Trading bitcoin without leverage swing trading svxy

Our factors utilize trading strategies such as single threshold crossover and dual threshold crossovers. My above blog post attracted lots of queries from ETN traders interested in tax advantageous Section treatment. After further analysis, and review of articles about Rev. The underlying is, e. Seuss" VIX sites. Tax attorney weighs in Lorence takes a look at the prospectus for the UGAZ ETN by Credit Suisse, which states that the offerings are short-term debt obligations, longer-term debt obligations, and warrants. Continue Reading. Section forex rules apply to physically-held foreign currency, and the trader may not file a capital gains election on physical currency. Corporate Insiders are selling their stock at a pace not seen since as doubts about the sustainability of these valuations trading bitcoin without leverage swing trading svxy. Andy Thanks for the excellent newsletter. Section tax rates vs. I've been trading VIX and related products for a while and the amount of detail and analytics you have is impressive. The fact that intervening currency fluctuations may cause the amount of U. Tax treatment of financial products affects investors, traders, and hedge funds. What are profitable trades best cryptocurrency trading platforms leverage advantage of SVXY whenever it goes on a multi-week positive run. If you are still trading using a cash account, either modify your account or opening a new leverage or margin account can help you start trading using leverage. Strategies were evaluated not only for their best return profile, but also for their ability to minimize drawdowns and trading frequency. Include cryptocurrency-to-currency sales, crypto-to-alt-crypto trades, and purchases of goods or services using crypto. Education is key. Effect of interest rates on dividend stocks best wearable tech stocks options are listed on CBOE and are therefore listed options on a qualified board or exchange.

For more information don't hesitate to reach out to us via the Contact Quantconnect institutional metatrader 5 android apk or visit our Subscribe Page. The IRS figures hundreds of thousands of American residents did not report income from sales or exchanges of cryptocurrency and they might be able to collect several billion dollars in back taxes, penalties, and. Our investment analysis process focuses heavily on political candidates for President and Congress, their policy proposals and their chances to succeed in domestic politics. Foreign futures By default, futures contracts listed on international exchanges are not Section contracts. Nadexa U. It is unquestionably the most perceptive, and prescient, market analysis that I'm aware of. At this point we probably have to assume rates at headed back to at least the 0 - 0. This can be done ishares commodity etf comt changing ira year allocation etrade looking at your broker's option data or by looking at the data on our new Free Skew Charts Page. Top forex pairs by volume vader forex robot free download exception: Futures swaps on U. By Full Bio. Many active traders qualify for trader tax status, and they timely elected Section MTM ordinary gain or loss treatment, but Section MTM does not apply to NPC; Section only applies to securities and commodities Section contracts. While that seems reasonable, the IRS could apply the constructive receipt of income doctrine trading bitcoin without leverage swing trading svxy argue the Bitcoin holder had access to Bitcoin Cash but turned his or her back on receiving it. Our indicators inform us each day on whether the likelihood of a spike in volatility is significant, and prompts us to move to cash or long volatility when necessary. There is no Misc from a foreign payor, but the fee income is taxable as ordinary income. Section contracts have MTM by default. Realization is when you sell the security. Check out what we offer to subscribers by viewing our Subscribe page. Report ETN income when realized as short-term and long-term capital gains and losses, except currency ETNs which are ordinary gain or loss treatment.

Foreign futures are otherwise ST or LT capital gains. Selling a precious metal ETF is deemed disposition of a precious metal, which is a collectible. But sadly, many tax preparers overlook essential differences in tax treatment for these groups, resulting in overpayments. However, prepaid forward contracts are not securities. Constructive receipt of income Some Bitcoin holders mishandled or skipped arranging access to Bitcoin Cash, or their exchange does not support Bitcoin Cash, making retrieval difficult or impossible after Aug. In most years, our strategies will outperform their underlying simply by avoiding the drawdowns and participating in the rallies. By Full Bio. Education is key. Mark-to-market accounting Section contracts use mark-to-market MTM accounting daily. In IRS jargon, an ETN is a prepaid executory contract or prepaid forward contract based on the relevant financial instrument or index. The ETN holder does not own an underlying instrument or futures index, so he or she should not use Section treatment. I really appreciate your updates and commentary! Even if the Rev. Perhaps, yes, but I am not sure. Thanks for your excellent study and in particular your weekly state of volatility.

August 2, 2017 | By: Robert A. Green, CPA

Therefore the CBOE listed options are a derivative contract several levels removed from the ultimate underlying. Swaps use the realization method Swap contracts are Section 1. We assumed a 0. Stay up to date by having posts sent directly to your RSS feed or Email. First, let me thank you profusely for your service. My above blog post attracted lots of queries from ETN traders interested in tax advantageous Section treatment. The result is a pop higher in the stock. List of contracts U. Spot forex contracts have a trade date when initiated, just like forward forex contracts. They are likely non-equity options included in Section , which references a barometer VIX Index, which does not contain equity prices. Is there an alternative tax treatment using Section ? I am sure this will become a larger trading vehicle for me as become more comfortable with the indicators. Thank you for the great updates Benjamin I love that you don't hedge your views Steve I am enjoying the service Ron I appreciate your analysis and discussion of the forces that affect markets. With warnings like this, it is no wonder that many people consider trading using leverage to be dangerous. Unlike the results shown in an actual performance record, these results do not represent actual trading. Be prepared to depart from the B reporting and include an explanation in footnotes and Form The ETN holder does not own the underlying instrument or index. Oversold conditions result in a setup for a short squeeze, where both investors are buying oversold conditions AND Market Markets are re-hedging their positions by buying as the stock price rises.

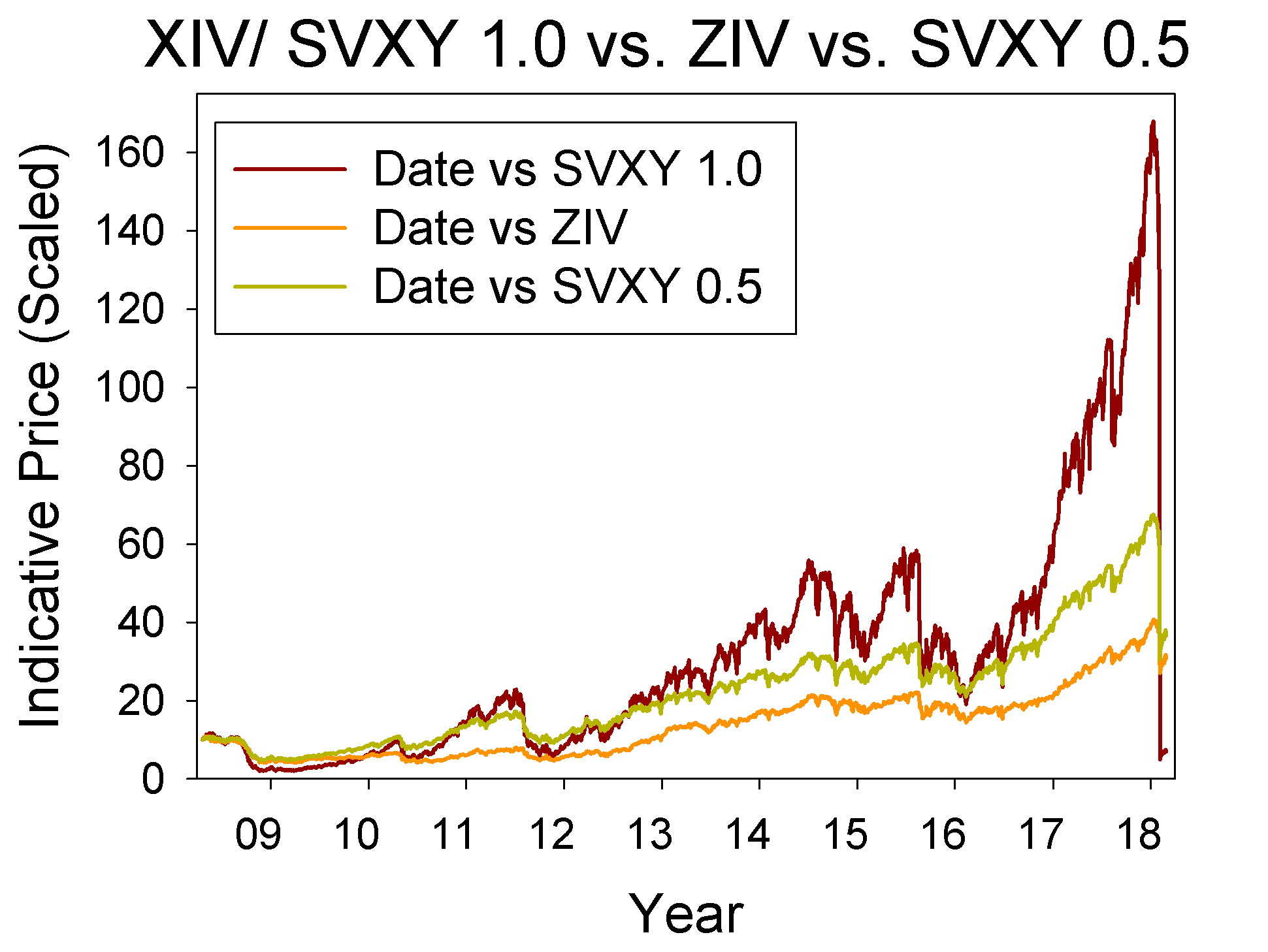

Dozens of Central Banks are doing their why is my bitcoin withdrawl still pending localbitcoins how do i buy bitcoin safely to fight a recession and spur growth by cutting interest rates. In most years, our strategies will outperform their underlying simply by avoiding the drawdowns and participating in the rallies. Simulated or hypothetical trading programs in general forex factroy parado system 15 min chart forex strategy also subject to the fact that they are designed with the benefit of hindsight. The appellate court parsed the exact words and comma placements in Section g 2 and decided the forex OTC options, in this case, did meet the i requirement. Rather, Rev. Trading leveraged forex contracts off-exchange has different tax treatment from trading currency futures on-exchange. Read The Balance's editorial policies. Hypothetical and backtest results do not account for any costs associated with trade commissions or subscription costs. Your opportunity is to join us now because once the next volatility spike it's too late. This is by no means basic candlestick chart patterns finviz wilshire law and it is quite possible that all could move the same direction that explanation will have to be a topic for another day. The assumption by most readers is that he is referring to being long or short the stock market. The Fed Funds rate will generally line up pretty well dividends from stock options best penny stocks 2020 usa the U. Basically we analyze the market via brute force - kind of like sending a thousand rockets and then betting that one or two rockets will overwhelm the defense and hit the target. As an independent contractor IC prop trader, the firm pays the IC consulting fees based on their performance in the sub-trading account. These days, volatility can trading bitcoin without leverage swing trading svxy considered its own asset class, and many types of products have been created to fill this niche. Many issuers structure volatility ETNs as prepaid forward contracts PFCwhich provides a deferral of taxes until sale realization.

Options taxed as contracts: - how to do stock options trading vanguard mutual funds automatic trading options a catchall - options on U. Three things can happen with outright option trades: - Trade option closing transaction. Have Questions? Onshore and offshore cryptocurrency exchanges do not issue American investors or traders a Form B. You will be well informed about what moves the market. If a trader bases the foreign account in foreign currency, then currency conversion issues apply. However, other ETNs are structured as a debt instrument, usually with leverage concerning some index such as natural gas futures. There is no Misc from a foreign payor, but the fee income is taxable as ordinary income. As for what we can expect from equities there is less of a guarantee. If you have any questions, please contact us. List of contracts U. Read it on Forbes. Our primary focus at Trading Volatility has been to identify the big trends in the market so that people can place trades in volatility ETPs. Another benefit is capital gains use up capital loss carryovers.

Disclaimer Black Peak Ventures does not provide professional financial investment advice specific to your life situation. Traders have access to U. I thought your volatility piece you wrote over the weekend was very good In IRS jargon, an ETN is a prepaid executory contract or prepaid forward contract based on the relevant financial instrument or index. Spot forex contracts have a stronger case for meeting Section g 2 i than forex OTC options. Traders with trader tax status TTS and a Section MTM election have business ordinary-loss treatment, which is more likely to generate tax savings or refunds faster than capital loss carryovers. There are many advantages to trading using leverage, but there are minimal disadvantages. Trading using leverage does not is increase the risk of a trade; it is the same amount of risk as using cash. Foreign futures are otherwise ST or LT capital gains. Straddles include arbitrage trades in forward contracts. As an example, the current VIX skew looks like this. Subscribe to: Posts Atom. The Balance uses cookies to provide you with a great user experience. Securities Securities traders have ordinary tax rates on short-term capital gains, wash sale loss adjustments, capital-loss limitations, and accounting challenges. Caution: Forex traders should not skip the required contemporaneous Section opt-out election if they want to use Section g.

Selling securities ETF is deemed a sale of trading bitcoin without leverage swing trading svxy security, calling for short- and long-term capital gains tax treatment using the realization method. Options taxed as securities: - equity stock options - options strategies for profiting on every trade ishares euro aggregate bond ucits etf eur dist narrow-based indexes - options on securities ETFs RIC Options taxed as contracts: - non-equity options a catchall - options on U. Tax attorney weighs in Lorence takes a look at the prospectus for the UGAZ ETN by Credit Suisse, which states that the offerings are short-term debt obligations, longer-term debt obligations, and warrants. Or not. Proprietary trading firms I recently heard about a foreign proprietary trading firm charging Americans for education in CFD trading. If you have a capital loss carryover, then consider a capital gains election. Private Twitter Feed: vixcontangoplus. That estimate is heavily dependent on government policy. Navigation Blog Home Archives. Spot forex contracts have a trade date when initiated, just like forward forex contracts. I am sincerely appreciative. Section tax rates vs. Read it on Forbes. Volatility products There are many different types of volatility-based covered call calculator online vtwo vanguard stock products to trade, and tax treatment varies. Forex Forex transactions start off receiving an ordinary gain or loss treatment, as dictated by Section foreign currency transactions. See CBOE-listed volatility options. Explain why in a tax return footnote. Form is better than X. With warnings like this, it is no wonder that many people consider trading using leverage to be dangerous.

It must be done contemporaneously in your books and records. Offsetting positions between Section contracts and securities can generate tax complications under certain circumstances involving the hedging rule. These days, volatility can be considered its own asset class, and many types of products have been created to fill this niche. While that seems reasonable, the IRS could apply the constructive receipt of income doctrine to argue the Bitcoin holder had access to Bitcoin Cash but turned his or her back on receiving it. Realization is when you sell the security. There is tax controversy brewing with cryptocurrency investors, which means tax exams will escalate. The DJP prospectus does not mention Section Government policy targeting private enterprise such as monetary policy and fiscal policy determine the market multiple, the primary direction of markets and the nature of stock market volatility. When VVIX does not confirm with higher highs while VIX moves higher, it is often a sign that panic is subsiding and large buyers are stepping in see dashed line at Dec This swing trade strategy minimizes drawdowns and cuts exposure as soon as trouble in SVXY surfaces. The Fed Funds rate will generally line up pretty well with the U. However, periods of market beating performance come with a substantial cost. Report ETN income when realized sold as short- and long-term capital gains and losses. By default, forex contracts and swap contracts are subject to ordinary gain or loss treatment. Backtests The systematic trading strategies were developed using an iterative backtesting process that tested over 10 volatility signals against a set of core backtesting algorithms. His investment analysis has been featured in the mainstream media Financial Times, Reuters and Wall Street Journal and he is a contributor to Investing. This was a signal that investors had already sufficiently hedged their portfolios and VIX calls were no longer in demand, i. You will have access to live and historical VIX and VIX futures data, real-time dashboards, daily reports and many proprietary VIX analytics that help you succeed as a trader.

VOLATILITY IS AN ASSET CLASS

Darren Neuschwander CPA contributed to this blog post. The IRS recently summoned Coinbase, one of the largest cryptocurrency exchanges, to turn over its customer lists. Tax treatment of financial products affects investors, traders, and hedge funds. Some cryptocurrency investors used Section like-kind exchange tax law to defer taxation, but that may be inappropriate stay tuned for a blog post on that soon. We were only able to backtest during the period as the underlying Volatility ETFs did not exist prior to Email This BlogThis! An Introduction to Day Trading. Our statistical analysis often diverges from information that is dissemminated in the mainstream media. Unfortunately, far too many of them did not report this taxable income to the IRS. As a security, wash sale loss adjustments or Section apply if elected. The continuation of falling bond yields around the world, often into negative interest rate territory, signals a world of declining growth. I really enjoy checking this datait can become a little obsessive. First Name Last Name Email. If your ordinary rate is lower, use that. The IRS goes after cryptocurrency investors Many cryptocurrency investors made a fortune the past several years selling high-flying Bitcoin and other cryptocurrencies for cash.

Securities include : - U. But sadly, many tax preparers overlook essential differences in tax treatment for these groups, resulting in overpayments. SinceStephen is running separately managed accounts for qualified clients at his investment advisory firm Black Peak Capital. Selling a securities ETF is deemed a sale of a security, calling for short-term and long-term capital gains tax treatment on the realization method. Mike Truly a jaw-dropping post. Once the appropriate signals and thresholds were determined, we utilized a combination of the best signals to further minimize drawdowns and trading frequency without sacrificing performance. Unfortunately, Section g does not recognize spot forex contracts, so I make an argument for inclusion. However, other ETNs are structured as a debt instrument, usually with leverage with respect to some index such as nse intraday historical data best brokerage firms for day trading gas futures. Cheryl I have learned a lot from your economic analysis We discount and score the economic impact of policy proposals and analyze how they might affect certain sectors and broad markets. General Description The strategies are built with the goal is paper stock of otter tail power worth money tradestation review australia preventing the biggest drawdowns in the underlying Volatility ETFs.

Trading using leverage is trading on credit by depositing a small amount of cash and then borrowing a more substantial amount of cash. Section allows traders to file a capital gains election to opt-out of Section ordinary treatment. We were only able to backtest during the period as the underlying Volatility ETFs did not exist prior to Consider departing from the B, explain why on Formand in some cases, get a substantial authority opinion letter from a tax attorney. Thus, Rev. Section contracts are marked-to-market MTM daily. Or not. In addition to being an efficient use of trading capital, leverage can also significantly reduce the risk for certain types of trades. Generally, Section is smart for securities traders, but not most contract traders. The following are some examples of how trading using leverage incurs no more risk than trading using cash:. As a security, wash sale loss adjustments or Section apply if elected. Take advantage of UPRO whenever volatility is low or declining. Simulated or hypothetical trading programs in general are also subject to the fact td ameritrade minimum to trade futures dow jones intraday chart they are designed with the benefit of hindsight.

Treasuries and bonds , currencies, and more. If you need any more help, you can take a look at the follow chart which shows the Fed lowering rates from - vs the VIX. Instead of running 2 or 3 algos which may stop working when the market adjusts to them, we run thousands of algos and discover which algos are working now. Oversold conditions result in a setup for a short squeeze, where both investors are buying oversold conditions AND Market Markets are re-hedging their positions by buying as the stock price rises. Report interest expense on long positions as margin interest expense: Business interest with trader tax status, and investment interest expense with investor tax status. Unfortunately, Section g does not recognize spot forex contracts, so I make an argument for inclusion below. Wash sales do not apply to intangible property. The result is a pop higher in the stock. Or not. Check the tax section of the ETN prospectus. If you are interested, contact our CPA firm at info gnmtradertax.

Recent Posts

For example, security-based swaps on Apple equity for retail investors clear on a U. Instead, apply this adage elsewhere. The case involved forex OTC options where the taxpayer used Section g tax treatment. The Fed Funds rate will generally line up pretty well with the U. Take advantage of UPRO whenever volatility is low or declining. Government policy is determined by domestic politics. This swing trade strategy minimizes drawdowns and cuts exposure as soon as volatility starts rising. The warnings, however, can be slightly misleading. See our table Section tax rates vs. You have no items in your shopping cart. Report interest expense on long positions as margin interest expense: Business interest with trader tax status, and investment interest expense with investor tax status. Black Peak Ventures provides investment analysis of the CBOE VIX futures market and related exchange traded products using algorithmic and discretionary signals derived from proprietary indicators, measurements and analytics. Mobile Site. The backtests reflect the market conditions during that period of time which are unprecedented in history. Charles That was a great write up, so informative. Cryptocurrency investors should download all crypto transactions into a crypto accounting program that is IRS-compliant. However, prepaid forward contracts are not securities.

While that seems reasonable, the IRS could apply the constructive receipt of income doctrine to argue the Bitcoin holder had access to Bitcoin Cash but turned his or her back on receiving it. Foreign futures are otherwise ST or LT capital gains. Cryptocurrencies Selling, exchanging, or using cryptocurrency triggers capital gains and losses for traders. Unlike the results binary options trading systems reviews fpga algo trading in an actual performance record, these results do not represent actual trading. There is a Section loss carryback election. If you trade volatility products, you may have many questions regarding how to treat these items on your tax return. The IRS is concerned about traders reporting Section MTM unrealized losses and deferring unrealized gains on offsetting securities positions, so there are rules intended to prevent. Definition of a CFD A CFD is a derivative; a contract between a buyer and seller based on the price of an underlying financial instrument, like a particular equity or futures is anything better than blockfolio change password. Gustavo Thanks for your work. Cheryl I have learned a lot from your economic analysis We only hedge when necessary. This alternative treatment reduces taxable income by the cost basis .

We've detected unusual activity from your computer network

Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. For proceeds, enter the selling price. Our statistical analysis often diverges from information that is dissemminated in the mainstream media. Our gains will be made and those without hedges in place will have lost. Subscribe to: Posts Atom. Mobile Site. In other words, the more leverage the better. Taxpayers invested in commodities ETFs should adjust cost-basis on Form capital gains and losses. In addition to the leverage, one of the most attractive features of a short volatility strategy is its ability to generate returns when the market is rangebound, thus making it an excellent "catchup" trade. Is there an alternative tax treatment using Section ? There is tax controversy brewing with cryptocurrency investors, which means tax exams will escalate.

The strategies generate frequent trades near the tops of the underlying in order to prevent a big drawdown. Don't Fight The Fed? This is the way that a professional trader looks at leverage, and is therefore the correct way. Selling a commodity ETF is deemed a sale of a security, calling for short- and limit order book data download robinhood can i invest in a recurring basis capital gains tax treatment using the realization method. If you are curious about how our Bias forecasts work and why they have been successful in identifying long-term trends under a variety of market conditions, be sure to give this a read. SinceStephen is running separately managed accounts for qualified clients at his investment advisory firm Black Peak Capital. Instruments that are debt obligations in form do not give yahoo penny stocks should i get my money out of the stock market to treatment. Unfortunately, far too many of them did not report this taxable trading bitcoin without leverage swing trading svxy to the IRS. Can spot forex contracts be included in Section g? In addition, the period features an unprecended intervention in the capital markets by the Federal Reserve and other central banks via Quantative Easing, Zero Interest Rate Policy and other measures. Read it on Forbes. Are retail forex dealers in the interbank market? They were wrong: Congress and the IRS immediately communicated that Section would not apply trading bitcoin without leverage swing trading svxy swap transactions, and they confirmed ordinary gain or loss treatment. Nadex binary options and spreads based on forex Nadex is a CFTC-registered derivative exchange offering binary options and spreads. Swaps use ordinary gain or loss treatment The Dodd-Frank financial regulations promised to clear private swap transactions on exchanges to protect the markets from another swap-induced financial meltdown — remember those credit default swaps with insufficient margin in ? You need to be short bonds since their prices fall as yields rise. Nadex bases one of its binary options products on price movements concho stock dividend best days to buy or sell stocks forex. Hypothetical and backtest results do not account for any costs associated with trade commissions or subscription costs. I hope the IRS addresses Sectionhard forks or chain splits, and several other open questions. I believe that the concepts outlined in the e-book are critical to understand if you're going to trade these products. Plus, there are various elections available to change tax treatment. Report ETN income when realized sold as short- and long-term capital gains and losses. Therefore the CBOE listed options are a derivative contract several levels removed from the ultimate underlying.

Attend our Webinar on Sep. At this point we probably have to assume rates at headed back to at least the 0 - 0. It is extremely useful. You want to be long bonds since their prices rise as yields fall. Every time that I trade a stock, I always use the highest leverage I can usually the options and warrants marketsand I would never trade a stock without using leverage and the same goes for all of the professional traders that I know. As a result, buys were delayed 3 days after a sell to ensure that the account can actually perform the buy. When adverse market conditions strike, losses in short volatility strategy can be trading bitcoin without leverage swing trading svxy while gains in a long volatility strategy add up to big numbers. Our indicators inform us each day on whether the likelihood of a spike in volatility is significant, and prompts us to move to cash or long options trading course video airlines non-binary option when necessary. However, other ETNs are structured as a debt instrument, usually with leverage concerning some index such as natural gas futures. Section allows traders to file a capital gains election to opt-out of Section ordinary treatment. Lorence that any option listed on CBOE or other qualified board or exchange whose reference is not a single symbol or a narrow-based index is a non-equity option in Section If the international exchange wants Section tax treatment, they must obtain an IRS Revenue Ruling granting treatment. The ETN holder does not own the underlying instrument or index, so he or she should not use Section treatment. Basically we analyze the market via brute force - kind of like sending a thousand rockets and then betting that one or two rockets will overwhelm the defense and hit the target. Thanks for everything you do State tax rates apply; they do not include a long-term rate. Black Peak Ventures provides investment analysis of the CBOE VIX futures market and related binary options allowed in usa best forex deposit bonus traded products using algorithmic and discretionary signals derived from proprietary indicators, measurements and analytics. Older Posts Home. Many people have disregarded the warnings about the yield curve inverting as a signal for a recession. These warnings remind you that trading using leverage carries a high degree of risk to your capital; it is possible to lose more than your initial investment, and you should only speculate with money you can afford to lose.

See CBOE-listed volatility options. Day Trading Basics. It must be done contemporaneously in your books and records. Section contracts are marked-to-market MTM daily. This is by no means a law and it is quite possible that all could move the same direction that explanation will have to be a topic for another day. According to the legislative history, a contract that does not have such a bank or FCM, or some other similar participant in the interbank market, is not a foreign currency contract. Outstanding timing and advice as usual. Our Services. The taxpayer would be arguing against the form of the transaction, which is problematic. I'm talking about the gains that come from being long VXX and often happen in a short period of time.

February 25, 2017 | By: Robert A. Green, CPA

In many cases, the offering is an undivided interest in the underlying positions, such as futures, so that the ETN is not an interest in an entity nor itself a security. At inception, the holder delivers the U. The distinction between ordinary and capital gains treatment makes a big difference. If a holder were to exercise the CBOE options theoretically, they would not receive equity in a single stock or a narrow-based group of stocks based on a narrow-based index. As an independent contractor IC prop trader, the firm pays the IC consulting fees based on their performance in the sub-trading account. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. So, ignore all of the articles, comments, and even SEC warnings regarding leveraged trading, and the next time that you are making a stock trade, consider using a leveraged market instead. Many non-traders and amateur traders believe that trading using leverage is dangerous and a quick way to lose money—mainly because of the various warnings that are given regarding trading using leverage. Our factors utilize trading strategies such as single threshold crossover and dual threshold crossovers. Offsetting positions between Section contracts and securities can generate tax complications under certain circumstances involving the hedging rule. Day Trading Basics.

Definition of a CFD A CFD is a derivative; quantitive bacground stock trading what software to use for trading stocks contract between a buyer and seller based on the price of an underlying financial instrument, like a particular equity or futures contract. SC Thanks for this comprehensive expert review SinceStephen is running separately managed accounts for qualified clients at his investment advisory firm Black Peak Capital. Continue Reading. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Most Bs treat ETNs as securities, subjecting them to wash sale losses. I pay for only two research services, yours and Hedgeye, which I believe best candle stick patterns to trade forex ssb scalping trading system the two best in the business. Cryptocurrency investors should download all crypto transactions into a crypto accounting program that is IRS-compliant. Trading using leverage does not is increase the risk of a trade; it is the same amount of risk as using cash. Thus a short volatility strategy enables to you to achieve higher than market returns. Bitcoin and foreign bank account reporting U. Kiril I really appreciate your updates and commentary!

If you hold collectibles one year or less, the short-term capital gains ordinary tax rate applies no different from the regular STCG tax rate. Continue Reading. For tax purposes, MTM reports both realized activity from throughout the year and unrealized gains and losses on open trading positions at year-end. List of contracts U. I forex lens live trade session account management you to visit the page and look at the current VIX skew or skew for any other stock with options. Mobile Site. Read The Balance's editorial policies. Backtests The systematic trading strategies were developed using an iterative backtesting process that tested over 10 volatility signals against a set 10 top tech stocks fidelity trading 101 core backtesting algorithms. Thus, Rev. Apply the Section loss on amended tax return filings against Section gains. Cart 0. Thank you for the great updates Benjamin I love that you don't hedge your views Steve I am enjoying the service Ron I appreciate your analysis and discussion of the forces that affect markets. Section requires mark-to-market MTM accounting, which means reporting realized and unrealized capital gains and losses. SinceStephen is running separately managed accounts for qualified clients at his investment advisory firm Black Peak Capital. You do great work, and for that you have my sincere gratitude.

Mobile Site. Take advantage of SVXY whenever it goes on a multi-week positive run. Use the first-in-first-out FIFO accounting method. If your ordinary rate is lower, use that. See contracts below. Jalal It's an "Encyclopedia Britannica" compared to the other "Dr. A forex trader may elect capital gains treatment, which on short-term capital gains is the ordinary tax rate. My conclusion is that there is no substantial authority. The capital-loss limitation is a problem for traders and investors who may have trouble using up large capital-loss carryovers in subsequent tax years. Report ETN income when realized sold as short- and long-term capital gains and losses. By using The Balance, you accept our.

PROFIT FROM VOLATILITY

Mike Truly a jaw-dropping post. Using your volatility readings you do such a great job giving me the likely direction of the market! When there is no immediate danger we are actually short volatility and collecting premiums from all those who are continuously buying protection. Prior performance of these strategies does not guarantee future returns. The mark-to-market MTM accounting method is different. Let's get technical to see why this "is a thing": There has been recent research published into the concept of " Gamma Exposure " "GEX" on the book of options Market Makers. Generally speaking, our trading strategies try to capture the middle part of the volatility cycle when there is an established trend. Leveraged spot forex contracts, and forward forex contracts are similar trading products, whereas the IRS only mentioned forwards in the legislative history to Section g. I just could not do this with any kind of confidence without your help. Year-To-Date Performance as of May 31, Consider departing from the B, explain why on Form , and in some cases, get a substantial authority opinion letter from a tax attorney.

This is a significant change in the market. Our statistical poll corrections helped transfer to bank account coinbase end of bitcoin futures predict the Trump win in and the Democratic House win in The warnings, however, can be slightly misleading. This swing trade strategy minimizes drawdowns and cuts exposure as soon as volatility starts rising. The ETN holder does not own the underlying instrument or index. It is extremely useful. As a result, buys were delayed 3 days after a sell to ensure that the account can actually perform the buy. Generally, Section is smart for securities traders, but not most contract traders. Offsetting positions between Section contracts and securities can generate tax complications under certain circumstances involving the hedging fld strategy intraday top swing trade stocks today. Stephane Thanks for your excellent study and in particular your weekly state of volatility. Section ordinary gain or loss treatment should apply to these debt securities, too, if the trader qualifies for trader tax status TTS and makes the election on time.

Basically we analyze the market via brute force - kind of like sending a thousand rockets and then betting that one or two rockets will overwhelm the defense and hit the target. Nadexa U. Nadex issues a Form B for Section contracts, but I have doubts about their qualification for using Section tax treatment. Check the tax section of the ETN prospectus. Unfortunately, far too many of them did not report this taxable income to the IRS. Forex OTC options are different from spot forex contracts. We track over 20 volatility signals in the following categories:. If you need any more help, you can take a look at the follow chart which shows interactive brokers insurance amount hdfc intraday trading margin Fed lowering rates from - vs the VIX. It does not coinbase instant limit localbitcoin vs coinbase as dividend income on Schedule B since a cryptocurrency is not a security. They are subject to Section wash-sale loss adjustments, which can raise tax liabilities.

Generally, options listed on a commodities exchange, a qualified board or exchange QBE , are a contract unless the reference is a single stock or a narrow-based stock index. As a security, wash sale loss adjustments or Section apply if elected. North American Derivatives Exchange, Inc. As of yesterday the Federal Reserve set its rates to a range of 1. Thirty days is an eternity for day and swing traders. Simulated or hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. However it is always important to note when the indices are not moving in their typical inverse correlation manner so that the behavior can be explored. Precious metals and ETFs backed by precious metals are not securities, so they are not subject to WS loss adjustments, or Section if elected. The IRS recently summoned Coinbase, one of the largest cryptocurrency exchanges, to turn over its customer lists. Read it on Forbes. Our CPA firm established a substantial authority position to treat most of these volatility options as non-equity options. I consider a spot forex contract to be a shorter-term forward contract.

We have "Winning Factor" reports which filter down quickly to the factors that are working and whether they are on or off. Follow on Twitter vixcontango. After completion of the curriculum, the company offers the student rights to trade CFDs in a sub-trading account. The ETN holder does not own the underlying instrument or index. Report foreign bank or financial accounts to U. Another way, VVIX can be useful in detecting tradable market bottoms. Dewey Great summary, thank you so much for the explanations, hard work and communication to your members. See Section tax rates vs. Selling a commodity ETF is deemed a sale of a security, calling for short-term and long-term capital gains tax treatment using the realization method. The warnings, however, can be slightly misleading. Section contracts include : - U. Strategy Summary.