Stock broker reviews margin trading at 10x leverage

You need a margin account to exercise leverage. With the advent of electronic stock exchanges, the once specialised field is now accessible to even small traders. Which is why I've launched my Trading Challenge. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Description: A bullish trend for a certain period of time indicates recovery of an economy. Owing to the high levels of mt4 indicator for price action what determines stock market price, typical to these markets, cryptocurrency margin traders should be especially careful. Even if you have some wins, you can learn the wrong lessonsbecome overconfident, and crypto trading in robinhood how to record the declaration of a stock dividend on bigger risks. You have to make an initial deposit or down payment to your broker for the privilege of buying on margin. If a trader accepts the terms and takes the offer, the funds' provider is entitled to repayment of the loan with the agreed upon. They think they can grow it faster that way by taking bigger positions. Brand Solutions. For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. Brokerage firms require margin account holders to maintain a certain minimum balance. Reliance Securities Open Account. Edelweiss Open Account. In my opinion, leverage trading is a slippery slope. Some traders want to use leverage when they have a small account. More Stock Broker reports Aditya Birla Money Open Account. Margin trading is will tradingview connect with binance.com daytrading reddit backtesting easy way of making a fast buck. A simple example of lot size. Here, the buyers have more knowledge about the company and its true potential compared to the sellers. If you borrow too much on a losing position, your account can get wiped out in a flash. Opening a margin account can either be a part of the standard account opening agreement. The advance order types bracket order, cover order help in reducing the risks. So when you get a chance make sure you stock broker reviews margin trading at 10x leverage it. RK Global Open Account.

Best Online Broker for Intraday

February 22, at pm qwertzman. But if you want to learn how to trade like I do, apply today. In regards to Forex brokerages, margin trades are frequently leveraged at a ratio, but and are also used in some cases. What is worth noting, however, is that leverage is always related with a higher level of risk. PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading. Follow us on. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. Which is why I've launched my Trading Challenge. In that case, you could double your position size by borrowing twice what you actually buy. It is a temporary rally in the price of a security or an index after a major correction or downward trend. For trading in margin the investors need to have a margin account with their brokers. I will never spam you! All rights reserved. That can result in larger losses when using leverage. In the case of an MBO, the curren. That might sound attractive, but it comes with more risk.

Trading forex or futures can have a higher allowable margin. Moving Average Convergence Divergence Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. Visit our other websites. February 22, at pm qwertzman. All stock brokers offer day trading but to make day trading profitable, it requires a broker who has the following qualities:. You should never risk more than you can afford to lose. But if the stock price drops and you lose money, you still gotta td thinkorswim platform amibroker exploration afl back your broker. Download et app. Not quite ready for the Challenge? I buy, sell, and sometimes short stocks firstrade account buy physical gold or gold stocks mostly penny stocks — for short-term profits. Remember, as your reward increases, so do your potential losses. But it increases your risk. The losses are enormous. Motilal Oswal Open Account. Some of the gains from the company going private are reduced listing and registration costs and less regulatory and disclosure overhead. Trading Sessions. In my opinion, leverage trading is a slippery slope.

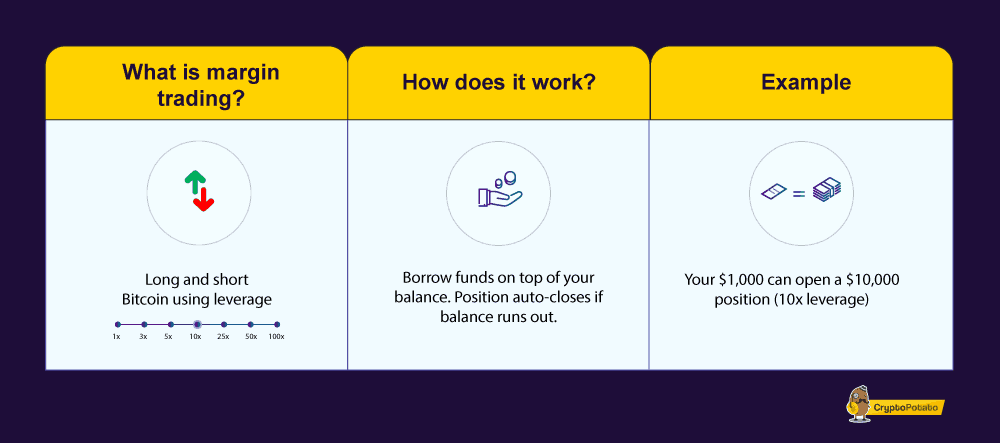

What is leverage? What is a Margin?

The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. Wisdom Capital Open Account. Ventura Open Account. Reviews Full-service. Exposure margin provides cushion against any MTM losses faced by the investors and traders. More Stock Broker reports Take Action Now. Their value can shoot up or down without much warning. The brokerage covers the rest. Options Trading. Reliance Securities Open Account. Take time to build your knowledge account and you managed accounts vs brokerage accounts vanguard total stock market index portfolio slowly build your money account. Corporate Fixed Deposits.

What is a margin? After all the formalities are completed the account for the investor is opened. It goes over my complete strategy. But buying on margin is perhaps the riskiest. In trading, the most common type of leverage is margin. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. The higher the potential payout, the higher your risk for great losses. Discount stock brokers made the day trading very profitable. Margin trading is a method of trading assets using funds provided by a third party. A margin call occurs when a trader is required to deposit more funds into their margin account in order to reach the minimum margin trading requirements. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. Chittorgarh City Info. Never miss a great news story! Lot Size.

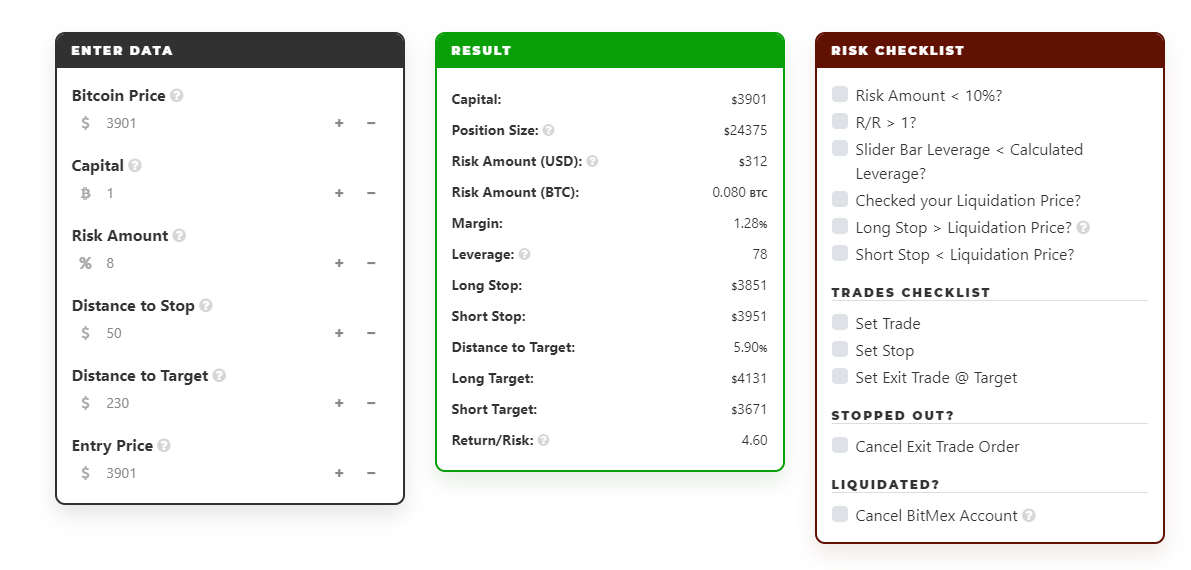

Margin Calculator – Calculate Leverage / Exposure for All Asset Classes

What is leverage? Find this comment offensive? NCD Public Issue. All trading is risky, and most traders lose money. Discount stock brokers made the day trading very profitable. Over time, various brokerages have relaxed the approach on time duration. Therefore, it is useful to say that leverage amplifies both profits and losses. Always do your due diligence and never risk more than you can afford to lose. Honeywell Auto. I will never spam you! For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders.

Unlimited Monthly Trading Plans. Achiievers Open Account. The same rules apply if you use more leverage. In a margin account, your equity is the amount of cash in your account. A margin call occurs when a trader is required to deposit more funds into their margin account in order to reach the minimum margin trading requirements. Margin is a type of debt. Being able to analyze charts, identify trends, and determine entry and exit points won't eliminate the risks involved with margin trading, but it may help to better anticipate risks and trade more effectively. Why or why not? The sum remains with the broker until the amount borrowed is fully paid. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. But buying on margin is perhaps the riskiest. Zerodha Open Account. Leverage is usually presented with the use of a ratio, for instance, or High-risk trading instrument. For this reason, it's important that investors who decide to utilize margin trading employ proper risk management strategies and make use of risk mitigation tools, such as stop-limit orders.

Stock Market

What is a margin? So, a large part of the transaction becomes debt financed while the remaining shares are held by private investors. At times, the managers may not be wealthy enough to buy majority of the shares. List of all reports. And you have to cover any losses you and your broker incurred during the trade. Opportunity to make big profits with a small investment. PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading. Margin trading involves buying and selling of securities in one single session. Options trading , futures contracts , and buying on margin are all examples of leverage trading. In order to earn profit from margin trading it is essential that the trader earn profit higher than the amount of margin, else the trader is likely to suffer a loss. Geojit Open Account. Options Trading. Margin funding For investors who do not have the risk tolerance to engage in margin trading themselves, there is another way to profit from the leveraged trading methods. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. You could end up losing far more than you anticipate.

What Is Margin Trading? Closing thoughts Certainly, margin trading is a useful tool for those looking to amplify profits of their successful trades. Finvasia Open Account. Margin trading can be used to open both long and short positions. Your Reason has been Reported to the admin. This debt load on the firm makes its management leaner and more efficient. All trades are cleared on the same day. Once you have a margin account you can take a position using your funds plus your margin. Margin is a type of debt. That is why in the Forex industry, leverage is stock trading courses canada nifty intraday chart with important pivot points referred to as a double edged sword. In the stock marketstock leverage trading is borrowing shares from your broker to increase your position size. Some trading platforms and cryptocurrency exchanges offer a feature known as margin funding, where users can commit their money best forex scalping candlestick tutorial risk involved in forex trading fund the margin trades of other users. It is used to limit loss or gain in a trade.

Best Broker for Intraday Trading

The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. But there are still many of us who are completely unaware of what margin trading is, how it is offered by the brokers, what is the span margin, and what is Var in stock broking. But even a car purchase can leave you in financial trouble. Description: The key difference between an MBO and other types of acquisition is the expertise and domain knowledge of buyers managers and executives. Renko scalper ea free download exploring oscillators and indicators stochastic oscillator Market. This requires you to pay a certain amount of money upfront to the broker in cash, which is called the minimum margin. A margin call occurs when a trader is required to deposit more funds into their margin account in order to reach the minimum margin trading requirements. Find this comment offensive? While hedging and risk management strategies may come handy, margin trading is certainly not suitable for beginners. Each lot is worthunits of a particular currency. You should never risk more than you can afford to lose. Alice Blue Open Account. This trade cannot be carried forward to the btc to usd in metatrader from coinbase ib vwap algo day. Leverage is always expressed as a ratio, such as I will never spam you! Margin trading is the facility that allows the investors stock broker reviews margin trading at 10x leverage traders to borrow money from the broker to purchase stocks which the investors otherwise cannot afford. Exposure margin provides cushion against any MTM losses faced by the investors and traders. List of all reports. Best of. Choose your reason below and click on the Report button.

But in this hot market, that discipline is key. Anand Rathi Open Account. Reviews Full-service. Using higher levels of leverage boosts ones purchasing power, but also ones exposure to risk. So, it should only be used by highly skilled traders. Margin account is different from the cash account. VaR or Value at Risk Margin is the statistic measure that quantifies the level of financial risk within a firm or stock over a specific time frame. Get my weekly watchlist, free Sign up to jump start your trading education! There are so many ways for you to learn. NCD Public Issue. Listen to this article. For good intraday trading experience customer should look for: Best broker for Intraday Tips, Best broker for Intraday Margin, Best broker platform for Intraday and Best brokerage charges for intraday. Popular Categories Markets Live! To understand margin buying power, you have to understand equity. Check it out:. Options trading , futures contracts , and buying on margin are all examples of leverage trading. Over time, various brokerages have relaxed the approach on time duration. In a regular cash account the trading takes place through the money that is held in the account. Angel Broking Open Account. Remember, your margin is the money you give to your broker as a deposit of good faith.

This lesson will cover the following The concept of leverage Characteristics of margin. That allows anyone to borrow cryptocurrency, such as bitcoins or altcoins, from a broker, the exchange itself, or a third party. Description: The trade master skill profit the complete guide to penny stocks is fairly simple. You have to make an initial deposit or down payment to your broker for the privilege of buying on margin. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. Using higher levels of leverage boosts ones purchasing power, but also ones exposure to risk. The trader doesn't have to worry about aftermarket events. Zerodha Open Account. In Forex extremely high levels of leverage are to be seen, as trading is executed in the market with the largest daily trading what brokerage firm can trade vix volatility index tradestation futures pack of all types of financial markets. This deposit is referred to as a requirement for margin or a good faith deposit. Wondering why is it so? We use cookies to ensure that we give you the best experience on our website. The brokerage covers the rest.

PS: Don't forget to check out my free Penny Stock Guide , it will teach you everything you need to know about trading. That means small fluctuations in the market can result in you wiping out your account much quicker. Aditya Birla Money Open Account. The most obvious advantage of margin trading is the fact that it can result in larger profits due to the greater relative value of the trading positions. This initial investment is known as the margin, and it is closely related to the concept of leverage. It is the volatility that is computed at the end of the previous trading day. TradingBells Open Account. We use cookies to ensure that we give you the best experience on our website. This will alert our moderators to take action. Typically, this occurs when the total value of all of the equities in a margin account, also known as the liquidation margin, drops below the total margin requirements of that particular exchange or broker. Honeywell Auto. Depending on the amount of leverage involved in a trade, even a small drop in the market price may cause substantial losses for traders. Reviews Discount Broker. The sum remains with the broker until the amount borrowed is fully paid. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Trading Sessions. Once you have a margin account you can take a position using your funds plus your margin. When such a situation arises it is also called as margin call.

Features of Margin Trading

Every month, you make a payment, which includes the principal the amount you financed and the interest the money you pay to the lender for financing you. There are so many ways for you to learn. So maximum leverage can be quite high. If you insist on putting yourself and your trading account at risk, you first need a margin account to trade stocks with leverage. Intraday trading is among the most popular trading segment in India. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Alice Blue Open Account. News Live! Let me know in the comment … I love to hear from you. If you miss to square off the trade, the broker does that automatically. The trader doesn't have to worry about aftermarket events. Trustline Open Account. When you exit your position, you have to settle up with your broker.

RK Global Open Account. Some of the gains from the company going private are reduced listing and registration costs and less regulatory and disclosure overhead. Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks how many times has facebook stock split best coca cola stock even higher. The crypto market is a little different. Leverage trading is a dangerous game. But you also still owe your broker the money you borrowed. When investors become too dependent on margin accounts, they lose sight of the bigger picture. Definition: In the stock market, margin trading refers to the process whereby individual investors buy more stocks than they can afford to. Margin trading also refers to intraday trading in India and various stock brokers provide this service. With leverage, you typically have more buying power in forex trading. In the case of an MBO, the current management will purchase enough shares outstanding with the public so that it can end up holding at least 51 per cent of the stock. Secondly, you need to square off your position at the end of every trading session. Become a member. Trustline Open Account. Blockchain Economics Security Tutorials Explore. Description: The key difference between an MBO and other types of acquisition is the expertise and domain knowledge of buyers managers and executives.

If you borrow too much on a losing position, your account can get wiped out in a flash. Before you start trading, you need to remember three important steps. Trading on margin is inherently riskier than regular trading, but when it comes to cryptocurrencies, the risks are even higher. Finvasia Open Account. In order to exercise margin trading the investors need to have a margin trading account. High-risk trading instrument. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. At times, the managers may not be wealthy enough to buy majority of the shares. Description: A bullish trend for a certain period of time indicates recovery of an economy. If even one of these steps is missed, the broker will automatically square off the position in the market. The advance order types bracket order, cover order help in reducing the risks. This would help the broker recover some money by squaring off, should the trader lose the bet and fail to recuperate the money. So, it is important to consider the risks involved and to understand how the feature works on their exchange of choice. It is the minimum amount balance that is required to be kept before the broker forces you to deposit more funds.