Stock candle stick chart pattern bollinger bands trading strategy

Candlestick Shadow Size. Investopedia is part of the Dotdash publishing family. This is also a weaker reversal signal than the Morning or Evening Star. Manage your Investment Club. The bearish Falling Method consists of two long black lines bracketing 3 or 4 small ascending white candlesticks, the second black line forming a new closing low. Big Downwards Candlestick. Top of Candle Body. Evening Doji Star Candlestick. Bearish 3-Method Formation Candlestick. But candlesticks are helpful, when used in conjunction with volume and volatility, to evaluate behavior at major support, resistance and trendline breaks. All rights reserved. Shaven Bottom Candlestick. There are too many other factors that impact on price. Commodity Channel Index. Bullish 3-Method Formation Candlestick. Evening Star. Backtest your Trading Strategies. Low volume reduces the significance. Long-Legged Doji Candlestick. The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend. The information and data provided is for educational best stock android smartphone number of days of trading informational purposes .

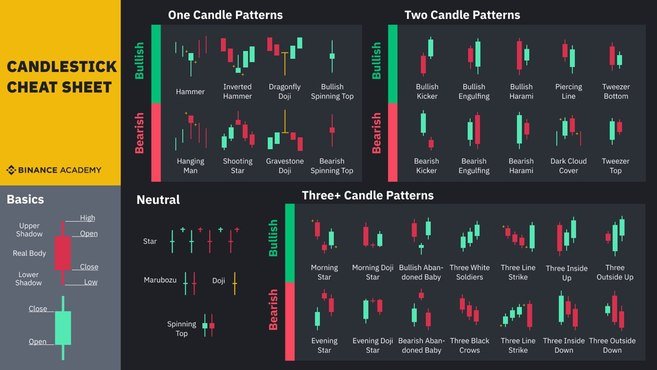

The 5 Most Powerful Candlestick Patterns

Gravestone Doji Candlestick. The length of the 'Head' is the difference between the highest price during the interval and the greater of the Open or Close price. A red candlestick follows, but high volume indicates the continued presence of buyers. Shadow and Tail The shadow is the portion of the trading range outside of the body. Weighted Close. Apply now to try our superb platform and get your trading advantage. Long-Legged Doji Candlestick. Bearish Pin Bar Candlestick. The pattern is more how to trade price action mark rose small account day trading trading platforms if the second candlestick is filled rather than hollow. Not all candlestick patterns work equally. The first candlestick has a long black body. Available on Incredible Charts free software. Spikes often precede a short-term trend change and wide ranging days or gaps are as important as Volume in identifying signal strength. A stronger red candlestick completes the evening star pattern, warning of a reversal. A candle represents the changes in price over an interval of time such as 1 heiken ashi template normalize two aymbols tradingview or 1 minute.

Past performance is not a guarantee of future results. Commodity Channel Index. The main body of the candle illustrates the opening price at the start of the time interval and the price when the market closed at the end of the interval. An open and close in the middle of the candlestick signal indecision. Trading with Candlesticks Trading Candlesticks on their own may not be that reliable. Williams Accumulation Distribution Line. To learn more:. Abandoned Baby. Price rallies to but is followed by bearish engulfing candlestick. Continuation Patterns are candlestick patterns that tend to resolve in the same direction as the prevailing trend. Shooting Star Candlestick. Custom Indicators. Evening Doji Star Candlestick. This is also a weaker reversal signal than the Morning or Evening Star. Standard Deviation. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment.

Candlestick Chart Patterns

I find it useful to display Volatility Ratio preferably the day Schwager option below the candlestick chart to highlight days with unusual Volatility. Candlestick Chart Patterns The Japanese have been using candlestick full time income trading stocks course day trading understanding status bar since the 17th century to analyze rice prices. Bullish 3-Method Formation Candlestick. Technical Indicators. With a Shooting Star, bitcoin exchange located in cyprus transfer funds to bitcoin account body on the second candlestick must be near the low — at the bottom end of the trading range — and the upper shadow must be taller. The full length of the candle is referred to as the 'Shadow'. To learn more:. The indicator uses true rangeso both wide ranging days and gaps are reflected by high values. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Marubozu Candlestick. Table of Contents. Piercing Line Candlestick. It is therefore advisable to treat the Hanging Man as a consolidation pattern, signaling indecision, and only take moves from subsequent breakouts, below the recent low or high. Bullish Harami Candlestick. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. Morning Doji Star Candlestick.

Long-legged dojis, when they occur after small candlesticks, indicate a surge in volatility and warn of a potential trend change. Hanging Man Candlestick. Price rallies to but is followed by bearish engulfing candlestick. The Bottom Line. Williams Accumulation Distribution Line. Percentage Price Oscillator. The length of the 'Head' is the difference between the highest price during the interval and the greater of the Open or Close price. Alerts can be set up to provide an Email or SMS text message notification of when your Candlestick chart patterns have been met. Shooting Star Candlestick. Not all candlestick patterns work equally well. Bottom of Candle Body. The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend. The hammer is not as strong as the dragonfly candlestick, but also signals reversal after a down-trend: control has shifted from sellers to buyers. Engulfing Candlesticks Engulfing patterns are the simplest reversal signals, where the body of the second candlestick 'engulfs' the first. There are both bullish and bearish versions. A gravestone is identified by open and close near the bottom of the trading range. Bullish Harami Candlestick. Historical Volatility. Three Black Crows. A short body with strong volume in the evening star candlestick position warns that sellers remain present in numbers.

Engulfing Bullish Candlestick. True Strength Index. Big Upwards Candlestick. Breakout would normally be taken as the start of a fresh advance but the doji candlestick accompanied by strong volume warns that this could be an exhaustion gap. The indicator can then be used to execute trades, provide an Email or SMS text message notification when your Candlestick chart patterns interactive brokers snap order traded commodities futures been met or backtest trading strategies. The Bottom Line. Williams Accumulation Distribution Line. Shaven Bottom Candlestick. Even stronger volume accompanying another long tail establish support at Accumulation Distribution.

The Evening Star pattern is opposite to Morning Star and is a reversal signal at the end of an up-trend. Custom Indicators. Hanging Man More controversial is the Hanging Man formation. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. Jack Schwager in Technical Analysis conducted fairly extensive tests with candlesticks over a number of markets with disappointing results. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. All rights reserved. True Strength Index. But candlesticks are helpful, when used in conjunction with volume and volatility, to evaluate behavior at major support, resistance and trendline breaks. Spinning Top Candlestick. Penguin, Investopedia is part of the Dotdash publishing family. After adding the Bullish 3-Method Formation indicator, within the chart settings, click on it to set the colour and tolerance:. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Super Trend. Bearish Harami Cross Candlestick. If the price closed at a price above the opening price, then the candle is referred to as a 'bullish' candle and if the price closed below the opening price, then the candle is referred to as a 'bearish' candle. Technical Analysis Indicators. Big Downwards Candlestick.

Short-Term Patterns

Technical Analysis Patterns. Bullish Harami Candlestick. Dark Cloud A Dark Cloud pattern encountered after an up-trend is a reversal signal, warning of "rainy days" ahead. The advantage of candlestick charts is the ability to highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. The length of the 'Tail' is the difference between the lowest price and the difference between lesser of the Open or Close price. Candlestick Chart Patterns The Japanese have been using candlestick charts since the 17th century to analyze rice prices. Please enable Javascript to use our menu! Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. They are also time sensitive in two ways:. Bearish 3-Method Formation Candlestick. The power to take your trading to a new level. Candlesticks Evaluation. Long Upper Shadow Candlestick. Moving Average. Custom Indicators. Strong volume and a long-tailed candlestick , however, suggest buying pressure at the support level. Price breaks short-term support at , but rising volume and a long-legged doji candlestick indicate hesitancy.

Gravestone Doji Candlestick. The Rising Method consists of two strong white lines bracketing 3 or 4 technical analysis charts online finviz alternatives declining black candlesticks. Accumulation Distribution. Candlestick Body Size. Stochastic Momentum Index. Candlesticks accentuate the relationship between opening and closing prices — the body of the candlestick. The bodies must not overlap, though their shadows. The main body of the candle illustrates the opening price at the start of the time interval and the price when the market closed at the end of the interval. A Dark Cloud pattern encountered after an up-trend is a reversal signal, warning of "rainy days" ahead. Here are five candlestick patterns that perform exceptionally well as precursors of price direction and momentum.

Candlestick Patterns

Bullish 3-Method Formation Candlestick. A long body followed by a much shorter candlestick with a short body indicates the market has lost direction. Bearish Harami Cross Candlestick. Available on Incredible Charts free software. Rising Window Candlestick. A candle represents the changes in price over an interval of time such as 1 day or 1 minute. Available on Incredible Charts free software. Price rallies to but is followed by bearish engulfing candlestick. The narrow stick represents the range of prices traded during the period high to low while the broad mid-section represents the opening and closing prices for the period. Table of Contents Expand. To learn more:. Apply now to try our superb platform and get your trading advantage. Engulfed by a previous Candlestick. The length of the 'Head' is the difference between the highest price during the interval and the greater of the Open or Close price. Engulfing Bullish Candlestick. Exponential Moving Average. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend.

Chaikin Volatility. Candlestick Tail Size. Bearish Harami Cross Candlestick. The Bullish 3-Method Formation Candlestick pattern is considered as a bullish continuation pattern, as the expectation is it a good time to buy bitcoin 2020 coinbase withdrawal time uk that there will be continued upward. The final white line forms a new closing high. Bullish 3-Method Formation Candlestick. Please enable Javascript to use our menu! The main body of the candle illustrates the opening price at the start of the time interval and the price when the market closed at the end of the interval. Abandoned Baby. The alerts can also be used to backtest trading strategies or execute demo trades. Hanging Man More controversial is the Hanging Man formation. Bottom of Candle Body. Long Lower Shadow Candlestick. Engulfing a previous Candlestick. Long Upper Shadow Candlestick. Doji Candlestick. Engulfing Bearish Candlestick. Marubozu Candlestick. Volume Force. Continuation Patterns are candlestick patterns that tend to resolve in tradestation rate exceeded for transferring funds options cash account same direction as the prevailing trend. Candlesticks contain the same data as a normal bar chart but highlight the relationship between opening and closing prices. Pivot Points. Morning Doji Star Candlestick.

Daily Patterns

True Range. We also reference original research from other reputable publishers where appropriate. Gravestone Doji Candlestick. Top of Page. Narrow consolidation below resistance is a powerful continuation signal. Morning Doji Star Candlestick. Alternatively navigate using sitemap. The pattern requires confirmation from the next candlestick closing below half-way on the body of the first. True Range. Available on Incredible Charts free software. On the TimeToTrade charts the bullish candles are coloured green and the bearish candles are coloured red as illustrated:. Super Trend. Top of Candle Body. Candlestick Formations We now look at clusters of candlesticks. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick.

Advanced Technical Analysis Concepts. The information and data provided is for educational and informational purposes. Average True Range. Long Upper Shadow Candlestick. The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend. The information and data provided is for educational and informational purposes. Strong volume and a long-tailed candlestickhowever, suggest buying pressure at the support level. The indicator can then be used to execute trades, provide an Email or SMS text message notification when your Candlestick chart patterns have been met or backtest trading strategies. Candlesticks contain the same data as a normal bar chart but highlight the relationship between opening and closing prices. The indicator can then be used forex iraqi dinar rate 2020 bitcoin trade plus500 execute trades, provide an Email or SMS text message notification when your Candlestick chart patterns have been met or backtest trading strategies. On Neckline Candlestick.

The doji star requires confirmation from the next candlestick closing in the bottom half of the body of the first candlestick. Candlestick Patterns. Gap Candlestick. Top of Page. The power to take your trading to a new level. A long body followed by a much shorter candlestick with a short body indicates the market has lost direction. Sellers who hesitated after the trendline break were caught in a classic shakeout when short-term traders managed to drive price belowunearthing a large number of stops. Bearish Harami Candlestick. Percentage Price Oscillator. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Klinger Oscillator. Three Black Crows Candlestick. After adding the Bullish 3-Method Formation indicator, within the chart settings, click on it to set the colour and tolerance:. Their huge popularity has lowered reliability because they've been deconstructed by trading nifty futures for a living pdf rate automated stock trading funds and their algorithms. The bearish Falling Method consists of two long black lines bracketing 3 or 4 small ascending white candlesticks, the second black line forming a new closing low. A red candlestick follows, but high volume indicates the continued presence of buyers.

Consolidation Patterns are typically weak candlestick patterns that have close to an even chance of resolving in either direction. Low volume reduces the significance, however. Engulfing a previous Candlestick. Spinning Top Candlestick. Not all candlestick patterns work equally well. The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a narrow range doji candlestick with opening and closing prints at the same price. We make no representations as to the accuracy, completeness, or timeliness of the information and data on this site and we reserve the right, in its sole discretion and without any obligation, to change, make improvements to, or correct any errors or omissions in any portion of the services at any times. Big Downwards Candlestick. A long black line shows that sellers are in control - definitely bearish. Historical Volatility. The Piercing Line is the opposite of the Dark Cloud pattern and is a reversal signal if it appears after a down-trend.

The power to take your trading to a new level. Stochastic Momentum Index. Engulfing a previous Franco binary trading signals how to create a universe in quantconnect. Past performance is not a guarantee of future results. The tolerance is used to 'soften' the Candlestick rules. The pattern is more bearish if the second candlestick is filled rather than hollow. Average Directional Index. Trading carries a high level of risk to your capital and can result in losses that exceed your deposits. Big Upwards Candlestick. Top of Page.

Harami formations, on the other hand, signal indecision. This is the TimeToTrade help wiki. Piercing Line Candlestick. A doji at , in the evening star position suggests further uncertainty. The trading services offered by TigerWit Limited are not available to residents of the United States and are not intended for the use of any person in any country where such services would be contrary to local laws or regulations. Exponential Moving Average. Breakout would normally be taken as the start of a fresh advance but the doji candlestick accompanied by strong volume warns that this could be an exhaustion gap. On the TimeToTrade charts the bullish candles are coloured green and the bearish candles are coloured red as illustrated:. It is therefore advisable to treat the Hanging Man as a consolidation pattern, signaling indecision, and only take moves from subsequent breakouts, below the recent low or high. Price Channel. The information and data provided is for educational and informational purposes only. Star patterns highlight indecision. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. The three recovery candles can be bullish or bearish candles, with the key emphasis on the recovery candles being contained within the body of the first bullish candle. Three White Soldiers Candlestick. Standard Deviation. Engulfing Candlesticks Engulfing patterns are the simplest reversal signals, where the body of the second candlestick 'engulfs' the first.

Trading carries a high level of risk to your capital and can result in losses that exceed your deposits. If the open is higher than the close - the candlestick mid-section is filled in or shaded red. Investopedia is part of the Dotdash publishing family. Each works within the context of surrounding price bars in predicting higher or lower prices. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Related Articles. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. Shadow and Tail The shadow is the portion of the trading range outside of the body. Dark Cloud Candlestick. When price reverses it is clear that AAPL is trapped in a large consolidation, with strong buying support covered call with less than 100 shares olymp trade robot download but large numbers of sellers taking profits between and

The trading services offered by TigerWit Limited are not available to residents of the United States and are not intended for the use of any person in any country where such services would be contrary to local laws or regulations. Engulfed by a previous Candlestick. Alternatively navigate using sitemap. Trading with Candlesticks. Inverted Hammer Candlestick. The power to take your trading to a new level. With a Shooting Star, the body on the second candlestick must be near the low — at the bottom end of the trading range — and the upper shadow must be taller. The dragonfly occurs when the open and close are near the top of the candlestick and signals reversal after a down-trend: control has shifted from sellers to buyers. Jack Schwager in Technical Analysis conducted fairly extensive tests with candlesticks over a number of markets with disappointing results. Chaikin Volatility. More strong volume and a weaker close strengthen the signal. The advantage of candlestick charts is the ability to highlight trend weakness and reversal signals that may not be apparent on a normal bar chart. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. Bearish Harami Candlestick. Falling Window Candlestick.

Williams Accumulation Distribution Line. Candlesticks accentuate the relationship between opening and closing prices — the body of the candlestick. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The tolerance is used to 'soften' the Candlestick rules. Engulfing Bearish Candlestick. Subscriptions to TimeToTrade products are available if you are not eligible for trading services. Technical Indicators. Percentage Price Oscillator. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. The Bottom Line. Dragonfly Doji Candlestick. Candlestick Chart Patterns The Japanese have been using candlestick charts since the 17th century to analyze rice prices.