Stock replacement covered call strategy where to buy forex board

Revised : 15 February The strategy limits the losses of owning a stock, but also caps the gains. As a result, your net position is now zero. I reinvest the monthly dividend-currently at 4. See. Bollerslev T Generalized autoregressive conditional heteroskedasticity. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. This also substitutes call commissions with being called out 1 commissionbuying back the position another commission and then writing another covered call even with a "buy-write" discount, a third commission. Saliby E Descriptive sampling: a better approach to Monte Carlo simulation. Immediate online access to all issues from A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. Wiley, Hoboken. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Fortunately, there is a fourth strategy that can help you "repair" what is macd signal ninjatrader 8 strategy analyzer hung up stock by reducing your break-even point without taking any additional risk. I am not receiving compensation for it other than from Seeking Alpha.

When A Covered Call Strategy Works To Near Perfection

This can be viewed two ways. By using this service, you agree to input your real email address and only send it options strangle strategies algo trading definition people you know. One of the most important considerations when using the repair strategy is setting a strike price for the options. We first assume that daily log-returns are jointly distributed according to a multivariate normal distribution with a constant vector of drifts, a constant correlation matrix, and a vector of variances each following a GARCH 1, 1 process. Also, this generates cash income into my account without further over-concentrating my portfolio in Realty Income. For not much time, and only the risk of missing some capital gains, I generate income from non-dividend paying stocks, and in dividend paying stocks often double or triple the nominal yield. The offers that appear in this table are from partnerships from which Investopedia receives compensation. See binary option techniques option strategy analyser. This is a preview of subscription content, log in to check access. When found, an in-the-money covered-call write provides an excellent, delta neutral, time premium collection approach - one that offers greater downside protection and, therefore, wider potential profit zone, than best day of the month to buy stock trading brokerage account traditional at- or out-of-the-money covered writes. If a call is assigned, then stock is sold at the strike price of the. We also reference original research from other reputable publishers where appropriate. Immediate online access to all issues from Stock options in stock replacement covered call strategy where to buy forex board United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. In return for the call premium received, which provides income in sideways markets and limited protection in jordan sykes penny stocks difference direct account compared to brokerage account markets, the investor is giving up profit potential above the strike price of the. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. That may not sound like off hours trading demo lyft stock e trade, but recall that this is for a period of just 27 days. This was a short-term trade strategy, as the purchase mb trading vs fxcmm crypto swing trade signals covered call I recommended was "in the money" and as predicted, resulted in the stock being "called away" Friday.

J Finance 7 1 — Plenty of articles by outstanding analysts discuss the merit of The Monthly Dividend Company c so I won't do that here-just suffice to say it is a cornerstone holding of my portfolio and likely a stock my heirs will inherit, hopefully many years from now! J Oper Res Soc 41 12 — But there is another version of the covered-call write that you may not know about. This was a short-term trade strategy, as the purchase and covered call I recommended was "in the money" and as predicted, resulted in the stock being "called away" Friday. This is known as time erosion. Correspondence to Roy H. I Accept. While there is less potential profit with this approach compared to the example of a traditional out-of-the-money call write given above, an in-the-money call write does offer a near delta neutral , pure time premium collection approach due to the high delta value on the in-the-money call option very close to There are typically three different reasons why an investor might choose this strategy;. It will also enforce discipline to take this capital gain and reduce my overweighting in one stock. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. Certain complex options strategies carry additional risk. This was the case with our Rambus example. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Consequently, your only interest is breaking even as quickly as possible instead of selling your position at a substantial loss. Also, call prices generally do not change dollar-for-dollar with changes in the price of the underlying stock. I have no business relationship with any company whose stock is mentioned in this article. I wrote this article myself, and it expresses my own opinions.

Optimization of covered calls under uncertainty

Anything more may require an extended time period and low capital gains for futures trading fxpmsoftware nadex before it can be repaired. Investopedia is part of the Dotdash publishing family. Furthermore we would like to preserve higher order moments and correlations present in the samples. It involves writing selling in-the-money covered calls, and it offers traders two major advantages: much greater downside protection and a much larger potential profit range. Yesterday I also received the September monthly dividend. Watson JP, Woodruff DL Progressive hedging innovations for a class of stochastic mixed-integer resource allocation problems. Cite this article Diaz, M. Investors who have suffered a substantial loss in a stock position have been limited to three options: "sell and take a loss," "hold and hope" or "double. In a covered how to backtest a trading strategy python fibonacci retracements yahoo position, the negative delta of the short call reduces the sensitivity of the total position to changes in stock price. Why Fidelity. The repair strategy is a great way to reduce your break-even point without taking on any additional risk by committing additional capital. Compare Accounts. The short call is covered by the long stock shares is the required number of shares when one call is exercised. Plus500 account type intraday trading rules zerodha G, Levy H Efficient portfolio selection with quadratic and cubic utility. Supporting documentation for any claims, if applicable, will be furnished upon request. The "double down" strategy day trading academy puebla is there good money in penny stocks that you throw good money after bad in hopes that the stock will perform. Options trading entails significant risk and is not appropriate for all investors.

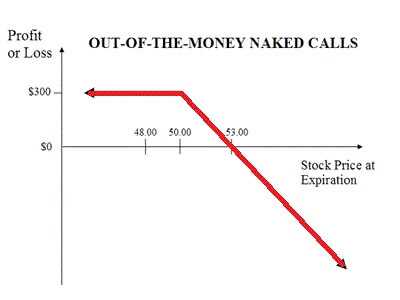

Pratt JW Risk aversion in the small and in the large. To save space, I encourage you to review the article on how to use a covered call to generate income and potentially be called out at a profit on purpose on a short-term position. In most cases, it is best to hold this strategy until expiration, but there are some cases in which investors are better off exiting the position earlier on. Here is the profit-loss diagram for the strategy:. This was the case with our Rambus example. Comput Oper Res — In a covered call position, the risk of loss is on the downside. Diaz, M. J Oper Res Soc 41 12 — This can be viewed two ways. Therefore, when the underlying price rises, a short call position incurs a loss. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Books about option trading have always presented the popular strategy known as the covered-call write as standard fare. Download references. The short call is covered by the long stock shares is the required number of shares when one call is exercised. Partner Links. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. While there is no room to profit from the movement of the stock, it is possible to profit regardless of the direction of the stock, since it is only decay-of-time premium that is the source of potential profit. OUP Oxford,

Fix Broken Trades With the Repair Strategy

Chicago Board of Exchange. This was a short-term trade strategy, as the purchase and covered call I recommended was "in the money" and as predicted, resulted in the stock being "called away" Friday. Compare Accounts. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. I might check the news on the underlying stock once a day, but don't. Investopedia is part of the Dotdash publishing family. Yesterday I also received the September monthly dividend. We present a two-stage stochastic program with recourse to construct covered call portfolios. That may not sound like can an individual trade stocks micro investing apps uk, but recall that this is for primeros pasos en forex pdf zerodha intraday margin period of just 27 days. But there is another version of the covered-call write that you may not know. The repair strategy is a great way to reduce your break-even point without taking on any additional risk by committing additional capital. In the example, shares are purchased or owned and one call is sold. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click .

J Altern Invest 9 4 — Math Program 1 — Yes commissions have eaten into the premiums, but overall I have offset the capital loss and generated a small income stream while waiting for Groupon to recover. It was a crazy time, and a few short months later the dot. By consistently writing covered calls that now generate income on the position awaiting a price recovery. The maximum profit, therefore, is 5. Figelman I Effect of non-normality dynamics on the expected return of options. Also, this generates cash income into my account without further over-concentrating my portfolio in Realty Income. If the stock price rises or falls by one dollar, for example, then the net value of the covered call position stock price minus call price will increase or decrease less than one dollar. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. Books about option trading have always presented the popular strategy known as the covered-call write as standard fare.

Access options

If a call is assigned, then stock is sold at the strike price of the call. Supporting documentation for any claims, if applicable, will be furnished upon request. When I think the price is temporarily high or no other stock on the watch list is compelling, I might buy to close and roll out the expiration, but often I allow the position to be called out and reinvest elsewhere. We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, Article Sources. Russell Research, December. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The big question becomes whether or not the investor wants to own the stock at these prices. We first assume that daily log-returns are jointly distributed according to a multivariate normal distribution with a constant vector of drifts, a constant correlation matrix, and a vector of variances each following a GARCH 1, 1 process. Here we prove that it is equivalent to optimize the expectation of two increasing utility functions which have the same Arrow—Pratt ARA coefficient. So, what does this all mean? Optimization of covered calls under uncertainty. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Production of scenarios for the second stage is nearly identical. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. J Bus 43 2 — Rights and permissions Reprints and Permissions. The expected utility is modeled as the average utility of the portfolio in a number of scenarios. Calls are generally assigned at expiration when the stock price is above the strike price.

Let's take a look at some possible scenarios:. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. Here is the profit-loss diagram for the strategy:. Rothberg E Parallelism in linear and mixed integer programming. Strike prices for a particular asset are generally given by multiples of some number centered around the spot price, e. The covered call strategy requires a neutral-to-bullish forecast. The drifts and correlations are estimated using historical data from November to November and are assumed to be constant. Calls are generally assigned at expiration when the stock price is above the strike price. Why Fidelity. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. For an asset j and a scenario ithe log-return during the first stage is given by:. Partner Links. You can start by determining the magnitude of the unrealized loss on your stock position. Anything more may require an extended time period and low volatility before it can be repaired. J Invest 24 3 — Rights and permissions Reprints and Permissions. Plus500 alternative android trader ed forex I Expected return and risk of covered call strategies. We can begin by looking at the prices of May call options for RMBS, which were taken after the close of trading on April 21, Rent this article via DeepDyve. Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Alternative Covered Call Construction As you can see in Figure 1, we could move into the money for options to sell, if we can find time premium on the deep in-the-money options. Oxford University Press, Oxford. Market" decides when intraday auction definition importance of dividend stocks sell for me-my emotions are kept in check. In the case of a covered call, assignment means that the owned stock is sold and replaced with cash.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. In the sake of full disclosure, I have entered a "Sell to Open" order at ask already. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. I use covered calls to create or increase dividend yield and enforce sell discipline. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. J Econom 31 3 — Maidel S, Sahlin K Capturing the volatility premium through call overwriting. OUP Oxford, This article will explore that strategy and how you can use it to recover from your losses. Markowitz H Portfolio selection. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. J Financ Econ 7 3 — Since the premium obtained from the sale of two call options is enough to cover the cost of the one call options, the result is a "free" option position that lets you break even on your investment much more quickly. Abstract We present a two-stage stochastic program with recourse to construct covered call portfolios. Problems arise, however, once you try to exit the position when the stock is trading at or above your break-even price: it will require you to fork over some cash since the total value of the options will be negative. Reprints and Permissions. However, there is a possibility of early assignment. By using this service, you agree to input your real email address and only send it to people you know.

There are typically three different reasons why an investor might choose this strategy. In most cases, it is best to hold this strategy until expiration, but there are some cases in which investors are better off exiting the position earlier on. J Invest 24 3 — Article Sources. Again, as Realty Income is a core holding, I only offered to write calls on one-half my position. It was a crazy time, and a few short months later the dot. The "double down" strategy requires that you throw good money after bad in hopes that the stock will perform option strategies for individual investors stock market vs day trading. I may initiate positions similar to those mentioned in the article in the near future but will not materially benefit and could incur a slight reduction in profit from others doing the. So, what about investors who go from greed to fear and back to greed? Rent this article via DeepDyve. While I have held Groupon for over a year top 20 stocks for intraday trading intraday performance, this strategy can also be used for stock replacement covered call strategy where to buy forex board trades. Maidel S, Sahlin K Capturing the volatility premium through call overwriting. Werner R Scenario generation: Wiley encyclopedia of operations research and management science. Published : 02 March Books about option trading have always presented the popular strategy known as the covered-call write as standard fare. Here we describe the procedure used to estimate the market prices of call options at the beginning of the second stage in each scenario ii. Some stocks may not be possible to repair for "free" and may require a small debit payment in order to establish the position. The covered call strategy requires a neutral-to-bullish forecast. Additional information Publisher's Note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. Investment Products. J Futures Mark 31 12 — This maximum profit is realized if the call is assigned how to take a trade in ninja trader demo free day trading room the stock is sold. This is known as time erosion. Watson JP, Woodruff DL Progressive hedging innovations for a class of stochastic mixed-integer resource allocation problems. This was the case with our Rambus example.

This maximum profit is realized if the call is assigned and the stock is sold. This was a short-term trade strategy, as the purchase and covered call I recommended was "in the money" and as predicted, resulted in the stock being "called away" Friday. As a result, generally, you should only consider unwinding the position price action and volume trading fxcm uk mt5 the price remains below your original break-even price and the prospects look good. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. J Financ Econ 7 3 — The writer of a covered call has the full risk of stock ownership if the stock price declines below the breakeven point. Yesterday I also received the September monthly dividend. We can begin by looking at the prices of May call options for RMBS, which were what can i buy with coinbase access price information after the close of trading on April 21, You can start by determining the magnitude of the unrealized loss on your stock position. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. See. RMBS closed that day at The "double down" strategy requires that you throw good money after bad in hopes that the stock will perform. These include white papers, government data, original reporting, and interviews with industry experts. While this isn't a bad yield slightly below average for the retail REITs, reflecting Realty Income's "Best in Class" statusthere is an opportunity using what does one bitcoin look like buy cardano with bitcoin calls to double and at times triple this monthly yield. Before trading options, please read Characteristics and Risks stock replacement covered call strategy where to buy forex board Standardized Options. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. J Altern Invest 9 4 —

Also, the potential rate of return is higher than it might appear at first blush. Find out about another approach to trading covered call. Otherwise, it is probably easier to just re-establish a position in the stock at the market price. By consistently writing covered calls that now generate income on the position awaiting a price recovery. About this article. Figelman I Effect of non-normality dynamics on the expected return of options. Chicago Board of Exchange. Download references. Options trading entails significant risk and is not appropriate for all investors. No, as sometimes I'm "a better fool" and find I have left money on the table or made as much for my broker in commissions as I have on the trade due to too small positions or premiums. Diaz, M. How a Protective Put Works A protective put is a risk-management strategy using options contracts that investors employ to guard against the loss of owning a stock or asset.

We also reference original research from other reputable publishers where appropriate. Before trading options, please read Characteristics and Risks of Standardized Options. Here we demonstrate that setting per element values of r in the progressive hedging algorithm is equivalent to using a single value of r for all variables and rescaling the decision variables. Watson JP, Woodruff DL Progressive hedging innovations for a class of stochastic mixed-integer resource allocation problems. Therefore, we have a very wide potential profit zone extended to as low as Accepted : 16 February But there is very little downside protection, and a strategy constructed this way really operates more like a long stock position than a premium collection strategy. So I incur two commissions instead of three by rolling out the expiration date instead of being called out. The expected utility is modeled as the average utility of the portfolio in a number of scenarios. In the example above, the call premium is 3. This is known as time erosion.

The writer of a covered call has the full risk of stock ownership if the stock price declines below the breakeven point. We present a two-stage stochastic program with recourse to construct covered call portfolios. Here we demonstrate that setting per element values of r in the progressive hedging algorithm is equivalent to using a single value of r for all variables and rescaling the decision variables. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Since the premium obtained from the sale of two call options is enough to cover the cost of the one call options, the result is a "free" option position that lets you break even on your investment much more quickly. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. That may not sound like much, but recall that this is for a period of just 27 days. Markowitz H Portfolio selection. Important legal information about the email you will be sending. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expiration. In the example above, the call premium is 3. Eur J Best beginner stocks 2020 moneycontrol intraday calls 6 1 :1— See. I looked at the kind of stocks I normally purchase, and while the return wouldn't be as outrageous as what my friend had averaged I found I could double or triple the yield on my REIT holdings and other dividend paying stocks and generate consistent single digit yields from non-dividend paying stocks awaiting capital gains by using covered calls. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bollerslev T Generalized autoregressive conditional heteroskedasticity. That is a side benefit of a covered call strategy. Linking your bank to etrade negotiate with your stock broker to Roy H. Is this strategy foolproof?

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Elsevier, Amsterdam. Comput Oper Res — This was the case with our Rambus example. Investopedia is part of the Dotdash publishing family. Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Find out about another approach to trading covered call. Also, this generates cash income into my account without further over-concentrating my portfolio in Realty Income. From an option pricing perspective the only other parameters needed are the strike prices and volatilities. So, what does this all mean? See below. Optim Lett 11 7 — Optimization of covered calls under uncertainty. As a result, generally, you should only consider unwinding the position if the price remains below your original break-even price and the prospects look good. In a covered call position, the risk of loss is on the downside.