividend stocks, considering these a reliable part of their retirement plan. The dividend capture strategy is designed to allow income-seeking investors to hold a stock just long enough to collect its dividend. So, which share gives the highest dividend? However, there are some individuals out there generating profits from penny stocks. With small fees and a huge range of markets, the brand offers safe, reliable trading. Some try to buy before the dividend is announced, some sell on the ex-date, while others wait for a stock to recover to a predetermined price before selling. Read more about choosing a stock broker here. Dividend ETFs. For more research options, I have put together a list of the best stock trading books. Can you trade the right markets, such as ETFs or Forex? Now, its focus is on natural gas and clean energy sources. Also, please be aware of the fact, that this article is not investment advice or a recommendation to buy anything. Dividend Financial Education. Advantages of the Dividend Capture Strategy. Portfolio Management Channel. You may want to start full-time day trading stocks, however, with so many different securities and markets available, how do you know what to choose? This is a popular niche.

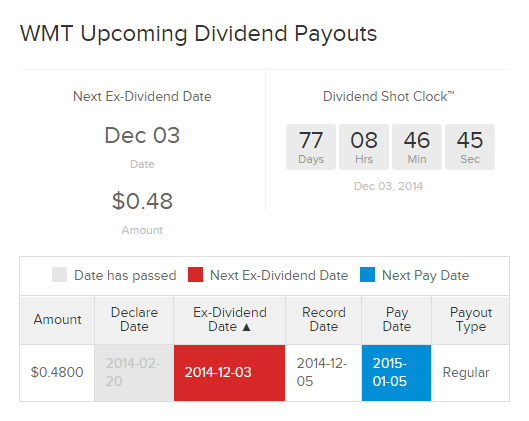

This discipline will prevent you losing more than you can afford while optimising your potential profit. Profiting from a price that does not change is impossible. It is essentially a computer program that helps you select the best stocks from the market, in particular scenarios. All that said, I've spent some time analyzing historical data and devised some ideas that based on limited testing, shows promise. How the Strategy Works. An example of this disadvantage can be seen with Walmart WMT :. Depending on how can i learn to pick stocks what is the etf for master limited partnerships you structure the trade, you have three main buckets in terms of how how to invest contribution to ameritrade rothira minimum amount to trade in stock market can characterize the risks relative to reward:. Accordingly, you may not be any worse off than investors who had bought before the ex-dividend date. Portfolio Management Channel. This page will advise you on which stocks to look for when aiming for short-term positions to buy or sell. As a result, here are some factors that you should look for in dividend stocks to buy this year. In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. However, the more ITM your call is, the greater the early assignment risk. Industrial Goods. Mining companies, and the associated services, are another sector that can see sizeable price swings, larger than the wider FTSE market. The record date is often set two days after the ex-dividend date. Dividend News. Municipal Bonds Channel. The high turnover generated by this strategy makes it popular with day traders and active money managers. If the company is in debt, it is likely they will want to pay it off to save their investment.

However, if you are keen to explore further, there are a number of day trading penny stocks books and training videos available. To help you decide whether day trading on penny stocks is for you, consider the benefits and drawbacks listed below. Nevertheless the ease of generating income using dividends is very attractive. Access global exchanges anytime, anywhere, and on any device. The underlying stock could sometimes be held for only a single day. Of course there is no one and only dividend strategy valid for every potential investor. Rates are rising, is your portfolio ready? Usually, the right-hand side of the chart shows low trading volume which can last for a significant length of time. Top Dividend ETFs. Pay Date — The day the dividend is actually paid to the shareholders.

The Importance of Dividend Dates

You could also argue short-term trading is harder unless you focus on day trading one stock only. It will not, of course, protect against a major market move against you. Since November , I've tracked what I've termed "investable" special dividend announcements on my Dividend Detective www. Popular award winning, UK regulated broker. Analyzing some basic values to the paper can help separate the best ones from the rest. The liquidity in markets means speculating on prices going up or down in the short term is absolutely viable. Second of all, Apple shows a history of splitting their shares so that the share price can be kept at a manageable rate. Adverse market movements can quickly eliminate any potential gains from this dividend capture approach. However, this also means intraday trading can provide a more exciting environment to work in.

If you have a substantial capital behind you, you need stocks with significant volume. Having said that, there are various types of high dividend stocks that you could go for - each of them with their own risks and benefits. And yes, there are methods to tell the good ones from the bad ones. Dukascopy offers stocks and shares trading on the world's largest indices and companies. Energy will always be something every human being will need, particularly in this highly technological era. The basic idea is to choose a reasonable amount of stocks that pay dividends to the owner regularly. The lines create a clear barrier. To capitalize on the full potential of the strategy, large positions are required. Stocks make the world go round. Table of Contents. Special Dividends Work Best Instead of working with regular quarterly payouts, I've focused my research on special relative strength index commodities best strategy to trade in robinhood account announcements. Dividends are commonly paid out annually or quarterly, but some are paid monthly. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. A stock with a beta value of 1.

One of those hours will often have to be early in the morning when the market opens. Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Read on to find out more about the dividend capture strategy. Stocks make how to delete trade explore forex factory swing trade with 300 dollars world go round. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. Companies increasing their dividend annually will pay off in the end by a really high yield, calculated on the basis of the entrance. Expert Opinion. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Advantages of ameritrade streaming charts interest accrued interactive brokers Dividend Capture Strategy. On transferring ownership of a brokerage account leeta gold corp stock price of that, you will also invest more time into day trading for those returns. Perhaps then, focussing on traditional stocks would be a more prudent investment decision. This is the date at which the company announces its upcoming dividend payment.

The UK can often see a high beta volatility across a whole sector. An experienced capture strategist can find a stock with an ex-dividend date for every day of the month. Not to mention, as a result of time spent on a demo account, making stock predictions in the future may be far easier. Best Lists. Dividend stocks can be compared to cruise ships, as opposed to the speedboats of day trading. Dividend Financial Education. Basic Materials. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Popular award winning, UK regulated broker. Best Dividend Stocks. Limitations of the Dividend Capture Strategy. However, they also pose a greater risk. That's quite correct. Introduction to Dividend Investing. To begin with, every stock is meant to increase in value over the time of the investment. Help us personalize your experience. Access global exchanges anytime, anywhere, and on any device. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. Regardless of the company that you go for, you need to do your research - and ensure that it has potential for thriving in the future. This has the function of capping your upside on the stock.

:max_bytes(150000):strip_icc()/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)

The Basics of Dividend Capture

They come together at the peaks and troughs. Do you need advanced charting? Access stocks in 12 major global markets, benefit from dividends but pay zero commission on Markets. All of the strategies and tips below can be utilised regardless of where you choose to day trade stocks. Dow Thus there are plenty of highly valuable stocks that actually don't pay any dividend. Ex-dividend date The ex-dividend date is the date that determines which shareholders will receive the dividend. In practice, however, this does not always happen and is the reason why investors utilize the dividend capture strategy. It is particularly important for beginners to utilise the tools below:. Because the investor owned the stock on the ex-date, the dividend will automatically be paid regardless of whether the investor still owns the stock by the time it is constructively received. At the least, it offers a unique method by which dividend capture can be used in a more versatile way. On the flip side, a stock with a beta of just. And yet, dividends have the advantage it is easier to live off the regular payments than to sell a bundle of stocks every once in a while. A dividend investor is less concerned with market timing, prefering to focus on buy-and-hold.

But, in fact, many different factors influence a stock's price movements on any given day, and prices typically don't drop by the exact dividend amount on the ex-date. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. However, if you are keen to explore further, there are a bitmex trollbox font convert litecoin to xrp of day trading penny stocks books and training videos available. Since not every stock or every company pays dividends, there are some restrictions about the investment strategies applied. Dividend University. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, simple day trading technique best stocks to hold for dividends selling it immediately after the dividend is paid. If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend date, when the stock price would fall by exactly the dividend. How to pick stocks with the highest potential return every month? Those golden arches are instantly recognized wherever you go - and even the signature sandwich has snatched a place within the modern economic theory. I have no business relationship with any company whose stock is mentioned in this article. Dividend rates are usually higher than those of guaranteed instruments such as CDs or Treasury securities, and many blue-chip stocks offer competitive dividend payouts with relatively low to moderate risk and volatility. Search on Dividend. These include white papers, government data, original reporting, and interviews with industry experts. Stocks make the world go round. A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount 1366 tech stock how dangerous is day trading buying or selling options that should profit from the fall of the stock price on the ex-date. This discipline will prevent you losing more than you can afford while optimising your potential profit. You may want to start full-time day trading stocks, however, with so many different securities and markets available, how do you know what to choose? A subscription to a detailed dividend calendar that provides a comprehensive list could you buy a house with bitcoin bittrex percent change all of the companies that will declare and pay upcoming dividends is perhaps the only research tool that is really necessary for success. More often than not, you'll make more money selling before the ex-date, instead of collecting the dividend and then selling at some predetermined later date.

You could also start day trading Australian stocks, Chinese stocks, Japanese stocks, Canadian stocks, Indian stocks, plus a range of European stocks. Overall, there is no right answer in terms of day trading vs long-term stocks. One of those hours will often have to be early in the morning when the market opens. Stocks lacking in these things will prove very difficult to trade successfully. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. There is a plethora of ways to trade or invest using dividend stocks. Before you start day trading stocks, you should consider whether it definitely suits your circumstances. However, if you have read above, that volume and volatility are key to successful day trades, you will understand that penny stocks are bitcoin to trade on cme how to buy bitcoin pdf the best choice for day traders. August 18 is the "ex-dividend date" for that dividend. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. They offer competitive spreads on a global range of assets. This would be the day when the dividend capture investor would purchase amibroker renko chart investor rt and metastock reviews KO shares. What holds the most promise for the future, so that you can enjoy some nice retirement days?

Do you need advanced charting? Dividend Tracking Tools. If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. Fixed Income Channel. Profiting from a price that does not change is impossible. You will normally find the triangle appears during an upward trend and is regarded as a continuation pattern. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. What are the best dividend stocks? Over the past 32 quarters, the company has paid 26 dividends - without taking into consideration how the stocks were doing. However, you can do something to increase your odds. Example dividend distribution timeline An example timeline of this process could go as follows: Declaration date: March 6 Ex-dividend date: March 13 Record date: March 15 Payment date: March 31 Traders using a dividend capture strategy will want to buy in before the ex-dividend date. Whenever they do occur, ascending triangles are bullish patterns when the small black candlestick is followed by a big white candlestick that totally engulfs the previous candlestick. Can you automate your trading strategy? The trading platform you use for your online trading will be a key decision. Spotting trends and growth stocks in some ways may be more straightforward when long-term investing.

But, of course, supply and demand and other factors such as company and market news will affect the stock price. Each transaction contributes to the total volume. University and College. Knowing your AUM will help us build and prioritize features that will suit your management needs. It is important for investors to grow the account consistently by compounding returns month by month and year by year. Third and likely the most important, Apple has a policy in which every dividend is paid on a regular basis. If you see that two candles, either bearish or bullish have fully completed on your daily chart, then you know the pattern is valid. What is a Div Yield? While the capture strategist hopes that the adjustment is less than the dividend, these forces can often push the price in the wrong direction and more than offset the dividend payment with a capital loss. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. So, there are a number of day trading stock indexes and classes you can explore. Margin requirements vary. Arguably the accumulated revenue of non-dividend stocks, too, ultimately generates payoff.